Professional Documents

Culture Documents

CTA Rules of Procedure Simplified

Uploaded by

Ramon T. Conducto II0 ratings0% found this document useful (0 votes)

218 views1 page1. The Simplified Court of Tax Appeals (CTA) Rules of Procedure summarize the rules for different types of tax-related cases.

2. Cases decided by the Commissioner of Internal Revenue (CIR) or involving amounts over 1,000,000 pesos are appealed to the CTA following the Court of Appeals rules.

3. Lower court tax cases or those involving smaller amounts use the regular court rules. The CTA exercises original jurisdiction over large criminal or civil tax collection cases.

Original Description:

Simple flowchart of the CTA Rules of Procedure

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The Simplified Court of Tax Appeals (CTA) Rules of Procedure summarize the rules for different types of tax-related cases.

2. Cases decided by the Commissioner of Internal Revenue (CIR) or involving amounts over 1,000,000 pesos are appealed to the CTA following the Court of Appeals rules.

3. Lower court tax cases or those involving smaller amounts use the regular court rules. The CTA exercises original jurisdiction over large criminal or civil tax collection cases.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

218 views1 pageCTA Rules of Procedure Simplified

Uploaded by

Ramon T. Conducto II1. The Simplified Court of Tax Appeals (CTA) Rules of Procedure summarize the rules for different types of tax-related cases.

2. Cases decided by the Commissioner of Internal Revenue (CIR) or involving amounts over 1,000,000 pesos are appealed to the CTA following the Court of Appeals rules.

3. Lower court tax cases or those involving smaller amounts use the regular court rules. The CTA exercises original jurisdiction over large criminal or civil tax collection cases.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

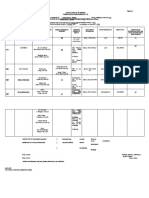

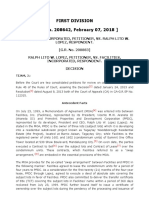

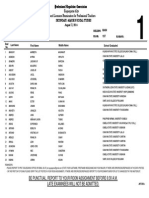

Case Rule of Procedure

1. Decisions of the Commissioner of Same as Court of Appeals (Rule 42,

Simplified Court of Tax Appeals (CTA) Rules of Procedure Internal Revenue (CIR) [including Rules of Court), unless otherwise

his inaction]; Customs provided by the Court of Tax

Commissioner; and Departments Appeals Rules of Procedure;

of Finance, Trade and Industry, Pleading: Petition for Review;

EN BANC and Agriculture Caption: Petitioner v. Respondent

2. RTCs deciding in their original For criminal, governing rule is Rule

jurisdiction (criminal, local tax 124 of Rules of Court; Notice of

cases, or tax collection cases) Appeal is needed within 15 days

from decision/resolution appealed

from.

#3 DIVISION #4 For tax collection cases, same as

Court of Appeals (Rule 42, Rules of

Court). Caption, however, is still the

original plus Appellant v. Appellee.

3. RTCs deciding in their appellate

jurisdiction (criminal, local tax

#1 #2 cases, or tax collection cases);

Rule 43, Rules of Court

and Central Board of Assessment

Appeals (CBAA)

4. Criminal: violation of Tax or

Customs Codes or any law In these cases, CTA is exercising its

administered by BIR or Customs exclusive original jurisdiction.

where principal amount involved Nevertheless, in both criminal and

is over Php1,000,000 civil cases, the procedure of trial as

Legend: observed in regular courts are

Civil: Tax collection cases where likewise applied.

Rectangle with arrows – Cases wherein CTA exercises its exclusive appellate

principal amount involved is over

jurisdiction. The arrows represent to where these cases are cognizable (either in Php1,000,000

the CTA En Banc or CTA Division).

Oval with line – Cases wherein CTA exercises its exclusive original jurisdiction.

The line connects to where these cases are cognizable (that is, CTA Division).

The numbers appearing both in the rectangles and oval correspond to the description in the table.

References: A.M. No. 05-11-07-CTA, November 22, 2005, as amended by A.M. No. 05-11-07-CTA, September 16, 2008, and Republic Act No. 9282.

Prepared By: Ramon T. Conducto II, October 9, 2014.

You might also like

- Comm Law Review - IP Law PDFDocument43 pagesComm Law Review - IP Law PDFTristan HaoNo ratings yet

- 3 BIR Ruling 103-96Document2 pages3 BIR Ruling 103-96Leia VeracruzNo ratings yet

- DENR Administrative OrderDocument5 pagesDENR Administrative OrderEsper LM Quiapos-SolanoNo ratings yet

- Evidence Pronove Lecture PDFDocument31 pagesEvidence Pronove Lecture PDFEllen DebutonNo ratings yet

- Tax Cases'RemediesDocument137 pagesTax Cases'RemediesDigna Burac-CollantesNo ratings yet

- CTA Cases For Tax 2Document53 pagesCTA Cases For Tax 2SuiNo ratings yet

- 4.27.18 MOA With NHA and R.R. Encabo ZaldyDocument8 pages4.27.18 MOA With NHA and R.R. Encabo ZaldyJanet BattungNo ratings yet

- SpecPro - Venue and Jurisdiction - Settlement of Estate - MdabarcomaDocument9 pagesSpecPro - Venue and Jurisdiction - Settlement of Estate - MdabarcomaMa. Danice Angela Balde-BarcomaNo ratings yet

- Ejectmjwent JecinalejjeejDocument4 pagesEjectmjwent JecinalejjeejAlvin renomeron JaroNo ratings yet

- Joint Manifestation For ReconciliationDocument3 pagesJoint Manifestation For ReconciliationEmmanuel EsmerNo ratings yet

- Deed of SaleDocument3 pagesDeed of SalelornNo ratings yet

- Estate of Ong vs. DiazDocument17 pagesEstate of Ong vs. DiazAji AmanNo ratings yet

- Judaff SampleDocument6 pagesJudaff SampleKobe Bryant100% (1)

- Precautionary Hold Departure OrderDocument3 pagesPrecautionary Hold Departure OrderMogsy PernezNo ratings yet

- Heirs of Pacres v. Heirs of YgonaDocument1 pageHeirs of Pacres v. Heirs of YgonalividNo ratings yet

- PCU - LMT - Civil Law - 2019Document24 pagesPCU - LMT - Civil Law - 2019SJ LiminNo ratings yet

- CTA ProcedureDocument60 pagesCTA ProcedureNori LolaNo ratings yet

- Margallo NotarialRegisterDocument2 pagesMargallo NotarialRegisterFrankel Gerard MargalloNo ratings yet

- Bir Ruling (Da 576 06)Document26 pagesBir Ruling (Da 576 06)Rieland CuevasNo ratings yet

- Public International Law: By: Atty. CandelariaDocument2 pagesPublic International Law: By: Atty. CandelariaEan PaladanNo ratings yet

- Intra Corporate DisputeDocument3 pagesIntra Corporate Disputemonica may ramos100% (1)

- Art 36 MemorandumDocument27 pagesArt 36 MemorandumPevi Mae Jalipa100% (1)

- Division - Alabang Supermarket v. City Government of MuntinlupaDocument8 pagesDivision - Alabang Supermarket v. City Government of MuntinlupaPaul Joshua SubaNo ratings yet

- SPIT Abella SamplexDocument5 pagesSPIT Abella SamplexJasperAllenBarrientosNo ratings yet

- Memorandum For The AccusedDocument5 pagesMemorandum For The AccusedfuckvinaahhhNo ratings yet

- RMC 26-85Document1 pageRMC 26-85matinikkiNo ratings yet

- Pre-Trial Brief: Decision Be Set Aside and That A New Trial Be Granted For Them ToDocument11 pagesPre-Trial Brief: Decision Be Set Aside and That A New Trial Be Granted For Them ToManang Ven TioNo ratings yet

- Usufruct As An EncumbranceDocument2 pagesUsufruct As An EncumbranceLuigi JaroNo ratings yet

- SC Adopts Revisions To The Law Student Practice Rule: July 16, 2019Document2 pagesSC Adopts Revisions To The Law Student Practice Rule: July 16, 2019SS0% (1)

- Formal Offer of Evidence-CIACDocument2 pagesFormal Offer of Evidence-CIACRolan Jeff Amoloza LancionNo ratings yet

- Rules of Procedure-LBAADocument6 pagesRules of Procedure-LBAADianne MedianeroNo ratings yet

- TERCERIADocument14 pagesTERCERIAiris_irisNo ratings yet

- Emigration Clearance Certificate (Ecc) Application FormDocument1 pageEmigration Clearance Certificate (Ecc) Application FormJec GaguaNo ratings yet

- AM No. 05-11-07-CTADocument10 pagesAM No. 05-11-07-CTAPrincess MelodyNo ratings yet

- M 24Document4 pagesM 24Gilbert Aldana GalopeNo ratings yet

- Vesta Property Holdings, Inc. v. CIR, CTA Case No. 9234 (2018)Document7 pagesVesta Property Holdings, Inc. v. CIR, CTA Case No. 9234 (2018)Kriszan Manipon100% (1)

- Republic of The Philippines) Iriga City) S.SDocument3 pagesRepublic of The Philippines) Iriga City) S.SRB AbacaNo ratings yet

- SAO FAO ND Appealable To The COA ProperDocument2 pagesSAO FAO ND Appealable To The COA ProperJuan CrisostomoNo ratings yet

- Prerogative Writs Matrix 1Document6 pagesPrerogative Writs Matrix 1Perla ArroyoNo ratings yet

- Exam Legal FormsDocument2 pagesExam Legal FormsAljunBaetiongDiazNo ratings yet

- Letter To Supreme Court - SALN GuidelinesDocument3 pagesLetter To Supreme Court - SALN GuidelinesBlogWatchNo ratings yet

- Rule 39 Sec. 5 & 6Document16 pagesRule 39 Sec. 5 & 6Kareen BaucanNo ratings yet

- BIR Ruling OT-212-2022 - Transfer of Manila Polo Club Shares To Another Trustee Not Subject To CGT and DSTDocument6 pagesBIR Ruling OT-212-2022 - Transfer of Manila Polo Club Shares To Another Trustee Not Subject To CGT and DSTMark DomingoNo ratings yet

- Affidavit of Undertaking - DTI-FTEBDocument2 pagesAffidavit of Undertaking - DTI-FTEBShane SaldonNo ratings yet

- 08 Ambrosio V SalvadorDocument1 page08 Ambrosio V SalvadorevgciikNo ratings yet

- 02 Draft Director's Certificate - Ez Aug 2017Document2 pages02 Draft Director's Certificate - Ez Aug 2017Archie MuyrongNo ratings yet

- Sample Judicial AffidavitDocument4 pagesSample Judicial AffidavitChristian KongNo ratings yet

- Fillable PDF (MCLE Form 3) Attorney's MCLE Compliance ReportDocument1 pageFillable PDF (MCLE Form 3) Attorney's MCLE Compliance ReportWin Cee100% (1)

- MANIFESTATION WITH MOTION FOR DEFERMENT-K29 (Blandino Bantog)Document4 pagesMANIFESTATION WITH MOTION FOR DEFERMENT-K29 (Blandino Bantog)Leo Archival ImperialNo ratings yet

- R.A. 10023 Flow ChartDocument2 pagesR.A. 10023 Flow ChartDabert CandadoNo ratings yet

- Rule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFDocument2 pagesRule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFiptrinidadNo ratings yet

- Rule 35 (Summary Judgment)Document4 pagesRule 35 (Summary Judgment)Al-husaynLaoSanguilaNo ratings yet

- The VA As Super Labor Arbiter by Ismael KhanDocument7 pagesThe VA As Super Labor Arbiter by Ismael KhanClarisse ValdecantosNo ratings yet

- Spec Pro NotesDocument7 pagesSpec Pro NotesJake Zhan Capanas AdrianoNo ratings yet

- Torts DigestsDocument52 pagesTorts DigestsJosephine BercesNo ratings yet

- Branch 4 City of Manila Prime Antonio Ramos: Court Calendar 04 March 2021. Thursday. 7:30 PMDocument2 pagesBranch 4 City of Manila Prime Antonio Ramos: Court Calendar 04 March 2021. Thursday. 7:30 PMarianneNo ratings yet

- Sample Form - Submission AgreementDocument1 pageSample Form - Submission AgreementMaria Resper100% (1)

- Numbered Correlatively in Letters (Succession Full Text) Art 805Document36 pagesNumbered Correlatively in Letters (Succession Full Text) Art 805harvaeNo ratings yet

- Petition For Notarial Commission HIGHLIGHTSDocument3 pagesPetition For Notarial Commission HIGHLIGHTSRem D.No ratings yet

- CTA Jurisdiction (Updated)Document2 pagesCTA Jurisdiction (Updated)Andie Player100% (1)

- Why Poverty Has Declined - Inquirer OpinionDocument6 pagesWhy Poverty Has Declined - Inquirer OpinionRamon T. Conducto IINo ratings yet

- Facilities, Inc. v. Lopez P.D. 957Document11 pagesFacilities, Inc. v. Lopez P.D. 957Ramon T. Conducto IINo ratings yet

- Domestic CorpDocument1 pageDomestic CorpRamon T. Conducto IINo ratings yet

- A Broader-Based Economy - Inquirer OpinionDocument6 pagesA Broader-Based Economy - Inquirer OpinionRamon T. Conducto IINo ratings yet

- People of The Philippines v. Tamani (G.R. Nos. L-22160 & L-22161)Document7 pagesPeople of The Philippines v. Tamani (G.R. Nos. L-22160 & L-22161)Ramon T. Conducto IINo ratings yet

- Case Digests in Statutory Construction IDocument43 pagesCase Digests in Statutory Construction IRamon T. Conducto IINo ratings yet

- Statcon Digests Chapter 9Document16 pagesStatcon Digests Chapter 9Ramon T. Conducto IINo ratings yet

- Digests of Aguinaldo v. Santos and Carpio-Morales v. CA and BinayDocument3 pagesDigests of Aguinaldo v. Santos and Carpio-Morales v. CA and BinayRamon T. Conducto IINo ratings yet

- References Bar 2018Document3 pagesReferences Bar 2018Ramon T. Conducto IINo ratings yet

- CLAS Form No. 005 Affidavit of Full ComplianceDocument1 pageCLAS Form No. 005 Affidavit of Full ComplianceRamon T. Conducto IINo ratings yet

- Template of The Verification Page in SMALL CLAIMSDocument1 pageTemplate of The Verification Page in SMALL CLAIMSRamon T. Conducto IINo ratings yet

- Excel of PenaltiesDocument10 pagesExcel of PenaltiesRamon T. Conducto IINo ratings yet

- Selected Cases in Crimes Against PersonDocument24 pagesSelected Cases in Crimes Against PersonRamon T. Conducto IINo ratings yet

- 2014march - Castillo v. Prudentialife, Inc. - ConductoDocument2 pages2014march - Castillo v. Prudentialife, Inc. - ConductoRamon T. Conducto II100% (1)

- Flowchart CanvassingDocument3 pagesFlowchart CanvassingRamon T. Conducto IINo ratings yet

- Labor Relations 1st Case Digest AssignmentDocument23 pagesLabor Relations 1st Case Digest AssignmentRamon T. Conducto IINo ratings yet

- Reyes v. RTC of Makati Branch 12Document2 pagesReyes v. RTC of Makati Branch 12Ramon T. Conducto IINo ratings yet

- Proc 117 RRDDocument1 pageProc 117 RRDRamon T. Conducto IINo ratings yet

- IPL DigestDocument2 pagesIPL DigestRamon T. Conducto IINo ratings yet

- Fairfax County Circuit Court Forms PDFDocument2 pagesFairfax County Circuit Court Forms PDFJackieNo ratings yet

- CivPro Riano SummarizedDocument181 pagesCivPro Riano SummarizedKoko91% (11)

- The Five Pillars of The Criminal Justice SystemDocument2 pagesThe Five Pillars of The Criminal Justice SystemArzaga Dessa BCNo ratings yet

- Rajya Sabha: Membership and ElectionDocument4 pagesRajya Sabha: Membership and ElectionSshhvctvNo ratings yet

- Zeta vs. MalinaoDocument4 pagesZeta vs. MalinaoAngelina Villaver ReojaNo ratings yet

- Difference Between Prohibition and CertiorariDocument3 pagesDifference Between Prohibition and CertiorariSaransh BhardwajNo ratings yet

- Book 3Document91 pagesBook 3maggiNo ratings yet

- Cert TemplateDocument10 pagesCert TemplateWilbert Dela CruzNo ratings yet

- ABS-CBN Broadcasting Corporation vs. World Interactive Network Systems (WINS) Japan Co. LTD 544 SCRA 308 (2008)Document3 pagesABS-CBN Broadcasting Corporation vs. World Interactive Network Systems (WINS) Japan Co. LTD 544 SCRA 308 (2008)apremsNo ratings yet

- Revised Rules On Civ ProDocument13 pagesRevised Rules On Civ ProErica TuicoNo ratings yet

- User GuideDocument9 pagesUser Guideravindrarao_mNo ratings yet

- Paclik v. Urquiaga-Paclik - Document No. 10Document2 pagesPaclik v. Urquiaga-Paclik - Document No. 10Justia.comNo ratings yet

- Faizal Hasamali Mirzab V State of Maharashtra NIADocument56 pagesFaizal Hasamali Mirzab V State of Maharashtra NIAÇhòçólàty BøyNo ratings yet

- The Florida Bar, Interim Reply To Kenneth Marvin Review Closure of Castagliuolo ComplaintDocument93 pagesThe Florida Bar, Interim Reply To Kenneth Marvin Review Closure of Castagliuolo ComplaintNeil GillespieNo ratings yet

- Fagan V Metropolitan Police Commissionner Case NoteDocument2 pagesFagan V Metropolitan Police Commissionner Case Notesujith ksNo ratings yet

- Rule 36: Supreme CourtDocument116 pagesRule 36: Supreme CourtLA RicanorNo ratings yet

- Judge Lacurom Vs Atty. JacobaDocument8 pagesJudge Lacurom Vs Atty. JacobamanilatabajondaNo ratings yet

- ALEA NORTH AMERICA v. SALEM MASONRY CO., Et Al - Document No. 51Document4 pagesALEA NORTH AMERICA v. SALEM MASONRY CO., Et Al - Document No. 51Justia.comNo ratings yet

- 155855Document12 pages155855Ali BastiNo ratings yet

- SOCIAL0814 TugueDocument11 pagesSOCIAL0814 TugueangelomercedeblogNo ratings yet

- Record On AppealDocument11 pagesRecord On Appealacie600No ratings yet

- People v. Atienza Et Al and Sandiganbayan G.R. No. 171671Document2 pagesPeople v. Atienza Et Al and Sandiganbayan G.R. No. 171671Chinky Dane SeraspiNo ratings yet

- Dinapol Vs BaldadoDocument2 pagesDinapol Vs BaldadopandambooNo ratings yet

- Remedial Law CasesDocument23 pagesRemedial Law Casesmonica may ramosNo ratings yet

- Important Cases of History of PakistanDocument9 pagesImportant Cases of History of PakistanALISHBA ALI100% (1)

- United States Court of Appeals, Eleventh CircuitDocument5 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Basa V MercadoDocument1 pageBasa V MercadoLuz Celine CabadingNo ratings yet

- Judges Who Turn 70 in 2015 Through 2017Document4 pagesJudges Who Turn 70 in 2015 Through 2017PennLiveNo ratings yet

- US PATRIOT Tactical LLC - SHELLBACK TACTICAL LLC Filed Summons and Complaint Richland County Fifth Judicial Circuit Case# 2019CP4005900 Columbia, SC South Carolina https://uspatriottactical.com https://www.shellbacktactical.comDocument15 pagesUS PATRIOT Tactical LLC - SHELLBACK TACTICAL LLC Filed Summons and Complaint Richland County Fifth Judicial Circuit Case# 2019CP4005900 Columbia, SC South Carolina https://uspatriottactical.com https://www.shellbacktactical.comDavid JohnsonNo ratings yet

- People v. WebbDocument3 pagesPeople v. WebbRah-rah Tabotabo ÜNo ratings yet