Professional Documents

Culture Documents

Chadha Investment Consultant PVT LTD: Gopal Kaushik

Uploaded by

gopalkaushikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chadha Investment Consultant PVT LTD: Gopal Kaushik

Uploaded by

gopalkaushikCopyright:

Available Formats

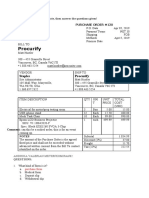

Chadha Investment Consultant Pvt Ltd

R5, Ansal Chambers I Bhikaji Cama Place, New Delhi 110066

Ph : 011-41658879,26712055 Fax : 011-41658986

Email : maj_chadha@chadhainvestment.com

PORTFOLIO RETURNS - Unrealized Holding Your Relationship Manager

As on :02/04/2018 Diwakar Pant

8800263987

Gopal kaushik

1124, Sec-14

Faridabad

HARYANA 121007

Mobile No : 9873233331

Email : gopalkaushik@hotmail.com

Investment Snapshot since Inception Current Asset Allocation

a. Investment 125,000 EQUITY : 100.00 %

b. Switch In 0

c. Switch Out 0

d. Redemption 54,805

e. Dividend Payout 82,792

f. Interest Accrued/

Paid 0

Equity

g. Net Investment -12,597 100.00%

(a+b-c-d-e-f)

h. Market Value 60,057

i. Net Gain (h-g) 72,654

Gopal kaushik

Allocation by AMCs Allocation by Scheme

Company Purchase Market Abs Ret Ann Alloc. Scheme Purchase Market Abs Ann Ret Alloc

Cost Value (%) Ret (%) (%) Cost Value Ret(%) (%) (%)

Franklin Templeton Mutual 30,000 36,428 137.64 12.34 60.66 Franklin - India Taxshield (D) 30,000 36,428 137.64 12.34 60.66

Fund HDFC - Tax Saver (D) 30,000 23,629 83.00 7.44 39.34

HDFC Mutual Fund 30,000 23,629 83.00 7.44 39.34

60,000 60,057 110.32 9.89 100.00

60,000 60,057 110.32 9.89 100.00

Allocation by Category Allocation by Applicant

Category Purchase Market Abs Ret Ann Ret Alloc Applicant Purchase Market Abs Ret Ann Ret Alloc

Cost Value (%) (%) (%) Cost Value (%) (%) (%)

Equity: Tax Planning 60,000 60,057 110.32 9.89100.00 Krishna Kaushik 60,000 60,057 110.32 9.89 100.00

60,000 60,057 110.32 9.89100.00 60,000 60,057 110.32 9.89 100.00

Allocation by Goal

Goal Purchase Market Abs Ret Ann Alloc

Cost Value (%) Ret(%) (%)

Wealth Creation 60,000 60,057 110.32 9.89 100.00

60,000 60,057 110.32 9.89 100.00

Allocation By Sector [MF] Allocation by Type

Financial 24.3

Energy 16.0

Automobile 7.0

Technology 4.9

Metals 3.8 Equity: Tax Planning

Equity: Tax Planning 100.0%

Construction 3.8

Total: 100.0%

FMCG 3.3

Healthcare 2.1

Communication 1.9

Cons Durable 1.8

Others 1.8

Gopal kaushik PORTFOLIO RETURNS - Unrealized Gains only Page 2 of 3

Amount in INR

Transaction DR Purchase Balance Purchase Purchase Market Dividend Gain Absolute Holding Annualized

Type Date Units/Nos Price Value Value (Rs.) /FD Interest (Rs) Return Days Return (%)

(%)

Chadha Investment Consultant Pvt Ltd [Ref:02658]

Gopal kaushik PORTFOLIO RETURNS - Unrealized Gains only Page 3 of 3

Amount in INR

Transaction DR Purchase Balance Purchase Purchase Market Dividend Gain Absolute Holding Annualized

Type Date Units/Nos Price Value Value (Rs.) /FD Interest (Rs) Return Days Return (%)

(%)

Krishna Kaushik

Equity: Tax Planning

Franklin - India Taxshield (D) [Folio:0359902808428] - [Balance Units/Nos : 860.8320]

Avg Cost : 34.8500, Current Price: 42.3173 as on 02/04/2018

Inv. Obj. : Wealth Creation

NOR 08/02/2007 860.832 34.8500 30,000.00 36,428.09 34,863.71 41,291.80 137.64 4071 12.34

Franklin - India Taxshield (D) [Folio:0359902808428] Total : 860.832 30000.00 36,428.09 34,863.71 41,291.80 137.64 4071 12.34

HDFC - Tax Saver (D) [Folio:3571203/41] - [Balance Units/Nos : 406.1300]

Avg Cost : 73.8680, Current Price: 58.1800 as on 02/04/2018

Inv. Obj. : Wealth Creation

NOR 08/02/2007 406.130 73.8680 30,000.00 23,628.64 31,272.02 24,900.66 83.00 4071 7.44

HDFC - Tax Saver (D) [Folio:3571203/41] Total : 406.130 30000.00 23,628.64 31,272.02 24,900.66 83.00 4071 7.44

Grand Total : 1,266.962 60000.00 60,056.73 66,135.73 66,192.46 110.32 4071 9.89

* All returns are rounded to 2 digits precision after decimal.

Please refer to Absolute return for Equity Investments held for less than and upto 1 year, and Annualized Return / CAGR for investments held for greater than 1 year.

S&P BSE SENSEX as on 02/04/2018 : 33255.36 and NSE - CNX NIFTY as on 02/04/2018 : 10211.80

Model Asset Allocation

Disclaimer :

This statement is based on the information available with us, and is only for your reference. The statement from the resp. fund reflects the exact information for the respective folio. Any discrepancy may please be reported to us.

Current value of investments shown may be reduced by Exit Load/Unammortized expenses/Securities Transaction Tax (STT), as applicable on the date of redemption.

All investments in Mutual Funds carry risk of loss of principal. No returns are guaranteed, all projections are indicative and subject to market fluctuations.

Tax is payable on all your debt and equity transactions. Please contact your Accountant for the exact calculations. You can contact us for any assistance.

Maturity Date, where displayed is based on available information. Please confirm from respective AMC also.

Chadha Investment Consultant Pvt Ltd [Ref:02658]

You might also like

- Thelemic StudiesDocument56 pagesThelemic StudiesTsaphiel Assiah Hernandez100% (5)

- Cleaning Product Business PlanDocument4 pagesCleaning Product Business PlanSantosh Arakeri0% (1)

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Musical Gem AtriaDocument34 pagesMusical Gem AtriakrataiosNo ratings yet

- Pilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pagePilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib Dahal50% (2)

- Customer Relationship ManagementAKMppt 22 NovDocument205 pagesCustomer Relationship ManagementAKMppt 22 NovAbhimaurya50% (2)

- Chapter 7 Primer On Relative Valuation MethodsDocument16 pagesChapter 7 Primer On Relative Valuation MethodsPankaj AgrawalNo ratings yet

- Airtel-Brand Equity MeasurementDocument35 pagesAirtel-Brand Equity MeasurementPratik Gupta100% (2)

- Case Assignment 8 - Diamond Energy Resources PDFDocument3 pagesCase Assignment 8 - Diamond Energy Resources PDFAudrey Ang100% (1)

- Burmistrov, Endel - Kabbalah Russian FreemasonryDocument42 pagesBurmistrov, Endel - Kabbalah Russian Freemasonryloanthi666No ratings yet

- Liber AlbaDocument0 pagesLiber AlbaBawbagzNo ratings yet

- A.E. Waite - Great Symbols of Tarot PDFDocument12 pagesA.E. Waite - Great Symbols of Tarot PDFRicardo TakayamaNo ratings yet

- Corporate Finance II - Alibaba's IPO DilemmaDocument27 pagesCorporate Finance II - Alibaba's IPO DilemmaGiancarlo Corradini100% (1)

- 1st Exam Chapter 11Document9 pages1st Exam Chapter 11Imma Therese YuNo ratings yet

- Mercedes Benz PDFDocument23 pagesMercedes Benz PDFManisha DeewanNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Fintech Vietnam Startups 151126150047 Lva1 App6891Document59 pagesFintech Vietnam Startups 151126150047 Lva1 App6891Anonymous 45z6m4eE7pNo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- MilindapanhaDocument200 pagesMilindapanhaRavi ChanderNo ratings yet

- 01 Adm 01482 Vipinkumar 20220110 Portfolio DetailedDocument4 pages01 Adm 01482 Vipinkumar 20220110 Portfolio DetailedVipin DobriyalNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Solution 18preparation of Financial Statements Company Final AccDocument2 pagesSolution 18preparation of Financial Statements Company Final AccKajal BindalNo ratings yet

- FS - LandscapeDocument9 pagesFS - LandscapeMekay OcasionesNo ratings yet

- Laketran FoloDocument1 pageLaketran Fololkessel5622No ratings yet

- FR-Master Final Exam Solutions-JJ2023Document18 pagesFR-Master Final Exam Solutions-JJ2023panhapichhaiNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Document40 pagesCa Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Shashank SikarwarNo ratings yet

- Tradecoms ITR Balancesheet 20-21Document6 pagesTradecoms ITR Balancesheet 20-21Abhishek Kr SinghNo ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- MTP 1 Suggested Answers AADocument9 pagesMTP 1 Suggested Answers AAYash RankaNo ratings yet

- Name:: Salary Income CertificateDocument2 pagesName:: Salary Income CertificateSamiul Alim SanyNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- Chap 3: Problem 4: Multiple Choice-ComputationalDocument24 pagesChap 3: Problem 4: Multiple Choice-ComputationalAlarich CatayocNo ratings yet

- ParticularDocument5 pagesParticularVinayNo ratings yet

- Chap 3: Problem 4: Multiple Choice-ComputationalDocument30 pagesChap 3: Problem 4: Multiple Choice-ComputationalAlarich CatayocNo ratings yet

- Account Status: Printed On: 26-Jul-2018 6:20:01PMDocument2 pagesAccount Status: Printed On: 26-Jul-2018 6:20:01PMTanzir HasanNo ratings yet

- Chapter 14 LEASINGDocument17 pagesChapter 14 LEASINGKaran KashyapNo ratings yet

- Bos 50091Document15 pagesBos 50091Gokul dnNo ratings yet

- CAF-6 Mock Solution by SkansDocument6 pagesCAF-6 Mock Solution by SkansMuhammad YahyaNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Document34 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Makoy BixenmanNo ratings yet

- Mar 2023Document1 pageMar 2023gaurav sharmaNo ratings yet

- Corporate AccontingDocument4 pagesCorporate AccontingIshita GuptaNo ratings yet

- CA Foundation Accounts A MTP 2 Dec 2022Document11 pagesCA Foundation Accounts A MTP 2 Dec 2022shagana212005No ratings yet

- Final Slide of PresentationDocument27 pagesFinal Slide of PresentationShekh FaridNo ratings yet

- Problem 6-26: Contribution Format Income StatementDocument2 pagesProblem 6-26: Contribution Format Income StatementHira Mustafa ShahNo ratings yet

- Dipak Kumar Ganeriwala April09: Liabilities Capital Account Assets Fixed AssetsDocument1 pageDipak Kumar Ganeriwala April09: Liabilities Capital Account Assets Fixed AssetsPriya BiswasNo ratings yet

- Assignment - Installment SalesDocument5 pagesAssignment - Installment SalesEllaNo ratings yet

- Book 1Document6 pagesBook 1chrstncstlljNo ratings yet

- Advanced Accounts Revision Notes by Jai Chawla Sir PDFDocument100 pagesAdvanced Accounts Revision Notes by Jai Chawla Sir PDFRaghavendra PrasadNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Capital Budgeting IiiDocument25 pagesCapital Budgeting IiiRanu AgrawalNo ratings yet

- Readymade Chappathi Project ReportDocument13 pagesReadymade Chappathi Project ReportachusmohanNo ratings yet

- Project Report On NurseryDocument6 pagesProject Report On NurseryManju Mysore100% (1)

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- FAR210 Aug 2023 S PDFDocument10 pagesFAR210 Aug 2023 S PDFNUR AYUNI BALQISH AHMAD MULIADINo ratings yet

- Financials 2022-23Document2 pagesFinancials 2022-23manwanim18No ratings yet

- Ramos Assignment No.2Document4 pagesRamos Assignment No.2Joneric RamosNo ratings yet

- Tutorial 3 AnswersDocument7 pagesTutorial 3 AnswersFEI FEINo ratings yet

- Suggested Solution: Test Code - CNP 2231Document14 pagesSuggested Solution: Test Code - CNP 2231adityatiwari122006No ratings yet

- Assign - Chap 3Document5 pagesAssign - Chap 3EllaNo ratings yet

- Neeraj Mutual FundDocument6 pagesNeeraj Mutual FundRUCHINEERAJNo ratings yet

- Accountancy 12 - DS2 - Set - 1Document15 pagesAccountancy 12 - DS2 - Set - 1Deepa Saravana KumarNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Ch02 SolutionDocument6 pagesCh02 SolutionMalekNo ratings yet

- Offer LetterDocument3 pagesOffer LetterGopi ReddyNo ratings yet

- Revised Compensation ETDocument2 pagesRevised Compensation ETSantosh SonavaneNo ratings yet

- MS Xii Accountancy Set 1Document10 pagesMS Xii Accountancy Set 1arikoff07No ratings yet

- A1. Fm-2018-Sepdec-Sample-ADocument4 pagesA1. Fm-2018-Sepdec-Sample-ANirmal ShresthaNo ratings yet

- 1860788077acct3006 T06a PDFDocument4 pages1860788077acct3006 T06a PDF徐滢No ratings yet

- Lagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFDocument3 pagesLagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFSarah Nicole S. LagrimasNo ratings yet

- Cost DJB - July21 Suggested AnswersDocument30 pagesCost DJB - July21 Suggested AnswersMayuri KolheNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Benq MonitorDocument1 pageBenq MonitorgopalkaushikNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)gopalkaushikNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)gopalkaushikNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)gopalkaushikNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)gopalkaushikNo ratings yet

- Batch 2.3 3 May PDFDocument1 pageBatch 2.3 3 May PDFgopalkaushikNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Gopal KaushikNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)gopalkaushikNo ratings yet

- Batch 3 Ticket 3Document1 pageBatch 3 Ticket 3gopalkaushikNo ratings yet

- Batch 3 Ticket 1Document1 pageBatch 3 Ticket 1gopalkaushikNo ratings yet

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)gopalkaushikNo ratings yet

- Batch 3 Ticket 2Document1 pageBatch 3 Ticket 2gopalkaushikNo ratings yet

- WL WL: Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageWL WL: Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)gopalkaushikNo ratings yet

- Batch 1 Ticket 4Document1 pageBatch 1 Ticket 4gopalkaushikNo ratings yet

- Batch 2 Ticket 1Document1 pageBatch 2 Ticket 1gopalkaushikNo ratings yet

- Batch 1 Ticket 2Document1 pageBatch 1 Ticket 2gopalkaushikNo ratings yet

- Batch 1 Ticket 1Document1 pageBatch 1 Ticket 1gopalkaushikNo ratings yet

- The Word As Power (Being and Non-Being) by Frenando Pessoa PDFDocument1 pageThe Word As Power (Being and Non-Being) by Frenando Pessoa PDFgopalkaushikNo ratings yet

- Batch 1 Ticket 3Document1 pageBatch 1 Ticket 3gopalkaushikNo ratings yet

- BlinkMax Catalogue2017 TreoDocument10 pagesBlinkMax Catalogue2017 Treogopalkaushik100% (1)

- CameronDocument5 pagesCameronMarshal RussellNo ratings yet

- The Word As Power (Being and Non-Being) by Frenando Pessoa PDFDocument1 pageThe Word As Power (Being and Non-Being) by Frenando Pessoa PDFgopalkaushikNo ratings yet

- Hessel - The Value of DivinationDocument16 pagesHessel - The Value of DivinationgopalkaushikNo ratings yet

- Yorke Microfilm Index PDFDocument72 pagesYorke Microfilm Index PDFDiletta Anselmi100% (2)

- Pampa Energia S.A.: Price, Consensus & SurpriseDocument1 pagePampa Energia S.A.: Price, Consensus & SurpriseoaperuchenaNo ratings yet

- P79 MKG303Document2 pagesP79 MKG303monalika7deshmukhNo ratings yet

- What Is A Touchpoint?: Touchpoints Relate To A Specific Context or NeedDocument2 pagesWhat Is A Touchpoint?: Touchpoints Relate To A Specific Context or NeedMANAV SAHUNo ratings yet

- 114Document2 pages114mercyvienhoNo ratings yet

- 7-12. (Byron, Inc.)Document2 pages7-12. (Byron, Inc.)Gray JavierNo ratings yet

- IFM Topic 1 PDFDocument99 pagesIFM Topic 1 PDFIshaan PunjabiNo ratings yet

- Trends in Global Trade - v1Document13 pagesTrends in Global Trade - v1castro dasNo ratings yet

- CUEGIS AssignmentDocument4 pagesCUEGIS AssignmentNaheel AyeshNo ratings yet

- Impress PMS - Feb 24 - Anand Rathi PMSDocument19 pagesImpress PMS - Feb 24 - Anand Rathi PMSshivamsundaram794No ratings yet

- Modere Compensation PlanDocument11 pagesModere Compensation Planapi-257671934No ratings yet

- Obe Ecmf 013Document5 pagesObe Ecmf 013AmalMdIsaNo ratings yet

- B2C Sales SampleDocument2 pagesB2C Sales SampleJoy GuptaNo ratings yet

- Objectives of Managerial EconomicsDocument5 pagesObjectives of Managerial Economicssukul756No ratings yet

- ASX Index - Options PDFDocument2 pagesASX Index - Options PDFZolo ZoloNo ratings yet

- Assignment: Fin 441 Bank ManagementDocument11 pagesAssignment: Fin 441 Bank ManagementNazir Ahmed ZihadNo ratings yet

- Review in General Mathematics (Quiz Bee)Document26 pagesReview in General Mathematics (Quiz Bee)cherrie annNo ratings yet

- Genghis Hela Imara Fund: DownloadDocument2 pagesGenghis Hela Imara Fund: DownloadErick M'bwanaNo ratings yet

- 4Ps in Rural Markets: Rural Marketing by Jyoti MaratheDocument26 pages4Ps in Rural Markets: Rural Marketing by Jyoti Marathedesh87_sagar3672No ratings yet

- Case 10: South Africa Bank: Revenue Mckinsey Struct. Comm QuantDocument7 pagesCase 10: South Africa Bank: Revenue Mckinsey Struct. Comm QuantDuong TranNo ratings yet

- Syn 7 - Introduction To Debt Policy and ValueDocument11 pagesSyn 7 - Introduction To Debt Policy and Valuerudy antoNo ratings yet

- Soal B Inggris Form Andhika Xiii Mipa 6 02Document3 pagesSoal B Inggris Form Andhika Xiii Mipa 6 02Andhika MeyerNo ratings yet

- Set A - Problems On Relevant Decision MakingDocument6 pagesSet A - Problems On Relevant Decision MakingNitin KhareNo ratings yet