Professional Documents

Culture Documents

Income Statements For The Year Ended 30 June

Uploaded by

Mercy AnaneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Statements For The Year Ended 30 June

Uploaded by

Mercy AnaneCopyright:

Available Formats

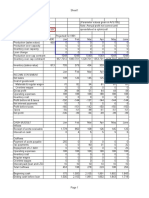

Income statements for the year ended 30 June

2008 2009

000 000

Revenue 1,180 1,200

Cost of sales -680 -750

Gross profit 500 450 0.423729

Operating expenses -200 -208

Depreciation -66 -75

Operating profit 234 167 0.198305

Interest (–) -8

Profit before taxation 234 159

Taxation -80 -48

Profit for the year 154 111 0.130508

Dividend paidout 0.309524

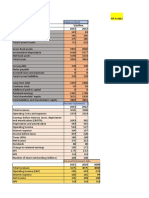

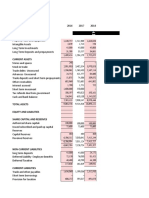

Statements of financial position as at 30 June

2008 2009

ASSETS 000 000

Non-current assets

Property, plant and equipment 702 687

Current assets

Inventories 148 236 0.527638

Trade receivables 102 156 0.527638

Cash 3 4

253 396 1.271357

Total assets 955 1,083

EQUITY AND LIABILITIES

Equity

Ordinary share capital of £1 (fully paid) 500 500

etained earnings 256 295

756 795

Non-current liabilities

liabilities Borrowings – Bank loan (-) 50

Current liabilities

Trade payables 60 76

Other payables and accruals 18 16

Taxation 40 24

Short-term borrowings (all bank overdraft) 81 122

199 238

Total equity and liabilities 955 1,083

return on capital employed

(2) operating profit margin

(3) gross profit margin

(4) current ratio

(5) acid test ratio

(6) settlement period for trade receivables

(7) settlement period for trade payables

(8) inventories turnover period.

0.375

0.1391666667

0.0925

0.2100628931

0.6722689076

1.6638655462

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- X82 - Threads LTD v01Document4 pagesX82 - Threads LTD v01Udaya Makineni33% (3)

- Seminar Solutions Consolidations 3 Question 2Document2 pagesSeminar Solutions Consolidations 3 Question 2张紫翠No ratings yet

- Financial Statement ACIFL 31 March 2015 ConsolidatedDocument16 pagesFinancial Statement ACIFL 31 March 2015 ConsolidatedNurhan JaigirdarNo ratings yet

- Financial Statement Analysis Group-3Document19 pagesFinancial Statement Analysis Group-3MostakNo ratings yet

- Exercises of Session 8Document4 pagesExercises of Session 8tranhlthNo ratings yet

- Financial Report For The Year 2020-21-DDocument74 pagesFinancial Report For The Year 2020-21-DAmanuel TewoldeNo ratings yet

- Rafhan Vertical Analysis Profit and Loss Accounts: Total Assets 5304524 5,287,371Document30 pagesRafhan Vertical Analysis Profit and Loss Accounts: Total Assets 5304524 5,287,371usmanazizbhattiNo ratings yet

- Top Star Polymer (PVT) Ltd. Final ReportDocument2 pagesTop Star Polymer (PVT) Ltd. Final ReportMuhammad Amin Muhammad AminNo ratings yet

- gLLjeluWEem7ixL - 6m9HFg - PolyPanel TO DO Before WEEK 1Document2 pagesgLLjeluWEem7ixL - 6m9HFg - PolyPanel TO DO Before WEEK 1Mohammed Soliman MasliNo ratings yet

- Pohuat (7088)Document100 pagesPohuat (7088)Wong Kai WenNo ratings yet

- Balance Sheet of Maple Leaf: AssetsDocument12 pagesBalance Sheet of Maple Leaf: Assets01290101002675No ratings yet

- Xyz Mills Limited Balance Sheet AS AT JUNE 30, 2009Document27 pagesXyz Mills Limited Balance Sheet AS AT JUNE 30, 2009yasirg786No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Attock Cement 3 Statement ModelDocument67 pagesAttock Cement 3 Statement ModelRabia HashimNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- DCF Valuation SolvedDocument13 pagesDCF Valuation Solvedhimanshi sharmaNo ratings yet

- SG Series Trim q2 2020Document6 pagesSG Series Trim q2 2020Divya MukherjeeNo ratings yet

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- Data Bodie Industrial Supply V1Document10 pagesData Bodie Industrial Supply V1Giovani R. Pangos RosasNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 5Document5 pagesEngineering Management 3000/5039: Tutorial Set 5SahanNo ratings yet

- Misc Accounts FilesDocument229 pagesMisc Accounts Filesapi-19622983No ratings yet

- Company Information: Fecto Sugar Mills LimitedDocument30 pagesCompany Information: Fecto Sugar Mills LimitedSyeda Kainat AqeelNo ratings yet

- 2001 Interim Results Release EngDocument14 pages2001 Interim Results Release EngVikas SinghalNo ratings yet

- Playtime Excel PeruDocument4 pagesPlaytime Excel PeruPatrick Rock RamirezNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Hartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesDocument6 pagesHartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesJUWAIRIA BINTI SADIKNo ratings yet

- Larsen & Toubro Infotech LTD - Income Statement - Thomson Reuters Eikon 10-Aug-2019 01:04Document140 pagesLarsen & Toubro Infotech LTD - Income Statement - Thomson Reuters Eikon 10-Aug-2019 01:04Nishant SharmaNo ratings yet

- Ratio Analysis ClassworkDocument4 pagesRatio Analysis ClassworkMo HachimNo ratings yet

- Statement of Comprehensive Income For The Year 31 March 2009Document1 pageStatement of Comprehensive Income For The Year 31 March 2009Trevoir YungRowe WilliamsNo ratings yet

- Evaluating Financial PerformanceDocument31 pagesEvaluating Financial PerformanceShahruk AnwarNo ratings yet

- Yates Case Study - LT 11Document23 pagesYates Case Study - LT 11JerryJoshuaDiazNo ratings yet

- Interim Financial Report 2016.Q2Document26 pagesInterim Financial Report 2016.Q2Shungchau WongNo ratings yet

- MO QuestionDocument2 pagesMO Questionlingly justNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- MR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Document15 pagesMR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Mzm Zahir MzmNo ratings yet

- 03RATIO ANALYSIS MbaDocument18 pages03RATIO ANALYSIS MbaAbid XargarNo ratings yet

- These Financial Statements Should Be Read in Conjunction With The Annexed NotesDocument10 pagesThese Financial Statements Should Be Read in Conjunction With The Annexed NotesSK. Al Mamun MamunNo ratings yet

- La Trobe Cash QuestionDocument2 pagesLa Trobe Cash QuestionKimberly MarkNo ratings yet

- DG Cement Financial DataDocument4 pagesDG Cement Financial DataMuneeb AhmedNo ratings yet

- $ Million 2013 2012: Balance SheetDocument3 pages$ Million 2013 2012: Balance Sheetyash sarohaNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Tencent Q2 08Document38 pagesTencent Q2 08suedelopeNo ratings yet

- Description Variable 2008: Financial Leverege (Nfo/cse)Document9 pagesDescription Variable 2008: Financial Leverege (Nfo/cse)Nizam Uddin MasudNo ratings yet

- Golden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012Document8 pagesGolden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012khurshid topuNo ratings yet

- Overseas BankingDocument16 pagesOverseas BankingafzalhashimNo ratings yet

- Assignment - 1Document2 pagesAssignment - 1asfandyarkhaliq0% (1)

- 1 Competition in Alternative Drinks 2009 Case StudyDocument21 pages1 Competition in Alternative Drinks 2009 Case StudyTeerawat RakkamnerdNo ratings yet

- 20101208.pleyel Cash Flow 2008-09 - Cash ManagementDocument14 pages20101208.pleyel Cash Flow 2008-09 - Cash ManagementPamela ZukerNo ratings yet

- Report CalculationsDocument2 pagesReport CalculationsammassumairNo ratings yet

- Standardized Financial Statements - SolutionDocument25 pagesStandardized Financial Statements - SolutionanisaNo ratings yet

- The Balance Sheet Items For CIBDocument1 pageThe Balance Sheet Items For CIBKhalid Al SanabaniNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- Draft ADocument16 pagesDraft ABiplob K. SannyasiNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Siemens Annual Report 2020Document224 pagesSiemens Annual Report 2020Anirudh ManglaNo ratings yet

- TCS LIMITED ACCOUNTS ASSIGNMENT-converted-compressedDocument7 pagesTCS LIMITED ACCOUNTS ASSIGNMENT-converted-compressedALEN AUGUSTINENo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Financial Statement AnalysisDocument25 pagesFinancial Statement AnalysisAldrin CustodioNo ratings yet

- Management Advisory Services: BudgetedDocument26 pagesManagement Advisory Services: Budgetedi hate youtubersNo ratings yet

- Null 5 PDFDocument620 pagesNull 5 PDFJames100% (2)

- MCB Internship ReportDocument31 pagesMCB Internship ReportShakeel QureshiNo ratings yet

- Banking Regulation Act, 1949Document8 pagesBanking Regulation Act, 1949Animesh BawejaNo ratings yet

- AFARDocument16 pagesAFARCheska MangahasNo ratings yet

- Keown IM CH 07Document32 pagesKeown IM CH 07Muhammad ZafarNo ratings yet

- Financial RatioDocument21 pagesFinancial RatioAbiola BabajideNo ratings yet

- Annual Report 2020 V3Document179 pagesAnnual Report 2020 V3Uswa KhurramNo ratings yet

- Statements 7576Document10 pagesStatements 7576Cathy CastyNo ratings yet

- AR Ali 80Document1 pageAR Ali 80Lieder CLNo ratings yet

- Mayr-Melnhof: A Dark Quarter Ahead in Q2Document10 pagesMayr-Melnhof: A Dark Quarter Ahead in Q2Camila CalderonNo ratings yet

- Setoff & Carry Forward of LossDocument3 pagesSetoff & Carry Forward of LossDr. Mustafa KozhikkalNo ratings yet

- Accounts Debit Credit: TotalDocument8 pagesAccounts Debit Credit: TotaljangjangNo ratings yet

- UnlockedDocument11 pagesUnlockedharshgulve04No ratings yet

- FIN 330 Final Project IDocument9 pagesFIN 330 Final Project ISarai SternzisNo ratings yet

- Standard Bank BEE Financing StructuresDocument15 pagesStandard Bank BEE Financing StructuresKhanyile NcubeNo ratings yet

- 09-Capital BudgetingDocument24 pages09-Capital BudgetingsaninaNo ratings yet

- Ia2 ReviewerDocument7 pagesIa2 ReviewerAiden MagnoNo ratings yet

- Fdnacct - ProjectDocument2 pagesFdnacct - ProjectMaria Tamia HensonNo ratings yet

- Correcting Entries AnswersDocument2 pagesCorrecting Entries AnswersLizette MedranoNo ratings yet

- Reading 18 - Evaluating Quality of Financial ReportsDocument10 pagesReading 18 - Evaluating Quality of Financial ReportsJuan MatiasNo ratings yet

- IcicicicDocument76 pagesIcicicicNikhil MaheshwariNo ratings yet

- XYZ CorporationDocument5 pagesXYZ CorporationredNo ratings yet

- Aud Rev - Accounts ReceivableDocument4 pagesAud Rev - Accounts ReceivablexjammerNo ratings yet

- Uniparts India LTD.: Jatin MahajanDocument2 pagesUniparts India LTD.: Jatin Mahajanpradeep kumar pradeep kumarNo ratings yet

- 2020 DITO CME SEC FS REISSUED - Conso - Final With Sustainability ReportDocument128 pages2020 DITO CME SEC FS REISSUED - Conso - Final With Sustainability ReportPaulNo ratings yet

- Accounting For Property Plant and Equipment Practice QuestionsDocument18 pagesAccounting For Property Plant and Equipment Practice QuestionsSophia Varias CruzNo ratings yet

- In-Depth Guide To Public Company Auditing:: The Financial Statement AuditDocument20 pagesIn-Depth Guide To Public Company Auditing:: The Financial Statement AuditThùy Vân NguyễnNo ratings yet

- Financial Accounting (Canadian Edition)Document45 pagesFinancial Accounting (Canadian Edition)Harsh Vora100% (1)

- Prof Dev 5 (Users of Accounting Information)Document3 pagesProf Dev 5 (Users of Accounting Information)Arman CabigNo ratings yet