Professional Documents

Culture Documents

MOD LE Taxes: Transactions in Propert: Ltip E-Choi W R

Uploaded by

El Sayed AbdelgawwadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MOD LE Taxes: Transactions in Propert: Ltip E-Choi W R

Uploaded by

El Sayed AbdelgawwadCopyright:

Available Formats

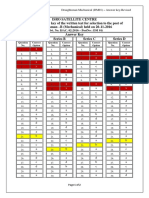

1.

d - - 1 MODULE

a - 34 TAXES:2 TRANSACTIONS

- c - - IN PROPERTY

4 a - - 5 - - 515

2 d - - 5.

161 - 9 c

30. 3.

44. c - - 7

58. c -

C - - - -

.3. c - - 17. c - - 31. d - - 45. c - - 59. c - -

MULTIPLE-CHOICE

- ANSWERS

4. b - - 18. d - - 32. a - 46. b - - , 60. b - -

5. c - - 19. d - - 33. a - - 47. b - - 61. b - -

6. b - - 20. d - - 34. b - - 48. b - - 62. a - -

7. b - - 21. b - - 35. c - - 49. d - -

8. b - - 22. c - - 36. a - - 50. a - -

9. d - - 23. d - - 37. c - - 51. b - -

10. b - - 24. c - - 38. a - - 52. a - -

11. c - - 25. a - - 39. b - - 53. b - -

12. c - - 26. b - - 40. d - - 54. a - -

13. d - - 27. b - - 41. d - - 55. d - - 1st: _/62 - %

14. b - - 28. a - - 42. b - - 56. a - - 2nd: =

~62= - %

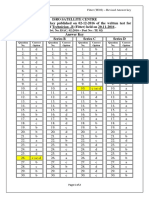

MULTIPLE-CHOICE ANSWER EXPLANATIONS

A.I. Basis of 6. (b) The requirement is to determine Ruth's holding

Property period for stock received as a gift. If property is received as

1. (d) The requirement is to determine Birch's tax ba- a gift, and the property's FMV on date of gift is used to de-

sis for the purchased-land and building. The basis of prop- termine a loss, the donee's holding period begins when the

erty acquired by purchase is a cost basis and includes not gift was received. Thus, Ruth's holding period starts in

only the cash paid and liabilities incurred, but also includes 2008.

certain settlement fees and closing costs such as abstract of

title fees, installation of utility services', legal fees (including 7. (b) The requirement is to determine the basis of the

title search, contract, and deed fees), recording fees, surveys, Liba stock if it is sold for $5,000. If property acquired by

transfer taxes, owner's title insurance, and any amounts the gift is sold at a gain, its basis is the donor's basis ($4,000),

seller owes that the buyer agrees to pay, such as back taxes increased by any gift tax paid attributable to the net ap-

and interest, recording or mortgage fees, charges for im- preciation in value of the gift ($0).

provements or repairs, and sales commissions. .

2. (d) The requirement is to determine the basis for the 8. (b) The requirement is to determine the basis of the

purchased land. The basis of the land consists of the cash Liba stock if it is sold for $2,000. If property acquired by

paid ($40,000), the purchase money mortgage ($50,000), gift is sold at a loss, its basis is the lesser of (1) its gain basis

and the cost of the title insurance policy ($200), a total of ($4,000 above), or (2) its FMV at date of gift ($3,000).

$90,200. 9. (d) The requirement is to determine the amount of

A.I.e. Acquired by Gift reportable gain orloss if the Liba stock is sold for $3,500.

No gain or loss is recognized on the sale of property ac-

3. (c) The requirement is to determine the amount of quired by gift if the basis for loss ($3,000) results in again

gain recognized by Thompson resulting from the sale of and the basis for gain ($4,000) results in a loss.

appreciated property received as a gift. A donee's basis for

appreciated property received as a gift is generally the same

as the donor's basis. Since Smith had a basis for the property A.I.d. Acquired from Deeedent

of $1,200 and Thompson sold the property for $2,500,

Thompson must recognize a gain of $1,300. 10. (b) The requirement is to determine the holding

period for stock received as a bequest from the estate of a

4. (b) The requirement is to determine Julie's basis for deceased uncle. Property received from a decedent is

the land received as a gift. A donee's basis for gift property deemed to be held long-term regardless of the actual period

is generally the same as the donor's basis, increased by any of time that the decedent or beneficiary actually held the

gift tax paid that is attributable to the property's net appre- property and is treated as held for more than twelve m0l!ths.

ciation in value. That is, the amount of gift tax that can be

added is limited to the amount that bears the same ratio as 11. (c) The requirement is to determine Ida's basis for

the property's net appreciation bears to the amount of tax- stock inherited from a decedent. The basis of property re-

able gift. For this purpose, the amount of gift is reduced by ceived from a decedent is generally the property's FMV at

any portion of the $13,000 annual exclusion that is allowable date of the decedent's death, or FMV on the alternate valua-

with respect to the gift. Thus, Julie's basis is $23,000 + tion date (six months after death). Since the executor of

[$14,000 ($83,000 - 23,000) / ($83,000 - $13,000)] = Zorri's estate elected to use the alternate valuation for estate

$35,000. tax purposes, the stock's basis to Ida is its $450,000 FMV

six months after Zorn's death.

5. (c) The requirement is to determine Ruth's recog-

NOTE: If the stock had been distributed to Ida within six

nized loss if she sells the stock received as a gift for $7,000. months of Zom's death, the stock's basis would be its FMVon

Since the stock's FMV ($8,000) was less than its basis date of distribution.

($10,000) at date of gift, Ruth's basis for computing a loss is

the stock's FMV of $8,000 at date of gift. As a result, 12. (c) The requirement is to determine Lois' basis for

Ruth's recognized loss is $8,000 - $7,000 = $1,000.

gain or loss on the sale of Elin stock acquired from a dece-

dent. Since the alternate valuation was elected for Prevor's

estate, but the stock was distributed to Lois within six

You might also like

- Scan 0068Document1 pageScan 0068Zeyad El-sayedNo ratings yet

- 2 Eptanc: C Offer C - Acc eDocument3 pages2 Eptanc: C Offer C - Acc eHazem El SayedNo ratings yet

- Scan 0001Document1 pageScan 0001El-Sayed MohammedNo ratings yet

- MCQ PRDocument1 pageMCQ PREl-Sayed MohammedNo ratings yet

- Module 21 Professional Responsi Ilities: MU EADocument1 pageModule 21 Professional Responsi Ilities: MU EAHazem El SayedNo ratings yet

- MCQ PRDocument1 pageMCQ PREl-Sayed MohammedNo ratings yet

- MOD LE T XES Gift and Estate: MUL E C CE N EDocument3 pagesMOD LE T XES Gift and Estate: MUL E C CE N EZeyad El-sayedNo ratings yet

- Secured Transactions: MU IP E C Ce A Swe SDocument1 pageSecured Transactions: MU IP E C Ce A Swe SHazem El SayedNo ratings yet

- NT T R L D: SalesDocument1 pageNT T R L D: SalesEl-Sayed MohammedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Oblicon AnswerDocument4 pagesOblicon AnswerJp CombisNo ratings yet

- ACCTNGDocument3 pagesACCTNGLynnie KimNo ratings yet

- Corporate Liquidation - 105Document3 pagesCorporate Liquidation - 105Lynnie KimNo ratings yet

- Commercial Paper: 4S. 3S. 2S. IS. SODocument3 pagesCommercial Paper: 4S. 3S. 2S. IS. SOEl-Sayed MohammedNo ratings yet

- 27Document3 pages27Carlo ParasNo ratings yet

- Quiz GR 9 p1Document4 pagesQuiz GR 9 p1Larry MofaNo ratings yet

- Cpar-Chapter 13: Current Liabilities and ContingenciesDocument37 pagesCpar-Chapter 13: Current Liabilities and ContingenciesJanine anzanoNo ratings yet

- Lembar Jawaban UAS BP2Document1 pageLembar Jawaban UAS BP2Apriyani DikaNo ratings yet

- ch13 CURRENT LIABILITIES AND CONTINGENCIES PDFDocument37 pagesch13 CURRENT LIABILITIES AND CONTINGENCIES PDFRenz AlconeraNo ratings yet

- Cpar-Chapter 13: Current Liabilities and ContingenciesDocument37 pagesCpar-Chapter 13: Current Liabilities and Contingenciesspur ious100% (1)

- Intermediate Accounting 1 Week AnswersDocument7 pagesIntermediate Accounting 1 Week Answersimsana minatozakiNo ratings yet

- Multiple Choice Answers: - ConceptualDocument1 pageMultiple Choice Answers: - ConceptualDing CostaNo ratings yet

- Multiple Choice AnswersDocument3 pagesMultiple Choice AnswersrenNo ratings yet

- Test 1Document7 pagesTest 1allancelis51No ratings yet

- MO ULE Taxes: Partne Ships: Multiple Choice AnswersDocument3 pagesMO ULE Taxes: Partne Ships: Multiple Choice AnswersZeyad El-sayedNo ratings yet

- 4Document3 pages4Carlo ParasNo ratings yet

- Pre Algebra Multiple ChoiceDocument24 pagesPre Algebra Multiple ChoiceRICHARD DINGALNo ratings yet

- Toaz - Info Chapter18doc PRDocument35 pagesToaz - Info Chapter18doc PRRoland CatubigNo ratings yet

- Home Based w7 8 Submission Next WeekDocument1 pageHome Based w7 8 Submission Next WeekJenny MctavishNo ratings yet

- Answer SheetDocument2 pagesAnswer Sheetvima.acostaNo ratings yet

- Find The Sine, Cosine, and Tangent of Angle TDocument2 pagesFind The Sine, Cosine, and Tangent of Angle TAngela PeligroNo ratings yet

- Test-1 GC Leong AnswerKey 1706012920346Document1 pageTest-1 GC Leong AnswerKey 1706012920346ishugautam777No ratings yet

- Evaluation 1 QuestionnairesDocument4 pagesEvaluation 1 QuestionnairesgregNo ratings yet

- Qa-Dm01 Key PDFDocument2 pagesQa-Dm01 Key PDFapugbcl.centralzoneNo ratings yet

- Test Bank Intermediate Accounting Ifrs Edition Volume 2 1st Edition KiesoDocument53 pagesTest Bank Intermediate Accounting Ifrs Edition Volume 2 1st Edition KiesoJason MalikNo ratings yet

- Math 9 Practice Final ExamDocument17 pagesMath 9 Practice Final ExamJessica Sarches NiñaNo ratings yet

- Board Exam 2016Document27 pagesBoard Exam 2016Bryan Miranda MacapinlacNo ratings yet

- Technician-B AnsDocument2 pagesTechnician-B Ansmana valanNo ratings yet

- C++ Question Test2Document1 pageC++ Question Test2Arindam MondalNo ratings yet

- Long-Term Liabilities: True-FalseDocument43 pagesLong-Term Liabilities: True-Falsespur iousNo ratings yet

- Kunci JAwabanDocument2 pagesKunci JAwabansdn 4kabatNo ratings yet

- Multiple Choice AnswersDocument4 pagesMultiple Choice AnswersCarlo ParasNo ratings yet

- PB Exam - AnswersDocument1 pagePB Exam - AnswersJazehl ValdezNo ratings yet

- CH 14Document35 pagesCH 14Shaneen AdorableNo ratings yet

- Long-Term Liabilities: True-FalseDocument42 pagesLong-Term Liabilities: True-FalseGrace Eva RosanaNo ratings yet

- Answer Key For Engineering Maths 1 MCQ QuestionsDocument4 pagesAnswer Key For Engineering Maths 1 MCQ QuestionsKIRUTHIKA V UCS20443No ratings yet

- Engineering Mathematics MCQ - Answer Key (20MA101)Document4 pagesEngineering Mathematics MCQ - Answer Key (20MA101)KIRUTHIKA V UCS20443No ratings yet

- Non Current Liabilities Test BankDocument38 pagesNon Current Liabilities Test BankRenzo Ramos100% (3)

- Isro Ans Key 2017 IIDocument1 pageIsro Ans Key 2017 IIjithinaravind007No ratings yet

- CH 14Document35 pagesCH 14Leila50% (2)

- GenMath Prelim ExamDocument4 pagesGenMath Prelim ExamJesamie Bactol SeriñoNo ratings yet

- Intermediate Accounting 14th Edition Kieso Test BankDocument25 pagesIntermediate Accounting 14th Edition Kieso Test BankReginaGallagherjkrb100% (58)

- Chapter 14 Test BankDocument44 pagesChapter 14 Test BankAlvin DantesNo ratings yet

- CH 14Document44 pagesCH 14tya theaNo ratings yet

- Long-Term Liabilities PDFDocument44 pagesLong-Term Liabilities PDFDiane Cris DuqueNo ratings yet

- PTS SMT Ganjil Kelas 6 MTKDocument6 pagesPTS SMT Ganjil Kelas 6 MTKMI Alhidayah MadiunNo ratings yet

- Chapter 14 Test Bank Test BankDocument45 pagesChapter 14 Test Bank Test Bankngan phanNo ratings yet

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- P L N L U N N T MP: Sarbanes-Ox Eyactof2 2Document2 pagesP L N L U N N T MP: Sarbanes-Ox Eyactof2 2El Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust LawDocument3 pagesFederal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Agency: I. Formation of The Agency RelationshipDocument7 pagesAgency: I. Formation of The Agency RelationshipEl Sayed AbdelgawwadNo ratings yet

- M Dule 22 Federal Securities Acts and Antitrust LawDocument2 pagesM Dule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Scan 0015Document2 pagesScan 0015El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Scan 0021Document2 pagesScan 0021El Sayed AbdelgawwadNo ratings yet

- Contracts: Over IDocument2 pagesContracts: Over IEl Sayed AbdelgawwadNo ratings yet

- C Ayton Act of 1914: Module 22 Fe E A SE UDocument2 pagesC Ayton Act of 1914: Module 22 Fe E A SE UEl Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust Law: C o C eDocument2 pagesFederal Securities Acts and Antitrust Law: C o C eEl Sayed AbdelgawwadNo ratings yet

- Cont A: R CTSDocument2 pagesCont A: R CTSEl Sayed AbdelgawwadNo ratings yet

- Scan 0020Document2 pagesScan 0020El Sayed AbdelgawwadNo ratings yet

- Scan 0003Document2 pagesScan 0003El Sayed AbdelgawwadNo ratings yet

- Contracts: D Still Owes CTDocument2 pagesContracts: D Still Owes CTEl Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- S S S T I E: ContractsDocument2 pagesS S S T I E: ContractsEl Sayed AbdelgawwadNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Ill LLQ J: ContractsDocument2 pagesIll LLQ J: ContractsEl Sayed AbdelgawwadNo ratings yet

- Cont Acts: G A A yDocument1 pageCont Acts: G A A yEl Sayed AbdelgawwadNo ratings yet

- Secured Transactions: FreezerDocument2 pagesSecured Transactions: FreezerEl Sayed AbdelgawwadNo ratings yet

- Scan 0007Document2 pagesScan 0007El Sayed AbdelgawwadNo ratings yet

- J .T/DTD: Tjrrji?"Document1 pageJ .T/DTD: Tjrrji?"El Sayed AbdelgawwadNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Priorities: Secu Ed TransactionsDocument2 pagesPriorities: Secu Ed TransactionsEl Sayed AbdelgawwadNo ratings yet

- Module 26 Secured Transactions:: o C, G eDocument2 pagesModule 26 Secured Transactions:: o C, G eEl Sayed AbdelgawwadNo ratings yet

- Module 26 Secured Transactions:: S G S C R eDocument2 pagesModule 26 Secured Transactions:: S G S C R eEl Sayed AbdelgawwadNo ratings yet

- Fi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsDocument2 pagesFi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsEl Sayed AbdelgawwadNo ratings yet

- Basis of Charge and Scope of TotalDocument24 pagesBasis of Charge and Scope of TotalSujithNo ratings yet

- ReceiptDocument1 pageReceiptPtesgNo ratings yet

- LD AccountDocument5 pagesLD AccountYandisa Ngaleka0% (1)

- Salaryslip - Soniya Dhull - For - February - 2023Document1 pageSalaryslip - Soniya Dhull - For - February - 2023Heer BatraNo ratings yet

- 1208payweek (1) JerryDocument1 page1208payweek (1) Jerryesteysi775No ratings yet

- Impact On IT Sector Related To BudgetDocument2 pagesImpact On IT Sector Related To BudgetAmruta SawantNo ratings yet

- Bill FaisalabadDocument2 pagesBill FaisalabadTech With UsNo ratings yet

- MBA 2nd SEM Sec B. Group 5Document20 pagesMBA 2nd SEM Sec B. Group 5Alexander PandyanNo ratings yet

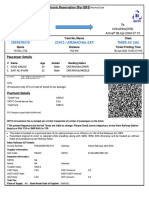

- Tez Ticket PrintDocument1 pageTez Ticket Printosama amjad.hy8ggNo ratings yet

- Boat Bassheads 242 Wired Headset: Grand Total 449.00Document1 pageBoat Bassheads 242 Wired Headset: Grand Total 449.00acaNo ratings yet

- Research Paper On GST PDFDocument2 pagesResearch Paper On GST PDFsamiullahNo ratings yet

- Soriano vs. Sec. of Finance G.R. No. 184550 Jan. 24, 2017Document3 pagesSoriano vs. Sec. of Finance G.R. No. 184550 Jan. 24, 2017Xavier BataanNo ratings yet

- Lurimar A. Raguini Tax Final ExamDocument45 pagesLurimar A. Raguini Tax Final Examfrance marie annNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document71 pagesFundamentals of Accountancy, Business and Management 2Carmina DongcayanNo ratings yet

- CIR vs. BPIDocument5 pagesCIR vs. BPImonalisacayabyabNo ratings yet

- Solution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesDocument5 pagesSolution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesThanhTrúcc100% (1)

- EY Tax Administration Is Going DigitalDocument12 pagesEY Tax Administration Is Going DigitalVahidin QerimiNo ratings yet

- CIR Vs LedesmaDocument2 pagesCIR Vs LedesmaAnonymous wvx7n36No ratings yet

- RR 4-99Document3 pagesRR 4-99matinikkiNo ratings yet

- Tax AssignmentDocument4 pagesTax AssignmentkaRan GUptД100% (1)

- Jawaban UAS Pajak Internasional 2Document4 pagesJawaban UAS Pajak Internasional 2Eko SiswantoNo ratings yet

- General Purpose Distribution Request FormDocument19 pagesGeneral Purpose Distribution Request FormWilliamNo ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- Part IV 2 Exclusion and Inclusion Regular Income TaxationDocument11 pagesPart IV 2 Exclusion and Inclusion Regular Income Taxationmary jhoyNo ratings yet

- Ongc Pension&mediDocument17 pagesOngc Pension&medidipti bhimNo ratings yet

- TAX-304 (VAT Compliance Requirements)Document4 pagesTAX-304 (VAT Compliance Requirements)Ryan AllanicNo ratings yet

- PDF Projected Income Statement and Balance SheetDocument4 pagesPDF Projected Income Statement and Balance Sheetnavie VNo ratings yet

- lIST OF sEPARATEDDocument15 pageslIST OF sEPARATEDBhing Rebustis MedidaNo ratings yet

- R&D Expenses: Despite Establishing New Facilities With Updated Technologies, R&D Expenses Have Not Been ExplicitlyDocument1 pageR&D Expenses: Despite Establishing New Facilities With Updated Technologies, R&D Expenses Have Not Been ExplicitlyAmarjeet SinghNo ratings yet

- Tax Answers - Chapter 6Document55 pagesTax Answers - Chapter 6Jonathan Vela100% (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- The Value of a Whale: On the Illusions of Green CapitalismFrom EverandThe Value of a Whale: On the Illusions of Green CapitalismRating: 5 out of 5 stars5/5 (2)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyFrom EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyRating: 3 out of 5 stars3/5 (1)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterFrom EverandMind over Money: The Psychology of Money and How to Use It BetterRating: 4 out of 5 stars4/5 (24)