Professional Documents

Culture Documents

Sample Format of Individual Income Tax Return y A 2017 2018

Uploaded by

Chathuranga LSIS0 ratings0% found this document useful (0 votes)

309 views3 pagesSample Format of Individual Income Tax Return

Original Title

Sample Format of Individual Income Tax Return y a 2017 2018

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSample Format of Individual Income Tax Return

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

309 views3 pagesSample Format of Individual Income Tax Return y A 2017 2018

Uploaded by

Chathuranga LSISSample Format of Individual Income Tax Return

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Form No.

- Asmt_IIT_001_E

For Office Use

DLN

Date

RETURN OF INCOME - INDIVIDUAL

YEAR OF ASSESSMENT : 2017/2018

Taxpayer Identification Number (TIN)

Address

Date of Issue: Due Date:

Notice under Section 106(7) and Form specified understSection 213 of the Inland Revenue Act, No. 10 of 2006.

Declare income and other particulars for year ended 31 March, 2018.

You are required to complete this form, with attached statement of accounts, tax computation and schedules where

necessary and return it to this office on or before 30th November, 2018.

Please note that penalties are imposed on any person, making an incorrect Return or not submitting a Return.

Part 1 – DECLARATION OF PROFITS AND INCOME LIABLE TO TAX

Income from Employment (Schedule 1) 100

Profits from Trade, Business, Profession or Vocation (Schedule 2) 110

Net Annual Value and/or Rents (Schedule 3) 120

Dividend (Schedule 4) 130

Interest (Schedule 5) 140

Annuities and Royalties etc. (Schedule 6) 150

Income from any other source (Schedule 7) 160

Income of Children (only applicable to residents of Sri Lanka) Cage 655 170

TOTAL STATUTORY INCOME (100+110+120+130+140+150+160+170) 200

Part 2 – DEDUCTIONS FROM TOTAL STATUTORY INCOME

Deductible losses from Trade, Business, Profession or Vocation (Schedule 8) 210

Interest, Annuities, Royalties & Ground Rent (Schedule 9) 220

Total Deductions from Total Statutory Income (210 + 220) 240

ASSESSABLE INCOME (200 - 240) 250

Tax Free Allowance (only applicable to residents or citizens of Sri Lanka) 260

Qualifying Payments (Schedule 10) 300

Total Deductions From Assessable Income (260 +300) 400

TAXABLE INCOME (250-400) 410

Part 3 – CALCULATION OF INCOME TAX PAYABLE

Tax on Once-and-for-all receipts from Employment (Schedule 12) 500

Tax on balance Taxable Income (Schedule 12) 520

Gross Income Tax Payable (500+520) 530

Tax Credits (Schedule 11) 540

Tax Payable (if 530 > 540, = 530 – 540) 590

Refund Claimed (if 530 < 540, = 540 – 530) 595

Please note that penalty will accrue for non-payment of taxes on or before the due date.

Please note that this return of income has

been issued by the Inland Revenue

Department of Sri Lanka

Part 4 – INCOME NOT INCLUDED IN STATUTORY INCOME AND INCOME EXEMPTED FROM TAX

Required by the Section 106(6) of the Inland Revenue Act, No. 10 of 2006, to declare the Income Exempt from Tax

Section A - Income not included in Total Statutory Income

A) Interest Income from which tax has been deducted by the Banks or Financial Institutions (Including Treasury Bills etc. )

Bank/Financial Institution Amount Invested(Rs.) Net Interest Income (Rs.)

601 602 603

.01

.02

Total Income from Interest 604

B) Dividends from which tax at 10% has been deducted at source

Name of the Company No. of Shares as at 31.03.2018 Net Dividend Income (Rs.)

611 612 613

.01

.02

Total Income from Dividends 614

C) Rewards, Share of Fines, Lottery Winnings etc. from which tax at 10% has been deducted at source

Paying Institution Date of Payment Net Income (Rs.)

621 622 623

.01

.02

Total Income from Rewards, Share of Fines, Lottery Winnings etc. 624

D) Income from Sale of Gems from which tax at 2.5% has been deducted by the National Gem and Jewellery Authority

Transaction Date Certificate No. Details Net Income (Rs.)

631 632 633 634

.01

.02

Total Income from Sale of Gems 635

Section B - Income Exempt from Tax

Details of Income Amount (Rs.)

641 642

.01

.02

.03

Total Income Exempt from Tax 643

Part 5 – DECLARATION

Name of Spouse 650

TIN of Spouse 651

Names of Children Date of Birth Income of Child (Rs.)

652 653 654

.01

.02

.03

Total Income of Children 655

I declare to the best of my knowledge and belief that all particulars furnished in this Return and in the Schedules attached hereto are true,

correct and complete. I am aware that making an incorrect or false statement or giving false information in relation to a Return is an offence.

Full Name of Declarant

Official Address

Residential Address

National Identity Card No.

Telephone No. Mobile Email

OFFICIAL FRANK

Signature

Date D D / M M / Y Y Y Y

You might also like

- Individuals Tax Return - US 2016Document2 pagesIndividuals Tax Return - US 2016Yousef M. AqelNo ratings yet

- 2007 Federal ReturnDocument2 pages2007 Federal ReturnbradybunnellNo ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- New Hire Paperwork 2021aDocument27 pagesNew Hire Paperwork 2021aTom BondalicNo ratings yet

- 398 2019 ArchiveTaxReturnDocument10 pages398 2019 ArchiveTaxReturnjimmy naranjoNo ratings yet

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Document69 pagesCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519No ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusfelix angomasNo ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- Form - I 9 - 10 21 2019Document3 pagesForm - I 9 - 10 21 2019Mitch SabioNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Document42 pages2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- 0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Document1 page0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Osvaldo CalderonUACJNo ratings yet

- Florida Homestead AplicationDocument4 pagesFlorida Homestead AplicationJohn DollNo ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- Chase Mortgage Finance Trust 2007-S6 ProspectusDocument214 pagesChase Mortgage Finance Trust 2007-S6 ProspectusBrenda ReedNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Legitimate Illegitimate and Legitimated Filiation PFRDocument3 pagesLegitimate Illegitimate and Legitimated Filiation PFRAngie JapitanNo ratings yet

- Corrected Tuition Statement SummaryDocument2 pagesCorrected Tuition Statement Summaryed redfNo ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- Individual Tax CalculationDocument11 pagesIndividual Tax CalculationSunil ChelladuraiNo ratings yet

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Advia Credit Union 2Document1 pageAdvia Credit Union 2kathyNo ratings yet

- Mart1552 21i FCDocument23 pagesMart1552 21i FCOlga M.No ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- 2010 Psztur R Form 1040 Individual Tax ReturnDocument20 pages2010 Psztur R Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- 34 Wihh 504331 H 0714320240524151104202Document3 pages34 Wihh 504331 H 0714320240524151104202jamelmhunt22No ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNo ratings yet

- 2016 1040 Individual Tax Return Engagement LetterDocument11 pages2016 1040 Individual Tax Return Engagement LettersarahvillalonNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- Form1095a 2017 PDFDocument8 pagesForm1095a 2017 PDFTina ReyesNo ratings yet

- Request for Taxpayer ID FormDocument4 pagesRequest for Taxpayer ID FormMichael RamirezNo ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- Juridical Necessity: ObligationsDocument11 pagesJuridical Necessity: ObligationsAllyna Jane EnriquezNo ratings yet

- Contract To SellDocument2 pagesContract To SellUnsolicited CommentNo ratings yet

- The Philippines Under The Spanish Colonial RuleDocument37 pagesThe Philippines Under The Spanish Colonial RuleClarissa Ü Burro100% (1)

- Checklist of Bid Documents (Goods)Document2 pagesChecklist of Bid Documents (Goods)Julius Caesar Panganiban100% (1)

- Soriano vs. Dizon Disbarment Case Upholds Conviction for Frustrated Homicide Involves Moral TurpitudeDocument2 pagesSoriano vs. Dizon Disbarment Case Upholds Conviction for Frustrated Homicide Involves Moral TurpitudeCarlos JamesNo ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

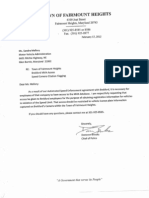

- Fairmount Heights - Documents 1 PDFDocument88 pagesFairmount Heights - Documents 1 PDFAri AsheNo ratings yet

- 2018 Form I Individual Income Tax Return 2017Document20 pages2018 Form I Individual Income Tax Return 2017KSeegurNo ratings yet

- PA Individual Income Tax Declaration for Electronic FilingDocument4 pagesPA Individual Income Tax Declaration for Electronic FilingDiana JuanNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchNo ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- PUA 1099G tax form summaryDocument1 pagePUA 1099G tax form summaryClifton WilsonNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- Return of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationDocument50 pagesReturn of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationNBC MontanaNo ratings yet

- Investment Declaration Form - FY 2022-23Document7 pagesInvestment Declaration Form - FY 2022-23varaprasadNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- Receipts Expenditures: WarningDocument3 pagesReceipts Expenditures: WarningParents' Coalition of Montgomery County, MarylandNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- MTN Roaming SIM Service GuaranteeDocument2 pagesMTN Roaming SIM Service Guaranteenanayaw asareNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroDocument5 pagesCertificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroChristcelda lozadaNo ratings yet

- Tilaknagar DRHP PDFDocument221 pagesTilaknagar DRHP PDFsusegaadNo ratings yet

- Form DGT 12017Document16 pagesForm DGT 12017hendrikNo ratings yet

- DLSU 2015 Consti Law OutlineDocument13 pagesDLSU 2015 Consti Law OutlineMico Maagma CarpioNo ratings yet

- Davis Product Creation v. Blazer - ComplaintDocument114 pagesDavis Product Creation v. Blazer - ComplaintSarah BursteinNo ratings yet

- SK AgarwalDocument14 pagesSK AgarwalAmit WaskelNo ratings yet

- RTI To PIODocument3 pagesRTI To PIOavinash71778907No ratings yet

- February 1, 2017 G.R. No. 188146 Pilipinas Shell Petroleum Corporation, Petitioner Royal Ferry Services, Inc., Respondent Decision Leonen, J.Document13 pagesFebruary 1, 2017 G.R. No. 188146 Pilipinas Shell Petroleum Corporation, Petitioner Royal Ferry Services, Inc., Respondent Decision Leonen, J.Graile Dela CruzNo ratings yet

- Abbotsford ApplicationDocument4 pagesAbbotsford Applicationapi-233115027No ratings yet

- Criminal Fiction 2015 For Practice CourtDocument1 pageCriminal Fiction 2015 For Practice CourtSean RamosNo ratings yet

- Cambodia's Electoral System: A Window of Opportunity For ReformDocument50 pagesCambodia's Electoral System: A Window of Opportunity For ReformyuthyiaNo ratings yet

- Anna Wolfe V MDHSDocument4 pagesAnna Wolfe V MDHSAnna WolfeNo ratings yet

- RCMP BMC Final ReportDocument48 pagesRCMP BMC Final ReportJustin LingNo ratings yet

- 2017 Exam Scope With Answers CompletedDocument34 pages2017 Exam Scope With Answers CompletedMpend Sbl CkkNo ratings yet

- Trump Admin Motion To DismissDocument582 pagesTrump Admin Motion To DismissLaw&CrimeNo ratings yet

- LAW 5112 Capital and FinancingDocument143 pagesLAW 5112 Capital and FinancingDebra SigaNo ratings yet

- UK Supreme Court and Parliament relationship under Human Rights ActDocument7 pagesUK Supreme Court and Parliament relationship under Human Rights ActAaqib IOBMNo ratings yet

- Appendix 'A' - GREF Recruitment Application FormDocument4 pagesAppendix 'A' - GREF Recruitment Application Formhindu dasNo ratings yet

- Removal of Director Under Companies Act, 2013Document3 pagesRemoval of Director Under Companies Act, 2013Madhav MathurNo ratings yet

- Bolluyt, Karen - Citizens For Bolluyt - 1374 - DR2 - SummaryDocument1 pageBolluyt, Karen - Citizens For Bolluyt - 1374 - DR2 - SummaryZach EdwardsNo ratings yet

- Parayno vs. Jovellanos: Distinction Between Gasoline Filling and Service StationsDocument2 pagesParayno vs. Jovellanos: Distinction Between Gasoline Filling and Service StationsKarl Francis EstavillaNo ratings yet

- Order Ganting FurloughDocument1 pageOrder Ganting FurloughKathrina Jane PalacpacNo ratings yet

- Human Rights Dignity and Common GoodDocument11 pagesHuman Rights Dignity and Common Goodflash driveNo ratings yet