Professional Documents

Culture Documents

Republic Act No. 10632 - IRR

Uploaded by

Jonas QuilantipCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Republic Act No. 10632 - IRR

Uploaded by

Jonas QuilantipCopyright:

Available Formats

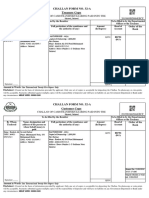

Certificate of Final Tax

2306

BIR Form No.

Republika ng Pilipinas

Withheld At Source

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

September 2005 (ENCS)

1 For the Period

From (MM/DD/YY) To (MM/DD/YY)

Part I Income Recipient/Payee Information Withholding Agent/Payor Information

2 TIN 3 TIN

4 Payee's Name (For Non-Individuals ) 5 Payor's Name (For Non- Individuals)

6 Payee's Name (Last Name, First Name, Middle Name) For Individuals 7 Payor's Name (Last Name, First Name, Middle Name) For Individuals

8 Registered Address 9 Registered Address

8A Zip 9A Zip

Code Code

10 Foreign Address 10A Zip Code 10B ICR No. (For Alien Income Recipient Only)

Part II Details of Income Payment and Tax Withheld (Attach additional sheet if necessary)

Nature of Income Payment ATC Amount of Payment Tax Withheld

Total

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

correct pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Payor/Payor's Authorized Representative/Accredited Tax Agent TIN of Signatory Title/Position of Signatory Date Signed

Signature Over Printed Name

Tax Agent Accreditation No./Attorney's Roll No. (if applicable) Date of Issuance Date of Expiry

CONFORME:

Payee/Payee's Authorized Representative/Accredited Tax Agent TIN of Signatory Title/Position of Signatory Date Signed

Signature Over Printed Name

Tax Agent Accreditation No./Attorney's Roll No. (if applicable) Date of Issuance Date of Expiry

To be accomplished for Value-Added Tax/Percentage Tax Withholding (substituted filing)

I declare, under the penalties of perjury, that the information I declare under the penalties of perjury that I am qualified under substituted filing of Percentage

herein stated are reported under BIR Form No. 1600 which Tax/Value Added Tax Returns (BIR Form 2551M/2550M/Q), since I have only one payor from

have been filed with the Bureau of Internal Revenue. whom I earn my income; that, in accordance with RR 14-2003, I have availed of the Optional

Registration under the 3% Final Percentage Tax Wthholding/10% Final VAT Withholding in lieu

of the 3% Percentage Tax/10% VAT in order to be entitled to the privileges accorded by the

Substituted Percentage Tax Return/Substituted VAT Return System prescribed in the aforesaid

Payor/Payor's Authorized Representative/Accredited Tax Agent Regulations; that, this Declaration is sufficient authority of the withholding agent to withhold 3%

Signature Over Printed Name Final Percentage Tax/10% Final VAT from my sale of goods and/or services.

TIN of Signatory Title/Position of Signatory Payee/Payee's Authorized Representative/Accredited Tax Agent Title/Position of Signatory

Signature Over Printed Name

Tax Agent Accreditation No./Attorney's Roll No. (if applicable) Tax Agent Accreditation No./Attorney's Roll No. (if applicable) TIN of Signatory

Date of Issuance Date of Expiry Date of Issuance Date of Expiry

W I 320

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- TaxReturn PDFDocument24 pagesTaxReturn PDFga80% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Estmt - 2021-05-06 2Document6 pagesEstmt - 2021-05-06 2Moctar GueyeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Form 57ADocument2 pagesForm 57AAbdunnajar Mahamud83% (6)

- QM-WM Interface IssuesDocument28 pagesQM-WM Interface IssuesJagannadh Pradeep Ivaturi100% (2)

- Please Confirm To ContinueDocument4 pagesPlease Confirm To ContinueMahakaal Digital PointNo ratings yet

- VAC - Barangay Data Capture FormDocument3 pagesVAC - Barangay Data Capture FormJonas Quilantip100% (4)

- Regular Income TaxDocument11 pagesRegular Income Taxwhat ever100% (4)

- Barangay San Agustin ClearanceDocument1 pageBarangay San Agustin ClearanceJonas QuilantipNo ratings yet

- Accounting Cycle of A Service Business: Chapter 10-11Document2 pagesAccounting Cycle of A Service Business: Chapter 10-11des marzanNo ratings yet

- Oath of UndertakingDocument1 pageOath of UndertakingJonas Quilantip100% (2)

- Classic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Document4 pagesClassic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Deva LinaNo ratings yet

- 7bneo BbisDocument11 pages7bneo BbisAnthony Briones ClidoroNo ratings yet

- Barangay Indigency Form 2Document2 pagesBarangay Indigency Form 2Jonas QuilantipNo ratings yet

- Affidavit of Lost Official ReceiptDocument1 pageAffidavit of Lost Official ReceiptJonas QuilantipNo ratings yet

- Appoint 2Document2 pagesAppoint 2Jonas QuilantipNo ratings yet

- Barangay Indigency FormDocument2 pagesBarangay Indigency FormJonas Quilantip100% (1)

- Summon NewDocument1 pageSummon NewJonas QuilantipNo ratings yet

- Brgy ResidencyDocument1 pageBrgy ResidencyJonas QuilantipNo ratings yet

- BADAC Form - ID CouncilDocument3 pagesBADAC Form - ID CouncilJonas QuilantipNo ratings yet

- Officers ReturnDocument1 pageOfficers ReturnJonas Quilantip100% (1)

- Appoint 2Document2 pagesAppoint 2Jonas QuilantipNo ratings yet

- AppointmentDocument2 pagesAppointmentJonas QuilantipNo ratings yet

- Barangay Case Summons Physical InjuryDocument1 pageBarangay Case Summons Physical InjuryJonas QuilantipNo ratings yet

- Summons: Office of The Lupon TagapamayapaDocument1 pageSummons: Office of The Lupon TagapamayapaJonas QuilantipNo ratings yet

- BADAC TEMPLATE - Committee On Advocacy Organizational StructureDocument1 pageBADAC TEMPLATE - Committee On Advocacy Organizational StructureJonas QuilantipNo ratings yet

- VAW - Barangay Data Capture FormDocument2 pagesVAW - Barangay Data Capture FormJonas Quilantip100% (1)

- Certificate of Indigence: Office of The Punong BarangayDocument1 pageCertificate of Indigence: Office of The Punong BarangayJonas Quilantip100% (3)

- Certificate of Indigence: Office of The Punong BarangayDocument1 pageCertificate of Indigence: Office of The Punong BarangayJonas Quilantip100% (3)

- DLL - Science 6 - Q3 - W5Document6 pagesDLL - Science 6 - Q3 - W5Jonas QuilantipNo ratings yet

- Solid Waste OrdinanceDocument7 pagesSolid Waste OrdinanceJonas QuilantipNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- ExpendituresDocument13 pagesExpendituresJonas QuilantipNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- Eo Gad Focal Point System NewDocument2 pagesEo Gad Focal Point System NewJonas QuilantipNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- Barangay Development Council: Republic of The PhilippinesDocument1 pageBarangay Development Council: Republic of The PhilippinesJonas QuilantipNo ratings yet

- Legal Services AgreementDocument1 pageLegal Services AgreementJonas QuilantipNo ratings yet

- IT2021112401011395486Document4 pagesIT2021112401011395486ali aabisNo ratings yet

- TAX 1016 Lesson TWODocument8 pagesTAX 1016 Lesson TWOMonica MonicaNo ratings yet

- Philippine Economic Zone Authority (PEZA)Document7 pagesPhilippine Economic Zone Authority (PEZA)LeaNo ratings yet

- IRCTC Booking Confirmation for Train 22948 on 05-Aug-2019 from KIUL to STDocument1 pageIRCTC Booking Confirmation for Train 22948 on 05-Aug-2019 from KIUL to STSamar DasNo ratings yet

- ERP MarketplaceDocument14 pagesERP MarketplaceSuraj MuktiNo ratings yet

- 23052700153286FDRL ChallanReceiptDocument2 pages23052700153286FDRL ChallanReceiptNARAYAN KUMAR MONDALNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVeeresh ShettarNo ratings yet

- Global Port Operator Yilport Expands ReachDocument43 pagesGlobal Port Operator Yilport Expands ReachKam MohamadNo ratings yet

- Salary Slip Format by FormulaDocument4 pagesSalary Slip Format by FormulaSamsul AlamNo ratings yet

- (Reviewer) TaxDocument13 pages(Reviewer) TaxchxrlttxNo ratings yet

- Business Taxation MeaningDocument4 pagesBusiness Taxation MeaningSheila Mae AramanNo ratings yet

- E StampDocument1 pageE StampUmer ShaukatNo ratings yet

- Sun Life Payment Channels GuideDocument1 pageSun Life Payment Channels GuideJesus HernandezNo ratings yet

- Dub 5198522Document1 pageDub 5198522Anand BabuNo ratings yet

- Attachment 4 To Item 8.1-Safe Speed Plan Proposed Speed Limits Bylaw 201...Document108 pagesAttachment 4 To Item 8.1-Safe Speed Plan Proposed Speed Limits Bylaw 201...Stuff NewsroomNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFPragna NachikethaNo ratings yet

- Presentación Argos INGLESDocument10 pagesPresentación Argos INGLESCarlos Alberto SilvaNo ratings yet

- DownloadDocument6 pagesDownloadFaris KhazaharNo ratings yet

- CSDB Registration FormDocument1 pageCSDB Registration Formanon-675234No ratings yet

- Budgeting QuestionsDocument13 pagesBudgeting QuestionsShafiq UrRehmanNo ratings yet

- Statement - XXXX XXXX 0561 - 15mar2024 - 17 - 44Document25 pagesStatement - XXXX XXXX 0561 - 15mar2024 - 17 - 44dipakk21051994No ratings yet

- Tally Document For Set 2Document4 pagesTally Document For Set 2Chandu123 ChanduNo ratings yet

- Rwu BGnzyij BWR9 F3Document3 pagesRwu BGnzyij BWR9 F3Prakash kumarTripathiNo ratings yet