Professional Documents

Culture Documents

w4 Voluntary

Uploaded by

crazybuttful100%(1)100% found this document useful (1 vote)

924 views1 pageThe i.r.s. Form W-4 is a voluntary withholding agreement between an employer and an employee. There is no law requiring a worker or employee to complete the I.R.S Form W-4. An employee and his employer may enter into an agreement under section 3402(b) to provide for the withholding of income tax upon payments made after December 31, 1970. An agreement may be entered into only with respect to amounts includible in the gross income of the employee under section 61.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe i.r.s. Form W-4 is a voluntary withholding agreement between an employer and an employee. There is no law requiring a worker or employee to complete the I.R.S Form W-4. An employee and his employer may enter into an agreement under section 3402(b) to provide for the withholding of income tax upon payments made after December 31, 1970. An agreement may be entered into only with respect to amounts includible in the gross income of the employee under section 61.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

924 views1 pagew4 Voluntary

Uploaded by

crazybuttfulThe i.r.s. Form W-4 is a voluntary withholding agreement between an employer and an employee. There is no law requiring a worker or employee to complete the I.R.S Form W-4. An employee and his employer may enter into an agreement under section 3402(b) to provide for the withholding of income tax upon payments made after December 31, 1970. An agreement may be entered into only with respect to amounts includible in the gross income of the employee under section 61.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Notice

To All Workers, Employees and Employers

Regarding the Voluntary Nature

of I.R.S Form W-4

Internal Revenue Code, Title 26, Chapter I, Part 31, Section 3402(p)-1

(26CFR31.3402(p)-1) provides that the I.R.S. Form W-4 is a voluntary withholding

agreement between an employer and an employee. There is no law requiring a worker

or employee to complete the I.R.S Form W-4.

Sec. 31.3402(p)-1 Voluntary withholding agreements.

(a) In general. An employee and his employer may enter into an agreement under section 3402(b) to provide for the withholding

of income tax upon payments of amounts described in paragraph (b)(1) of Sec. 31.3401(a)-3, made after December 31, 1970. An

agreement may be entered into under this section only with respect to amounts which are includible in the gross income of the employee

under section 61, and must be applicable to all such amounts paid by the employer to the employee. The amount to be withheld pursuant

to an agreement under section 3402(p) shall be determined under the rules contained in section 3402 and the regulations thereunder.

See Sec. 31.3405(c)-1, Q&A-3 concerning agreements to have more than 20-percent Federal income tax withheld from eligible rollover

distributions within the meaning of section 402.

(b) Form and duration of agreement. (1)(I) Except as provided in subdivision (ii) of this subparagraph, an employee who desires

to enter into an agreement under section 3402(p) shall furnish his employer with Form W-4 (withholding exemption certificate)

executed in accordance with the provisions of section 3402(f) and the regulations thereunder. The furnishing of such Form W-4 shall

constitute a request for withholding.

(ii) In the case of an employee who desires to enter into an agreement under section 3402(p) with his employer, if the employee

performs services (in addition to those to be the subject of the agreement) the remuneration for which is subject to mandatory income

tax withholding by such employer, or if the employee wishes to specify that the agreement terminate on a specific date, the employee

shall furnish the employer with a request for withholding which shall be signed by the employee, and shall contain-

(a) The name, address, and social security number of the employee making the request,

(b) The name and address of the employer,

(c) A statement that the employee desires withholding of Federal income tax, and applicable, of qualified State individual income

tax (see paragraph (d)(3)(I) of Sec. 301.6361-1 of this chapter (Regulations on Procedures and Administration)), and

(d) If the employee desires that the agreement terminate on a specific date, the date of termination of the agreement.

If accepted by the employer as provided in subdivision (iii) of this subparagraph, the request shall be attached to, and constitute part

of, the employee's Form W-4. An employee who furnishes his employer a request for withholding under this subdivision shall also

furnish such employer with Form W-4 if such employee does not already have a Form W-4 in effect with such employer.

(iii) No request for withholding under section 3402(p) shall be effective as an agreement between an employer and an employee until

the employer accepts the request by commencing to withhold from the amounts with respect to which the request was made.

(2) An agreement under section 3402 (p) shall be effective for such period as the employer and employee mutually agree upon.

However, either the employer or the employee may terminate the agreement prior to the end of such period by furnishing a signed written

notice to the other. Unless the employer and employee agree to an earlier termination date, the notice shall be effective with respect to

the first payment of an amount in respect of which the agreement is in effect which is made on or after the first ``status determination

date'' (January 1, May 1, July 1, and October 1 of each year) that occurs at least 30 days after the date on which the notice is furnished.

If the employee executes a new Form W-4, the request upon which an agreement under section 3402 (p) is based shall be attached to,

and constitute a part of, such new Form W-4.

This notice must be posted in a conspicuous place where it can be read by all employees and workers.

You might also like

- Voluntary Withholding Agreement: Termination or Withdrawal From W-4 AgreementDocument2 pagesVoluntary Withholding Agreement: Termination or Withdrawal From W-4 Agreementkildea89% (19)

- Notice About w-4Document2 pagesNotice About w-4Apollo Myles Lafrance El100% (1)

- Terminate W-4 Voluntary Withholding AgreementDocument1 pageTerminate W-4 Voluntary Withholding AgreementFreeman Lawyer100% (1)

- W 4tDocument1 pageW 4tfredlox92% (13)

- IrsnoticeDocument1 pageIrsnoticeRidalyn AdrenalynNo ratings yet

- Revocation of Election RF 340 910 042 USDocument13 pagesRevocation of Election RF 340 910 042 USDonald L. Wise100% (2)

- Revocation of ElectionDocument15 pagesRevocation of ElectionTitle IV-D Man with a plan100% (27)

- IRS Form W-9 Notice Regarding Use and ApplicationDocument1 pageIRS Form W-9 Notice Regarding Use and ApplicationSovereignSonNo ratings yet

- Notice Regarding SSN DisclosureDocument1 pageNotice Regarding SSN DisclosureBobDicsounNo ratings yet

- Notice of Dishonor of W-4 TerminationDocument2 pagesNotice of Dishonor of W-4 TerminationMichael Kovach100% (4)

- Notice To Terminate W4Document2 pagesNotice To Terminate W4Pamela Boss100% (1)

- Affidavit of Revocation and Rescission SSNDocument9 pagesAffidavit of Revocation and Rescission SSNDarrell Hughes100% (6)

- IRS Rescission of SignatureDocument23 pagesIRS Rescission of SignaturePaulStaples100% (12)

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationAnonymous puqCYDnQNo ratings yet

- Declaration of Revocation of ElectionDocument10 pagesDeclaration of Revocation of ElectionAkil Bey95% (39)

- RevocationOfElection Unta Property 05Document4 pagesRevocationOfElection Unta Property 05James neteruNo ratings yet

- US Internal Revenue Service: p1212 - 2004Document109 pagesUS Internal Revenue Service: p1212 - 2004IRS100% (2)

- IRS W4T Request LetterDocument1 pageIRS W4T Request LetterJane G. PierreNo ratings yet

- IRS Rev of ElectionDocument4 pagesIRS Rev of ElectionTitle IV-D Man with a plan100% (7)

- Late Entity Classification ReliefDocument11 pagesLate Entity Classification ReliefLexu100% (2)

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Suhar LinaNo ratings yet

- ADR 1041 2010cDocument83 pagesADR 1041 2010cPeggy W Satterfield100% (1)

- Revocation of ElectionDocument11 pagesRevocation of ElectionMichael Focia100% (9)

- #Tl16H: How To Stop Employers From Withholding Income TaxesDocument13 pages#Tl16H: How To Stop Employers From Withholding Income TaxesJohn Sutphin100% (5)

- Form 56 PDFDocument2 pagesForm 56 PDFdee donnarumma75% (8)

- Revocation of Election Established by The US CongressDocument11 pagesRevocation of Election Established by The US CongressJames neteru100% (2)

- WW SS-4Document3 pagesWW SS-4cstocksg1100% (7)

- W8Ben With US Mailing (FILLABLE)Document2 pagesW8Ben With US Mailing (FILLABLE)Veronica Mtz100% (1)

- Foreign Tax Form W-8BEN GuideDocument1 pageForeign Tax Form W-8BEN Guidehector100% (1)

- Revocation of Election KJ Mine 12 14 22Document13 pagesRevocation of Election KJ Mine 12 14 22James neteru100% (3)

- Affidavit of Fact IRSDocument13 pagesAffidavit of Fact IRS123pratus89% (9)

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- Form Quit Social SecurityDocument2 pagesForm Quit Social SecurityAkil Bey50% (2)

- Challenge IRS AuthorityDocument6 pagesChallenge IRS AuthorityJeff Anderson91% (11)

- Notice of Fiduciary Relationship FormDocument2 pagesNotice of Fiduciary Relationship FormBenne James100% (6)

- Revoking Election to Pay Federal Income TaxDocument3 pagesRevoking Election to Pay Federal Income TaxRed Moon Essentials100% (3)

- Certificate Foreign StatusDocument1 pageCertificate Foreign Statusdavid_valentine_184% (19)

- IRS Response LetterDocument3 pagesIRS Response Letternoname6100% (1)

- Terminating IRS 668 Notice of LienDocument4 pagesTerminating IRS 668 Notice of LienKellie100% (4)

- f8832 PDFDocument7 pagesf8832 PDFCC100% (1)

- CP-22E IRS Response LetterDocument4 pagesCP-22E IRS Response LetterTRISTARUSA100% (2)

- 31 Questions and Answers About The Internal Revenue ServiceDocument29 pages31 Questions and Answers About The Internal Revenue ServiceAlberto100% (2)

- Affidavit of RescissionDocument1 pageAffidavit of RescissionJim Hannah100% (2)

- Lien RemovalDocument3 pagesLien Removalspcbanking100% (3)

- Revocation of Election Affirms Non-Taxpayer StatusDocument26 pagesRevocation of Election Affirms Non-Taxpayer StatusTitle IV-D Man with a planNo ratings yet

- Affidavit of TaxexpDocument5 pagesAffidavit of Taxexpdemon100% (7)

- Decoration of Status of Matthew Joseph QuinteroDocument5 pagesDecoration of Status of Matthew Joseph QuinteroAut Beat100% (3)

- Postage Prepaid Avery 8163Document1 pagePostage Prepaid Avery 8163BrooksNo ratings yet

- W 4t Word Format Example 2Document1 pageW 4t Word Format Example 2dmpaul32No ratings yet

- Employment Regulations 1980 (Amended As at 2006)Document43 pagesEmployment Regulations 1980 (Amended As at 2006)Nelo BuensalidaNo ratings yet

- TN Gratuity RulesDocument42 pagesTN Gratuity RulesKAVIYANo ratings yet

- Retrenchment ActDocument12 pagesRetrenchment ActaspsoundsNo ratings yet

- showfileDocument22 pagesshowfileAkshansh NegiNo ratings yet

- Payment_of_Gratuity_Rules (1)Document82 pagesPayment_of_Gratuity_Rules (1)jyotikunaljhaNo ratings yet

- It Bare ActDocument4 pagesIt Bare ActAbhinav SwarajNo ratings yet

- Chapter_4_Law relating to Trade Unions _ Settlement of Industrial DisputesDocument17 pagesChapter_4_Law relating to Trade Unions _ Settlement of Industrial Disputeswasewsadab262000No ratings yet

- Maharashtra - The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) (Maharashtra) Rules, 1985Document26 pagesMaharashtra - The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) (Maharashtra) Rules, 1985Ayesha AlwareNo ratings yet

- Securities and Exchange Commission (SEC) - Forms-4Document19 pagesSecurities and Exchange Commission (SEC) - Forms-4highfinanceNo ratings yet

- Standard Contract AmendmentsDocument66 pagesStandard Contract Amendmentsmarx0506No ratings yet

- (1816) Limborch, Philippus Van - The History of The InquisitionDocument576 pages(1816) Limborch, Philippus Van - The History of The InquisitionBert Hooter100% (4)

- Testimonies From The Swamp of DesperationDocument762 pagesTestimonies From The Swamp of Desperationcrazybuttful100% (1)

- Was Peter The First PopeDocument16 pagesWas Peter The First PopeIasminNo ratings yet

- The Two Republics - A.T. JonesDocument461 pagesThe Two Republics - A.T. JonespropovednikNo ratings yet

- Holocaust in Romania - CARP PDFDocument239 pagesHolocaust in Romania - CARP PDFIlie GogosoiuNo ratings yet

- History of The PapacyDocument387 pagesHistory of The PapacyJesus Lives100% (1)

- Tupper Saussy Rulers of EvilDocument352 pagesTupper Saussy Rulers of Evilcrazybuttful100% (19)

- Mike Perl - From A Hopeless End To An Endless HopeDocument6 pagesMike Perl - From A Hopeless End To An Endless HopecrazybuttfulNo ratings yet

- Israel 101Document40 pagesIsrael 101crazybuttful100% (3)

- A Complete History of The Popes of RomeDocument507 pagesA Complete History of The Popes of Romecrazybuttful100% (1)

- Antony Sutton Trilaterals Over WashingtonDocument134 pagesAntony Sutton Trilaterals Over Washingtoneugen-karl100% (1)

- Vatican Design ExposedDocument40 pagesVatican Design ExposedJoseph Smith100% (1)

- The Falling Away From Truth - George BurnsideDocument8 pagesThe Falling Away From Truth - George BurnsideSteve RocheNo ratings yet

- Alexander Hislop - The Two BabylonsDocument255 pagesAlexander Hislop - The Two BabylonsCitac_1No ratings yet

- Romanism, A Menace To The NationDocument714 pagesRomanism, A Menace To The Nationcrazybuttful100% (4)

- Secret Instructions of The Jesuits - W. C. BrownleeDocument144 pagesSecret Instructions of The Jesuits - W. C. Brownleemika2k01100% (1)

- Roman Catholicism PDFDocument10 pagesRoman Catholicism PDFvampirex79No ratings yet

- Select Historical Documents of The Middle AgesDocument536 pagesSelect Historical Documents of The Middle Agescrazybuttful100% (1)

- Religion Los Asesinos Del VaticanoDocument178 pagesReligion Los Asesinos Del VaticanoGerardoNo ratings yet

- Edmond Paris - The Secret History of Jesuits (1975)Document197 pagesEdmond Paris - The Secret History of Jesuits (1975)adrian_pirlea89% (9)

- The History of Romanism - John DowlingDocument674 pagesThe History of Romanism - John Dowlingmika2k01100% (1)

- Last Day DelusionsDocument54 pagesLast Day Delusionscrazybuttful100% (1)

- Ecclesiastical EmpireDocument534 pagesEcclesiastical EmpireIasmin100% (1)

- Hughes - The Secret Terrorists JesuitsDocument105 pagesHughes - The Secret Terrorists JesuitsOnder-Koffer89% (9)

- Futurisms Faulty FoundationDocument4 pagesFuturisms Faulty FoundationKunedog1No ratings yet

- Edmond Paris - The Secret History of Jesuits (1975)Document197 pagesEdmond Paris - The Secret History of Jesuits (1975)adrian_pirlea89% (9)

- History of The Jesuits - G. B. NicoliniDocument556 pagesHistory of The Jesuits - G. B. Nicolinimika2k01100% (1)

- Religion Los Asesinos Del VaticanoDocument46 pagesReligion Los Asesinos Del VaticanoGerardoNo ratings yet

- CHRIST AND ANTICHRIST by Samuel J. CasselsDocument300 pagesCHRIST AND ANTICHRIST by Samuel J. CasselsKunedog1No ratings yet

- The Black Pope - M. F. CusackDocument404 pagesThe Black Pope - M. F. Cusackmika2k01No ratings yet

- Keynes Presentation - FINALDocument62 pagesKeynes Presentation - FINALFaith LuberasNo ratings yet

- Password CrackingDocument13 pagesPassword CrackingBlue MagicNo ratings yet

- Pass Issuance Receipt: Now You Can Also Buy This Pass On Paytm AppDocument1 pagePass Issuance Receipt: Now You Can Also Buy This Pass On Paytm AppAnoop SharmaNo ratings yet

- Sap Fi/Co: Transaction CodesDocument51 pagesSap Fi/Co: Transaction CodesReddaveni NagarajuNo ratings yet

- Difference Between Knowledge and SkillDocument2 pagesDifference Between Knowledge and SkilljmNo ratings yet

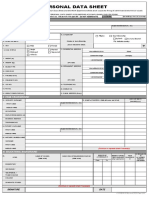

- PDS-1st PageDocument1 pagePDS-1st PageElmer LucreciaNo ratings yet

- Kuliah Statistik Inferensial Ke4: Simple Linear RegressionDocument74 pagesKuliah Statistik Inferensial Ke4: Simple Linear Regressionvivian indrioktaNo ratings yet

- Sampling Fundamentals ModifiedDocument45 pagesSampling Fundamentals ModifiedArjun KhoslaNo ratings yet

- Tutorial Manual Safi PDFDocument53 pagesTutorial Manual Safi PDFrustamriyadiNo ratings yet

- A - Bahasa Inggris-DikonversiDocument96 pagesA - Bahasa Inggris-DikonversiArie PurnamaNo ratings yet

- Whats The Average 100 M Time For An Olympics - Google SearchDocument1 pageWhats The Average 100 M Time For An Olympics - Google SearchMalaya KnightonNo ratings yet

- Best Homeopathic Doctor in SydneyDocument8 pagesBest Homeopathic Doctor in SydneyRC homeopathyNo ratings yet

- English 8-Q3-M3Document18 pagesEnglish 8-Q3-M3Eldon Julao0% (1)

- Modulus of Subgrade Reaction KsDocument1 pageModulus of Subgrade Reaction KsmohamedabdelalNo ratings yet

- 1 N 2Document327 pages1 N 2Muhammad MunifNo ratings yet

- Contemporary World Prelim Exam Test DraftDocument5 pagesContemporary World Prelim Exam Test DraftGian Quiñones93% (45)

- Broadband BillDocument1 pageBroadband BillKushi GowdaNo ratings yet

- Unit 13 AminesDocument3 pagesUnit 13 AminesArinath DeepaNo ratings yet

- 272 Concept Class Mansoura University DR Rev 2Document8 pages272 Concept Class Mansoura University DR Rev 2Gazzara WorldNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesAdonis BesaNo ratings yet

- Telangana Budget 2014-2015 Full TextDocument28 pagesTelangana Budget 2014-2015 Full TextRavi Krishna MettaNo ratings yet

- Numark MixTrack Pro II Traktor ProDocument3 pagesNumark MixTrack Pro II Traktor ProSantiCai100% (1)

- The Basic New Keynesian Model ExplainedDocument29 pagesThe Basic New Keynesian Model ExplainedTiago MatosNo ratings yet

- Wordbank Restaurants 15Document2 pagesWordbank Restaurants 15Obed AvelarNo ratings yet

- Forms of Business Organization: Sole Proprietorship, Partnership, Corporation, CooperativesDocument17 pagesForms of Business Organization: Sole Proprietorship, Partnership, Corporation, CooperativesSanti BuliachNo ratings yet

- Recommended lubricants and refill capacitiesDocument2 pagesRecommended lubricants and refill capacitiestele123No ratings yet

- FEM IntroductionDocument47 pagesFEM IntroductionShanmuga RamananNo ratings yet

- User-Centered Website Development: A Human-Computer Interaction ApproachDocument24 pagesUser-Centered Website Development: A Human-Computer Interaction ApproachKulis KreuznachNo ratings yet

- InvoiceDocument1 pageInvoiceAnurag SharmaNo ratings yet

- Nammo Bulletin 2014Document13 pagesNammo Bulletin 2014Dmitry Karpov0% (1)