Professional Documents

Culture Documents

Tambunting Pawnshop

Uploaded by

Mona LizaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tambunting Pawnshop

Uploaded by

Mona LizaCopyright:

Available Formats

TAMBUNTING PAWNSHOP, INC. vs.

COMMISSIONER OF

INTERNAL REVENUE- Value Added Tax, Documentary

Stamp Tax

FACTS:

Petitioner was assessed for deficiency Value Added Tax and Documentary Stamp Tax on

the premise that, for the Value Added Tax, it was engaged in the sale of services.

ISSUES:

(1) Is Petitioner liable for the Value Added Tax?

(2) Can the imposition of surcharge and interest be waived on the imposition of deficiency

Documentary Stamp Tax?

HELD:

(1) NO. Since Petitioner is considered a non-bank financial intermediary, it is subject to

10% VAT for the tax years 1996 to 2002 but since the collection of Value Added Tax from

non-bank financial intermediaries was specifically deferred by law, Petitioner is not liable

for Value Added Tax during these tax years. With the full implementation of the Value

Added Tax system on non-bank financial intermediaries starting January 1, 2003,

Petitioner is liable for 10% Value Added Tax for said tax year. And beginning 2004 up to

the present, by virtue of R.A. No. 9238, petitioner is no longer liable for VAT but it is subject

to percentage tax on gross receipts from 0% to 5%, as the case may be.

(2) YES. Petitioner's argument against liability for surcharges and interest — that it was in

good faith in not paying documentary stamp taxes, it having relied on the rulings of

respondent CIR and the CTA that pawn tickets are not subject to documentary stamp taxes

— was found to be meritorious. Good faith and honest belief that one is not subject to tax

on the basis of previous interpretations of government agencies tasked to implement the

tax law are sufficient justification to delete the imposition of surcharges and interest.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- X.V. G.r.no. 108524, Nov. 10,1994Document1 pageX.V. G.r.no. 108524, Nov. 10,1994Mona LizaNo ratings yet

- Civil Procedure Up BarsoftDocument12 pagesCivil Procedure Up BarsoftMona LizaNo ratings yet

- Criminal Law Cases2Document2 pagesCriminal Law Cases2Mona LizaNo ratings yet

- VegetablesDocument7 pagesVegetablesMona LizaNo ratings yet

- Criminal Law CASEsDocument2 pagesCriminal Law CASEsMona LizaNo ratings yet

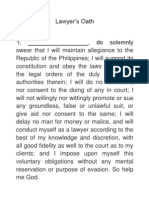

- Lawyer's OathDocument1 pageLawyer's OathKukoy PaktoyNo ratings yet

- Cir Vs BF GoodrichDocument1 pageCir Vs BF GoodrichMona LizaNo ratings yet

- Zuno Vs CabredoDocument2 pagesZuno Vs CabredoMona Liza100% (1)

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- Phil Acetylene V CIRDocument1 pagePhil Acetylene V CIRShaneBeriñaImperialNo ratings yet

- Rodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Document3 pagesRodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Mona LizaNo ratings yet

- Intestado de Don Valentin Descals - Tax2Document1 pageIntestado de Don Valentin Descals - Tax2Mona LizaNo ratings yet

- X.viii. G.R.No. 168129Document2 pagesX.viii. G.R.No. 168129Mona LizaNo ratings yet

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Document1 pageEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaNo ratings yet

- Mary Grace Natividad S PoeDocument4 pagesMary Grace Natividad S PoeMona LizaNo ratings yet

- Trinidad GamboaDocument10 pagesTrinidad GamboaMona LizaNo ratings yet

- De Borja Vs de BorjaDocument2 pagesDe Borja Vs de BorjaArgel Joseph CosmeNo ratings yet

- Palaganas V Palaganas Case DigestDocument2 pagesPalaganas V Palaganas Case Digesthistab100% (3)

- Bernas PIL ReviewerDocument42 pagesBernas PIL ReviewerDarla Grey100% (11)

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument2 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Document1 pageEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument10 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Palaganas V Palaganas Case DigestDocument1 pagePalaganas V Palaganas Case DigestMona LizaNo ratings yet

- Reaction Paper On The Principle of Jus Cogens by Mona LizaDocument3 pagesReaction Paper On The Principle of Jus Cogens by Mona LizaMona LizaNo ratings yet

- REDocument2 pagesREMona LizaNo ratings yet

- Third Party Affidavit 1Document1 pageThird Party Affidavit 1Mona Liza100% (1)

- 4Document5 pages4Mona LizaNo ratings yet

- Pale Cases EugeneDocument6 pagesPale Cases EugeneMona LizaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)