Professional Documents

Culture Documents

1 Annual Internal Audit Report NH 201819

Uploaded by

api-205664725Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 Annual Internal Audit Report NH 201819

Uploaded by

api-205664725Copyright:

Available Formats

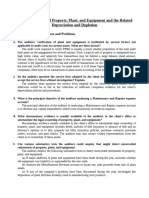

&mmua$ lruterma$ Audit Report SfitBfts

NEW HUTTON PARISH COUNCIL

This authority's internal auditor, acting independently and on the basis of an assessment of risk,

carried out a selective assessment of compliance with relevant procedures and controls to be in

operation during the financialyear ended 31 March 2019.

The internai audit for 2018/'t9 has been carried out in accordance with this authority's needs

and planned coverage. On the basis of the findings in the areas examined, the internal audit

conclusions are sumrnarised in this table. Set out below are the objectives of internal control

and alongside are ihe internal audit conclusions on whether, in all significant respects, the control

ob.lectives were being achieved throughout the financlal year to a standard adequate to rneet the

needs of this authority"

A. Appropriate accounting records have been properly kept throughout the financial year" {

B. This authority complied with its financial regulations, payments were supported by invoices, all

expenditure was approved and VAT was appropriately accounted for.

C. This authority assessed the significant risks to achieving its objectives and reviewed the adequacy

of arrangements to manage these.

D. The precept or rates requirement resulted from an adequate budgetary process; progress against

the budget was regularly monitored; and reserves were appropriate.

E. Expected income was fully received, based on conect prices, properly recorded and promptly

banked; and VAT was appropriately accounted for.

F. Petty cash payments were properly supported by receipts, all petty cash expenditure was

approved and VAT appropriately accounted for.

G. Salaries to employees and allowances to members were paid in accordance with this authority's

approvals, and PAYE and Nl requirements were properly applied.

h{. Asset and investments registers were complete and accurate and properly maintained.

I. Periodic and year-end bank account reconciiiations were properly carried out.

J. Accounting statements prepared during the year were prepared on the correct accounting basis

(receipts and payments or income and expenditure), agreed to the cash book, supported by an

adequate audit trail from underlying records and where appropriate debtors and creditors were

properly recorded.

K. lF the authority certified itself as exemptfom a limited assurance review in 2017118, it met the

exemption criteria and conectly declared itself exempt. ('Not Covered" shauld only be ticked

where the authority had a limited assurance review of its 2017/18 AGAR)

L. During summer 2018 this authority has correctly provided the proper opportunity for

the exercise of public rights in accordance with the requirements of the Accounts and

Audit Regulations. {

For any other risk areas identified by this authority adequate controls existed (list any other risk areas on separate sheets if needed).

Date(s) internal audii undeftaken l.lame of person vrho cai-ried out ihe internal audit

14!fi2ft41s Itlathew fllwoad

.?-isl I t'l

Sigrrature of person who

garried *ut the internal audit Date

"lf lhe response is'no'please state the implicatians and action being taken to arlcress anv weakness in control identified

(add separate sheets if needed).

*"Note: lf the response is 'nat covei"ed' please state when the mo$l recent internal audii work was done in this area and when it is

next planned. or, tf correrage is nct iequired. ihe annual internal audit report musi expiain why not (add separate sheets if needed)"

Annual Governance and Accountabiiity Return 2A1Bl19 Part 2 Page 4 of 6

Local Councils, lniernal Drainage Eoards and other SmallerAuthorities

You might also like

- Agar Oh Annual Internal Audit Report 2019-20Document1 pageAgar Oh Annual Internal Audit Report 2019-20api-205664725No ratings yet

- Agar NH Annual Governance Statement 2019-20Document1 pageAgar NH Annual Governance Statement 2019-20api-205664725No ratings yet

- All Audit Papers 2021Document7 pagesAll Audit Papers 2021api-317438049No ratings yet

- Management's Responsibility For The Financial ReportDocument3 pagesManagement's Responsibility For The Financial ReportNazim Uddin MahmudNo ratings yet

- 2 Annual Governance Statement NH 201819Document1 page2 Annual Governance Statement NH 201819api-205664725No ratings yet

- Auditing and Assurance ServicesDocument49 pagesAuditing and Assurance Servicesgilli1tr100% (1)

- Lira District Report of The Auditor General 2015 PDFDocument59 pagesLira District Report of The Auditor General 2015 PDFlutos2No ratings yet

- AARS Solution Class Test 1 FinalDocument3 pagesAARS Solution Class Test 1 FinalWaseim KhanNo ratings yet

- Governance, Business Ethics, Ris MNGT, & Internal Conrol QuizDocument3 pagesGovernance, Business Ethics, Ris MNGT, & Internal Conrol Quizsharon5lotinoNo ratings yet

- Midterm - Exam PDFDocument16 pagesMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Audit ManualDocument10 pagesAudit ManualSusan PascualNo ratings yet

- Chapter 15Document25 pagesChapter 15cruzchristophertangaNo ratings yet

- Type of AuditingDocument28 pagesType of AuditingSreekarNo ratings yet

- Propriety AuditDocument6 pagesPropriety AuditMandeep BashisthaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument10 pages© The Institute of Chartered Accountants of IndiaSanjay SahuNo ratings yet

- Internal Audit: January 2018Document11 pagesInternal Audit: January 2018Usama RahatNo ratings yet

- L4 - Documentation of Accounting RecordsDocument11 pagesL4 - Documentation of Accounting RecordsMumba KennedyNo ratings yet

- Settlement of Audit ObjectionsDocument32 pagesSettlement of Audit ObjectionsMillat AfridiNo ratings yet

- Auditing and Assurance by Ca Nitin Gupta PDFDocument25 pagesAuditing and Assurance by Ca Nitin Gupta PDFVijaya LaxmiNo ratings yet

- CA Inter Paper 6 Compiler 8-8-22Document316 pagesCA Inter Paper 6 Compiler 8-8-22KaviyaNo ratings yet

- Overview of AccountingDocument35 pagesOverview of AccountingAiyana AlaniNo ratings yet

- Accounting Standards Book Excercises CompilationDocument34 pagesAccounting Standards Book Excercises CompilationJay Ar OmbleroNo ratings yet

- 5 Chapter 1-05f91150b420b57.47894646Document5 pages5 Chapter 1-05f91150b420b57.47894646starrboii21No ratings yet

- Unit 3 (I)Document4 pagesUnit 3 (I)Saniya HashmiNo ratings yet

- Quiz Quiz 1Document6 pagesQuiz Quiz 1Donna TumalaNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- Comm - Ica Asa510 App1ill1Document3 pagesComm - Ica Asa510 App1ill1Hay JirenyaaNo ratings yet

- QUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With SolutionsDocument9 pagesQUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With Solutionsfinn mertens100% (1)

- Settlement of Audit ObjectionsDocument32 pagesSettlement of Audit ObjectionsFaizan Ch67% (6)

- Q.No.3 Distinguish Between Auditing and Accounting?Document12 pagesQ.No.3 Distinguish Between Auditing and Accounting?Shahzad HussainNo ratings yet

- P7int 2011 Jun ADocument16 pagesP7int 2011 Jun AShujaALONENo ratings yet

- Philippine Government Accounting StandardsDocument9 pagesPhilippine Government Accounting StandardsShien AgucayNo ratings yet

- Dr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingDocument15 pagesDr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingZenni T XinNo ratings yet

- Internal Audit, Management and Operational AuditDocument14 pagesInternal Audit, Management and Operational AuditNeetu gargNo ratings yet

- Financial Statements YE 31.12.21Document15 pagesFinancial Statements YE 31.12.21maharajabby81No ratings yet

- Auditing Part 1Document54 pagesAuditing Part 1Deepak NayakNo ratings yet

- C13 Audit Question BankDocument27 pagesC13 Audit Question BankVINUS DHANKHARNo ratings yet

- AP 20 Prepaid Expenses and Other Assets PDFDocument5 pagesAP 20 Prepaid Expenses and Other Assets PDFmyangel_peach3305No ratings yet

- Ag Gar Wal Ag Gar WalDocument12 pagesAg Gar Wal Ag Gar WalAmar ShahNo ratings yet

- Audit Programme For Audit of BanksDocument8 pagesAudit Programme For Audit of BanksGaurav AgrawalNo ratings yet

- AUDITINGDocument12 pagesAUDITINGS k Priya DharshiniNo ratings yet

- Screenshot 2023-09-12 at 7.48.02 PMDocument149 pagesScreenshot 2023-09-12 at 7.48.02 PMDisha JainNo ratings yet

- Final Exam - Ae14 CfasDocument7 pagesFinal Exam - Ae14 CfasVillanueva RosemarieNo ratings yet

- Accounting QuizDocument3 pagesAccounting Quizmarygrace carbonelNo ratings yet

- ToR Audit TenderDocument9 pagesToR Audit TenderIslamicRelief AlbaniaNo ratings yet

- Ramo 4-86Document2 pagesRamo 4-86matinikkiNo ratings yet

- Audit Report ROPADocument10 pagesAudit Report ROPAgianneism100% (1)

- Govt AuditDocument6 pagesGovt AuditVenus B. MacatuggalNo ratings yet

- Inter-Paper-6-RTPs, MTPs and Past PapersDocument149 pagesInter-Paper-6-RTPs, MTPs and Past Paperssixipa1033No ratings yet

- Cfas With AnsDocument20 pagesCfas With AnsFlehzy EstollosoNo ratings yet

- Quiz - 1 - Overview of AccountingDocument4 pagesQuiz - 1 - Overview of AccountingBritnys NimNo ratings yet

- Introduction To Auditing Notes - Kenyan ContextDocument11 pagesIntroduction To Auditing Notes - Kenyan ContextHilda Muchunku100% (1)

- External AuditDocument26 pagesExternal Auditjuju1992No ratings yet

- 06-DFA2022 Part1-Auditor's ReportDocument5 pages06-DFA2022 Part1-Auditor's ReportjoevincentgrisolaNo ratings yet

- Assignment Auditing Unit-4: Submitted To Keerti Mam Submitted by Bhavna PathakDocument9 pagesAssignment Auditing Unit-4: Submitted To Keerti Mam Submitted by Bhavna PathakBhavnaNo ratings yet

- AuditDocument54 pagesAuditmadhumithamadhu2003No ratings yet

- Cfas Overview To Pas 28Document31 pagesCfas Overview To Pas 28Miss ANo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Minutes Oh 2020-12-02Document2 pagesMinutes Oh 2020-12-02api-205664725No ratings yet

- Minutes NH 2020-09-07Document1 pageMinutes NH 2020-09-07api-205664725No ratings yet

- Minutes NH 2020-08-19Document2 pagesMinutes NH 2020-08-19api-205664725No ratings yet

- Agar NH Annual Internal Audit Report 2019-20Document1 pageAgar NH Annual Internal Audit Report 2019-20api-205664725No ratings yet

- Minutes NH 2020-11-26Document2 pagesMinutes NH 2020-11-26api-205664725No ratings yet

- NH Wind Farm Funding 2000 - 2021Document1 pageNH Wind Farm Funding 2000 - 2021api-205664725No ratings yet

- Agar NH Accounting Statements 2019-20Document1 pageAgar NH Accounting Statements 2019-20api-205664725No ratings yet

- Agar Parish Accounts NH 201920Document6 pagesAgar Parish Accounts NH 201920api-205664725No ratings yet

- Agar Oh Certificate of Exemption 2019-20Document1 pageAgar Oh Certificate of Exemption 2019-20api-205664725No ratings yet

- Agar NH Notice of Public RightsDocument4 pagesAgar NH Notice of Public Rightsapi-205664725No ratings yet

- Minutes NH 2020-06-16Document3 pagesMinutes NH 2020-06-16api-205664725No ratings yet

- Agar NH Certificate of Exemption 2019-20Document1 pageAgar NH Certificate of Exemption 2019-20api-205664725No ratings yet

- Minutes NH 2020-04-24Document1 pageMinutes NH 2020-04-24api-205664725No ratings yet

- Agar Oh Notice of Public RightsDocument3 pagesAgar Oh Notice of Public Rightsapi-205664725No ratings yet

- Agar Oh Accounting Statements 2019-20Document1 pageAgar Oh Accounting Statements 2019-20api-205664725No ratings yet

- Agar Parish Accounts Oh 201920Document6 pagesAgar Parish Accounts Oh 201920api-205664725No ratings yet

- Minutes NH 2020-02-13Document2 pagesMinutes NH 2020-02-13api-205664725No ratings yet

- Agar Oh Annual Governance Statement 2019-20Document1 pageAgar Oh Annual Governance Statement 2019-20api-205664725No ratings yet

- Minutes Oh 2020-06-11Document3 pagesMinutes Oh 2020-06-11api-205664725No ratings yet

- Minutes Oh 2020-03-23Document2 pagesMinutes Oh 2020-03-23api-205664725No ratings yet

- Minutes NH 2020-05-18Document1 pageMinutes NH 2020-05-18api-205664725No ratings yet

- Minutes NH 2020-03-19 1Document2 pagesMinutes NH 2020-03-19 1api-205664725No ratings yet

- Minutes Oh 2019-11-28Document3 pagesMinutes Oh 2019-11-28api-205664725No ratings yet

- Parish Accounts NH 201920Document1 pageParish Accounts NH 201920api-205664725No ratings yet

- Parish Accounts Oh 202021Document1 pageParish Accounts Oh 202021api-205664725No ratings yet

- Minutes Oh 2020-02-12Document2 pagesMinutes Oh 2020-02-12api-205664725No ratings yet

- Minutes NH 2019-11-25Document3 pagesMinutes NH 2019-11-25api-205664725No ratings yet

- NH Financial Regulations 2019Document18 pagesNH Financial Regulations 2019api-205664725No ratings yet

- Sevana - Hospital Kiosk ConceptNoteDocument103 pagesSevana - Hospital Kiosk ConceptNotemanojNo ratings yet

- Modern Computerized Selection of Human ResourcesDocument10 pagesModern Computerized Selection of Human ResourcesCristina AronNo ratings yet

- Economic History of The PhilippinesDocument21 pagesEconomic History of The PhilippinesBench AndayaNo ratings yet

- Rules and Regulations Governing Private Schools in Basic Education - Part 2Document103 pagesRules and Regulations Governing Private Schools in Basic Education - Part 2Jessah SuarezNo ratings yet

- CS8792 CNS Unit5Document17 pagesCS8792 CNS Unit5024CSE DHARSHINI.ANo ratings yet

- Service Laws ProjectDocument4 pagesService Laws ProjectRaman PatelNo ratings yet

- Zeb OSARSInstallDocument128 pagesZeb OSARSInstallThien TranNo ratings yet

- STB9NK60Z, STP9NK60Z, STP9NK60ZFPDocument19 pagesSTB9NK60Z, STP9NK60Z, STP9NK60ZFPyokonakagimaNo ratings yet

- Report On PesoDocument10 pagesReport On PesoAerish RioverosNo ratings yet

- 2 FT Batch Recipe Editor User GuideDocument211 pages2 FT Batch Recipe Editor User GuideleandrovaffonsoNo ratings yet

- 2023 - Kadam - Review On Nanoparticles - SocioeconomicalDocument9 pages2023 - Kadam - Review On Nanoparticles - Socioeconomicaldba1992No ratings yet

- Hyperformance Plasma: Manual GasDocument272 pagesHyperformance Plasma: Manual GasSinan Aslan100% (1)

- Enerpac Hydratight Powergen CapabilitiesDocument81 pagesEnerpac Hydratight Powergen CapabilitiesAhmed El TayebNo ratings yet

- Ahi Evran Sunum enDocument26 pagesAhi Evran Sunum endenizakbayNo ratings yet

- Holiday Activity UploadDocument6 pagesHoliday Activity UploadmiloNo ratings yet

- GSM Controlled RobotDocument33 pagesGSM Controlled RobotAbhishek KunalNo ratings yet

- Apayao Quickstat: Indicator Reference Period and DataDocument4 pagesApayao Quickstat: Indicator Reference Period and DataLiyan CampomanesNo ratings yet

- HTML5 3D VisualizacionesDocument31 pagesHTML5 3D VisualizacionesHENRY ISAAC GONZALEZ CRUZNo ratings yet

- 34-Samss-718 (12-02-2015)Document14 pages34-Samss-718 (12-02-2015)Mubin100% (1)

- IT Disaster Recovery Planning ChecklistDocument2 pagesIT Disaster Recovery Planning ChecklistYawe Kizito Brian PaulNo ratings yet

- 04 Handout 1 (Midterms)Document14 pages04 Handout 1 (Midterms)Emmanuel DelarosaNo ratings yet

- Oracle Flash Storage System CLI ReferenceDocument454 pagesOracle Flash Storage System CLI Referencebsduser07No ratings yet

- ''Adhibeo'' in LatinDocument5 pages''Adhibeo'' in LatinThriw100% (1)

- Optical Current TransformerDocument22 pagesOptical Current TransformerchallaramcharanreddyNo ratings yet

- DSU ManualDocument204 pagesDSU ManualCarlos Alberto Rueda100% (1)

- 4th Party LogisticsDocument3 pages4th Party Logisticsch_salmanNo ratings yet

- Best of Thekkady (Periyar) Recommended by Indian Travellers: Created Date: 27 December 2015Document8 pagesBest of Thekkady (Periyar) Recommended by Indian Travellers: Created Date: 27 December 2015sk_kannan26No ratings yet

- Royal Classic e BrochureDocument14 pagesRoyal Classic e Brochureidreesali8654No ratings yet

- 01 FundamentalsDocument20 pages01 FundamentalsTay KittithatNo ratings yet

- Foreclosure Letter - 20 - 26 - 19Document3 pagesForeclosure Letter - 20 - 26 - 19Santhosh AnantharamanNo ratings yet