Professional Documents

Culture Documents

Vat Guide Eng

Uploaded by

Mohit GaurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat Guide Eng

Uploaded by

Mohit GaurCopyright:

Available Formats

Banana Accounting 5.

Introduction Guide to the use of VAT in Accounting

VAT (Value-added Tax) is a tax that weighs on the final consumer. Every VAT subject must

calculate and periodically deposit the tax to the Revenues Authority.

Every country has its own VAT rates that are established in different percentages depending on the

type of merchandise or service. Certain merchandise and services are exempt or excluded.

The percentages vary according to the financial necessity of the country; therefore, there can be

changes in the years.

The periodic VAT statement automatically managed on the basis of the VAT codes

© Copyright 1989/2006 Banana.ch SA 1

VAT rate

In this document, to make calculating easier, we will use the following rates:

10 % normal rate

5% reduced rate

0% excluded operations or exempt operations

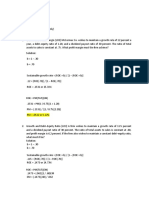

VAT calculation

Net Price x VAT Percentage / 100 = VAT Amount

Example:

Net price 300

Tax rate 10%

VAT amount = 300 x 10 / 100 = 30

Gross price calculation

Net price + VAT Amount = Gross Price

Example:

300 + 30 = 330

Sometimes the gross amount is known and it is necessary to find the net and VAT amounts.

Net price calculation

Gross Price / (100 + VAT rate) x 100 = Net Price

Example:

330 / (100 + 10) x 100 = 300

The net price represents the cost (purchase) or the revenue (sale) of the company

VAT amount calculation

Gross Price – Net Price = VAT Amount

Example:

330 - 300 = 30

or

330 – [330 / (100 + 10) x 100] = 30

The VAT amount represents the debit (sales) or the credit (purchases) towards the Revenues

Authority.

© Copyright 1989/2006 Banana.ch SA 2

VAT rate calculation

VAT Amount / Net Amount x 100 = VAT Rate

Example:

30 / 300 x 100 = 10%

or

[330 - 330 / (100 + 10) x 100]/100 = 10%

Another example:

20 / 400 x 100 = 5%

This way of calculating is used when the rate is not known.

Calculation of the VAT due to the Revenues Authority

1. Sum up all the VAT amounts of the sales (VAT due)

2. Sum up all the VAT amounts of the purchases (VAT recovered)

3. Total VAT on sales – Total VAT on purchases = VAT due to the Revenues Authority

The operations that converge in the VAT calculation must be grouped and presented in the VAT

Statement.

Sometimes the total VAT amount to be recovered (VAT on purchases) can be more than the VAT

amount due (VAT on sales). In this case, there is a credit which will be reimbursed by the Revenues

Authority.

VAT Management with Banana Accounting

The program allows the operations with VAT to be recorded on the VAT codes.

To be able to manage the VAT it is necessary to:

- Choose the “Accounting with VAT” type of accounting

- Select from the examples a predefined accounting plan

- Arrange the VAT accounts if they had not been present

- Arrange the “VAT Code” table with current rates and input the automatic VAT account, (it

should be present in the accounting plan).

© Copyright 1989/2006 Banana.ch SA 3

Automatic VAT Account and VAT Treasury Account

To be able to have a report of what is due to the state, it is necessary to insert the following in the

accounting plan:

1. The Automatic VAT account – is used by the program to automatically record VAT

amounts:

- in Debit the VAT amounts related to the purchases (VAT to be recovered),

- in Credit the VAT amounts related to the sales (VAT due)

2. The VAT Revenues Authority account – is used only for endorsing and closing the balance

at the end of the VAT period. It closes with the payment of the VAT debit to the Revenues

Authority or eventually with the cash inflow of the VAT credit from Revenues Authority.

- in Debit the creditor balance is endorsed from the automatic VAT account

(VAT due).

- in Credit the debtor balance is endorsed from the automatic VAT account

(VAT to be recovered).

© Copyright 1989/2006 Banana.ch SA 4

The VAT Code Table

The VAT Code table setup allows the definition of all the parameters that are necessary to manage

the transactions with VAT. Once defined, the calculations and the splittings will always refer to the

input parameters.

When the VAT codes are inserted in the “Transactions” table (in the VAT Code column), all the

VAT operations will be transferred automatically in the VAT account.

© Copyright 1989/2006 Banana.ch SA 5

Accounting Transaction

Cash Sales

The sales VAT code (S10) is applied.

Purchase in Cash

The purchases VAT code (P10) is applied.

Transaction Effects

Cash Card

© Copyright 1989/2006 Banana.ch SA 6

Sales Card

Purchase Card

Automatic VAT Card

VAT Statement at End of Period

The VAT Statement is a form sent from the Revenues Authority to all VAT contributors to declare

the operations with VAT, divided by VAT rates. All data automatically calculated from the program

must be reported manually on the VAT Statement form.

To obtain the VAT Statement, select, from the “Account1” menu, the VAT report command and

choose the appropriate options in the window that appears.

The program automatically elaborates the VAT operations either by transactions or by totals and

calculates the balance to be paid to the Revenues Authority.

© Copyright 1989/2006 Banana.ch SA 7

The balance of the VAT to/for Revenues Authority must always coincide with the balance of

the Automatic VAT account for the period.

Resetting the Automatic VAT Account

After the calculation of the VAT report, it is necessary to bring the Automatic VAT account balance

to zero, transferring the amount to the VAT to/for Revenues Authority account.

© Copyright 1989/2006 Banana.ch SA 8

Automatic VAT Card

After the periodical closing transaction, the automatic VAT account will have a zero balance.

Payment of the VAT

With the payment of the VAT, the VAT to/from Revenue Authority account will have a zero

balance.

© Copyright 1989/2006 Banana.ch SA 9

VAT to/for Revenue Authority account Card

© Copyright 1989/2006 Banana.ch SA 10

You might also like

- Taxes (FI-AP/AR) : PurposeDocument4 pagesTaxes (FI-AP/AR) : PurposeTeja SaiNo ratings yet

- SAP TaxesDocument3 pagesSAP Taxesgokul.pNo ratings yet

- SD - Tax Determination in Sales and DistributionDocument15 pagesSD - Tax Determination in Sales and DistributionNarendra BodhisatvaNo ratings yet

- Statement ChaseDocument4 pagesStatement ChaseYoel Cabrera100% (1)

- Act130 Testbank FinalsDocument220 pagesAct130 Testbank FinalsMelanie SamsonaNo ratings yet

- Magaling vs. Ong SC Ruling on Officer LiabilityDocument1 pageMagaling vs. Ong SC Ruling on Officer LiabilityRaje Paul Artuz100% (1)

- VatDocument5 pagesVatninaryzaNo ratings yet

- TAX On Sales and Purchases2Document27 pagesTAX On Sales and Purchases2harishNo ratings yet

- Plants in Foreign CountriesDocument10 pagesPlants in Foreign CountriesjshafiNo ratings yet

- VAT On Merchandise Purchased and SoldDocument5 pagesVAT On Merchandise Purchased and SoldBernadette Solis100% (1)

- Tax Code and SAP SDDocument3 pagesTax Code and SAP SDThiru Mani100% (1)

- How To Compute For VATDocument29 pagesHow To Compute For VATNardsdel RiveraNo ratings yet

- Tax Calculation Process in SDDocument4 pagesTax Calculation Process in SDVinayNo ratings yet

- Harvard Financial Accounting Final Exam 3Document11 pagesHarvard Financial Accounting Final Exam 3Bharathi Raju0% (1)

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Percentage Taxes: Use BIR Form 2550MDocument17 pagesPercentage Taxes: Use BIR Form 2550Mcha11No ratings yet

- VAT On CashDocument3 pagesVAT On Cashapl16No ratings yet

- An Introduction To VATDocument3 pagesAn Introduction To VATSudipta MondalNo ratings yet

- VAT PayableSetupDocument15 pagesVAT PayableSetupHyder Abbas100% (1)

- Spain PDFDocument4 pagesSpain PDFbbazul1No ratings yet

- Italian Purchase VAT RegisterDocument9 pagesItalian Purchase VAT RegisterArcotsinghNo ratings yet

- VAT Other Aspects - January 2024Document5 pagesVAT Other Aspects - January 2024Charisma CharlesNo ratings yet

- VAT FS1 What You Need To Know About VATDocument3 pagesVAT FS1 What You Need To Know About VATPardeep RanaNo ratings yet

- Set Up Thailand Withholding TaxDocument3 pagesSet Up Thailand Withholding TaxNeeraj KumarNo ratings yet

- IFRS News: Beginners' Guide: Nine Steps To Income Tax AccountingDocument4 pagesIFRS News: Beginners' Guide: Nine Steps To Income Tax AccountingVincent Chow Soon KitNo ratings yet

- Accounting For VAT in The Philippines - Tax and Accounting Center, IncDocument8 pagesAccounting For VAT in The Philippines - Tax and Accounting Center, IncJames SusukiNo ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- Tally Erp 9.0 Material Value Added Tax (VAT) in Tally Erp 9.0Document86 pagesTally Erp 9.0 Material Value Added Tax (VAT) in Tally Erp 9.0Raghavendra yadav KM100% (5)

- Project Report On Value Added Tax VATDocument77 pagesProject Report On Value Added Tax VATshehzanamujawarNo ratings yet

- VAT Return 2015 SAP LibraryDocument17 pagesVAT Return 2015 SAP LibraryTatyana KosarevaNo ratings yet

- Vendor Prepayments (1) Dynamics 365FO - AX Finance & ControllingDocument10 pagesVendor Prepayments (1) Dynamics 365FO - AX Finance & ControllingKhorusakiNo ratings yet

- Value Added TaxDocument11 pagesValue Added TaxPreethi RajasekaranNo ratings yet

- ES M303 ProdAssistDocument16 pagesES M303 ProdAssistLAURANo ratings yet

- ExposéDocument1 pageExposéibrahimboulaminefaridNo ratings yet

- Taxes (FI-APAR)Document3 pagesTaxes (FI-APAR)tsfs111001No ratings yet

- RealSoft VAT Module - User ManualDocument26 pagesRealSoft VAT Module - User ManualKhaleel Abdul GaffarNo ratings yet

- Accounting For VAT in Th... Accounting Center, Inc.Document4 pagesAccounting For VAT in Th... Accounting Center, Inc.Martin EspinosaNo ratings yet

- Business EnvironmentDocument12 pagesBusiness EnvironmentArpit JainNo ratings yet

- VAT ReturnsDocument39 pagesVAT ReturnsTaha AhmedNo ratings yet

- Post VAT Only Invoices in Dynamics NAVDocument2 pagesPost VAT Only Invoices in Dynamics NAVAgi HarrarNo ratings yet

- HANDOUT FOR VAT-NewDocument25 pagesHANDOUT FOR VAT-NewCristian RenatusNo ratings yet

- Introduction to Value Added Tax in MaharashtraDocument38 pagesIntroduction to Value Added Tax in MaharashtraKavita NadarNo ratings yet

- Withholding of TaxesDocument26 pagesWithholding of TaxesnalmatirajeshNo ratings yet

- Value Added Tax (VAT) : A Project OnDocument24 pagesValue Added Tax (VAT) : A Project OnSourabh SinghNo ratings yet

- VAT Guide SummaryDocument22 pagesVAT Guide SummaryAkash TeeluckNo ratings yet

- SAP - VAT ConfgireDocument11 pagesSAP - VAT ConfgireTop NgôNo ratings yet

- Vat Guide Accounts PayableDocument24 pagesVat Guide Accounts Payablekrishnan_rajesh5740No ratings yet

- 2017 PWC-europe PDFDocument715 pages2017 PWC-europe PDFaammNo ratings yet

- Value Added Tax (VAT)Document1 pageValue Added Tax (VAT)Parth UpadhyayNo ratings yet

- Account Setup - e Business TaxDocument5 pagesAccount Setup - e Business TaxANUPNo ratings yet

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- Peza ReportDocument2 pagesPeza ReportDiana FernandezNo ratings yet

- SUITS THE C-SUITE by Saha P. Adlawan-Bulagsak Business World (10/31/2016 - p.S1/4)Document2 pagesSUITS THE C-SUITE by Saha P. Adlawan-Bulagsak Business World (10/31/2016 - p.S1/4)Bryce BihagNo ratings yet

- What Is Value Added TaxDocument2 pagesWhat Is Value Added TaxsushanwinsNo ratings yet

- Changes Faces of Vat TaxDocument103 pagesChanges Faces of Vat TaxArvind MahandhwalNo ratings yet

- GST Presentation ExplainedDocument26 pagesGST Presentation ExplainedShubham GoyalNo ratings yet

- Vat Presentation: Nikita GanatraDocument26 pagesVat Presentation: Nikita Ganatrapuneet0303No ratings yet

- Value Added Tax (VAT)Document33 pagesValue Added Tax (VAT)chirag_nrmba15No ratings yet

- Columbia WHTDocument7 pagesColumbia WHTAnilNo ratings yet

- Value Added Tax (VAT) : A Presentation by Sanjay JagarwalDocument39 pagesValue Added Tax (VAT) : A Presentation by Sanjay JagarwalJishu Twaddler D'CruxNo ratings yet

- AQ2016 IDRX FA2016 Reference MaterialDocument31 pagesAQ2016 IDRX FA2016 Reference Materialmarla_ffonteNo ratings yet

- VAT CALCULATIONDocument14 pagesVAT CALCULATIONJishu Twaddler D'CruxNo ratings yet

- Prime Focus Limited - IPO ProspectusDocument162 pagesPrime Focus Limited - IPO Prospectusmanishkul-100% (4)

- The Impact of IFRS On Financial StatementsDocument84 pagesThe Impact of IFRS On Financial StatementsPrithviNo ratings yet

- Frontier Springs Financial AnalysisDocument8 pagesFrontier Springs Financial AnalysisSaurav RanaNo ratings yet

- 1 - p.3 7 8 Week 5 Financial AnalysisDocument4 pages1 - p.3 7 8 Week 5 Financial AnalysisTamoor BaigNo ratings yet

- Quiz For AbmDocument8 pagesQuiz For AbmAnne lorenz SicatNo ratings yet

- Failed Companies: Profile and Ill-Fated HistoryDocument15 pagesFailed Companies: Profile and Ill-Fated HistoryMary Jane MasulaNo ratings yet

- ACCOUNTING POLICY CHANGESDocument68 pagesACCOUNTING POLICY CHANGESGedion EndalkachewNo ratings yet

- Ventura, Mary Mickaella R Chapter4 - p.112-118Document8 pagesVentura, Mary Mickaella R Chapter4 - p.112-118Mary VenturaNo ratings yet

- Instructions To Students: Annual Examinations For Schools 2019Document8 pagesInstructions To Students: Annual Examinations For Schools 2019parapara11No ratings yet

- Working Capital Part IIDocument16 pagesWorking Capital Part IINoman SulemanNo ratings yet

- Business Finance-Semi-Final ExamDocument3 pagesBusiness Finance-Semi-Final ExamHLeigh Nietes-Gabutan100% (1)

- SHS financial document questions analyzedDocument2 pagesSHS financial document questions analyzedclaire juarezNo ratings yet

- Grofers India Private Limited: Detailed ReportDocument10 pagesGrofers India Private Limited: Detailed Reportb0gm3n0tNo ratings yet

- Ross Corporate 13e PPT CH13 AccessibleDocument34 pagesRoss Corporate 13e PPT CH13 AccessibleVy Dang PhuongNo ratings yet

- Module 1 Notes Shared With StudentsDocument9 pagesModule 1 Notes Shared With StudentsROY PAULNo ratings yet

- Analyzing Transactions To Start A BusinessDocument22 pagesAnalyzing Transactions To Start A BusinessPaula MabulukNo ratings yet

- NISM Series XX Taxation in Securities Markets Workbook June 2021Document353 pagesNISM Series XX Taxation in Securities Markets Workbook June 2021Karthick S NairNo ratings yet

- Balance Sheet As of June 2015: Jalan Supratman 007 BandungDocument1 pageBalance Sheet As of June 2015: Jalan Supratman 007 BandungveriaryantoNo ratings yet

- BASIC PARTNERSHIP FORMATIONDocument13 pagesBASIC PARTNERSHIP FORMATIONJohn Lery YumolNo ratings yet

- MEGHMANI ANNUAL REPORTDocument254 pagesMEGHMANI ANNUAL REPORTmredul sardaNo ratings yet

- Daftar Akun Kel 9 - Ud AbadiDocument2 pagesDaftar Akun Kel 9 - Ud AbadiAyni Zakiah ramadhaniNo ratings yet

- Women Director Role and ImportanceDocument6 pagesWomen Director Role and ImportanceMayank Sen100% (1)

- Course Planner: GC University FaisalabadDocument3 pagesCourse Planner: GC University Faisalabadgoharmahmood203No ratings yet

- In Philippine PesoDocument4 pagesIn Philippine PesoAitanna Sophia LagunaNo ratings yet

- Dentons HPRP Maintains Top Tier Recognition Global Publications 2022Document3 pagesDentons HPRP Maintains Top Tier Recognition Global Publications 2022Nydia PribadiNo ratings yet

- Tan General Merchandise financial analysisDocument2 pagesTan General Merchandise financial analysisCatty Kiara RamirezNo ratings yet