Professional Documents

Culture Documents

Mba-III-Advanced Financial Management m1

Uploaded by

KedarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mba-III-Advanced Financial Management m1

Uploaded by

KedarCopyright:

Available Formats

Smartworld.

asia 1

ADVANCED FINANCIAL MANAGEMENT 14MBAFM304

No. of Lecture Hrs/week: 04 Exam Hrs. 03

Total No. of Lecture Hrs. 56 IA Marks: 50

Practical Component: 01 Hr/ Week Exam Marks: 100

Syllabus

MODULE 1

Working capital management

Determination of level of current Assets Sources for financing working capital. Bank

finance for working capital (No problems on estimation of working capital) Working capital

financing: Short term financing of working capital, long term financing of working capital.

Working capital leverages

MODULE 2

Cash Management

Forecasting cash flows – Cash budgets, long-term cash forecasting, monitoring collections and

receivables, optimal cash balances – Baumol model, Miller-orr model, and stone model.

Strategies for managing surplus fund.

MODULE 3

Receivables Management

Credit management through credit policy variables, marginal analysis, and Credit

evaluation: Numerical credit scoring a n d d i s c r i m i n a t e anal ysi s . Control o f a c c o u n t s

recei v abl es , Factoring.

MODULE 4

Inventory Management

Determinations of inventory control levels: Ordering, reordering, danger level. EOQ model.

Pricing of raw material. Monitoring and control of inventories, ABC Analysis.

MODULE 5

Capital structure decisions

capital structure & market value of a firm. Theories of capital structure – NI

approach, NOI approach, Modigliani Miller approach, traditional approach. Arbitrage

process in capital structure. Planning the capital structure: EBIT and EPS analysis. ROI &

ROE analysis. Capital structure policy.

MODULE 6

Dividend policy

Theories of dividend policy: relevance and irrelevance dividend decision. Walter‟s &

Gordon‟s model, Modigliani & Miller approach. Dividend policies – stable dividend, stable

payout and growth. Bonus shares and stock split corporate dividend behavior. Legal and

procedural aspects of dividends Corporate Dividend Tax.

MODULE 7

Special issues in financial management

Corporate financial modelling Agency problem and consideration. Effect of inflation on Asset

value, firm value, returns Financial planning – Basis of financial planning, sales forecast method,

pro-forma P & L account method, pro-forma balance sheet method, determination of External

Financing Requirement (EFR).

Dept. of MBA- SJBIT 1

Smartworld.asia 2

ADVANCED FINANCIAL MANAGEMENT 14MBAFM304

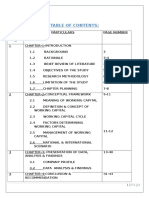

Index

Modules Content Page No.

1 Working Capital Management 3-6

2 Cash Management 7-10

3 Receivables Management 11-24

4 Inventory Management 25-32

5 Capital structure decisions 33-39

6 Dividend policy 40-42

7 Special issues in financial management 43-49

Dept. of MBA- SJBIT 2

Smartworld.asia 3

ADVANCED FINANCIAL MANAGEMENT 14MBAFM304

Module-1

Working Capital Management

One of the most important areas in the day to day management of the firm is the management of

working capital. Working capital refers to the funds held in current assets. Current assets are

essential to use fixed assets. The requirements for current assets are usually greater than the

amount of funds available through current liabilities

OPTIMUM INVESTMENT

The importance of adequate working capital can never be over emphasized. A firm has to be

very careful in estimating its working capital. The effective management of working capital is

the primary means of achieving the firm’s goal of adequate liquidity. A very big amount of

working capital would mean that the firm has idle funds. This results in over capitalization.

Over capitalization implies that the firm has too large funds for its requirements, resulting in a

low rate of return. If the firm has inadequate working capital, it is said to be undercapitalized.

Such a firm runs the risk of insolvency. Shortage of working capital may lead to a situation

where the firm may not be able to meet its liabilities. Hence it is very essential to estimate the

requirements of working capital carefully and determine the optimum level of investment in it.

At the optimum level of working capital the profitability will be maximum.

Concepts of working capital

Gross Working Capital:

The Gross working capital refers to investment in all the current assets taken together. Current

assets are the assets which can be converted into cash within an accounting year or operating

cycle and include cash, short-term securities, debtors, bills receivable and inventory.

2. Net working Capital:

The term ‘net working capital’ refers to excess of total current assets over total current

liabilities. Current liabilities are those claims of outsider’s which are expected to mature for

payments within an accounting year and include creditors, bills payable and outstanding

expenses. Networking capital can be positive (CA>CL) or negative (CA< CL). Net working

capital is that position of current assets which is financed with the long term funds.

Need for working capital management

In a typical manufacturing firm, current assets exceed one-half of total assets.

Excessive levels can result in a substandard Return on Investment (ROI).

Current liabilities are the principal source of external financing for small firms.

Requires continuous, day-to-day managerial supervision.

Working capital management affects the company’s risk, return, and share price.

Importance

A firm needs funds for its day to day running. Adequacy or inadequacy of these funds would

determine the efficiency with which the daily business may be carried on. It is to be ensured that

Dept. of MBA- SJBIT 3

Smartworld.asia 4

ADVANCED FINANCIAL MANAGEMENT 14MBAFM304

the amount of working capital available within the firms is neither too large nor too small for its

requirements.

For the following reasons working capital should be adequate.

To meet the short term obligations.

To avail the market opportunities such as purchase of raw materials at the lowest price,

with discount etc.

To enable the firm to operate more efficiently and meet the raising turnover thus peak

needs can be taken care off.

To enable the firm to extend favourable credit terms to the customers.

Optimum working Capital

Current ratio, with acid test ratio to supplement it, has traditionally been considered the best

indicator of the working capital situation.

A current ratio of 2 for a manufacturing firm implies that the firm has an optimum account of

working capital.

This is supplemented by the Acid Test Ratio which should be at least one.

It is considered that there is a comfortable liquidity position if liquid current assets are equal to

current liabilities.

Optimum working capital can be determined only with reference to the particular circumstances

of a specific situation.

In a firm where the inventories are easily saleable and the sundry debtors are as good as liquid

cash, the current ratio may be lower than 2 and yet firm may be sound. An optimum working

capital ratio dependent upon the business situation as such, and the nature and composition of

various current assets.

WORKING CAPITAL CYCLE

The working capital cycle/ Operating cycle refers to the length of time between the firms paying

cash for materials etc., entering into the production process/inventory and the inflow of cash

from sale of finished goods.

PHASES OF WORKING CAPITAL

The operating cycle (working capital cycle) in a manufacturing firm consists of the following

events, which continues throughout the life of business.

Conversion of cash into raw materials

Conversion of raw materials into work in progress

Conversion of working progress into finished goods

Conversion of finished goods into accounts receivable through sales

Dept. of MBA- SJBIT 4

Smartworld.asia 5

ADVANCED FINANCIAL MANAGEMENT 14MBAFM304

Conversion of account receivable into cash (OR finished good into cash in the case cash sales)

The duration of the Gross operating cycle for the purpose of estimating working capital is equal

to the sum of the durations of each of above said events. Net operating cycle is calculated as

Gross operating cycle less the credit period allowed by the suppliers.

Types Of working Capital

From the point of view of time, the term working capital can be divided into two categories:

1. Permanent working capital:

It is that minimum level of investment in the current assets that is carried by the firm at all times

to carryout minimum level of its activities. It also refers to the Hard core working capital.

2. Temporary working capital:

It refers to that part of total working capital, which is required by a business over and above

permanent working capital. It is also called as variable or fluctuating working capital. Since the

volume of temporary working capital keeps on fluctuating from time to time, according to the

business activities it may be financed.

Hedging (or Maturity Matching) Approach

A method of financing where each asset would be offset with a financing instrument of the same

approximate maturity

Financing Needs and the Hedging Approach

Fixed assets and the non-seasonal portion of current assets are financed with long-term debt and

equity (long-term profitability of assets to cover the long-term financing costs of the firm).

Seasonal needs are financed with short-term loans (under normal operations sufficient cash flow

is expected to cover the short-term financing cost).

Self-Liquidating Nature of Short-Term Loans

Seasonal orders require the purchase of inventory beyond current levels.

Increased inventory is used to meet the increased demand for the final product.

Sales become receivables.

Receivables are collected and become cash.

The resulting cash funds can be used to pay off the seasonal short-term loan and cover

associated long-term financing costs.

Risks vs. Costs Trade-Off (Conservative Approach)

Long-Term Financing Benefits

Less worry in refinancing short-term obligations

Less uncertainty regarding future interest costs

Dept. of MBA- SJBIT 5

Smartworld.asia 6

ADVANCED FINANCIAL MANAGEMENT 14MBAFM304

Long-Term Financing Risks

Borrowing more than what is necessary, Borrowing at a higher overall cost

Comparison with an Aggressive Approach

Short-Term Financing Benefits

Financing long-term needs with a lower interest cost than short-term debt

Borrowing only what is necessary

Short-Term Financing Risks

Refinancing short-term obligations in the future

Uncertain future interest costs

Result

Manager accepts greater expected profits in exchange for taking greater risk.

Combining Liability Structure and Current Asset Decisions

u The level of current assets and the method of financing those assets are interdependent.

u A conservative policy of “high” levels of current assets allows a more aggressive method

of financing current assets.

u A conservative method of financing

(all-equity) allows an aggressive policy of “low” levels of current assets.

Dept. of MBA- SJBIT 6

You might also like

- Mba III Advanced Financial Management NotesDocument49 pagesMba III Advanced Financial Management NotesThahir Shah100% (2)

- A Project Report On Cost AnalysisDocument65 pagesA Project Report On Cost AnalysisRoyal Projects83% (41)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Mba-III-Advanced Financial Management (14mbafm304) - NotesDocument48 pagesMba-III-Advanced Financial Management (14mbafm304) - NotesSyeda GazalaNo ratings yet

- Working Capital On WIPRO ITCDocument50 pagesWorking Capital On WIPRO ITCB Swaraj100% (1)

- Mba-III-Advanced Financial Management (14mbafm304) - NotesDocument49 pagesMba-III-Advanced Financial Management (14mbafm304) - NotesAnilKotthur100% (1)

- Working CapitalDocument62 pagesWorking CapitalHrithika AroraNo ratings yet

- Project WCMDocument36 pagesProject WCMmohammedabdullah2162No ratings yet

- Working Plag FileDocument48 pagesWorking Plag Fileaurorashiva1No ratings yet

- A Project Study On Working Capital With Reference To: Mr. Syed Mohammed ShahnawazDocument77 pagesA Project Study On Working Capital With Reference To: Mr. Syed Mohammed ShahnawazRiyaz AliNo ratings yet

- Working Capital ManagementDocument45 pagesWorking Capital ManagementssanjitkumarNo ratings yet

- Dcom505 Working Capital Management PDFDocument242 pagesDcom505 Working Capital Management PDFRaj KumarNo ratings yet

- Working Capital Management 1Document108 pagesWorking Capital Management 1bunny37100% (1)

- Working Capital ManagementDocument45 pagesWorking Capital ManagementAnonymous NPhhW0No ratings yet

- Working Capital at SbiDocument65 pagesWorking Capital at SbiRahul ShrivastavaNo ratings yet

- A Study On Woking CapitalDocument33 pagesA Study On Woking Capitaljayeshlohar39No ratings yet

- Final Project1Document107 pagesFinal Project1Arun KumarNo ratings yet

- CH 7 Working CapitalDocument97 pagesCH 7 Working CapitalAnkur AggarwalNo ratings yet

- Summer Training Report: Working Capital ManagementDocument73 pagesSummer Training Report: Working Capital ManagementanilkavitadagarNo ratings yet

- Role of Banks in Working Capital ManagementDocument59 pagesRole of Banks in Working Capital Managementashwin thakurNo ratings yet

- Mba II Financial Management (14mba22) NotesDocument53 pagesMba II Financial Management (14mba22) NotesPriya PriyaNo ratings yet

- Jim Financial ManagementDocument37 pagesJim Financial ManagementGARUIS MELINo ratings yet

- 1 W C ChapDocument11 pages1 W C ChappoovarasnNo ratings yet

- Research Report Project: Analysis of Working Capital Management of Shriram Pistons & Rings LTD"Document88 pagesResearch Report Project: Analysis of Working Capital Management of Shriram Pistons & Rings LTD"Tripta kumariNo ratings yet

- Noor Mohamed - Working Capital Management-Full ReportDocument94 pagesNoor Mohamed - Working Capital Management-Full ReportananthakumarNo ratings yet

- Working Capital Kesoram FinanceDocument56 pagesWorking Capital Kesoram FinanceRamana GNo ratings yet

- Full Report HereDocument25 pagesFull Report HereAnu PomNo ratings yet

- WCM PSBDocument41 pagesWCM PSBVISHAKHA BHALERAONo ratings yet

- A Project Report On: "A Study On Working Capital Management Done at State Bank of India (Bangalore)Document15 pagesA Project Report On: "A Study On Working Capital Management Done at State Bank of India (Bangalore)Nirnaya AgarwalNo ratings yet

- 1.1) Introduction: Study of Working Capital Management and Financial Planning of Jain Irrigation System LTDDocument39 pages1.1) Introduction: Study of Working Capital Management and Financial Planning of Jain Irrigation System LTDsarvesh.bhartiNo ratings yet

- Project PDFDocument74 pagesProject PDFAniketNo ratings yet

- A Project Report On Cost AnalysisDocument67 pagesA Project Report On Cost AnalysisArov KDNo ratings yet

- Working Capital Desicion: Unit - IvDocument26 pagesWorking Capital Desicion: Unit - Ivshaik masoodNo ratings yet

- Working Capital Sagar CementDocument98 pagesWorking Capital Sagar CementVamsi SakhamuriNo ratings yet

- Fci Project SreeDocument94 pagesFci Project SreeLiju LawrenceNo ratings yet

- Kavita Final YearDocument54 pagesKavita Final YearVinayNo ratings yet

- Chapter-I: Financial Management Financial Management, As An Integral Part of Over All Management Is Not ADocument120 pagesChapter-I: Financial Management Financial Management, As An Integral Part of Over All Management Is Not AmaxminfastNo ratings yet

- 200 Final ProjectDocument85 pages200 Final ProjectmujeebNo ratings yet

- Working Capital ManagementDocument28 pagesWorking Capital ManagementLeUqar Bico-Enriquez GabiaNo ratings yet

- Smpe 202 Financial ManagementDocument131 pagesSmpe 202 Financial Managementfmebirim100% (2)

- Working Capital ManagementDocument45 pagesWorking Capital Managementbulu_bbsr03No ratings yet

- A Synopsis Report ON Working Capital Management AT: Submitted byDocument24 pagesA Synopsis Report ON Working Capital Management AT: Submitted byMOHAMMED KHAYYUMNo ratings yet

- Unit 05Document98 pagesUnit 05Shah Maqsumul Masrur TanviNo ratings yet

- Fm-Ii CH-2Document11 pagesFm-Ii CH-2Benol MekonnenNo ratings yet

- Financial Management PDFDocument111 pagesFinancial Management PDFcheri kok100% (1)

- A Study On Working CapitalDocument92 pagesA Study On Working CapitalNeehasultana ShaikNo ratings yet

- FIN303 - Chap 14Document49 pagesFIN303 - Chap 14Hoang Thanh HangNo ratings yet

- Unit 5Document78 pagesUnit 5raqeebalareqi1998No ratings yet

- 6 Working Capital ManagementDocument28 pages6 Working Capital Managementrommel legaspi0% (1)

- Working Capital CapolDocument87 pagesWorking Capital CapolDasari AnilkumarNo ratings yet

- Working Capital Management HeritageDocument61 pagesWorking Capital Management Heritagedr btNo ratings yet

- Project ReportDocument86 pagesProject Reportbunty.0991No ratings yet

- Working CapitalDocument125 pagesWorking CapitalNeeraj Singh RainaNo ratings yet

- Sai Agro IndustriesDocument77 pagesSai Agro Industriesanon_562144670No ratings yet

- Working Capital Honda CompanyDocument3 pagesWorking Capital Honda CompanyLokanath ChoudhuryNo ratings yet

- Project Report PDFDocument86 pagesProject Report PDFAkash KumarNo ratings yet

- Bs CSV 22444161Document10 pagesBs CSV 22444161Raghav Sharma0% (1)

- CH 11Document12 pagesCH 11Bushra HaqueNo ratings yet

- Requirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)Document4 pagesRequirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)MyunimintNo ratings yet

- Investment Valuation SlideDocument231 pagesInvestment Valuation Slidehung311aNo ratings yet

- ASE20091 Bank Recon - 2017-04 - P53212A0120Document2 pagesASE20091 Bank Recon - 2017-04 - P53212A0120Thooi Joo Wong0% (1)

- Session 1 - Describing The AOM and Its Linkages To ISSAI and The IARDocument44 pagesSession 1 - Describing The AOM and Its Linkages To ISSAI and The IARmadalangin.coaNo ratings yet

- Types of Business OrganisationDocument28 pagesTypes of Business Organisationdenny_sitorusNo ratings yet

- Wire Transfer Form 08Document2 pagesWire Transfer Form 08eghideafesumeNo ratings yet

- Unclaimed Financial Assets-Bill 2011-KenyaDocument31 pagesUnclaimed Financial Assets-Bill 2011-KenyaelinzolaNo ratings yet

- Major Transaction Used in TRMDocument9 pagesMajor Transaction Used in TRMAbhishek SarawagiNo ratings yet

- PWT 90Document1,315 pagesPWT 90burcakkaplanNo ratings yet

- Industry Spectra Volume 1 Series 1Document82 pagesIndustry Spectra Volume 1 Series 1Vinay KhandelwalNo ratings yet

- FEMA DeclarationDocument3 pagesFEMA DeclarationShijo ThomasNo ratings yet

- BookDocument98 pagesBookmuthulakshmiNo ratings yet

- Mariel Princess TabilangonDocument2 pagesMariel Princess TabilangonMariel PrincessNo ratings yet

- P4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFDocument45 pagesP4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFasim tariqNo ratings yet

- DU M.Com Information Brochure 2015Document14 pagesDU M.Com Information Brochure 2015Neepur GargNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- Catchment Mapping BillaDocument12 pagesCatchment Mapping Billa28-RPavan raj. BNo ratings yet

- RECEIPT UTILITIES 20210312 Elektrik EapDocument1 pageRECEIPT UTILITIES 20210312 Elektrik EapTahap TeknikNo ratings yet

- Confirmation of Execution PDFDocument1 pageConfirmation of Execution PDFZsolt GyongyosiNo ratings yet

- Pre-Feasibility Study: Printing PressDocument25 pagesPre-Feasibility Study: Printing PressMusa AfridiNo ratings yet

- Financial Statement ANALYSIS 2014-2015: ObjectiveDocument15 pagesFinancial Statement ANALYSIS 2014-2015: ObjectiveMahmoud ZizoNo ratings yet

- Marketing Strategies For Mortgage Lenders and BrokersDocument2 pagesMarketing Strategies For Mortgage Lenders and BrokersTodd Lake100% (7)

- PAS 7 Summary NotesDocument2 pagesPAS 7 Summary NotesdaraNo ratings yet

- Request ListDocument21 pagesRequest ListHadi SumartonoNo ratings yet

- R13-Brand ValuationDocument3 pagesR13-Brand ValuationYashi GuptaNo ratings yet

- MFiN HkustDocument26 pagesMFiN Hkustjackson510024No ratings yet

- 161 15 PAS 28 Investment in AssociateDocument2 pages161 15 PAS 28 Investment in AssociateRegina Gregoria SalasNo ratings yet

- ZS Associates - E-School Compensation Annexure - 2023-24Document2 pagesZS Associates - E-School Compensation Annexure - 2023-24manjot singhNo ratings yet