Professional Documents

Culture Documents

Ext Public Policy

Uploaded by

Tamash Majumdar0 ratings0% found this document useful (0 votes)

9 views4 pagesENVIRONMENTAL ECONOMICS NOTES

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentENVIRONMENTAL ECONOMICS NOTES

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views4 pagesExt Public Policy

Uploaded by

Tamash MajumdarENVIRONMENTAL ECONOMICS NOTES

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

Ext and Public Polic:

1, Definition of Externalities

Externalities arise whenever an individual or a firm undertakes an action that has an effect on

another individual or firm,

Consequences:

(a) Over production of goods generating negative externalities.

(b) Under-supply of goods generating positive externalities.

‘An important class of externalities arises from what is referred to as a common property resource

problem such as a pasture which is common property and there is free access or a fishing ground,

‘More generally, externalities are associated with incomplete property rights. The requirements

for perfect property rights of universality and exclusivity are violated.

An activity with a cost externality imposes net costs on other people. The fishing industry has a

cost externality, and so does producing or consuming goods that cause pollution such as

gasoline. An activity with a benefit externality confers benefits on other people without them

having to pay for them. When a child is immunized against polio, other children benefit because

the immunized child cannot contract polio and infect them. If I drain the swamp on my property

to get rid of mosquitoes I help the adjoining property owners.

Another classification distinguishes between a production externality e.g. the production of

gasoline imposes a cost externality as air quality is reduced. ‘The consumption of the gasoline

imposes a consumption externality as our quality is also reduced by this activity.

‘The externality in the fishing industry is an example of an output externality. The burning of

high-sulfur coal to produce electricity is an example of an input externality. The quality of

electricity produced by hydroelectric plants cause little or no air pollution.

‘There is also the example of a network externality. If I get a telephone or e-mail service I can

communicate with others and they can also communicate with me. A telephone would be of no

use if no one else had one.

One important distinction is between relevant and irrelevant externalities. As all economic

activity is interrelated it becomes easy to "see" externalities everywhere. One example of an

irrelevant externality maybe education. Education is an example of an inter-marginal externality.

Say we all gain from having more literate people and everyone becomes literate at 10 years of

education. But if everyone gets 12 years of education the last two years are irrelevant for literacy

and there is not externality that we have to deal with at the margin. ‘The externality associated

with education is inframarginal.

Another example of an irrelevant externality that does not result in inefficiencies and is irrelevant

for policy purposes is that of a pecuniary externality. This externality works indirectly through

prices. The actions of the second party do not enter directly into the utility function of the

production function of the first party. For example, if I increase my demand for strawberries and

drive up the price I may make other consumers worse off but I make producers of strawberries,

better off. Similarly, suppose if I didn't show up at an auction you could buy a table you just,

have to have" for $100. If I show up I bid up the price to $300 and you buy the table at that,

price. You are made worse off by my presence but the seller of the table is made better off.

‘There is no social inefficiency as a result. Pecuniary externalities are irrelevant,

2. Externalities are reciprocal in nature.

It seems natural to think of the polluter as the injurer and the person(s) hurt by the pollution as

the victim(s). But in many cases there would be no externality if the "victims" were to locate

elsewhere. If a motorist is driving down the street, a child runs in front of the car and the

motorist to avoid the child, hits a telephone pole who is the injurer? Similarly, consider the

following example, two houses heated by fireplaces peacefully co-exist until one owner builds an

elevated extension so that the smoke from the other house no longer escapes but "backs down"

into the house. Who is the injurer, the person who has built the extension or the person who is,

lighting the fires and choking on her own smoke?

Still another example, a smoker imposes an externality on the non-smoker — but the non-smoker

also imposes a burden on the smoker by being sensitive to the smoke.

3. Public goods can be viewed as a special kind of externality.

The boundary between externalities and public goods is at times quite fuzzy. For example if I

install in my backyard a device for attracting and electrocuting mosquitoes and I Kill all the

mosquitoes I have, in effect created a pure public good.

Similarly, if Canada’s expenditures on national defense are a perfect substitute (in consumption)

for US residents and vice-versa the Canadians (Americans) are creating a pure public good, the

countries will need to coordinate their expenditure programs.

4. Private Solutions to Externalities.

(a) Under some circumstances private markets can deal with externalities without government

assistance. One way to internalize the externality is by forming economic units of sufficient size

so that most of the consequences of any action occur within the unit. Owners in an apartment

building or a community may form a community association. To avoid free rider problems they

‘may write contracts with one another about cost sharing. Here there must be resources to the

legal system, which insures that the terms of the agreement are adhered to.

(b) The Coase Theorem. Externalities arise when individuals do not have to pay for the full

consequences of their actions, One common property resource is an oil pool below the ground.

All you need to tap into this pool is a piece of land and drilling equipment. The more you pump

out the less is left for other owners. Too many wells will be drilled. One way to solve this

problem is for a single firm to control the entire pool. In principle no outside intervention is

required for an efficient pattern of property rights to emerge. Alternatively, all well owners

unitize their property. They draw upon an agreement to restrict production and drilling and agree

on a fair division of revenue.

‘The more general proposition is whenever there are externalities the parties involved can get

together and make some set of arrangements by which the externality is internalized and

efficiency is assured regardless of who is given the property right (referred to as the Coase

Theorem).

This proposition is appealing to the advocate markets that are skeptical about the effectiveness of

government intervention and regulation. In his classic paper The Problem of Social Cost Ronald

Coase criticized the use of publicly imposed taxes to internalize externalities (the Pigou

solution). He also argued that the assignment of property rights to different parties will in a

world of zero transactions costs have no effect on the choice of the efficient solution to the

externality problem. Consider the case of a power plant that pollutes and five households that

live in the neighborhood. The damage to each household is $200 so total damages are equal to

$1000. There are two solution to this problem. One is to install a pollution devise at a cost of

$200 that will eliminate the damage. The second is for each household to install an air filter at a

per-unit cost of $100 at a total cost of $500, Clearly, the smoke should be eliminated. Now if

the households have the right to clean air, i.e. the power plant is liable for damages, the factory

will have the incentive to buy the pollution devise,

But if the power plant has the right to pollute it may appear that the more expensive air filters

will be chosen. Coase's basic insight was that in a world of zero transaction costs households

will have an incentive to bargain with the power plant and for the households to pay for the

installation of the more cost effective solution. The distributional consequences of the two-

property rights rule are quite different but the allocative or efficiency implications are quite

different, One possible practical application of the Coasian bargaining approach is in the area of

land use regulation. Most cities (Houston is an important exception) have central systems of

citywide zoning ordinances which prescribes the type of land use permitting in each zone.

Houston, in contrast, has deed restrictions which are private contracts drawn up by the developer

restricting the type of land use permitted in any neighborhood and enforced by the community

associations.

For the bargaining approach to be practical for land use regulating the externalities of land uses

would have to be quite localized. Jf a gas station were to be located on the edge of a residential

neighborhood only a few houses next to the station would be affected. If this were the case, the

‘owner and the homeowner could bargain over compensation and a way in which the effects of

the land use non-conformity could be internalized. There is in fact some empirical evidence that

the effects of land-use externalities are, in fact, limited in areas.

Bruce’s textbook, p. 114, illustrates the Coase theorem in action, and its shortcomings. In Los

Angeles and other areas popular for filming residents blow horns, walk through shots and make

their dogs bark or crank their stereos. They all demand money to stop. They have the right to

make noise and filmmakers adopt the Coasian Solution of paying them to keep quite near the set.

But filmmakers claim that people are manipulating the system and legislation has been

introduced to alter the distribution of property rights.

(c) Using the Legal System. Even when property rights are perfectly defined the legal system

can provide protection against externalities. Under the Law of Torts property rights are

protected by a liability rule rather than a property rule, If I damage you or your property [ have

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Taylor and CopelandDocument5 pagesTaylor and CopelandTamash MajumdarNo ratings yet

- File 60544Document42 pagesFile 60544pumpboygrNo ratings yet

- Trade EnvDocument7 pagesTrade EnvTamash MajumdarNo ratings yet

- SO2Document3 pagesSO2Tamash MajumdarNo ratings yet

- Population EnvironmentDocument7 pagesPopulation EnvironmentTamash MajumdarNo ratings yet

- Limits To Growth IDocument3 pagesLimits To Growth ITamash MajumdarNo ratings yet

- SixDocument3 pagesSixTamash MajumdarNo ratings yet

- RISKSDocument9 pagesRISKSTamash MajumdarNo ratings yet

- Water PollutionDocument10 pagesWater PollutionsonuraaNo ratings yet

- Environmental Regulations and The Competitiveness of U.S. IndustryDocument5 pagesEnvironmental Regulations and The Competitiveness of U.S. IndustryTamash MajumdarNo ratings yet

- Limits To Growth IiDocument2 pagesLimits To Growth IiTamash MajumdarNo ratings yet

- Environmental Regulation An Evolutionary ApproachDocument5 pagesEnvironmental Regulation An Evolutionary ApproachTamash MajumdarNo ratings yet

- Gloobal WarmingDocument5 pagesGloobal WarmingTamash MajumdarNo ratings yet

- SixDocument3 pagesSixTamash MajumdarNo ratings yet

- Review Questions 2007 UpdatedDocument3 pagesReview Questions 2007 UpdatedTamash MajumdarNo ratings yet

- Enviro Topics PDFDocument4 pagesEnviro Topics PDFTamash MajumdarNo ratings yet

- The Environmental Kuznet Curve (EKC)Document3 pagesThe Environmental Kuznet Curve (EKC)Tamash MajumdarNo ratings yet

- ENERGYDocument5 pagesENERGYTamash MajumdarNo ratings yet

- Discounting The FutureDocument5 pagesDiscounting The FutureTamash MajumdarNo ratings yet

- Sunstein On Benefit-Cost Analysis and RiskDocument5 pagesSunstein On Benefit-Cost Analysis and RiskTamash MajumdarNo ratings yet

- MEC 1st Year Assignments 2018-19 (English) PDFDocument9 pagesMEC 1st Year Assignments 2018-19 (English) PDFTamash MajumdarNo ratings yet

- 480 Review QuestionsDocument6 pages480 Review QuestionsTamash MajumdarNo ratings yet

- Env NaftaDocument5 pagesEnv NaftaTamash MajumdarNo ratings yet

- Econ 480 Spring 2004 - Book - List PDFDocument2 pagesEcon 480 Spring 2004 - Book - List PDFTamash MajumdarNo ratings yet

- Double DividendDocument5 pagesDouble DividendTamash MajumdarNo ratings yet

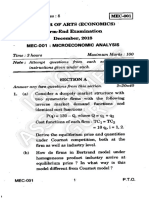

- MEC-001-J16 - ENG - Compressed PDFDocument4 pagesMEC-001-J16 - ENG - Compressed PDFTamash MajumdarNo ratings yet

- 291 - MEC-001 - ENG D18 - Compressed PDFDocument4 pages291 - MEC-001 - ENG D18 - Compressed PDFTamash MajumdarNo ratings yet

- MEC-001-D15 - ENG - Compressed PDFDocument6 pagesMEC-001-D15 - ENG - Compressed PDFTamash MajumdarNo ratings yet

- 4 Social Roots of Terrorism A Critical ADocument23 pages4 Social Roots of Terrorism A Critical ATamash MajumdarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)