Professional Documents

Culture Documents

How To Zero Bills With The Bill Itself

Uploaded by

Joshua Sygnal GutierrezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Zero Bills With The Bill Itself

Uploaded by

Joshua Sygnal GutierrezCopyright:

Available Formats

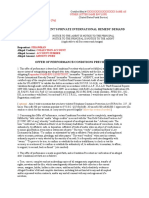

How to Zero Bills with the Bill Itself

BY MJT · PUBLISHED APRIL 18, 2016 · UPDATED MAY 3, 2016

When a BILL is Not Really a Bill

This explanation is proposing a much-needed paradigm shift in our mind regarding the bills we

receive in the mail from corporations, including the United States (Inc.; a Corporation).

Everything commercial in our system is actually a Trust since 1933, because lawful money was

taken out of circulation. After that a “Bill” cannot be a Bill, since they cannot “charge” anyone

for anything since they know we have no money to pay for anything. This includes “charges" by

so called courts and prosecutors. "Charges” are all commercial events.

Checks and all liability currency are “promises to pay”, and essentially are a dishonor

event because actual payment is delayed. You technically can't “pay” anything since you have

no substance money to pay with. However, in commerce, this MIS-TAKE can be forgiven.

So, then what is a “Bill”? Logically, it must be a request for us to authorize the release of “assets

held in trust” by the Trustee as the so called payment (asset/credit – liability/debit = 0).

This “payment by EQUITABLE TITLE TRANSFER” results in the extinguishment of

debt!

THAT is how we should be doing it. Notice that the amount on the bill is a positive number; a

CREDIT. It does not have parentheses around it, or a minus sign in front of it, which commonly

indicates a negative number.

This positive number represents an ‘asset” that will offset a liability held by the corporation for

a commercial transaction. They just need our authorization. The only way to give and

authorization is with an endorsement on the back of the bill (like endorsing a check), to get

ownership of that asset amount as grantee of the instrument (receiving it as a trust), and as

grantor to the party wanting credit money (transferring assets to them), so that they can then

apply it to discharge the liability on their books for that same amount. They gave you paper to

form a trust, you give them a signature on the back of that paper back = credit issued =

settlement. Once the instrument is presented, we (you) have the equitable title to that

amount.

When we indorse the back of a Bill, then the legal and equitable titles to the asset (credit) are

now vested in that one piece of paper (it is all about trusts), and when that indorsed instrument

is returned to the party that sent it, then that party is now the Holder in due course of the legal

AND equitable titles to both the asset and liability amounts for that account. They must then

EXTINGUISH the debt by operation of law.

The Corporation is already holding both legal and equitable titles to the Liability. They are also

holding the legal title to the Asset as implied by them sending you the Bill (the US Corp and all

their sub-corps hold legal title to all assets since 1933 and are Trustees, or agents thereof, per the

purpose and intent of the HJR 192, June 5, 1933 TRUST , codified in 31 USC 5118). The only

thing they are missing is the Equitable title to the Asset, so that they can finally do the discharge

to balance the books and extinguish the debt. They have the charge (DEBIT/DEBT) amount –

they just need the discharge (CREDIT/ASSET) amount to balance the books to zero.\

Having both of the titles for the asset/credit amount now allows them to use that asset/credit

amount to perform their duty as Trustee to extinguish (discharge) the Liability/Debit (debt)

amount by operation of law, the trust laws that are invoked when the legal and equitable titles

are merged.

So The Bill is NOT a BILL, it is an asset credit voucher containing the credit amount that

we must release to the Trustee (or agent thereof) by indorsing the back of the Bill and returning

it. This is the duty that the beneficiaries (or agents thereof) have been failing to perform.

How can this apply?

Credit cards, mortgages, property tax bills, income taxes, child support, court charges, tickets,

grand jury true bills/indictments, etc. It doesn’t matter what it is. A “charge is a bill. So form

the trust and balance the books.

You might also like

- The Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeFrom EverandThe Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeRating: 4.5 out of 5 stars4.5/5 (9)

- The BILL Is NOT A BILL-2012-0821 PDFDocument1 pageThe BILL Is NOT A BILL-2012-0821 PDFterrorjoy100% (1)

- Lawful Money Is Equitable Title To Labor-Credit AssetDocument2 pagesLawful Money Is Equitable Title To Labor-Credit AssetTheplaymaker508100% (2)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Ett-The Bill Is Not A Bill-2012-0118-V12Document1 pageEtt-The Bill Is Not A Bill-2012-0118-V12Douglas StehlingNo ratings yet

- Code Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphFrom EverandCode Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphRating: 3.5 out of 5 stars3.5/5 (2)

- Supercedes Bond To Pay Our DebtsDocument2 pagesSupercedes Bond To Pay Our DebtsFreeman Lawyer100% (7)

- JACK'S HANDY GUIDE TO TRUSTS: Staying Out of CourtFrom EverandJACK'S HANDY GUIDE TO TRUSTS: Staying Out of CourtRating: 5 out of 5 stars5/5 (1)

- Bill of Exchange (Careful... )Document12 pagesBill of Exchange (Careful... )Jayanth Kumar93% (61)

- Dealing With Credit Card StatementsDocument3 pagesDealing With Credit Card Statementsjpes100% (6)

- 3 Day Notice To ReportDocument1 page3 Day Notice To ReportMarsha MainesNo ratings yet

- Stop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsFrom EverandStop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsRating: 5 out of 5 stars5/5 (1)

- Reclaim Your Securities - 363pgs New CondensedDocument323 pagesReclaim Your Securities - 363pgs New CondensedMaryUmbrello-Dressler93% (199)

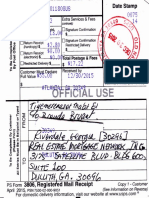

- Acceptance&Discharge-REAL ESTATE MORTGAGE NETWORKDocument13 pagesAcceptance&Discharge-REAL ESTATE MORTGAGE NETWORKTiyemerenaset Ma'at El86% (22)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Unsecured DebtDocument14 pagesUnsecured Debtapi-374440893% (15)

- Discharge The DebtDocument14 pagesDischarge The Debtedwin97% (146)

- 0 All Debts Are PrepaidDocument8 pages0 All Debts Are Prepaidtwocandawg89% (9)

- All Debts Are PrepaidDocument7 pagesAll Debts Are PrepaidLashawn El Bey96% (24)

- Stamp Duties Act 15 of 1993Document40 pagesStamp Duties Act 15 of 1993André Le Roux100% (4)

- Public Vs PrivateDocument1 pagePublic Vs PrivateYaw Mensah Amun RaNo ratings yet

- The Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationFrom EverandThe Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationRating: 5 out of 5 stars5/5 (1)

- Washington State Warrant Processing Division Scrubs Website That (Court) Warrants Are Merely ChecksDocument14 pagesWashington State Warrant Processing Division Scrubs Website That (Court) Warrants Are Merely Checkspanamahunt2267% (3)

- I GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRFrom EverandI GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRNo ratings yet

- Discharge of Public Debts 2Document39 pagesDischarge of Public Debts 2CK in DC100% (16)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills, and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills, and MoreNo ratings yet

- Private Bond Instructions Letter v1 1Document1 pagePrivate Bond Instructions Letter v1 1gordon scottNo ratings yet

- The Art of Passing the Buck: Vol I: The Secrets of Wills And Trusts RevealedFrom EverandThe Art of Passing the Buck: Vol I: The Secrets of Wills And Trusts RevealedRating: 5 out of 5 stars5/5 (4)

- How To Endorse A CheckDocument30 pagesHow To Endorse A Checkfreedompool11391597% (77)

- If You Are Stopped by A Chartered AgentDocument1 pageIf You Are Stopped by A Chartered AgentJoshua Sygnal Gutierrez100% (1)

- What Does "Accepted For Value" Mean?: in ALL Penal Actions For Violations of STATUTES, TheDocument53 pagesWhat Does "Accepted For Value" Mean?: in ALL Penal Actions For Violations of STATUTES, TheJason Lemmon90% (10)

- Acceptance For Value Summary PDFDocument6 pagesAcceptance For Value Summary PDFwill100% (1)

- The Nature of The Remedy of Account For Unauthorised ProfitsDocument2 pagesThe Nature of The Remedy of Account For Unauthorised Profitsafoy718100% (2)

- Steps To Discharging Debt CollectionsDocument3 pagesSteps To Discharging Debt Collectionserickutny92% (38)

- InstructionsDocument6 pagesInstructionslyocco191% (11)

- Debt Elimination Is Based On Understanding How YouDocument20 pagesDebt Elimination Is Based On Understanding How YouHorton Glenn100% (13)

- Title 15 Bankers Letter Billing ErrorDocument2 pagesTitle 15 Bankers Letter Billing ErrorDwayne Smith95% (19)

- Jakim Bey All Debt Discharge 1121 Dundas Street East Whitby, ON. Bill of Exchange To Samuel Soriano 2Document6 pagesJakim Bey All Debt Discharge 1121 Dundas Street East Whitby, ON. Bill of Exchange To Samuel Soriano 2jakim el bey100% (5)

- Bankers AcceptanceDocument2 pagesBankers AcceptanceKudzanai Allen Paraffin100% (5)

- How To Stop Creditors Harrassing Phone CallsDocument22 pagesHow To Stop Creditors Harrassing Phone CallsDave Falvey0% (1)

- Discharge Debts For Free!! (Info Letter)Document3 pagesDischarge Debts For Free!! (Info Letter)Shanae94% (158)

- A Simple Letter That Voids Any Debt.Document1 pageA Simple Letter That Voids Any Debt.GezaLive100% (4)

- The Negotiable Instruments LawDocument18 pagesThe Negotiable Instruments Lawcode4sale100% (1)

- UnderstandingYour BirthCertificateDocument4 pagesUnderstandingYour BirthCertificatefoxlol6718100% (2)

- EFT ScamDocument1 pageEFT ScamTonya Banks0% (1)

- Your Request For Authenticated Proof of DebtDocument4 pagesYour Request For Authenticated Proof of Debtin1or100% (2)

- Best A4VDocument7 pagesBest A4VDannyHeaggans98% (42)

- Discharging Debt Via HJR 192Document7 pagesDischarging Debt Via HJR 192Horton Glenn88% (17)

- All Debts Are PrepaidDocument12 pagesAll Debts Are PrepaidMihai Daniel83% (6)

- No Contract No CaseDocument6 pagesNo Contract No CasejpesNo ratings yet

- Proof Debt Is PrepaidDocument9 pagesProof Debt Is Prepaidfabrignani@yahoo.com92% (25)

- Sample BondDocument3 pagesSample BondJoshua Sygnal GutierrezNo ratings yet

- USA Account Science 101 - Lesson - (DUAL) LEGAL PERSONALITYDocument4 pagesUSA Account Science 101 - Lesson - (DUAL) LEGAL PERSONALITYuccmeNo ratings yet

- Demand For Verified Evidence of "Trade or Business" Activity: Currency Transaction Report (CTR) InstructionsDocument19 pagesDemand For Verified Evidence of "Trade or Business" Activity: Currency Transaction Report (CTR) InstructionsShawn Psenicnik (ShawniP)No ratings yet

- Form BRDocument17 pagesForm BRJoshua Sygnal GutierrezNo ratings yet

- FormbdDocument29 pagesFormbdStefano Bbc RossiNo ratings yet

- Accounting Perspective For CourtDocument1 pageAccounting Perspective For CourtJoshua Sygnal GutierrezNo ratings yet

- Attorney License FraudDocument8 pagesAttorney License FraudextemporaneousNo ratings yet

- Hobbs Act & MAIL FRAUDDocument20 pagesHobbs Act & MAIL FRAUDJoshua Sygnal Gutierrez100% (4)

- Production of Financial Documents For IRS and FinCENDocument8 pagesProduction of Financial Documents For IRS and FinCENJoshua Sygnal GutierrezNo ratings yet

- (First, Middle, Last Initial) - (Numeric Date, No Dashes) - CN: Plain Statement of FactDocument5 pages(First, Middle, Last Initial) - (Numeric Date, No Dashes) - CN: Plain Statement of FactJoshua Sygnal Gutierrez100% (6)

- FR 2046Document1 pageFR 2046Joshua Sygnal GutierrezNo ratings yet

- Ssa 150Document2 pagesSsa 150Joshua Sygnal GutierrezNo ratings yet

- GSA Bond PackageDocument26 pagesGSA Bond PackageJoshua Sygnal GutierrezNo ratings yet

- Power of Attorney In-FactDocument4 pagesPower of Attorney In-FactJoshua Sygnal GutierrezNo ratings yet

- GSA BONDS LETTER TemplateDocument4 pagesGSA BONDS LETTER TemplateJoshua Sygnal Gutierrez100% (24)

- Trust Deed Foreclosure Checklist and Sample DocumentsDocument55 pagesTrust Deed Foreclosure Checklist and Sample DocumentsJoshua Sygnal Gutierrez100% (4)

- 02 Notice of Suspicious Activities That Goes With 8300 BlankDocument1 page02 Notice of Suspicious Activities That Goes With 8300 BlankJoshua Sygnal Gutierrez100% (1)

- Official Form Proof of Claim Corte Fed. QuiebraDocument3 pagesOfficial Form Proof of Claim Corte Fed. QuiebraEmily RamosNo ratings yet

- How To Go After Bonds of OfficialsDocument9 pagesHow To Go After Bonds of OfficialsStephen Stewart92% (13)

- Quit-Claim and Notice of AssignmentDocument5 pagesQuit-Claim and Notice of AssignmentJoshua Sygnal Gutierrez100% (4)

- Courts in Commerce 3949a Attachment-For-JudgeDocument8 pagesCourts in Commerce 3949a Attachment-For-JudgeJoshua Sygnal Gutierrez100% (6)

- Ssa 3105Document2 pagesSsa 3105Joshua Sygnal Gutierrez100% (2)

- G Ssa 455 1Document2 pagesG Ssa 455 1Joshua Sygnal GutierrezNo ratings yet

- Name Change 2Document49 pagesName Change 2Patrick Long75% (4)

- Finance Q-ADocument1 pageFinance Q-AJoshua Sygnal GutierrezNo ratings yet

- W-4 3 Step ProcessDocument20 pagesW-4 3 Step ProcessJoshua Sygnal Gutierrez100% (45)

- Attention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsJoshua Sygnal Gutierrez100% (1)

- BulletProof - Debt Validation LetterDocument1 pageBulletProof - Debt Validation LetterJoshua Sygnal Gutierrez100% (6)

- Not For Hire 2Document1 pageNot For Hire 2Joshua Sygnal Gutierrez100% (1)

- Debt Validation-Private Remedy Letter-1rDocument5 pagesDebt Validation-Private Remedy Letter-1rJoshua Sygnal Gutierrez100% (19)

- Effect of Perceived Work Environment On Employees' Job Behaviour and Organizational EffectivenessDocument10 pagesEffect of Perceived Work Environment On Employees' Job Behaviour and Organizational EffectivenessTanvee SharmaNo ratings yet

- Money Habits - Saddleback ChurchDocument80 pagesMoney Habits - Saddleback ChurchAndriamihaja MichelNo ratings yet

- Sjögren's SyndromeDocument18 pagesSjögren's Syndromezakaria dbanNo ratings yet

- John Wick 4 HD Free r6hjDocument16 pagesJohn Wick 4 HD Free r6hjafdal mahendraNo ratings yet

- Architect Magazine 2023 0506Document152 pagesArchitect Magazine 2023 0506fohonixNo ratings yet

- THM07 Module 2 The Tourist Market and SegmentationDocument14 pagesTHM07 Module 2 The Tourist Market and Segmentationjennifer mirandaNo ratings yet

- Molecular Biology - WikipediaDocument9 pagesMolecular Biology - WikipediaLizbethNo ratings yet

- Write A Program in C To Check Whether A Entered Number Is Positive, Negative or ZeroDocument10 pagesWrite A Program in C To Check Whether A Entered Number Is Positive, Negative or ZeroSabin kandelNo ratings yet

- Sap Successfactors Training Materials Guide: April 2020Document4 pagesSap Successfactors Training Materials Guide: April 2020pablo picassoNo ratings yet

- WWW - Nswkendo IaidoDocument1 pageWWW - Nswkendo IaidoAshley AndersonNo ratings yet

- Bruxism Hypnosis Script No. 2Document12 pagesBruxism Hypnosis Script No. 2Eva Jacinto100% (2)

- Ebook Essential Surgery Problems Diagnosis and Management 6E Feb 19 2020 - 0702076317 - Elsevier PDF Full Chapter PDFDocument68 pagesEbook Essential Surgery Problems Diagnosis and Management 6E Feb 19 2020 - 0702076317 - Elsevier PDF Full Chapter PDFmargarita.britt326100% (22)

- Math Country Ranking Alevel 2023Document225 pagesMath Country Ranking Alevel 2023Lutaaya Paul BamutaliraNo ratings yet

- Math 3140-004: Vector Calculus and PdesDocument6 pagesMath 3140-004: Vector Calculus and PdesNathan MonsonNo ratings yet

- TAX Report WireframeDocument13 pagesTAX Report WireframeHare KrishnaNo ratings yet

- 08-20-2013 EditionDocument32 pages08-20-2013 EditionSan Mateo Daily JournalNo ratings yet

- All-India rWnMYexDocument89 pagesAll-India rWnMYexketan kanameNo ratings yet

- 2beloved Lizzo PDFDocument1 page2beloved Lizzo PDFAntwerpQueerChoir AQCNo ratings yet

- Class 11 Class Biology Syllabus 2011-12Document5 pagesClass 11 Class Biology Syllabus 2011-12Sunaina RawatNo ratings yet

- STAG-4 QBOX, QNEXT, STAG-300 QMAX - Manual - Ver1 - 7 - 8 (30-09-2016) - EN PDFDocument63 pagesSTAG-4 QBOX, QNEXT, STAG-300 QMAX - Manual - Ver1 - 7 - 8 (30-09-2016) - EN PDFIonut Dacian MihalachiNo ratings yet

- DeathoftheegoDocument123 pagesDeathoftheegoVictor LadefogedNo ratings yet

- Promises From The BibleDocument16 pagesPromises From The BiblePaul Barksdale100% (1)

- The Neuromarketing ConceptDocument7 pagesThe Neuromarketing ConceptParnika SinghalNo ratings yet

- 215 Final Exam Formula SheetDocument2 pages215 Final Exam Formula SheetH.C. Z.No ratings yet

- Jeoparty Fraud Week 2022 EditableDocument65 pagesJeoparty Fraud Week 2022 EditableRhea SimoneNo ratings yet

- Disciplinary Literacy Strategies To Support Transactions in Elementary Social StudiesDocument11 pagesDisciplinary Literacy Strategies To Support Transactions in Elementary Social Studiesmissjoseph0803No ratings yet

- Text Mohamed AliDocument2 pagesText Mohamed AliARYAJAI SINGHNo ratings yet

- 11 PJBUMI Digital Data Specialist DR NOOR AZLIZADocument7 pages11 PJBUMI Digital Data Specialist DR NOOR AZLIZAApexs GroupNo ratings yet

- Burton 1998 Eco Neighbourhoods A Review of ProjectsDocument20 pagesBurton 1998 Eco Neighbourhoods A Review of ProjectsAthenaMorNo ratings yet

- Material Requirement Planning (MRP)Document20 pagesMaterial Requirement Planning (MRP)Faisal Ibn RezaNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- California Employment Law: An Employer's Guide: Revised and Updated for 2024From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2024No ratings yet