Professional Documents

Culture Documents

Carson Family

Uploaded by

Chance Caprarola0 ratings0% found this document useful (0 votes)

200 views1 pageproject

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentproject

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

200 views1 pageCarson Family

Uploaded by

Chance Caprarolaproject

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

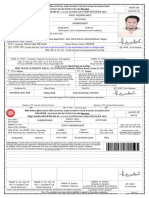

Spending Plan for: Sarah and Jim Carson

Time Period: May

Actual Amount Planned Amount

Income

Earned Income

Wages or salary before deductions 1200.00 1200.00

Commissions/tips/bonuses 2400.00 2400.00

Unearned Income 0.00 0.00

Scholarships/grants from non-government sources 460.00 460.00

Other: Student Loan money Received 200.00 200.00

Received Income from Government Programs

Grants from government sources 90.00 90.00

Total Income $4,350.00 $4,350.00

Expenses

Deductions Often Taken from Paychecks

Federal Income Tax 600.00 600.00

Social Security 223.20 223.20

Medicare 52.20 52.20

Saving and Investing (Pay Yourself First)

Contribution to savings and investments 50.00 50.00

Contribution to savings to pay tuition 0.00 0.00

Insurance Premiums

Health insurance, Medicaid and Medicare 400.00 400.00

Automobile insurance 35.00 35.00

Life insurance 0.00 75.00

Housing Costs

Housing payment (rent or mortgage) 575.00 575.00

Utilities (gas, electricity, water, garbage) 100.00 100.00

Transportation Costs

Fuel (gasoline/diesel) 100.00 100.00

Automobile repairs and maintenance 75.00 75.00

Automobile license and registration (yearly fee) 10.00 10.00

Food Costs

Food at the grocery store 400.00 400.00

Meals at restaurants 100.00 40.00

Non-food kitchen supplies (plastic wrap, dish soap) 20.00 20.00

Communication and Computers

Cell phone 90.00 50.00

Medical Costs Not Covered by Insurance

Medical care 100.00 100.00

Medications – prescription, over-the-counter 100.00 100.00

Clothing and Personal Care

Clothing 75.00 75.00

Personal care (shampoo, haircuts, cosmetics, laundry, etc.) 50.00 50.00

Educational Expenses

Tuition for private school or higher education 750.00 750.00

Educational supplies (books, news) 75.00 75.00

Entertainment

Movies, books, and other entertainment 50.00 50.00

Other: Cigarettes 266.00 0.00

Credit Costs

Credit card payment 30.00 344.60

Total Expenses $4,326.40 $4,350.00

Net Gain or Net Loss (Income less Expenses) $23.60 $0.00

You might also like

- Bud 17Document1 pageBud 17api-415326690No ratings yet

- Post-Secondary Financial PlanDocument1 pagePost-Secondary Financial Planapi-533857788No ratings yet

- Post-Secondary Financial PlanDocument1 pagePost-Secondary Financial Planapi-533857788No ratings yet

- Cit12 BudgetDocument1 pageCit12 Budgetapi-415600152No ratings yet

- Personal Monthly Budget 1Document1 pagePersonal Monthly Budget 1Verneiza Pabiran BalbastroNo ratings yet

- Personal Finance Statement Analysis (Monthly) : IncomeDocument1 pagePersonal Finance Statement Analysis (Monthly) : IncomeSaurabhNo ratings yet

- HowardDocument1 pageHowardapi-531984773No ratings yet

- (Name) Personal Finance PortfolioDocument3 pages(Name) Personal Finance PortfolioAzaleah Gem FonteNo ratings yet

- 2016 BudgetDocument14 pages2016 Budgetapi-415326012No ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthjuanNo ratings yet

- Budget Worksheet v4Document2 pagesBudget Worksheet v4chery mae maribojocNo ratings yet

- Finance 1050 Financial FormsDocument162 pagesFinance 1050 Financial Formsapi-492847624No ratings yet

- Gajendhiran-Personal Budget-December-23Document14 pagesGajendhiran-Personal Budget-December-23Amudhavalli ElumalaiNo ratings yet

- Simple Personal Budget V1.0Document4 pagesSimple Personal Budget V1.0SujithNo ratings yet

- Personal Monthly Budget PlannerDocument4 pagesPersonal Monthly Budget PlannerSpreadsheet123No ratings yet

- Income Statement Budget ComparisonDocument4 pagesIncome Statement Budget ComparisonRyan DizonNo ratings yet

- Budget ExampleDocument4 pagesBudget ExampleLizmarie ColónNo ratings yet

- Project Income CalculatorDocument4 pagesProject Income CalculatorMahmoud ElmohamdyNo ratings yet

- Sample Income and Expense SheetDocument7 pagesSample Income and Expense SheetJumar MikeNo ratings yet

- Best Money Manager - BudgetDocument3 pagesBest Money Manager - BudgetGeremy SandyNo ratings yet

- 2020 Information Budget 2020 Income FIS Monthly Takehome (Estimate) Overtime? Bonus ????Document2 pages2020 Information Budget 2020 Income FIS Monthly Takehome (Estimate) Overtime? Bonus ????Troy CampbellNo ratings yet

- SpreadsheetDocument14 pagesSpreadsheetapi-386911446No ratings yet

- Personal Monthly Budget TemplateDocument4 pagesPersonal Monthly Budget TemplatePaty HernándezNo ratings yet

- Startup Costs WorksheetDocument1 pageStartup Costs WorksheetBushra Zakir100% (1)

- About This TemplateDocument2 pagesAbout This Templateapi-658027506No ratings yet

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- Household Budget Worksheet Downloadable-6.Xls 0 1Document3 pagesHousehold Budget Worksheet Downloadable-6.Xls 0 1Ysmery DC Mercado Rivas de SalazarNo ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthjuanNo ratings yet

- Post-Secondary Financial PlanDocument1 pagePost-Secondary Financial Planapi-534063226No ratings yet

- Mind Your Money TrackerDocument13 pagesMind Your Money TrackerdhawalthefoodieNo ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthGabrielle HancelNo ratings yet

- 2017 BudgetDocument42 pages2017 Budgetapi-386914076No ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthjuanNo ratings yet

- Basic Budget Sheet For Household BudgetsDocument1 pageBasic Budget Sheet For Household Budgetsapi-26960820No ratings yet

- Presupuesto PersonalDocument9 pagesPresupuesto PersonalAobando10No ratings yet

- Startup Costs Worksheet-508 - EditedDocument1 pageStartup Costs Worksheet-508 - EditedVIVEK PNo ratings yet

- Sample Monthly Treasurer Report Template 1 4Document1 pageSample Monthly Treasurer Report Template 1 4Ban SheraidahNo ratings yet

- BULPM3892A: Chembond Centre, EL-71, MIDC, Mahape, Navi Mumbai-400710Document1 pageBULPM3892A: Chembond Centre, EL-71, MIDC, Mahape, Navi Mumbai-400710uma sankarNo ratings yet

- 50-30-20 Budget TemplateDocument1 page50-30-20 Budget TemplateKhairul IkhwanNo ratings yet

- Monthly Budget 2019Document36 pagesMonthly Budget 2019Sergiu MerticariuNo ratings yet

- My Monthly BudgetDocument2 pagesMy Monthly Budgetapi-444425700No ratings yet

- Cash FlowDocument3 pagesCash Flowkl2304013112No ratings yet

- Production and Operation Management-PARDUCHO, NICOLE S.A-Course Requirement 2Document11 pagesProduction and Operation Management-PARDUCHO, NICOLE S.A-Course Requirement 2NicoleParduchoNo ratings yet

- ASSESSMENTDocument1 pageASSESSMENTJM RomiasNo ratings yet

- Emily Annual BudgetDocument1 pageEmily Annual Budgetapi-485794458No ratings yet

- Monthly BudgetDocument4 pagesMonthly BudgetĐỗ Thị HiềnNo ratings yet

- Budget 2017 TestDocument2 pagesBudget 2017 Testapi-386921353No ratings yet

- 2017 BudgetDocument1 page2017 Budgetapi-198049502No ratings yet

- Accounting Software in ExcelDocument9 pagesAccounting Software in ExcelAvengers endgameNo ratings yet

- Baldwin 4Document4 pagesBaldwin 4api-455849499No ratings yet

- Budget 00 To 00-2022 TemplateDocument3 pagesBudget 00 To 00-2022 TemplateBrandonNo ratings yet

- Partido State UniversityDocument1 pagePartido State UniversityPaul EpoyNo ratings yet

- About This TemplateDocument3 pagesAbout This TemplateDennis KingNo ratings yet

- Personal Monthly Budget1Document3 pagesPersonal Monthly Budget1Iswan RaufNo ratings yet

- Personal Monthly Budget1Document3 pagesPersonal Monthly Budget1J FNo ratings yet

- No.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210Document1 pageNo.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210amitNo ratings yet

- Personal Monthly BudgetDocument3 pagesPersonal Monthly BudgetAhmad FarhanNo ratings yet

- Contoh Rab BulananDocument3 pagesContoh Rab Bulananalyaputripinilih12No ratings yet

- Contoh Rab BulananDocument3 pagesContoh Rab BulananusahadinamisatjehNo ratings yet

- Soloist: Owner'S ManualDocument11 pagesSoloist: Owner'S ManualAnonymous d9gckPDNo ratings yet

- Education Over The IneternetDocument1 pageEducation Over The IneternetChance CaprarolaNo ratings yet

- GradingFourMalletMarimbaLiterature PDFDocument48 pagesGradingFourMalletMarimbaLiterature PDFChance CaprarolaNo ratings yet

- Education Over IneternetDocument1 pageEducation Over IneternetChance CaprarolaNo ratings yet

- Winters Mill Warm-Up TechniqueDocument18 pagesWinters Mill Warm-Up TechniqueChance CaprarolaNo ratings yet

- Winters Mill Warm-Up TechniqueDocument18 pagesWinters Mill Warm-Up TechniqueChance CaprarolaNo ratings yet

- Theme and Variations PDFDocument12 pagesTheme and Variations PDFChance CaprarolaNo ratings yet

- PercussionDocument10 pagesPercussionAnna Maria Lopez RealNo ratings yet

- Marimba Four HandsDocument5 pagesMarimba Four HandsChance CaprarolaNo ratings yet

- Jazz TheoryDocument89 pagesJazz Theorymelvin_leong100% (18)

- GradingFourMalletMarimbaLiterature PDFDocument48 pagesGradingFourMalletMarimbaLiterature PDFChance CaprarolaNo ratings yet

- Spreadsheet PDFDocument1 pageSpreadsheet PDFChance CaprarolaNo ratings yet

- Text FileDocument1 pageText FileChance CaprarolaNo ratings yet

- Theme and Variations PDFDocument12 pagesTheme and Variations PDFChance CaprarolaNo ratings yet

- Flir One Pro User Guide 3rd Gen enDocument7 pagesFlir One Pro User Guide 3rd Gen enChance CaprarolaNo ratings yet

- Quest Sales Representatives: Name OfficeDocument7 pagesQuest Sales Representatives: Name OfficeChance CaprarolaNo ratings yet

- Text FileDocument1 pageText FileChance CaprarolaNo ratings yet

- Flir One Pro User Guide 3rd Gen enDocument7 pagesFlir One Pro User Guide 3rd Gen enChance CaprarolaNo ratings yet

- Text FileDocument1 pageText FileChance CaprarolaNo ratings yet

- Text FileDocument1 pageText FileChance CaprarolaNo ratings yet

- Research PaperDocument1 pageResearch PaperChance CaprarolaNo ratings yet

- DocumentDocument2 pagesDocumentChance CaprarolaNo ratings yet

- p115 en Om BDocument32 pagesp115 en Om Brute silvaNo ratings yet

- Housing Schemes Form 1952 To 2018 and Their Objectives: WaterDocument12 pagesHousing Schemes Form 1952 To 2018 and Their Objectives: WaterRonakNo ratings yet

- 14 Legal Duties of A CoachDocument2 pages14 Legal Duties of A CoachSai Cabarles BermasNo ratings yet

- Personnel Security Management ProtocolDocument60 pagesPersonnel Security Management Protocoljose100% (1)

- 1069 Eyeglasses 2023 2024Document2 pages1069 Eyeglasses 2023 20247v5d8b59wbNo ratings yet

- Madac EoDocument3 pagesMadac EoShirly100% (3)

- Workload Management Guide For ManagersDocument25 pagesWorkload Management Guide For ManagersFabíola GarciaNo ratings yet

- Corporate-Civic-Responsibility Chan TechTalentProject 1.6.21Document26 pagesCorporate-Civic-Responsibility Chan TechTalentProject 1.6.21Amazing HolidayNo ratings yet

- 4052271519Document2 pages4052271519rohitNo ratings yet

- FD ss43 FSDDocument6 pagesFD ss43 FSDRichard SchulzeNo ratings yet

- PR Social Protection ENDocument2 pagesPR Social Protection ENAli IqbalNo ratings yet

- Role Nurse Exec Patient SafetyDocument4 pagesRole Nurse Exec Patient SafetyInesNo ratings yet

- Sample Gad Plan For BarangaysDocument6 pagesSample Gad Plan For Barangaysyan dee67% (3)

- LSG Unit 2Document20 pagesLSG Unit 2smritig1199No ratings yet

- Georgia Drivers Handbook - Georgia Drivers ManualDocument60 pagesGeorgia Drivers Handbook - Georgia Drivers Manualpermittest100% (1)

- Operational Excellence: Protect People and The EnvironmentDocument2 pagesOperational Excellence: Protect People and The EnvironmentmakamahamisuNo ratings yet

- KCP G29 Chemical Resistance Guide ApprovedDocument4 pagesKCP G29 Chemical Resistance Guide Approvedphilip00165No ratings yet

- Appendix 4. ALDAR OSH-EHS Enforcement NoticeDocument2 pagesAppendix 4. ALDAR OSH-EHS Enforcement NoticeXtreme-DesignsNo ratings yet

- Spurious Drug SDocument16 pagesSpurious Drug SAjay SainiNo ratings yet

- Camden 120 Day Letter Steve HowardDocument2 pagesCamden 120 Day Letter Steve HowardPba DigitalservicesNo ratings yet

- Program Operations Manual For UIIDP. REVISED FINAL.6.2.20Document326 pagesProgram Operations Manual For UIIDP. REVISED FINAL.6.2.20Asmerom Mosineh100% (3)

- HRM Health Action Framework 7-28-10 WebDocument32 pagesHRM Health Action Framework 7-28-10 Webloket klinik satelitNo ratings yet

- Performance Metrics of RI D3780 RY 2017-18 To 2019-20Document9 pagesPerformance Metrics of RI D3780 RY 2017-18 To 2019-20rc_holyspiritNo ratings yet

- Health Recharge - Single SheeterDocument2 pagesHealth Recharge - Single SheeterRavi JoshiNo ratings yet

- Sexual Assault ScriptDocument7 pagesSexual Assault ScriptPriyanka MukherjeeNo ratings yet

- Comparative Position of Indonesian Pharma Industry With India and Gujarat IndexDocument39 pagesComparative Position of Indonesian Pharma Industry With India and Gujarat IndexmakvanabhaveshNo ratings yet

- Sample Position Paper 1 (Brazil)Document2 pagesSample Position Paper 1 (Brazil)Nehme Mkhael0% (1)

- 2-SOP For SOP Writing-00Document5 pages2-SOP For SOP Writing-00gopihcNo ratings yet

- Important Note Important Telephone Numbers: Florida Medicare Quick Reference Guide May 2020Document9 pagesImportant Note Important Telephone Numbers: Florida Medicare Quick Reference Guide May 2020hardeeNo ratings yet

- DOC01 - Project Brief PDFDocument9 pagesDOC01 - Project Brief PDFDanielCasadoNo ratings yet

- 01-27-12 EditionDocument32 pages01-27-12 EditionSan Mateo Daily JournalNo ratings yet