Professional Documents

Culture Documents

Transfer Pricing Adjustments

Uploaded by

NimalanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transfer Pricing Adjustments

Uploaded by

NimalanCopyright:

Available Formats

Benetton India Pvt. Ltd.

, Haryana vs Assessee

Income Tax Appellate Tribunal - Delhi

Benetton India Pvt. Ltd., Haryana vs Assessee

IN THE INCOME TAX APPELLATE TRIBUNAL

DELHI BENCH "A" NEW DELHI

BEFORE SHRI R.P. TOLANI AND SHRI SHAMIM YAHYA

ITA No. 3829/Del/2010

Asstt. Yr: 2006-07

Benetton India Pvt. Ltd. Vs. Income Tax Officer,

B-25, Infocity, Gurgaon, Ward 2(4), New Delhi.

(Haryana)

PAN/GIR No. AAACD1013F

(Appellant ) ( Respondent )

Appellant by : Shri G.C. Srivastava & Sh. Mononut Dalal Adv.

Respondent by : Shri N.K. Chand

ORDER

PER R.P. TOLANI, J.M :

This is assessee's appeal against the Addl. CIT's order dated 14-10- 2009, passed u/s 92 CA(3) of the

Income-tax Act, 1961, relating to A.Y. 2006-07.

2. Following grounds are raised:

"1. On the facts and in the circumstances of the case and in law, the Hon'ble Dispute

Resolution Panel (DRP) erred in confirming order under section 92CA(3) the Income

Tax Act, 1961 ("the Act") passed by the learned Transfer Pricing Officer ("TPO") and

thereby confirming the draft order passed by learned Assessing Officer ("AO");

2. On the facts and in the circumstances of the case and in law, the Hon'ble DRP/TPO

erred in confirming rejection of the transaction by transaction analysis carried out by

the appellant and by applying Transactional Net Margin Method ("TNMM") on a

company wide basis.

3. Without prejudice to the above ground, on the facts and in the circumstances of the

case and in law, the Hon'ble Dispute 2 ITA 3829/Del/10 Benetton India Pvt. Ltd.

Resolution Panel (DRP) erred in not directing to make suitable adjustment to the margins of the

appellant to adjust for material differences between the appellant and comparable companies, while

applying TNMM on a company wide basis.

4. Without prejudice to the above ground, on the facts and in the circumstances of the case and in

law, the Hon'ble DRP/TPO erred in not selecting appropriate comparables for benchmarking the

international transactions of the appellant. 4.1. The Hon'ble DRP/TPO erred in accepting Page

Industries Limited and Microtex India Limited which earned significant revenues from

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 1

Benetton India Pvt. Ltd., Haryana vs Assessee

non-comparable products as comparable companies.

4.2. The Hon'ble DRP/TPO erred in accepting Raymond Apparel Limited which has significant

related party transactions, as comparable company.

4.3. The Hon'ble DRP/TPO erred in accepting Kewal Kiran Clothing Company and Koutons Retail

India Limited which underwent major restructuring changes during the relevant year as comparable

companies.

5. On the facts and in the circumstances of the case and in law, the Hon'ble DRP/TPO erred in

confirming adjustment to the arm's length value of the international transactions involving import

of garments and accessories, import of law material and payment of royalty which were at already

established arm's length on the basis of Comparable Uncontrolled Price ("CUP") analysis submitted

by the appellant in the absence of any adverse observations regarding the analysis of these

transactions by DRP/TPO.

6. Without prejudice to the above, on the facts and in the circumstances of the case and in law, the

Hon'ble DRP erred in not directing TPO to allow downward variation of 5 percent in determining

the arm's length price as amended proviso to section 92C of the Act is not applicable to A.Y.

2006-07.

7. On the facts and in the circumstances of the case and in law, the learned AO erred in not meeting

the preconditions for making reference to the TPO under section 92CA(1) of the Act and in not

providing an opportunity of being heard before referring the transfer pricing issues to the learned

TPO.

3 ITA 3829/Del/10

Benetton India Pvt. Ltd.

2. Brief facts are: The assessee is a wholly owned subsidiary of Benetton International NV,

Netherlands, which in turn is a subsidiary of Benetton Group SPA, Italy, the ultimate holding

company and is engaged in the manufacture and sale of wide range of readymade garments and

accessories under the brand name of 'Benetton'. The assessee is also engaged in the business of

providing buying services to the associated enterprise for sourcing of garments, handicrafts, leather

products, etc. in India. The assessee during the relevant previous year entered into the international

transactions and their method of evaluations with the associated enterprises, as under:

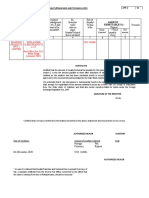

Sl. No. Name of the Associated International Amount Method

Enterprise transactions (Rs.) Used

(i) Bencom S.r.l., Benind Purchase (Import) 12,490,7 CUP

Australia Pty. Ltd, accessories as

Benetton Asia Pacific samples

Ltd.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 2

Benetton India Pvt. Ltd., Haryana vs Assessee

(ii) Benind S.p.A, Purchase (Import) 14,993,9 CUP

Ltd.

(iii) Benind S.p.A Purchase of fixed 3,559,48 CUP

(iv) Bencom S.r.l. Payment of 29,517,7 CUP

(v) Bencom S.r.l., Benind Reimbursement of 5,851,44 CUP

Italy, Benetton Asia

Pacific Ltd, Benetton

Group, S.p.A.

(vi) Bencom S.r.l., Reimbursement of 270,145 CUP

Benetton Asia Pacific expenses

Ltd. (received)

(vii) Benind S.p.A, Export of garments 124,923, TNMM

4 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Ltd,

Benetton Retail

Hongkong Ltd.

(viii) Benind S.p.A Receipt of 7,611,36 TNMM

(ix) Benind S.p.A, Payment of 33,822,1 Cost

Bencom S.r.l. expatriates' cost 75 Plus

Method

2.1. According to assessee, the ALP was determined on a "transaction by- transaction" basis for

applying arm's length price on above method, using the most appropriate method having regard to

functional analysis and availability of the comparable uncontrolled benchmark. 2.2. AO referred the

report to ld. TPO for determination of ALP. Assessee submitted following justification for

"transaction to transaction" basis and methods adopted for its TP report.

(a) Import of garments/ accessories/ raw material - CUP method: For benchmarking the

abovementioned international transactions, the assessee filed the invoices raised by the AE on the

unrelated third parties as CUPs along with the standard price list at which such garments were sold

to unrelated parties. On the basis of such comparison, it was concluded that the payment made to

the AEs was at arm's length applying the CUP method.

(b) Purchase of fixed assets:

For the purpose of benchmarking, CUP method was applied and the third party invoices were

furnished to the TPO as an evidence for purchase of fixed assets. There being no element of income,

such transactions were to be regarded as being at arm's length.

(c) Payment of Royalty:

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 3

Benetton India Pvt. Ltd., Haryana vs Assessee

5 ITA 3829/Del/10

Benetton India Pvt. Ltd.

The assessee pays royalty @ 4.8% on domestic sales excluding sales to the associated enterprise. The

transaction was benchmarked applying CUP method and the following documents were placed on

record-

(i) The royalty rates of the following comparable companies were filed during the course of the

assessment-

Royalty Licensor Licensee rates Yes clothing CS Sportswear Inc 5% Limited Crystal

brands Inc Lacoste Alligator S.A. 5% Blue holdings, Inc. Taverniti Holdings, 5-8%

LLC Jones Apparel Polo Ralph Lauren 7% Group Corp Reebok National Football 13%

League

(ii) The copy of approval granted by the Central Government approving the rate of

royalty.

Hence, since the average of royalty paid by the abovementioned companies was higher than the

royalty paid by the assessee company, the international transaction of payment of royalty is to be

regarded as being at arm's length applying CUP method.

(d) Reimbursement of expenses (paid and received): CUP method was also found suitable for

benchmarking international transactions of reimbursement made to and received from the

associated enterprises in respect of expenses incurred as the same were merely reimbursement of

expenses incurred by AEs for/on behalf of assessee. For benchmarking, such transactions were 6

ITA 3829/Del/10 Benetton India Pvt. Ltd.

adequately supported by third party evidences. Since, such transactions do not have any element of

income, hence it was considered to be at arm's length applying CUP method.

(e) Export of finished goods:

For benchmarking the transaction of exports, there was no internal comparable available to apply

CUP method as the assessee and the AEs did not enter into similar transactions with unrelated

parties. Hence, for determining the arm's length price of international transaction of export of

finished goods, Transactional Net Margin Method (TNMM) was selected as the most appropriate

method.

For the purpose of applying TNMM, operating profit to total sales was considered as the base or the

profit level indicator. 46 companies in readymade garment business were identified based on

selection criteria, which were considered functionally comparable to the business activity of the

assessee. The result of TNMM analysis for transactions other than buying services is summarized as

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 4

Benetton India Pvt. Ltd., Haryana vs Assessee

under:

Average OP/ OC % of comparable companies 8.73%

OP/ OC % of the assessee 17.41%

Since the operating profit ratio of the assessee for exports made to related parties @17.41% is higher

than the average of operating profit ratio of 8.73% of comparable companies, the international

transaction of export of finished goods was therefore, considered being at arm's length using

TNMM. Operating profit margin of the assessee company in respect of international transactions of

export of manufactured goods at 17.41% was higher than the operating profit 7 ITA 3829/Del/10

Benetton India Pvt. Ltd.

margin of comparable companies identified in the notice at 8.59% (determined by the assessee at

3.38%).

(f) Receipt of commission:

For determining the arm's length price of international transaction of receipt of commission,

Transactional Net Margin Method (TNMM) was selected as the most appropriate method.

For the purpose of applying TNMM, operating profit to operating cost was considered as the base.

After considering various criteria, comparable companies were identified.

The results of TNMM analysis for buying services are summarized as under:

Average OP/ Sales % of comparable companies 9.68% OP/ Sales % of assessee from buying services

23.96% Since the operating profit ratio of the assessee @ 23.96% was higher than the average of

operating profit ratio of 9.68% of comparable companies, the aforesaid international transactions

was considered having been entered at arm's length price, using TNMM.

(g) Payment of expatriates' cost:

For determining the arm's length price of international transaction of reimbursement of expatriates'

costs, there was no mark up and the expat's cost was reimbursed on cost to cost basis. Accordingly,

such payment was considered to be at arm's length.

All the international transactions entered into by the assessee with the associated enterprises have

been satisfactorily evaluated separately by 8 ITA 3829/Del/10 Benetton India Pvt. Ltd.

applying the most appropriate method for determining the arm's length price of the various

international transactions.

2.3. In order to arrive at the most precise approximation of fair market value, the ALP should be

determined on a transaction by-transaction basis and only in case when the separate transactions

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 5

Benetton India Pvt. Ltd., Haryana vs Assessee

are so closely linked or continuous that they cannot be evaluated adequately on a separate basis,

that such transactions may be evaluated together.

2.4. Combining all transactions together, was not in conformity with the Income tax rules, OECD

commentary and any internationally accepted benchmarking principles. All segments cannot be

evaluated together as each activity will result in completely different functions and there is no basis

for undertaking the benchmarking analysis combining all international transactions whereby a rate

of operating profit margin is applied on the entire sales of the assessee company which is largely

domestic sale not involving any international transaction.

2.5. The company in the relevant previous year had incurred substantial expenses to promote and

establish its business in the domestic market.

2.6. The low profitability is entirely on account of the expenses incurred by the assessee company on

establishing new show room, creating presence in the various parts of the country, large

demonstration, marketing and selling expenses, etc. In other words, the low profitability of the

assessee company is not on account of the international transactions as would be evident from the

following:

9 ITA 3829/Del/10

Benetton India Pvt. Ltd.

(i) The gross profit margin of the assessee company is worked out

at 44.53% as against 31.76% in the case of the comparable companies identified by the TPO. The

profitability of the assessee is not impacted on account of the international transaction of imports,

which is, in any case, only 2.54% of the total turnover.

(ii) The operating profit margin of the assessee company after excluding some of the expenses, such

as, rent, advertisement, shop running and guarantee charges, etc., is worked out at 20.41%

(OP/Sales %) as against 15.29% in case of the comparable companies identified the TPO.

2.7. In other words, low profitability of the assessee company could be largely attributed to the

expenses incurred by the assessee to establish and promote itself in the domestic market and has

nothing to do with the various international transactions undertaken by the associated enterprise. 3.

The TPO in his order, however, held that arm's length should not be determined on a transaction

by-transaction basis. The TPO argued that:

- segmental analysis done by the auditors in the notes to the financial statements is not appropriate

- the financials have been split artificially for the purpose of transfer pricing.

- the basis of allocation to compute net operating margin while separately benchmarking

international transaction of export of finished goods and receipt of commission is not disclosed 3.1.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 6

Benetton India Pvt. Ltd., Haryana vs Assessee

The TPO in his order, for undertaking benchmarking analysis of the international transactions of

import of garments & accessories, import of raw 10 ITA 3829/Del/10 Benetton India Pvt. Ltd.

material, export of garments, payment of royalty and receipt of commission applying TNMM on

entity level, rejected the benchmarking carried out by the assessee as aforesaid on transaction wise

basis. 3.2. The TPO identified the following companies as comparable companies as per the

selection criteria as stated in the 6.6 of the transfer pricing order and computed the operating profit

margin as follows:

S. Name of the company OP/Sales OP/OC

No.

1. Raymond Apparel Limited 12.14% 12.99%

2. Arvind Brands Limited -16.64% -13.91%

3. Lux Hosiery Industries 2.44% 2.49%

Limited

4. Koutons Retail India Ltd. 15.44% 18.26%

5. Page Industries Ltd. 18.51% 22.51%

6. Kewal Kiran Clothing Ltd. 22.32% 28.28%

7. Nash Fashion (India) Ltd. 7.16% 7.04%

8. Oswal Knit India 5.42% 5.73%

9. Microtex India Limited 10.51% 11.71%

Arithmetic Mean 8.59% 10.57%

3.3. The average mean of the comparable at 10.57% being more than the operating profit margin of

the entity @2.57%, the TPO proposed an adjustment in the arm's length price as per computation as

follows:

Value of international transactions 189,537,478.00

OP/OC of comparables 10.57%

Arm's length Margin A 20,034,111.42

Arm's length price 209,571,589.42

Margin shown by the assessee B 4,871,113.18

@2.57%

Difference A-B 15,162,998.24

% difference 8.00%

11 ITA 3829/Del/10

Benetton India Pvt. Ltd.

3.4. TPO did not agree with assessee's T.P. report and proposed an adjustment of Rs.1,51,62,998 on

account that average margin of the comparable at 10.57% is more than the operating profit margin

of the assessee company, computed by the TPO, at 2.57%.

4. The TPO's proposal was confirmed by AO who proposed this addition to assessee's income.

Aggrieved, assessee approached DRP where following contentions were raised:

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 7

Benetton India Pvt. Ltd., Haryana vs Assessee

(1) The TPO has undertaken entity level benchmarking analysis applying TNMM

combining all the international transactions as against transaction by transaction

analysis as provided in the Transfer Pricing Regulations recommended by OECD

guidelines (in paragraph 1.42). Reliance is also placed on the following decisions,

wherein, determination of arm's length price of international transactions on

transaction by transaction basis is upheld:

- Development Consultants (P) Ltd. vs. DCIT: 115 TTJ 577 (Cal)

- ACIT v. Star India Limited (ITA No.3846 / 3585/M/2006)

- Aztec Software and Technical Services Ltd. vs. ACIT 107 ITD 141 (SB)

- UCB India (P) Ltd. v ACIT 30 SOT 95 (Mum.) In the case of UCB India (P) Ltd. vs. ACIT : 30 SOT

95, relied upon by the TPO, too, the Hon'ble Mumbai Bench of the Tribunal upheld the

determination of the arm's length price by considering segmental margin on a stand alone basis.

In view of the aforesaid, the various international transactions, other than international transaction

of export of finished goods and receipt of buying service commission, which are separately

established to be at arm's length and are not disputed by the TPO, should be accepted as being at

arm's length.

12 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Further, the TPO clearly erred in aggregating international transactions of export of finished goods

and rendering of buying services which are functionally different international transactions

undertaken with different associated enterprises.

In view of the aforesaid, the benchmarking analysis carried out by the assessee on transaction by

transaction basis for manufacturing export activities and buying services activities cannot be

disregarded. (2) The following companies have been unjustifiably included in the list of comparable

companies by the TPO:

a. Raymond Apparel Limited:

The company had substantial high related party transactions of 26.22%, which is beyond the limit of

10% to 15% as laid down by the Hon'ble Delhi Bench of the Tribunal in the case of DCIT v. Sony

India Pvt. Ltd: 114 ITD 448.

b. Kewal Kiran Clothing Limited The company has undergone major restructuring during the

relevant previous year by way of bringing forth an Initial Public Offer; acquisition of substantial

assets of Kewal Kiran Enterprises, a partnership firm and the cessation Kewal Kiran Retail India

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 8

Benetton India Pvt. Ltd., Haryana vs Assessee

Private Limited and Kornorstone Retail Limited to be its subsidiaries.

Since, the relevant previous year was abnormal; the operating result of the said company cannot be

taken into account for the purpose of benchmarking analysis.

The TPO, however, rejected the contention of the assessee holding that the impact of business

restructuring on profit margin of a company, always reduces profit margin of the restructured

company in initial years.

13 ITA 3829/Del/10

Benetton India Pvt. Ltd.

The contention of the TPO is incorrect and not sustainable since year-wise comparative statement of

profitability of M/s. Kewal Kiran Clothing Limited clearly demonstrates the substantial increase in

the sales and income of the company on account of the business restructuring as aforesaid.

c. Microtex India Ltd Microtex India Ltd. had turnover of 48.34 crores in the relevant year which

was not within the filter of 50-210 crores as applied by the TPO. Accordingly, the company does not

satisfy the selection criteria as considered by the TPO himself.

d. Koutons Retail India Limited:

The financial statements of Koutons Retail India Limited are not available on any public domain for

financial year 2005-06. Secondly, the company has undergone major restructuring during the

previous year 2005-06 as Koutons retail India Limited was incorporated by acquiring, Charlie

creations, which was a partnership firm. Evidently, the profit of the company has considerably

increased due to such restructuring and hence should not be considered as a comparable for the

relevant assessment year.

4.1. Assessee contended that the following companies should be excluded from the set of

comparable companies considered by TPO, applying TNMM:

S.No. Companies Reason for rejection

(i) Raymond Substantial related party transactions to the

Apparel extent of 26%.

Limited

(ii) Microtex Does not satisfy turnover criteria considered by

India Limited the TPO.

(iii) Kewal Kiran Major restructuring during the relevant

14 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Clothing Ltd. previous year resulting in abnormally high

sales and operating profit margin.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 9

Benetton India Pvt. Ltd., Haryana vs Assessee

(iv) Koutons Major restructuring during the relevant

Retail India previous year and financial statements not

Ltd available on any public domain. The assessee

company deals in high-end ready-made

garment products in comparison to Koutons and the economic/ market scenario of the assessee

company so far as well assessee's product is concerned is completely different and is not comparable

to that of Koutons.

4.2. The average operating profit margin (OP/OC%) of the remaining established companies, to be

comparable, works out as under:

S.No. Name of the companies OP/OC %

1. Oswal Knit India 5.73%

2. Nash Fashion (India) Ltd. 7.04%

3. Page Industries Ltd. 22.51%

4. Lux Hosiery Industries Limited 2.49%

5. Arvind Brands Limited -13.91%

Average 4.77%

4.3. Since the operating profit margin of the assessee from the international transactions of exports

@17.41% was higher than the average of operating profit ratio of 3.38% of comparable companies,

the international transaction of export of goods, therefore, considered being at arm's length

applying TNMM.

(3) The low profitability of the assessee was entirely on account of the expenses incurred on

establishing new show rooms, creating presence in the various parts of the country, large

demonstration, marketing and selling expenses, etc. They were not on account of the international

transactions under taken by the assessee due to following factors:

15 ITA 3829/Del/10

Benetton India Pvt. Ltd.

(i) The gross profit margin of the assessee company is worked out at 44.53% as against 31.76% in the

case of the comparable companies identified by the TPO.

(ii) The operating profit margin of the assessee company after excluding some of the expenses, such

as, rent, advertisement, shop running and guarantee charges, etc., is worked out at 20.41%

(OP/Sales %) as against operating profit margin of the comparable companies similarly computed at

15.29%.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 10

Benetton India Pvt. Ltd., Haryana vs Assessee

(4) Even otherwise, considering that the operating profit margin of the assessee at entity level at

2.57% is within the range of ± 5% of the operating profit margin of the comparable companies at

4.77%., the adjustment is liable to dropped.

4.4. Learned DRP, however, upheld the order proposed by AO on the basis of TPO's order by

following observations:

"TPO has done the comparison of operating profit margin OP/OC with operating

margin of assessee's companies. Assessee has objection to entity level analysis against

transaction by transaction. We don't find any invalidity in aggregating international

Transactions of exports of finished goods and rendering of buying services which are

functionally different International transactions undertaken with different associated

enterprises.

Assessee has summed up his arguments in the table below in which the reasons for rejections are

also given S.No. Companies Reason for rejection

(i) Raymond Substantial related party transactions to the Apparel extent of 26%.

Limited

(ii) Microtex Does not satisfy turnover criteria considered by India Limited the TPO.

16 ITA 3829/Del/10

Benetton India Pvt. Ltd.

(iii) Kewal Kiran Major restructuring during the relevant

Clothing Ltd. previous year resulting in abnormally high

sales and operating profit margin.

(iv) Koutons Major restructuring during the relevant

Retail India previous year and financial statements not

Ltd available on any public domain. The assessee

company deals in high-end ready-made

garment products in comparison to Koutons and the economic/ market scenario of the assessee

company so far as well assessee's product is concerned is completely different and is not comparable

to that of Koutons.

Assessee has also tried to submit that low profitability in this years is entirely on account of the

expenses incurred on establishing new show room, creating presence in the various parts of the

country, large demonstration, marketing and selling expenses.

The exclusion of four companies on account of reinstructing related party transaction has been

considered by us. Some objections raised by assessee has been answered by TPO in para 6.7, 6.8 and

6.9. Taking in view brand value of assessee company discussed, no directions are being issued

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 11

Benetton India Pvt. Ltd., Haryana vs Assessee

regarding the arm's length price of international transactions determined by APO.

Aggrieved, assessee is before us.

5. Learned counsel for the assessee vehemently contends that:

(1) The benchmarking undertaken by the assessee on the following international transactions has

not been disputed by the TPO

- Purchase of fixed assets

- Reimbursement of expenses (paid)

- Reimbursement of expenses (received)

- Payment of expatriates' cost The assessee had undertaken the benchmarking of the following

international transactions as follows:

17 ITA 3829/Del/10

Benetton India Pvt. Ltd.

(a). Import of garments/ accessories/ raw material - CUP method:

For benchmarking the abovementioned international transactions, the assessee filed the invoices

raised by the AE on the unrelated third parties as CUPs along with the standard price list at which

such garments were sold to unrelated parties. On the basis of such comparison, it was concluded

that the payment made to the AEs was at arm's length applying the CUP method.

(b) Payment of Royalty:

The assessee pays royalty @ 4.8% on domestic sales excluding sales to the associated enterprise. The

transaction was benchmarked applying CUP method and the following documents were placed on

record-

(i) The royalty rates of the following comparable companies were filed during the course of the

assessment-

Royalty Licensor Licensee rates Yes clothing Limited CS Sportswear Inc 5% Crystal

brands Inc Lacoste Alligator S.A. 5% Blue holdings, Inc. Taverniti Holdings, 5-8%

LLC Jones Apparel Group Polo Ralph Lauren 7% Corp Reebok National Football 13%

League

(ii) The copy of approval granted by the Central Government approving the rate of

royalty.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 12

Benetton India Pvt. Ltd., Haryana vs Assessee

Hence, since the average of royalty paid by the abovementioned companies was higher than the

royalty paid by the assessee company, 18 ITA 3829/Del/10 Benetton India Pvt. Ltd.

the international transaction of payment of royalty is to be regarded as being at arm's length

applying CUP method.

(c) Export of finished goods:

For benchmarking the transaction of exports, there was no internal comparable available to apply

CUP method as the assessee and the AEs did not enter into similar transactions with unrelated

parties. Hence, for determining the arm's length price of international transaction of export of

finished goods, Transactional Net Margin Method (TNMM) was selected as the most appropriate

method.

For the purpose of applying TNMM, operating profit to total sales was considered as the base or the

profit level indicator. 46 companies in readymade garment business were identified based on

selection criteria, which were considered functionally comparable to the business activity of the

assessee. The result of TNMM analysis for transactions other than buying services is summarized as

under:

Average OP/ OC % of comparable companies 8.73%

OP/ OC % of the assessee 17.41%

Since the operating profit ratio of the assessee for exports made to related parties @17.41% is higher

than the average of operating profit ratio of 8.73% of comparable companies, the international

transaction of export of finished goods was therefore, considered being at arm's length using

TNMM. Operating profit margin of the assessee company in respect of international transactions of

export of manufactured goods at 17.41% was higher than the operating profit 19 ITA 3829/Del/10

Benetton India Pvt. Ltd.

margin of comparable companies identified in the notice at 8.59% (determined by the assessee at

3.38%).

(d) Receipt of commission:

For determining the arm's length price of international transaction of receipt of commission,

Transactional Net Margin Method (TNMM) was selected as the most appropriate method.

For the purpose of applying TNMM, operating profit to operating cost was considered as the base.

After considering various criteria, comparable companies were identified.

The results of TNMM analysis for buying services are summarized as under:

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 13

Benetton India Pvt. Ltd., Haryana vs Assessee

Average OP/ Sales % of comparable companies 9.68% OP/ Sales % of assessee from

buying services 23.96% Since the operating profit ratio of the assessee @ 23.96% was

higher than the average of operating profit ratio of 9.68% of comparable companies,

the aforesaid international transactions was considered having been entered at arm's

length price, using TNMM.

5.1. Ld. counsel contends that the TPO proceeded to apply TNMM on entity wide basis disregarding

the aforesaid benchmarking undertaken by the assessee. The adjustment proposed by the TPO is

arbitrary and unjustified due to following:

(I) The TPO proposed to benchmark the international transactions of export of

garments and receipt of buying services applying 20 ITA 3829/Del/10 Benetton India

Pvt. Ltd.

Transactional Net Margin Method (TNMM) after combining the two transactions on

an entity basis as against separate benchmarking the net profit margin from these

transactions undertaken by the assessee.

(II) The TPO has applied TNMM, in the case of the assessee, on entity basis, combining the

international transactions of export of garments and receipt of buying service commission allegedly

on the following basis-

(a) The various costs have been allocated artificially for computing margin in different business

segments for Transfer Pricing purposes.

(b) Separate transactions closely interlinked and cannot be evaluated adequately on a separate basis

(c) separate segmental accounts not maintained (III) For the purpose of determining the arm's

length price in relation to international transactions, in terms of sub-section (2) of section 92C of

the Act, Rule 10B of the Rules provides the manner of application of the various prescribed

methods. Clause (e) of sub-rule (1) of Rule 10B of the Rules provides for application of Transactional

Net Margin Method as under:

"(e) Transactional Net Margin Method, by which,--

(i) the net profit margin realised by the enterprise from an international transaction entered into

with an associated enterprise is computed in relation to costs incurred or sales effected or assets

employed or to be employed by the enterprise or having regard to any other relevant base;

21 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 14

Benetton India Pvt. Ltd., Haryana vs Assessee

(ii) the net profit margin realised by the enterprise or by an unrelated enterprise from a comparable

uncontrolled transaction or a number of such transactions is computed having regard to the same

base;

(iii) the net profit margin referred to in sub-clause (ii) arising in comparable uncontrolled

transactions is adjusted to take into account the differences, if any, between the international

transaction and the comparable uncontrolled transactions, or between the enterprises entering into

such transactions, which could materially affect the amount of net profit margin in the open market;

(iv) the net profit margin realised by the enterprise and referred to in sub-clause (i) is established to

be the same as the net profit margin referred to in sub-clause (iii);

(v) the net profit margin thus established is then taken into account to arrive at an arm's length

price in relation to the international transaction."

(IV) For application of TNMM the net profit margin (over an appropriate base) realised by the

enterprise from an international transaction entered into with the associated enterprise is to be

compared with that from comparable uncontrolled transaction by an unrelated enterprise. The net

profit margin arising in comparable uncontrolled transactions is adjusted to take into account the

difference, if any, between the international transaction(s) and the comparable uncontrolled

transaction(s) or between the enterprise entering into such transaction which would materially

affect the amount of net margin profit.

The OECD guidelines provide that in order to arrive at the most precise approximation of fair

market value, the arm's length principle should, ideally be applied on a transaction-by-transaction

basis. Your 22 ITA 3829/Del/10 Benetton India Pvt. Ltd.

Honour's attention is invited to paragraph 1.42 of the OECD guidelines which provide that "Ideally,

in order to arrive at the most precise approximation of fair market value, the arm's length principle

should be applied on a transaction-by-transaction basis ..."

(V) The Calcutta Bench of the Tribunal in the case of Development Consultants (P) Ltd. vs. DCIT:

115 TTJ 577 reiterated the principle in this regard and provided to the following effect:

"The assessee had entered into the following types of transactions (a) Engineering

drawing and design services, (b) Deputation of employees, (c) Reimbursement of

traveling costs and (d) Rendering data entry services through its group entity

Datacore India. Therefore, the ALP of each of the international transactions should

be determined separately as the nature of transactions entered by the assessee with

its AEs was different. Hence, the ALP would be determined based on the nature of

services provided by the assessee for each class of transaction taking into

consideration the functions performed, assets employed and the risks assumed, by

the respective parties to the transactions.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 15

Benetton India Pvt. Ltd., Haryana vs Assessee

(VI) Similar convtroversy came up before Mumbai Bench of the ITAT in the case of Star India

Limited (ITA No.3846 / 3585/M/2006. In this case TPO has ignored the detailed analysis of the

various international transactions individually entered into by the assessee in respect of its two

principal business activities namely the export business and buying services business. The TPO

treated all the activities as one and determined the arms length price at an entity level ignoring that

one cannot compare a distributor with a principal and an agent at the same 23 ITA 3829/Del/10

Benetton India Pvt. Ltd.

time, as each activity will result in completely different functions and reasons analysis.

The ITAT upholding the contention of the assessee, held as under in this behalf:

"63. We have carefully examined all the activities of the assessee and we find that the

assessee is in fact involved in three independent activities, i.e. (a) distribution activity

for which assessee has to pay the license fee for the right to distribute the Star

channels to Asian Broadcasting Corporation Ltd also based in Dubai and Indian

Region Broad Casting Ltd., a company based in Hong Kong. This distribution right

cannot be linked up with other activities of the assessee, i.e. with commission for

collecting the advertisement sales or with the export of TV programmes. The other

activity that results in receipt of commission is also independent activity and the

assessee acts as a marketing and collecting agent for Star Ltd. and NGC Asia in

relation to advertisement sales to the satellite television channels broadcast by them

in India. The contract for advertisement is directly entered into between the

advertisers, advertising agencies and Star Ltd and NGC Asia, as the case may be.

These entities directly raise the invoice on the advertisers and the advertisement

agencies and for the services rendered by the assessee, it receives commission at 10%

of the advertisement revenue collected by it from Star Ltd in respect Star channels. In

the case of NGC Asia, the assessee recovers 15% commission in respect of

advertisement sales revenue of NGC. The assessee collects the dues from the

advertisement agencies on behalf of Star Ltd. or NGC Asia as the case may be, but out

of the advertisement commission at a maximum of 15% of the gross billing and

applicable income-tax withholding. The assessee is entitled to the agreed commission

on the net billed amount, and deduct its own commission at the time of realisation

and the rest of the amount is paid to the principal. In the light of these facts,

commission on advertisement sales arises out of an independent activity, which

cannot he linked up with the other activities of the assessee, i.e. distribution activity

or activity of exporting television programmes. Likewise, the third activity of export

of television 24 ITA 3829/Del/10 Benetton India Pvt. Ltd.

programmes or supply of content of television channels to its group entities is also an independent

activity, in which assessee provides content procurement service and also acts as a creator/procurer

of various types of content for sale to its group entities viz. Star Ltd. and SGL. The various types of

content procured by the assessee fall under the category of programs, films, format shows, in house

productions and promotions. The assessee procures content in any one of the ways, such as

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 16

Benetton India Pvt. Ltd., Haryana vs Assessee

acquiring content from external producers, in house production, joint production with external

producers. Assessee also produces the content on the basis of formal specified by the overseas

entities and film procurement. In these activities, assessee's assets were utilized and the risks were

assumed. This activity is also an independent activity and could not be linked up with the other two

remaining activities. Since all the three activities of the assessee are not inter related or interlinked,

the Arms Length Price for all the activities should have been determined independently, in the light

of comparable case. But. the TPO has consolidated and treated all the three activities as one activity

and has determined a common Arms Length Price, having adopted Arithmetic Mean of operating

cost margins of six comparable cases., which are not involved in all the activities as involved by the

assessee.

64. We have thoroughly examined the order of the Special Bench in the case of Aztec Software and

Technologies Ltd. (supra) and we find that the Tribunal has examined the Chapter-X of the

Income-tax Act, relating special provisions relating to avoidance of tax in detail and the Tribunal has

held that ideally in order to arrive at the most precise approximation of fair market value arms

length principle should be applied on transaction to transaction basis. However, there are often

situations where separate transactions are so closely linked or continuous that they cannot be

adequately dealt with on a separate basis. The Tribunal has also held that the burden of proving and

establishing Arms Length Price and to furnish the relevant information lies initially on the

assessee......................"

25 ITA 3829/Del/10

Benetton India Pvt. Ltd.

(VII) Ld. counsel contends that the manufacturing export segment is functionally different and

distinct from the buying service segment as:

(i) In manufacturing export segment, the international transactions related to export

of finished goods, viz., garments manufactured by the assessee, buying service

segment involves undertaking source related services, such as, identifying of the

vendors, merchandize, undertakings, design, quality control, handling, co-ordination

and logistics, etc. These two activities are entirely different.

(ii) Manufacturing export activities and buying service activities are independent of

each other and are not inter- connected or inter-related.

(iii) Manufacturing export segment and buying services segment involve the

following different functions, assets and risk:

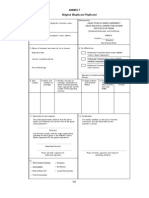

S. Description Manufacturi Buying

No. ng Export Services

I Functions performed

(i) Strategic Planning Significant Significant

(ii) Sourcing and supply chain Significant NA

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 17

Benetton India Pvt. Ltd., Haryana vs Assessee

management

(iii) Manufacturing/Trading Significant NA

(iv) Marketing & Brand Significant NA

Building - Domestic

(v) Sales & Distribution - Significant NA

Domestic Insignificant

-

Export

(vi) Design & Development Insignificant NA

26 ITA 3829/Del/10

Benetton India Pvt. Ltd.

(vii) Quality Control Significant NA

(viii General Management Significant Significant

) Functions

(ix) Research, identification of NA Significant

supplier, sourcing and

supply chain management

(x) Production management, NA Significant

quality control and

Inspection

(xi) Developing customer/buyer NA Significant

relations

(xii) Merchandising - sample NA Significant

display

(xiii Maintenance of shipping NA Significant

) documentation

(xiv Basic documentation NA Significant

) support

II Risk Assumed

(i) Inventory risk Significant Insignificant

(ii) Credit risk - Domestic Significant Insignificant

(iii) Marketing risk - Domestic Significant Insignificant

(iv) Foreign Exchange risk Significant Insignificant

(v) Technology risk Significant NA

(vi) R & D risk Insignificant NA

(vii) Manpower risk Significant Significant

(viii Price risk Significant NA

)

(ix) Capacity utilization risk Significant NA

III Assets Employed

(i) Tangible Assets Significant Insignificant

(ii) Intangible Assets Acquired NA

(iv) The two business activities require performing different functions, utilization of

assets and risks are entirely separate and different activities.

27 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 18

Benetton India Pvt. Ltd., Haryana vs Assessee

(v) There is a separate team of people for the two business segments.

Reliance is placed on the judgment of ITAT in the case of UCB India (P) Ltd. v ACIT

30 SOT 95 (Mumbai) where ITAT while examining the applicability of TNMM of

entity level or on a transaction by transaction basis held that under TNMM, an

international transaction or class of transaction should be evaluated on a standalone

basis by computing the segmental margins -

(VIII) The TPO has adopted a combined analysis of manufacturing transactions and buying services,

undertaken by the assessee, and considered comparable companies engaged in manufacturing of

garments on entity level basis. The comparison of manufacturing enterprises for bench marking of

the buying services by the assessee. Therefore, it would be erroneous and inconsistent with

fundamental test of comparability as provided in the Transfer Pricing regulations. Having regard to

the functional analysis of the transactions, it would be inappropriate and in consistence with the

accepted transfer pricing convention and practices to evaluate manufacturing exports and buying

service segment together on an entity level for determining the arm's length price.

Therefore, benchmarking analysis carried out by the assessee separately considering manufacturing

export activities and buying services activities provide an ideal benchmark for the respective

international transaction and cannot be disregarded.

28 ITA 3829/Del/10

Benetton India Pvt. Ltd.

(IX) The TPO for the purpose of undertaking the benchmarking of the international transactions of

export of finished goods and rendering of buying services applied Transactional Net Margin Method

("TNMM"). The TPO for the purpose of applying TNMM identified the following 9 comparable

companies having average operating profit margin (OP/OC) at 10.57%:

S.No. Name of the company OP/Sales OP/OC

1. Raymond Apparel Limited 12.14 12.99

2. Arvind Brands Limited -16.64 -13.91

3. Lux Industries Limited 2.44 2.49

4. Koutons Retail India Ltd. 15.44 18.26

5. Page Industries Limited 18.51 22.51

6. Kewal Kiran Clothing Ltd. 22.32 28.28

7. Nash Fashions India Limited 7.16 7.04

8. Oswal Knit India Limited 5.42 5.73

9. Microtex India Limited 10.51 11.71

Mean 8.59% 10.57%

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 19

Benetton India Pvt. Ltd., Haryana vs Assessee

In this exercise the following companies have been unjustifiably included in the list of comparable

companies by the TPO:

(i) Raymond Apparel Limited:

The company had substantially high related party transactions of 26.22% during the previous year

2005-06.

Related Party Transactions (RPT) (Refer Rs. 525,917,000

Annexure-I)

Total Revenue (TR) Rs.

2,005,427,000

RPT/TR % 26.22%

29 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Delhi ITAT in the case of Sony India - 114 ITD 448 held that:

"We are further of view that an entity can be taken as uncontrolled if its related party

transaction do not exceed 10 to 15% of total revenue. Within the above limit,

transactions cannot be held to be significant to influence the profitability of

comparable. For the purposes of comparison, what is to be judged is the impact of the

related party transaction vis-a-vis sales and not profit since profit of an enterprise is

influenced by large number of other factors"

The TPO, however, disregarded the contention of the assessee that the above company having

related party transaction should not be considered as part of the comparable companies. TPO

erroneously held that since the filter of substantial related party transactions was not applied by the

assessee in the Transfer Pricing documentation, the said contention could not be raised by the

assessee at this stage.

The assessee did not undertake benchmarking analysis in the Transfer Pricing documentation

applying TNMM. The assessing officer for the first time in the show cause notice has applied TNMM

to determine the arm's length price of the international transaction and identified the aforesaid

companies as comparable companies. Consequently, there was no occasion for the assessee to apply

the substantial related party filter in the Transfer Pricing documentation.

Therefore, Raymond Apparel Ltd. having substantial related party transactions calls for being

excluded from the list of comparables.

(ii) Kewal Kiran Clothing Limited

30 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 20

Benetton India Pvt. Ltd., Haryana vs Assessee

The company has undergone major restructuring during the relevant previous year. As given in its

annual report, the company brought an IPO of 31,00,037 Equity shares of Rs. 10/- and became a

public limited company w.e.f. from 02.11.05. The sales and operating income increased from Rs.

261.19 mn to Rs. 859.64 mn during the year. The net profit before tax also increased to Rs. 181.99

mn as against Rs 48.79 mn because of the major restructuring in the company in the relevant

previous year.

Besides, the company during the year acquired substantial assets of Kewal Kiran Enterprises, a

partnership firm and two of its subsidiaries, viz. Kewal Kiran Retail India Private Limited and

Kornorstone Retail Limited ceased to be subsidiaries of the company w.e.f. August 6, 2005. These

facts are evident from annual report of the company.

The relevant extract from the annual report are as follows: a. "Results of the company include effect

of the above for part of the year and hence previous year figures are not strictly comparable.

b. "Your Company had during the year acquired substantial assets of Kewal Kiran Enterprises, a

partnership firm and therefore the data for the current year would not be strictly comparable with

that of the previous year for the corresponding period.

c. "As a result of restructuring of the group entities during the year, the entire apparel

manufacturing and marketing business now rests with the company.

31 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Due to above major restructuring in the business of Kewal Kiran Clothing Limited, the relevant

previous year was abnormal year and the operating result of the said company cannot be taken into

account for the purpose of benchmarking analysis.

iv. The TPO in his order sought to identify comparable companies considering turnover filter of

50-210 crores. In other words, only companies having turnover in the range of 50-210 crores were

identified as comparable by the TPO. The TPO, however, inadvertently considered Microtex India

Ltd. having turnover of 48.34 crores also as part of the comparable companies. The said company, it

would be appreciated, does not satisfy the selection criteria as considered by the TPO himself. The

said company for that reason is to be excluded from the set of comparable companies.

v. The financial statements of Koutons Retail India Limited are not available on any public domain

for financial year 2005-06.

Besides, as per various news reports on the internet, in public domain, the company has undergone

major restructuring during the previous year 2005-06. On 07.02.06, Koutons retail India Limited

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 21

Benetton India Pvt. Ltd., Haryana vs Assessee

was incorporated by acquiring, Charlie creations, which was a partnership firm.

As a result of the restructuring, as reported,the total income of Koutons Retail India Limited has

increased to Rs. 21,270.78 32 ITA 3829/Del/10 Benetton India Pvt. Ltd.

lakhs in financial year 2005-06 as against 986.6 lakhs in financial year 2004-05 (Source:

Capitaline).

(X) It has been consistent stand of the Revenue that the companies with major restructuring should

not have been accepted as a comparable, Koutons Retail India Limited should not be included as a

comparable company. The TPO without basis has observed that the business restructuring reduces

the profit margin of the company in the initial years. The comparative statement of profitability of

the Koutons is as under:

Year Sales % PBT % PAT %

increase increase increase

31.03.2005 96.33 3.05 1.93

31.03.2006 158.34 64.37% 20.93 586.23% 13.62 605.70%

31.03.2007 402.40 154.14% 52.59 151.27% 33.95 149.27%

31.03.2008 793.46 97.18% 105.15 99.94% 69.49 104.68%

31.03.2009 1046.68 31.91% 120.82 14.90% 79.56 14.49%

Thus, the profit of the company increased due to restructuring. Hence, company should not be

considered as a comparable for the relevant assessment year.

(XI) If these companies are excluded, the average operating profit margin (OP/OC%) of the

remaining comparable companies, works out as under:

S.No. Name of the companies OP/OC %

1. Oswal Knit India 5.73%

2. Nash Fashion (India) Ltd. 7.04%

3. Page Industries Ltd. 22.51%

4. Lux Hosiery Industries Limited 2.49%

5. Arvind Brands Limited -13.91%

Average 4.77%

33 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Since the operating profit ratio of the assessee for exports made to related parties @17.41% is higher

than the average of operating profit ratio of comparable companies, the international transaction of

export of goods, therefore, considered being at arm's length using TNMM.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 22

Benetton India Pvt. Ltd., Haryana vs Assessee

(XII) The TPO has applied the operating profit margin of the aforesaid comparable companies to the

value of all the international transactions as follows:

Value of international transactions A 189,537,478.00

OP/OC of comparables 4.77%

Arm's length Margin B=A*10.57% 9,047,836.18

Arm's length price 198,585,314.18

Margin shown by the assessee C=A*2.57% 4,871,113.18

@2.57%

Difference B-C 4,176,722.99

% difference 2.20%

5.2. The adjustment on account of the difference in the arm's length price computed by the TPO in

the impugned order passed under section 92CA(3) of the Act being within the range of ± 5%, is thus

liable to be excluded. The provision reads as under:

"92C. Computation of arm's length price.

xxx xxx (2) The most appropriate method referred to in sub-section (1) shall be

applied, for determination of arm's length price, in the manner as may be prescribed:

Provided that where more than one price is determined by the most appropriate

method, the arm's length price shall be taken to be the arithmetical mean of such

prices, or, at the option of the assessee, a price which may vary from the arithmetical

mean by an amount not 34 ITA 3829/Del/10 Benetton India Pvt. Ltd.

exceeding five per cent of such arithmetical mean." (emphasis supplied) 5.3. Reliance is placed on

the decision of Calcutta Bench of the ITAT in the case of Development Consultants (P) Ltd. vs.

DCIT: 115 TTJ 577, wherein the aforesaid contention of the assessee has been upheld by the Hon'ble

Tribunal.

5.4. The benefit of +/(-) 5% as per proviso to section 92C(2) of the Act has been held to be

admissible as standard deduction while computing the arm's length price of the international

transactions in the following decisions:

- ACIT vs. Philips Software Centre Pvt. Ltd. : (2008) (26 SOT 226

- DCIT vs. Sony India Ltd. (2008) (114 ITD 448 (Delhi), 118 TTJ (Delhi)

865)

- Skoda Auto India Pvt. Ltd. v. ACIT: (2009) 122 TTJ (Pune) 699

- Development Consultants (P) Ltd. vs. DCIT: 115 TTJ 577, 5.5. Assuming even if assessee's other

arguments are not accepted, in view of the clear provisions of proviso to section 92C (2) of the

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 23

Benetton India Pvt. Ltd., Haryana vs Assessee

Act___ No adjustment is called for as assessee ALP is not less than 95% of the average operating

profit margin of the comparable uncontrolled enterprises determined applying TNMM method.

5.6. In any case the assessee company during the relevant previous year has incurred substantial

expenses to promote and establish its business in the domestic market. Low profitability of the

assessee is mainly on account of the expenses incurred for establishing new show rooms creating

presence in the various parts of the country, large demonstration, marketing and selling expenses,

etc. Low profitability of the assessee company is not on account 35 ITA 3829/Del/10 Benetton India

Pvt. Ltd.

of the international transactions, which is clear from the facts that:

(i) The gross profit margin of the assessee company is worked out at 44.53% as

against 31.76% in the case of the comparable companies. It would be appreciated that

the profitability of the assessee is not impacted on account of the international

transaction of imports, which is, in any case, only 2.54% of the total turnover.

(ii) The operating profit margin of the assessee company after excluding some of the

expenses, such as, rent, advertisement, shop running and guarantee charges, etc., is

worked out at 20.41% (OP/Sales %) as against 15.29% in case of the comparable

companies.

5.7. The low profitability of the assessee company being largely attributable to the expenses incurred

by the assessee to establish and promote itself in the domestic market, has nothing to do with the

various international transactions undertaken with associated enterprise.

6. Learned DR supports the TPO's reports and orders passed by AO and DRP and contends that T.P.

analysis requires consideration of various bench marks, comparable & FAR analysis. The TPO has

given detailed reasons in support of analysis which should be upheld.

7. We have heard rival contentions, perused the material available on record. The first and foremost

question in this case is to determine whether the action of TPO in undertaking entity level

benchmarking by TNM method combining of the international transactions is justifiable or the TP

analysis 36 ITA 3829/Del/10 Benetton India Pvt. Ltd.

provided by assessee, based on "transaction to transaction" basis in respect of different segments

should be adopted.

7.1. From the facts mentioned above, it is clear that assessee's manufacturing export activities;

buying/sourcing and commission earning activities are independent of each other. Each activity has

different factors in respect of source, identification of vendors, merchandise, designs quality control,

handling etc. The FAR analysis in each of the activity will have distinct and separate considerations.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 24

Benetton India Pvt. Ltd., Haryana vs Assessee

7.2. We, find merit in the argument of the learned counsel that the TPO should have accepted the

method of assessee's benchmarking analysis on the basis of transaction to transaction basis in

respect of different segments of assessee's international transactions with associated enterprises. In

our view, assessee's functions, risk and assets FAR considerations, which are given in the above

table, deserves to be merited. TPO did not appreciate the assessee's transactions correctly and

applied entity level benchmarking on TNMM method by combining assessee's all international

transactions with associated enterprise without justification.

7.3. Our view is supported by ITAT judgments - Mumbai Bench in the cases of UCB India (P) Ltd.

Vs. ACIT (supra); and ACIT v. Star India Ltd. (supra); and Kolkata Bench in the case of

Development Consultants (P) Ltd. (supra). All these cases clearly lay down that ALP would be

determined based on the nature of service provided by assessee for each class of transaction based

on various factors and analysis. In the case of Star India Ltd. (supra), also the TPO treated all the

activities of the assessee as one and 37 ITA 3829/Del/10 Benetton India Pvt. Ltd.

determined the ALP at entity level without appreciating that one cannot compare the FAR of a

principal and agent on same footing.

7.4. In our view, in the assessee's case there are different segmental activities, which are

independent of each other. They are required to be analyzed on transaction to transaction basis and

not by combining all activities. Consequently, we uphold the assessee's method of ALP.

7.5. In respect of working of the assessee's ALP, we see no infirmity in the FAR analysis given by

assessee, which is detailed above. Therefore, we uphold the assessee's method and working of ALP.

In combine benchmarking also, TPO has not considered the fact that the cases of Raymond, Kewal

Kiran Clothing Ltd., Microtex India Ltd., Koutons Retail India Ltd. cannot be taken as comparables

due to their substantially high related party transactions, restructuring etc. Consequently, these

comparables are to be excluded. On exclusion thereof, what remains out of the comparables i.e.

Oswal Knit India, Lux Hosiery Industries Ltd., Page Industries Ltd. with average OP/sales of 4.77%.

In contrast the assessee's operating profit ratio of export to related parties at 17.41% is higher than

the average operating profit.

7.6. Coming to the assessee's alternate contention based on plus -minus 5% acceptance of variation,

as prescribed by Sec. 92CA(3), we find merit in the argument of learned counsel that even if all the

factors are assumed against assessee; the operating profit margin of the assessee entity level comes

to 2.47%, which is within the end of plus - minus 5% margin. In this eventuality also assessee

deserves to succeed.

38 ITA 3829/Del/10

Benetton India Pvt. Ltd.

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 25

Benetton India Pvt. Ltd., Haryana vs Assessee

7.7. In view of the foregoings, we have no hesitation to uphold the assessee's working of ALP for

international transactions with associated enterprises, the additions made are deleted.

8. In the result, assessee's appeal is allowed. Order pronounced in open court on 30-11-2011.

Sd/- Sd/-

(SHAMIM YAHYA ) ( R.P. TOLANI )

ACCOUNTANT MEMBER JUDICIAL MEMBER

Dated: 30-11-2011.

MP

Copy to :

1. Assessee

2. AO

3. CIT

4. CIT(A)

5. DR

Indian Kanoon - http://indiankanoon.org/doc/145857764/ 26

You might also like

- Moot Memo On GAAR ProvisionDocument34 pagesMoot Memo On GAAR ProvisionVivek VaibhavNo ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Tracking Market GammaDocument11 pagesTracking Market Gammadeepak777100% (1)

- Government Support Options: Laura Kiwelu Norton Rose FulbrightDocument15 pagesGovernment Support Options: Laura Kiwelu Norton Rose FulbrightE BNo ratings yet

- Law No 28 Year 2007 (UU KUP English)Document85 pagesLaw No 28 Year 2007 (UU KUP English)cariiklan100% (1)

- ITA No. 565/Ahd/17 questions Rs 1,588 crore TP adjustmentDocument161 pagesITA No. 565/Ahd/17 questions Rs 1,588 crore TP adjustmentRaj A KapadiaNo ratings yet

- Aar 1082 Endemol India PVT LTDDocument7 pagesAar 1082 Endemol India PVT LTDMukesh RathodNo ratings yet

- Form 15CB - Filed FormDocument3 pagesForm 15CB - Filed Formprachi12gargNo ratings yet

- Flytxt - ECB Interest - Form 15CB - 21 Nov 22Document4 pagesFlytxt - ECB Interest - Form 15CB - 21 Nov 22RahulNo ratings yet

- Kansai Nerolac Software TDSDocument17 pagesKansai Nerolac Software TDSkumargaurav21281No ratings yet

- Wipro Finance LTD Vs The Commissioner of Income Tax On 12 April 2022Document14 pagesWipro Finance LTD Vs The Commissioner of Income Tax On 12 April 2022Umashankar SinhaNo ratings yet

- Annual Secretarial Compliance Report For The Year Ended 31st March 2021Document4 pagesAnnual Secretarial Compliance Report For The Year Ended 31st March 2021Pushkar SharmaNo ratings yet

- GtimasterpolicyDocument14 pagesGtimasterpolicykarthikreddymNo ratings yet

- Korean Certain PaperDocument17 pagesKorean Certain Paperabhavmehta08No ratings yet

- TS 24 ITAT 2013 (Mum) P T McKinsey IndonesiaDocument5 pagesTS 24 ITAT 2013 (Mum) P T McKinsey IndonesiaNeeta Punjabi BhatiaNo ratings yet

- Visen Industries Board Meeting Minutes Review (2018-2021Document19 pagesVisen Industries Board Meeting Minutes Review (2018-2021AnoushkaBorkerNo ratings yet

- Charleon Pokphand Thailand Krung Thep Maha Nakhon, Bangkok 10110, ThailandDocument2 pagesCharleon Pokphand Thailand Krung Thep Maha Nakhon, Bangkok 10110, ThailandIF GAME100% (1)

- Summary of Case Laws of Direct TaxDocument14 pagesSummary of Case Laws of Direct TaxAvaniJainNo ratings yet

- Taxation of foreign shipping company's profits in IndiaDocument7 pagesTaxation of foreign shipping company's profits in IndiaRupal MaheshwariNo ratings yet

- Legal Update: Circulars/NotificationsDocument9 pagesLegal Update: Circulars/NotificationsAnupam BaliNo ratings yet

- Awarding Higher Rate of Interest - Against Public Policy - SAIL Case 2020 Delhi HCDocument33 pagesAwarding Higher Rate of Interest - Against Public Policy - SAIL Case 2020 Delhi HCMuthu OrganicsNo ratings yet

- Anf 5BDocument3 pagesAnf 5BAkash KediaNo ratings yet

- Everest Kanto Cylinder LTD 1Document17 pagesEverest Kanto Cylinder LTD 1ramitkatyalNo ratings yet

- Application For Remittance of Royalty Fee (App-V53)Document4 pagesApplication For Remittance of Royalty Fee (App-V53)Soniya KhuramNo ratings yet

- Providing Technical Services from IndiaDocument11 pagesProviding Technical Services from IndiaVaidehi KolheNo ratings yet

- Case 2 VODAFONE INDIA LTD CP 407-2017 NCLT ON 17.5.2018 FINALDocument9 pagesCase 2 VODAFONE INDIA LTD CP 407-2017 NCLT ON 17.5.2018 FINALShubham PhophaliaNo ratings yet

- UAE Exchange Centre LTD Vs Union of India UOI and Anr 13022009 DELHC 1Document17 pagesUAE Exchange Centre LTD Vs Union of India UOI and Anr 13022009 DELHC 1UdayyIklNo ratings yet

- Moot Prem & ManishDocument21 pagesMoot Prem & ManishKUSHAL100% (1)

- Before The Authority For Advance Rulings (Income Tax), New DelhiDocument16 pagesBefore The Authority For Advance Rulings (Income Tax), New DelhiShreyas ShahNo ratings yet

- Application For WaiverDocument4 pagesApplication For WaivershanuNo ratings yet

- ASEAN goods certificate chocolate Indonesia SingaporeDocument2 pagesASEAN goods certificate chocolate Indonesia SingaporeIF GAMENo ratings yet

- Form D Cels ChocoDocument2 pagesForm D Cels ChocoIF GAMENo ratings yet

- Intimation of Order Passed by National Company Law Tribunal NCLTDocument13 pagesIntimation of Order Passed by National Company Law Tribunal NCLTmecbecsNo ratings yet

- Appeal Before The Commissioner of Income Tax (Appeals) - 12, BangaloreDocument4 pagesAppeal Before The Commissioner of Income Tax (Appeals) - 12, BangaloreKrishna ChaitanyaNo ratings yet

- 22I27525Document3 pages22I27525Pankaj SinghNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- ITAT Ruling Excludes Oman Investment from Section 14A DisallowanceDocument43 pagesITAT Ruling Excludes Oman Investment from Section 14A DisallowanceTrisha MajumdarNo ratings yet

- Rollatainers LTDDocument5 pagesRollatainers LTDmydearg1305No ratings yet

- Arguments Advanced Returns 3000Document25 pagesArguments Advanced Returns 3000Manya JainNo ratings yet

- Nit061 PDFDocument5 pagesNit061 PDFAbhishek SinghNo ratings yet

- Petitioner MemorialDocument26 pagesPetitioner Memorial16048 PALLAV RATHINo ratings yet

- 0993 HL AssociatesDocument5 pages0993 HL AssociatesYakshit JainNo ratings yet

- 0929 I P ElectronicsDocument5 pages0929 I P ElectronicsYakshit JainNo ratings yet

- Civil Case Dispute Over Breach of ContractDocument12 pagesCivil Case Dispute Over Breach of ContractHari Sudhan LPNo ratings yet

- International TaxationDocument19 pagesInternational TaxationRavi TejaNo ratings yet

- Jagatjit Industries LimitedDocument3 pagesJagatjit Industries LimitedFARUKH N MႮNՏHiNo ratings yet

- आयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Document8 pagesआयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Saksham ShrivastavNo ratings yet

- Memorial For The PlaintiffDocument20 pagesMemorial For The PlaintiffLogan DavisNo ratings yet

- (2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian JurisprudenceDocument4 pages(2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian Jurisprudencesuraj gulipalliNo ratings yet

- Form ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFDocument3 pagesForm ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFFirstBusiness.inNo ratings yet

- Certificate of InsuranceDocument3 pagesCertificate of InsurancePrateek MondolNo ratings yet

- Form No. 15Cb: (See Rule 37BB)Document3 pagesForm No. 15Cb: (See Rule 37BB)Live GracefullyNo ratings yet

- ASEAN Trade Certificate DetailsDocument2 pagesASEAN Trade Certificate DetailsDustin SangNo ratings yet

- 240405RR00 - Legal Memorandum - Acquisition[45]Document20 pages240405RR00 - Legal Memorandum - Acquisition[45]NylzarreNo ratings yet

- Form CHG-1 - 25 - 11 - 2022 - 25 - 11 - 2022Document10 pagesForm CHG-1 - 25 - 11 - 2022 - 25 - 11 - 2022technowireinNo ratings yet

- 2020 116 Taxmann Com 325 Bombay 20 08 2019 Principal Commissioner of Income Tax 7 VsDocument3 pages2020 116 Taxmann Com 325 Bombay 20 08 2019 Principal Commissioner of Income Tax 7 Vsbaviv70579No ratings yet

- Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedDocument6 pagesVodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedasdfqwerasdNo ratings yet

- Notes To Form IDocument9 pagesNotes To Form ITauheedAlamNo ratings yet

- 376808061899518109713$5 1REFNOITA No.109-Alld-2012 Shiv Shakti BuildersDocument11 pages376808061899518109713$5 1REFNOITA No.109-Alld-2012 Shiv Shakti BuildersPrabhash ChandNo ratings yet

- IRP Replacement for Failure to Conduct CIRPDocument9 pagesIRP Replacement for Failure to Conduct CIRPKashaf JunaidNo ratings yet

- RGNUL Moot Court Taxation DisputeDocument17 pagesRGNUL Moot Court Taxation DisputejanveeNo ratings yet

- Form 15CB - Filed FormDocument4 pagesForm 15CB - Filed FormBhagya RajoriaNo ratings yet

- Format TenderDocument2 pagesFormat TenderAashish JanardhananNo ratings yet

- SLR DetailsDocument1 pageSLR DetailsNimalanNo ratings yet

- Importance of Banking in IndiaDocument2 pagesImportance of Banking in IndiaNimalanNo ratings yet

- JurisdictionDocument3 pagesJurisdictionNimalanNo ratings yet

- AY 2013-14 Indian Income Tax Return FormDocument81 pagesAY 2013-14 Indian Income Tax Return FormNimalanNo ratings yet

- Sachin Pol SciDocument19 pagesSachin Pol SciNimalanNo ratings yet

- CPC ADCdecDocument16 pagesCPC ADCdeckingNo ratings yet

- Transfer Pricing Adjustments: by CA - Karnik GulatiDocument9 pagesTransfer Pricing Adjustments: by CA - Karnik GulatiNimalanNo ratings yet

- Private Placement ChangesDocument4 pagesPrivate Placement ChangesNimalanNo ratings yet

- Moot NPPDocument5 pagesMoot NPPNimalanNo ratings yet

- Declaration Form (Parents)Document4 pagesDeclaration Form (Parents)NimalanNo ratings yet

- Declaration Form (Parents)Document1 pageDeclaration Form (Parents)NimalanNo ratings yet

- Synopsis For CorporateDocument4 pagesSynopsis For CorporateNimalanNo ratings yet

- TN National Law School Admission Form 2018-19Document2 pagesTN National Law School Admission Form 2018-19NimalanNo ratings yet

- Re-Admission FormDocument70 pagesRe-Admission FormNimalanNo ratings yet

- Statement of JurisdictionDocument5 pagesStatement of JurisdictionNimalanNo ratings yet

- "Aspect Theory" Justify Overlapping of Central and State TaxesDocument8 pages"Aspect Theory" Justify Overlapping of Central and State TaxesNimalanNo ratings yet

- Narasu AppaDocument1 pageNarasu AppaNimalanNo ratings yet

- Ait 2008 155 ItatDocument4 pagesAit 2008 155 ItatNimalanNo ratings yet

- Rules For IADRC 2018Document12 pagesRules For IADRC 2018NimalanNo ratings yet

- Negotiation InternalsDocument2 pagesNegotiation InternalsNimalanNo ratings yet

- Tamil Nadu National Law School: TiruchirappalliDocument1 pageTamil Nadu National Law School: TiruchirappalliNimalanNo ratings yet

- Ningawa V ByrappaDocument7 pagesNingawa V ByrappaNimalanNo ratings yet

- TN National Law School Admission Form 2018-19Document2 pagesTN National Law School Admission Form 2018-19NimalanNo ratings yet

- Annexure - IIDocument14 pagesAnnexure - IINimalanNo ratings yet

- Declaration Form (Parents)Document1 pageDeclaration Form (Parents)NimalanNo ratings yet

- JP Response PaperDocument3 pagesJP Response PaperNimalanNo ratings yet

- Annexure - IiDocument1 pageAnnexure - IiNimalanNo ratings yet

- Circular (Fee Payment) - Ay 18-19Document2 pagesCircular (Fee Payment) - Ay 18-19NimalanNo ratings yet

- Financial Performance Analysis FormulasDocument1 pageFinancial Performance Analysis FormulasNimalanNo ratings yet

- Hybrid Agreement Business Project Management ReportDocument45 pagesHybrid Agreement Business Project Management Reportandrei4i2005No ratings yet

- Tangible Asset Value Per Share CalculationDocument1 pageTangible Asset Value Per Share Calculationimtehan_chowdhuryNo ratings yet

- Opinion - Mary Mcculley V US Bank Homeowner WinsDocument28 pagesOpinion - Mary Mcculley V US Bank Homeowner WinsmcculleymaryNo ratings yet

- 2122 s3 Bafs Notes STDocument3 pages2122 s3 Bafs Notes STKiu YipNo ratings yet

- 2011HB 06651 R00 HBDocument350 pages2011HB 06651 R00 HBPatricia DillonNo ratings yet

- CBSE Class 12 Economics Sample Paper (For 2014)Document19 pagesCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperNo ratings yet

- Global Transition of HR Practices During COVID-19Document5 pagesGlobal Transition of HR Practices During COVID-19Md. Saifullah TariqueNo ratings yet

- 15968615919016284WDocument2 pages15968615919016284WSourya MitraNo ratings yet

- Prosper September 2020 Small Business SurveyDocument17 pagesProsper September 2020 Small Business SurveyStuff NewsroomNo ratings yet

- Analyze datesDocument31 pagesAnalyze datesHussain AminNo ratings yet

- A Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeDocument143 pagesA Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeRathod JayeshNo ratings yet

- HTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFDocument99 pagesHTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFДмитрий ЮхановNo ratings yet

- Fria MCQDocument13 pagesFria MCQJemima LalaweNo ratings yet

- FS FactoringDocument17 pagesFS FactoringJai DeepNo ratings yet

- BPI's Opposition to Sarabia Manor's Rehabilitation PlanDocument2 pagesBPI's Opposition to Sarabia Manor's Rehabilitation PlanJean Mary AutoNo ratings yet

- Dianne FeinsteinDocument5 pagesDianne Feinsteinapi-311780148No ratings yet

- Sino-Forest 2010 ARDocument92 pagesSino-Forest 2010 ARAnthony AaronNo ratings yet

- Accounting For CorporationDocument5 pagesAccounting For CorporationZariyah RiegoNo ratings yet