Professional Documents

Culture Documents

Tradable Banks Index Based On Free-Float and Impact Cost

Uploaded by

Shahid Ur RehmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tradable Banks Index Based On Free-Float and Impact Cost

Uploaded by

Shahid Ur RehmanCopyright:

Available Formats

TRADABLE BANKS INDEX

BASED ON

FREE-FLOAT AND IMPACT COST

KARACHI STOCK EXCHANGE (G) LTD.

The Karachi Stock Exchange (Guarantee) Limited,

Stock Exchange Building, Stock Exchange Road,

Karachi-74000, Pakistan.

1. BRIEF OF TRADABLE BANKS INDEX _________________________________________________ 1

2. INTRODUCTION TO TRADABLE BANKS INDEX _________________________________________ 2

3. METHODOLOGY ________________________________________________________________ 3

3.1 OBJECTIVE AND DESCRIPTION: _____________________________________________________ 3

3.2 FREE-FLOAT CALCULATION METHODOLOGY: ____________________________________________ 3

3.3 DETERMINING FREE-FLOAT FACTOR: _________________________________________________ 4

3.4 FREE-FLOAT BANDS: ____________________________________________________________ 5

3.5 STEPS IN INDEX CALCULATION ______________________________________________________ 5

4. PRE - REQUISITES FOR INCLUSION __________________________________________________ 7

5. SELECTION CRITERIA _____________________________________________________________ 8

5.1 FREE-FLOAT MARKET CAPITALIZATION ________________________________________________ 8

5.2 LIQUIDITY (IC) ________________________________________________________________ 8

5.5 FINAL RANK __________________________________________________________________ 9

5.6 COMPANIES SELECTION FOR INCLUSION _________________________________________ 9

5.7 CALCULATION ______________________________________________________________ 9

5.8. MAINTENANCE OF TRADABLE BANKS INDEX _____________________________________ 10

5.9 REVIEW PERIOD / RE-COMPOSITION ___________________________________________ 10

5.10 ON - LINE COMPUTATION OF THE INDEX ________________________________________ 10

5.11 ADJUSTMENT FOR CASH DIVIDEND, BONUS, RIGHT AND NEWLY ISSUED CAPITAL ________ 10

5.12 ADJUSTMENT FOR CASH DIVIDEND _____________________________________________ 11

5.13 ADJUSTMENT FOR BONUS SHARES _____________________________________________ 11

5.14 ADJUSTMENT FOR RIGHT SHARES ______________________________________________ 13

ST

BANKS TRADABLE INDEX COMPOSITION AS ON NOVEMBER 1 , 2011 _______________________ 20

KSE Tradable Banks Index

1. BRIEF OF TRADABLE BANKS INDEX

Banking Sector plays vital roles in Pakistan’s economy and therefore KSE has

developed a Tradable Banks index which tracks at least 80% free-float market

capitalization of the Banking Sector. This index provides Investors and Market

Intermediaries with an appropriate benchmark that captures the performance of each

segment of the economy.

Karachi Stock Exchange (Guarantee) Limited Page 1 of 20

KSE Tradable Banks Index

2. INTRODUCTION TO TRADABLE BANKS INDEX

The primary objective of the Tradable Banks index is to have a benchmark by which

the stock price performance of the Banking Sector can be gauged and compared

over a period of time. This index is designed to provide investors with a depiction of

the breath of the sector and their performance in Pakistan’s equity market.

Globally, the Free-float Methodology of index construction is considered to be an

industry best practice and all major index providers like MSCI, FTSE and S&P have

adopted the same. MSCI, a leading global index provider, shifted all its indices to the

Free-float Methodology in 2002.

Tradable Banks index is calculated using the “Free-Float Market Capitalization”

methodology. In accordance with methodology, the level of index at any point of time,

reflects the free-float market value of top companies in relation to the base period.

The free-float methodology refers to an index construction methodology that takes

into account only the market capitalization of free-float shares of a company for the

purpose of index calculation.

Free-float Methodology improves index flexibility in terms of inclusion any stock from

all the listed stocks. This improves market coverage and sector coverage of the

index. For example, under a Full-Market Capitalization Methodology, companies with

large market capitalization and low free-float can be included in the Index. However,

under the Free-float Methodology, since only the free-float market capitalization of

each company is considered for index calculation, it becomes difficult to include

closely held companies in the index while at the same time preventing their undue

influence on the index movement.

Tradable Banks index offer unparalleled benefits to Investors who have a portfolio

comprising of the respective stocks and intend to hedge their portfolio risks against

volatility of the Banking sector. It will also help those Investors who wish to take a

view on the overall movement on the Banking Sector.

Karachi Stock Exchange (Guarantee) Limited Page 2 of 20

KSE Tradable Banks Index

3. METHODOLOGY

This Index is based on the internationally accepted standard of Free Float Market

Capitalization weightage. The weightage of each scrip is determined in the based on

the 50% Free Float (FF) and 50% Impact Cost (IC).

Free-Float means proportion of total shares issued by a company that are readily

available for trading at the Stock Exchange. It generally excludes the shares held by

controlling directors / sponsors / promoters, government and other locked-in shares

not available for trading in the normal course.

The selection criteria give 50% weightage to the FF and 50% to IC of each stock. The

lowest IC and highest FF are given top marks. Companies are selected based on

total marks (in descending order) until at least 80% FF market cap of the given sector

(Banks) has been included. Once a minimum 80% FF market cap has been achieved,

no more companies shall be added to the index.

3.1 Objective and Description:

Free-Float calculation can be used to construct stock indices for better market

representation than those constructed on the basis of total market capitalization of

companies.

It gives weight for constituent companies as per their actual liquidity in the market and

is not unduly influenced by tightly held large-cap companies.

Free-Float can be used by the Exchange for regulatory purposes such as risk

management and market surveillance.

3.2 Free-Float Calculation Methodology:

Total Outstanding Shares XXX

Less: Shares held by Directors/sponsors XXX

Government Holdings as promoter/acquirer/

Controller XXX

Shares held by Associated Companies

(Cross holdings) XXX

Shares held with general public in

Physical Form XXX XXX

_______

Free-Float: XXX

Notwithstanding to the above calculations, under no circumstances, free-float of a

scrip shall exceed its book entry shares, available in the Central Depository System.

Share holdings held by investors that would not, in the normal course come into the

Karachi Stock Exchange (Guarantee) Limited Page 3 of 20

KSE Tradable Banks Index

market for trading shall be treated as “Controlling / Strategic Holdings” and shall not

be included in the Free-Float. In specific, the following categories shall be excluded in

determination of Free-Float:

Share holdings held by investors that would not, in the normal course come into the

market for trading shall be treated as “Controlling / Strategic Holdings” and shall not

be included in the Free-Float. In specific, the following categories shall be excluded in

determination of Free-Float:

Holdings by promoters / directors / acquirers which has control element

Holdings by persons / bodies with "Controlling Interest"

Government holding as promoter / acquirer

Equity held by associated/group companies (cross-holdings)

Shares that could not be sold in the open market, in normal course.

3.3 Determining Free-Float Factor:

The listed companies shall submit their pattern of shareholding, in the prescribed

manner, to the Exchange. The Exchange will determine the Free-Float Factor for

each such company. Free-Float Factor is a multiple with which the total market

capitalization of a company is adjusted to arrive at the Free-Float market

capitalization. Once the Free-Float of a company is determined, it is rounded-off to

the higher multiple of 5 and each company is categorized into one of the 20 bands

given below.

Karachi Stock Exchange (Guarantee) Limited Page 4 of 20

KSE Tradable Banks Index

3.4 Free-Float Bands:

% Free-Float Free-Float Factor

>0 – 5% 0.05

>5 – 10% 0.10

>10 – 15% 0.15

>15 – 20% 0.20

>20 – 25% 0.25

>25 – 30% 0.30

>30 – 35% 0.35

>35 – 40% 0.40

>40 – 45% 0.45

>45 – 50% 0.50

>50 – 55% 0.55

>55 – 60% 0.60

>60 – 65% 0.65

>65 – 70% 0.70

>70 – 75% 0.75

>75 – 80% 0.80

>80 – 85% 0.85

>85 – 90% 0.90

>90 – 95% 0.95

>95 – 100% 1.00

3.5 Steps in Index Calculation

The Tradable Banks index is composed by assigning Relevant Weights to the two

factors on which the Index is based namely Impact Cost 50% and 50%, Free Float

Market Capitalization.

The (Relevant weight of Impact Cost) is obtained by first calculating relevant weight in

a manner that the smallest value of Impact Cost gets the Highest Weight so the

weights are obtained by the formula:

A (pooled weight of each individual scrip IC) ={Max(IC)-IC (Scrip)}/ {sum(IC)}

Relevant Weight of Impact Cost=A (pooled weight of each individual scrip IC)/sum of

all pooled weights (A)

The Relevant Weight of Free Float Market Capitalization of each Individual Scrip is

obtained by dividing each Scrip Free Float Market Capitalization by the sum of

Free Float Market Capitalization of all scrips in the Index

Karachi Stock Exchange (Guarantee) Limited Page 5 of 20

KSE Tradable Banks Index

The total weight is obtained by multiplying each Factor Relevant Weight by their

assigned weights and adding the two products (multiplied values) as mentioned in the

first point.

Finally multiplying the closing price with the Total Weights gives the Index Level.

Karachi Stock Exchange (Guarantee) Limited Page 6 of 20

KSE Tradable Banks Index

4. PRE - REQUISITES FOR INCLUSION

The Company which is on the Defaulters’ Counter and/or its trading is

suspended, declared Non-Tradable (i.e. NT) in preceding 6 months from

the date of re-composition or which is in the process of de-listing or is on the

non-compliant segment shall not be considered for inclusion in KSE-Tradable

Banks index

The Company will be eligible for KSE-Tradable Banks index if its securities

are available in the Central Depository System

The Company should have a formal listing history of at least six months on

KSE;

The company must have an operational track record of at least one financial

year and it should not be in default(s) of the Listing Regulations;

The Company should have minimum free-float shares of 10% of total

outstanding shares or 30 million free-float shares;

Karachi Stock Exchange (Guarantee) Limited Page 7 of 20

KSE Tradable Banks Index

5. SELECTION CRITERIA

The companies which qualify the prerequisites will be selected on the basis of highest

marks obtained as per the following criteria:

5.1 Free-Float Market Capitalization

The scrip should include in the Top Companies, ranked on the basis of free-float

market capitalization. Free-Float means proportion of total shares issued by a

company that are readily available for trading at the Stock Exchange. It generally

excludes the shares held by controlling directors / sponsors / promoters, government

and other locked-in shares not available for trading in the normal course. The free-

float market capitalization for each company is calculated by multiplying its total

outstanding free-float shares with the closing market price on the day of composition /

re-composition.

5.2 Liquidity (IC)

The Company will be eligible for KSE-Tradable Banks index if its securities are traded

for 75% of the total trading days.

The scrips included in the top companies should also be characterized by adequate

liquidity i.e. transaction cost and one of the practical, realistic and accurate measures

of market liquidity is Impact Cost. It is defined as the cost of executing a transaction

in a given stock for a specific predefined order size of fixed rupee amount (currently

set to Rs. 500,000). The transaction cost referred here is not the fixed cost typically

incurred in terms of transaction charges or cost arising through CDC, rather it is the

cost attributable to the market liquidity, which comes from buyers and sellers in the

market. Average of the best bid price and the best offer price of a scrip at any time,

called ideal price, is considered as the best price to trade in that particular scrip at

that time. However, every buyer/seller suffers a cost in excess of this ideal price while

actually executing a transaction (buy or sell). This price movement from the ideal

price is known as the transaction cost and when measured as the percentage of ideal

price is called Impact Cost.

Under impact cost analysis high liquidity is represented by low impact cost. A stock

with high market capitalization cannot be assumed to be liquid just because of its

sheer size. Some large market capitalization stocks are in reality very illiquid.

Similarly, high trading volumes, in themselves, are not enough to confirm consistent

liquidity of a stock.

Karachi Stock Exchange (Guarantee) Limited Page 8 of 20

KSE Tradable Banks Index

Impact cost analysis looks at the order book of each stock throughout the whole

trading day and based on the bids and offers calculates impact costs in terms of

percentages for each instance of the order book.

The Impact Cost of each security is calculated as described hereunder:

First the impact cost is calculated separately for the buy and the sell-side in each

order book for past six months.

The buy-side impact cost (or the sell-side impact cost) is the simple average of the

buy-side impact cost (or the sell-side impact cost) computed in the last six months.

Impact Cost reckoned for the purpose of all computation is the mean of such buy-side

impact cost and sell-side impact cost.

5.5 Final Rank

The scrip should be included in the top companies on the basis of final ranking. The

final rank is arrived by assigning the following weightages of the respective elements:

Parameters Weight

Impact Cost (lower IC means higher weight) 50%

Free Float 50%

Total 100%

The security having highest overall weight will be given a higher rank compared to

lower overall weight scrip.

5.6 COMPANIES SELECTION FOR INCLUSION

The companies selected for inclusion in the Tradable Banks index is determined on

the basis of "Free-Float Market Capitalization" methodology. As per this methodology,

the level of Index at any point of time reflects combined weightages of the two key

components of the stocks relative to a base period.

5.7 CALCULATION

Karachi Stock Exchange (Guarantee) Limited Page 9 of 20

KSE Tradable Banks Index

The base Tradable Banks Index level is the opening Banking Sector Index (from All-

st

Shares Index) value as on 1 November 2011. The calculation of Tradable Banks

index adds up the respective weights of the two elements of each stock marks in

order to get the Index. The Divisor is the only link to the original base period value of

the Tradable Banks index. It will keep the Index comparable over a period of time and

will also be the adjustment point for all future corporate actions, replacement of scrips

etc.

5.8. MAINTENANCE OF TRADABLE BANKS INDEX

The day-to-day maintenance of the Index will be carried out within the Broad Index

Policy Framework set by the Exchange. The Management will ensure that Tradable

Banks index and maintain their benchmark properties by striking a balance between

frequent replacements in indices and maintaining their historical continuity.

5.9 REVIEW PERIOD / RE-COMPOSITION

The first Tradable Banking Sector Index values are based on the price and free-float

st

data as on 1 November 2011. Subsequent index re-compositions shall be on semi-

annual basis as specified below:

Basis Revision

th th

June 30 August 15

st th

December 31 February 15

5.10 ON - LINE COMPUTATION OF THE INDEX

During market hours, prices of the Index scrips at which trades are executed, are

automatically used by the trading computer to calculate the Tradable Banks index

and continuously make updates on all trading workstations connected to the KSE

trading computers on real time basis.

5.11 ADJUSTMENT FOR CASH DIVIDEND, BONUS, RIGHT AND

NEWLY ISSUED CAPITAL

The arithmetic calculation involved in calculating Tradable Banks index is simple,

however the issue arises when one of the component stocks pays a bonus or issues

rights shares. If no adjustments were made, a discontinuity would arise between the

current value of the index and its previous value despite the non-occurrence of any

economic activity of substance. At the Exchange, the base value will be adjusted,

which is used to alter market capitalization of the component stocks to arrive at the

Tradable Banks index value. In line with the international practices the adjustment for

corporate actions will be made as given under:

Karachi Stock Exchange (Guarantee) Limited Page 10 of 20

KSE Tradable Banks Index

5.12 ADJUSTMENT FOR CASH DIVIDEND

No adjustment of cash dividend will be made contrary to the practice applicable in

KSE-100 Index.

5.13 ADJUSTMENT FOR BONUS SHARES

If company A has declared 10% bonus shares its book closure date commence from

day 4 then it will be adjusted after the close of Day 3.

Tradable Banks index as on Day 3 = 1120

Tradable Banks index free-float market capitalization on Day 3= 13,950,000,000

Divisor as on Day 3 = 12,455,357

Step 1

Determine the Ex-Bonus Price of the stock A to calculate the revised free-float market

capitalization and a new divisor for the next day i.e. Day 4.

Stock A

Market value on Day 3: Rs 22.50

Bonus : 10 %

For simplicity in working, we will calculate the Ex-bonus price on the basis of a lot of

100 shares.

i. Total free-float shares after the Bonus issue

100 shares + (100 shares x 10 % Bonus) = 110 shares

ii. Cost of a lot (100 shares)

100 shares x market price of A

= 100 x 22.50

= Rs. 2250

iii. Ex- Bonus price per share = 2250/110

= Rs. 20.45

Step 2

Calculation the total number of free-float shares after the Bonus issue.

Total number of free-float shares on Day 3 + (Bonus % x total number of free-float

shares on Day 3)

= 50,000,000 + (10% x 50,000,000)

Karachi Stock Exchange (Guarantee) Limited Page 11 of 20

KSE Tradable Banks Index

= 55,000,000 shares

Step 3

Share price and the total number of free-float shares of A is adjusted after the close

of Day 3 to calculate the New Divisor for the next day (i.e. Day 4).

TABLE 1

Stock Share Price Number of Market Value

(in Rs.) Free-float Shares (in Rs.)

A. 20.45 55,000,000 1,125,000,000

B. 41.00 150,000,000 6,150,000,000

C. 44.50 150,000,000 6,675,000,000

——————————

Revised free-float Market Capitalization 13,950,000,000

——————————

New Divisor = Revised Market Cap.

Index point as on Day 3

13,950,000,000

New Divisor = ————————————— = 12,455,357

1120

Step 4

Index Value as on Day 4.

TABLE 2

Stock Share Price on day 4 Number of Market Value

(in Rs.) Free-float Shares (in Rs.)

A. 21.00 55,000,000 1,155,000,000

B. 41.00 150,000,000 6,150,000,000

C. 44.50 150,000,000 6,675,000,000

————————

Free-float Market Capitalization 13,980,000,000

————————

Index = Market Capitalization

New Divisor

13,980,000,000

Index = —————————————— = 1122.41

12,455,357

Karachi Stock Exchange (Guarantee) Limited Page 12 of 20

KSE Tradable Banks Index

5.14 ADJUSTMENT FOR RIGHT SHARES

The Right issues of the companies which constitute the Tradable Banks index is

adjusted in two stages. At first stage the Ex-Right price is adjusted and at the second

stage the capital (free-float shares) are adjusted. A brief detail about the right issues

is mentioned below:

The company which declares Right shares has to close its books (share holders

register) to determine entitlement with in 45 days of its declaration.

At the date of book closure, the Ex–Right price is ascertained and if the company

belongs to the Tradable Banks index then the Divisor is adjusted due to the Ex-Right

price of the company.

When the company informs the Exchange that it has dispatched Letter of Rights Offer

to the shareholders, the trading in the Letter of Rights Offer (Un- paid) are

commenced. A separate block of capital, Un-Paid-Right, is formed equal to amount

of right issue and the trading continues till next 45 days or till the last date of

payment.

After the last date of payment the trading in Un-Paid-Right (Letter of Rights Offer) is

discontinued.

th

By the end of 30 day of the last date of payment or earlier, the company informs that

shares certificates are ready for exchange with Right Allotment Letter (RAL) or

credited in the CDS, the capital of the RAL is merged with the company. At this stage

the Divisor of the Tradable Banks index is adjusted for the increase in the number of

shares of the company.

A) Right issue without premium

If Company A has issued 10 % right shares and its Book Closure Date starts from

day 4 then it will be adjusted after the close of Day 3.

Tradable Banks index as on Day 3 = 1120

Tradable Banks index Market Capitalization

on Day 3 = 13,950,000,000

Divisor as on Day 3 = 12,455,357

Karachi Stock Exchange (Guarantee) Limited Page 13 of 20

KSE Tradable Banks Index

FIRST STAGE

Step 1

Determine the Ex-Right price of the stock A to calculate the revised free-float market

capitalization and a new divisor for the next day i.e. Day 4.

Stock A

Market value on Day 3: Rs 22.50

Right : 10 %

For simplicity in working, we will calculate the Ex-Right price on the basis of a lot of

100 shares.

i. Total free-float shares after the Right issue

100 shares + (100 shares x 10 % Right) = 110 shares

ii. Cost of a lot ( 100 shares)

100 shares x market price of A + 10 right shares x par value

= 100 x 22.50+ 10 x 10

= Rs 2350

iii. Ex- Right price per share = 2350/110

= Rs 21.36

Step 2

Share price of A is adjusted after the close of Day 3 to calculate the New Divisor for

the next day (i.e. Day 4)

TABLE 3

Stock Share Price Number of Market Value

(in Rs.) free-float Shares (in Rs.)

A. 21.36 50,000,000 1,068,000,000

B. 41.00 150,000,000 6,150,000,000

C. 44.50 150,000,000 6,675,000,000

———————————

Revised free-float Market Capitalization 13,893,000,000

———————————

New Divisor = Revised Market Cap.

Index as on Day 3

13,893,000,000

Karachi Stock Exchange (Guarantee) Limited Page 14 of 20

KSE Tradable Banks Index

New Divisor = ————————————— = 12,404,464

1120

Step 4

Index Value as on Day 4.

TABLE 4

Stock Share Price Number of Market Value

(in Rs.) free-float Shares (in Rs.)

A. 22.00 50,000,000 1,100,000,000

B. 41.00 150,000,000 6,150,000,000

C. 44.50 150,000,000 6,675,000,000

——————————

Free-float Market Capitalization 13,925,000,000

——————————

Index = Market Capitalization

New Divisor

13,925,000,000

Index = —————————— = 1122.57

12,404,464

SECOND STAGE

After 15 days of the last date of payment the company confirm the subscription

amount, accordingly the capital of RAL is merged with the company and the Divisor

is adjusted for the increase in number of free-float shares.

Step 1

i. Calculate the total number of free-float shares of the RAL:

Total number of free-float shares on Day 3 x Right issue %

= 50,000,000 x 10 %

= 5,000,000 shares

ii. Total number of free-float shares after the merger of RAL capital with the

company’s capital.

Total number of free-float shares on Day 3 + RAL Capital

Karachi Stock Exchange (Guarantee) Limited Page 15 of 20

KSE Tradable Banks Index

= 50,000,000 + 5,000,000

= 55,000,000 shares

Step 2

Increase the number of free-float shares of company A to calculate the New Divisor

for the next day

TABLE 5

Stock Share Price Number of Market Value

(in Rs.) free-float Shares (in Rs.)

A. 21.00 55,000,000 1,155,000,000

B. 42.00 150,000,000 6,300,000,000

C. 45.00 150,000,000 6,750,000,000

——————————

Revised free-float Market Capitalization 14,205,000,000

——————————

New Divisor = Revised Market Cap.

Index as on Day 14

14,205,000,000

New Divisor = ————————————— = 12,504,401

1136

Step 3

Index Value as on Day 15

TABLE 6

Stock Share Price Number of Market Value

(in Rs.) free-float Shares (in Rs.)

A. 22.00 55,000,000 1,210,000,000

B. 41.50 150,000,000 6,225,000,000

C. 44.00 150,000,000 6,600,000,000

——————————

Free-float Market Capitalization 14,035,000,000

——————————

Index = Market Capitalization

New Divisor

14,035,000,000

Karachi Stock Exchange (Guarantee) Limited Page 16 of 20

KSE Tradable Banks Index

Index = —————————————— = 1122.40

12,504,401

B) Right issue with premium

If Company A has announced 10 % Right issue with a premium of Rs 10 per share.

Step 1

Determine the Ex-Right price of the stock A.

Stock A

Market value on Day 3: Rs 22.50

Right : 10 %

Premium : Rs 10 per right share

For simplicity in working , we will calculate the Ex-Right price on the basis of a lot of

100 shares.

i. Total shares after the Right issue

100 shares + (100 shares x 10 % Right)

= 110 shares

ii. Cost of a lot ( 100 shares)

100 shares x market price of A + {10 right shares x (par value + premium)}

= 100 x 22.50+ 10 x (10+10)

= Rs 2450

iii. Ex- Right price per share = 2450/110

=Rs 22.27

Note: The rest of the working would be same as mentioned in part A.

Bonus & Right Issue Adjustment (SIMULTANEOUSLY)

If Company A has announced;

Bonus: 10%

Right: 10% at a Premium of Rs 10 per share

and its Book Closure Date starts from Day 4 then it will be adjusted after the close of

Day 3.

Tradable Banks index as on Day 3 = 1120

Karachi Stock Exchange (Guarantee) Limited Page 17 of 20

KSE Tradable Banks Index

Tradable Banks index Market Capitalization on Day 3 = 13,950,000,000

Divisor as on Day 3 = 12,454,357

Step 1

Calculate the Ex-Bonus and Ex- Right price of the stock A:

Calculate the Ex- Bonus and Ex – Right price:

For simplicity we will calculate its price on the basis of a lot of 100 shares.

i) Total shares after the Right issue and Bonus

100 shares + (100 shares x 10 % Right) + (100 shares x 10% Bonus)

100+ 10 +10

= 120 shares

ii) Cost of a lot ( 100 shares)

100 shares x market price of A + {10 right shares x (par value+premium)}

= 100 x 22.50+ 10 x (10+10)

= Rs 2450

iii) Ex-Bonus and Ex- Right price per share = 2450/120

= Rs 20.42

Step 2

Calculate the total number of free-float shares after the Bonus issue.

Total number of shares + Total number of shares x Bonus %

= 50,000,000 + 50,000,000 x 10% Bonus

= 55,000,000 shares

Step 3

Share price and the total number of free-float shares of A shall be adjusted after the

close of Day 3 to calculate the New Divisor for the next day (i.e. Day 4)

Karachi Stock Exchange (Guarantee) Limited Page 18 of 20

KSE Tradable Banks Index

TABLE 7

Stock Share Price Number of Market Value

(in Rs.) free-float Shares (in Rs.)

A. 20.42 55,000,000 1,123,100,000

B. 41.00 150,000,000 6,150,000,000

C. 44.50 150,000,000 6,675,000,000

———————————

Revised free-float Market Capitalization 13,948,100,000

———————————

New Divisor = Revised Market Cap.

Index as on Day 3

New Divisor = 13,948,100,000 = 12,453,661

1120

Step 4

Index Value as on Day 4.

TABLE 8

Stock Share Price Number of Market Value

(in Rs.) free-float Shares (in Rs.)

A. 21.00 55,000,000 1,155,000,000

B. 41.00 150,000,000 6,150,000,000

C. 44.50 150,000,000 6,675,000,000

———————————

Free-float Market Capitalization 13,980,000,000

———————————

Index = Market Capitalization

New Divisor

Index = 13,980,000,000 = 1122.56

12,453,661

The working for the Second Stage would be same as mentioned in (A) above.

Karachi Stock Exchange (Guarantee) Limited Page 19 of 20

BANKS TRADABLE INDEX COMPOSITION AS ON NOVEMBER 1st, 2011

BANKS TRADABLE INDEX

Free Float Rate as on Free Float

Scrips Symbol as 1st Nov-2011 1st Nov-2011 Mkt Capitalisation FF WT

MCB Bank Ltd. MCB 334,494,590 154.28 51,605,825,345.20 34%

National Bank of Pakistan NBP 398,273,580 44.03 17,535,985,727.40 11%

United Bank Ltd. UBL 306,044,922 55.52 16,991,614,069.44 11%

Habib Bank Ltd. HBL 110,206,800 117.54 12,953,707,272.00 8%

Bank ALHabib Ltd. BAHL 483,228,442 30 14,496,853,260.00 9%

Bank Alfalah Ltd. BAFL 674,578,125 10.9 7,352,901,562.50 5%

Allied Bank Ltd. ABL 86,031,092 63.22 5,438,885,636.24 4%

Total 2,392,857,551 126,375,772,872.78 82%

Karachi Stock Exchange (Guarantee) Limited Page 20 of 20

You might also like

- Tradable Oil & Gas Index Based On Free-Float and Impact CostDocument22 pagesTradable Oil & Gas Index Based On Free-Float and Impact CostHadia SarwarNo ratings yet

- BrochureBK TI IdxDocument22 pagesBrochureBK TI IdxShakeel IqbalNo ratings yet

- KSE - 30 IndexDocument21 pagesKSE - 30 IndexNadeem uz Zaman100% (1)

- Kse - 30 Index Based On Free-Float: The Karachi Stock Exchange (Guarantee) LimitedDocument21 pagesKse - 30 Index Based On Free-Float: The Karachi Stock Exchange (Guarantee) LimitedJan Muhammad MemonNo ratings yet

- KSE-30 Index Updated VersionDocument20 pagesKSE-30 Index Updated VersionHamza AbidNo ratings yet

- Kse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedDocument21 pagesKse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedAbdullah AbdullahNo ratings yet

- Kse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedDocument21 pagesKse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedAbdullah AbdullahNo ratings yet

- OGTI Index New BrochureDocument13 pagesOGTI Index New BrochureHadia SarwarNo ratings yet

- Bse FunctionsDocument41 pagesBse FunctionsSree LakshmiNo ratings yet

- KIM and Application Form For Axis Long Term Equity FundDocument17 pagesKIM and Application Form For Axis Long Term Equity FundAnilkumarNo ratings yet

- PSX Indices AssDocument7 pagesPSX Indices AssFlourish edible CrockeryNo ratings yet

- Stock MarketDocument12 pagesStock MarketMuhammad Saleem SattarNo ratings yet

- Estmo 0001Document1 pageEstmo 0001ShahamijNo ratings yet

- KSE 100 Index New BrochureDocument13 pagesKSE 100 Index New BrochureMuhammad AtharNo ratings yet

- The BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementFrom EverandThe BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementRating: 2 out of 5 stars2/5 (1)

- SENSEX - The Barometer of Indian Capital Markets: Dollex Series of BSE Indices'Document6 pagesSENSEX - The Barometer of Indian Capital Markets: Dollex Series of BSE Indices'yraghav_1No ratings yet

- SENSEX - The Barometer of Indian Capital MarketsDocument6 pagesSENSEX - The Barometer of Indian Capital MarketsmondalsunilNo ratings yet

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Sharekhan's Top Equity Mutual Fund Picks: April 20, 2012Document4 pagesSharekhan's Top Equity Mutual Fund Picks: April 20, 2012rajdeeppawarNo ratings yet

- ITC Project ReportDocument50 pagesITC Project ReportKeshavNo ratings yet

- Investment PolicyDocument9 pagesInvestment PolicyShyaam SheoranNo ratings yet

- (Type The Document Subtitle) : Salhia Real Estate Company KSC - Ratio AnalysisDocument20 pages(Type The Document Subtitle) : Salhia Real Estate Company KSC - Ratio AnalysisAnkitGoyalNo ratings yet

- BCG Growth-Matrix: Relative Market Share. One of The Dimensions Used To Evaluate BusinessDocument4 pagesBCG Growth-Matrix: Relative Market Share. One of The Dimensions Used To Evaluate BusinessAshley EspinoNo ratings yet

- Tata Regular Savings Equity Fund StudyDocument4 pagesTata Regular Savings Equity Fund StudyVikas NaiduNo ratings yet

- Bamimo 0001Document1 pageBamimo 0001sarha sharma0% (1)

- KMI 30 Index (New Broucher)Document13 pagesKMI 30 Index (New Broucher)Hadia SarwarNo ratings yet

- Working Capital ManagementDocument49 pagesWorking Capital ManagementAshok Kumar KNo ratings yet

- Strategy Paper: Enhancing Kse-100 Index To Free Float MethodologyDocument24 pagesStrategy Paper: Enhancing Kse-100 Index To Free Float MethodologysakiaslamNo ratings yet

- Auto 03jun16 MoslDocument4 pagesAuto 03jun16 Moslravi285No ratings yet

- CoreShares Introduction To Index Investing PDFDocument10 pagesCoreShares Introduction To Index Investing PDFBuyelaniNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Smart Investment Basket: Beginners Equity - Small Cap: 28th Oct 2021Document2 pagesSmart Investment Basket: Beginners Equity - Small Cap: 28th Oct 2021Marshall CountyNo ratings yet

- SBI Equity Savings Fund - Presentation PDFDocument23 pagesSBI Equity Savings Fund - Presentation PDFPankaj RastogiNo ratings yet

- Operating Guidelines NewDocument23 pagesOperating Guidelines NewRENU BALANo ratings yet

- Market Index or Benchmark:: The Passive/Active Investment SpectrumDocument4 pagesMarket Index or Benchmark:: The Passive/Active Investment SpectrumBuyelaniNo ratings yet

- Executive SummaryDocument19 pagesExecutive SummaryMd. Real MiahNo ratings yet

- Financial Risk Management 2007-2008 Subprime CrysisDocument11 pagesFinancial Risk Management 2007-2008 Subprime CrysisDiinShahrunNo ratings yet

- BCG Growth-Share Matrix: Invest in and Which Ones Should Be DivestedDocument5 pagesBCG Growth-Share Matrix: Invest in and Which Ones Should Be DivestedChanthini VinayagamNo ratings yet

- How To Calculate The Value of The Sensitive IndexDocument6 pagesHow To Calculate The Value of The Sensitive IndexMohankumarpgdmNo ratings yet

- How Have Mutual Funds Been ClassifiedDocument7 pagesHow Have Mutual Funds Been Classifiedritvik singh rautelaNo ratings yet

- SCTR 0014Document1 pageSCTR 0014Sumeet SoniNo ratings yet

- SCIF Factsheet 0315Document2 pagesSCIF Factsheet 0315MLastTryNo ratings yet

- Analyzing Mutual Fund RiskDocument7 pagesAnalyzing Mutual Fund RiskSriKesavaNo ratings yet

- Calculation of SensexDocument6 pagesCalculation of SensexHarshad KatariyaNo ratings yet

- Welcome TO Project SeminorDocument18 pagesWelcome TO Project SeminorRamNo ratings yet

- Bimaljalan) ReportDocument3 pagesBimaljalan) ReportchauhanprakashNo ratings yet

- SENSEX - The Barometer of Indian Capital MarketsDocument7 pagesSENSEX - The Barometer of Indian Capital MarketsSachin KingNo ratings yet

- Assignment INVESTMENTDocument3 pagesAssignment INVESTMENTfariaNo ratings yet

- IntroductionDocument6 pagesIntroductionCarol SilveiraNo ratings yet

- Ratio Analysis: Related ArticlesDocument4 pagesRatio Analysis: Related ArticlesdibopodderNo ratings yet

- Raja & SukhneetDocument10 pagesRaja & SukhneetHBhatlaNo ratings yet

- LOVISA V PANDORA FINANCIAL ANALYSIS RATIODocument30 pagesLOVISA V PANDORA FINANCIAL ANALYSIS RATIOpipahNo ratings yet

- Chap 8 - Advanced Issues in ValuationDocument50 pagesChap 8 - Advanced Issues in Valuationrafat.jalladNo ratings yet

- Fallen Angels: Invest in This Smallcase HereDocument1 pageFallen Angels: Invest in This Smallcase HereSahil ChadhaNo ratings yet

- Securities and Exchange Board of India: Rajeshkd@sebi - Gov.inDocument35 pagesSecurities and Exchange Board of India: Rajeshkd@sebi - Gov.inAshish GargNo ratings yet

- Financial Analysis Through RatiosDocument8 pagesFinancial Analysis Through RatiosChandramouli KolavasiNo ratings yet

- Imforme de Ingles (Financial Anlisis) en InglesDocument7 pagesImforme de Ingles (Financial Anlisis) en InglesKristhian SilvaNo ratings yet

- PDF 132490607617482980Document22 pagesPDF 132490607617482980Swades DNo ratings yet

- Stock Screener PDFDocument9 pagesStock Screener PDFClaude Bernard100% (2)

- Ratios & Interpretation 2022Document12 pagesRatios & Interpretation 2022Uma NNo ratings yet

- Eligibility Citeria AcademicDocument10 pagesEligibility Citeria AcademicShahid Ur RehmanNo ratings yet

- Adv 10 2019Document5 pagesAdv 10 2019Sehar Keven MallNo ratings yet

- Alfalah Endowment PlanDocument2 pagesAlfalah Endowment PlanShahid Ur RehmanNo ratings yet

- Ecp Application FormDocument1 pageEcp Application FormShafi MuhammadNo ratings yet

- CE-2016 Public NoticeDocument1 pageCE-2016 Public NoticeKenneth MillerNo ratings yet

- 6 Tips For Breastfeeding With Flat Nipples 6 Tips For Breastfeeding With Flat NipplesDocument2 pages6 Tips For Breastfeeding With Flat Nipples 6 Tips For Breastfeeding With Flat NipplesShahid Ur RehmanNo ratings yet

- 04 Afc It MP 2013 PDFDocument6 pages04 Afc It MP 2013 PDFGaming WorldNo ratings yet

- 02 Afc BC MP 2013 PDFDocument5 pages02 Afc BC MP 2013 PDFShahid Ur RehmanNo ratings yet

- Max Ex Depot Sale PriceDocument3 pagesMax Ex Depot Sale PriceShahid Ur RehmanNo ratings yet

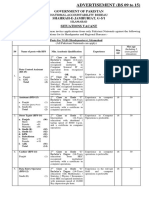

- Advertisement (Bs 09 To 15) : National Accountability BureauDocument5 pagesAdvertisement (Bs 09 To 15) : National Accountability BureauTanveer Ahmad AfridiNo ratings yet

- Detail Computation Ex Depot Sale Price Effective October 01 2018 PDFDocument2 pagesDetail Computation Ex Depot Sale Price Effective October 01 2018 PDFGhazanfer AliNo ratings yet

- Institute and Faculty (Ifoa) Exams Passed Waivers From Soa ExaminationDocument1 pageInstitute and Faculty (Ifoa) Exams Passed Waivers From Soa ExaminationtitooluwaNo ratings yet

- IFMP BrochureDocument4 pagesIFMP BrochureShahid Ur RehmanNo ratings yet

- 6 Tips For Breastfeeding With Flat Nipples 6 Tips For Breastfeeding With Flat NipplesDocument2 pages6 Tips For Breastfeeding With Flat Nipples 6 Tips For Breastfeeding With Flat NipplesShahid Ur RehmanNo ratings yet

- Pakistan Tax Guide 2016 17Document14 pagesPakistan Tax Guide 2016 17Shahid Ur RehmanNo ratings yet

- Case Study IllinoisDocument38 pagesCase Study IllinoisSyed Sherry Hassan0% (1)

- Complete PDFDocument102 pagesComplete PDFShahid Ur RehmanNo ratings yet

- Scheme On Pso GridDocument2 pagesScheme On Pso GridShahid Ur RehmanNo ratings yet

- Market Pulse: InterDocument4 pagesMarket Pulse: InterShahid Ur RehmanNo ratings yet

- Finance Bill Sep-18Document6 pagesFinance Bill Sep-18Shahid Ur RehmanNo ratings yet

- Bop CW PDFDocument1 pageBop CW PDFShahid Ur RehmanNo ratings yet

- Directors and Secretaries Guidenov29Document29 pagesDirectors and Secretaries Guidenov29Kashif NiaziNo ratings yet

- HBL - Fund Manager SMA PDFDocument1 pageHBL - Fund Manager SMA PDFShahid Ur RehmanNo ratings yet

- Discharge and Cancellation PDFDocument35 pagesDischarge and Cancellation PDFMuhammad AamirNo ratings yet

- BTDocument8 pagesBTShahid Ur RehmanNo ratings yet

- Certified Actuarial Analyst - CAA GlobalDocument2 pagesCertified Actuarial Analyst - CAA GlobalAlok ThakkarNo ratings yet

- 02 Advance Money Management in Forex TradingDocument21 pages02 Advance Money Management in Forex TradingShahid Ur RehmanNo ratings yet

- Time Tables Phase 2 2019 MCQDocument4 pagesTime Tables Phase 2 2019 MCQMir Zohaib Raza TalpurNo ratings yet

- SoftX3000 Hardware Installation ManualDocument39 pagesSoftX3000 Hardware Installation ManualMubarak AliNo ratings yet

- Phone No. 051-9205075 Ext. 385, 377,236,243,241 & 298Document10 pagesPhone No. 051-9205075 Ext. 385, 377,236,243,241 & 298Asad KhanNo ratings yet

- Bocconi PE and VC CourseraDocument15 pagesBocconi PE and VC CourseraMuskanDodejaNo ratings yet

- 1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistDocument5 pages1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistNick RamboNo ratings yet

- Fogarty HardwickDocument35 pagesFogarty HardwickBen KellerNo ratings yet

- 4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)Document172 pages4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)gregory berlemontNo ratings yet

- Josephine Morrow: Guided Reflection QuestionsDocument3 pagesJosephine Morrow: Guided Reflection QuestionsElliana Ramirez100% (1)

- Marimba ReferenceDocument320 pagesMarimba Referenceapi-3752991No ratings yet

- Michelle E. Parsons-Powell CVDocument3 pagesMichelle E. Parsons-Powell CVMichelle ParsonsNo ratings yet

- Infographic Group Output GROUP 2Document2 pagesInfographic Group Output GROUP 2Arlene Culagbang GuitguitinNo ratings yet

- Study of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesDocument60 pagesStudy of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesVinay SurendraNo ratings yet

- Chapter 4Document20 pagesChapter 4Alyssa Grace CamposNo ratings yet

- Sperber Ed Metarepresentations A Multidisciplinary PerspectiveDocument460 pagesSperber Ed Metarepresentations A Multidisciplinary PerspectiveHernán Franco100% (3)

- Max3080 Max3089Document21 pagesMax3080 Max3089Peter BirdNo ratings yet

- IPASO1000 - Appendix - FW Download To Uncurrent SideDocument11 pagesIPASO1000 - Appendix - FW Download To Uncurrent SidesaidbitarNo ratings yet

- Serenity Dormitory PresentationDocument16 pagesSerenity Dormitory PresentationGojo SatoruNo ratings yet

- Project Presentation (142311004) FinalDocument60 pagesProject Presentation (142311004) FinalSaad AhammadNo ratings yet

- Iris Sofía Tobar Quilachamín - Classwork - 16-09-2022Document4 pagesIris Sofía Tobar Quilachamín - Classwork - 16-09-2022IRIS SOFIA TOBAR QUILACHAMINNo ratings yet

- Becg Unit-1Document8 pagesBecg Unit-1Bhaskaran Balamurali0% (1)

- Modern America Study Guide With Answers 2020 21Document2 pagesModern America Study Guide With Answers 2020 21maria smithNo ratings yet

- Guide To Tanzania Taxation SystemDocument3 pagesGuide To Tanzania Taxation Systemhima100% (1)

- Peer Pressure and Academic Performance 1Document38 pagesPeer Pressure and Academic Performance 1alnoel oleroNo ratings yet

- Bible QuizDocument4 pagesBible QuizjesukarunakaranNo ratings yet

- Mall Road HistoryDocument3 pagesMall Road HistoryKaleem Ahmed100% (1)

- Dairy IndustryDocument11 pagesDairy IndustryAbhishek SharmaNo ratings yet

- Nursery Rhymes Flip ChartDocument23 pagesNursery Rhymes Flip ChartSilvana del Val90% (10)

- EPM Key Design Decisions - Design PhaseDocument7 pagesEPM Key Design Decisions - Design PhaseVishwanath GNo ratings yet

- NE5000E V800R003C00 Configuration Guide - QoS 01 PDFDocument145 pagesNE5000E V800R003C00 Configuration Guide - QoS 01 PDFHoàng Tùng HưngNo ratings yet

- Betz Handbook of Industrial Conditioning: WaterDocument13 pagesBetz Handbook of Industrial Conditioning: Waterlini supianiNo ratings yet

- Fmi Unit 2Document86 pagesFmi Unit 2Pranav vigneshNo ratings yet

- First Floor Plan SCALE:1:50: Master BedroomDocument1 pageFirst Floor Plan SCALE:1:50: Master BedroomRiya MehtaNo ratings yet

- Case Note Butler Machine 201718Document4 pagesCase Note Butler Machine 201718Maggie SalisburyNo ratings yet