Professional Documents

Culture Documents

Kabelindo Murni TBK

Uploaded by

Istrinya TaehyungOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kabelindo Murni TBK

Uploaded by

Istrinya TaehyungCopyright:

Available Formats

KBLM Kabelindo Murni Tbk.

COMPANY REPORT : JANUARY 2019 As of 31 January 2019

Development Board Individual Index : 8.267

Industry Sector : Miscellaneous Industry (4) Listed Shares : 1,120,000,000

Industry Sub Sector : Cable (45) Market Capitalization : 277,760,000,000

515 | 0.28T | 0.004% | 99.80%

506 | 0.01T | 0.0006% | 99.98%

COMPANY HISTORY SHAREHOLDERS (December 2018)

Established Date : 11-Oct-1979 1. PT Tutulan Sukma 389,000,000 : 34.73%

Listing Date : 01-Jun-1992 (IPO Price: 6,000) 2. PT Sibalec 380,000,000 : 33.93%

Underwriter IPO : 3. Erwin Suryo Raharjo 100,000,000 : 8.93%

PT Danareksa Sekuritas 4. PT Erdikha Elit Sekuritas 78,095,400 : 6.97%

Securities Administration Bureau : 5. Badan Penyehatan Perbankan Nasional 69,882,400 : 6.24%

PT Sinartama Gunita 6. Public (<5%) 103,022,200 : 9.20%

BOARD OF COMMISSIONERS DIVIDEND ANNOUNCEMENT

1. Soepono Bonus Cash Recording Payment

F/I

2. Budi Setiono Santoso *) Year Shares Dividend Cum Date Ex Date Date Date

3. Dewa Nyoman Adnyana *) 1992 228.50 14-Jun-93 15-Jun-93 23-Jun-93 23-Jul-93 F

*) Independent Commissioners 1993 275.00 1-Jul-94 4-Jul-94 11-Jul-94 11-Aug-94 F

1993 70.00 20-Jul-94 21-Jul-94 28-Jul-94 27-Aug-94 F

BOARD OF DIRECTORS 1994 1:1 28-Mar-95 29-Mar-95 6-Apr-95 5-May-95 BS

1. Elly Soepono 1994 84.00 6-Jul-95 7-Jul-95 17-Jul-95 16-Aug-95 F

2. Andika S Wongkar 1995 47.00 25-Jun-96 26-Jun-96 4-Jul-96 2-Aug-96 F

3. Petrus Nugroho Dwisantosa 1996 57.00 23-Jul-97 24-Jul-97 1-Aug-97 22-Aug-97 F

4. Veronica Lukman 2010 2.00 15-Jun-11 16-Jun-11 20-Jun-11 5-Jul-11 F

2011 3.00 27-Jun-12 28-Jun-12 2-Jul-12 16-Jul-12 F

AUDIT COMMITTEE 2012 3.00 4-Jul-13 5-Jul-13 9-Jul-13 23-Jul-13 F

1. Budi Setiono Santoso 2015 3.00 6-Jun-16 7-Jun-16 9-Jun-16 1-Jul-16 F

2. Dedy Hendrawan 2016 5.00 2-Jun-17 5-Jun-17 7-Jun-17 22-Jun-17 F

3. Ricky Rudolf 2016 5.00 2-Jun-17 5-Jun-17 7-Jun-17 23-Jun-17 F

2017 10.00 17-May-18 18-May-18 22-May-18 8-Jun-18 F

CORPORATE SECRETARY

Intan Eka Dewi ISSUED HISTORY

Listing Trading

HEAD OFFICE No. Type of Listing Shares Date Date

Kawasan Industri Pulogadung 1. First Issue 3,100,000 1-Jun-92 1-Jun-92

Jl. Rawa Girang No. 2 2. Company Listing 10,900,000 1-Jun-92 2-Dec-92

Jakarta 3. Bonus Shares 14,000,000 8-May-95 8-May-95

Phone : (021) 460-9065 4. Right Issue 28,000,000 7-Jul-95 7-Jul-95

Fax : (021) 460-9064 5. Additional Shares 1,064,000,000 19-Dec-01 19-Dec-01

Homepage : www.kabelindo.co.id

Email : intan@kabelindo.co.id

info@kabelindo.co.id

KBLM Kabelindo Murni Tbk.

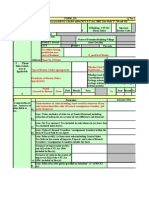

TRADING ACTIVITIES

Closing Price* and Trading Volume

Kabelindo Murni Tbk. Closing Price Freq. Volume Value

Day

Closing Volume

Price* January 2015 - January 2019 (Mill. Sh) Month High Low Close (X) (Thou. Sh.) (Million Rp)

600 240 Jan-15 163 136 150 206 156 23 14

Feb-15 167 135 139 86 578 81 15

525 210 Mar-15 157 136 147 98 160 22 19

Apr-15 153 131 144 35 161 23 8

May-15 154 131 140 47 57 8 9

450 180

Jun-15 149 101 134 170 29,989 5,161 18

Jul-15 138 117 136 25 92 12 9

375 150

Aug-15 138 101 113 74 541 68 11

Sep-15 138 105 138 85 27,251 3,135 16

300 120

Oct-15 139 108 133 38 65 7 14

Nov-15 138 111 131 28 228 29 10

225 90 Dec-15 186 121 132 40 33 4 9

150 60 Jan-16 144 117 117 45 171 21 11

Feb-16 143 115 138 73 234 30 15

75 30 Mar-16 138 112 125 202 476 58 15

Apr-16 150 118 133 302 181,574 22,692 20

May-16 155 121 129 202 537 70 20

Jun-16 180 134 160 1,606 4,809 732 21

Jan-15 Jan-16 Jan-17 Jan-18 Jan-19

Jul-16 238 152 204 531 2,277 440 16

Aug-16 294 197 288 471 2,142 476 22

Sep-16 318 260 304 373 583 165 20

Closing Price*, Jakarta Composite Index (IHSG) and Oct-16 590 260 540 1,559 3,894 1,551 21

Miscellaneous Industry Index Nov-16 650 308 314 1,536 2,527 1,190 22

January 2015 - January 2019 Dec-16 450 240 240 1,018 3,711 1,109 20

280%

Jan-17 310 240 266 2,751 6,251 1,662 21

240% Feb-17 290 250 274 1,603 4,380 1,204 18

Mar-17 615 256 490 12,288 61,359 30,440 22

200% Apr-17 555 370 380 15,817 97,247 45,108 17

May-17 398 270 334 6,653 30,450 10,711 20

160% Jun-17 350 302 308 950 4,108 1,339 15

Jul-17 340 294 300 1,328 4,920 1,528 21

Aug-17 304 256 284 1,770 5,006 1,399 22

120%

Sep-17 312 242 262 1,319 3,786 1,005 19

Oct-17 300 230 270 1,257 4,393 1,190 22

80%

Nov-17 318 250 276 802 2,579 729 22

60.0% Dec-17 290 232 282 442 930 248 18

40%

24.6%

Jan-18 396 264 330 3,317 14,063 4,809 22

11.2%

- Feb-18 350 300 312 1,105 3,263 1,057 19

Mar-18 330 284 318 609 1,458 448 21

-40% Apr-18 378 304 324 1,350 8,779 3,027 21

Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 May-18 390 248 268 2,318 9,487 3,027 20

Jun-18 284 228 234 608 2,490 657 13

Jul-18 290 218 290 393 964 237 22

SHARES TRADED 2015 2016 2017 2018 Jan-19 Aug-18 280 212 280 560 1,724 441 20

Volume (Million Sh.) 59 203 225 54 5 Sep-18 296 212 296 253 2,280 617 18

Value (Billion Rp) 9 29 97 17 1 Oct-18 290 220 232 514 2,972 731 23

Frequency (Thou. X) 0.9 8 47 12 1 Nov-18 252 220 252 262 3,205 786 21

Days 152 223 237 237 22 Dec-18 286 202 250 985 3,476 925 17

Price (Rupiah) Jan-19 260 228 248 1,372 5,362 1,314 22

High 186 650 615 396 260

Low 101 112 230 202 228

Close 132 240 282 250 248

Close* 132 240 282 250 248

PER (X) 11.57 6.34 13.04 23.03 22.84

PER Industry (X) 0.95 13.86 4.78 16.15 17.64

PBV (X) 0.50 0.83 0.41 0.35 0.35

* Adjusted price after corporate action

KBLM Kabelindo Murni Tbk.

Financial Data and Ratios Book End : December

Public Accountant : Kanaka Puradiredja, Suhartono

BALANCE SHEET Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(in Million Rp, except Par Value) Assets Liabilities

Cash & Cash Equivalents 34,219 6,748 69,820 126,807 17,364 1,250

Receivables 220,478 189,980 130,998 226,525 172,135

91,037 137,507 153,138 148,328 246,427 1,000

Inventories

Current Assets 356,749 362,278 394,738 548,840 475,957

750

Fixed Assets 289,755 291,209 244,139 682,651 684,503

Other Assets - - - - -

500

Total Assets 647,697 654,386 639,091 1,235,199 1,164,817

Growth (%) 1.03% -2.34% 93.27% -5.70% 250

Current Liabilities 342,700 342,644 303,264 434,423 365,509 -

Long Term Liabilities 14,709 15,267 15,172 9,347 9,959 2014 2015 2016 2017 Sep-18

Total Liabilities 357,409 357,910 318,436 443,770 375,468

Growth (%) 0.14% -11.03% 39.36% -15.39%

TOTAL EQUITY (Bill. Rp)

Authorized Capital 211,400 211,400 763,767 211,400 211,400 791 789

Paid up Capital 211,400 211,400 211,400 211,400 211,400 791

Paid up Capital (Shares) 1,120 1,120 1,120 1,120 1,120

Par Value 963 & 148 963 & 148 963 & 148 963 & 148 963 & 148

630

Retained Earnings 77,118 84,176 100,043 140,443 138,363

290,288 296,475 320,655 791,429 789,348

469

Total Equity

296 321

290

Growth (%) 2.13% 8.16% 146.82% -0.26% 307

INCOME STATEMENTS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 146

Total Revenues 919,538 967,710 987,409 1,215,477 717,563

Growth (%) 5.24% 2.04% 23.10%

-16

2014 2015 2016 2017 Sep-18

Cost of Revenues 841,196 870,095 884,705 1,109,572 669,846

Gross Profit 78,342 97,615 102,704 105,905 47,717

TOTAL REVENUES (Bill. Rp)

Expenses (Income) 28,861 76,142 68,175 61,357 34,738

Operating Profit 49,481 21,473 34,529 - 12,979 1,215

Growth (%) -56.60% 60.80% -100.00%

1,215

968 987

968

920

Other Income (Expenses) -22,111 - - - -

718

Income before Tax 27,371 21,473 34,529 44,548 12,979 720

Tax 6,872 8,712 13,284 553 -3,859

Profit for the period 20,499 12,760 21,245 43,995 9,120 472

Growth (%) -37.75% 66.49% 107.08%

224

Period Attributable 20,687 12,783 19,825 44,021 9,120 -24

Comprehensive Income 20,624 11,788 20,114 476,953 9,120 2014 2015 2016 2017 Sep-18

Comprehensive Attributable 20,687 11,810 18,694 476,979 9,120

RATIOS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 PROFIT FOR THE PERIOD (Bill. Rp)

Current Ratio (%) 104.10 105.73 130.16 126.34 130.22

44

Dividend (Rp) - 3.00 10.00 10.00 - 44

EPS (Rp) 18.47 11.41 17.70 39.30 8.14

BV (Rp) 259.19 264.71 286.30 706.63 704.78 35

DAR (X) 0.55 0.55 0.50 0.36 0.32

DER(X) 1.23 1.21 0.99 0.56 0.48 20 21

26

ROA (%) 3.16 1.95 3.32 3.56 0.78 17

13

ROE (%) 7.06 4.30 6.63 5.56 1.16 9.1

GPM (%) 8.52 10.09 10.40 8.71 6.65 8

OPM (%) 5.38 2.22 3.50 - 1.81

NPM (%) 2.23 1.32 2.15 3.62 1.27

-1

2014 2015 2016 2017 Sep-18

Payout Ratio (%) - 26.29 56.49 25.44 -

Yield (%) - 2.27 4.17 3.55 -

*US$ Rate (BI), Rp 12,436 13,794 13,436 13,548 14,929

You might also like

- Asuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Document3 pagesAsuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Marvin ArifinNo ratings yet

- Citra Marga Nusaphala Persada TBK.: Company Report: July 2018 As of 31 July 2018Document3 pagesCitra Marga Nusaphala Persada TBK.: Company Report: July 2018 As of 31 July 2018Melinda KusumaNo ratings yet

- Indah Kiat Pulp & Paper TBKDocument3 pagesIndah Kiat Pulp & Paper TBKDenny SiswajaNo ratings yet

- Pakuwon Jati TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesPakuwon Jati TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Ciputra Development TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesCiputra Development TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Matahari Department Store TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMatahari Department Store TBK.: Company Report: January 2019 As of 31 January 2019Denny SiswajaNo ratings yet

- Lap Keu SMCBDocument3 pagesLap Keu SMCBDavid Andriyono AchmadNo ratings yet

- Indocement Tunggal Prakarsa TBKDocument3 pagesIndocement Tunggal Prakarsa TBKRika SilvianaNo ratings yet

- Laporan Keuangan BUMIDocument3 pagesLaporan Keuangan BUMIBreak HabitNo ratings yet

- Lippo Karawaci TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesLippo Karawaci TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Alakasa Industrindo TBK.: Company Report: July 2018 As of 31 July 2018Document3 pagesAlakasa Industrindo TBK.: Company Report: July 2018 As of 31 July 2018Putri Rizky MayLinaNo ratings yet

- Bumi Resources TBKDocument3 pagesBumi Resources TBKadjipramNo ratings yet

- DildDocument3 pagesDildPrasetyo Indra SuronoNo ratings yet

- Almi PDFDocument3 pagesAlmi PDFHENI OKTAVIANINo ratings yet

- Almi PDFDocument3 pagesAlmi PDFHENI OKTAVIANINo ratings yet

- Almi PDFDocument3 pagesAlmi PDFchoirul dwiNo ratings yet

- Almi PDFDocument3 pagesAlmi PDFdindakharismaNo ratings yet

- Asuransi Bina Dana Arta TBK.: Company History SHAREHOLDERS (July 2012)Document3 pagesAsuransi Bina Dana Arta TBK.: Company History SHAREHOLDERS (July 2012)Marvin ArifinNo ratings yet

- Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesGajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Global Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesGlobal Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Dicky L RiantoNo ratings yet

- Metrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMetrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Reza CahyaNo ratings yet

- Charoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesCharoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019ayyib12No ratings yet

- Kawasan Industri Jababeka TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesKawasan Industri Jababeka TBK.: Company Report: January 2018 As of 31 January 2018Pandu Aditya KurniawanNo ratings yet

- Zebra Nusantara TBK.: Company Report: July 2018 As of 31 July 2018Document3 pagesZebra Nusantara TBK.: Company Report: July 2018 As of 31 July 2018roxasNo ratings yet

- Bank Negara Indonesia (Persero) TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesBank Negara Indonesia (Persero) TBK.: Company Report: January 2017 As of 31 January 2017Eka FarahNo ratings yet

- Enseval Putera Megatrading TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesEnseval Putera Megatrading TBK.: Company Report: January 2019 As of 31 January 2019Nur WahyudiNo ratings yet

- Charoen Pokphand Indonesia TBK.: Company Report: July 2018 As of 31 July 2018Document3 pagesCharoen Pokphand Indonesia TBK.: Company Report: July 2018 As of 31 July 2018tomo_dwi1No ratings yet

- Adira Dinamika Multi Finance TBKDocument3 pagesAdira Dinamika Multi Finance TBKrofiqsabilalNo ratings yet

- Bank Pan Indonesia TBKDocument3 pagesBank Pan Indonesia TBKParas FebriayuniNo ratings yet

- Panasia Indo Resources TBKDocument3 pagesPanasia Indo Resources TBKfranshalawaNo ratings yet

- Blta PDFDocument3 pagesBlta PDFyohannestampubolonNo ratings yet

- Arwana Citramulia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesArwana Citramulia TBK.: Company Report: January 2019 As of 31 January 2019dindakharismaNo ratings yet

- CMNP SumDocument3 pagesCMNP SumadjipramNo ratings yet

- Akpi Ratio PDFDocument3 pagesAkpi Ratio PDFFaznikNo ratings yet

- SPMADocument3 pagesSPMAMade WinnerNo ratings yet

- LpgiDocument3 pagesLpgiSyafira FirdausiNo ratings yet

- Eratex Djaja TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesEratex Djaja TBK.: Company Report: January 2018 As of 31 January 2018Frederico PratamaNo ratings yet

- Global Mediacom TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesGlobal Mediacom TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Indofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesIndofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Aryanto ArNo ratings yet

- Barito Pacific TBKDocument3 pagesBarito Pacific TBKTaufik Hidayat LubisNo ratings yet

- Resource Alam Indonesia TBKDocument3 pagesResource Alam Indonesia TBKsriyupiagustinaNo ratings yet

- ASBI Idx EmitenDocument3 pagesASBI Idx EmitenRudi PramonoNo ratings yet

- Darya-Varia Laboratoria TBKDocument3 pagesDarya-Varia Laboratoria TBKArsyitaNo ratings yet

- BfinDocument3 pagesBfinjonisugandaNo ratings yet

- Almi PDFDocument3 pagesAlmi PDFyohannestampubolonNo ratings yet

- EkadDocument3 pagesEkadErvin KhouwNo ratings yet

- LAPORAN KEUANGAN 2020 CsapDocument3 pagesLAPORAN KEUANGAN 2020 CsapMT Project EnokNo ratings yet

- Kalbe Farma TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesKalbe Farma TBK.: Company Report: January 2019 As of 31 January 2019safiraNo ratings yet

- KLBFDocument3 pagesKLBFSHINTA ADHA MARISKANo ratings yet

- PP London Sumatra Indonesia TBKDocument3 pagesPP London Sumatra Indonesia TBKRIZAL HARDIANSYAHNo ratings yet

- Mustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Febrianty HasanahNo ratings yet

- Mrat PDFDocument3 pagesMrat PDFHENI OKTAVIANINo ratings yet

- BRPT 2014-2018Document3 pagesBRPT 2014-2018Abdur RohmanNo ratings yet

- RigsDocument3 pagesRigssulaiman alfadliNo ratings yet

- Alk - Fika - Tugas Ke 1Document3 pagesAlk - Fika - Tugas Ke 1fika rizkiNo ratings yet

- Bank CIMB Niaga TBKDocument3 pagesBank CIMB Niaga TBKEka FarahNo ratings yet

- WikaDocument3 pagesWikaParas FebriayuniNo ratings yet

- Wijaya Karya (Persero) TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesWijaya Karya (Persero) TBK.: Company Report: January 2019 As of 31 January 2019Hafidz RidloiNo ratings yet

- WikaDocument3 pagesWikaParas FebriayuniNo ratings yet

- Cost-Effective Pension Planning: Work in America Institute Studies in Productivity: Highlights of The LiteratureFrom EverandCost-Effective Pension Planning: Work in America Institute Studies in Productivity: Highlights of The LiteratureNo ratings yet

- HorngrenIMA14eSM ch07Document57 pagesHorngrenIMA14eSM ch07manunited83100% (3)

- Accountancy Sample Question PaperDocument8 pagesAccountancy Sample Question PaperSoNam ZaNgmoNo ratings yet

- Accounting Procedures and ConceptsDocument36 pagesAccounting Procedures and ConceptsIlwynFreiresGascal0% (1)

- F7-06 IAS 18 RevenueDocument10 pagesF7-06 IAS 18 Revenuesayedrushdi100% (1)

- Meghmani OrganicsDocument223 pagesMeghmani OrganicsReTHINK INDIANo ratings yet

- FSET TemplateDocument12 pagesFSET TemplatePrakriti ChaturvediNo ratings yet

- Chart of Accounts With DescriptionsDocument8 pagesChart of Accounts With DescriptionsKhan Mohammad100% (2)

- Summative Test-FABM2 2018-19Document3 pagesSummative Test-FABM2 2018-19Raul Soriano Cabanting0% (1)

- BookDocument190 pagesBookAnonymous e4KPPyl100% (1)

- CalcManual - DCFDocument91 pagesCalcManual - DCFJorge WillemsenNo ratings yet

- Diwan Case-Study Without WatermarkDocument3 pagesDiwan Case-Study Without WatermarkMohamed Ashraf0% (1)

- Revenue Receipts and Capital ReceiptsDocument17 pagesRevenue Receipts and Capital Receiptsvivek mishra100% (2)

- Accounting Terminology: By: Dr. Deepika Saxena Associate Professor, JIMSDocument20 pagesAccounting Terminology: By: Dr. Deepika Saxena Associate Professor, JIMSumangNo ratings yet

- Chapter 6 Solutions Comm 305Document31 pagesChapter 6 Solutions Comm 305mike0% (5)

- Baldwin Bicycle Company - Final Assignment - Group F - 20210728Document4 pagesBaldwin Bicycle Company - Final Assignment - Group F - 20210728ApoorvaNo ratings yet

- Tax On Corporation MaterialsDocument18 pagesTax On Corporation Materialsjdy managbanagNo ratings yet

- Income StatementDocument4 pagesIncome StatementBurhan AzharNo ratings yet

- Accounting QuestionsDocument16 pagesAccounting QuestionsPrachi ChananaNo ratings yet

- DocumentDocument17 pagesDocumentCharlene FiguracionNo ratings yet

- Reviewer in FabmDocument5 pagesReviewer in FabmJhoanna Elaine CuizonNo ratings yet

- Tax 2 ZedDocument16 pagesTax 2 ZedIsidore Tarol IIINo ratings yet

- Strategic Control Mechanism 1Document38 pagesStrategic Control Mechanism 1John Patrick Lazaro Andres80% (5)

- University Malaysia Kelantan (UMK) : Course NameDocument18 pagesUniversity Malaysia Kelantan (UMK) : Course NameshobuzfeniNo ratings yet

- Business Model CanvasDocument2 pagesBusiness Model CanvasNavin SidhuNo ratings yet

- SDocument8 pagesSdebate ddNo ratings yet

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- Term I Report - FA - Berger PaintsDocument8 pagesTerm I Report - FA - Berger PaintsSumant IssarNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- Co-Investor Letter H1 2014 3Document9 pagesCo-Investor Letter H1 2014 3HoseNo ratings yet

- ACCT 2301 PP CH 1Document41 pagesACCT 2301 PP CH 1Ela PelariNo ratings yet