Professional Documents

Culture Documents

SAP - SD - Whitepaper-Down Payment Request With Billing Plan

Uploaded by

smiti84Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAP - SD - Whitepaper-Down Payment Request With Billing Plan

Uploaded by

smiti84Copyright:

Available Formats

White Paper on Down Payment Request with reference to Billing Plan

Issue Description – SAP Invoices with reference to Contract to be created Regular timelines and in Future

timelines to reflect the Media and Entertainment Renewal/Subscription Business.

Key Tax/Finance Considerations:

a. Billing EUR from UK Entity with GBP functional currency creates FX exposure between

invoice date and the payment date

b. Deferred Revenue should not be recorded until payment is received or subscription

period has started

Fix –

Current Functionality

The Subscription orders in the system are with the current start date as billing date and if any future date

orders are processed in the system will have a billing in future.

There is no functionality of Down payment request in the current system or any deferred revenue possibility.

Desired Functionality

Send a pro-forma invoice to request payment in advance of service period.

Invoice should look that same as a firm invoice except noted as “not a Tax invoice”.

Noted items in AR for collections, but not posted to General Ledger or Tax. A/R is held in the billing

entity until next step

Generate a firm invoice upon earlier of payment receipt or subscription start (to coincide with

transfer of receivable to IP owners)

If payment is received, invoice will show the applied payment amount and balance due

If payment is not received, but subscription period started, the firm invoice is generated with

balance due referencing the original invoice number.

when payment is received after the subscription period start, there will be FX differences between

date of firm invoice (start of sub) and payment

UK issued invoices subject to VAT tax require the final firm VAT invoice to be sent to the customer

US issued invoices should send advance invoice only, with firm invoice created in system to post

to GL and trigger intercompany, but not sent to customer.

Deferred Revenue, Tax and AR are recorded at FX spot rate. If paid, AR is cleared immediately.

No FX gain/loss.

Intercompany will be created to transfer revenue to IP entity at time of the firm invoice.

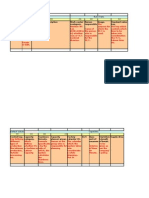

1) Billing Due List standard. : to be enhanceed for adding sales office exmaple below. VF04

2) Control the FAZ Requirement

Need to include the Logic in LV60A007 ( Copying requirements Billing ) or create a new one for

checking if the FAZ exists for the Contract order else create FAZ billing.

3) Billing Date logc in User-Exit “EXIT_SAPLV60F_001” to populate the “Billing Plan – Billing date”

field (FPLT-AFDAT)

a. For all Contract Orders with Sales office Billing Plan -Billing date will be Current date of

Order Creation even if the Contract date is in Past or Future. Billing plan –Billing date will

be VBKD-FKDAT from the Billing Tab instead of Order Creation logic )

b. Identify the payment based on the down payment FAZ. No checking on the Payment

during the Order creation . Once the Payment if receivedd from Customer against the FAZ

the Order needs to be updated with Billing Plan Date as Payment receipt date.

4) RAR Billing

AWZR condition type copy from order to down payment request and ZF2 (AR)

· Condition type “AWZR” should be copied from Contract order to Down payment request (FAZ)

· Condition type “AWZR” should be copied from down payment request.

Down Payment Request.

Down Payment request (FAZ) uses billing Rule (milestone billing) “4 or 5”. Update the Billing rule during

the FAZ and ZF2 creation as “ 4 - Down payment in milestone billing on percentage basis” from “6”.

No Changes to configuration - Routine 023 and 008 are used.

When Customer Pays the Down Payment request it includes the Tax amount . One Source updates the

Tax amount on the Down Payment in Fixed Feed Condition. Since it’s a fixed fee and Tax GL is similar to

Billing GL implement below Logic.

If TAXIT = X then copy the Account Key from ZF2 – Tax line to Down Payment line.

If the Tax Amount ZIFT = 0 then no chages to KBERT else Update the KBERT to 100%.

You might also like

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Pure Down Payments in A Standard OrderDocument32 pagesPure Down Payments in A Standard Ordervalis73No ratings yet

- Sap FiDocument4 pagesSap FiNicky AugustineNo ratings yet

- Search String - Part 1Document5 pagesSearch String - Part 1Kenisha KhatriNo ratings yet

- Sap Fico: About The TrainerDocument5 pagesSap Fico: About The TrainerkhushbooNo ratings yet

- STODocument4 pagesSTOSachin BhalekarNo ratings yet

- Search String Basics: Scenario-1: Trading Partner Update in Inter-Company GL AccountDocument6 pagesSearch String Basics: Scenario-1: Trading Partner Update in Inter-Company GL AccountKenisha KhatriNo ratings yet

- CAPEX Acquisition ProcessDocument5 pagesCAPEX Acquisition ProcessRajaIshfaqHussainNo ratings yet

- Sap Fico DemoDocument13 pagesSap Fico DemokprakashmmNo ratings yet

- 1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?Document163 pages1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?sudhakarNo ratings yet

- MM - Down Payment RequestDocument8 pagesMM - Down Payment RequestSUBHOJIT BANERJEENo ratings yet

- How Central Finance System Handles The Inbound Messages by AIFDocument9 pagesHow Central Finance System Handles The Inbound Messages by AIFRaju Raj RajNo ratings yet

- Zshow Man Fi Docs On Stock AccDocument7 pagesZshow Man Fi Docs On Stock Accmy291287No ratings yet

- Unit 1: Business Consolidation With SAP Group Reporting OverviewDocument3 pagesUnit 1: Business Consolidation With SAP Group Reporting Overviews4hanasd 1809No ratings yet

- SAPGUI Release NotesDocument14 pagesSAPGUI Release NotesPratik ChaudhariNo ratings yet

- Q. 01 Explain The Client Concept of SAP?Document35 pagesQ. 01 Explain The Client Concept of SAP?Nithin JosephNo ratings yet

- SAP Easy Access - SAP Training and CertificationDocument16 pagesSAP Easy Access - SAP Training and Certificationfiestamix100% (1)

- Sap FIDocument9 pagesSap FIGayatri PandaNo ratings yet

- All About Internal Order in SAPDocument4 pagesAll About Internal Order in SAPTito TalesNo ratings yet

- Preparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsDocument25 pagesPreparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsarunvisNo ratings yet

- Down Payments - ERP SCM - SCN WikiDocument8 pagesDown Payments - ERP SCM - SCN WikiMuhammad NassrNo ratings yet

- Inter Company Billing Configuration PDFDocument10 pagesInter Company Billing Configuration PDFAnanthakumar ANo ratings yet

- Account Determination From SDDocument9 pagesAccount Determination From SDDamodar GaliNo ratings yet

- Sap GST Sample 26.02.2018Document26 pagesSap GST Sample 26.02.2018manas dasNo ratings yet

- CopaDocument11 pagesCopaHeamanth Kkumar ChiittibommaNo ratings yet

- Asset Creation in Plant MaintenanceDocument23 pagesAsset Creation in Plant MaintenanceRabindra Kumar SahuNo ratings yet

- BTE (How To)Document16 pagesBTE (How To)emc_cefre1735No ratings yet

- DebuggingDocument23 pagesDebuggingRAMNo ratings yet

- CustomizingDocument6 pagesCustomizingMurdum MurdumNo ratings yet

- Learn SAP FICO in 1 Day: ALL RIGHTS RESERVED. No Part of This Publication May BeDocument20 pagesLearn SAP FICO in 1 Day: ALL RIGHTS RESERVED. No Part of This Publication May BeSainath 149No ratings yet

- Section 9: Reporting On Line Items: Transaction KSB1 - Display Actual Cost Line Items For Cost CentresDocument24 pagesSection 9: Reporting On Line Items: Transaction KSB1 - Display Actual Cost Line Items For Cost CentresAnil ReddyNo ratings yet

- Activate Open Item Management For GL Account-1Document11 pagesActivate Open Item Management For GL Account-1Vishal KumarNo ratings yet

- EBRS by Ranga SwamyDocument17 pagesEBRS by Ranga SwamyamarnathreddylNo ratings yet

- Consultancy For Customization and Configuration of SAP FI and MM at FBRDocument29 pagesConsultancy For Customization and Configuration of SAP FI and MM at FBRFurqanNo ratings yet

- Business Transaction Events (BTE) - OverviewDocument3 pagesBusiness Transaction Events (BTE) - Overviewravindramalviya3145No ratings yet

- Define Company Code PDFDocument2 pagesDefine Company Code PDFDipeshNo ratings yet

- SAP FIORI System NavigationDocument13 pagesSAP FIORI System NavigationIrinaElenaCososchiNo ratings yet

- Initiate and Complete A Journal Entry Document Via Park Document (Document Types SA or ZB)Document18 pagesInitiate and Complete A Journal Entry Document Via Park Document (Document Types SA or ZB)Padma NagaNo ratings yet

- SAP Internet SalesDocument34 pagesSAP Internet Salesmanindra_tiwariNo ratings yet

- Bonus Depreciation in 2010Document9 pagesBonus Depreciation in 2010Neelesh KumarNo ratings yet

- Checklist For VAT Rate Changes in SAP - Tax Management ConsultancyDocument3 pagesChecklist For VAT Rate Changes in SAP - Tax Management Consultancyfairdeal2k1No ratings yet

- Basic Settings Notes of SAP FICODocument2 pagesBasic Settings Notes of SAP FICOshubhamNo ratings yet

- Accounts Payable & APP (Accounts Payment Program) - VenkateshbabuDocument40 pagesAccounts Payable & APP (Accounts Payment Program) - VenkateshbabuVenkatesh BabuNo ratings yet

- F-02 General DoumentDocument9 pagesF-02 General DoumentP RajendraNo ratings yet

- Regenration of COPA Documents-After Change of Sales Order Key Fields-Nov2015Document9 pagesRegenration of COPA Documents-After Change of Sales Order Key Fields-Nov2015Shravan DaraNo ratings yet

- Month-End Closing Is A ProcedureDocument25 pagesMonth-End Closing Is A ProcedureSR-Manas KumarNo ratings yet

- First Steps in Sap Production Processes PPDocument6 pagesFirst Steps in Sap Production Processes PPMichael Platt OlabodeNo ratings yet

- Check Enter Company Code Global Parameters in Sap PDFDocument7 pagesCheck Enter Company Code Global Parameters in Sap PDFAMIT AMBRENo ratings yet

- SD RevRec MigrationDocument11 pagesSD RevRec MigrationAlina Cristina VranceanuNo ratings yet

- House BanksDocument24 pagesHouse BanksNarsimha Reddy YasaNo ratings yet

- Sap Fi Ques N AnswersDocument67 pagesSap Fi Ques N AnswersRANAGADONGA100% (1)

- Prop Class Method D. B Rate Year FactorDocument9 pagesProp Class Method D. B Rate Year FactorracesapNo ratings yet

- Year End Closing in Asset AccountingDocument8 pagesYear End Closing in Asset AccountingudayredekarNo ratings yet

- Integration Layout TXT Suministrolr Aeat Sii v5Document53 pagesIntegration Layout TXT Suministrolr Aeat Sii v5Murdum MurdumNo ratings yet

- SAP NetWeaver Business Warehouse A Complete Guide - 2021 EditionFrom EverandSAP NetWeaver Business Warehouse A Complete Guide - 2021 EditionNo ratings yet

- A Division Is Used To Represent The Way in Which Goods and Services Are Distributed To CustomersDocument33 pagesA Division Is Used To Represent The Way in Which Goods and Services Are Distributed To Customerssmiti84No ratings yet

- TS460 1909-QnADocument30 pagesTS460 1909-QnAsmiti84No ratings yet

- Vendor: SAP Exam Code: C - TSCM62 - 66 Exam Name: SAP Certified Application Associate - SalesDocument6 pagesVendor: SAP Exam Code: C - TSCM62 - 66 Exam Name: SAP Certified Application Associate - Salessmiti84No ratings yet

- To Create A Quotation With Reference To An Inquiry, The Corresponding Copying Control Must First Be Configured in CustomizingDocument37 pagesTo Create A Quotation With Reference To An Inquiry, The Corresponding Copying Control Must First Be Configured in Customizingsmiti84No ratings yet

- WorkflowDocument1 pageWorkflowsmiti84No ratings yet

- DropShip Scenario ConfigurationDocument5 pagesDropShip Scenario Configurationsmiti840% (1)

- Work FlowDocument2 pagesWork Flowsmiti84No ratings yet

- InterCompany Billing IDocDocument31 pagesInterCompany Billing IDocAnurag Verma100% (2)

- PP Routing TemplateDocument2 pagesPP Routing Templatesmiti84No ratings yet

- PP Routing TemplateDocument2 pagesPP Routing Templatesmiti84No ratings yet

- Material Old Material No. MRP Group: Raw Sheet Sheet Raw Struc Structure Bo Mech Bomech Boelec BoeleDocument17 pagesMaterial Old Material No. MRP Group: Raw Sheet Sheet Raw Struc Structure Bo Mech Bomech Boelec Boelesmiti84No ratings yet

- WC TemplateDocument3 pagesWC Templatesmiti84No ratings yet

- Chapter 8 6Document116 pagesChapter 8 6Yogesh SharmaNo ratings yet

- Motor Vehicle Registration and Post Registration Transaction - Excise & TaxationDocument4 pagesMotor Vehicle Registration and Post Registration Transaction - Excise & TaxationAltaf Ur RahmanNo ratings yet

- Rebate: Due DateDocument2 pagesRebate: Due DateRakesh Dey sarkarNo ratings yet

- Chase Statement 28032021Document4 pagesChase Statement 28032021yungler0% (2)

- Rmo 29-2014 Annex ADocument1 pageRmo 29-2014 Annex AteekeiseeNo ratings yet

- Penawaran Charlie HospitalDocument6 pagesPenawaran Charlie Hospitalmunirul anamNo ratings yet

- Tax ComprehensiveDocument11 pagesTax ComprehensiveDawn digolNo ratings yet

- Customer Inquiry ReportDocument10 pagesCustomer Inquiry ReportDokter riskiNo ratings yet

- Archived Statement PDFDocument3 pagesArchived Statement PDFJohn-EdwardNo ratings yet

- First Citizens Checking: Important Account InformationDocument3 pagesFirst Citizens Checking: Important Account InformationAbhishek VNo ratings yet

- Renewal Notice: Policy No.P/141126/01/2019/003974Document1 pageRenewal Notice: Policy No.P/141126/01/2019/003974manoharNo ratings yet

- Understanding The Letter of Credit Process: What Every Exporter Needs To KnowDocument34 pagesUnderstanding The Letter of Credit Process: What Every Exporter Needs To KnowMuhammadSohailNo ratings yet

- RB Statement 2022 12 12 448307994Document15 pagesRB Statement 2022 12 12 448307994akhbar akhbar0% (1)

- 5) BL Corrector y Manifiesto de CargaDocument3 pages5) BL Corrector y Manifiesto de CargaKevin Yair FerrerNo ratings yet

- XXXXXXX 1029Document18 pagesXXXXXXX 1029Jamaluddin GauriNo ratings yet

- BPI Express Online PDFDocument2 pagesBPI Express Online PDFAce ViarNo ratings yet

- CFR PDFDocument11 pagesCFR PDFNana SutisnaNo ratings yet

- Appendix 35 RCIDocument6 pagesAppendix 35 RCIJan Mikel RiparipNo ratings yet

- State Bank of Pakistan (8)Document1 pageState Bank of Pakistan (8)Corporate IncomeNo ratings yet

- High-Speed Rail Freight Sub-Report in Efficient Train Systems For Freight TransportDocument93 pagesHigh-Speed Rail Freight Sub-Report in Efficient Train Systems For Freight Transportwizz33No ratings yet

- Brian Le Sar and David Porteous (2013) - "Introduction To The National Payments SystemDocument2 pagesBrian Le Sar and David Porteous (2013) - "Introduction To The National Payments SystemShemair LewisNo ratings yet

- Picop VS CaDocument17 pagesPicop VS CaQuennie Jane SaplagioNo ratings yet

- Business and Income TaxationDocument58 pagesBusiness and Income TaxationFrancisNo ratings yet

- RTGSDocument1 pageRTGSsales Celsol57% (21)

- Transport ModeDocument5 pagesTransport ModeDrinkwell AccountsNo ratings yet

- Week 2 - 1Document8 pagesWeek 2 - 1Bala MuruganNo ratings yet

- Q-Arsi-0319-0868 EmailDocument4 pagesQ-Arsi-0319-0868 EmailDimasBagusRukhmantiarnoNo ratings yet

- Invoice-PAYHOST - 4287 PDFDocument1 pageInvoice-PAYHOST - 4287 PDFdoge redNo ratings yet

- Chapter-20 Inventory ManagementDocument20 pagesChapter-20 Inventory ManagementPooja SheoranNo ratings yet

- F&A Best - SAPOSTDocument23 pagesF&A Best - SAPOSTsheikh arif khan100% (2)