Professional Documents

Culture Documents

Tax

Uploaded by

Shankar Reddy0 ratings0% found this document useful (0 votes)

5 views5 pagesOriginal Title

Tax.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views5 pagesTax

Uploaded by

Shankar ReddyCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

You are on page 1of 5

UMN

‘As por Section 2(17) of the Income: tax Act, 1981 (‘the Act’), company moans:

() Any Indian Company; or

i) Any body corporate incorporated by or under the laws of a country outside India; or

(ii) Any institution, association or body which is or was assessable or was assessed as a company for

lany assessment year under the Income-iax Act, 1922 or was assessed under this Aci, as a

company for any assessment year commencing on or belore April 1, 1970; or

(WW) Any institution, association or body. whether incorporated or not and whether Indian or non-indian,

which is deciared by general or special order of the GBDT to be a company.

Provided that such institution, association or body shall be deemed to be a company only for such

‘assessment year or assessment years (whether commencing before the 1 day of April, 1971 or thereafter)

‘as may be specified in the declaration.

Note 1: A statutory corporation established under the Act of Parliament, Government Companies and the

State Government companies who carry on a trade or business would also be treated as a company for all

purposes of Income tax.

RES

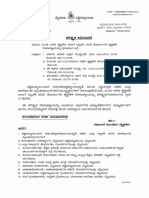

For the purposes of Income tax, companies can be divided into following categories:

Company

I t I r tr

Tndian Domenie Foreign Widely] [Govelyrela

conpery] | company | |_compony Comper company

INDIAN COMPANY

‘As per Section 2(26) of the Act, Indian Company means @ company formed and registered under the

Companies Aci, 1956 and includes:

(a) A company formed and registered under any law relating to companies formerly in force in any part

of India (other than the State of Jammu & Kashmir, and the Union Territories specified in (e) below);

(0) Any corporation established by or under a Central, State or Provincial Act;

(©) Any institution, association or body declared by the Board to be 2 company under section 2(17) of

the Act:

(d) In the case of Jammu & Kashmir, any company formed and registered under any law for the time

being in force in that State; and

(@) In the case of any of the Union Territories of Dadra and Nagar Haveli, Daman and Diu and

Pondicherry, a company formed and rogistored undor any law for tho time being in force in that

Union Territory;

Provided that the registered or as the case may be, principal office of the company, corporation, institution,

association or bedy in all cases is in India.

DOMESTIC COMPANY

Section 2(22A) defines domestic company as an Indian company or any other company which, in respect of

its income Fable to tax under the Income-tax Act, has made the prescribed arrangements for the declaration

and payment within India, of the dividends (including dividends on preference shares) payable out of such

‘Thus, all Indian companies are domestic companies. However, 2 nor-Indian company would be a domestic

‘company only if it makes the following prescribed arrangements for the declaration and payment of dividends

in Inia:

{@) The share register of the company concerned, forall its shareholders, shall be regularly maintained

at its principal place of business within india in respect of any assessment year from a date not later

than the tirst day of April of such year:

(©) The general meeting for passing the accounts of the previous year relevant to the assessment year

declaring any dividends in respect therect shall be held only at a place within India;

(c) The dividends deciared, if any, shall be payable only within India to all shareho\ders.

FOREIGN COMPANY

Section 2(23A) dafines foreign company as a company which is not a domestic company. However, all non-

Indian companies are not foreign companies as a non-indian company can be a domestic company it it

makes the above-mentioned prescribed arrangements for the declaration and payment of dividends in India.

COMPANY IN WHICH PUBLIC ARE SUBSTANTIALLY INTERESTED (A WIDELY HELD

COMPANY)

‘As per Section 2(18), a company is said to be one in which public are cubstantially interestedin the following

‘cases, namely:

() tfitis a company owned ty the Government or RBI or in which at least 40% cf the shares, whether

singly or taken togeiner, are nel by the Government or FEI of 2 corporation owned by FEI; or

(i) Ititis @ company registered under Section 25 of the Companies Act, 1956"; or

(i) 1 itis a company, having no share capital and if, having regard to its objects, the nature and

Compesition of is membership and other relevant considerations, itis declared by an order of the

Central Board of Direct Taxes (CBDT) 10 be a company in which the public are substantially

interested:

() If itis 2 company which cauties on its 2s is principal business, the business of acceptance of

doposts from its membors ard which is declared by tho Central Government undar Soction 620A of

th Companiss act, 1956" to bo a Nidh or Mutual Bonoft Sociaty; or

() Itt is company in wnich shares carrying atleast 50% ot ihe voing power nave been allotted

‘unconditionally to or aequited uncondlionaly by, and are troughout the relevant previous year

beneficially held by, one oF more cooperative soceties; oF

(wi itis company which is not a private company as defined in Section cf the Companies Act, 1956”

‘and equity shares cf the compary were, as on the last day ofthe relevant previous year, listed in a

recognised siock exchange in India;

(vi) itis a company which is not a private company and the shares in the company (other then

preierence shares) carrying atleast 50% (40% in case of an Industrial company) ofthe voting power

have been alloted unconditionally to, oF acquited unconditionally by, and were throughout the

relevant aocountng year benefically held by (a) Government, or (b) a corporation establishment by

a Ceniral or State or Provincial Act, or (¢) ary company in which the public are substantialy

interested or a wholy owned subsidiary company.

‘CLOSELY HELD COMPANY

‘A Company in which the Publics not substantially nterestedis known as a closely held company.

‘The dstincton between 2 closey held and widely held company is significant rom the following viewpoints

Section 220\(e) which deems certain payments as dividend is appicable only to the shareholders

of a cbsely held company; and

i) A closely held company is allowed o cary forward its business lesses only if the conditions

specified in secton79 are satisied

DES

Incidence of tax depends upon the residential status of @ person. A company may be resident or non-

resident in Indi.

|As per Section (3), a company is resident in India in any previous year, i

(@ tis an indian company; or

(during that year, POEM is situated wholly in India;

From Assessment Year 2017-18 a foreign company will be resident in India if its Place of Effective

Management (POEM) during the previous year is in India. For this purpose, the Place of Effective

Management means a place where Key management and commercial decisions that are necessary for the

‘conduct of the business of an entity as a whole are, in substance are mace

‘Therefore if any of the above two tests is not satisfied, the company would be a non-resident in India during

that previous yea.

‘According to Section 5(1) of the Act, the total income of a resident company would consist ot

(© Income received oF deemed to be received in India during the previous year by or on behalf of such

‘company; or

(Income which accrues or arises or is deemed to accrue or arises to it in India ducing the previous

year; or

(Income which accrues or arises fo it outside India during the previous year,

Under Section 5(2) ofthe Act, the total income of a nor-esident company would consist of

(@ Income received or deemed to be received in India during the previous year by or on behalf of such

company; oF

(Income which accrues or atises or is deemed to accrue or aries to it in India during the previous

year,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 2018-19 Feedback ReportsDocument3 pages2018-19 Feedback ReportsShankar ReddyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- National Corporate Governance PolicyDocument25 pagesNational Corporate Governance PolicyNandan MaluNo ratings yet

- 3056 - Government First Grade College, Halebeedu Internal Marks - Dec 2019Document11 pages3056 - Government First Grade College, Halebeedu Internal Marks - Dec 2019Shankar ReddyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Concept of Indirect Tax in IndiaDocument16 pagesConcept of Indirect Tax in IndiaShankar ReddyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 2019-20 FB Report and APDocument18 pages2019-20 FB Report and APShankar ReddyNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Emerging Trends in Digital MarketingDocument18 pagesEmerging Trends in Digital MarketingShankar ReddyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- CTP-5 Ans PDFDocument54 pagesCTP-5 Ans PDFShankar ReddyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- InsuranceDocument58 pagesInsuranceShankar ReddyNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- BRM - SyllabusDocument1 pageBRM - SyllabusShankar ReddyNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Designing A Global Financing StrategyDocument23 pagesDesigning A Global Financing StrategyShankar ReddyNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Syll 2015-16Document40 pagesSyll 2015-16yathishaNo ratings yet

- Ifm - TheoremsDocument7 pagesIfm - TheoremsShankar ReddyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- QP 2 PDFDocument7 pagesQP 2 PDFShankar ReddyNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Calender of EventsDocument89 pagesCalender of EventsShankar ReddyNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Calender of EventsDocument89 pagesCalender of EventsShankar ReddyNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- GST - Practice Pointer IssuesDocument58 pagesGST - Practice Pointer IssuesShankar ReddyNo ratings yet

- Capital StructureDocument14 pagesCapital StructureShankar ReddyNo ratings yet

- Present Value TablesDocument2 pagesPresent Value TablesFreelansir100% (1)

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyNo ratings yet

- Calender of Events PDFDocument3 pagesCalender of Events PDFShankar ReddyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- List of Chapters: SL No Chapters NumbersDocument4 pagesList of Chapters: SL No Chapters NumbersShankar ReddyNo ratings yet

- NPV Versus IrrDocument5 pagesNPV Versus IrrAmitNo ratings yet

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BBM Course Curriculum and Syllabus-2014!11!1Document23 pagesBBM Course Curriculum and Syllabus-2014!11!1darshanNo ratings yet

- Benefits of GST To The Indian EconomyDocument6 pagesBenefits of GST To The Indian EconomyShankar ReddyNo ratings yet

- First Case Law On GSTDocument4 pagesFirst Case Law On GSTShankar ReddyNo ratings yet

- 01Document126 pages01Shankar ReddyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- MIS006: Form KFC 62 B: Hosakote 2016-2017 01 - Government FebruaryDocument2 pagesMIS006: Form KFC 62 B: Hosakote 2016-2017 01 - Government FebruaryShankar ReddyNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)