Professional Documents

Culture Documents

Kristen Lu Purchased A Used Automobile For

Uploaded by

Kailash KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kristen Lu Purchased A Used Automobile For

Uploaded by

Kailash KumarCopyright:

Available Formats

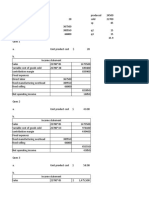

purchased 20250

depreciation 20250 5 $ 4,050.00

Insurance $ 2,100.00

garage rent $ 1,100.00

Autombile tax and license $ 550.00

Variable operating cost $ 0.09

time 5

SLM 4050

q1 26000

q2

q3

Solution

Ques 1

Fixed cost per mile $ 0.30

Variable operating cost per mile $ 0.09

Average cost per mile $ 0.39

Working

Fixed cost per mile calculation

Depreciation $ 4,050.00

Insurance $ 2,100.00

Garage rent $ 1,100.00

Automobile tax and license $ 550.00

total $ 7,800.00

Divided by miles 26,000

Cost per mile $ 0.30

Ques 2

Option A:variable operating costs

Because

a)Depreciaiton is sunk cost/historical cost

b)Insurance cost is irrelevant cost

c)Automobile tax and license cost is also irrelevant cost

d)garge rent is relevant if she drives her own car but this is not mentioned in options

You might also like

- PUP-Summary of Chapter 8Document40 pagesPUP-Summary of Chapter 8rachel banana hammockNo ratings yet

- Requirement 1Document2 pagesRequirement 1Eevan SalazarNo ratings yet

- Truck Operating CostDocument5 pagesTruck Operating Costjani.annapanNo ratings yet

- Grain Truck Transportation Cost Calculator: Ag Decision Maker - Iowa State University Extension and OutreachDocument4 pagesGrain Truck Transportation Cost Calculator: Ag Decision Maker - Iowa State University Extension and OutreachdharmawanNo ratings yet

- Jordan Managment Accounting 71Document45 pagesJordan Managment Accounting 71Ace RividiNo ratings yet

- SCM 2Document17 pagesSCM 2M JIYAD SHAIKH Supply Chain PodcastNo ratings yet

- Grain Truck Transportation Cost Calculator: Ag Decision Maker - Iowa State University ExtensionDocument4 pagesGrain Truck Transportation Cost Calculator: Ag Decision Maker - Iowa State University ExtensionvengadeshNo ratings yet

- Relevant Costs For Decision MakingDocument90 pagesRelevant Costs For Decision Makingmohamed el kadyNo ratings yet

- Cost Accounting Level 3/series 2 2008 (Code 3017)Document18 pagesCost Accounting Level 3/series 2 2008 (Code 3017)Hein Linn Kyaw50% (2)

- Analisis Economico Conversion EVADocument4 pagesAnalisis Economico Conversion EVAAixer Alexander PadronNo ratings yet

- Summary BMW x3 MDocument13 pagesSummary BMW x3 MvenetiansorcererNo ratings yet

- Extra Sum: Find Out Cost Per Kilometre of One Vehicle: Transport Service Cost SheetDocument25 pagesExtra Sum: Find Out Cost Per Kilometre of One Vehicle: Transport Service Cost Sheetchirag shahNo ratings yet

- Exercise 12-8: TotalDocument10 pagesExercise 12-8: TotalAbdul MoeezNo ratings yet

- Aaz Mileage Rates August 2023Document1 pageAaz Mileage Rates August 2023Prince Mubaiwa100% (1)

- Open Source Autonomous Model - Forgithub - 3.29.19 - v4 2Document12 pagesOpen Source Autonomous Model - Forgithub - 3.29.19 - v4 2Laika AerospaceNo ratings yet

- Cee3 - CH - 03 (Cost Concepts and Behaviors)Document28 pagesCee3 - CH - 03 (Cost Concepts and Behaviors)VismoNo ratings yet

- Vehicle Operating Cost ModelDocument23 pagesVehicle Operating Cost ModelWaqas Muneer KhanNo ratings yet

- Carz FinalDocument9 pagesCarz Finalapi-400402696No ratings yet

- Save $30 Flying to Visit a FriendDocument4 pagesSave $30 Flying to Visit a FriendLê Tuấn AnhNo ratings yet

- Selling bread loaves through distributor networkDocument14 pagesSelling bread loaves through distributor networkSoumya Ranjan PandaNo ratings yet

- Metal Sheet Rev2Document5 pagesMetal Sheet Rev2Mohammad SyeduzzamanNo ratings yet

- Common Inputs: Vibe 1.8 Malibu LT1 HHR LT Vue XE Cobalt LT2 Aura XEDocument4 pagesCommon Inputs: Vibe 1.8 Malibu LT1 HHR LT Vue XE Cobalt LT2 Aura XEapi-28217671No ratings yet

- Obtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts ApplyDocument4 pagesObtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts Applydahnil dicardoNo ratings yet

- For More Details Call 262-649-2919: King Air Analysis - 350, 300, & 250Document26 pagesFor More Details Call 262-649-2919: King Air Analysis - 350, 300, & 250Alexandre F. M.No ratings yet

- Alifian Faiz NovendiDocument5 pagesAlifian Faiz Novendialifianovendi 11No ratings yet

- Special Orders: Decision: To Accept or Reject This OfferDocument2 pagesSpecial Orders: Decision: To Accept or Reject This OfferHassan KhanNo ratings yet

- Piper Seneca V Report Breaks Down CostsDocument7 pagesPiper Seneca V Report Breaks Down CostsDumitruNo ratings yet

- CostDocument18 pagesCostSabri ÇifçibaşıNo ratings yet

- Car 02Document8 pagesCar 02Sanjay RoopnarineNo ratings yet

- Acc Report Atr 72-500 PDFDocument15 pagesAcc Report Atr 72-500 PDFDumitruNo ratings yet

- LEASING FINANCING DECISIONSDocument3 pagesLEASING FINANCING DECISIONSMk SANo ratings yet

- Acc Report Cirrus Operating CostsDocument17 pagesAcc Report Cirrus Operating CostsDumitruNo ratings yet

- Acc Report cj1 Vs cj3Document14 pagesAcc Report cj1 Vs cj3DumitruNo ratings yet

- Current Operating Costs 7 15 2019Document1 pageCurrent Operating Costs 7 15 2019amir7980No ratings yet

- GSLC MANAGERIAL ACC 18 NOVEMBER GROUP DISCUSSIONDocument2 pagesGSLC MANAGERIAL ACC 18 NOVEMBER GROUP DISCUSSIONRudy Setiawan KamadjajaNo ratings yet

- Save Design Model20y20performance 20230724Document2 pagesSave Design Model20y20performance 20230724republicpewNo ratings yet

- Calc of Verna With NildepDocument1 pageCalc of Verna With Nildepniren4u1567No ratings yet

- Vehicle Life Cycle Cost AnalysisDocument3 pagesVehicle Life Cycle Cost Analysislabmve8941No ratings yet

- Hanwha 115kv Transmission Line Conceptual Design-Template No.1Document15 pagesHanwha 115kv Transmission Line Conceptual Design-Template No.1JojolasNo ratings yet

- Exemplu Calcul Costuri Soferi Si CombustibilDocument4 pagesExemplu Calcul Costuri Soferi Si Combustibildasca petronelaNo ratings yet

- Operating Costing Assignment SolutionsDocument9 pagesOperating Costing Assignment Solutionsayesha parveenNo ratings yet

- Cost of Running 2022 Honda CivicDocument1 pageCost of Running 2022 Honda CivicRachelleNo ratings yet

- C208 Operating Costs PDFDocument20 pagesC208 Operating Costs PDFTrevor BairNo ratings yet

- Aircraft Cost Calculator BBJ Vs B737-700Document13 pagesAircraft Cost Calculator BBJ Vs B737-700Harry NuryantoNo ratings yet

- Morang Civil Rate Analysis 076-77Document142 pagesMorang Civil Rate Analysis 076-77Vivek KumarNo ratings yet

- Trucking Profit and Loss StatementDocument2 pagesTrucking Profit and Loss StatementAHMAD FIRDAUS BIN IDRIS KPM-Guru0% (1)

- Transportation Cost Analysis Spreadsheets CalculatorDocument41 pagesTransportation Cost Analysis Spreadsheets CalculatoranarevNo ratings yet

- Transportation Cost Analysis Spreadsheets: Default ValuesDocument50 pagesTransportation Cost Analysis Spreadsheets: Default ValuesКари МедNo ratings yet

- Cop Agrienergy 3.5kwwindturbineDocument7 pagesCop Agrienergy 3.5kwwindturbineK Divakara RaoNo ratings yet

- Tugas Pak Sujono Pak Dimas MMDocument2 pagesTugas Pak Sujono Pak Dimas MMDimas GhiffariNo ratings yet

- LeasingDocument14 pagesLeasingSana SarfarazNo ratings yet

- CMA PGP23 ClassPPT Module4 PDFDocument41 pagesCMA PGP23 ClassPPT Module4 PDFSaransh Chauhan 23No ratings yet

- PolicyDocument2 pagesPolicyVinod KumarNo ratings yet

- Customer Location Sq Ft Cost BreakupDocument7 pagesCustomer Location Sq Ft Cost BreakupAbhimanyu ArjunNo ratings yet

- Butyl CostingDocument1 pageButyl Costing0911khanNo ratings yet

- Financial Performance Reports and Transfer Pricing Chapter 12 AnswersDocument11 pagesFinancial Performance Reports and Transfer Pricing Chapter 12 AnswersgerNo ratings yet

- Vehicle Costing TemplateDocument10 pagesVehicle Costing TemplateKishan DhanrajaniNo ratings yet

- Cost of Operation MotorcycleDocument1 pageCost of Operation MotorcyclereggbbugNo ratings yet

- Napa Tours Co. Is A Travel Agency. The Nine Transactions Recorded by NapaDocument2 pagesNapa Tours Co. Is A Travel Agency. The Nine Transactions Recorded by NapaKailash KumarNo ratings yet

- Pastore Drycleaners Has Capacity To Clean UpDocument4 pagesPastore Drycleaners Has Capacity To Clean UpKailash KumarNo ratings yet

- (Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Document4 pages(Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Kailash KumarNo ratings yet

- Silven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsDocument5 pagesSilven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsKailash KumarNo ratings yet

- Periodic Inventory Three MethodsDocument2 pagesPeriodic Inventory Three MethodsKailash KumarNo ratings yet

- Thompson Industrial Products Inc Is A DiversifiedDocument4 pagesThompson Industrial Products Inc Is A DiversifiedKailash KumarNo ratings yet

- Whispering-Air Is Selling A New Model of High-Efficiency Air ConditionerDocument2 pagesWhispering-Air Is Selling A New Model of High-Efficiency Air ConditionerKailash KumarNo ratings yet

- Alpha Corporation Issued 2,500 Shares of $4 Par Value Common Stock.Document1 pageAlpha Corporation Issued 2,500 Shares of $4 Par Value Common Stock.Kailash KumarNo ratings yet

- Calculate inventory balances, cost of goods sold, and net income with corrected inventory amountsDocument3 pagesCalculate inventory balances, cost of goods sold, and net income with corrected inventory amountsKailash KumarNo ratings yet

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument1 pageCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNo ratings yet

- On April 1, 2018, Intel Issued $1,600,000 of 12% Face Value Bonds For $1,703,411.40.Document3 pagesOn April 1, 2018, Intel Issued $1,600,000 of 12% Face Value Bonds For $1,703,411.40.Kailash KumarNo ratings yet

- Adjusting Entry Pracyice Perry Company PaidDocument1 pageAdjusting Entry Pracyice Perry Company PaidKailash KumarNo ratings yet

- Jennys FroyoDocument16 pagesJennys FroyoKailash Kumar100% (2)

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- Is A Construction Company Specializing in Custom PatiosDocument8 pagesIs A Construction Company Specializing in Custom PatiosKailash KumarNo ratings yet

- Schrand Corporation PurchaseDocument1 pageSchrand Corporation PurchaseKailash KumarNo ratings yet

- Calculating differential values and percentages from financial statementsDocument2 pagesCalculating differential values and percentages from financial statementsKailash KumarNo ratings yet

- O-Level Accounting Paper 2 Topical and yDocument343 pagesO-Level Accounting Paper 2 Topical and yKailash Kumar100% (3)

- Prince Corporation Acquired 100 Percent of Sword CompanyDocument2 pagesPrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- Industry Volume and Market Share Missing DataDocument1 pageIndustry Volume and Market Share Missing DataKailash KumarNo ratings yet

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument2 pagesCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNo ratings yet

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocument17 pagesOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarNo ratings yet

- Bracey Company Manufactures and Sells One ProductDocument2 pagesBracey Company Manufactures and Sells One ProductKailash KumarNo ratings yet

- Accounting entries for asset valuationDocument2 pagesAccounting entries for asset valuationKailash KumarNo ratings yet

- Turcotte Corp Reported The Following Revenues and Cost of Goods Sodl AmountsDocument1 pageTurcotte Corp Reported The Following Revenues and Cost of Goods Sodl AmountsKailash KumarNo ratings yet

- Diamond Hardware Uses The Periodic Inventory SystemDocument7 pagesDiamond Hardware Uses The Periodic Inventory SystemKailash KumarNo ratings yet

- La Femme Accessories Inc Produces Womens HandbagsDocument1 pageLa Femme Accessories Inc Produces Womens HandbagsKailash KumarNo ratings yet

- James Kimberley President of National Motors Receives A BonusDocument1 pageJames Kimberley President of National Motors Receives A BonusKailash KumarNo ratings yet

- Bethany's Bicycle CorporationDocument15 pagesBethany's Bicycle CorporationKailash Kumar100% (2)