Professional Documents

Culture Documents

Notes For Students Amalgamation 1

Uploaded by

vanvun0 ratings0% found this document useful (0 votes)

273 views3 pagesVendor Company, Purchasing Company

Original Title

Notes for Students Amalgamation 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVendor Company, Purchasing Company

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

273 views3 pagesNotes For Students Amalgamation 1

Uploaded by

vanvunVendor Company, Purchasing Company

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Amalgamation is defined as a simple arrangement or reconstruction of business.

It is a process that involves

combining of two or more companies as either absorption or as blend. Two or more companies can either be

absorbed by an entirely new firm or a subsidiary powered by one of the basic firm. In such cases all the shareholders

of the absorbed company automatically become the shareholders of the ruling company as the amalgamating

company loses its existence. All the assets and liabilities are also transferred to the new entity.

Amalgamation has given different forms to different actions in due course of the merger taking place. It can either

be classified in the nature of merger or in the nature of purchase. If the process takes place in the nature of merger

then the all assets, liabilities, and shareholders holding not less than 90% of equity shares are automatically

transferred to the new company or the holding company by virtue of the amalgamation.

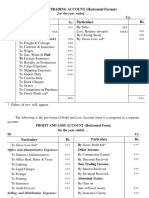

II. Accounting Treatment in the Books of Transferor/Vendor Company:

Transfer to realization account

SL.NO PARTICULAR DEBIT CREDIT

1 Transfer all Assets at book value to realization a/c ( except

Miscellaneous)

Realisation A/C Dr XXX

To Assets A/c XXX

2 Transfer all liabilities taken over purchasing company(Except

equity, preference and reserves)

Liabilities A/c Dr

To Realisation A/c XXX

XXX

PURCHASE CONSIDERATION

Purchase consideration represents consideration paid in cash, shares, debentures etc.

SL.NO PARTICULAR DEBIT CREDIT

1 Due entry for consideration

Transferee company A/C Dr XXX

To Realisation A/c XXX

2 Receipt of consideration

Shares/Cash A/c Dr XXX

To Transferee company A/c XXX

SALE OF ASSETS NOT TAKEN OVER BY PURCHASING COMPANY

SL.NO PARTICULAR DEBIT CREDIT

1 Sale with assuming profit

Bank A/C Dr XXX

To Assets A/C(book value) XXX

To Realisation A/c(Profits) XXX

2 Sale with assuming loss

Bank A/c Dr XXX

Realisation A/c(loss) Dr XXX

To Assets A/c(Book Value) XXX

SETTLEMENT OF LIABILITIES NOT TAKEN OVER BY PURCHASING COMPANY

SL.NO PARTICULAR DEBIT CREDIT

1 Settlement with assuming at discount)

Liabilities A/C Dr XXX

To Bank A/C(book value) XXX

To Realisation A/c(Profits) XXX

2 Settlement with assuming at loss

Liabilities A/c Dr XXX

Realisation A/c(loss) Dr XXX

To Bank A/c(Book Value) XXX

Realisation Expense

SL.NO PARTICULAR DEBIT CREDIT

1 Incurred by transferor(Selling Co.) company

Realisation A/c XXX

To Bank A/c XXX

2 Incurred by transferee(purchasing Co.) company

NO ENRTY NIL NIL

3 Incurred by transferor(Selling Co.) company

Reimbursed by transferee company

Transferee company A/c Dr XXX

To Bank A/c XXX

On Reimbursement

Bank A/c Dr XXX

To Transferee company A/c XXX

SETTLEMENT OF PREFERENCE SHARES AND DEBENTURES

SL.NO PARTICULAR DEBIT CREDIT

1 Preference Share Capital A/c xxxx

Realisation A/c (Loss on settlement) XXX

To Preference Shareholders a/c XXX

To Realisation A/c ( Gain on settlement) xxxx

2 Preference Shareholders A/c xxxx

To Preference shares in Purchasing Co. XXX

To Bank A/c XXX

3 --% Debenture A/c xxxx

Realisation A/c (Loss on settlement) XXX

To Debentureholders a/c XXX

To Realisation A/c ( Gain on settlement) Xxxx

4 Debentureholders A/c xxxx

To Debentures in Purchasing Co. XXX

To Bank A/c XXX

AMOUNT DUE TO EQUITY SHAREHOLDERS

SL.NO PARTICULAR DEBIT CREDIT

1 Transfer of share capital and reverse to shareholders

account

Equity Share capital A/c Dr XXX

Reserves A/c Dr XXX

To Shareholders A/c XXX

2 Transfer of balances in realization account

Realisation A/c (Profit) Dr XXX

To shareholders A/c XXX

In Case of loss

Shareholders A/c Dr XXX

To Realisation A/c (Loss) XXX

SETTLEMENT TO SHAREHOLDERS BY TRANSFER OF CONSIDERATION RECCEIVED

SL.NO PARTICULAR DEBIT CREDIT

1 Shareholders A/c Dr XXX

To shares of transferee company A/c XXX

To Bank A/c XXX

IN THE BOOKS OF TRANSFEREE COMPANY(PURCHASING COMPANY)

Accounting should be done as per accounting standard 14.

Accounting standard classifies amalgamation for the purpose of accounting into two types:

Amalgamation in nature of merger

Amalgamation in nature of purchase

Depending upon nature of amalgamation the method of accounting is decided

Method of Accounting

Nature of Amalgamation Method of Accounting

Merger Pooling of Interest Method

Purchase Purchase Method

Journal Entries in case of purchase

Due entry for business purchase

SL.NO PARTICULAR DEBIT CREDIT

1 Business Purchase A/c Dr XXX

To Liquidator transferor company A/c XXX

Incorporation of assets and liabilities taken over

SL.NO PARTICULAR DEBIT CREDIT

1 Sale consideration more than net assets of selling company.

Assets A/c Dr

Goodwill A/c Dr(Bal.Fig) XXX

To Liabilities A/c XXX

To Business Purchase A/c XXX

XXX

2 Sale consideration less than net assets of selling company.

Assets A/c Dr

To Liabilities A/c XXX

To Business Purchase A/c XXX

To Capital Reserve A/c (Bal.Fig) XXX

XXX

Sale consideration - net assets of selling company = positive amount = Goodwill (loss to

purchasing Company)

Sale consideration - net assets of selling company = Negative amount = Capital Reserve (profit

to Purchasing company)

DISCHARGE OF PURCHASE CONSIDERATION

SL.NO PARTICULAR DEBIT CREDIT

1 Liquidator of transferor company A/c Dr XXX

To Share capital A/c XXX

To Securities premium A/c XXX

To Bank A/c XXX

2 Realisation expense

Incurred by purchasing company

Goodwill/Capital reserve A/c Dr XXX

To Bank A/c XXX

Realisation incurred by selling company

NO ENTRY NIL NIL

Realisation expense by selling and the same was reimbursed

by purchasing company

Goodwill/Capital reserve A/c Dr XXX

To Bank A/c XXX

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Chapter 5 - Solution ManualDocument95 pagesChapter 5 - Solution ManualSuhud100% (1)

- Soal ChapterDocument8 pagesSoal ChapterArfenta SatriaNo ratings yet

- Amalgamation Journal EntriesDocument5 pagesAmalgamation Journal EntriesBCS78% (9)

- Branch Accounts NotesDocument19 pagesBranch Accounts NotesChandra BhattaNo ratings yet

- Sol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsDocument13 pagesSol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsFery Ann100% (5)

- Post Acquisition Integration Handbook 2011Document187 pagesPost Acquisition Integration Handbook 2011bubba5319100% (1)

- Purchase Consideration NumericalsDocument8 pagesPurchase Consideration NumericalsIsfh 67No ratings yet

- Amalgamation, Conversion & Sale of Partnership FirmDocument141 pagesAmalgamation, Conversion & Sale of Partnership FirmdhruvrohatgiNo ratings yet

- Acquisition of BusinessDocument14 pagesAcquisition of BusinessTholai Nokku [ தொலை நோக்கு ]No ratings yet

- ConsignmentDocument9 pagesConsignmentthella deva prasadNo ratings yet

- Innovative Teaching Practices - S. ValliDocument18 pagesInnovative Teaching Practices - S. ValliVaishnavi CNo ratings yet

- Partnership Final Accounts PDFDocument97 pagesPartnership Final Accounts PDFKaushik Patel75% (4)

- Depreciation of AssetDocument2 pagesDepreciation of AssetWelcome 1995No ratings yet

- Accounts From Incomplete RecordsDocument4 pagesAccounts From Incomplete RecordsGargiNo ratings yet

- Consignment Account PDFDocument13 pagesConsignment Account PDFAyush KumarNo ratings yet

- Balance Sheet NotesDocument4 pagesBalance Sheet NotesAudrey RolandNo ratings yet

- SYJCBKLMRDocument33 pagesSYJCBKLMRghostinhouse223No ratings yet

- Issue and Redemption of DebenturesDocument14 pagesIssue and Redemption of Debentureskasimsettysai ramkrirshnaNo ratings yet

- Fund Flow - RevisedDocument11 pagesFund Flow - RevisedModhish NothumanNo ratings yet

- Branch Accounts: Classification of BranchesDocument8 pagesBranch Accounts: Classification of BranchesgargaldoNo ratings yet

- 37 19 Branch Accounts Theory ProblemsDocument19 pages37 19 Branch Accounts Theory Problemsemmanuel Johny100% (2)

- Branch Accounts Theory and Problems PDFDocument18 pagesBranch Accounts Theory and Problems PDFketanNo ratings yet

- INCOMPLETE RECORDS O LevelDocument5 pagesINCOMPLETE RECORDS O LevelRECALL JIRIVENGWA100% (1)

- 3.disposal of Subsidiary AAFRDocument6 pages3.disposal of Subsidiary AAFRRana Ammar waheedNo ratings yet

- Ch-01: Accounting For Partnership Firms - Fundamental: Maintenance of Partners Capital AlcDocument70 pagesCh-01: Accounting For Partnership Firms - Fundamental: Maintenance of Partners Capital AlcPawan TalrejaNo ratings yet

- Branch Account Problems & AnswerDocument11 pagesBranch Account Problems & Answeranand dpiNo ratings yet

- Interest On DrawingsDocument2 pagesInterest On DrawingsWelcome 1995No ratings yet

- Secondary Book of Account: Prof. S. Y. ShewaleDocument10 pagesSecondary Book of Account: Prof. S. Y. Shewalesneharsh2370No ratings yet

- FFS Working NotesDocument3 pagesFFS Working NotesVignesh NarayananNo ratings yet

- Joint 2 VentureDocument13 pagesJoint 2 VentureMAGOMU DAN DAVIDNo ratings yet

- Microsoft PowerPoint - PL & BS (Compatibility Mode)Document30 pagesMicrosoft PowerPoint - PL & BS (Compatibility Mode)Riyasat khanNo ratings yet

- Form One NotesDocument2 pagesForm One NotesSalim Abdulrahim Bafadhil50% (2)

- PL and BSDocument30 pagesPL and BSAdefolajuwon ShoberuNo ratings yet

- Financial Statements Part A&bDocument6 pagesFinancial Statements Part A&b16115dxbpNo ratings yet

- Chapt 5. Internal ReconstructionDocument12 pagesChapt 5. Internal ReconstructionAnoop Mishra100% (1)

- CH 01 Accounting For Partnership - Basic ConceptsDocument11 pagesCH 01 Accounting For Partnership - Basic ConceptsMahathi AmudhanNo ratings yet

- Funds Flow Statement FormatDocument2 pagesFunds Flow Statement FormatBheemeswar ReddyNo ratings yet

- CHDocument124 pagesCHDeeran DhayanithiRPNo ratings yet

- PledgingDocument2 pagesPledgingKimNo ratings yet

- Retirement or Death of Partner NewDocument5 pagesRetirement or Death of Partner NewAnkit Roy100% (1)

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Unit 1 Amalgamation of Companies-Accounting TreatmentDocument7 pagesUnit 1 Amalgamation of Companies-Accounting Treatmentmadhushree madhushreeNo ratings yet

- Advanced Financial AccountingDocument102 pagesAdvanced Financial AccountingYash WanthNo ratings yet

- Control Accounts NotesDocument7 pagesControl Accounts NotesRithvik SangilirajNo ratings yet

- Tally Trading and Profit Loss Acc Balance SheetDocument14 pagesTally Trading and Profit Loss Acc Balance Sheetsuresh kumar10No ratings yet

- Mepa Unit 5Document18 pagesMepa Unit 5Tharaka RoopeshNo ratings yet

- 02 Partnership Final AccountsDocument43 pages02 Partnership Final AccountsroyNo ratings yet

- Accounting For Inventory, Control Accounts and A Bank ReconciliationDocument13 pagesAccounting For Inventory, Control Accounts and A Bank ReconciliationMonicah NyamburaNo ratings yet

- S.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDocument11 pagesS.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDheer BhanushaliNo ratings yet

- General Format For Final AccountsDocument2 pagesGeneral Format For Final AccountsGokulCj GroveNo ratings yet

- Format of Trading Profit Loss Account Balance Sheet PDFDocument6 pagesFormat of Trading Profit Loss Account Balance Sheet PDFsonika7100% (1)

- A3. Year End AdjustmentsDocument9 pagesA3. Year End AdjustmentsFrankNo ratings yet

- Final - Accounts Format PDFDocument13 pagesFinal - Accounts Format PDFajaychatta100% (1)

- Final - Accounts Format 234 PDFDocument13 pagesFinal - Accounts Format 234 PDFajaychattaNo ratings yet

- CMAINTER SelfBalLedgDocument13 pagesCMAINTER SelfBalLedgnobi85804No ratings yet

- Accounts Receivable - Demo TeachingDocument59 pagesAccounts Receivable - Demo TeachingNicole Flores100% (1)

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- 2 Corporate LiquidationDocument12 pages2 Corporate LiquidationMark Tayson100% (1)

- Unit IDocument10 pagesUnit IsoundarpandiyanNo ratings yet

- Chartered Accoutant - Student: AS - 12: Accounting For Government GrantsDocument6 pagesChartered Accoutant - Student: AS - 12: Accounting For Government GrantsRena Rose MalunesNo ratings yet

- 6 Branch AccountingDocument48 pages6 Branch AccountingsmartshivenduNo ratings yet

- Cost Accounting Unit 3 BBA (B&I) GGSIPUDocument10 pagesCost Accounting Unit 3 BBA (B&I) GGSIPUAkshansh Singh ChaudharyNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Nature and Context of Research 1Document16 pagesNature and Context of Research 1vanvunNo ratings yet

- GK For Class TestDocument3 pagesGK For Class TestvanvunNo ratings yet

- Nature and Context of Research 2Document2 pagesNature and Context of Research 2vanvunNo ratings yet

- Interdependence Between Micro and Macro EconomicsDocument1 pageInterdependence Between Micro and Macro Economicsvanvun0% (1)

- Costing and Cost AccountingDocument1 pageCosting and Cost AccountingvanvunNo ratings yet

- Multiple Choice Questions On Ratio and ProportionDocument1 pageMultiple Choice Questions On Ratio and Proportionvanvun100% (3)

- Logical ReasoningDocument3 pagesLogical ReasoningvanvunNo ratings yet

- Concept of Commercial Banks of Nepa1Document8 pagesConcept of Commercial Banks of Nepa1vanvunNo ratings yet

- Notes For Students Amalgamation 2Document4 pagesNotes For Students Amalgamation 2vanvunNo ratings yet

- Implications of Baumol's Sales Revenue Maximization ModelDocument1 pageImplications of Baumol's Sales Revenue Maximization ModelvanvunNo ratings yet

- Importance of OBDocument3 pagesImportance of OBvanvunNo ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- Concept of Commercial Banks of NepalDocument2 pagesConcept of Commercial Banks of Nepalvanvun100% (1)

- Teacher Vacant Announcement 1Document2 pagesTeacher Vacant Announcement 1vanvunNo ratings yet

- Contract Rent Economic Rent +wage+ Interest + Depreciation + ProfitDocument11 pagesContract Rent Economic Rent +wage+ Interest + Depreciation + ProfitvanvunNo ratings yet

- Banking: Meaning of BankDocument8 pagesBanking: Meaning of BankvanvunNo ratings yet

- SDX?SF) KL/DF) FLS/) F 1 DKLQSF) X:TFGT/) F: Quantifiaciton of Amounts (Sec. 27)Document1 pageSDX?SF) KL/DF) FLS/) F 1 DKLQSF) X:TFGT/) F: Quantifiaciton of Amounts (Sec. 27)vanvunNo ratings yet

- Liquidity Management in BanksDocument28 pagesLiquidity Management in BanksvanvunNo ratings yet

- Networking Basic Components: Merge and Burst Events: It Is Necessary For An Event To Be The Ending Event of Only OneDocument7 pagesNetworking Basic Components: Merge and Burst Events: It Is Necessary For An Event To Be The Ending Event of Only OnevanvunNo ratings yet

- Relation Between TPDocument7 pagesRelation Between TPvanvunNo ratings yet

- Worksheet 3Document21 pagesWorksheet 3Ariel von Cork100% (1)

- SHARANNLDocument2 pagesSHARANNLJade ChengNo ratings yet

- 56.IFRS Vs IASDocument3 pages56.IFRS Vs IASmercatuzNo ratings yet

- 2011 Bar MCQDocument7 pages2011 Bar MCQJDR JDRNo ratings yet

- Derivatives MarketDocument12 pagesDerivatives MarketShushmita SoniNo ratings yet

- Bus Org OutlineDocument31 pagesBus Org OutlineporkyxpNo ratings yet

- A.soriano Corporation Notice of Meeting Proxyform Infostatement PreliminaryDocument59 pagesA.soriano Corporation Notice of Meeting Proxyform Infostatement PreliminaryJayrick James AriscoNo ratings yet

- Chapter 1 Homework Assignment Fall 2018Document8 pagesChapter 1 Homework Assignment Fall 2018Marouf AlhndiNo ratings yet

- Becg Unit-4.Document12 pagesBecg Unit-4.Bhaskaran Balamurali100% (2)

- 3.sistem Operasional Asuransi SyariahDocument61 pages3.sistem Operasional Asuransi SyariahMahmudah AzizNo ratings yet

- SwapsDocument13 pagesSwapsHitesh ShadijaNo ratings yet

- Consolidated Statement of Financial PositionDocument2 pagesConsolidated Statement of Financial PositionEvita Ayne TapitNo ratings yet

- PBank 09Document350 pagesPBank 09YogaretnamNo ratings yet

- International Financial Management Abridged 10 Edition: by Jeff MaduraDocument16 pagesInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhNo ratings yet

- Updates On Open Offer (Company Update)Document3 pagesUpdates On Open Offer (Company Update)Shyam SunderNo ratings yet

- Corporate Governance (Law 506) Models of Corporate Governance: Japanese Model and German ModelDocument18 pagesCorporate Governance (Law 506) Models of Corporate Governance: Japanese Model and German Modelprabhat chaudharyNo ratings yet

- Lifting The Corporate VeilDocument48 pagesLifting The Corporate VeilalexanderdroushiotisNo ratings yet

- Bhubaneswar Circle and BranchesDocument632 pagesBhubaneswar Circle and BranchesParesh MishraNo ratings yet

- Options and Corporate Finance: Multiple Choice QuestionsDocument58 pagesOptions and Corporate Finance: Multiple Choice Questionsbaashii4No ratings yet

- Merger Agreement DraftDocument10 pagesMerger Agreement DraftrajNo ratings yet

- Razon V IAC (De Leon)Document2 pagesRazon V IAC (De Leon)ASGarcia24No ratings yet

- Ethics & Corporate Social Responsibility of BusinessDocument12 pagesEthics & Corporate Social Responsibility of BusinessDeepakNo ratings yet

- Final Exam Audapp2 2020Document5 pagesFinal Exam Audapp2 2020HisokaNo ratings yet

- ExecutivesDocument49 pagesExecutivesUmesh BatraNo ratings yet

- Laporan Transaksi Pinjaman: Juwar Niningsih JL Lobak Kel Malawele Kec AimasDocument2 pagesLaporan Transaksi Pinjaman: Juwar Niningsih JL Lobak Kel Malawele Kec AimasARD SORONGNo ratings yet

- SSRN Id1159453 PDFDocument42 pagesSSRN Id1159453 PDFgeniNo ratings yet