Professional Documents

Culture Documents

Sybcom Sem 4 Auditing Smart Notes Mumbai University

Uploaded by

Rehan RizviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sybcom Sem 4 Auditing Smart Notes Mumbai University

Uploaded by

Rehan RizviCopyright:

Available Formats

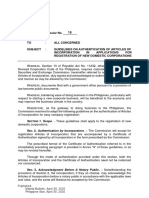

We request you to read and accept the declaration below:

Declaration

Reliance SMSL Limited,

Lokmanya Tilak Marg, Dhobi Talao, Mumbai 400002.

Dear Sirs,

Ref: Declaration relating to reimbursement, allowance claims and investments

1. I, declare and confirm that:

(i) The Permanent Account Number (PAN) allotted to me as per Income Tax records is

[CDVPR3812D];

(ii) The reimbursements and allowances claimed by me from the Company for the Financial Year

2018-2019 are and shall be the expenses actually incurred by me during the said Financial Year

and such claims are and shall be in accordance with and to the extent permissible under the

Income Tax Act, 1961, as amended from time to time (IT Act);

(iii) The investments made and expenses incurred by me during the Financial Year 2018-2019 in

respect of which I am seeking deductions (including under Chapter VI-A of the IT Act), and the

proofs submitted by me to the Company for computing the tax deductible at source on my salary,

are and shall be in accordance with and within the extent permissible under the IT Act;

(iv) I shall retain all the original documents and records in support of the reimbursements mentioned

above, and of allowances and deductions for a minimum period of 5 years or such longer period

as may be required under applicable laws.

2. I shall immediately inform the Company upon becoming aware of any changes, errors or omissions in,

any information or documents previously provided by me to the Company.

3. I agree that I shall be solely responsible and liable for any and all liabilities (including under the IT Act)

that arise due to or in connection with :

(i) My failure to provide documents or information or

(ii) Provision of false or incorrect declarations or documents.

4. I shall indemnify, defend and hold the Company, its affiliates and respective officers, directors, employees

and representatives harmless from and against any and all losses, damages, liabilities, claims, suits,

proceedings, costs and expenses incurred or suffered by Company in relation to or arising from or in

connection with :

(i) Any declaration or information provided by me or

(ii) Any breach of applicable law by me

I hereby authorize the Company to adjust and set off such amounts from any amounts payable to me.

5. I understand that the Company has a ‘zero tolerance approach’ to submission of incorrect or false

declarations, documents and claims and submission by me. Any incorrect or false declaration, document

or claim may result in termination of my employment with the Company and forfeiture of any retirement or

separation benefits.

Place : Reliance Smart - AcmeMall Employee Name : Rehan Rizvi

Date : 15.10.2018 Employee ID : 60405141

You might also like

- Non Resident Ordy Rupee Nro AccountDocument5 pagesNon Resident Ordy Rupee Nro AccountAmar SinhaNo ratings yet

- Income From SalaryDocument26 pagesIncome From SalaryAkash VisputeNo ratings yet

- Agreement FormDocument8 pagesAgreement FormCamera Alaul100% (1)

- Ots 2011 Application Format AcknowledgementDocument3 pagesOts 2011 Application Format AcknowledgementRajesh SkNo ratings yet

- OB Welingkar Exam QuestionsDocument12 pagesOB Welingkar Exam QuestionsGanesh Devendranath Panda100% (1)

- Exempt IncomeDocument18 pagesExempt IncomeSarvar PathanNo ratings yet

- Relativity of ContractsDocument7 pagesRelativity of ContractsCristy C. Bangayan100% (1)

- CV - Parisi - UChileDocument5 pagesCV - Parisi - UChileFen_udechileNo ratings yet

- PRIMER - CFC Young Couples ProgramDocument3 pagesPRIMER - CFC Young Couples Programgeorgeskie8100% (2)

- A) Startup India QuestionnaireDocument1 pageA) Startup India Questionnairesubudhiprasanna50% (2)

- Agreement For GroupHealth Insurance PolicyDocument20 pagesAgreement For GroupHealth Insurance Policysohalsingh1No ratings yet

- TDSDocument18 pagesTDSPratik NaikNo ratings yet

- Unit-II Financial ServicesDocument20 pagesUnit-II Financial ServicesramamohanvspNo ratings yet

- Consumer Protection Act - Question BankDocument9 pagesConsumer Protection Act - Question BankDr. S. PRIYA DURGA MBA-STAFFNo ratings yet

- Sales Force Management in B2BDocument10 pagesSales Force Management in B2BChandan SahNo ratings yet

- Inter-Firm ComparisonDocument5 pagesInter-Firm Comparisonanon_672065362100% (1)

- E Anudan RegistrationDocument2 pagesE Anudan RegistrationNgo PartnerNo ratings yet

- CH 4 VouchingDocument19 pagesCH 4 VouchingHimanshu UtekarNo ratings yet

- MOA As Per New Companies Act 2013Document4 pagesMOA As Per New Companies Act 2013Harneet KaurNo ratings yet

- Dsa Invoice - Points To Remember: Don'tsDocument3 pagesDsa Invoice - Points To Remember: Don'tsMadhan Kumar BobbalaNo ratings yet

- Buy Back of SecuritiesDocument7 pagesBuy Back of SecuritiesTaruna SanotraNo ratings yet

- Cost of Acquisition of A Capital AssetDocument4 pagesCost of Acquisition of A Capital AssetTPA GST100% (1)

- Tax Planning MergerDocument4 pagesTax Planning MergerAks SinhaNo ratings yet

- To Whom It May ConcernDocument2 pagesTo Whom It May ConcernShree CyberiaNo ratings yet

- First Time Adoption of Ind As 101Document3 pagesFirst Time Adoption of Ind As 101vignesh_vikiNo ratings yet

- Customer Satisfaction: Punjab National BankDocument59 pagesCustomer Satisfaction: Punjab National BankvivekNo ratings yet

- New Account Opening Form (Final)Document2 pagesNew Account Opening Form (Final)plr.post50% (2)

- TdsDocument4 pagesTdsshanikaNo ratings yet

- Cooperative SocietyDocument5 pagesCooperative SocietyKavita SinghNo ratings yet

- Chapter 5 Acceptance of Deposits by CompaniesDocument52 pagesChapter 5 Acceptance of Deposits by CompaniesAbhay SharmaNo ratings yet

- Of Mployees' Tock Ption Lan: E S O PDocument35 pagesOf Mployees' Tock Ption Lan: E S O Pashwani7789No ratings yet

- Advance TaxDocument11 pagesAdvance TaxAdv Aastha MakkarNo ratings yet

- Income From Salary Final SEM 3Document49 pagesIncome From Salary Final SEM 3Baleshwar ChauhanNo ratings yet

- Msme Case Filing ProcedureDocument7 pagesMsme Case Filing Proceduremanish88rai100% (1)

- Nes Ratnam College of Arts, Science and Commerce Internal Exam - Semester Iv Subject: GST Name: Pooja Maurya Roll No: 26Document10 pagesNes Ratnam College of Arts, Science and Commerce Internal Exam - Semester Iv Subject: GST Name: Pooja Maurya Roll No: 26Pooja MauryaNo ratings yet

- Assignment - Explain Income From Other SourcesDocument9 pagesAssignment - Explain Income From Other SourcesPraveen SNo ratings yet

- Assessment of Various EntitiesDocument31 pagesAssessment of Various Entitiesinsathi0% (1)

- Partnership Firm Registration in TelanganaDocument6 pagesPartnership Firm Registration in TelanganaPrathap GoudNo ratings yet

- Insurance OmbudsmanDocument2 pagesInsurance OmbudsmanVivek GuptaNo ratings yet

- Ip Franchising AgreementDocument12 pagesIp Franchising Agreementaswin donNo ratings yet

- Taxguru - In-Guide To Approved Gratuity FundDocument12 pagesTaxguru - In-Guide To Approved Gratuity FundnanuNo ratings yet

- Powered by Ninja X SamuraiDocument2 pagesPowered by Ninja X SamuraiArkadeep TalukderNo ratings yet

- Axis Bank EasyPay in SlipDocument1 pageAxis Bank EasyPay in SlipAshish Kumar0% (1)

- One-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorDocument7 pagesOne-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorMadhav KotechaNo ratings yet

- CHP 4 Buy BackDocument52 pagesCHP 4 Buy BackRonak ChhabriaNo ratings yet

- Dissolution of Partnership FirmDocument28 pagesDissolution of Partnership FirmViransh Coaching Classes100% (2)

- Registration of CompanyDocument8 pagesRegistration of CompanySachin PatelNo ratings yet

- Amalgamation and Absorption of CompaniesDocument89 pagesAmalgamation and Absorption of CompaniesHarshit Kumar GuptaNo ratings yet

- Application Form - WiproDocument4 pagesApplication Form - WiproVictorBotezNo ratings yet

- Weakness of Indian Financial SystemDocument7 pagesWeakness of Indian Financial SystemAnonymous So5qPSnNo ratings yet

- Ever Blue Apparel LTDDocument19 pagesEver Blue Apparel LTDRinha MuneerNo ratings yet

- HundiDocument21 pagesHundinitesh kumar satsangiNo ratings yet

- Unit 2: Indian Accounting Standard 34: Interim Financial ReportingDocument28 pagesUnit 2: Indian Accounting Standard 34: Interim Financial ReportingvijaykumartaxNo ratings yet

- UFCE FEDAI FormatDocument2 pagesUFCE FEDAI FormatPRAVALLIKA NNo ratings yet

- Sybcom Final Semester III and IV PDFDocument49 pagesSybcom Final Semester III and IV PDFRaj0% (1)

- Income Tax AY 18-19 Vol I PDFDocument224 pagesIncome Tax AY 18-19 Vol I PDFAashish Kumar SinghNo ratings yet

- CSR Activities of Titan: A. IntroductionDocument6 pagesCSR Activities of Titan: A. IntroductionNeXuS BLZNo ratings yet

- FCRA (PPT Notes)Document26 pagesFCRA (PPT Notes)Udaykiran Bheemagani100% (1)

- AMUL Enrollment Form - Zomato MarketDocument2 pagesAMUL Enrollment Form - Zomato MarketMeet KotakNo ratings yet

- Narayan Murthy Role Model of Corporate GovernanceDocument32 pagesNarayan Murthy Role Model of Corporate GovernanceRahul RafaliyaNo ratings yet

- ECGCDocument24 pagesECGCShilpa KhannaNo ratings yet

- $valueDocument1 page$valueBikeworldNo ratings yet

- S 1. Scope. - These Guidelines Shall Apply To The Registration of NewDocument3 pagesS 1. Scope. - These Guidelines Shall Apply To The Registration of NewCzarina Danielle EsequeNo ratings yet

- PoetryDocument5 pagesPoetryKhalika JaspiNo ratings yet

- Alkyl Benzene Sulphonic AcidDocument17 pagesAlkyl Benzene Sulphonic AcidZiauddeen Noor100% (1)

- WN On LTC Rules 2023 SBDocument4 pagesWN On LTC Rules 2023 SBpankajpandey1No ratings yet

- Dewi Handariatul Mahmudah 20231125 122603 0000Document2 pagesDewi Handariatul Mahmudah 20231125 122603 0000Dewi Handariatul MahmudahNo ratings yet

- Impact of Money Supply On Economic Growth of BangladeshDocument9 pagesImpact of Money Supply On Economic Growth of BangladeshSarabul Islam Sajbir100% (2)

- ModernismDocument4 pagesModernismSiya SunilNo ratings yet

- No Man An IslandDocument10 pagesNo Man An IslandIsabel ChiuNo ratings yet

- 12.2 ModulesDocument7 pages12.2 ModulesKrishna KiranNo ratings yet

- Role of A ManagerDocument8 pagesRole of A ManagerMandyIrestenNo ratings yet

- Insurance OperationsDocument5 pagesInsurance OperationssimplyrochNo ratings yet

- CTC VoucherDocument56 pagesCTC VoucherJames Hydoe ElanNo ratings yet

- Contemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitDocument1 pageContemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitGab RabagoNo ratings yet

- COVID19 Management PlanDocument8 pagesCOVID19 Management PlanwallyNo ratings yet

- Expense ReportDocument8 pagesExpense ReportAshvinkumar H Chaudhari100% (1)

- Ulta Beauty Hiring AgeDocument3 pagesUlta Beauty Hiring AgeShweta RachaelNo ratings yet

- Hudson Legal CV Interview GuideDocument16 pagesHudson Legal CV Interview GuideDanielMead100% (1)

- Union Africana - 2020 - 31829-Doc-Au - Handbook - 2020 - English - WebDocument262 pagesUnion Africana - 2020 - 31829-Doc-Au - Handbook - 2020 - English - WebCain Contreras ValdesNo ratings yet

- NSBM Student Well-Being Association: Our LogoDocument4 pagesNSBM Student Well-Being Association: Our LogoMaithri Vidana KariyakaranageNo ratings yet

- S0260210512000459a - CamilieriDocument22 pagesS0260210512000459a - CamilieriDanielNo ratings yet

- Theodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Document4 pagesTheodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Scribd Government DocsNo ratings yet

- Adidas Case StudyDocument5 pagesAdidas Case StudyToSeeTobeSeenNo ratings yet

- Yahoo Tabs AbbDocument85 pagesYahoo Tabs AbbKelli R. GrantNo ratings yet

- Henry Garrett Ranking TechniquesDocument3 pagesHenry Garrett Ranking TechniquesSyed Zia-ur Rahman100% (1)

- I'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Document13 pagesI'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Chantel100% (3)

- Sikfil ReviewerDocument6 pagesSikfil ReviewerBarrientos Lhea ShaineNo ratings yet

- The Holy Rosary 2Document14 pagesThe Holy Rosary 2Carmilita Mi AmoreNo ratings yet

- Test 6Document7 pagesTest 6RuslanaNo ratings yet