Professional Documents

Culture Documents

Bacc 401 PDF

Uploaded by

MyMy MargalloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bacc 401 PDF

Uploaded by

MyMy MargalloCopyright:

Available Formats

BACC 401 –Corporation and Partnership Accounting

Basic Information

Course Title: Corporation and Partnership Accounting

Code: BACC 401

Hours: Lecture: 3 hours Credit Hours: 3

Prerequisite(s): BACC 302

Academic Year / Level: Year: 3 Term: 5

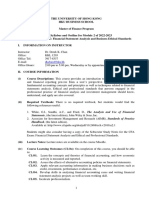

1-Course Description and Overall Objectives:

This course focuses on accounting for partnership entities and Corporations. It describes

general matters relating to the partnership form of business organization, including

partnership formation, accounting for partnership operations, and accounting for changes

in ownership interests. A special kind of partnership, the limited partnership, which is

frequently used in professional partnerships, is described also. It also covers matters

relating to dissolution and liquidation of partnerships. The course, also, covers

investments in stocks and bonds related to corporations.

Course Objectives:

A. Recognize the concepts and conditions of accounting for partnerships and

corporations.

B. Understand the main differences between partnerships and corporations.

C. Recognize and apply appropriate concepts relevant to partnerships and

corporations.

D. Analyze and interpret information from a variety of sources relevant to

partnerships and corporations.

2-Intended Learning Outcomes of the Course

(ILOs):

(A) Through knowledge and understanding, students will be able to:

(K1) Recognize different types of Business.

(K2) Identify the difference between different accounting treatments for

a new partner admission and an old partner retirement.

(K3) Recognize the difference between equity and debts.

(B) Through intellectual skills, students will be able to:

(I1) Critically assess and evaluate the accounting treatment used in

admission

and retirement.

(I2) Describe accounting treatments used in bonds payable issuance

and interest.

(I3) Distinguish different types of dividends.

(I4) Analyze and interpret information from a variety of sources

relevant

to corporation and partnership accounting.

(C) Through professional and practical skills, students will be able to:

(P1) Analyze and interpret partnership accounting problems such

as formation and admission, retirement and liquidation.

(P2) Solve partnership accounting problems such as retirement and

liquidation.

(P3) Analyze and solve corporation accounting problems such as

issuance

of equity, treasury stocks and dividend.

(P3) Analyze and interpret corporation accounting problems such as

issuance

of debt and interest on debt.

(D) Through general and transferable skills, students will be able to:

(G1) Develop effective written and oral communication skills

(G2) Develop the ability to self-appraise and reflect on relevant practices

to partnership and corporation accounting.

3-Course Outline:

Week Number 1: Initial Investment

Week Number 2: Continue initial Investment

Week Number 3: Profit and loss distribution

Week Number 4: Admission of a new partner

Week Number 5: Continue admission of a new partner

Week Number 6: Retirement of existing partner

Week Number 7: First Assessment (Lecture will continue after the assessment)

Week Number 8: Liquidation

Week Number 9: Issuance of stocks

Week Number 10: Continue issuance of stocks

Week Number 11: Treasury stocks

Week Number 12: Second Assessment (Lecture will continue after the assessment)

Week Number 13: Dividends

Week Number 14: Issuance of bonds

Week Number 15: Recording the interest

Week Number 16: Final Examination

4- Teaching and Learning Methods

The course comprises a combination of lectures, and case discussions.

Required facilities: Data Show.

5-Student Assessment Methods, Schedule and

Grading:

Start Submit

Assessment Weight

Type Week Week

No. %

No. No.

1 First Assessment 1 7 30

2 Second Assessment 8 12 30

3 Final examination 16 40

Total 100

6-List of References:

(a) Course Notes:

Notes will be distributed to the students throughout the semester.

(b) Essential Books (Text Books):

Beams, F. A., Anthony, J. H., Bettinghaus, B., Smith K. A., Advanced Accounting,

Pearson Prentice Hall, 12th Edition, 2014.

Kieso, D., Weygandt, J., Warfield, T., Intermediate Accounting, Wiley and Sons,

IFRS edition, 2011.

(c) Recommended Books:

Jeter D. C., Chaney P. K., Advanced Accounting, John Wiley & Sons, 5th Edition,

2012.

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- BACC 201 - Principles of Accounting I: Basic InformationDocument4 pagesBACC 201 - Principles of Accounting I: Basic InformationGemechu AlemuNo ratings yet

- Busn 401Document4 pagesBusn 401equalizertechmasterNo ratings yet

- MGMT 002 - Entrepreneurship: Basic InformationDocument4 pagesMGMT 002 - Entrepreneurship: Basic InformationTalal HashemNo ratings yet

- Afsa IvDocument7 pagesAfsa IvShivangi BhasinNo ratings yet

- Course OutlineDocument6 pagesCourse OutlineNancyNo ratings yet

- Intermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseDocument11 pagesIntermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseSZANo ratings yet

- 12 Accountancy English 2020 21Document464 pages12 Accountancy English 2020 21Anuja bisht100% (1)

- BMIS 301 - Management Information Systems IDocument4 pagesBMIS 301 - Management Information Systems IAA BB MMNo ratings yet

- Principles of Financial Accounting 1Document6 pagesPrinciples of Financial Accounting 1Amonie ReidNo ratings yet

- 4 - Financial Management, Course Specification, Fall 2021Document6 pages4 - Financial Management, Course Specification, Fall 2021ASIMLIBNo ratings yet

- 2022-23 - CFRA - IIMC Course Outline - SentDocument10 pages2022-23 - CFRA - IIMC Course Outline - SentAnanya DevNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)haroonsaeed12No ratings yet

- POA Course Outline Fall Revised CLO PLOs 15032022 094328am 1 05102022 124426pm 1 21022023 020034pm 3 20092023 121722pmDocument14 pagesPOA Course Outline Fall Revised CLO PLOs 15032022 094328am 1 05102022 124426pm 1 21022023 020034pm 3 20092023 121722pmDeesha BachaniNo ratings yet

- Course Outline Marketing of BFSDocument7 pagesCourse Outline Marketing of BFSKaranNo ratings yet

- ACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Document4 pagesACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Hohoho134No ratings yet

- 4539261Document2 pages4539261venkat naiduNo ratings yet

- MBM 804 Module OutlineDocument6 pagesMBM 804 Module OutlineAutorix InvestmentsNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document9 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)Muhammad AbdullahNo ratings yet

- The University of New South WalesDocument21 pagesThe University of New South WalesallanNo ratings yet

- Course Outline AFS Fall 2023Document5 pagesCourse Outline AFS Fall 2023ASIMLIBNo ratings yet

- Course Outline AFS Fall 2023Document5 pagesCourse Outline AFS Fall 2023ASIMLIBNo ratings yet

- ACCT5170 Syllabus - 2023Document7 pagesACCT5170 Syllabus - 2023bafsvideo4No ratings yet

- CommerceDocument32 pagesCommerceyashwanthbnyashwanthNo ratings yet

- Principles of Accounting V1Document6 pagesPrinciples of Accounting V1Umar AnsariNo ratings yet

- Asm 7868Document48 pagesAsm 7868sampannkhanna21No ratings yet

- AC418 Module OutlineDocument5 pagesAC418 Module OutlinetinashekuzangaNo ratings yet

- ACCT3114A - Valuation Using Financial Statements - Dr. Jing LiDocument8 pagesACCT3114A - Valuation Using Financial Statements - Dr. Jing LiTheo GalvannyNo ratings yet

- FINS1612 Capital Markets and Institutions S12016Document15 pagesFINS1612 Capital Markets and Institutions S12016fakableNo ratings yet

- Indian Institute of Management CalcuttaDocument10 pagesIndian Institute of Management CalcuttaBHAWANI SHANKAR MISHRANo ratings yet

- Acctg 2Document8 pagesAcctg 2justineNo ratings yet

- Fsa Co 08 04 2019 SSDocument6 pagesFsa Co 08 04 2019 SSDeepika PadukoneNo ratings yet

- Finance 351Document5 pagesFinance 351Bhavana KiranNo ratings yet

- Fall2015-Financial Reporting and AnalysisDocument8 pagesFall2015-Financial Reporting and AnalysisASIMLIBNo ratings yet

- RPS Akuntansi Menengah IIDocument18 pagesRPS Akuntansi Menengah IIAnyaaNo ratings yet

- Financial Accounting: Instructor: Sílvia CortêsDocument4 pagesFinancial Accounting: Instructor: Sílvia CortêsJose RodriguesNo ratings yet

- UNIT ONE Accounting Theory 2020 2021Document74 pagesUNIT ONE Accounting Theory 2020 2021JOSIANENo ratings yet

- Syllabus 2016 ADV ACCT IIDocument6 pagesSyllabus 2016 ADV ACCT IIKristina KittyNo ratings yet

- ST4S19 - FF - Essay - 2 - Tamika Inglis.Document4 pagesST4S19 - FF - Essay - 2 - Tamika Inglis.Tamika InglisNo ratings yet

- Course Outline IM (1.5) AroraDocument5 pagesCourse Outline IM (1.5) AroraKaranNo ratings yet

- 1afd4b5c-2c3f-46cc-9473-6cc7c66f0c15 (1)Document60 pages1afd4b5c-2c3f-46cc-9473-6cc7c66f0c15 (1)singhkeshav175No ratings yet

- Allama Iqbal Open University, Islamabad (COL MBA/MPA Program)Document8 pagesAllama Iqbal Open University, Islamabad (COL MBA/MPA Program)Yasin ShakirNo ratings yet

- FM Ii - PGDMDocument7 pagesFM Ii - PGDMsaarah.p23No ratings yet

- 2MINVESDocument3 pages2MINVESMynn Ü DeLa CruzNo ratings yet

- ACCT 402 - Tax Accounting: Basic InformationDocument4 pagesACCT 402 - Tax Accounting: Basic InformationDima AbdulhayNo ratings yet

- International Gcse Accounting GSGDocument58 pagesInternational Gcse Accounting GSGThusi SakthiNo ratings yet

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Document7 pages1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelNo ratings yet

- FA MBA Quarter I SNU Course Outline 2020Document7 pagesFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajNo ratings yet

- Student Handbook ACC3015 2018 - 19 DLDocument123 pagesStudent Handbook ACC3015 2018 - 19 DLThara DasanayakaNo ratings yet

- Department of Business Administration: Course DescriptionDocument4 pagesDepartment of Business Administration: Course DescriptionSadia FarahNo ratings yet

- Module For Fundamentals of AccountingDocument9 pagesModule For Fundamentals of AccountingJohn Rey Bantay Rodriguez50% (2)

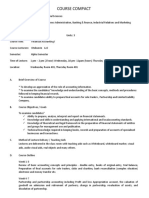

- ACC 211 Course CompactDocument2 pagesACC 211 Course CompactKehindeNo ratings yet

- Ass 1 - MERIT - Vu Ngoc LinhDocument40 pagesAss 1 - MERIT - Vu Ngoc LinhNguyen Minh Thanh (FGW HCM)No ratings yet

- Syllabus IY2589Document2 pagesSyllabus IY2589Maaz KhanNo ratings yet

- BBA: I Semester Principles of Management Paper Code: 101Document6 pagesBBA: I Semester Principles of Management Paper Code: 101Madhu mithraNo ratings yet

- Accounting SyllabusDocument16 pagesAccounting SyllabusTarry YzalNo ratings yet

- Corporate and Academic Services Module Specification Part 1: Basic DataDocument4 pagesCorporate and Academic Services Module Specification Part 1: Basic DataDesireeNo ratings yet

- RPS Analisa Laporan Keuangan Agustus 2020Document24 pagesRPS Analisa Laporan Keuangan Agustus 2020Shiel VhyNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- In Partnership With The University of Suffolk BABS AssignmentDocument8 pagesIn Partnership With The University of Suffolk BABS AssignmentMohammad helal uddin ChowdhuryNo ratings yet

- Urgency of SalvationDocument1 pageUrgency of SalvationMyMy MargalloNo ratings yet

- Margallo, Elizar - TOP 10 BANKS IN THE PHIL.Document44 pagesMargallo, Elizar - TOP 10 BANKS IN THE PHIL.MyMy MargalloNo ratings yet

- Urgency of SalvationDocument1 pageUrgency of SalvationMyMy MargalloNo ratings yet

- ExhortationDocument5 pagesExhortationMyMy MargalloNo ratings yet

- Prospects and Walk Ins 2019Document5 pagesProspects and Walk Ins 2019MyMy MargalloNo ratings yet

- Pananaliksik RefrencesDocument2 pagesPananaliksik RefrencesMyMy MargalloNo ratings yet

- Govermentvsgovernance 161129133440 PDFDocument15 pagesGovermentvsgovernance 161129133440 PDFJeffrey EstacioNo ratings yet

- Prayer SermonDocument1 pagePrayer SermonMyMy MargalloNo ratings yet

- Fight The Good Fight of FaithDocument2 pagesFight The Good Fight of FaithMyMy MargalloNo ratings yet

- Thy Will Be DoneDocument2 pagesThy Will Be DoneMyMy MargalloNo ratings yet

- Redeeming The TimeDocument4 pagesRedeeming The TimeMyMy MargalloNo ratings yet

- OK MKTG 10 Services Marketing Course SyllabusDocument9 pagesOK MKTG 10 Services Marketing Course Syllabuseugene pilotonNo ratings yet

- Proposal of SYCODocument4 pagesProposal of SYCOMyMy MargalloNo ratings yet

- May Schedule: KeyindicatorsforthemonthofaprilDocument3 pagesMay Schedule: KeyindicatorsforthemonthofaprilMyMy MargalloNo ratings yet

- Strategic Marketing ManagementDocument12 pagesStrategic Marketing ManagementEarl Russell S PaulicanNo ratings yet

- Consultation Form: (To Be Accomplished If The Issue(s) or Concern(s) Was/were Not Solved at The Faculty-Student Level.)Document1 pageConsultation Form: (To Be Accomplished If The Issue(s) or Concern(s) Was/were Not Solved at The Faculty-Student Level.)MyMy MargalloNo ratings yet

- HUMSS - Philippine Politics and Governance CG PDFDocument10 pagesHUMSS - Philippine Politics and Governance CG PDFReggie Regalado83% (6)

- MAR 4232 Retail Management Syllabus Spring 2014 Term: Course Objectives & Student Learning OutcomesDocument8 pagesMAR 4232 Retail Management Syllabus Spring 2014 Term: Course Objectives & Student Learning OutcomesMyMy MargalloNo ratings yet

- 100 Most Important Grammar Rules For SSC-CGL 2017 ExamDocument17 pages100 Most Important Grammar Rules For SSC-CGL 2017 Examameya meshramNo ratings yet

- Error EnglishDocument34 pagesError EnglishDebarshi DalaiNo ratings yet

- Retail Marketing Syllabus 2013Document6 pagesRetail Marketing Syllabus 2013MyMy MargalloNo ratings yet

- Intro To Partnership Corporation Accounting PDFDocument11 pagesIntro To Partnership Corporation Accounting PDFMyMy Margallo100% (1)

- Retail Marketing Syllabus 2013Document6 pagesRetail Marketing Syllabus 2013MyMy MargalloNo ratings yet

- Attendnce Warning NoticeDocument2 pagesAttendnce Warning NoticeMyMy MargalloNo ratings yet

- 1097 Course Syllabus Entrepreneurial ManagementDocument3 pages1097 Course Syllabus Entrepreneurial ManagementMyMy MargalloNo ratings yet

- BACC 401 - Corporation and Partnership AccountingDocument4 pagesBACC 401 - Corporation and Partnership AccountingMyMy MargalloNo ratings yet

- Bacc 401Document10 pagesBacc 401MyMy MargalloNo ratings yet

- Intro To Partnership Corporation AccountingDocument11 pagesIntro To Partnership Corporation AccountingMyMy MargalloNo ratings yet

- HBO Syllabus OkDocument10 pagesHBO Syllabus OkMyMy MargalloNo ratings yet

- Services Marketing Syllabus: 12 Classes For 2 CreditsDocument8 pagesServices Marketing Syllabus: 12 Classes For 2 CreditsMyMy MargalloNo ratings yet

- Drones and Disruptive WarDocument20 pagesDrones and Disruptive WaralexandremagachoNo ratings yet

- DTI Department Administrative Order No. 004-14, December 15, 2014Document2 pagesDTI Department Administrative Order No. 004-14, December 15, 2014Mak FranciscoNo ratings yet

- Evaluating SOWsDocument1 pageEvaluating SOWsAnonymous M9MZInTVNo ratings yet

- AP Human Geo Final Study GuideDocument9 pagesAP Human Geo Final Study GuideRenae BarnesNo ratings yet

- Jha RWFW Raft Cocrete JobDocument3 pagesJha RWFW Raft Cocrete JobsoubhagyaNo ratings yet

- David Benson Errata Sheet Oct 6 2016 PDFDocument8 pagesDavid Benson Errata Sheet Oct 6 2016 PDFMaría100% (1)

- A Roadmap Towards The Implementation of An Efficient Online Voting System in BangladeshDocument5 pagesA Roadmap Towards The Implementation of An Efficient Online Voting System in BangladeshNirajan BasnetNo ratings yet

- Annual Report On RefugeeDocument2 pagesAnnual Report On RefugeePaul Mike100% (1)

- Using Patterns of Development in Writing Across DisciplinesDocument15 pagesUsing Patterns of Development in Writing Across Disciplinesbaby jane omabay50% (4)

- 3 6 3 1 Disaster Operations CenterDocument7 pages3 6 3 1 Disaster Operations CenterLorenzo Raphael C. ErlanoNo ratings yet

- 1 Senior High School CurriculumDocument85 pages1 Senior High School CurriculumWarren Dela CernaNo ratings yet

- Supplementary Regulations - FIM Speedway Grand Prix Vojens DENDocument4 pagesSupplementary Regulations - FIM Speedway Grand Prix Vojens DENАлексей ПолянцевNo ratings yet

- Course Outline 2021 SCMA7CODocument5 pagesCourse Outline 2021 SCMA7COShannalNo ratings yet

- DCDN 082Document175 pagesDCDN 082dklawofficeNo ratings yet

- Employee Green BehaviorDocument13 pagesEmployee Green BehaviorDeep KhatiNo ratings yet

- Bid StandardDocument119 pagesBid StandardFau JohnNo ratings yet

- Business and Finance: Professional Stage Knowledge LevelDocument6 pagesBusiness and Finance: Professional Stage Knowledge Levelroben6kaizenNo ratings yet

- 10 Proven Templates For Writing Value Propositions That WorkDocument6 pages10 Proven Templates For Writing Value Propositions That WorkGeo GlennNo ratings yet

- Curriculum PlanningDocument16 pagesCurriculum PlanningArcee ZelNo ratings yet

- 15 Sa 225Document12 pages15 Sa 225Dhwani Antala100% (1)

- Chapter 4 PMP StudyDocument24 pagesChapter 4 PMP StudyAbdülhamit KayyaliNo ratings yet

- Hatikvah International Academy Charter SchoolDocument5 pagesHatikvah International Academy Charter SchooldarciecimarustiNo ratings yet

- 5 Pts and 5 Pts 1Document5 pages5 Pts and 5 Pts 1Shannon B BuyuccanNo ratings yet

- Be Prepared! - Pass That Job InterviewDocument98 pagesBe Prepared! - Pass That Job InterviewvixosaNo ratings yet

- ENR 5.1 - Proh - Rest - DangerareasDocument32 pagesENR 5.1 - Proh - Rest - DangerareasNoob GamingNo ratings yet

- Aspecn1 Reaction PaperDocument2 pagesAspecn1 Reaction PaperDenmar BalbonaNo ratings yet

- LeadsDocument3 pagesLeadsMd. RobinNo ratings yet

- Salesmanship: A Form of Leadership: Dr. Dennis E. MaligayaDocument22 pagesSalesmanship: A Form of Leadership: Dr. Dennis E. MaligayaDennis Esik MaligayaNo ratings yet

- Reading 1: Read The Text Quickly. Who Started Friends of The Earth?Document1 pageReading 1: Read The Text Quickly. Who Started Friends of The Earth?adrianmaiarotaNo ratings yet

- MARKETING MANAGEMENT - 1st Unit - Introduction To MarketingDocument51 pagesMARKETING MANAGEMENT - 1st Unit - Introduction To MarketingDr VIRUPAKSHA GOUD GNo ratings yet