Professional Documents

Culture Documents

April 2016 Tax Brief 1

Uploaded by

Rheneir MoraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April 2016 Tax Brief 1

Uploaded by

Rheneir MoraCopyright:

Available Formats

01 BIR Issuances

• ATRIGs required before release of imported

automobiles from Customs

• Credit/debit/prepaid card payment of taxes

• AABs open on March 19 and April 02 to accept

tax payments

• RP Turkey double tax treaty in effect starting

January 1, 2016

• Protocol amending RP- New Zealand tax treaty

• Availability of version 6.0 of eBIRForms package

Tax brief

and other reminders

• BOA resolution no. 3 effective fiscal year ending

June 30, 2016

April 2016 • Additional/ alternative documentary requirements

on application for BIR registration

02 CTA Cases

• Appealing Oplan Kandado at the CTA

• Government issued certificates are deemed valid

unless proven to the contrary

• BIR cannot compel payment of compromise

penalties

• Assessment is invalid for failure to prove receipt

by the taxpayer; WDL may be directly appealed

to the CTA

• Form 1606 as proof of withholding on sale of real

properties

• Strict compliance with documentation for tax

refund

Punongbayan & Araullo (P&A) is the Philippine member firm of

Grant Thornton International Ltd

BIR Issuances

ATRIGs required before release of production thereof, as well as the machinery, after qualifying the testing procedures.

imported automobiles from Customs equipment, apparatus or any mechanical

> BIR Issuances contrivances especially used for its assembly/ Payments by credit/debit/prepaid cards shall

(Revenue Regulations 2- 2016, March 4, 2016) production; and on all importations of articles be voluntary on the part of the taxpayers.

> CTA Cases exempt from VAT.

> Highlight on All imported automobiles released from As such, the taxpayer shall bear the

P&A Grant customs custody after March 31, 2016 without Excisable items released without the requisite convenience fee and other fees being charged

Thornton required Authority to Release Imported Goods ATRIG presupposes that taxes due were not by banks and/or credit card companies for

services (ATRIGs) may be detained, and if warranted, paid or not properly paid. Such items may the use of this payment facility. Such fees,

shall be subject to seizure. be detained by any Revenue Officer, and if including the “Merchant Discount Rate”

warranted, subsequently forfeited. Responsible (MDR), shall not be deducted from the

In the transition, those that were released person for such unlawful possession or removal amount of tax due to the BIR.

without securing ATRIGs may still apply until shall be held liable for the penalties under the

March 31, 2016 with the Excise LT Regulatory law. Only Philippine-issued cards under the name

Division (ELTRD) and pay any unpaid excise of the taxpayers shall be used in payment of

tax and VAT, subject to 50% surcharge and Credit/debit/prepaid card for payment of taxpayers’ liabilities.

20% interest for late payment. taxes

The BIR shall neither have any responsibility

An ATRIG is an authority issued by the BIR, (Revenue Regulations No. 3- 2016, March 23, nor liability on any issues concerning the

addressed to the Commissioner of Customs, 2016) taxpayer-cardholder and the card issuer,

allowing the release of imported goods from including, but not limited to, “charge back”,

customs custody upon payment of applicable The BIR has authorized additional mode of erroneous posting or charging, nonpayment

taxes, or proof of exemption from payment payments for internal revenue taxes through of the taxpayer-cardholder to the issuer, and

thereof, whichever is applicable. credit/debit/prepaid cards. However, other issues.

authority to accept payments through these

The ATRIG shall be issued for all importations new modes shall be limited to Authorized In case of erroneous tax payments, BIR shall

of articles subject to excise tax (whether exempt Agent Banks (AABs) with whom the BIR not be liable to automatically charge the

or taxable), including raw materials in the has entered into service level agreement (SLA) amount back to the taxpayer-cardholders’

Tax brief – April 2016 2

BIR Issuances

account. The taxpayer may file an application and Araw ng Kagitingan), • 15% in all other cases

for refund/tax credit with the BIR.

Extension of banking hours from 3:00 PM to Interest

AABs-acquirer are responsible to accurately 5:00 PM from April 1 – 15 still stands. • 0% when paid to the government

> BIR Issuances

and timely report payment transactions to the Item 2.1.2 of the memorandum agreement • 10% in all other cases

> CTA Cases BIR and remit the payments to the BTr. In executed by the Bureau on Internal Revenue

case the EPSP is not the AABs-acquirer, EPSP (BIR) and Bureau of Treasury (BTR) Royalties

> Highlight on

shall electronically transmit daily payment mandates that Authorized Agent Banks • Maximum of 15% for broadcasting

P&A Grant

transactions to the BIR not later than 9:00 a.m. (AABs) to carry bank operations two (2) activities

Thornton

the next day. Saturdays immediately prior to April 15 of

services

every year. Professional Income of a Turkish resident shall

The payment shall be deemed made on not be taxable in the Philippines provided that

the date and time appearing in the system- RP-Turkey tax treaty in effect starting Jan such services are not rendered regularly and

generated payment confirmation receipt 1, 2016 residence herein does not exceed 183 days

issued to the taxpayer-cardholder by the within any 12-month period.

MB-Acquirer, provided that payment is (Revenue Memorandum Circular No. 31-

actually received by the BIR pursuant to these 2016, March 15, 2016) Turkish resident income earner or an authorized

Regulations. The taxpayers’ liability shall exist representative should file a duly accomplished

until actual receipt of payments by the BIR. The Agreement between the Republic of the BIR Form No. 0901 (Application for Relief

Philippines and the Republic of Turkey for from Double Taxation) together with required

AABs open on March 19 and April 02 to the Avoidance of Double Taxation and the documents to the International Tax Affairs

accept tax payments Prevention of Fiscal Evasion with respect to Division (ITAD) National Office to effect.

Taxes on Income shall effect starting January

(Revenue Memorandum Circular No. 26- 1, 2016.

2016, March 3, 2016)

The following preferential treaty rates are

Authorized Agent Banks (AABs) will observe provided:

regular banking days on March 19 and April

02 for purposes of accepting tax payments. Dividends

This is in lieu of March 26 and April 9 which • 10% if payee is a company (except

are non-working holidays (Black Saturday partnerships) who owns at least 25% of the

company’s capital

Tax brief – April 2016 3

BIR Issuances

Protocol amending RP- New Zealand tax 3. Dropbox using this link: http://goo.gl/ submitted by the taxpayer within 15 days

treaty UCr8XS; after filing of the return to the concerned LT

4. Direct link: http://ftp.pregi.net/bir/ Office/RDO.

(Revenue Memorandum Circular No. 32- ebirforms_package_v6.0.zip; or

> BIR Issuances 2016, March 21, 2016) 5. www.bir.gov.ph 4. Summary Alphalist of Withholding Tax

> CTA Cases (SAWT) shall be emailed to esubmission@bir.

The protocol amending the Republic of the Modification of the new package includes: gov.ph

> Highlight on Philippines and Government of New Zealand a. one-click submission of Tax Returns; and

P&A Grant for the Avoidance of Double Taxation and the b. reduced package size for easier BOA resolution no. 3 effective fiscal year

Thornton Prevention of Fiscal Evasion has entered into downloading ending June 30, 2016

services force on October 2, 2008 and shall take effect

on taxes due beginning January 2009. Filing procedures: (Revenue Memorandum Circular No. 36-

2016, March 21, 2016)

New Zealand resident income earner or 1. eFPS Taxpayers

an authorized representative should file a a. annual income tax returns and excise tax Implementation of BOA Resolution No. 3

duly accomplished BIR Form No. 0901 returns: prepare using the offline package and shall become effective only for the Financial

(Application for Relief from Double Taxation) submit to eFPS by clicking the SUBMIT/ Statements to be submitted for fiscal year

together with required documents to the FINAL COPY button. ending June 30, 2016 and subsequent periods.

International Tax Affairs Division (ITAD) This is still not applicable for the Income Tax

National Office to effect the treaty rates. b. other returns: file using the online eFPS. Return (ITR) filing covering calendar year

Payments shall be made online through eFPS 2015, due on or before April 15, 2016.

Availability of version 6.0 of eBIRForms facility.

package and other reminders Among others, the Resolution requires

2. Non-eFPS Taxpayers: tax returns shall be that annual FS of companies who have

(Revenue Memorandum Circular No. 35- prepared through eBIRForms, printed, and gross sales exceeding P10 million should

2016, March 21, 2016) payment be made through Authorized Agent be accompanied by a “Certificate on the

Banks (AABs), Revenue Collection Officer Preparation of Financial Statement and Notes

The latest latest eBIRForms Package Version (RCOs), or GCASH to the Financial Statements” issued by a

6.0 is now available and may be downloaded BOA-accredited CPA who can either be an

from the following sites: 3. Schedules and manual attachments, duly employee of the company or a CPA in public

1. www.knowyourtaxes.ph; signed printed efiled return and printed practice contracted by the company

2. www.dof.gov.ph system-generated confirmation receipt shall be

Tax brief – April 2016 4

BIR Issuances

Additional/ alternative documentary certificate with civil registry number of b. properly authenticated DVDs

requirements on application for declared dependents containing electronic books of accounts and

registration with BIR records

New application for Authority to Print (ATP): c. affidavit attesting completeness, accuracy

> BIR Issuances (Revenue Memorandum Circular No. 37- 1. Job Order and correctness of entries and number of used

2016, March 22, 2016) 2. Final & clear sample of principal and loose-leaf books of accounts

> CTA Cases supplementary receipts/invoices d. current year proof of payment- annual

> Highlight on The list of documentary requirements on registration fee (BIR Form 0605)

P&A Grant application for registration of individuals/ New registration of books of accounts:

Thornton entities with the BIR has been amended and 1. Manual books of accounts Securing permit for use:

services updated. Below are the specific additions or a. new sets of permanently bound books of

alternatives of documents to be presented for accounts 1. Manual loose-leaf books of accounts and/or

registration applications. b. official appointment book (for OR or SI

professionals only) a. letter of request to use manual loose-leaf

Self-employed, professionals, mixed income c. current year proof of payment- annual books of accounts and/or OR or SI

earners: registration fee (BIR Form 0605)\ b. application for permit to use manual

loose-leaf books of accounts and/or OR or SI

1. Original or certified true copy of NSO 2. Manual loose-leaf books of accounts and/or c. sample format and print-out to be used

birth certificate OR or SI

2. Proof of ownership/ legal possession of a. permit to use loose-leaf books of 2. Computerized accounting system (CAS)/

business accounts and/or OR or SI computerized books of accounts (CBA) and/

a. Owned place of business- photo copy b. permanently bound loose-leaf books of or its components

of OR of RPT (current year); or transfer/ accounts a. duly accomplished BIR Form No. 1900

original certificate of title (TCT/OCT) c. affidavit attesting completeness, b. photocopy of previously issued permit

b. Rented place of business- photo copy of accuracy and correctness of entries and to use CAS/CBA and/or its components, if

contract of lease and lessor’s permit number of used loose-leaf books of accounts applicable

c. Free of use of business place- consent d. current year proof of payment- annual c. proof of ownership or license agreement,

from the owner with ID and proof of registration fee (BIR Form 0605) whichever is applicable

ownership d. location map of the place of business

3. Contract of service 3. Computerized books of accounts e. list of branches that will use CAS/CBA

4. Two (2) valid government-issued IDs or a. computerize accounting system (CAS)/ and/or its components, if any

Barangay clearance computerized books of accounts (CBA) and/

5. Original or certified true copy of birth or its components permit

Tax brief – April 2016 5

BIR Issuances

f. certification that the branch/es use the Branch/Facility types: d. sworn certification of “non-forum

same CAS/CBA and/or its components with shopping”

that of the head office, if applicable 1. Proof of ownership/ legal possession of e. sworn undertaking by a responsible

g. photocopy of previously issued permit business officer of the taxpayer

> BIR Issuances of mother/sister company, another branch a. Owned place of business- photo copy

using the same system, if any of OR of RPT (current year); or transfer/

> CTA Cases h. certification from the NAB which original certificate of title (TCT/OCT)

> Highlight on previously evaluated the approved system, if b. Rented place of business- photo copy of

P&A Grant any contract of lease and lessor’s permit

Thornton c. Free of use of business place- consent

services Employees: from the owner with ID and proof of

1. Local ownership

a. Original or Certified True Copy of

NSO birth certificate Purely TIN issuance:

2. Alien

a. Passport; and 1. One-time taxpayer (ONETT)

b. Working Permit a. Affidavit of self-adjudication (alternative

option for extrajudicial settlement of estate

Corporations, partnerships:

Other Updates:

1. Certificate of Recording (alternative

option for the copy of SEC certificate of 1. Update of books of accounts

incorporation) a. new sets of permanently bound books of

2. Proof of ownership/ legal possession of accounts; and

business b. current year proof of payment- annual

a. Owned place of business- photo copy registration fee (BIR Form No. 0605)

of OR of RPT (current year); or transfer/ 2. Change in accounting period

original certificate of title (TCT/OCT) a. letter request

b. Rented place of business- photo copy of b. duly filled-up BIR Form No. 1905

contract of lease and lessor’s permit c. certified true copy of SEC certificate of

c. Free of use of business place- consent filing of amended by-laws showing the change

from the owner with ID and proof of in accounting period

ownership

Tax brief – April 2016 6

CTA Cases

Appealing Oplan Kandado at the CTA VAT was invalid because of failure to In this case, taxpayer is a multi-purpose

indicate the basis of the assessment, how agricultural cooperative belonging to the first

(Commissioner of Internal Revenue v Elric the surveillance was conducted and the category as shown by its Certificate of Tax

Auxiliary Services Corporation, CTA EB No. method used in arriving at the estimated tax Exemption. As such, it shall not be subject to

> BIR Issuances 1174, March 3, 2016) due. The result only showed that daily sales taxes and fees imposed under internal revenue

over the 10-day surveillance was averaged laws and other tax laws, including VAT.

> CTA Cases The decision of the Commissioner of Internal and multiplied by 365 days to arrive at the However, pending the release of its Certificate

> Highlight on Revenue (CIR) on “Oplan Kandado”, VAT due for the whole year. The CTA of Tax Exemption, the BIR required the

P&A Grant through the 48-Hour Notice and 5-Day ruled that it is necessary that the basis of cooperative to pay the advanced VAT for

Thornton VAT Compliance Notice as implemented by the assessment must likewise be disclosed the issuance of the Certificate Authorizing

services Revenue Memorandum Order No. 3-2009, to enforce the assessment of the deficiency Release of Refined Sugars (CARRS).

can be appealed to the Court of Tax Appeals VAT.

(CTA). The appellate jurisdiction of the The Cooperative subsequently applied for

CTA is not limited to cases which involve Government issued certificates are deemed the refund of the VAT paid. To prove its

decisions of the CIR on matters relating to valid unless proven to the contrary entitlement, the Cooperative presented its (1)

assessments or refunds. The CTA also has Certificate of Registration with the CDA; (2)

jurisdiction on other cases that arise out of (Commissioner of Internal Revenue v VMC Certificate of Good Standing issued by the

the NIRC or related laws administered by the Farmers Multi-purpose Cooperative, CTA EB CDA; and (3) Certificate of Tax Exemption

BIR. No. 1253, March 3, 2016) issued by the BIR.

In this case, the CIR issued a 48-hour notice Section 109 (L) of the National Internal The BIR argued that the Cooperative should

and 5-day VAT compliance notice demanding Revenue Code (NIRC) 1997 alongside have presented additional documents such as:

that the taxpayer pay an amount of deficiency Sections 6 and 7 of the joint rules and

VAT calculated as a result of surveillance regulations classifies registered cooperatives a. proof that it actually and exclusively

conducted by revenue officers. The taxpayer into: transacted with its members by providing its

was correct when, within 30 days from list of members and sales invoices;

receipt of the BIR’s denial of the taxpayer’s 1. those which transact business with b. copies of the quedans to show that the

explanation, he filed an appeal with the CTA. member only; and refined sugar were actually produced by the

It has already been previously ruled that such 2. those which transact business with both cooperative through its members;

proceedings are within the scope of CTA’s members and non-members

jurisdiction. The CTA ruled that the certificates presented

Cooperatives belonging to the first category created the presumption that, in the issuance

The CTA further ruled that the assessment for are exempted from internal revenue taxes. of the same, official duty has been regularly

Tax brief – April 2016 7

CTA Cases

performed and that the law has been In this case, BIR imposed on the taxpayer In this present case, the BIR alleged that the

obeyed. The certificates are sufficient and compromise penalty amounting to Letter Notice, follow-up letter, Preliminary

the Cooperative is deemed a tax-exempt Php75,000.00. It is however clear that Assessment Notice, Final Assessment Notice,

cooperative on that basis. taxpayer, through its replies and protests, Preliminary Collection Letter, Final Notice

does not consent to such penalties. The CTA before Issuance of Warrant of Distraint and

> BIR Issuances

Being disputable presumptions, these should ruled that, absence of any clear showing Levy were all sent by registered mail or left

> CTA Cases have been controverted by the BIR by that taxpayer consented to the compromise in the mailbox of at the registered address of

offering evidence to the contrary, which the penalty, its imposition should be cancelled. the taxpayer. Subsequently, the Warrants of

> Highlight on

BIR did not do. Garnishment addressed to several commercial

P&A Grant

Assessment is invalid for failure to prove banks was issued.

Thornton

The CTA ruled that the Cooperative is receipt by the taxpayer; WDL may be

services

entitled to the refund. directly appealed to the CTA The taxpayer denied receipt of said notices.

The BIR, on the other hand, failed to present

BIR cannot compel payment of compromise (Esper R. Vargas, Jr. v Commissioner of proof of actual receipt of the notices by the

penalties Internal Revenue, CTA Case No. 8750, March taxpayer.

8, 2016)

(Oriental Assurance Corporation v The taxpayer informed that learned of the

Commissioner of Internal Revenue, CTA Case In assessments made against taxpayers, it WDL only when his bank wrote him a letter

No. 8582, March 7, 2016) is elementary that a taxpayer must actually informing him of the Notice of Garnishment.

receive any assessment issued in order for it On the same date, the taxpayer, through his

Under RMO No. 01-90, as amended by RMO to be valid. This is true in so far the existing personal accountant, secured a copy from the

No. 19-07, compromise penalties are amounts presumption that constructive service of an BIR of the FAN with attached Assessment

suggested in settlement of criminal liability, and assessment-provided the same is properly Notices for deficiency income tax and VAT.

may not be imposed or exacted on the taxpayer addressed with postage prepaid and is actually Within thirty days from securing a copy of

in the event that the taxpayer refuses to pay the mailed is received by the taxpayer in the the FAN, the taxpayer filed a Petition for

same. It is also well-settled that even the Court ordinary course of mail. However, the same Review, with an application for Temporary

has no jurisdiction to compel a taxpayer to pay is merely a disputable presumption, which Restraining Order (“TRO”) and Writ of

the compromise penalty. By its very nature, can be directly denied by the taxpayer. In Preliminary Injunction with the Court of Tax

a compromise implies a mutual agreement such an instance, respondent-CIR has the Appeals.

between the parties with respect to the thing burden of proving that the assessment was

or subject matter that is so compromised, and indeed received by the taxpayer. Failure to According to the CTA, where the BIR cannot

the choice of paying or not paying the penalty prove such renders the assessment void and prove that service of the assessment was made

distinctly belongs to the taxpayer. unenforceable. on the taxpayer, the date when a taxpayer

Tax brief – April 2016 8

CTA Cases

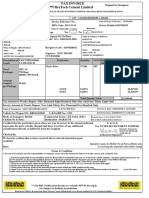

secures a copy of the assessment shall Form 1606 as proof of withholding on sale Form No. 2307) issued by the withholding

be considered the date of service of the of real properties agent/buyer attesting to the fact of

assessment. In this case, considering withholding.

respondent could not prove that the (PBCom v Commissioner of Internal

assessment was duly served on petitioner, Revenue, CTA EB No. 1194, March 21, 2016) BIR Form No. 2307’s probative value is to

> BIR Issuances

the date of service of the assessment shall be establish only the fact of withholding of the

> CTA Cases deemed the date when petitioner secured a The following requisites must be satisfied to claimed CWT. Considering that BIR Form

copy of the same. However, the period to be entitled to a refund of excess creditable No. 1606 contains the same key information

> Highlight on

assess had already prescribed by the time withholding taxes (CWT): that could be gathered from BIR Form No.

P&A Grant

petitioner secured a copy of the FAN. 2307, it necessarily follows that BIR Form

Thornton

1. The claim for refund must be filed within No. 1606 can likewise prove the fact of

services

The CTA ruled that the taxpayer was correct the two-year prescriptive period as provided withholding.

in going directly to the CTA upon securing under Sections 204(C) and 229 of the National

the FAN. The CTA disagreed with the Internal Revenue Code (NIRC); Substantial compliance with statutory and

BIR’s argument that, since the taxpayer did 2. The fact of withholding must be administrative requirements is relevant

not protest the FAN, the CTS does not have established by a copy of a statement duly for the entitlement to refund/issuance of

jurisdiction over an undisputed assessment. issued by the payor (withholding agent) to Tax Credit Certificate (TCC) as provided

the payee, showing the amount paid and the under RR 2- 98. However, the same RR

The CTA reiterated that it’s jurisdiction is amount of tax withheld therefrom; and does not specifically prohibit a taxpayer

not limited to validly protested assessments. 3. The income upon which the taxes were from introducing evidences other than the

It also has jurisdiction over “other matters” withheld must be included in the return of the prescribed BIR Form No 2307 to support

including prescription of the BIR’ s right to recipient. claim for refund of creditable withholding

collect taxes and determination of the validity tax CWT. In fact, there is no basis in law or

of a warrant of distraint and levy issued by The statement referred to in item (2) is the jurisprudence to say that BIR Form No. 2307

the CIR, such as in the case of the taxpayer- Certificate of Creditable Tax Withheld at is the only evidence to support such claim.

petitioner. Source or BIR Form 2307. The taxpayer,

however, presented BIR Form 1606 instead, Strict compliance with documentation for

The CTA ruled that the assessments made which is the Withholding Tax Remittance tax refund

against the taxpayer are void for failure to Return (For Transactions Involving Real

comply with due process, and cannot be final, Property other than Capital Asset including (Commissioner of Internal Revenue v. Nokia

executory, and demandable. Taxable and Exempt) required by law to be Philippines Inc., CTA EB No. 1241, March 30,

filed by the buyer in triplicate copies for the 2016)

transfer of title of the property to the buyer.

The form supports the certification (BIR Tax refunds are in the nature of tax

exemptions which result to loss of revenue for

Tax brief – April 2016 9

CTA Cases

the government. Such exemptions therefore the amount in the invoice/receipt/IEIRD

must be strictly construed against the d. the authority to print is dated later than

taxpayer, as taxes are the lifeblood of the OR date

governement. e. name and TIN of the company is not

indicated

> BIR Issuances

The burden of justifying the exemption rests f. input VAT on importation not supported

> CTA Cases upon the person claiming an exemption by IEIRD

from tax payments. The exemption is never

> Highlight on

presumed, nor allowed solely on the ground

P&A Grant

of equity. These exemptions, therefore, must

Thornton

not rest on vague, uncertain or indefinite

services

inference, but should be granted only by a

clear and unequivocal provision of law.

Hence, in this case where taxpayer is claiming

for tax refund/TCC for unutilized input

VAT, strict compliance with the invoicing

and substantiation requirements as provided

by law shall be observed. The invoicing and

substantiation requirements to support the

input VAT must be followed because it is

the only way to determine the veracity of

petitioner’s claims.

Input VAT supported by non-compliant

documents were therefore denied for refund,

as in the following instances:

a. the VAT is not separately indicated in the

invoice/receipt

b. the address of the buyer indicated in

the invoice/receipt is not the same as the

registered address

c. the VAT amount claimed is higher than

Tax brief – April 2016 10

Highlight on P&A Grant Thornton services

Tax ruling

> BIR Issuances

We prepare and file, for and on behalf of our clients, requests for rulings

> CTA Cases to confirm the proper tax treatment of certain business structures and

> Highlight on transactions. Requests for rulings are generally required in the case of tax-

P&A Grant free exchange of assets for shares of stock; application of preferential rates

Thornton of withholding taxes on income payments to nonresident aliens and foreign

services corporations pursuant to tax treaties; entitlement to tax exemption under

Section 30 of the Tax Code; and other transactions whose tax treatment is

not clearly provided in the Tax Code, implementing regulations, or other

issuances of the BIR or the Department of Finance (DOF).

If you would like to know more about our Tax Ruling

Lina P. Figueroa

Principal

Tax Advisory and Compliance

T + 63 2 988 2288 loc. 520

E Lina.Figueroa@ph.gt.com

Tax brief – April 2016 11

Tax brief is a regular publication of Punongbayan & Araullo (P&A) that aims to

> BIR Issuances keep its clientele, as well as the general public, informed of various developments

in taxation and other related matters. This publication is not intended to be a

> CTA Cases substitute for competent professional advice. Even though careful effort has

been exercised to ensure the accuracy of the contents of this publication, it

should not be used as the basis for formulating business decisions. Government

> Highlight on pronouncements, laws, especially on taxation, and official interpretations are

P&A Grant all subject to change. Matters relating to taxation, law and business regulation

require professional counsel.

Thornton

services We welcome your suggestions and feedback so that the Tax brief may be made

even more useful to you. Please get in touch with us if you have any comments

and if it would help you to have the full text of the materials in the Tax brief.

Lina Figueroa

Principal, Tax Advisory and Compliance Division

T +632 988-2288 ext. 520

E Lina.Figueroa@ph.gt.com

grantthornton.com.ph

© 2016 Punongbayan & Araullo. All rights reserved.

Punongbayan & Araullo (P&A) is the Philippine member firm of

Grant Thornton International Ltd (GTIL). “Grant Thornton” refers

to the brand under which the Grant Thornton member firms provide

assurance, tax and advisory services to their clients and/or refers to one

or more member firms, as the context requires. GTIL and the member

firms are not a worldwide partnership. GTIL and each member firm is a

separate legal entity. Services are delivered by the member firms. GTIL

does not provide services to clients. GTIL and its member firms are not

agents of, and do not obligate, one another and are not liable for one

another’s acts or omissions.

Tax brief – April 2016

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Form45 1Document1 pageForm45 1Rheneir MoraNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- RDO No. 47 - East MakatiDocument83 pagesRDO No. 47 - East MakatiRheneir MoraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Form45 3Document2 pagesForm45 3Rheneir MoraNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Cit U Bsma ProspectusDocument4 pagesCit U Bsma ProspectusRheneir MoraNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Cit U Bsa ProspectusDocument4 pagesCit U Bsa ProspectusRheneir MoraNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Tax Alert Special Issue March 31, 2020 (Final)Document15 pagesTax Alert Special Issue March 31, 2020 (Final)Rheneir MoraNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 49 Insights June 2022V2Document24 pages49 Insights June 2022V2Rheneir MoraNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 2020soar 2019 Ifiar Survey ReportDocument28 pages2020soar 2019 Ifiar Survey ReportRheneir MoraNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Tax Alert (December 2020)Document10 pagesTax Alert (December 2020)Rheneir MoraNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- October 2020 Tax AlertDocument5 pagesOctober 2020 Tax AlertRheneir MoraNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Tax Alert (June 2020)Document7 pagesTax Alert (June 2020)Rheneir MoraNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Tax Alert (April 2020) FinalDocument30 pagesTax Alert (April 2020) FinalRheneir MoraNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Obligations and Contracts: Atty. Rheneir P. Mora, CPADocument55 pagesObligations and Contracts: Atty. Rheneir P. Mora, CPARheneir MoraNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- KAMMP Seminar - AccountingDocument37 pagesKAMMP Seminar - AccountingRheneir MoraNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- KAMMP SeminarDocument2 pagesKAMMP SeminarRheneir MoraNo ratings yet

- Invoice 18JPJAJ2 20180228Document2 pagesInvoice 18JPJAJ2 20180228Pedro CabreraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bill 202208 789875010 enDocument2 pagesBill 202208 789875010 enSonu JaiswarNo ratings yet

- Audit of CashDocument14 pagesAudit of CashMarah ArcederaNo ratings yet

- HBL Bank Voucher - ICAP - SYEDA ALIZA RAZADocument1 pageHBL Bank Voucher - ICAP - SYEDA ALIZA RAZAazizkhan56777No ratings yet

- Evp6610005304464 - 2020 04 01 - 2020 04 20Document1 pageEvp6610005304464 - 2020 04 01 - 2020 04 20Pritom NasirNo ratings yet

- Voot 2Document8 pagesVoot 2techhacks gamingNo ratings yet

- Ericsson MLTNDocument3 pagesEricsson MLTNHashem AllahamNo ratings yet

- Epayments 149Document11 pagesEpayments 149Hassan Murtaza QaziNo ratings yet

- 6072-P2 - JawabanDocument50 pages6072-P2 - JawabanSyahrullah UllahNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Suite # 205-206 2Nd Floor, Progressive Centre Block-6, P.E.C.H.S Agility Logistics (PVT) LTDDocument33 pagesSuite # 205-206 2Nd Floor, Progressive Centre Block-6, P.E.C.H.S Agility Logistics (PVT) LTDChaudhary Hassan Arain50% (2)

- Bill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Document6 pagesBill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)شمس الدين إسماعيلNo ratings yet

- A - The Legal 500 and The in House Lawyer Comparative Legal GuideDocument13 pagesA - The Legal 500 and The in House Lawyer Comparative Legal GuideharshNo ratings yet

- Cashback Tncs FinalDocument3 pagesCashback Tncs FinalRicha KhatriNo ratings yet

- EzyCash I PDSDocument5 pagesEzyCash I PDSrickson dutisNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Kolkata Bokaro 2018-12-30: From TO Date of JourneyDocument3 pagesKolkata Bokaro 2018-12-30: From TO Date of JourneyDigvijay SingjNo ratings yet

- DSR FormatDocument1 pageDSR FormatFat ChefNo ratings yet

- Inv-Tg-B1-23263572-101311180030-April-2020 2Document2 pagesInv-Tg-B1-23263572-101311180030-April-2020 2Rohan Anand0% (1)

- Japan Travel GuideDocument20 pagesJapan Travel GuideWilroseNo ratings yet

- StatementEmail4321460000552091 - 23 Nov 200913 29 37Document1 pageStatementEmail4321460000552091 - 23 Nov 200913 29 37rasel_khn100% (1)

- Coles No Annual Fee Platinum Mastercard 5969 22102023 3Document2 pagesColes No Annual Fee Platinum Mastercard 5969 22102023 3dc464tzvtvNo ratings yet

- Signature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampDocument2 pagesSignature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampRitesh kumar0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Docslide - Us - Joint Costing 562a669cad8a8 PDFDocument5 pagesDocslide - Us - Joint Costing 562a669cad8a8 PDFjhouvanNo ratings yet

- Research PapersDocument16 pagesResearch PapersDavenry AtgabNo ratings yet

- Broadband Services: Your Account SummaryDocument5 pagesBroadband Services: Your Account SummaryMONISH NAYARNo ratings yet

- 1485 Muskogee County Sheriff Office May 20, 2020 PDFDocument2 pages1485 Muskogee County Sheriff Office May 20, 2020 PDFempress_jawhara_hilal_elNo ratings yet

- 23 (1) (1) .10.2011 As Per Merchant Payment ReportDocument108 pages23 (1) (1) .10.2011 As Per Merchant Payment Reportrupeshrudra003No ratings yet

- TNEB Online PaymentDocument1 pageTNEB Online PaymentShaha budeenNo ratings yet

- AZHAR RANA Statement of AccountDocument16 pagesAZHAR RANA Statement of AccountAzhar RanaNo ratings yet

- 1 PF Audit ChecklistDocument8 pages1 PF Audit ChecklistAmbarish Gondhalekar75% (4)

- Chapter 10-Compensation Income: True or FalseDocument15 pagesChapter 10-Compensation Income: True or FalseJarren Basilan57% (7)