Professional Documents

Culture Documents

Himatsingka Seida LTD.: Valuation Summary Sheet

Uploaded by

Neetesh DohareOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Himatsingka Seida LTD.: Valuation Summary Sheet

Uploaded by

Neetesh DohareCopyright:

Available Formats

Himatsingka Seida Ltd.

Valuation Summary Sheet

<<<----- Back to Index

Blended Valuation Weight (%)

DCF Methodology 85.0%

Relative Valuation 15.0%

Fair Value per share 403.0

Upside/(Downside) 9.7%

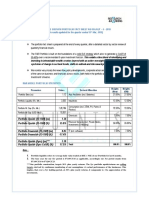

DCF Valuation: Summary FY 2017e FY 2018e FY 2019e FY 2020e FY 2021e

FCFF 41,617 56,881 45,141 54,475 58,402

Terminal Value 602,643

Discounted TV 290,545

Enterprise Value 456,681

Equity Value 414,673

Fair Value per share 413.4

Upside/(Downside) 12.6%

Relative Valuation: Summary Weights (%)

Implied EV/Sales 0.9x 20.0%

Implied EV/EBITDA 7.5x 30.0%

Implied P/E 13.9x 50.0%

Fair Value per share 344.1

Upside/(Downside) -6.3%

Key Charts

Himatsingka Himatsingka

Seide Seide

250000 20.0%

Bhandari 200000 Nahar Bhandari 15.0% Nahar Spinning

Hosiery 150000 Spinning Hosiery…10.0% Mills Ltd.

Exports 100000 Mills Ltd. 5.0%

50000

0 0.0%

Zenith Exports

VTM Limited

Rupa and Ltd.

VTM Limited

Company

Rupa and

TT Limited

TT Limited Company

Sales FY 2014 Sales FY 2015 EBITDA Margin 2014 EBITDA Margin 2015

Sales FY 2016 EBITDA Margin 2016

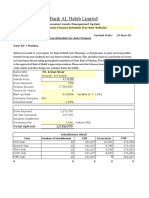

Himatsingka Seida share price performance vs peers

900.00

800.00

700.00

600.00

Stock rallied post

500.00 the approval of

expansion plan.

400.00

300.00

200.00

100.00

-

5-Jan-10 5-Jan-11 5-Jan-12 5-Jan-13 5-Jan-14 5-Jan-15 5-Jan-16 5-Jan-17

Nahar Spinning mills Zenith Expo JJ expo Eastern silk Himatsingka Seida Ltd.

Himatsingka Seida share price performance vs Indices

900.00

800.00

700.00

600.00

500.00

400.00

300.00

200.00

100.00

-

4-Jan-10 4-Jan-11 4-Jan-12 4-Jan-13 4-Jan-14 4-Jan-15 4-Jan-16 4-Jan-17

Himatsingka Seida Ltd. BSE Sensex S&P BSE Small Cap

You might also like

- EOC13Document28 pagesEOC13jl123123No ratings yet

- Chapter 8: Risk and ReturnDocument56 pagesChapter 8: Risk and ReturnMohamed HussienNo ratings yet

- Sri Lanka Automobile Demand Assignment PDFDocument2 pagesSri Lanka Automobile Demand Assignment PDFAmanda HerathNo ratings yet

- JFH SummaryDocument14 pagesJFH Summaryapi-350694642No ratings yet

- Frontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingDocument52 pagesFrontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingSusheel GautamNo ratings yet

- KS Super MultipleDocument9 pagesKS Super Multiplesachin vaddNo ratings yet

- (Atta, Maida & Suji) - : Market Survey Cum Detailed Techno Economic Feasibility Project ReportDocument56 pages(Atta, Maida & Suji) - : Market Survey Cum Detailed Techno Economic Feasibility Project ReportSagarTakNo ratings yet

- Presentation For East West InsuranceDocument11 pagesPresentation For East West Insurancezeeshan aliNo ratings yet

- Data JioDocument18 pagesData JioAnkit VermaNo ratings yet

- R&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Document3 pagesR&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Jaspreet SinghNo ratings yet

- Al Hokair: Investor Presentation Alhokair Fashion RetailDocument30 pagesAl Hokair: Investor Presentation Alhokair Fashion Retailjohn faredNo ratings yet

- Guar Gum Powder - : WWW - Entrepreneurindia.coDocument54 pagesGuar Gum Powder - : WWW - Entrepreneurindia.coKiran KumarNo ratings yet

- 20051600013463voltas Result UpdateDocument6 pages20051600013463voltas Result UpdatennsriniNo ratings yet

- Presentation On Auto MarketDocument11 pagesPresentation On Auto Marketতীর হারা তরীNo ratings yet

- Qualitative Aspect of BSE LimitedDocument14 pagesQualitative Aspect of BSE LimitedShilpi KumariNo ratings yet

- Equity Research of Stockbroking Companies: Group MembersDocument20 pagesEquity Research of Stockbroking Companies: Group MembersShilpi KumariNo ratings yet

- Exide Vs Amara Raja FinalDocument11 pagesExide Vs Amara Raja FinalNinad MaskeNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsDeep AnjarlekarNo ratings yet

- DG 2015irDocument28 pagesDG 2015irGary ManNo ratings yet

- DTA's Morning Cafe-04th Oct 2021Document1 pageDTA's Morning Cafe-04th Oct 2021aaryinfoNo ratings yet

- Internal Forces G, HDocument6 pagesInternal Forces G, HRui JiaNo ratings yet

- Master Template v1Document79 pagesMaster Template v1KiranNo ratings yet

- Working For Bread ModelDocument17 pagesWorking For Bread ModeltayyabtariqNo ratings yet

- Evaluating The Firm'S Dividend PolicyDocument11 pagesEvaluating The Firm'S Dividend PolicyYash Aggarwal BD20073No ratings yet

- Whirlpool Corporation: Every Home Everywhere With Pride, Passion and PerformanceDocument8 pagesWhirlpool Corporation: Every Home Everywhere With Pride, Passion and PerformanceIshmeet SinghNo ratings yet

- Commission Structure - May 2019Document16 pagesCommission Structure - May 2019Sabuj MollaNo ratings yet

- Financial Management ProjectDocument35 pagesFinancial Management ProjectGourav GuhaNo ratings yet

- Bicycle Manufacturing Industry - : Market Survey Cum Detailed Techno Economic Feasibility Project ReportDocument57 pagesBicycle Manufacturing Industry - : Market Survey Cum Detailed Techno Economic Feasibility Project ReportHarshal ShakkyaNo ratings yet

- Chaudhry Steel Re-Rolling Mills Limited: Consultant To The IssueDocument8 pagesChaudhry Steel Re-Rolling Mills Limited: Consultant To The IssueAbdul Wahaab KhokharNo ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3nsadnanNo ratings yet

- Closing Summary Sep 29 2022 EN - tcm10-29087 - tcm10-29087Document2 pagesClosing Summary Sep 29 2022 EN - tcm10-29087 - tcm10-29087indraseenayya chilakalaNo ratings yet

- Full Complete ModelDocument18 pagesFull Complete ModelSyed Mohammad Kishmal NNo ratings yet

- Financial Template GuidelineDocument9 pagesFinancial Template GuidelineAmzar SaniNo ratings yet

- BHEL - Rock Solid - RBS - Jan2011Document8 pagesBHEL - Rock Solid - RBS - Jan2011Jitender KumarNo ratings yet

- ABM 2017-FinalDocument25 pagesABM 2017-FinalRohit SharmaNo ratings yet

- Project Presentaiton PDFDocument63 pagesProject Presentaiton PDFKashifNo ratings yet

- Pdfanddoc 684813 PDFDocument48 pagesPdfanddoc 684813 PDFGeorgeNo ratings yet

- Infosys CAGRDocument4 pagesInfosys CAGRNithin VNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- Tata Consultancy: Gaining Wallet ShareDocument16 pagesTata Consultancy: Gaining Wallet Shareapalod_1No ratings yet

- Disposable Syringe & Needle ProductionDocument57 pagesDisposable Syringe & Needle ProductionKalpesh DaveNo ratings yet

- Pdfanddoc 410891 PDFDocument52 pagesPdfanddoc 410891 PDFMoghees AliNo ratings yet

- Pdfanddoc 732028 PDFDocument68 pagesPdfanddoc 732028 PDFhashim AbuNo ratings yet

- Krakatau A CGAR BUMN DupontDocument27 pagesKrakatau A CGAR BUMN DupontFirdausNo ratings yet

- Phoenix ModelDocument9 pagesPhoenix ModelShrivats SinghNo ratings yet

- Elpro International LTDDocument3 pagesElpro International LTDHimanshuNo ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Pdfanddoc 638378 PDFDocument56 pagesPdfanddoc 638378 PDFVimal Anbalagan100% (1)

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookAkshay ShaikhNo ratings yet

- Xim University, Bhubaneswar: Financial Institutions and MarketsDocument13 pagesXim University, Bhubaneswar: Financial Institutions and MarketsSattwik rathNo ratings yet

- IndefendDocument3 pagesIndefendSunny DhirNo ratings yet

- 0% Interest CalculationDocument2 pages0% Interest CalculationGet DigitalizeNo ratings yet

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- M Auto-Finance 8.0Document2 pagesM Auto-Finance 8.0Arslan NisarNo ratings yet

- Tata Motors PresentationDocument121 pagesTata Motors PresentationSrikanth Reddy VemulaNo ratings yet

- Appraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Document11 pagesAppraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Movie SenderNo ratings yet

- Portfolios Factsheet: Fund Objective Fund DetailsDocument1 pagePortfolios Factsheet: Fund Objective Fund DetailsJ. BangjakNo ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3BobbyNicholsNo ratings yet

- #BOLD STOP Marketing PlanDocument50 pages#BOLD STOP Marketing PlanAhmed Alaa100% (1)

- Earnings To Provide A Reality Check Sell: Reliance IndustriesDocument33 pagesEarnings To Provide A Reality Check Sell: Reliance IndustriesChetankumar ChandakNo ratings yet

- Fantraa Model UpdatedDocument133 pagesFantraa Model UpdatedDarsh Dilip DoshiNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Pengaruh Kinerja Keuangan Terhadap Return Saham Chrismas Bisara Lailatul Amanah Sekolah Tinggi Ilmu Ekonomi Indonesia (STIESIA) SurabayaDocument14 pagesPengaruh Kinerja Keuangan Terhadap Return Saham Chrismas Bisara Lailatul Amanah Sekolah Tinggi Ilmu Ekonomi Indonesia (STIESIA) SurabayaYumimura YoshimoriNo ratings yet

- Presentation 08 Mishkin - Econ12eGE - CH07 To TeacherDocument25 pagesPresentation 08 Mishkin - Econ12eGE - CH07 To TeacherKutman PamirovNo ratings yet

- Revised Direct Tax CodeDocument37 pagesRevised Direct Tax Codepankaj_adv5314No ratings yet

- Detailed Report On Investment AnalysisDocument4 pagesDetailed Report On Investment AnalysisRadha MaheshwariNo ratings yet

- Technical Analysis PresentationDocument73 pagesTechnical Analysis Presentationparvez ansariNo ratings yet

- Portfolio Summary: Chetan Vijayrao KaleDocument2 pagesPortfolio Summary: Chetan Vijayrao KaleChetan KaleNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Capital BudgetingDocument64 pagesCapital BudgetingNiaz AhmedNo ratings yet

- Project AppraisalDocument3 pagesProject AppraisalnailwalnamitaNo ratings yet

- Multinational Bank SlogansDocument55 pagesMultinational Bank SlogansSachin SahooNo ratings yet

- Bodie Investments 12e SM CH11Document9 pagesBodie Investments 12e SM CH11elvin andriNo ratings yet

- OMWealth OldMutualWealthInvestmentVehiclesOverviewDocument5 pagesOMWealth OldMutualWealthInvestmentVehiclesOverviewJohn SmithNo ratings yet

- Kings - Indicator BibleDocument13 pagesKings - Indicator BibleAkelly47sNo ratings yet

- Problem - No.1 Amalgamation in The Nature of Purchase - Net Asset Method Without Statutory Reserve)Document6 pagesProblem - No.1 Amalgamation in The Nature of Purchase - Net Asset Method Without Statutory Reserve)Siva SankariNo ratings yet

- Presentation 4 - Basics of Capital Budgeting (Draft)Document27 pagesPresentation 4 - Basics of Capital Budgeting (Draft)sanjuladasanNo ratings yet

- Project Preparation Consists of Four Stages VizDocument20 pagesProject Preparation Consists of Four Stages VizSuhail Shamsuddin50% (2)

- Chapter 8 ExamplesDocument10 pagesChapter 8 Examplesm bNo ratings yet

- International Business Expansion of Starbucks To PakistanDocument8 pagesInternational Business Expansion of Starbucks To PakistanmaryamehsanNo ratings yet

- Chapter 4 - RETURN and RiskDocument23 pagesChapter 4 - RETURN and RiskAlester Joseph ĻĕěNo ratings yet

- DetailsDocument28 pagesDetailsNeerajNo ratings yet

- Balance Sheet and Ratio Analysis of ItcDocument3 pagesBalance Sheet and Ratio Analysis of ItcNiraj VishwakarmaNo ratings yet

- Dissertation Report On Cash Management of Standard Chartered BankDocument92 pagesDissertation Report On Cash Management of Standard Chartered BankSunil Kumar100% (15)

- MSC - Actuarial - Brochure - PDF Imperial College of LondonDocument8 pagesMSC - Actuarial - Brochure - PDF Imperial College of Londonwahajbond007No ratings yet

- Currency War - Reasons and RepercussionsDocument15 pagesCurrency War - Reasons and RepercussionsRaja Raja91% (11)

- Analysis of The Capital Asset Pricing Models in The Saudi Stock MarketDocument12 pagesAnalysis of The Capital Asset Pricing Models in The Saudi Stock MarketDex BdexxNo ratings yet

- Dispensers California, IncDocument2 pagesDispensers California, IncRiturajPaulNo ratings yet

- Monnet Ispat: Performance HighlightsDocument13 pagesMonnet Ispat: Performance HighlightsAngel BrokingNo ratings yet

- Level II Alt Summary SlidesDocument25 pagesLevel II Alt Summary SlidesRaabiyaal IshaqNo ratings yet