Professional Documents

Culture Documents

Real Estate A Spreading Sinkhole

Uploaded by

Chi-Chu TschangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Estate A Spreading Sinkhole

Uploaded by

Chi-Chu TschangCopyright:

Available Formats

WHAT’S NEXT

088 China

slashed a property transfer tax for

new buyers to 1%, from as much

Real Estate: as 3%. After five years of tighten-

ing credit, the central bank has cut

interest rates twice in the past two

A Spreading Sinkhole

months and eased reserve require-

ments at banks to promote more

lending. And some cities have intro-

duced subsidies for buyers of small

homes and allowed mortgages of up

to 30 years, compared with a previ-

China’s all-important property values are plunging, ous maximum of 20 years.

A prolonged drop in property prices

hammering consumers and local governments could create big problems for China.

Real estate accounts for 25% of all

investment and

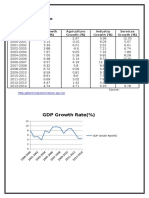

By Frederik Balfour and Chi-Chu Tschang about 10% of gross

Autumn is usually the domestic product in

busiest time for real estate the mainland, about

salesman Wang Yaodong. double the level in the

Last September and October, for U.S. Cities in China

instance, he sold more than a dozen often pay for infra-

luxury townhouses in western Shang- structure by selling

hai, but this year he has sold only one. land to developers

“Everybody is waiting for prices to and property-related

fall,” Wang says. income accounts for

Wang’s lament is a common refrain as much as a third of

in China these days. During the Golden government spend-

Week holiday in early October, nor- ing, brokerage Merrill

mally peak season for home buying, Lynch estimates.

sales in the southern city of Shenzhen “Beijing cannot af-

fell by a third from the previous week ford a collapse in the

and the average selling price was nearly housing sector,” says

halved. In Beijing, Jing Ulrich, chairman

software developer High-rises going of China Equities at

up in central

Answer Li has been China: Real estate

JPMorgan in Hong

looking at houses accounts for 25% Kong.

in the $100,000 to of all investment The slowdown in

$200,000 range, sales already is tak-

but he’s holding off because he fears Beijing had sought to rein in housing ing a heavy toll on China’s more than

further declines. “I don’t dare take the prices with measures such as manda- 60,000 developers. Many borrowed

plunge and buy a home,” Li says. tory down payments of at least 30% heavily to finance growth as real estate

Across China, property sales fell 15% and a steep tax on profits earned from values skyrocketed. Now, with prices

in August over the previous year. In flipping homes within five years of headed south, dozens have gone belly-

Beijing, they’re off more than 55% and purchase. Now those measures are up in recent months. Typical of the

in Shanghai 39%, reports the National starting to bite and—with economic more troubled companies is Zhejiang

Bureau of Statistics. Prices across the growth slowing and the stock market Zhonggang in the eastern city of Jin-

country registered a slight decline in Au- down by more than 60% this year— hua. Its chairman skipped the country

gust, the first time in years they haven’t there’s less demand for housing than in October, leaving behind some $20

increased. In the south, where the developers had anticipated. million in debt and dozens of angry

downturn began last year, prices are off families locked out of homes they had

by 30% in the past 12 months. “There is a easing the rules paid for. (The company couldn’t be

big likelihood that next year will be even Now Beijing is scrambling to keep reached for comment.)

lower,” says Li Yong, general manager of prices from falling too fast. On “Next year is looking very tough,”

Bobby Yip/Reuters

real estate brokerage Century 21 China in Oct. 22, the government exempted says Christopher Lee, director of

Changsha, an industrial city 700 miles land sales from the value-added tax, corporate ratings at Standard & Poor’s

west of Shanghai. cut down payments for first-time in Hong Kong. “We could see some

That’s a dramatic shift. Since 2005, homebuyers to 20%, from 30%, and high-level defaults.” ^

BUSINESSWEEK I NOVE M B E R 3, 2008

You might also like

- ICICI Bank StatementDocument15 pagesICICI Bank StatementManish Menghani0% (1)

- Personal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyFrom EverandPersonal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyNo ratings yet

- PayslipEncrypted 024297 May2021Document1 pagePayslipEncrypted 024297 May2021Sarvesh KumarNo ratings yet

- CMBS Special Topic: Outlook For The CMBS Market in 2011Document26 pagesCMBS Special Topic: Outlook For The CMBS Market in 2011Yihai YuNo ratings yet

- HSDF 8 2022Document12 pagesHSDF 8 2022AJ SinghNo ratings yet

- Short Memory Alternative Title - Shortened MemoryDocument50 pagesShort Memory Alternative Title - Shortened MemoryThe GuardianNo ratings yet

- 05 11 2022 Chennai PP UxzDocument8 pages05 11 2022 Chennai PP UxzPrime PlusNo ratings yet

- Africa Residential Dashboard h2 2020 7875Document2 pagesAfrica Residential Dashboard h2 2020 7875mdshoppNo ratings yet

- South China Morning Post (2023!07!08)Document24 pagesSouth China Morning Post (2023!07!08)murielNo ratings yet

- 2000s HK Property MarketDocument2 pages2000s HK Property MarketDel WNo ratings yet

- Orange County: Housing Growth Is On The WayDocument4 pagesOrange County: Housing Growth Is On The Wayapi-25886701No ratings yet

- Home Loans: Vinod WadhwaniDocument4 pagesHome Loans: Vinod WadhwaniMansur AliNo ratings yet

- PDF To WordDocument4 pagesPDF To WordWilliam HarrisNo ratings yet

- Alpha Times Smart Properties Inaugural Issue Dec. 5 - 19 2010Document16 pagesAlpha Times Smart Properties Inaugural Issue Dec. 5 - 19 2010S. RaghunathanNo ratings yet

- Orange County: Home Buyer Tax Credit Extended and ExpandedDocument4 pagesOrange County: Home Buyer Tax Credit Extended and Expandedapi-26807834No ratings yet

- San Diego County: Housing Growth Is On The WayDocument4 pagesSan Diego County: Housing Growth Is On The WaymiguelnunezNo ratings yet

- Newsletter 10 enDocument1 pageNewsletter 10 enTran Huyen VuNo ratings yet

- San Diego CountyDocument4 pagesSan Diego Countyapi-26216409No ratings yet

- Canada Cap Rate Report Q2 2023Document20 pagesCanada Cap Rate Report Q2 2023abahomed12No ratings yet

- Prefabrication: A Solution For A NZ Housing Shortage? Literature ReviewDocument17 pagesPrefabrication: A Solution For A NZ Housing Shortage? Literature ReviewAndres EnriqueNo ratings yet

- Real Estate Trends - MarchDocument1 pageReal Estate Trends - Marchjessica4384No ratings yet

- TD Economics: Special ReportDocument21 pagesTD Economics: Special ReportInternational Business TimesNo ratings yet

- Multifamily ResearchDocument4 pagesMultifamily ResearchNephenteNo ratings yet

- Newsletter 6 enDocument1 pageNewsletter 6 enTran Huyen VuNo ratings yet

- Episode 04 01dec09Document1 pageEpisode 04 01dec09finervaNo ratings yet

- San Diego County: A Normal Market Begins With Great InvestmentsDocument4 pagesSan Diego County: A Normal Market Begins With Great Investmentsjefflang3607No ratings yet

- RBC Econ Om Ices - Housing Trends & Afford AbilityDocument9 pagesRBC Econ Om Ices - Housing Trends & Afford AbilitymintcornerNo ratings yet

- US Housing: The Affordability Conundrum: Real Estate MarketsDocument8 pagesUS Housing: The Affordability Conundrum: Real Estate MarketsKevin ParkerNo ratings yet

- Why 2011 May Be End of Housing Crash: Pam Wilhelm, RealtorDocument4 pagesWhy 2011 May Be End of Housing Crash: Pam Wilhelm, RealtorPam Clark-WilhelmNo ratings yet

- Mumbai MMR ReportDocument13 pagesMumbai MMR ReportAnirban DasguptaNo ratings yet

- China and The Fall in 2023Document5 pagesChina and The Fall in 2023Pauline ChongNo ratings yet

- Orange County: Favorable News For The Economy and HousingDocument4 pagesOrange County: Favorable News For The Economy and Housingapi-25886701No ratings yet

- Real Estate Outlook: United StatesDocument29 pagesReal Estate Outlook: United StatestuhindebNo ratings yet

- San Diego County: A Normal Market Begins With Great InvestmentsDocument4 pagesSan Diego County: A Normal Market Begins With Great InvestmentsmiguelnunezNo ratings yet

- San Diego County: The State of The MarketDocument4 pagesSan Diego County: The State of The Marketapi-26157345No ratings yet

- Investment Check Land Vs Built Up 2022 Housing Research Za7LrtQDocument38 pagesInvestment Check Land Vs Built Up 2022 Housing Research Za7LrtQVenomNo ratings yet

- Helping Build A New Indigenous Health CentreDocument1 pageHelping Build A New Indigenous Health CentreGenieNo ratings yet

- DBS Flash: China: Growth Downgraded Amid Delta WorriesDocument5 pagesDBS Flash: China: Growth Downgraded Amid Delta WorrieslifeNo ratings yet

- OrangeTee - Property Market Outlook 2022Document11 pagesOrangeTee - Property Market Outlook 2022WNo ratings yet

- Indian Real Estate - An OverviewDocument26 pagesIndian Real Estate - An OverviewMustafa HussainNo ratings yet

- Ventura County: Favorable News For The Economy and HousingDocument4 pagesVentura County: Favorable News For The Economy and Housingapi-26714676No ratings yet

- Tonys View 8 December 2022 PDFDocument6 pagesTonys View 8 December 2022 PDFAndreas KleberNo ratings yet

- 2Q19 Washington DC Local Apartment ReportDocument4 pages2Q19 Washington DC Local Apartment ReportWilliam HarrisNo ratings yet

- VietRees Newsletter 65 Week2 Month1 Year09Document10 pagesVietRees Newsletter 65 Week2 Month1 Year09internationalvrNo ratings yet

- 3Q18 Boston LARDocument4 pages3Q18 Boston LARAnonymous Feglbx5No ratings yet

- Bangkok Property Market Snapshot 2Q2023Document2 pagesBangkok Property Market Snapshot 2Q2023alexm.linkedNo ratings yet

- Chanakya Volume I Issue VIIDocument4 pagesChanakya Volume I Issue VIIdjkpandianNo ratings yet

- 2017 Midyear Capital Flows Market Report US ColliersDocument8 pages2017 Midyear Capital Flows Market Report US ColliersCoy DavidsonNo ratings yet

- Just How Sick Is The Chinese Economy?: 29 August 2022Document6 pagesJust How Sick Is The Chinese Economy?: 29 August 2022Muhammad ImranNo ratings yet

- VietRees Newsletter 43 Week2 Month08 Year08Document7 pagesVietRees Newsletter 43 Week2 Month08 Year08internationalvrNo ratings yet

- The Most Important Sector in The Universe - Epsilon TheoryDocument15 pagesThe Most Important Sector in The Universe - Epsilon TheoryChintha jeromeNo ratings yet

- Give Us Our Flats! The Angry Victims of China's Property CrisisDocument17 pagesGive Us Our Flats! The Angry Victims of China's Property CrisisSummer fcNo ratings yet

- 3Q19 Atlanta Local Apartment ReportDocument4 pages3Q19 Atlanta Local Apartment ReportAnonymous amHficr9RNo ratings yet

- Home Without Equity RentalDocument31 pagesHome Without Equity RentalJoshua RosnerNo ratings yet

- Manila Residential Property Market OverviewDocument3 pagesManila Residential Property Market Overviewmackenzie02No ratings yet

- S1 Comprehension Property PricesDocument5 pagesS1 Comprehension Property PricesJustin KoNo ratings yet

- San Diego County: The State of The MarketDocument8 pagesSan Diego County: The State of The Marketapi-26157345No ratings yet

- 0714CIOWeeklyLetter FinalDocument5 pages0714CIOWeeklyLetter FinalAna MesarošNo ratings yet

- Thesun 2008-12-15 Page15 Makings Ens Unique Challenges in 2009Document1 pageThesun 2008-12-15 Page15 Makings Ens Unique Challenges in 2009Impulsive collectorNo ratings yet

- Housing Affordability Great Australian DreamDocument15 pagesHousing Affordability Great Australian DreamDamianEnnisNo ratings yet

- The Scariest Funds of AllDocument10 pagesThe Scariest Funds of AllChi-Chu TschangNo ratings yet

- Schemers Fill An Iphone Void in ChinaDocument1 pageSchemers Fill An Iphone Void in ChinaChi-Chu TschangNo ratings yet

- Chinese Banks Head For The U.S.Document2 pagesChinese Banks Head For The U.S.Chi-Chu TschangNo ratings yet

- China's E-Tail AwakeningDocument1 pageChina's E-Tail AwakeningChi-Chu TschangNo ratings yet

- Bottlenecks in ToylandDocument1 pageBottlenecks in ToylandChi-Chu TschangNo ratings yet

- China's B SchoolsDocument12 pagesChina's B SchoolsChi-Chu TschangNo ratings yet

- The Great Walt of ChinaDocument1 pageThe Great Walt of ChinaChi-Chu TschangNo ratings yet

- Playing The China CardDocument1 pagePlaying The China CardChi-Chu TschangNo ratings yet

- Got MilkDocument2 pagesGot MilkChi-Chu TschangNo ratings yet

- China Inc. Is Out On A LimbDocument4 pagesChina Inc. Is Out On A LimbChi-Chu TschangNo ratings yet

- China's Rising LeadersDocument4 pagesChina's Rising LeadersChi-Chu TschangNo ratings yet

- Private Banking, Chinese-StyleDocument2 pagesPrivate Banking, Chinese-StyleChi-Chu TschangNo ratings yet

- Olympic Tix On The FritzDocument1 pageOlympic Tix On The FritzChi-Chu TschangNo ratings yet

- On Your Mark, Get Set, Stop!Document2 pagesOn Your Mark, Get Set, Stop!Chi-Chu TschangNo ratings yet

- Floating Cars That Fight Beijing GridlockDocument1 pageFloating Cars That Fight Beijing GridlockChi-Chu TschangNo ratings yet

- The Little Red Book Is Way in The BlackDocument2 pagesThe Little Red Book Is Way in The BlackChi-Chu TschangNo ratings yet

- On Your Mark, Get Set, Stop!Document2 pagesOn Your Mark, Get Set, Stop!Chi-Chu TschangNo ratings yet

- China's Factory BluesDocument21 pagesChina's Factory BluesChi-Chu TschangNo ratings yet

- Motorola Fading in ChinaDocument2 pagesMotorola Fading in ChinaChi-Chu TschangNo ratings yet

- The Little Red Book Is Way in The BlackDocument2 pagesThe Little Red Book Is Way in The BlackChi-Chu TschangNo ratings yet

- Praying For Success in ShanghaiDocument3 pagesPraying For Success in ShanghaiChi-Chu TschangNo ratings yet

- Catering To A New MarketDocument2 pagesCatering To A New MarketChi-Chu TschangNo ratings yet

- The New Cyber ThreatDocument10 pagesThe New Cyber ThreatChi-Chu TschangNo ratings yet

- China's Post-Game Reality CheckDocument2 pagesChina's Post-Game Reality CheckChi-Chu TschangNo ratings yet

- Bloodied But UnbowedDocument3 pagesBloodied But UnbowedChi-Chu TschangNo ratings yet

- How Greed Tainted An IndustryDocument1 pageHow Greed Tainted An IndustryChi-Chu TschangNo ratings yet

- Asia Breathes A Sigh of ReliefDocument1 pageAsia Breathes A Sigh of ReliefChi-Chu TschangNo ratings yet

- Outsourcing The Drug IndustryDocument6 pagesOutsourcing The Drug IndustryChi-Chu TschangNo ratings yet

- Parts UnknownDocument10 pagesParts UnknownChi-Chu TschangNo ratings yet

- China's Great Railway AwakeningDocument1 pageChina's Great Railway AwakeningChi-Chu TschangNo ratings yet

- Layne - Worksheet Week 2Document2 pagesLayne - Worksheet Week 2JohnNo ratings yet

- OD126096654076016000Document6 pagesOD126096654076016000Manoj VarmaNo ratings yet

- DownloadDocument3 pagesDownloadChristina SalliNo ratings yet

- 6.1 International Trade and Specialization: Igcse /O Level EconomicsDocument10 pages6.1 International Trade and Specialization: Igcse /O Level EconomicsAvely AntoniusNo ratings yet

- Sales QuotationDocument1 pageSales QuotationTekbahadur SinghNo ratings yet

- Event Management: BMGT (Hons.) in Tourism and Hospitality Management Cinec Campus Submitted by Index NumberDocument4 pagesEvent Management: BMGT (Hons.) in Tourism and Hospitality Management Cinec Campus Submitted by Index NumberBunnyNo ratings yet

- UcspDocument1 pageUcspRosemarie AlfonsoNo ratings yet

- INB 372 " Apple Case ": Submitted To: Mahmud Habib Zaman (MHZ) SirDocument6 pagesINB 372 " Apple Case ": Submitted To: Mahmud Habib Zaman (MHZ) SirRabib AhmedNo ratings yet

- Quiz (F)Document1 pageQuiz (F)ArcheNo ratings yet

- PHILIPPINES Finance History Quiz Bee ReviewerDocument1 pagePHILIPPINES Finance History Quiz Bee ReviewerMomo MontefalcoNo ratings yet

- Power Infra 2Document2 pagesPower Infra 2siddharth_nptiNo ratings yet

- Chapter 5 Developing A Global VisionDocument23 pagesChapter 5 Developing A Global Visionrizcst9759No ratings yet

- Exercise 7.3Document5 pagesExercise 7.3Craig GrayNo ratings yet

- ASEAN and Its Free Trade Area PartnersDocument3 pagesASEAN and Its Free Trade Area Partnersianne Jeanne Del RosarioNo ratings yet

- Cbwas 1Document7 pagesCbwas 1PFENo ratings yet

- Expected Interview Questions - Bank ExamsDocument8 pagesExpected Interview Questions - Bank ExamsParag DahiyaNo ratings yet

- The U.S. Textile and Apparel Industry in The Age of GlobalizationDocument25 pagesThe U.S. Textile and Apparel Industry in The Age of GlobalizationChirag JainNo ratings yet

- Indian Economy 2 (1950-1990)Document42 pagesIndian Economy 2 (1950-1990)Alans TechnicalNo ratings yet

- United Nations Conference On Trade and DevelopmentDocument19 pagesUnited Nations Conference On Trade and DevelopmentBebeto BebitoNo ratings yet

- Maharashtra Industrial Development CorporationDocument6 pagesMaharashtra Industrial Development Corporationᗬᗴᐻ ᔤᗩᕼᕢᖆᘍNo ratings yet

- Assignment - 4 Thailand Imbalance of Payments Sumeet Kant Kaul-G20088Document4 pagesAssignment - 4 Thailand Imbalance of Payments Sumeet Kant Kaul-G20088sumeetkantkaulNo ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- Essay On Sugar Industry in IndiaDocument8 pagesEssay On Sugar Industry in Indialucifer1711No ratings yet

- Surat Keterangan Translate Judul SkripsiDocument2 pagesSurat Keterangan Translate Judul Skripsiyovie MuhammadNo ratings yet

- Current Scenario of Bangladesh Pharma MarketDocument2 pagesCurrent Scenario of Bangladesh Pharma Marketnourinta100% (1)

- Budget AnalysisDocument13 pagesBudget AnalysisRamneet ParmarNo ratings yet

- Singapore-Overview of EconomicDocument2 pagesSingapore-Overview of EconomicSothearothNo ratings yet

- Number Series Questions Free Ebook WWW - Letsstudytogether.coDocument22 pagesNumber Series Questions Free Ebook WWW - Letsstudytogether.coAyush AsatiNo ratings yet