Professional Documents

Culture Documents

Insecticides India

Uploaded by

Neeraj KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insecticides India

Uploaded by

Neeraj KumarCopyright:

Available Formats

INSECTICIDES INDIA LTD

2 INSECTICIDES INDIA RESEARCH REPORT

INSTITUTONAL EQUITY RESEARCH

JUNE 2017

INSECTICIDES INDIA LTD

Research Report________________________________

BUY

Company description

KEY STOCK DATA

Insecticides India made a foray into the Indian Agricultural space in 2002,

today Insecticides India is one of the premier names in the Crop protection SHARE PRICE 675

Industry. The company has more than 120 formulation products and 15

technical products. Insecticides (India) manufactures all types of insecticides, TARGET PRICE 965

weedicides, fungicides and PGRs for all types of crops and household.

The company has Tie ups with Nissan Chemical Industries Limited, Japan for MARKET CAP 1400 Cr

products like Pulsor and Hakama and technical collaboration with AMVAC,

USA for Products like Thimet and Nuvan corroborate our efforts to make 52 WEEK HIGH 717

agriculture rewarding for Indian Farmers. The company has a Tractor Brand

Range of products like Lethal, Victor, Thimet, Monocil, Nuvan, Xplode, Hijack, 52 WEEK LOW 419.5

Pulsor and Hakama are the choicest brands of every farmer. Another feather

in the cap is the state of the art R&D facility in India, in Joint Venture with a STOCK PERFORMANCE

Japanese company OAT Agrio Co., Ltd. with an objective to invent new agro

chemical molecules for India and global markets. The company has a state of 3M 12M 3YR

the art R&D facility in India and a Joint Venture with OAT Agrio Co, with an

objective to invent new agro chemical molecules for India and global markets.

The company has 5 state-of-the-art ultra-modern Formulation plants, 2 multi ABSOLUTE (%) 22.23 48.6 37.13

stream Technical Plants and 24 depots spread across the length and breadth

of the country, making it possible to make the products reach its end

RELATIVE (%) 10.67 11.99 20.03

consumers. Another major strength are the company’s channel partners

which include about 4800 distributors and 60000 dealers, who have always

formed the face of the company and played a vital role in smooth operations

of the company.

OWNERSHIP DETAILS

13% PROMOTERS

5%

13%

DII's

69%

FII's

SIGNAL2NOISE CAPITAL PARTNERS Page 2

3 INSECTICIDES INDIA RESEARCH REPORT

AGRICULTURE INDUSTRY OVERVIEW

The Agriculture Industry in our country is changing, the industry is becoming cereal centric and as a result more regionally biased

and input intensive. Rapid Industrialization and climate change have raised the scarcity value of land and water. There is an a higher

protein consumption as a result of evolving dietary patterns. According to a UN study, by the year 2022, India will surpass China to

become the most populous nation in the world. India currently supports approximately 18% of the world population with 2.4% of

the land resources and 4% of the water resources. It is also worth noting that 15-25% of potential crop production is lost due to

Insecticides pests, weeds and diseases. The amount of pulses and oilseeds imported remains high and cannot be sustained. Self-

sufficiency is the long term solution. All this leads us to the conclusion that the Indian farmers have to look to improve efficiency,

especially in relation to water via micro irrigation, prioritizing the cultivation of less water intensive crops, especially pulses and oil-

seeds, supported by a favorable Minimum Support Price (MSP) regime that incorporates the full social benefits of producing such

crops and backed by a strengthened procurement system; and re-invigorating agricultural research and extension in these crops.

GDP of agriculture and allied sectors in India was recorded at USD244.74 billion in FY16

According to the advanced estimates of MOSPI, agriculture and allied sector recorded a CAGR rise of 6.64 per cent during

FY07-16

Agriculture is the primary source of livelihood for about 58 per cent of India’s population

Source: IBEF

SIGNAL2NOISE CAPITAL PARTNERS Page 3

4 INSECTICIDES INDIA RESEARCH REPORT

The Key challenges for the Agriculture Industry are

1. High Monsoon Dependency

In India three-fifths of the land under cultivation is irrigated only by rainfall. A poor monsoon could hurt agriculture output and lead

to high food inflation.

2. Reduction in Arable Land

As per Indian agriculture census 2010-11, per capita arable land availability in India has consistently declined from ~0.34

ha in 1950s to ~0.15 ha in 2000s. With rising population it is further expected to reduce to ~ 0.07 ha by 2030.

3. Decreasing Farm Sizes

As per Indian agriculture census 2010-11, the average size of operational holding in India has declined from 1.23 ha in

2005-06 to 1.16 ha in 2010-11. The 2011 Census of India indicates that 85% of farms are less than two hectares in size.

While the average size of landholding is decreasing the number of operational holdings is increasing leading to poor

harvest and low incomes for the farmers.

4. Increasing Pest Attacks

The total number of pests attacking major crops has increased significantly from 1940s. For instance, the number of pests

which are harmful for crops such as rice has increased from 10 to 17 whereas for wheat have increased from 2 to 19

respectively. The increased damage to crops from pests and subsequent losses poses a serious threat to food security

and further underscores the importance of agrochemicals. The most recent example is the large scale whitefly infestation

of Bt cotton crop in North India last year. Due to this, cotton area in Punjab & Haryana has declined by 27% to 7.56 lakh

hectares in this year (FY 17 crop year) as farmers shifted to other crops after incurring huge losses owing to whitefly pest

attack.

5. Low per Hectare Yield

As per World Bank statistics for FY14, per hectare yield in India is amongst the lowest.Yields in India stand at 3 tons/ha

compared to the global average of 4 tons/ha. Developed countries like USA (7), UK (7), France (7.5) and Germany (7) are

able to achieve higher per hectare yields than India due to better farming practices.

SIGNAL2NOISE CAPITAL PARTNERS Page 4

5 INSECTICIDES INDIA RESEARCH REPORT

AGROCHEMICAL INDUSTRY OVERVIEW

India is the fourth largest global producer of agrochemicals after the US, Japan and China. This segment generated a value

of USD 4.4 billion in FY15 and is expected to grow at 7.5% per annum to reach USD 6.3 billion by FY20. Approximately 50%

of the demand comes from domestic consumers and the rest from exports. During the same period, the domestic demand

is expected to grow at 6.5% per annum and exports at 9% per annum. Indian agrochemicals market will be driven by growth

in herbicides and fungicides, increasing awareness towards judicious use of agrochemicals, contract manufacturing and

export opportunities.

At present, per hectare consumption of pesticides in India is amongst the lowest in the world and stands at 0.6 kg/ha

against 5-7 kg/ha in the UK and ~ 13 kg/ha in China. With the increase in awareness and market penetration, consumption

is likely to improve in the near future. Still there are challenges like non genuine products, low focus on R&D by domestic

manufacturers, inefficiencies in the supply chain etc.which need to be addressed on priority. The Indian crop protection

market is dominated by Insecticides, which form almost 60% of domestic crop protection

chemicals market. The major applications are found in rice and cotton crops. Fungicides and Herbicides are the largest

growing segments accounting for 18% and 16% respectively of total crop protection chemicals market respectively. As the

weeds grow in damp and warm weather and die in cold seasons, the sale of herbicides is seasonal. Rice and wheat crops are

the major application areas for herbicides. Increasing labor costs and labor shortage are key growth drivers for herbicides.

The fungicides find application in fruits, vegetables and rice. The key growth drivers for fungicides include a shift in

agriculture from cash crops to fruits and vegetables and government support for exports of fruits and vegetables.

Biopesticides include all biological materials organisms, which can be used to control pests. Currently bio- pesticides

constitute only 3% of Indian crop protection market; however there are significant growth opportunities for this product

segment due to increasing concerns of safety and toxicity of pesticides, stringent regulations and government support.

KEY GROWTH DRIVERS

The export of pesticides from India has seen a strong growth over the last few years. Globally, India is the thirteenth largest exporter

of pesticides. Most of the exports are off-patent products. The major exports from India happen to Brazil, USA, France and

Netherlands. The key growth drivers are India’s capability in low cost manufacturing, availability of technically trained manpower,

seasonal domestic demand, overcapacity, better price realization globally and strong presence in generic pesticide manufacturing

(India has process technologies for more than 60 generic molecules). Due to the reasons mentioned above, India offers good scope

for contract manufacturing as well. Agrochemicals worth USD 4.1 billion are expected to go off-patent by 2020. This provides

significant export opportunities for Indian companies which have expertise in generic segment. Top 6 importing nations constitute

only 44% of India’s agrochemical exports. This also indicates export potential for Indian companies. In order to build a strong export

base, companies could set up marketing offices in association with domestic players in export geographies. Companies could also

look for strategicalliances with local companies to expand their marketing and distribution reach. Merger and acquisition

opportunities could also be explored to increase their global presence.

Growth in Herbicides and Fungicides

Labor shortage, rising labor costs and growth in GM crops has led to growth in the use of herbicides. The herbicide consumption in

India stands at 0.4 USD billion in FY15 and is expected to grow at a CAGR of 15% over the next five years to reach ~0.8USD billion by

FY20. On the other hand the fungicide industry in India has grown due to the growth in Indian horticulture industry, which has

grown at a CAGR of 7.5% over the last five years.

Low Consumption of Pesticides in India

The per hectare consumption of pesticides in India is amongst the lowest in the world and currently stands at 0.6 kg/ha against 5-7

kg/ha in the UK and at almost 20 times ~ 13 kg/ha in China . In order to increase yield and ensure food security for its enormous

population agrochemicals penetration in India is bound to go up.

SIGNAL2NOISE CAPITAL PARTNERS Page 5

6 INSECTICIDES INDIA RESEARCH REPORT

The Other Growth Drivers are

Formation of Farmer Producer Organizations (FPOs) to counter the difficulties faced due to land fragmentation

Availability and dissemination of appropriate technologies that depend on quality of research and extent of skill

Development

Plan expenditure on agriculture and in infrastructure which together with policy must aim to improve functioning of

markets and more efficient use of natural resources

Governance in terms of institutions that make possible better delivery of services like credit, animal health and of quality

inputs like seeds, fertilizers, pesticides and farm machinery.

INVESTMENT THESIS

Promising Agriculture Sector

The Agriculture sector is changing in several ways. It has become cereal Centric, regionally biased and Input investive. The dietary

patters are moving towards higher protein consumption. This has pushed farmers to become more efficient. There is a requirement

to get more from less, especially in regions related to water via micro irrigation. In FY2016, total food grain production in India was

recorded at 253.16 million tonnes, which increased to 273.83 million tonnes in FY17. We believe that all these factors will push

farmers to protect their crops more with the use of agrochemicals.

Source: IBEF

SIGNAL2NOISE CAPITAL PARTNERS Page 6

7 INSECTICIDES INDIA RESEARCH REPORT

Export Driven Growth

The export of pesticides from India has seen a strong growth over the last few years. Globally, India is the thirteenth largest

exporter of pesticides. The major exports from India happen to Brazil, USA, France and Netherlands. The key growth drivers are

India’s capability in low cost manufacturing, availability of technically trained manpower, seasonal domestic demand, overcapacity,

better price realization globally and strong presence in generic pesticide manufacturing (India has process technologies for more

than 60 generic molecules). Due to the reasons mentioned above, India offers good scope for contract manufacturing as well.

grochemicals worth USD 4.1 billion are expected to go off-patent by 2020. This provides significant export opportunities for Indian

companies which have expertise in generic segment. Top 6 importing nations constitute only 44% of India’s agrochemical exports.

This also indicates export potential for Indian companies.

Source: IBEF

Positive Government Initiatives

The government has undertaken several schemes to aid the agriculture sector. Schemes like the Paramparagat Krishi

Vikas Yojana scheme promote the use of organic farming. This scheme will promote the use of chemical fertilizers which will

generate top line growth for the company. The image below shows details of various other schemes which have been introduced by

the government that will be beneficial for the company.

SIGNAL2NOISE CAPITAL PARTNERS Page 7

8 INSECTICIDES INDIA RESEARCH REPORT

Source: IBEF

Underpenetrated Market and Increasing Pest Attacks

The total number of pests attacking major crops has increased significantly from 1940s. For instance, the number of pests which are

harmful for crops such as rice has increased from 10 to 17 whereas for wheat have increased from 2 to 19 respectively. The

increased damage to crops from pests and subsequent losses poses a serious threat to food security and further underscores the

importance of agrochemicals. The most recent example is the large scale whitefly infestation of Bt cotton crop in North India last

year. Due to this, cotton area in Punjab & Haryana has declined by 27% to 7.56 lakh hectares in this year (FY 17 crop year) as farmers

shifted to other crops after incurring huge losses owing to whitefly pest attack. A study by industry body Assocham said that Indian

farmers lose crop worth Rs 50,000 crore annually due to pest and disease infestation . This coupled with the fact that India, despite

being the fourth largest producer of agrochemicals globally, after the US, Japan and China, the usage of agrochemicals in India

stands is actually very low. The usage stands at 0.58 Kg per Hectare against 4.5 Kg per Hectare in the United States and as high as

10.8 Kg per Hectare. The world Average being close to 3 Kg per Hectare. These two factors bode very well for the company and

would translate into high growth in the years to come.

SIGNAL2NOISE CAPITAL PARTNERS Page 8

9 INSECTICIDES INDIA RESEARCH REPORT

Low per Hectare yield and Decreasing farm sizes

According to the World Bank Statistics in FY 2014, the per Hectare yields in India stand at 3 tons/ha compared to the global average

of 4 tons/ha, with developed countries able to generate far higher much higher Yields. We believe that the yield should move more

towards the global average, with more agrochemicals being employed.

Global Tons per Hectare Output

7.5

8 7 7 7

7

6 4

5

4 3 Yield/ha

3

2

1

0

India Global USA UK France Germany

Average

Source: Company Annual Report

Growth in Herbicide and Fungicide usage

The Indian market is different from the Global Industry in terms of its consumption patterns. Globally Herbicides constitute about

44% of the crop protection market, whereas in India forms only about 16%. We believe that rising labor costs, growth in GM crops

will lead to growth in herbicide use. We expect this segment to grow at a CAGR of 15% over the next five years to reach a size of

about 800 Million USD. The fungicide market which forms only about 15% of the Indian market stands at 27% at a global level. We

believe that the Indian Horticulture Industry will drive the fungicide market and this segment will grow at a CAGR of 7.5%.

SIGNAL2NOISE CAPITAL PARTNERS Page 9

10 INSECTICIDES INDIA RESEARCH REPORT

KEY RISKS AND CONCERNS

Stringent regulations

Stringent environmental regulations across the world are increasing the cost of developing new products and simultaneously

delaying the introduction of new products in the market. For instance, in the European Union any agrochemical product if

found to be mutagenic, carcinogenic or classified as an endocrine disruptor would not achieve registration or re-registration

irrespective of the level of exposure generated.

Low focus on R&D by domestic manufacturers:

R&D for novel molecule discovery requires huge capital and manpower investments. Indian Companies spend only 1-2% of their

revenues in Research and Development as against the global MNCs which invest about 8-10% of their revenues. This makes Indian

manufacturers uncompetitive globally in specialty molecules.

Lack of education and awareness among farmers

It is important to educate the farmers about the appropriate kind of pesticide, its dosage and quantity and application frequency.

However it is not easy to reach the farmers owing to differences in regional languages and dialects and a general inertia towards

adoption of newer products on account of possible risks of crop failure.

Need for efficient distribution systems

The large number of end users and the predominantly generic nature of the market make it essential to have a strong and efficient

distribution network for the crop protection market. However, the industry has been plagued by problems arising out of supply

chain inefficiencies and inadequate infrastructure which result in postharvest losses estimated at INR 45,000 crore every year. Lack

of efficient distribution system also makes it difficult for agrochemical companies to reach out to the farmers and promote their

products and educate them about their benefits.

Shift To Genetically Modified Crops

Many Developed Countries have reduced the usage of Insecticides by shifting instead to Genetically Modified crops. If these

techniques are adopted by the Indian Agriculture Industry, it could translate to a hit in Income to the company.

VALUATION

The company trades at a PE of around 24, which is around its historic average. We do not predict and PE expansion for the company

moving forward. The company’s TTM Ebitda Margin is 10.34% , we expect the EBITDA to sustain at these levels moving forward. The

Gross margins are also to be maintained at around 10%. The main driver for the valuation is the expansion in the company’s market

share from about 6% currently to upwards of 9% by FY 2018.

We expect the Revenue to grow at a CAGR of 20.36%, with these growth being driven by an expanding agrochemical sector. We

expect the agrochemical sector to grow to a size of 27,000 Cr by FY 2022. This growth can be segmented into the domestic and

global agrochemical sectors. The Domestic and global markets are expected to grow at 9% CAGR.

We have a BUY recommendation on the stock with a Target price of 965, that is an upside of about 43%.

SIGNAL2NOISE CAPITAL PARTNERS Page 10

11 INSECTICIDES INDIA RESEARCH REPORT

Revenue Break-up

2797

3000.00

2553

2331

2500.00 2128

1942

2000.00 Net Profit

Depreciation

1500.00 1108 Interest

Tax

1000.00 Expenses

500.00

0.00

TTM 2017-18E 2018-19E 2019-20E 2020-21E 2021-22 E

Source: Company Annual Reports

SIGNAL2NOISE CAPITAL PARTNERS Page 11

12 INSECTICIDES INDIA RESEARCH REPORT

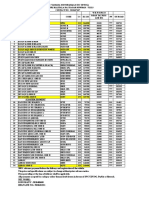

FINANCIALS SUMMARY

BALANCE SHEET

Narration 31-Mar-12 31-Mar-13 31-Mar-14 31-Mar-15 31-Mar-16

Equity Share Capital 12.68 12.68 12.68 12.68 20.67

Reserves 169.48 199.54 233.87 278.73 388.23

Borrowings 158.55 211.32 258.01 321.61 205.59

Other Liabilities 179.58 208.60 286.81 307.74 322.01

Total 520.29 632.14 791.37 920.76 936.50

Net Block 51.25 140.35 170.08 204.71 193.95

Capital Work in 91.97 44.87 54.20 37.65 51.23

Progress

Investments 0.00 0.00 11.09 11.09 11.09

Other Assets 377.07 446.92 556.00 667.31 680.23

Total 520.29 632.14 791.37 920.76 936.50

Working Capital 197.49 238.32 269.19 359.57 358.22

Debtors 89.21 116.51 127.87 166.81 207.64

Inventory 202.42 225.35 311.66 391.40 350.60

Debtor Days 62.41 68.96 54.01 63.15 76.70

Inventory Turnover 2.58 2.74 2.77 2.46 2.82

Return on Equity 18% 17% 16% 19% 10%

Return on Capital Emp 18% 14% 15% 16% 12%

SIGNAL2NOISE CAPITAL PARTNERS Page 12

13 INSECTICIDES INDIA RESEARCH REPORT

PROFIT AND LOSS STATEMENT

P&L Statement Mar-13 Mar-14 Mar-15 Mar-16 Trailing

Sales 616.68 864.08 964.19 988.15 1107.38

Expenses 547.36 782.31 853.13 897.03 993.44

Operating Profit 69.32 81.77 111.06 91.12 113.94

Other Income 0.21 0.45 0.44 0.56 0.55

Depreciation 5.76 6.66 14.17 15.93 15.96

Interest 17.35 26.91 33.16 25.88 18.54

Profit before tax 46.40 48.65 64.16 49.88 79.99

Tax 11.08 8.71 9.32 10.60 21.85

Net profit 35.32 39.94 54.84 39.29 58.14

EPS 27.85 31.49 43.24 19.01 28.13

Price to earning 9.86 5.48 12.44 20.34 24.08

Price 274.45 172.64 538.06 386.59 677.30

RATIOS:

Dividend Payout 10.76% 9.51% 0.00% 10.51%

OPM 11.24% 9.46% 11.52% 9.22% 10.29%

CASH FLOW STATEMENT

Cash Flow Statement Mar-12 Mar-13 Mar-14 Mar-15 Mar-16

Cash from Operating -35.91 -1.33 37.66 -5.73 84.54

Activity

Cash from Investing Activity -55.00 -46.45 -56.75 -32.78 -18.76

Cash from Financing Activity 104.92 34.72 23.43 36.04 -62.86

Net Cash Flow 14.01 -13.06 4.34 -2.48 2.92

PEER COMPARISON

SIGNAL2NOISE CAPITAL PARTNERS Page 13

14 INSECTICIDES INDIA RESEARCH REPORT

DISCLAIMER

Trading and investing in stocks and commodities is a risk involving activity and thus has its own share of risk. Sincere efforts have

been made to present the right investment perspective and thus the information contained herein is based on the analysis and the

sources that we consider reliable. However, any action you choose to take in the markets is totally your own responsibility.

Signal2noise will not be liable for any, direct or indirect, consequential or incidental damages or loss arising out of the use of the

information given in the website, phone or through SMS. Signal2noise has taken due care and caution in compilation of data for its

web site. The views and investment tips expressed by investment experts on Signal2noise are their own, and not that of the website

or its management. Signal2noise advises users to check with certified experts before taking any investment decision. However,

Signal2noise does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or

omissions or for the results obtained from the use of such information. Signal2noise especially states that it has no financial liability

whatsoever to any user on account of the use of information provided on its website. There are risks associated with utilizing

internet and short messaging system (sms) based information and research dissemination services. Subscribers are advised to

understand that the services can fail due to failure of hardware, software, and Internet connection. While we ensure that the

messages are delivered in time to the subscribers Mobile Network, the delivery of these messages to the customer’s mobile

phone/handset is the responsibility of the customer’s Mobile Network. SMS may be delayed or not delivered to the customer’s

mobile phone/handset on certain days, owing to technical reasons that can only be addressed by the customer’s Mobile Network,

and Signal2noise and its employees cannot be held responsible for the same in any case.

SIGNAL2NOISE CAPITAL PARTNERS Page 14

You might also like

- Tata Motors: India - AutomobilesDocument7 pagesTata Motors: India - AutomobilesNeeraj KumarNo ratings yet

- Ceat LTD: India - Auto AncillariesDocument13 pagesCeat LTD: India - Auto AncillariesNeeraj KumarNo ratings yet

- Varshini EquityresearchusingtechnicalanalysisDocument10 pagesVarshini EquityresearchusingtechnicalanalysisNeeraj KumarNo ratings yet

- Dewan Housing Finance LimitedDocument12 pagesDewan Housing Finance LimitedNeeraj KumarNo ratings yet

- Value Guard Signal Package: 1-2 Techno Funda Calls/MonthDocument1 pageValue Guard Signal Package: 1-2 Techno Funda Calls/MonthNeeraj KumarNo ratings yet

- Avanti Feeds Research ReportDocument9 pagesAvanti Feeds Research ReportNeeraj KumarNo ratings yet

- Fra PDFDocument27 pagesFra PDFNeeraj KumarNo ratings yet

- NISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFDocument40 pagesNISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFNeeraj Kumar100% (6)

- Financial Statement AnalysisDocument53 pagesFinancial Statement AnalysisNeeraj KumarNo ratings yet

- Safal Niveshak Stock Analysis Excel Version 4.0Document37 pagesSafal Niveshak Stock Analysis Excel Version 4.0Neeraj KumarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Management AccountingDocument2 pagesManagement AccountingVampire0% (1)

- VP Institutional Asset Management in Washington DC Resume Lisa DrazinDocument3 pagesVP Institutional Asset Management in Washington DC Resume Lisa DrazinLisaDrazinNo ratings yet

- Bba2 Eco2 Asg 2023 PDFDocument6 pagesBba2 Eco2 Asg 2023 PDFIzelle Ross GreenNo ratings yet

- Charles P. Jones, Investments: Analysis and Management, 12th Edition, John Wiley & SonsDocument19 pagesCharles P. Jones, Investments: Analysis and Management, 12th Edition, John Wiley & Sonssarah123No ratings yet

- International Business and Trade: Tony Angelo C. AlvaranDocument40 pagesInternational Business and Trade: Tony Angelo C. AlvaranKutoo BayNo ratings yet

- Minor ProjectDocument33 pagesMinor ProjectParth KhannaNo ratings yet

- Team NCL Ibs - NewDocument117 pagesTeam NCL Ibs - Newskaal1989No ratings yet

- Plug Power GenDrive™ Fuel Cells Support Green OperationsDocument1 pagePlug Power GenDrive™ Fuel Cells Support Green OperationsI. SANCHEZNo ratings yet

- Exam Guide - 416 - Kinetic Purchasing ManagementDocument9 pagesExam Guide - 416 - Kinetic Purchasing ManagementPiyush KhalateNo ratings yet

- Internship Report of YamahaDocument46 pagesInternship Report of YamahaSurya PrakashNo ratings yet

- Comprehensive Bike Insurance PolicyDocument2 pagesComprehensive Bike Insurance PolicyGodwin LoboNo ratings yet

- ZENITH Fábrica en ShangháiDocument24 pagesZENITH Fábrica en ShangháiJoseIsaacRamirezNo ratings yet

- Assembly - June 2017Document84 pagesAssembly - June 2017Varun KumarNo ratings yet

- Lesson 1 RIGHT OF APPRAISALDocument6 pagesLesson 1 RIGHT OF APPRAISALDi CanNo ratings yet

- 0-Updated-BR100 INV ALSACDocument110 pages0-Updated-BR100 INV ALSACVenkata SubramanyaNo ratings yet

- D155: Demo of Hse Document KitDocument8 pagesD155: Demo of Hse Document Kitfaroz khanNo ratings yet

- Litio GeotermaDocument10 pagesLitio GeotermaLucas CuezzoNo ratings yet

- Acc Quiz Class 12thDocument3 pagesAcc Quiz Class 12thTilak DudejaNo ratings yet

- Eccouncil: Exam 712-50Document10 pagesEccouncil: Exam 712-50shenyanNo ratings yet

- UntitledDocument1 pageUntitledReplacement AccountNo ratings yet

- CLC Byo Treasurers ReportDocument3 pagesCLC Byo Treasurers ReportAndrew May NcubeNo ratings yet

- Reasons For Not Getting A COVID-19 Vaccine.Document536 pagesReasons For Not Getting A COVID-19 Vaccine.Frank MaradiagaNo ratings yet

- Subenji Offer Letter FinalDocument2 pagesSubenji Offer Letter FinalAbhijith M WarrierNo ratings yet

- Consumer SurveyDocument18 pagesConsumer SurveyJahnvi DoshiNo ratings yet

- Case Study EHL Marked PDFDocument7 pagesCase Study EHL Marked PDFAsif IqbalNo ratings yet

- Abcaus - in-CBDT Instruction-Seized Assets Other Than Cash ReleaseDocument3 pagesAbcaus - in-CBDT Instruction-Seized Assets Other Than Cash Releasebaviv70579No ratings yet

- Feasib Articles of PartnershipDocument3 pagesFeasib Articles of PartnershipSañon TravelsNo ratings yet

- International Financial Management - Geert Bekaert Robert Hodrick - Chap 01 - SolutionDocument4 pagesInternational Financial Management - Geert Bekaert Robert Hodrick - Chap 01 - SolutionFagbola Oluwatobi Omolaja100% (1)

- Do Electric Vehicles Need Subsidies - A Comparison of Ownership Costs For Conventional, Hybrid, and Electric VehiclesDocument40 pagesDo Electric Vehicles Need Subsidies - A Comparison of Ownership Costs For Conventional, Hybrid, and Electric VehiclesNikos KasimatisNo ratings yet

- Happy PetsDocument19 pagesHappy Petsjainil patel100% (1)