Professional Documents

Culture Documents

Oracle Fusion Payables-Validating Payables Invoice, Roles Required and Preqrequisites

Uploaded by

priyanka_ravi14Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oracle Fusion Payables-Validating Payables Invoice, Roles Required and Preqrequisites

Uploaded by

priyanka_ravi14Copyright:

Available Formats

AP INVOICE CONVERSION

PREREQUISITE CONFIGURATION:

In order to load invoices into a particular period. It is mandatory to open that Accounting period. It can

be done by:

Navigating to Payables-> Invoices->Payables Periods-> Manage Accounting Periods.

VALIDATION:

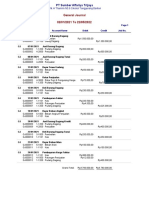

Template Name Sheet Name Columns Validations to be

performed

Payables AP_INVOICES_INTERFACE Invoice ID It must be unique in this

Standard sheet

Invoice Import

Source It must be configured

prior invoice load.

Navigate to Setup and

Maintenance->Manage

Payable Lookups.

Invoice Number It must be unique for a

supplier.

Invoice Amount It must be a positive

value for Standard and

Prepayment Invoices.

And it must be a negative

amount for Credit

memos

Invoice Date, It must be in

Accounting Date, YYYY/MM/DD format

Terms Date

Supplier Either one of the value is

Name/Supplier mandatory. Suppliers

Number must be loaded prior

invoice load.

Supplier Site It is a mandatory column.

Invoice Type It must be either

STANDARD, CREDIT,

PREPAYMENT.

Payment Terms It must be configured

prior invoice load.

Navigate to Setup and

Maintenance->Manage

Payment Terms

Payment Method It must be configured

prior invoice load.

Navigate to Setup and

Maintenance->Manage

Payment Methods

Pay Group It must be configured

prior invoice load.

Navigate to Setup and

Maintenance-> Manage

Payable Lookups

Prepayment If the Invoice Type is of

Number Prepayment, then

Prepayment Number is

mandatory.

Prepayment Line If the Invoice Type is of

Number Prepayment, then

Prepayment Line

Number is mandatory.

Calculate Tax If tax configuration is

During Import done and we do not

want the system to

recalculate tax during

Invoice Import, provide

value as N. Else if tax

configuration setup must

be overridden, provide

value as Y.

Add Tax To Invoice If Calculate Tax During

Amount Import is N, then Add Tax

to Invoice Amount can be

N since tax is not

calculated. Else provide

the value as Y.

AP_INVOICES_LINES_INTERFACE Invoice ID Invoice ID in the

AP_INVOICES_INTERFACE

sheet needs to be

mapped to the Invoice ID

in this sheet.

Line Type Valid Line Type values

are ITEM, TAX,

MISCELLANEOUS,

FREIGHT.

Amount This amount must sum

up to the Invoice

Amount.

ISSUES FACED

1.Business unit name, Supplier Name, Supplier Site, Payment Terms was blank.

2.Invoice Type values were invalid.

-Valid values are “CREDIT”,” STANDARD” and “PREPAYMENT”.

3.Terms Date, Accounting Date was not provided in YYYY/MM/DD format.

4. Pay Group was not configured

5. Distribution combination was not provided.

6. Line Type values were invalid.

-Valid values are “ITEM”,” FREIGHT”,” TAX”,” MISCELLANEOUS”.

7. Invoices had different Invoice Amount value in the Header and Line level.

8. Descriptive flex fields were not configured.

INTERFACE TABLES:

AP_INVOICES_INTERFACE

AP_INVOICE_LINES_INTERFACE

BASE TABLES:

AP_INVOICES_ALL

AP_INVOICE_LINES_ALL

AP_INVOICE_DISTRIBUTIONS_ALL

REJECTIONS TABLE:

AP_INTERFACE_REJECTIONS

OTBI SUBJECT AREA:

Payables-Invoices Transactions Real Time

STEPS TO BE PERFORMED POST INVOICE LOAD:

Once invoices are loaded and validated, we need to run Accounting to post entries in General ledger and

reverse the journal.

STEPS TO RECONCILE:

1. Create a report by querying the table AP_INVOICES_ALL or by using the Payables-Invoices

Transactions Real Time Subject area

-Consider the number of invoices in the report and compare it with the template provided.

2. In order to reconcile Accounting, the Accounted Debit and Credit can be verified. If they are equal the

Accounting has run properly.

SECURITY REQUIREMENT:

Accounts Payable Manager

Accounts Payable Specialist

Accounts Payable Supervisor

You might also like

- Purchase Order DocumentationDocument5 pagesPurchase Order Documentationpriyanka_ravi14No ratings yet

- Oracle Incentive Compensation Demo: Presenter: Abhijit ChakrabortyDocument20 pagesOracle Incentive Compensation Demo: Presenter: Abhijit Chakrabortyகண்ணன் ராமன்No ratings yet

- Oracle AP - R12Document68 pagesOracle AP - R12Shagun PanjwaniNo ratings yet

- Transaction Code.153Document2 pagesTransaction Code.153Kamran MallickNo ratings yet

- RM - Prepayment Release Training v4Document14 pagesRM - Prepayment Release Training v4RAVINDRAN1990No ratings yet

- Lecture 12 Audit of Accounts Payable and CashDocument37 pagesLecture 12 Audit of Accounts Payable and CashNabila SedkiNo ratings yet

- Global-E Integration Overview - MagentoDocument20 pagesGlobal-E Integration Overview - MagentorudeheroNo ratings yet

- Far 21 Notes and Loans Payable Debt RestructuringDocument7 pagesFar 21 Notes and Loans Payable Debt RestructuringJulie Mae Caling MalitNo ratings yet

- CHAPTER 3 Accruals and Deferrals (II)Document30 pagesCHAPTER 3 Accruals and Deferrals (II)Zemene HailuNo ratings yet

- R12 Receivables Enhancement - Overview: Ramaraju & AmitDocument54 pagesR12 Receivables Enhancement - Overview: Ramaraju & AmitPraveen MallikNo ratings yet

- ERP-3 - Group 9Document6 pagesERP-3 - Group 9Jaswasi SahooNo ratings yet

- Kwong Wai Shiu Hospital (KWSH) : Design DocumentDocument53 pagesKwong Wai Shiu Hospital (KWSH) : Design DocumentsureshNo ratings yet

- KWSH - Accounts Payable 28 - Oct-2020Document54 pagesKWSH - Accounts Payable 28 - Oct-2020sureshNo ratings yet

- KWSH - Accounts PayableDocument53 pagesKWSH - Accounts PayablesureshNo ratings yet

- Kwong Wai Shiu Hospital (KWSH) : Design DocumentDocument54 pagesKwong Wai Shiu Hospital (KWSH) : Design DocumentsureshNo ratings yet

- Operational Systems ExampleDocument3 pagesOperational Systems ExampleShahid RasheedNo ratings yet

- AA Product Design: Temenos Education CentreDocument52 pagesAA Product Design: Temenos Education CentreRaghavendra RaoNo ratings yet

- Revenueassurance101 150709111645 Lva1 App6891Document55 pagesRevenueassurance101 150709111645 Lva1 App6891Nashim MullickNo ratings yet

- Fica ExcelDocument171 pagesFica ExcelYash GuptaNo ratings yet

- Oracle R12 AR Receivables Enhancement - OverviewDocument54 pagesOracle R12 AR Receivables Enhancement - Overviewsanjayapps100% (5)

- Act.4 - Jose de Jesus Vargas EstradaDocument8 pagesAct.4 - Jose de Jesus Vargas EstradaJesus VargasNo ratings yet

- Standard Business FlowsDocument6 pagesStandard Business Flowsraa.aceroNo ratings yet

- Order To Cash (Standardized Services) ENDocument20 pagesOrder To Cash (Standardized Services) ENomar khaledNo ratings yet

- Improve Cure Rate in Credit Card CollectionsDocument40 pagesImprove Cure Rate in Credit Card CollectionsbiswazoomNo ratings yet

- Cash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaDocument26 pagesCash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaJewelyn CioconNo ratings yet

- Cash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaDocument26 pagesCash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaJewelyn CioconNo ratings yet

- Recurring Refactor PDFDocument1 pageRecurring Refactor PDFAnonymous 4LPX7G9No ratings yet

- Sales - A/R:: Overview of The Sales ProcessDocument15 pagesSales - A/R:: Overview of The Sales ProcessChadwick E VanieNo ratings yet

- Laboratory Group Assignment Online Presentation 01Document19 pagesLaboratory Group Assignment Online Presentation 01JR GabrielNo ratings yet

- Manage Invoice Options - US1 Business UnitDocument2 pagesManage Invoice Options - US1 Business UnitI'm RangaNo ratings yet

- Order-to-Cash (Standardized Services) : Scenario OverviewDocument20 pagesOrder-to-Cash (Standardized Services) : Scenario OverviewYuri SeredaNo ratings yet

- NetSuite Applications Suite - Enabling The Advanced Revenue Management FeatureDocument1 pageNetSuite Applications Suite - Enabling The Advanced Revenue Management Featuresunny155No ratings yet

- Notes Payable With Debt RestructuringDocument3 pagesNotes Payable With Debt RestructuringZehra LeeNo ratings yet

- EBTax UAT Test Script ARDocument2 pagesEBTax UAT Test Script ARchirag0% (1)

- Rizki Aditya Wiratama 2018230096Document1 pageRizki Aditya Wiratama 2018230096Annisa OriNo ratings yet

- Billing OLFMDocument4 pagesBilling OLFMutkarhNo ratings yet

- FR Chapter 3Document137 pagesFR Chapter 3Dheeraj TurpunatiNo ratings yet

- Finance Roles and ResponsibilitiesDocument10 pagesFinance Roles and ResponsibilitiesmmpetcoffNo ratings yet

- Paper 1.4Document137 pagesPaper 1.4vijaykumartaxNo ratings yet

- Statement of Cashflows (Ias 7) : LiquidityDocument7 pagesStatement of Cashflows (Ias 7) : LiquidityAyesha AliNo ratings yet

- Chart of Accounts PDFDocument2 pagesChart of Accounts PDFMwangi Josphat67% (9)

- Dedicated To Supplier Payments: Release Valuable Working Capital From Your Supply ChainDocument2 pagesDedicated To Supplier Payments: Release Valuable Working Capital From Your Supply Chainfahime nabipourNo ratings yet

- ASUG - Southwest Utilities Days TXU EnergyDocument16 pagesASUG - Southwest Utilities Days TXU EnergyRomulo QuispeNo ratings yet

- Cash and Liquidity Management: Scenario OverviewDocument7 pagesCash and Liquidity Management: Scenario OverviewEduardo BarrientosNo ratings yet

- Order-to-Cash (Sell-from-Stock) : Scenario OverviewDocument23 pagesOrder-to-Cash (Sell-from-Stock) : Scenario OverviewYuri SeredaNo ratings yet

- TTC Guide To Carrier Errors - 2019Document2 pagesTTC Guide To Carrier Errors - 2019Sarah BibitNo ratings yet

- Ifrs 15Document109 pagesIfrs 15gauravNo ratings yet

- Skill Matrix Version 1Document1 pageSkill Matrix Version 1lam nguyenNo ratings yet

- Accounting Equation - Part 1Document11 pagesAccounting Equation - Part 1Krrish Bosamia100% (1)

- Customer Invoice To Receipt Flow ModelDocument1 pageCustomer Invoice To Receipt Flow ModelJavier ScribNo ratings yet

- Reinstatement CSR Procedure - Job Aid - v.2.21.18 - FINALDocument2 pagesReinstatement CSR Procedure - Job Aid - v.2.21.18 - FINALKD F2021No ratings yet

- Yes Bank ProjectDocument2 pagesYes Bank ProjectKamlesh Kumar SahuNo ratings yet

- The Accounting Cycle: Preparing An Annual Report: Ahmed Raza MBA (Finance)Document36 pagesThe Accounting Cycle: Preparing An Annual Report: Ahmed Raza MBA (Finance)ahmedbloshiNo ratings yet

- HCM - Personal & Car Loan ProcessDocument1 pageHCM - Personal & Car Loan ProcessAman SiddiquiNo ratings yet

- Personal & Car LoanDocument1 pagePersonal & Car LoanAman SiddiquiNo ratings yet

- 3.7 Interim Payment Certificate FormatDocument1 page3.7 Interim Payment Certificate FormatJamal80% (5)

- Managing The Move To The Cloud - Analysing The Risks and Opportunities of Cloud-Based Accounting Information SystemsDocument17 pagesManaging The Move To The Cloud - Analysing The Risks and Opportunities of Cloud-Based Accounting Information SystemsManishaNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterFrom EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterNo ratings yet

- How To Load Worker Data Using HDLDocument41 pagesHow To Load Worker Data Using HDLpriyanka_ravi14No ratings yet

- Supplier Validation Oracle FusionDocument6 pagesSupplier Validation Oracle Fusionpriyanka_ravi14No ratings yet

- Create A Contact Via The Regular Customer ImportDocument3 pagesCreate A Contact Via The Regular Customer Importpriyanka_ravi14No ratings yet

- Create A Contact Via The Regular Customer ImportDocument3 pagesCreate A Contact Via The Regular Customer Importpriyanka_ravi14No ratings yet

- User AccessDocument1 pageUser Accesspriyanka_ravi14No ratings yet

- Oracle Fusion User and Roles CreationDocument8 pagesOracle Fusion User and Roles Creationpriyanka_ravi14No ratings yet

- Category Based Accounting ConfigurationDocument2 pagesCategory Based Accounting Configurationpriyanka_ravi14No ratings yet

- Lookup Codes LoadDocument4 pagesLookup Codes Loadpriyanka_ravi14No ratings yet

- Lookup Codes LoadDocument4 pagesLookup Codes Loadpriyanka_ravi14No ratings yet

- Lookup Codes LoadDocument4 pagesLookup Codes Loadpriyanka_ravi14No ratings yet

- 4 - Auditing MCQ 50Document23 pages4 - Auditing MCQ 50Muhammad Hamid100% (1)

- Accounting 141 2020Document7 pagesAccounting 141 2020alexcharles433No ratings yet

- Ap-5901 SheDocument7 pagesAp-5901 SheLizette Oliva80% (5)

- FRA Level 2 Question BankDocument244 pagesFRA Level 2 Question Bankamaresh gautam50% (2)

- Solution Manual For College Accounting 14th Edition Price, Haddock, FarinaDocument18 pagesSolution Manual For College Accounting 14th Edition Price, Haddock, Farinaa289899847No ratings yet

- م بتخطيط تدقيق الكشوفات المالية -دراسة عينة من محافظي الحسابات والخبراء المحاسبين بالجزائر العاصمة وبومرداس خلال سنة 2020Document12 pagesم بتخطيط تدقيق الكشوفات المالية -دراسة عينة من محافظي الحسابات والخبراء المحاسبين بالجزائر العاصمة وبومرداس خلال سنة 2020Tassadit BOUSBAINENo ratings yet

- Financial Accounting 2 Assignment 2Document3 pagesFinancial Accounting 2 Assignment 2BhodzaNo ratings yet

- A Study On Cash Flow Statement - HDFCDocument9 pagesA Study On Cash Flow Statement - HDFCkizieNo ratings yet

- SAP Purchase-Order-Accruals-WhitepaperDocument15 pagesSAP Purchase-Order-Accruals-WhitepaperSri Sathya Sai Anugraha GruhamNo ratings yet

- Industrial Training Manual-RevisedDocument30 pagesIndustrial Training Manual-Revisedsuzhen.al1314No ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- LLH9e Ch04 SolutionsManual FINALDocument80 pagesLLH9e Ch04 SolutionsManual FINALIgnjat0% (1)

- Transaksi Jurnal PT AlfamartDocument1 pageTransaksi Jurnal PT AlfamartSefriati MagdaNo ratings yet

- Monthwise Syllabus Class 12 ComDocument8 pagesMonthwise Syllabus Class 12 ComKritika ModiNo ratings yet

- Hira Arshad: ObjectiveDocument2 pagesHira Arshad: ObjectiveNabeel MaqsoodNo ratings yet

- Acca Competency Framework How and When To UseDocument6 pagesAcca Competency Framework How and When To UseKhurram MahmoodNo ratings yet

- Advanced Cost & Management AccountingDocument3 pagesAdvanced Cost & Management AccountingDawit DawitNo ratings yet

- Accounting The Purpose of Accounting: Michał Suchanek Keifpt, University of GdańskDocument38 pagesAccounting The Purpose of Accounting: Michał Suchanek Keifpt, University of GdańskMercio AdozilioNo ratings yet

- Pas 12Document2 pagesPas 12JennicaBailonNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Document5 pagesPamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Mariane Manangan100% (2)

- QUIZ Audit of InventoriesDocument3 pagesQUIZ Audit of Inventoriescrispin leanoNo ratings yet

- AFM Worksheet 1Document4 pagesAFM Worksheet 1Aleko tamiru100% (2)

- Conceptual Framework For Financial Reporting 2Document6 pagesConceptual Framework For Financial Reporting 2Nikki RañolaNo ratings yet

- Tugas 3 (Revisi) - Proses Posting-Ricky Andrian K. RumereDocument23 pagesTugas 3 (Revisi) - Proses Posting-Ricky Andrian K. RumererickyNo ratings yet

- 1641550441420Document24 pages1641550441420Deepesh VijayvargiyaNo ratings yet

- Cis Auditing Testbank 396543442Document4 pagesCis Auditing Testbank 396543442Vanesa SyNo ratings yet

- Please Get Out A Sheet of Notebook Paper and Draw This DiagramDocument33 pagesPlease Get Out A Sheet of Notebook Paper and Draw This DiagramQuinn FournierNo ratings yet

- Accounts 2019 FinalDocument210 pagesAccounts 2019 FinalPrashant Singh100% (1)

- AASB1021Document31 pagesAASB1021Nicole YvonneNo ratings yet

- Chapter 3 Presentation of Financial StatementsDocument24 pagesChapter 3 Presentation of Financial StatementsLEE WEI LONGNo ratings yet