Professional Documents

Culture Documents

Aug 2015 Question 4 - Topic 1: Introduction To FMGT

Uploaded by

Sharleen ZxzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aug 2015 Question 4 - Topic 1: Introduction To FMGT

Uploaded by

Sharleen ZxzCopyright:

Available Formats

Aug 2015 Question 4 – Topic 1: Introduction to FMGT

“We will further expand the scope of our efforts to deliver one UNIQLO article of clothing for

every refugee in the world. We will continue donations in the line with local needs the world

over. Having as many customers as possible bring in items for recycling helps steadily widen

the circle of support, we have created for people living in difficult environment.”

(a) Identify the ethical challenge that Uniqlo is addressing. Are Uniqlo’s actions consistent with

the financial goals of a firm? Briefly explain.

The ethical challenge Uniqlo is addressing is Corporate Social Responsibility (CSR). Uniqlo’s

support of the recycling and donating may affect its profits in the short-term in view of the costs

involved – manpower, time and resources. However, in the long-run, there will be increased

customer loyalty, better company image, lower litigation costs, which helps the value of the

firm to be enhanced.

(b) Who are Uniqlo’s stakeholders? Discuss briefly ‘stakeholders’ interest’ as an ethical

challenge faced by financial managers

Managers of Uniqlo

Non-manager level employees

Creditors, suppliers and customers who have a relationship with the firm.

Although the primary goal of the firm is to maximise the wealth of the owners, the interest of

these stakeholders can influence business decisions.

The ‘stakeholders’ interest’ view prescribes that firms make a conscious effort to avoid actions

that could be detrimental to the wealth position of its stakeholders.

(c) List TWO other Corporate Social Responsibility (CSR) activities that firms may undertake.

Uniqlo recovery assistance project and all-product recycling activities. (ACTIVITIES)

Topic 5: Short-Term Financing Question

Memphis Pte Ltd is also considering two short-term financing options:

Option A: Borrow $2,000,000 from a bank which charges 1% interest every 40 days. Assume

that interest is rolled over (compounding) every 40 days.

Option B: Issue a $2,000,000 face value 90-day commercial paper at 5% per annum interest

rate on a discounted basis. Total transaction fees on issuing commercial paper is 1.5% of the

amount issued. Assume interest is rolled over every 90 days.

What are the Effective Annual Rates of the two options above? Which should Memphis Pte

Ltd choose?

Use a 360-day year for computation, and round your answers to 1 decimal place.

Option A

Compounding periods in a year = 360 / 40

=9

EAR = [1 + 0.01]9 – 1

= 9.4%

Option B

Interest = 0.05 x $2,000,000 x (90/360)

= $25,000

Transaction Fee = (1.5/100) x $2,000,000

= $30,000

90-day cost = $55,000 / ($2,000,000 - $55,000) x 100%

= 2.828%

EAR = [(1 + 0.02828)4 – 1]

= 11.8%

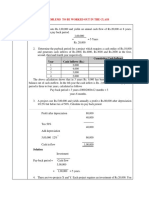

(i) The initial cost of investment

$ $

Cost of new machine 520,000

Add: Installation cost 30,000

Total cost of new machine 550,000

Add: Additional Working Capital

Increase in Inventory 20,000

Increase in Accounts Receivable 60,000

Increase in Accounts Payable (30,000) 50,000

Less: Proceeds from sale of old machine (70,000)

Total Initial Investment 530,000

(ii) The annual incremental cash flows

Annual incremental cash flows

(Years 1 to 4)

$

Year 1 300,000 + 90,000 = 390,000

Year 2 300,000 + 90,000 = 390,000

Year 3 350,000 + 90,000 = 440,000

Year 4 350,000 + 90,000 = 440,000

(iii) The terminal cash flows

$

Recovery of working capital 50,000

Salvage value of asset 30,000

Total Terminal Cash Flow 80,000

(iv) The non-discounted Payback Period of the project

Net After-tax Cash Flow

Year

$

0 - 530,000

1 390,000

2 390,000

3 440,000

4 440,000

4 80,000

Payback Period = 1 + (530,000 – 390,000) / 390,000

= 1.36 years

(v) Net Present Value (NPV) of the project. Should the company go ahead with the project?

Net After-tax Cash

Year PVIF @ 10% PV

Flow

0 -530,000

1 390,000

2 390,000

3 440,000

4 440,000

4 80,000

You might also like

- Accounting Fundamentals PracticeDocument9 pagesAccounting Fundamentals PracticealitohdezsalNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- BBF 321Document10 pagesBBF 321sipanjegivenNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (1)

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- Accounting Fundamentals Practice-ASH - IVADocument12 pagesAccounting Fundamentals Practice-ASH - IVAalitohdezsalNo ratings yet

- 23 Nov 2018 Mixed Questions With Solutions PDFDocument9 pages23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziNo ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Gross Profit 200,000 Down Payment 100,000Document9 pagesGross Profit 200,000 Down Payment 100,000Marko JerichoNo ratings yet

- Slides of Lecture#09 Corporate Finance (FIN-622)Document4 pagesSlides of Lecture#09 Corporate Finance (FIN-622)sukhiesNo ratings yet

- CF Assignment 2Document8 pagesCF Assignment 2saravanan.ANo ratings yet

- Question OneDocument16 pagesQuestion OneShesha Nimna GamageNo ratings yet

- Solutions On Capital BudgetingDocument25 pagesSolutions On Capital BudgetingASH GAMING GamesNo ratings yet

- Ty SPM L7Document15 pagesTy SPM L7sanilNo ratings yet

- Tugas AKM III - Week 3Document6 pagesTugas AKM III - Week 3Rifda AmaliaNo ratings yet

- Problems 7Document4 pagesProblems 7jojNo ratings yet

- Final Mock1 - AnswerDocument7 pagesFinal Mock1 - AnswerK58 Hà Phương LinhNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- ClassProblemsChapter5 SolutionDocument6 pagesClassProblemsChapter5 SolutionA373728272No ratings yet

- Homework Chapter 20 - Group 8Document5 pagesHomework Chapter 20 - Group 8Thư LuyệnNo ratings yet

- Universny: TshwaneDocument5 pagesUniversny: TshwaneAnonymous 1Ew0UPNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (60)

- Girum Tsega PerfectDocument13 pagesGirum Tsega PerfectMesi YE GINo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Accounts Paper Answer 24.06.2020Document17 pagesAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNo ratings yet

- Financial Management Session 10Document11 pagesFinancial Management Session 10Shivangi MohpalNo ratings yet

- Q3a. Capital Budget AssignmentDocument1 pageQ3a. Capital Budget AssignmentMorgan MunyoroNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Week 4 FA Lecture BBDocument24 pagesWeek 4 FA Lecture BBkk23212No ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Unit 3 Payback, IRR, NPV, PI - 24 - 12 - 2021 - 01 - 47 - 52Document12 pagesUnit 3 Payback, IRR, NPV, PI - 24 - 12 - 2021 - 01 - 47 - 52Tushara VenkateshNo ratings yet

- Construction ContractsDocument17 pagesConstruction ContractsCeline Marie AntonioNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Alternative Source of Financing, Pro-Forma, Preparation of Financial StatementsDocument3 pagesAlternative Source of Financing, Pro-Forma, Preparation of Financial StatementsAngel CastilloNo ratings yet

- Comparative and Common Size StatementsDocument10 pagesComparative and Common Size Statementsvanshikagoswami25No ratings yet

- Short-Term ExamDocument6 pagesShort-Term Examymkuzangwe16No ratings yet

- Sample Questions and Solutions - Final ExamDocument4 pagesSample Questions and Solutions - Final ExamNadjah JNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- 9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerDocument15 pages9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerMd SaifulNo ratings yet

- Group Assesment Part B 1,2,3Document7 pagesGroup Assesment Part B 1,2,3YajZaragozaNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Far460 Group Project 1Document3 pagesFar460 Group Project 1NURAMIRA AQILANo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- EE Practice Qs Foreign Currency - AnswersDocument6 pagesEE Practice Qs Foreign Currency - AnswersTham Ru JieNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Assignment Answer Sheet: Name: Subject: Assignment IiDocument6 pagesAssignment Answer Sheet: Name: Subject: Assignment IiAravindh ArulNo ratings yet

- Ffa ADocument5 pagesFfa Aaccounts officerNo ratings yet

- The New Issue MarketDocument15 pagesThe New Issue MarketAbanti MukherjeeNo ratings yet

- Incorp DatabaseDocument28 pagesIncorp DatabaseVikramNo ratings yet

- CPDD-ACC-02-A Application Form As Local CPD ProviderDocument2 pagesCPDD-ACC-02-A Application Form As Local CPD ProviderAnonymous 7HGskNNo ratings yet

- Chapter 6 - Nature and Formation - FinDocument26 pagesChapter 6 - Nature and Formation - FinSarah Mae BarrientosNo ratings yet

- IT Companies USA - AddedDocument16 pagesIT Companies USA - AddedSwapnilNo ratings yet

- Case 5.5: The Baptist Foundation of Arizona: Presentation and Disclosure of Related PartiesDocument8 pagesCase 5.5: The Baptist Foundation of Arizona: Presentation and Disclosure of Related PartiesZizidNo ratings yet

- Ultra ViresDocument4 pagesUltra ViresJoshua HilaryNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Radio Script Document 3rd UnitDocument4 pagesRadio Script Document 3rd Unitapi-314253269No ratings yet

- Monsanto 2010Document120 pagesMonsanto 2010Ilya VengerNo ratings yet

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 386Document4 pagesDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 386Justia.comNo ratings yet

- 413 Marketing of ServicesDocument94 pages413 Marketing of ServicesAishwarya ChauhanNo ratings yet

- Code of Corporate Governance in BangladeshDocument11 pagesCode of Corporate Governance in BangladeshMahmudur RahmanNo ratings yet

- Itinerary Email v2 20180725144431808Document2 pagesItinerary Email v2 20180725144431808Anonymous hk1fhAkwyNo ratings yet

- An Jar Ulna NoDocument14 pagesAn Jar Ulna NoMd Afzal NasirNo ratings yet

- 2015 08 Write Off GuidelinesDocument3 pages2015 08 Write Off GuidelinesMark Domingo MendozaNo ratings yet

- Horror Movie Film CompaniesDocument8 pagesHorror Movie Film Companiesapi-373307205No ratings yet

- Audit ReportDocument23 pagesAudit ReportNahid AhmedNo ratings yet

- MKT SegmentationDocument10 pagesMKT SegmentationDaniel NzokaNo ratings yet

- Novartis 2.0Document16 pagesNovartis 2.0Aditya BansalNo ratings yet

- Arcel or MittalDocument2 pagesArcel or MittalUmer RazzaqNo ratings yet

- JPMorgan Mission & VisionDocument6 pagesJPMorgan Mission & VisionPuneet Chawla100% (1)

- الفرق بين التعثر المالي والفشل الماليDocument16 pagesالفرق بين التعثر المالي والفشل الماليRoseNo ratings yet

- Chapter 18 Asset Management ConfigurationsDocument38 pagesChapter 18 Asset Management ConfigurationsSrinivas Yakkala100% (1)

- Members List Patal Ganga RasyaniDocument16 pagesMembers List Patal Ganga RasyanianupiodNo ratings yet

- Hagan Vol ConversionDocument4 pagesHagan Vol ConversionMikeD8891No ratings yet

- Cases On Mining LawsDocument4 pagesCases On Mining LawsKristine Mae QuibodNo ratings yet

- (03a) ZICO Offer Document (Clean) PDFDocument494 pages(03a) ZICO Offer Document (Clean) PDFInvest StockNo ratings yet

- Date Journal Code 04-10-2022 ACR221004-02646 04-10-2022 ACR221004-02646 07-10-2022 ACR221007-02462 07-10-2022 ACR221007-02462Document88 pagesDate Journal Code 04-10-2022 ACR221004-02646 04-10-2022 ACR221004-02646 07-10-2022 ACR221007-02462 07-10-2022 ACR221007-02462indra pamungkasNo ratings yet