Professional Documents

Culture Documents

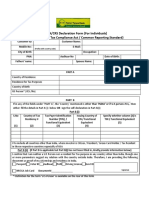

Aviva Crs Form

Uploaded by

AstroSunilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva Crs Form

Uploaded by

AstroSunilCopyright:

Available Formats

CRS/ FATCA Addendum

POLICYHOLDER DETAILS

Name of the PolicyHolder

Proposal/Policy Number

Residence for Tax Purposes in Jurisdiction(s) outside India Yes* No

(If“Yes”, it is mandatory to fill the below details and sign. If “NO”, please cancel, write N/A and sign)

Father’s Name

Gender Male Female Others Date of Birth D D M M Y Y Y Y

Place of Birth Country of Birth

Nationality PAN Number

Identity Proof (Tick as applicable)

Aadhaar Card Passport PAN Card Driving License Election ID Card NREGA Job Card Others

Identification Number (As given in the Identity Proof Document)

Occupation Type Service Business Professional Agriculturist Others

Occupation (Please specify)

Address Type Residential Business Registered Office Others

Current Address

City State Pin Code

Mobile Number Alternate Number

For the purposes of taxation, I am a resident in the following countries and my Tax Identification Number (TIN)/Functional Equivalent in each

country is set out below, or I have indicated that a TIN/Functional Equivalent is unavailable (Kindly fill details of all countries of tax residence,

if more than one):

Tax Identification Number Issuing Country for

Country/Countries of Address in the jurisdiction Validity of documentary

(TIN)/Functional Equivalent TIN/ Functional

Tax Residency for Tax Residence evidence provided

Number Equivalent Number

Note: Documentary evidence to be provided for foreign country of tax residence and TIN

F-Aviva-CRSF (Claims) /Ver:2.0/10th Nov 2017/ Public

Declaration and Undertaking:

I certify that:

1. It shall be my responsibility to educate myself and to comply at all times with all relevant laws relating to reporting under

section 285BA of the Act read with the Rules 114F to 114H of the Income Tax Rules, 1962 thereunder and the information provided in

the form is in accordance with the aforesaid rules.

2. The information provided by me in the form, its supporting Annexures as well as in the documentary evidence are, to the best of our

knowledge and belief, true, correct and complete and that I have not withheld any material information that may affect the

assessment/categorization of the account as a reportable account or otherwise.

3. I permit/authorise the Company to collect, store, communicate and process information relating to the Account and all

transactions therein, by the Company and any of its affiliates wherever situated including sharing, transfer and disclosure between

them and to the authorities in and/or outside India of any confidential information for compliance with any law or regulation whether

domestic or foreign.

4. I undertake the responsibility to declare and disclose within 30 days from the date of change, any changes that may take

place in the information provided in the form, its supporting Annexures as well as in the documentary evidence provided

by me or if any certification becomes incorrect and to provide fresh self-certification along with documentary evidence.

5. I also agree that in case of our failure to disclose any material fact known to me, now or in future, the Company may report to any

regulator and/or any authority designated by the Government of India (GOI) /RBI/IRDAI for the purpose or take any other action as may

be deemed appropriate by the Company if the deficiency is not remedied by me within the stipulated period.

6. I hereby accept and acknowledge that the Company shall have the right and authority to carry out investigations from the

information available in public domain for confirming the information provided by me to the Company.

7. I also agree to furnish such information and/or documents as the Company may require from time to time on account of any

change in law either in India or abroad in the subject matter herein.

8. I shall indemnify the Company for any loss that may arise to the Company on account of providing incorrect or incomplete

information.

Date: Signature:

Place: Name:

Instructions

1. All the above information is to be filled with respect to the person whose KYC is done & shall be filled at the time when KYC is done.

2. In case PAN is not available, father’s name of the applicant is mandatory.

3. All the addresses in the above annexure should contain City/Town, State, Postal Code and Country.

4. Clarification / Guidelines on filling details if the applicant’s residence for tax purposes is in a jurisdiction(s) outside India.

a) Jurisdiction(s) of Tax Residence: Since USA taxes the global income of its citizens, every USA citizen of whatever nationality, is also a

resident for tax purpose in USA

b) Tax Identification Number (TIN): TIN need not be reported if it has not been issued by the jurisdiction. However, if the said jurisdiction

has issued a high integrity number with an equivalent level of identification (a “Functional equivalent”), the same may be reported.

Examples of that type of number for individual include, a social security/insurance number, citizen/personal identification/services

code/number and resident registration number)

Aviva Life Insurance Company India Limited Customer Service Helpline Number Email

Aviva Tower, Sector Road, Opposite Golf Course 1800-103-77-66 (Toll Free) customerservices@avivaindia.com

DLF Phase-V, Sector 43, Gurugram-122003 0124-270-9046

www.avivaindia.com

F-Aviva-CRSF (Claims) /Ver:2.0/10th Nov 2017/ Public

You might also like

- FATCA/CRS Self-Certification - Individual: Tata Aia Life Insurance Company LimitedDocument2 pagesFATCA/CRS Self-Certification - Individual: Tata Aia Life Insurance Company Limitedvirjog0% (2)

- 1.FATCACRS Self-Certification - (Individual) Applicant (L&C Approved) PDFDocument1 page1.FATCACRS Self-Certification - (Individual) Applicant (L&C Approved) PDFPulkesh Pulak100% (1)

- Fatca Crs Declaration Individuals PDFDocument2 pagesFatca Crs Declaration Individuals PDFfujstructuralNo ratings yet

- 9AKIHKTQ FATCAIndividualZerodhapdfDocument2 pages9AKIHKTQ FATCAIndividualZerodhapdfSHOBHA VERMANo ratings yet

- FATCA CRS DeclarationDocument4 pagesFATCA CRS Declarationashokdas test5No ratings yet

- Final LIC Self Certfication Individuals 23 April 2023Document6 pagesFinal LIC Self Certfication Individuals 23 April 2023lalankishorerakeshNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- FATCA Non IndividualDocument6 pagesFATCA Non IndividualMarneni Yallamanda RaoNo ratings yet

- MUTUAL FUNDS FATCA & CRSDocument2 pagesMUTUAL FUNDS FATCA & CRSMaksim MikhailNo ratings yet

- Final LIC Self Certfication Individuals 23 April 2023Document6 pagesFinal LIC Self Certfication Individuals 23 April 2023Nikhil XavierNo ratings yet

- Apply for GST Tax Deductor RegistrationDocument4 pagesApply for GST Tax Deductor RegistrationthecoltNo ratings yet

- FATCA & CRS Compliance FormDocument2 pagesFATCA & CRS Compliance FormAakash SharmaNo ratings yet

- FATCA/CRS Declaration FormDocument2 pagesFATCA/CRS Declaration Formbala krishnanNo ratings yet

- Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowDocument2 pagesFatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowRaviJhaNo ratings yet

- FATCA Form Individual 061015 V1Document2 pagesFATCA Form Individual 061015 V1sanjay901No ratings yet

- Tab Banking Form With Income Undertaking11111Document5 pagesTab Banking Form With Income Undertaking11111Mahakaal Digital Point100% (1)

- FATCA Declaration For Individual Investors FormDocument2 pagesFATCA Declaration For Individual Investors FormnithiyNo ratings yet

- Fatca DeclarationDocument3 pagesFatca DeclarationManish ShahNo ratings yet

- Self-Certification for FATCA/CRS DeclarationDocument3 pagesSelf-Certification for FATCA/CRS DeclarationSean MayNo ratings yet

- Account Holder: AEOI Self-Certification For An Individual/Controlling PersonDocument3 pagesAccount Holder: AEOI Self-Certification For An Individual/Controlling PersonNigil josephNo ratings yet

- FATCA CRS Individual Declaration FormDocument2 pagesFATCA CRS Individual Declaration FormSrigandh's WealthNo ratings yet

- ASBL - FatcaDocument1 pageASBL - Fatcanitinjain9No ratings yet

- For Re-KYC Nredocument NRI - 18.5Document4 pagesFor Re-KYC Nredocument NRI - 18.5rajucbit_2000No ratings yet

- NRI Form Ver5Document12 pagesNRI Form Ver5enterprisesshreemarutiNo ratings yet

- Transmission Request FormDocument4 pagesTransmission Request FormVinayak SavanurNo ratings yet

- Addendum to Account opening Form for Non-Individuals reporting requirements under section 285BADocument6 pagesAddendum to Account opening Form for Non-Individuals reporting requirements under section 285BAguptasuneetNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- AFP Form Manual - 10 Oct 2016Document2 pagesAFP Form Manual - 10 Oct 2016sppramNo ratings yet

- FATCA Declaration Individual FINALDocument3 pagesFATCA Declaration Individual FINALadvaitNo ratings yet

- Bharat Sanchar Nigam Limited (A Government of India Enterprise) (Cutomer Agreement Form For New Landline Telephone Connection)Document2 pagesBharat Sanchar Nigam Limited (A Government of India Enterprise) (Cutomer Agreement Form For New Landline Telephone Connection)praveen kumar SaggurthiNo ratings yet

- DIR6Document3 pagesDIR6sameer06No ratings yet

- Revised-Customer-Information-Sheet-July-2023-1Document1 pageRevised-Customer-Information-Sheet-July-2023-1emzthineNo ratings yet

- Anf2a 2015Document4 pagesAnf2a 2015Vithani MehulNo ratings yet

- Fatca-Crs - Icici BankDocument8 pagesFatca-Crs - Icici BankSankaram KasturiNo ratings yet

- Fatca Crs FaqsDocument7 pagesFatca Crs FaqsMathew SimonNo ratings yet

- Business Banking Entity Self Certification FormDocument4 pagesBusiness Banking Entity Self Certification Formyogeshahire166No ratings yet

- Self Certifications PDFDocument2 pagesSelf Certifications PDFAhmed Issah100% (1)

- 1098 FormDIN1 HelpDocument8 pages1098 FormDIN1 HelpAlok RanjanNo ratings yet

- F 13551Document2 pagesF 13551IRSNo ratings yet

- Re-KYC NRI FormDocument9 pagesRe-KYC NRI FormPaxton FettelNo ratings yet

- FATCA Declaration Individual HUFDocument8 pagesFATCA Declaration Individual HUFMOHAN SNo ratings yet

- FATCA Individual PDFDocument2 pagesFATCA Individual PDFPrathik NamakalNo ratings yet

- Philippine Tax Treaty Relief ApplicationDocument2 pagesPhilippine Tax Treaty Relief ApplicationKoji ZerofourNo ratings yet

- Form 49A ApplicationDocument8 pagesForm 49A ApplicationashokkumarnklNo ratings yet

- EOI (Expression of Interest) GoaDocument2 pagesEOI (Expression of Interest) Goasurajsk9545No ratings yet

- CKYC Declaration Form 25 11 2020Document2 pagesCKYC Declaration Form 25 11 2020Sudhakar BNo ratings yet

- Request For Copy of Tax Return: Illinois Department of RevenueDocument1 pageRequest For Copy of Tax Return: Illinois Department of RevenueAsjsjsjsNo ratings yet

- BSNL Landline Application Form TermsDocument2 pagesBSNL Landline Application Form TermsAnjith A.SNo ratings yet

- FATCA & CRS Self Certification FormDocument3 pagesFATCA & CRS Self Certification Formvenkatesh801No ratings yet

- Fatca Form NewDocument1 pageFatca Form NewgaurdevNo ratings yet

- ANF PROFILEDocument10 pagesANF PROFILEtasneem89No ratings yet

- AEOI FormDocument2 pagesAEOI Formgheorgheadrianonea100% (1)

- DECLARATION UNDER INCOME-TAX RULESDocument2 pagesDECLARATION UNDER INCOME-TAX RULESArshad Rashid ShahNo ratings yet

- Vendor Registration For Channel PartnersDocument6 pagesVendor Registration For Channel Partnerspinak powerNo ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Drafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsFrom EverandDrafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsRating: 1 out of 5 stars1/5 (2)

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (13)

- Mathematics of AstrologyDocument37 pagesMathematics of Astrologyxkaliberlord100% (15)

- Saral JyotishDocument296 pagesSaral JyotishTushar Chadha50% (2)

- Chakras and HandwritingDocument8 pagesChakras and HandwritingAstroSunilNo ratings yet

- Mathematics of AstrologyDocument1 pageMathematics of AstrologyAstroSunilNo ratings yet

- GraphologyDocument34 pagesGraphologyAstroSunilNo ratings yet

- CombustionDocument4 pagesCombustionAstroSunilNo ratings yet

- Cusp or Krishnamurthy ChartDocument6 pagesCusp or Krishnamurthy ChartAstroSunilNo ratings yet

- 26 September StocksDocument3 pages26 September StocksAstroSunilNo ratings yet

- Baby Names From NakshatraDocument2 pagesBaby Names From NakshatraAstroSunilNo ratings yet

- A Systematic Approach To Medical AstrologyDocument7 pagesA Systematic Approach To Medical AstrologyHoracio TackanooNo ratings yet

- Discover Your Next Life Through D-108 AstrologyDocument11 pagesDiscover Your Next Life Through D-108 AstrologyAstroSunilNo ratings yet

- Broadband - RVR NetDocument2 pagesBroadband - RVR NetAstroSunilNo ratings yet

- Maraka Graha: Planets Causing Death in Vedic AstrologyDocument4 pagesMaraka Graha: Planets Causing Death in Vedic AstrologyAstroSunilNo ratings yet

- Cusp or Krishnamurthy ChartDocument8 pagesCusp or Krishnamurthy ChartAstroSunilNo ratings yet

- GraphsDocument2 pagesGraphsAstroSunilNo ratings yet

- Importance of Chanting Vishnu SahasranamamDocument2 pagesImportance of Chanting Vishnu SahasranamamAstroSunilNo ratings yet

- Laghu ParashariDocument7 pagesLaghu Parasharikm7781100% (1)

- Top MSOs in India by Town and StateDocument24 pagesTop MSOs in India by Town and StateAstroSunilNo ratings yet

- BurningquestionDocument0 pagesBurningquestionCor ScorpiiNo ratings yet

- Aviva Health Secure Plan by Aviva IndiaDocument7 pagesAviva Health Secure Plan by Aviva IndiaTiya RajputNo ratings yet

- Graphology and Grapho Therapy: It Is The Study of How An Individual's Handwriting Indicates TheirDocument24 pagesGraphology and Grapho Therapy: It Is The Study of How An Individual's Handwriting Indicates TheirAstroSunilNo ratings yet

- Cns Report For Delhi NetworksDocument10 pagesCns Report For Delhi NetworksAstroSunilNo ratings yet

- Cci ClausesDocument2 pagesCci ClausesAstroSunilNo ratings yet

- DasavtaarDocument2 pagesDasavtaarAstroSunilNo ratings yet

- 3 - Two Side Road - House ExamplesDocument123 pages3 - Two Side Road - House ExamplesRPh Krishna Chandra Jagrit100% (1)

- The Astrological Self Instructor - B Suryanarain Rao 1893Document224 pagesThe Astrological Self Instructor - B Suryanarain Rao 1893K Krishan Singla100% (2)

- Chappanna or Prasana Sastra - B Suryanarain Rao 1946 PDFDocument91 pagesChappanna or Prasana Sastra - B Suryanarain Rao 1946 PDFAstroSunilNo ratings yet

- Balaristha DoshaDocument4 pagesBalaristha DoshaAstroSunilNo ratings yet

- 26 September StocksDocument3 pages26 September StocksAstroSunilNo ratings yet

- Department of Education: Division of Oroquieta City Oroquieta City National High School-Villaflor CampusDocument2 pagesDepartment of Education: Division of Oroquieta City Oroquieta City National High School-Villaflor CampusMee Eun AeNo ratings yet

- 05.03 - G.G. Sportswear Mfg. Corp. vs. World Class Properties, Inc., G.R. No. 182720 March 2, 2010Document10 pages05.03 - G.G. Sportswear Mfg. Corp. vs. World Class Properties, Inc., G.R. No. 182720 March 2, 2010JMarcNo ratings yet

- 43 Diversified Credit Corporation vs. Felipe RosadoDocument6 pages43 Diversified Credit Corporation vs. Felipe RosadoVianice BaroroNo ratings yet

- NPC V National MerchandisingDocument2 pagesNPC V National MerchandisingRubyNo ratings yet

- Sutterfield & Frizzell VS San Marcos Green Investors (Iconic Village) PDFDocument13 pagesSutterfield & Frizzell VS San Marcos Green Investors (Iconic Village) PDFAnonymous Pb39klJNo ratings yet

- Savannah Green PlainsDocument2 pagesSavannah Green PlainswowbahayNo ratings yet

- Who bears loss before deliveryDocument2 pagesWho bears loss before deliverykelo100% (2)

- Affidavit-Of Desistance (Admin)Document2 pagesAffidavit-Of Desistance (Admin)Judilyn Ravilas100% (4)

- GCS 1Document1 pageGCS 1Luthfi AnandhikaNo ratings yet

- Chua v. CFI NegrosDocument10 pagesChua v. CFI NegrosAnna LesavaNo ratings yet

- Summary of The Berne Convention For The Protection of Literary and Artistic WorksDocument3 pagesSummary of The Berne Convention For The Protection of Literary and Artistic Workssweetlunacy00100% (2)

- G.R. No. L-26699 March 16, 1976 Salao Vs SalaoDocument9 pagesG.R. No. L-26699 March 16, 1976 Salao Vs SalaorodolfoverdidajrNo ratings yet

- Law of Property and Security ADocument32 pagesLaw of Property and Security ALipton NcubeNo ratings yet

- 4th Final B.Ed Merit List 2023Document3 pages4th Final B.Ed Merit List 2023Deep jyoti Dutta.No ratings yet

- Cambria Company v. Cosmos Granite & Marble, NC - ComplaintDocument17 pagesCambria Company v. Cosmos Granite & Marble, NC - ComplaintSarah BursteinNo ratings yet

- Legal Succession Case Upholds Co-Ownership but Denies RedemptionDocument2 pagesLegal Succession Case Upholds Co-Ownership but Denies RedemptionNina CastilloNo ratings yet

- Special power attorney retirementDocument1 pageSpecial power attorney retirementRey BaltazarNo ratings yet

- Continue..: - Appointment of InvigilatorsDocument6 pagesContinue..: - Appointment of InvigilatorsPawan KumarNo ratings yet

- TRANSPO Qs C17-20Document7 pagesTRANSPO Qs C17-20Dee LMNo ratings yet

- Source of Obligation in Jose Cangco vs. Manila Railroad CoDocument6 pagesSource of Obligation in Jose Cangco vs. Manila Railroad CordNo ratings yet

- Ias 37Document8 pagesIas 37Szetoo WeishyaNo ratings yet

- Vitangcol Vs New Vista Properties To Aldrsgate Vs GauuanDocument13 pagesVitangcol Vs New Vista Properties To Aldrsgate Vs Gauuanana ortizNo ratings yet

- Full Marks Hindi Class 10 Term 2 by MyxamideaDocument256 pagesFull Marks Hindi Class 10 Term 2 by Myxamideadon13% (8)

- Answer To ComplaintDocument7 pagesAnswer To ComplaintdianneNo ratings yet

- Asst - Rto, Baghpat Transport Department: Form 3 (See Rule 3 (A) and 13)Document1 pageAsst - Rto, Baghpat Transport Department: Form 3 (See Rule 3 (A) and 13)rajsingh199819No ratings yet

- Holt V Schweiger 05-15-09Document21 pagesHolt V Schweiger 05-15-09Legal WriterNo ratings yet

- Marine InsuranceDocument4 pagesMarine InsuranceRio AborkaNo ratings yet

- PAL v. RamosDocument2 pagesPAL v. Ramoskim_santos_20No ratings yet

- Ps Структуры Календарный График Проекта Sap HelpDocument39 pagesPs Структуры Календарный График Проекта Sap Helpdeveloper06100% (1)