Professional Documents

Culture Documents

Bs News

Uploaded by

Vikrant WaghmareOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bs News

Uploaded by

Vikrant WaghmareCopyright:

Available Formats

ILLUSTRATION BY BINAY SINHA

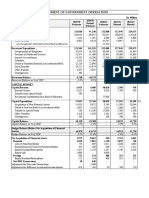

FACT SHEET

EQUITY INDEX@ GOVERNMENT BOND INDEX@

Dow FTSE Dax Nikkei US UK Germany Japan

31/1/1990

Nominal 2591 2337 1823 37189 123 149 126 119

Real* 4408 4260 n/a 40474 209 272 n/a 129 $30.3 billion from US equity funds and

31/1/1995 $11.6 billion from European stock

Nominal 4244 3303 2235 20591 182 252 209 252 funds. All this has to be a cause for

Real 6117 4926 2764 20397 263 376 259 249 concern in asset allocation decisions

in G20 countries, including India.

31/1/2000 Turning to the performance of eq-

Nominal 13337 7641 8333 23819 256 425 223 319 uity markets in India, real stock mar-

Real 17125 9987 9669 23214 329 555 258 311 ket returns were positive in the last

31/1/2005 20 years. For instance, the real return

on the Nifty — assuming dividends were

Nominal 14118 6530 5726 15326 370 666 414 363 reinvested and the dividend yield was

Real 16042 7530 6199 15219 420 768 449 361 1.5 per cent per annum — was about 42

31/1/2010 per cent in the nine-year period from

Nominal 14959 7710 8334 15153 472 728 542 447 September 1991 to September 2000.

Similarly, the real return from September

Real 14959 7710 8334 15153 472 728 542 447 2000 to September 2010 was 129 per

@ Dividends are assumed to be reinvested and the average dividend yield on stocks is assumed to be 2% per annum.

Coupon payments on bonds are also assumed to be reinvested. cent. The Indian rupee 91-day Treasury

* "Real" prices are as of 2010. Source for underlying numbers: Barclays Capital bill yield was 6.14 per cent as of Sep-

tember 15, 2010. Assuming a Treasury

bill yield of this level for the last 10 years,

the equity risk premium in India from

STOCKS VERSUS

2000-2010 was about 4 per cent.

The standard advice to retail in-

vestors is to hold their portfolio of

stocks for at least five-ten years and

not try to be day traders. For older in-

BONDS

vestors, the preference could be to hold

more bank deposits choosing regular

interest income to future growth. In

practice, in 2008-09, Indian invest-

ments out of household savings in

financial assets were as follows. About

8.2 per cent of GDP was invested in

A balanced portfolio of stocks can give higher return compared deposits as compared to 0.4 per cent

in shares and debentures and 2.8 per

to short-term, risk-free benchmarks, says JAIMINI BHAGWATI cent in insurance funds. The 0.4 per

cent of GDP investment in shares and

sset managers worry about portfolio of stocks as compared to short- and Mike Staunton (referred to in the debentures was after the global down-

A the composition of their

investment portfolios, that

is, the proportions of

stocks, bonds and cash in

their holdings. This article is aimed at

sensitising retail investors in India about

the risks involved in investing in stocks

term, risk-free benchmarks such as

Treasury bills (Treasury bonds carry

market risk, i.e. interest rate risk un-

less held to maturity). If stock mar-

ket returns were to be compared to sov-

ereign bonds, the equity risk premium

would be lower as government bond

Economist of September 4, 2010 and

available at ssrn.com/abstract=891620)

uses a database of “long-run stock,

bond, bill, inflation and currency re-

turns to estimate the equity risk pre-

mium for 17 countries and a world in-

dex over a 106-year interval”. This

turn and the average from 1994 to 2009

was around 1.6 per cent. (Source: RBI

Annual Reports.)

India’s growth prospects are bright,

its demographics are right and its stock

markets have risen sharply in the first

few days of this week. However, In-

vis-à-vis fixed income securities. yield curves are usually upward-slop- study finds that “taking US Treasury dia’s financial markets cannot be

Various empirical studies indi- ing, reflecting the liquidity premium bills as risk-free, the annualised risk decoupled from G7 economies and In-

cate that returns from long-term in- which has to be paid to issue longer premium for the world index was dian stocks are frothy in terms of price-

vestments in equity indices are high- maturity fixed income securities. 4.7 per cent”. Although different con- to-earnings (P/E) levels which are well

er than returns from risk-free gov- The nominal and real returns in clusions could be drawn on the size of above 20. One of the reasons for the

ernment debt. However, over the last the last 20 years on stocks and sov- the equity risk premium, depending financial sector meltdown in 2008 was

100 years, there have been patches of ereign bond indices (remaining ma- on the country and the evaluation pe- that regulators and macroeconomists

a decade or longer when diversified turities one to 10 years) in the US, the riod chosen, there have been peri- were not mindful of the extravagant

equity portfolios have yielded lower UK, Germany and Japan are shown ods when such a premium has per- risks taken by financial intermediaries.

returns than Treasury bills/bonds. In- in the table. These four G7 coun- sisted compared to short maturity sov- On the flip side, going forward Indian

dividual investors are tempted to make tries were chosen since they are cur- ereign Treasury bills. capital market participants should be

equity investments after a period of rently rated AAA. In G7 countries, growth projections careful to closely follow macroeco-

rising stock valuations and they get and demographics point towards rel- nomic developments, including the

burnt once markets inevitably correct risks associated with sovereign debt

sharply downwards.

Asset managers draw the attention

Ithenwhile

the 10 years from 1990 to 2000,

equity markets in the US,

UK and Germany were up in re-

atively bleak prospects for equity mar-

kets over the next 10 years. Concur-

rently, US, German and Japanese sov-

rescheduling or even default among

developed countries with relatively

of retail investors to the “equity risk al terms, the Japanese stock market ereign debt yields are likely to remain high credit ratings.

premium” in advising them to invest was down by 63 per cent. In the last at historic lows. The post-Second World

in stocks over the long term. Howev- 10 years from 2000 to 2010, the stock War baby-boomers will probably in- j.bhagwati@gmail.com

er, the risks involved are usually not markets in all four countries have pro- vest less and consume more in their

explained. Equity risk premium is the vided negative returns and have per- twilight years. Perhaps some of this The author is India’s ambassador

higher return, over an adequately long formed poorly compared to sovereign pessimism is reflected in EPFR Glob- to the European Union, Belgium

investment period, which can be ex- bonds. A London School of Business al Data’s findings that in calendar year and Luxembourg. The views

pected from investing in a balanced study by Elroy Dimson, Paul Marsh 2010, there have been net outflows of expressed are personal

You might also like

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Chap 60Document3 pagesChap 60Vijay ManeNo ratings yet

- Private Equity InvestmentDocument12 pagesPrivate Equity InvestmentRishipal ChauhanNo ratings yet

- Mutual Fund Portfolio Insight Report: Mohit GuptaDocument7 pagesMutual Fund Portfolio Insight Report: Mohit GuptaMohit GuptaNo ratings yet

- Real Estate: Presented By: Mukesh Singh SauravDocument13 pagesReal Estate: Presented By: Mukesh Singh SauravSaurabh SagarNo ratings yet

- SRPM Economy Analysis - Group-7Document58 pagesSRPM Economy Analysis - Group-7hiitsds12bNo ratings yet

- NNNNN NNNNNNNNN NNNNNNNNNDocument70 pagesNNNNN NNNNNNNNN NNNNNNNNNSheheryar KhanNo ratings yet

- Real Estate: Nishant Kumar PGDM 09 JimlDocument13 pagesReal Estate: Nishant Kumar PGDM 09 Jimlpankaj09128No ratings yet

- Japonia & TurciaDocument8 pagesJaponia & Turciabiancaftw90No ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- IREF V 6 Pager Brochure - X UnitsDocument6 pagesIREF V 6 Pager Brochure - X UnitsPushpa DeviNo ratings yet

- 'KQHK NhikoyhDocument12 pages'KQHK NhikoyhGiri BabaNo ratings yet

- IREF V 6 Pager Brochure - Regular UnitsDocument6 pagesIREF V 6 Pager Brochure - Regular UnitsPushpa DeviNo ratings yet

- Chap 62Document2 pagesChap 62api-19641717No ratings yet

- BD FinanceDocument5 pagesBD Financesibgat ullahNo ratings yet

- India: Asia-Pacific'S Next Mutual Funds Giant: Markets and Securities Services - 1Document10 pagesIndia: Asia-Pacific'S Next Mutual Funds Giant: Markets and Securities Services - 1EdifyNo ratings yet

- Aug-2010-Citi Indonesia ConferenceDocument67 pagesAug-2010-Citi Indonesia ConferenceFatchul WachidNo ratings yet

- Nitori Analyst ReportDocument7 pagesNitori Analyst ReportAhmad HaikalNo ratings yet

- The Philippine Stock Exchange, Inc.: February 26, 2021Document212 pagesThe Philippine Stock Exchange, Inc.: February 26, 2021Algen Lyn MendozaNo ratings yet

- DDW 20201105 PDFDocument1 pageDDW 20201105 PDFVimal SharmaNo ratings yet

- Monthly Bulletin July 2023 EnglishDocument13 pagesMonthly Bulletin July 2023 EnglishNirmal MenonNo ratings yet

- Government Domestic Borrowing: Monthly Report OnDocument8 pagesGovernment Domestic Borrowing: Monthly Report Onrashedul islamNo ratings yet

- Materi Mekanisme Perdagangan LMKA Nov 2020 - BPK IrvanDocument29 pagesMateri Mekanisme Perdagangan LMKA Nov 2020 - BPK IrvannurlisaNo ratings yet

- Debt 3Document16 pagesDebt 3mohsin.usafzai932No ratings yet

- January 21, 2022: Press ReleaseDocument2 pagesJanuary 21, 2022: Press ReleaseAayush GuptaNo ratings yet

- Statement of Government Operations: O/w Exceptional Contribution From Bank of Mauritius 33,000Document2 pagesStatement of Government Operations: O/w Exceptional Contribution From Bank of Mauritius 33,000Yashas SridatNo ratings yet

- India Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14Document5 pagesIndia Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14saransh saranshNo ratings yet

- Portfolio Management: Assortment of Investments Options To Enhance Portfolio ValueDocument24 pagesPortfolio Management: Assortment of Investments Options To Enhance Portfolio Valuechintan shahNo ratings yet

- PT Nusantara Infrastructure TBK: Draft 1 (For Discussion)Document6 pagesPT Nusantara Infrastructure TBK: Draft 1 (For Discussion)Cindy CinintyaNo ratings yet

- Iiww 031210Document4 pagesIiww 0312109913004606No ratings yet

- 0315富邦年報 - 英文.indd 1 2021/5/17 下午 02:54:09Document32 pages0315富邦年報 - 英文.indd 1 2021/5/17 下午 02:54:09YudyChenNo ratings yet

- DEL L&T Infrastructure BondDocument3 pagesDEL L&T Infrastructure Bondpoly899No ratings yet

- Indian Mutual Fund IndustryDocument25 pagesIndian Mutual Fund Industryravijha_1984No ratings yet

- 5e7d86f900475 2019 BPI Audited FS CompressedDocument125 pages5e7d86f900475 2019 BPI Audited FS CompressedHannah Brynne UrreraNo ratings yet

- Current State of Japanese Business in IndiaDocument13 pagesCurrent State of Japanese Business in IndiaPayal KathiawadiNo ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor PresentationKaveri PandeyNo ratings yet

- IapmDocument6 pagesIapmvishalsingh9669No ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor Presentationashokdb2kNo ratings yet

- Indian Stock MarketsDocument13 pagesIndian Stock Marketsmr.avdheshsharmaNo ratings yet

- List of Content: FINANCIAL STATEMENT - Asat30September2010 (Unaudited)Document17 pagesList of Content: FINANCIAL STATEMENT - Asat30September2010 (Unaudited)Aziz MuhammadNo ratings yet

- Infra Bonds FAQs PDFDocument3 pagesInfra Bonds FAQs PDFAnshuman SharmaNo ratings yet

- Debt Bulletin-Govt. of The PunjabDocument4 pagesDebt Bulletin-Govt. of The PunjabSaqib JoyiaNo ratings yet

- Investor Presentation FY13 v1Document16 pagesInvestor Presentation FY13 v1Shakti ShuklaNo ratings yet

- Indonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryDocument4 pagesIndonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryTopan ArdiansyahNo ratings yet

- Data SheetDocument3 pagesData SheetAmey SawantNo ratings yet

- BS Delhi English 22-10-2022Document26 pagesBS Delhi English 22-10-2022Relaxing MusicNo ratings yet

- Saad - IFDocument5 pagesSaad - IFRidwan KabirNo ratings yet

- Ptmail m1219 Ss Two Stock Special Report PDFDocument18 pagesPtmail m1219 Ss Two Stock Special Report PDFAaron MartinNo ratings yet

- Zee Entertainment SELL (Recommendation Downgrade) 20240122Document13 pagesZee Entertainment SELL (Recommendation Downgrade) 20240122Rohan KhannaNo ratings yet

- Role of FII in INDIAN Capital Market: Presented By: Sanketh Shetty HarishDocument35 pagesRole of FII in INDIAN Capital Market: Presented By: Sanketh Shetty HarishHarish ShettyNo ratings yet

- Strategic Financial Analysis of Diversified and Undiversified CompanyDocument15 pagesStrategic Financial Analysis of Diversified and Undiversified CompanyarunprakaashNo ratings yet

- Analyst PPT De9 PDFDocument65 pagesAnalyst PPT De9 PDFAmit GagraniNo ratings yet

- INDIA@2030 Presentation - M.D. PaiDocument33 pagesINDIA@2030 Presentation - M.D. Paimannugupta123No ratings yet

- Credit Risk - JPM Case Study IIM KDocument8 pagesCredit Risk - JPM Case Study IIM KSourabh Agrawal 23No ratings yet

- Globalising Cost of Capital Cap Budgeting Case - Akash LodhaDocument78 pagesGlobalising Cost of Capital Cap Budgeting Case - Akash LodhaKushal AdaniNo ratings yet

- Financials of Fleet Power Inc. 2020 - V2Document53 pagesFinancials of Fleet Power Inc. 2020 - V2john markNo ratings yet

- Wipro Investor PPT q4 Fy 2022Document22 pagesWipro Investor PPT q4 Fy 2022sri KarthikeyanNo ratings yet

- Ystematic Nvestment Lan UTI: An Early & Regular Investment Today, Leads To Prosperous TomorrowDocument26 pagesYstematic Nvestment Lan UTI: An Early & Regular Investment Today, Leads To Prosperous Tomorrown_akash3977No ratings yet

- Exporting Services: A Developing Country PerspectiveFrom EverandExporting Services: A Developing Country PerspectiveRating: 5 out of 5 stars5/5 (2)

- The 6 Pillars of Successful BusinessesDocument81 pagesThe 6 Pillars of Successful BusinessesJoshelle B. BanciloNo ratings yet

- At A Glance Corporate Fact SheetDocument4 pagesAt A Glance Corporate Fact SheetpanchoNo ratings yet

- DerivativesDocument12 pagesDerivativesVenn Bacus RabadonNo ratings yet

- The ABC of Creating A Mean Reversion StrategyDocument11 pagesThe ABC of Creating A Mean Reversion StrategyAnurag GroverNo ratings yet

- Pratim SIP FinalDocument74 pagesPratim SIP Finalpratim shindeNo ratings yet

- International Business and TerrorismDocument4 pagesInternational Business and TerrorismGregory George NinanNo ratings yet

- Fa Unit V Final PDFDocument8 pagesFa Unit V Final PDFAakaash100% (1)

- Are Market Efficient PDFDocument2 pagesAre Market Efficient PDFVignesh BhatNo ratings yet

- SEC Vs SantosDocument12 pagesSEC Vs SantosGigiRuizTicarNo ratings yet

- Ignou McomDocument6 pagesIgnou McomVijay Kumar GNo ratings yet

- Adjudication Order in Respect of Shailesh Shah Securities PVT LTD in The Matter of Essdee Aluminium LimitedDocument9 pagesAdjudication Order in Respect of Shailesh Shah Securities PVT LTD in The Matter of Essdee Aluminium LimitedShyam SunderNo ratings yet

- Capital Account Convertibility (ECO)Document40 pagesCapital Account Convertibility (ECO)KhushbooNo ratings yet

- Answer To MTP - Final - Syllabus 2012 - Dec2015 - Set 1: Paper - 18 - Corporate Financial ReportingDocument26 pagesAnswer To MTP - Final - Syllabus 2012 - Dec2015 - Set 1: Paper - 18 - Corporate Financial ReportingBasant OjhaNo ratings yet

- SFMSOLUTIONS Master Minds PDFDocument10 pagesSFMSOLUTIONS Master Minds PDFHari KrishnaNo ratings yet

- NO No Kwit No Container Size Tanggal Nopol Jumh Harga Keterangan IN OUT IN OUT HariDocument2 pagesNO No Kwit No Container Size Tanggal Nopol Jumh Harga Keterangan IN OUT IN OUT Hariapul sianturiNo ratings yet

- BPI Vs Guevara Case DigestDocument2 pagesBPI Vs Guevara Case DigestAnne Soria33% (3)

- Ross 7 e CH 31Document50 pagesRoss 7 e CH 31Antora HoqueNo ratings yet

- The Bankruptcy of The United StatesDocument8 pagesThe Bankruptcy of The United StatesncwazzyNo ratings yet

- Seth Klarman Baupost Group LettersDocument58 pagesSeth Klarman Baupost Group LettersAndr Ei100% (4)

- FINN 341-Financial Institutions & Market - BashrullahDocument11 pagesFINN 341-Financial Institutions & Market - BashrullahTahir AfzalNo ratings yet

- Global Technology Fund A Acc: Janus HendersonDocument2 pagesGlobal Technology Fund A Acc: Janus Hendersondoc_oz3298No ratings yet

- Blackbook Project On Foreign Exchange and Its Risk Management - 237312993Document61 pagesBlackbook Project On Foreign Exchange and Its Risk Management - 237312993Aman Tiwari75% (4)

- Calculation Methof of KSE-100 IndexDocument23 pagesCalculation Methof of KSE-100 Indexamina_rabia100% (2)

- Company Law PDFDocument3 pagesCompany Law PDFJaspreet SinghNo ratings yet

- Maritime Capital Partners LP Is A Hedge Fund Based in New York, New York Which Founded by Baris Dincer and Greg Gurevich in April 2010.Document2 pagesMaritime Capital Partners LP Is A Hedge Fund Based in New York, New York Which Founded by Baris Dincer and Greg Gurevich in April 2010.BONDTRADER100% (2)

- Super MACD Trader Guide PDFDocument36 pagesSuper MACD Trader Guide PDFPrajan J100% (1)

- Efx2.0 White PaperDocument13 pagesEfx2.0 White PaperThatOneRichGuyNo ratings yet

- DerivativesDocument53 pagesDerivativesnikitsharmaNo ratings yet

- Chapter 10 Stock Valuation A Second LookDocument33 pagesChapter 10 Stock Valuation A Second LookshuNo ratings yet