Professional Documents

Culture Documents

Sem-V - Principles of Taxation Law

Uploaded by

Naveen Sihare0 ratings0% found this document useful (0 votes)

123 views2 pagesThis document outlines the modules and units covered in a semester-long course on Principles of Taxation Law. The course covers topics such as the meaning and types of taxes, the difference between direct and indirect taxes, taxation under the Indian Constitution, canons of taxation, definitions for tax-related terms, the charge of income tax, residential status, the scope of total income, deductions, income from salaries, income from house property, income from business/profession, tax avoidance and evasion, tax authorities, an overview of customs duty, GST, and the prescribed textbooks for the course.

Original Description:

P

Original Title

Sem-V_Principles of Taxation Law

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the modules and units covered in a semester-long course on Principles of Taxation Law. The course covers topics such as the meaning and types of taxes, the difference between direct and indirect taxes, taxation under the Indian Constitution, canons of taxation, definitions for tax-related terms, the charge of income tax, residential status, the scope of total income, deductions, income from salaries, income from house property, income from business/profession, tax avoidance and evasion, tax authorities, an overview of customs duty, GST, and the prescribed textbooks for the course.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

123 views2 pagesSem-V - Principles of Taxation Law

Uploaded by

Naveen SihareThis document outlines the modules and units covered in a semester-long course on Principles of Taxation Law. The course covers topics such as the meaning and types of taxes, the difference between direct and indirect taxes, taxation under the Indian Constitution, canons of taxation, definitions for tax-related terms, the charge of income tax, residential status, the scope of total income, deductions, income from salaries, income from house property, income from business/profession, tax avoidance and evasion, tax authorities, an overview of customs duty, GST, and the prescribed textbooks for the course.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

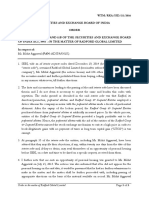

PRINCIPLES OF TAXATION LAW (SEMESTER - V)

Module-I: Introduction

Unit-1: Meaning of Tax

a. Types of Tax

b. Difference between Direct Tax and Indirect Tax

c. Characteristics of Tax, Fee and its differences

d. Difference between Tax and Duty

e. Concept of Cess and Surcharge

f. Principle of Ability/Capacity to pay

Unit-2: Taxation under the Indian Constitution

(Article-265, 246 & Specific Entries of Schedule-VII)

Unit-3: Canons of Taxation by Adam Smith and Additional/Modern Canons

Module-II: General Perspective

Unit-1: Important Definitions

a. Previous Year f. Company

b. Assessment Year g. Average Rate of Income Tax

c. Income h. Business

d. Assesse i. Capital Asset

e. Person j. Total Income

Unit 2: Charge (Section 4)

Unit-3: Residential Status of Assesse

Unit-4: Scope of Total Income

Unit-5: Basic Concept of Total Deduction at Source (TDS)

Unit-6: Agricultural Income and Its Tax Treatment

Module-III: Income from Salaries

Unit-1: Meaning and Characteristics of Salary

Unit-2: Relationship of Employer and Employee

Unit-4: Incomes Forming Part of Salary

(a. Basic Salary b. Fees, Commission and Bonus c. Taxable Value of Allowances d. Taxable Value

of Perquisites e. Retirement Benefit)

Unit-5: Deductions from Gross Salary (Section 16 and 80)

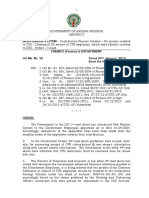

Module-IV: Income from House Property

Unit-1: Basis of Charge (Section 22)

Unit-2: Applicability of Section 22 (Buildings or lands appurtenant thereto, Ownership of house

property, Property used for own business or profession, Rental income of a dealer in

house property, House property in a foreign country)

Unit-3: Deduction from Income from House Property

Module-V: Income from Profit and Gains of Business or Profession

Unit-1: Concept of Profit and Gains

Unit-2: scope of Section 28 (Basis of Charge)

Unit-3: Business, Profession and Vocation

Unit-5: Different Deductions under This Head

a. Schemes of Business Deductions

b. Specific Deductions under this Act

c. Deductions under sections 30 & 31

Module-VI: Tax Avoidance, Tax Evasion and Tax Planning

Unit-1: Basic Concept of Tax Avoidance, Tax Evasion and Tax Planning

Unit-2: Reason of Tax Avoidance, Tax Evasion

Unit-3: Distinction between Tax Avoidance and Tax Evasion

Unit-4: Recommendation of Wanchoo Committee to Fight Tax Evasion

Unit-5: Effect of Tax Avoidance and Tax Evasion

Module –VII Income Tax Authorities

Unit-1: Hierarchy

Unit-2: Appointment

Unit-3: Powers: Search and Seizure- Section 132

a. Fulfillment of statutory Conditions

b. Test of ‘Reason to believe’

Module-VIII: Miscellaneous

Unit-1: An Overview of Custom Duty

Unit-2: Introduction to DTC Bill

Unit-3: Basic Concept of GST

Prescribed Books:

1. A C Sampath Iyengar, The Law of Income Tax, Bharat Law House

2. Chaturvedi and Pithisaria’s Income Tax Law

3. Girish Ahuja & Ravi Gupta, Direct Tax- Law and Practice

4. Girish Ahuja & Ravi Gupta, Direct Taxes Ready Reckoner (Bharat Publication)

5. Kanga, Palkhiwala and Vyas, The Law and Practice of Income Tax (Lexis Nexis

Butterworths)

6. Vinod K Singhania and Kapil Singhania, Taxman’s Direct Tax- Law and Practice.

You might also like

- Sem-V - Principles of Taxation LawDocument2 pagesSem-V - Principles of Taxation LawChoudhary Shadab phalwan100% (1)

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation Lawyogasri gNo ratings yet

- Sem-V Principle of Taxation LawDocument3 pagesSem-V Principle of Taxation LawAnantHimanshuEkkaNo ratings yet

- Sem-V Principle of Taxation Law PDFDocument3 pagesSem-V Principle of Taxation Law PDFAnantHimanshuEkkaNo ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawTaraChandraChouhanNo ratings yet

- LLB - Principles of Taxation LawDocument3 pagesLLB - Principles of Taxation LawVinay SahuNo ratings yet

- Syllabus of Principle of Taxation Law For BALLB V SemesterDocument3 pagesSyllabus of Principle of Taxation Law For BALLB V SemesterYashNo ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawAnantHimanshuEkkaNo ratings yet

- Paper - Vii TaxationDocument350 pagesPaper - Vii TaxationvengaidjNo ratings yet

- DTaxation PDFDocument808 pagesDTaxation PDFcoolmanzNo ratings yet

- Definition or Concept of TaxationDocument24 pagesDefinition or Concept of TaxationJustine DagdagNo ratings yet

- M Com Tax PDFDocument336 pagesM Com Tax PDFakshNo ratings yet

- Direct Tax - 2011Document494 pagesDirect Tax - 2011vinagoyaNo ratings yet

- Income Tax IDocument4 pagesIncome Tax InishatNo ratings yet

- Law of Direct TaxationDocument4 pagesLaw of Direct TaxationAshwanth M.SNo ratings yet

- Tax 1 Vthsem Module 1,2, and 3Document97 pagesTax 1 Vthsem Module 1,2, and 3Sahana narayanNo ratings yet

- Taxation Law Review SyllabusDocument14 pagesTaxation Law Review SyllabusRoxanne Peña100% (2)

- Direct TaxationDocument760 pagesDirect TaxationCalmguy Chaitu75% (4)

- Applied Direct Taxation Paper-7 Inter GR (1) .1Document552 pagesApplied Direct Taxation Paper-7 Inter GR (1) .1aliNo ratings yet

- Principles of TaxationDocument7 pagesPrinciples of TaxationNishant RajNo ratings yet

- Rsm324 Week 1Document18 pagesRsm324 Week 1Rudy GuNo ratings yet

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- School of Distance EducationDocument3 pagesSchool of Distance EducationDilip Sankar Parippay NeelamanaNo ratings yet

- Semester IIIDocument5 pagesSemester IIIayusharma1608No ratings yet

- CMA Inter Direct Tax Summary NotesDocument62 pagesCMA Inter Direct Tax Summary Notesamit kathait100% (3)

- Income Tax Law and Practice Renaissance Law College NotesDocument169 pagesIncome Tax Law and Practice Renaissance Law College NotesSiddhesh Vyas100% (1)

- SyllabusDocument1 pageSyllabusIsha KhuranaNo ratings yet

- Silabus Perpajakan 1 3 SKS REVISI 030219Document8 pagesSilabus Perpajakan 1 3 SKS REVISI 030219Baguz RyandraNo ratings yet

- U1A OverviewDocument7 pagesU1A Overview4mggxj68cyNo ratings yet

- SLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Document308 pagesSLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Deva T NNo ratings yet

- Aaa TAXDocument13 pagesAaa TAXLeyy De GuzmanNo ratings yet

- Public Finance and Taxation - 1 Nbaa Cpa-1Document265 pagesPublic Finance and Taxation - 1 Nbaa Cpa-1Osmund100% (1)

- III B.com. - 18UCOE2 - Dr. R Sathru Sankara VelsamyDocument132 pagesIII B.com. - 18UCOE2 - Dr. R Sathru Sankara VelsamyDebdeep C.No ratings yet

- TAX OutlineDocument42 pagesTAX Outlineabmo33No ratings yet

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- Business TaxationDocument319 pagesBusiness TaxationsiddheshNo ratings yet

- Public CHAPTER 4Document15 pagesPublic CHAPTER 4embiale ayaluNo ratings yet

- Income Tax Unit-1 PDFDocument12 pagesIncome Tax Unit-1 PDFAnirban ThakurNo ratings yet

- Taxation BookDocument490 pagesTaxation BookMukund PatelNo ratings yet

- App Dirt Ax 6Document490 pagesApp Dirt Ax 6Prem Anand KidambiNo ratings yet

- V Sem It Course Plan 2011Document4 pagesV Sem It Course Plan 2011Rohith MaheswariNo ratings yet

- Tax Final Book With Cover Page 4th Sem 2021Document134 pagesTax Final Book With Cover Page 4th Sem 2021H 0140 sayan sahaNo ratings yet

- Kratzke FedIncTax Fall 2010Document51 pagesKratzke FedIncTax Fall 2010dezraty14088No ratings yet

- Income TaxDocument109 pagesIncome TaxDaksh KohliNo ratings yet

- Icwa Inter FoundationDocument760 pagesIcwa Inter FoundationSunil Babu100% (1)

- LMR Tax Laws and PracticeDocument49 pagesLMR Tax Laws and PracticeGayathri MageshNo ratings yet

- Direct Taxation Paper-I - Course Outline - RahulDocument9 pagesDirect Taxation Paper-I - Course Outline - RahulABHIJEETNo ratings yet

- Sde 665Document123 pagesSde 665amritNo ratings yet

- Direct Tax - Likely QuestionsDocument4 pagesDirect Tax - Likely QuestionsVaishnaviNo ratings yet

- Income Tax Vol-2 48th EditionDocument540 pagesIncome Tax Vol-2 48th EditionVipul VatsNo ratings yet

- Taxation Laws - IDocument5 pagesTaxation Laws - IAadya AmbasthaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Shri Rawatpura Sarkar University Raipur (C.G.) : (Effective From The Session: 2023-24)Document10 pagesShri Rawatpura Sarkar University Raipur (C.G.) : (Effective From The Session: 2023-24)Naveen SihareNo ratings yet

- Social Media and Freedom of Speech Ad ExpressionDocument16 pagesSocial Media and Freedom of Speech Ad ExpressionNaveen SihareNo ratings yet

- Data Protection Law in IndiaDocument3 pagesData Protection Law in IndiaNaveen SihareNo ratings yet

- 0 2 1 5 (S.B. Sinha, J.) : Dabur India Ltd. v. K.R. IndustriesDocument13 pages0 2 1 5 (S.B. Sinha, J.) : Dabur India Ltd. v. K.R. IndustriesNaveen SihareNo ratings yet

- Need For Law On Genocide in India ADocument20 pagesNeed For Law On Genocide in India ANaveen SihareNo ratings yet

- Semester - VI (C) (Batch-XIII) ), Subject: Alternative Dispute Resolution Course Teacher: Ms. Tulika ShreeDocument3 pagesSemester - VI (C) (Batch-XIII) ), Subject: Alternative Dispute Resolution Course Teacher: Ms. Tulika ShreeNaveen SihareNo ratings yet

- Thank You For Buying From ABC Book Kart: Pranav VaidyaDocument1 pageThank You For Buying From ABC Book Kart: Pranav VaidyaNaveen SihareNo ratings yet

- Ights of Rrested Erson: Project Submitted ToDocument3 pagesIghts of Rrested Erson: Project Submitted ToNaveen SihareNo ratings yet

- Call For Papers Colonial Law 2016Document2 pagesCall For Papers Colonial Law 2016Naveen SihareNo ratings yet

- Sem8 Trademark PriyanshuGupta 102 ProjectDocument45 pagesSem8 Trademark PriyanshuGupta 102 ProjectNaveen Sihare100% (1)

- Ambit of The Disaster Management Act, 2005Document3 pagesAmbit of The Disaster Management Act, 2005Naveen SihareNo ratings yet

- Freedom of Speech and ExpressionDocument6 pagesFreedom of Speech and ExpressionNaveen SihareNo ratings yet

- Admin Law Syllabus 2016Document3 pagesAdmin Law Syllabus 2016Naveen SihareNo ratings yet

- Ights of Rrested ErsonDocument20 pagesIghts of Rrested ErsonNaveen SihareNo ratings yet

- Indian Judiciary in The Area of Freedom of Speech and Expression and MediaDocument45 pagesIndian Judiciary in The Area of Freedom of Speech and Expression and MediaNaveen SihareNo ratings yet

- Lecture Week 14Document23 pagesLecture Week 14XS3 GamingNo ratings yet

- How Is Inflation Calculated?Document2 pagesHow Is Inflation Calculated?Omkar SheteNo ratings yet

- Analysis of Balancesheet ItlDocument78 pagesAnalysis of Balancesheet Itlnational coursesNo ratings yet

- Confirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Document3 pagesConfirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Shyam SunderNo ratings yet

- WHT ManualDocument166 pagesWHT ManualFaizan HyderNo ratings yet

- History of Mutual FundDocument2 pagesHistory of Mutual FundArchana VishwakarmaNo ratings yet

- P2 2aDocument3 pagesP2 2aSakib Ul-abrarNo ratings yet

- Unit 20 and 21 - Derivatives and CommoditiesDocument6 pagesUnit 20 and 21 - Derivatives and CommoditiesHemant bhanawatNo ratings yet

- Market Outlook 13th January 2012Document6 pagesMarket Outlook 13th January 2012Angel BrokingNo ratings yet

- Somaliland Revenue Act 2016 English v2Document129 pagesSomaliland Revenue Act 2016 English v2Mohamed DaudNo ratings yet

- Bylaws 2011 Amended 8-1-11Document9 pagesBylaws 2011 Amended 8-1-11cadmorNo ratings yet

- Entrepreneurial Exit As A Critical Component of The Entrepreneurial ProcessDocument13 pagesEntrepreneurial Exit As A Critical Component of The Entrepreneurial Processaknithyanathan100% (2)

- Indian Money MarketDocument11 pagesIndian Money MarketPradeepKumarNo ratings yet

- 6 Advanced Accounting 2DDocument3 pages6 Advanced Accounting 2DRizky Nugroho SantosoNo ratings yet

- Olam Brokers' ReportDocument9 pagesOlam Brokers' Reportsananth60100% (1)

- Nepse Chart - Nepal Stock InformationDocument2 pagesNepse Chart - Nepal Stock InformationkabyaNo ratings yet

- Chapter 31,32,33Document9 pagesChapter 31,32,33Cherie Soriano AnanayoNo ratings yet

- The Great U.S. Fiat Currency FRAUDDocument7 pagesThe Great U.S. Fiat Currency FRAUDin1or100% (1)

- Goals GaloreDocument15 pagesGoals GaloreSandra_ZimmermanNo ratings yet

- Final Draft of AcceptanceDocument14 pagesFinal Draft of AcceptanceAditya JoshiNo ratings yet

- Powers of Minnesota State Chartered Banks: A Financial Examinations Division PublicationDocument16 pagesPowers of Minnesota State Chartered Banks: A Financial Examinations Division PublicationHeyYoNo ratings yet

- Gyanendra ResumeDocument1 pageGyanendra ResumeGyanendra BhadouriaNo ratings yet

- Marketing Digest PDFDocument26 pagesMarketing Digest PDFRia SinghNo ratings yet

- Research ProposalDocument4 pagesResearch Proposalsalman100% (2)

- TransactionHistory 3236776565Document2 pagesTransactionHistory 3236776565Badrulsyafiq -No ratings yet

- Harry MarkowitzDocument36 pagesHarry MarkowitzRana Uzair Saleem100% (1)

- Mycem CementDocument89 pagesMycem CementushadgsNo ratings yet

- Go.22 Da Arrears of CPS Account in CashDocument4 pagesGo.22 Da Arrears of CPS Account in CashVenkatadurgaprasad GopamNo ratings yet

- BMATH 3rd Quarter Short and Long QuizDocument128 pagesBMATH 3rd Quarter Short and Long QuizEstephanie Abadz73% (11)

- Financial Analysis of A Selected CompanyDocument20 pagesFinancial Analysis of A Selected CompanyAmid Abdul-Karim100% (1)