Professional Documents

Culture Documents

Leasing Standard IFRS 16

Uploaded by

Ani Nalitayui LifityaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leasing Standard IFRS 16

Uploaded by

Ani Nalitayui LifityaCopyright:

Available Formats

IFRS 16 / ASC 842 Accounting Challenges

“It sounds very simple to put your At Aptitude Software we believe that

operating leases on the balance the accounting complexities of the new

sheet but it’s actually very lease standard are under appreciated.

Moving hundreds or even thousands

complex. In order to do that the

of lease contracts onto the balance

standard requires a number of very sheet will require a new level of data

complex calculations and a collection and consolidation and a new

number of judgments within those range of lease accounting scenarios

calculations to actually get the that were not previously required.

numbers on the financial

Our time in the marketplace discussing

statements so that’s a huge

accounting and leasing focused issues

challenge for finance functions.” around IFRS 16 and ASC 842 have

-Lucy Newman, Partner, Deloitte uncovered several common areas we

see companies struggle with. Three of

these issues we discuss in depth here:

the complexity of subleases, supporting

standards that are not identical, and the

impact of the transition approach taken.

Financial software specialist

The challenge of subleases

One of the most difficult aspects of the new obligation of the original lease but maintains a

lease accounting standards is identifying and secondary liability, they would account for the

understanding the lease types in your portfolio. transaction as a termination of the original lease

While there are several lease types to be aware and recognize a guarantee obligation.

of, we frequently hear from prospects and clients

that accounting for subleases are one of the De-recognition and impairment requirements

most challenging. One potential area of complexity around

subleases has to do with the concept of de-

What is a sublease? recognition. When a lessee decides to sublease

A sublease originates when a lessee decides to an asset and it’s classified as a finance lease,

rent out an asset they already lease, to a third they must de-recognize the right of use asset

party. The third party must have the right to attached to the head lease.

control the use of the underlying asset for a

period of time in exchange for consideration, The tests applied to a sublease to determine

thus meeting the definition of a lease. When whether it is a finance lease differ between IFRS

this happens the original lessee, often called 16 and ASC 842 and mean that de-recognition is

the head lessee or intermediary lessor, must likely to be a more frequent requirement under

determine how to account for this change. IFRS 16.

Accounting challenges under the new standards

The new sublease accounting rules are a

significant departure from those outlined in

the current standard which were already quite

complex. We are seeing the following

accounting challenges around subleases:

• The intermediate lessor typically accounts

When making accounting decisions on how to for the head lease and sublease as separate

account for a sublease, there are a few things to contracts and will need to apply both lessee

consider: and lessor accounting models.

• The sublease classification tests for IFRS 16

Initial evaluation

differ from the regular lessor classification

Entering into a sublease is a significant event

tests.

that is within the control of the lessee, subject

to the terms of their lease. Since this action • Modifications to either the head lease

could affect things like the potential to exercise or the sublease must also account for the

an option, it is advisable for the head lessee to impact on de-recognition where appropriate.

reassess the lease term of the head lease before

signing the sublease. As is the case under IAS • Multiple subleases can be associated with

17 and ASC 840, subleases must be classified as one head lease.

either a finance or operating lease.

Subleases are just one of several complex lease

Follow the liability types that will have to be understood, modeled

In some cases, the sublease is a separate lease and accounted for correctly under the new

agreement. In other cases, a third party assumes leasing standards. We’ve compiled a list of 5

the original lease, but the original lessee remains complex lease types to keep your eye out for

the primary obligor under the original lease. when evaluating your lease portfolio.

Exactly how the sublease is accounted for by

the head lessee ultimately depends on who

maintains primary liability under the head lease.

If the intermediate lessor maintains primary

liability, they will continue to account for the

head lease on their balance sheet as a lessee

and account for the new sublease as a lessor.

If the head lessee is relieved of the primary

Visit our website: www.aptitudesoftware.com

Visit our lease accounting resource hub

The challenge of multi-GAAP reporting

The lease accounting standards, IFRS 16 and First, it’s important to make sure the solution

ASC 842 were designed in parallel by the IASB supports multi-GAAP reporting as standard. Look

and FASB. So, it’s not surprising that they seem for a solution that allows different entities to

to align in many ways. However, the Boards’ report under any or all of the leasing standards

views diverged over the course of the project (ASC 842, IFRS 16, ASC 840 or IAS 17) and

and resulted in some significant differences. where entering lease once will produce multiple

versions of the accounting.

In fact, while the two standards look very similar,

in almost any real-world scenario, the correct Make sure the solution natively supports the

application of IFRS 16 and ASC 842 accounting differences between the standards and adjusts

will lead to different balance sheet numbers. the lease liability (or not) as required. The

Companies may need to maintain different solution should apply entity specific accounting

processes, controls and accounting systems for policies to inform the correct configuration of

each framework to comply with the different the settings to ensure that the accounting aligns

lessee reporting requirements. This creates with the entity’s reporting requirements.

complexity for organizations that must report

under both GAAPs. The IFRS and GAAP leasing standards certainly

have a number of similarities and will both

So, if your organization needs to report under improve the ability of financial statement users

both IFRS 16 and ASC 842, what should you to better understand an organization’s overall

look for in a solution to help you navigate the financial position. However, dual preparers must

challenges of dual reporting? be aware of the differences and be prepared

to address the complexities and questions that

arise.

LEASING ASPECT IFRS 16 VS ASC 842

The reassessments of indices, interest rates or rent reviews

Variable lease payments linked to lease payments are incorporated into the lease liability

and right-of-use asset under IFRS 16 but not under ASC 842.

Dual reporters will have to separately track leases that have a

different classification under US GAAP and IFRS because they

will need to be accounted for differently. Under IFRS 16, lessees

Lease classification

no longer classify their leases between operating and finance.

Instead, all leases will be treated in a standard manner, similar

to that of finance leases under current IAS 17.

IFRS 16 has an exemption for low value leases while ASC 842

Low value lease exemptions

does not.

The classification tests under IFRS 16 are with reference to the

Sublease accounting

right-of-use asset, not the underlying asset.

There are significant differences in the treatment of sale and

Sale leaseback transactions

leaseback transactions between the two standards.

Depending on the transition options and expedients selected,

Transitions the transition data required may be significantly different

across the two standards.

Arrange a demonstration: info@aptitudesoftware.com

The challenge of choosing a transition method

The decision of which transition method IFRS 16 had always been applied. This means

to adopt when implementing IFRS 16 is an gathering all lease contract data and restating

important one, predominantly for lessees. prior period financial statements under the IFRS

This decision will impact the total amount of 16 standard. Alternately, choosing a modified

liabilities presented on a company’s balance retrospective transition option will impact the

sheet which in turn could impact their balance sheet from transition date onwards and

borrowing capabilities, earnings-per-share and does not require restating accounting for prior

other KPIs. periods.

The choice of transition will not just impact While a modified approach is considered simpler

the initial period after the standard goes into to adopt and requires less time, money and

effect – this decision “could affect your financial effort, in some cases it may be worth choosing

statements for years to come – until the last the more laborious and complicated full

lease in place at transition has expired.”1 This is retrospective approach. Adopting this approach

not a decision to make lightly and it will require will lead to a more accurate and holistic

detailed modeling to work out the correct representation of lease obligations, whilst

application of the chosen transition method granting greater comparability.

and the lease-by-lease assignment of practical

expedients. Your adopted transition option should be

influenced by your current lease portfolio. If

IFRS 16 reporting companies will need to you have lots of long term leases then full

carefully consider either a full retrospective retrospective may be the best choice for your

transition or a modified retrospective transition. balance sheets, while modified retrospective may

be more appropriate for a portfolio heavy with

Why did the IASB make these two options shorter term leases.

available?

The accounting standard boards typically “Your choice of transition option and

makes these types of options available during practical expedients will affect the costs

the implementation of a new standard. and timing of your implementation project

Essentially, they offer organizations tradeoffs in – and your financial statements for years to

cost (both time and money) and accuracy.

come.”

A full retrospective transition requires

organizations to account for all leases as if -KPMG Report: IFRS 16 – Transition to the

new leases standard

1 https://home.kpmg.com/content/dam/kpmg/ie/pdf/2016/11/ie-leases-transition-options.pdf

Visit our website: www.aptitudesoftware.com

Summary

Non-compliance with the new lease accounting

standards is not an option and could have severe ripple

effects throughout your business.

Aptitude Software’s pre-packaged and purpose-built

lease accounting solution, delivers IFRS 16 and ASC 842

compliance and core lease management capabilities,

for the most complex leasing requirements.

The solution is flexible, highly configurable and

integrates seamlessly with existing systems, finance

workflows and surrounding architecture.

For more information

Next steps North American Headquarters

101 Federal Street

As financial software specialists, we know accounting Suite 1310

Boston MA 02110

and we know software solutions. You are the

experts within your company and Aptitude’s Lease US: +1 (857) 201-3432

Accounting Engine puts the power back in the hands

of finance. Aptitude Software has extensive experience European Headquarters

implementing compliance initiatives with medium Old Change House

to large organizations. Let us help you achieve your 128 Queen Victoria Street

strategies and ambitions, contact us to walk through London EC4V 4BJ

your complex lease accounting scenarios that may be

UK: +44 (0) 20 7496 8196

creating headaches for your organization.

Asia Pacific Headquarters

15-10 High Street Centre

Arrange a demo 1 North Bridge Road

Singapore 179094

+65 82282403

Visit our lease accounting resource hub

or email

info@aptitudesoftware.com

Watch our lease accounting video

www.aptitudesoftware.com

Why choose Aptitude?

Aptitude Software combines specialist regulatory

knowledge with accounting expertise and industry leading

software products. With sharp focus on accounting, a

global network of partnerships and over 20 years of proven Copyright © Aptitude Software Limited 2014 - 2018.

success with the largest companies globally, Aptitude is the All Rights Reserved. APTITUDE, APTITUDE ACCOUNTING

HUB, APTITUDE ALLOCATION ENGINE, APTITUDE

software vendor to support your journey to comply with REVENUE RECOGNITION ENGINE and the Triangles

regulatory and reporting standards. device are trademarks of Aptitude Software Limited.

MICROGEN is a trademark of Microgen plc.

Aptitude – U.S. and European Patents Pending.

For more information please refer to:

https://www.aptitudesoftware.com/patentsandtrademarks

Financial software specialist

You might also like

- FM Class Notes Day1Document5 pagesFM Class Notes Day1febycvNo ratings yet

- MBA Accounting QuestionsDocument4 pagesMBA Accounting QuestionsbhfunNo ratings yet

- Chapter IIIDocument4 pagesChapter IIIDilip MargamNo ratings yet

- Leases AS PDFDocument2 pagesLeases AS PDFHimanshu YadavNo ratings yet

- Adr, GDR, Idr PDFDocument27 pagesAdr, GDR, Idr PDFmohit0% (1)

- Accounting principles, concepts and processesDocument339 pagesAccounting principles, concepts and processesdeepshrm100% (1)

- Applying IFRS Tech (Software) Rev Jan2015Document36 pagesApplying IFRS Tech (Software) Rev Jan2015Rajendran SureshNo ratings yet

- Chapter 8 Feb.5Document51 pagesChapter 8 Feb.5AaaNo ratings yet

- FRS 18, Accounting PoliciesDocument8 pagesFRS 18, Accounting PoliciesveemaswNo ratings yet

- Adv 160Document100 pagesAdv 160Asif Rafi100% (1)

- Ifrs 170120102142Document10 pagesIfrs 170120102142ajayNo ratings yet

- IFRS Standards OverviewDocument12 pagesIFRS Standards OverviewJeneef JoshuaNo ratings yet

- Unit: 5 Meaning of Accounting StandardsDocument13 pagesUnit: 5 Meaning of Accounting Standardsrajapriya 41No ratings yet

- Framework For Preparation of Financial StatementsDocument7 pagesFramework For Preparation of Financial StatementsAviral PachoriNo ratings yet

- Flow Chart - Trial Balance - WikiAccountingDocument6 pagesFlow Chart - Trial Balance - WikiAccountingmatthew mafaraNo ratings yet

- Generally Accepted Accounting Principles (GAAP)Document7 pagesGenerally Accepted Accounting Principles (GAAP)Laxmi GurungNo ratings yet

- IFRS Contract Analysis EnablerDocument7 pagesIFRS Contract Analysis EnablerPau Line EscosioNo ratings yet

- Business Transactions and the Accounting Equation ExplainedDocument30 pagesBusiness Transactions and the Accounting Equation ExplainedKen LatiNo ratings yet

- Network Design in Uncertain EnvironmentDocument17 pagesNetwork Design in Uncertain EnvironmentNiranjan ThirNo ratings yet

- IAS 32 Financial InstrumentDocument6 pagesIAS 32 Financial InstrumentArem CapuliNo ratings yet

- Departmental Accounts: by Dr. Pranabananda Rath Consultant & Visiting FacultyDocument16 pagesDepartmental Accounts: by Dr. Pranabananda Rath Consultant & Visiting FacultyAnamika VatsaNo ratings yet

- SAP FIORI System NavigationDocument13 pagesSAP FIORI System NavigationIrinaElenaCososchiNo ratings yet

- Question Bank SAPMDocument7 pagesQuestion Bank SAPMN Rakesh92% (12)

- Summary of Ifrs 4Document3 pagesSummary of Ifrs 4Woodliness McMahon100% (2)

- Ifrs SynopsisDocument3 pagesIfrs SynopsislalsinghNo ratings yet

- Accounting Standards SummaryDocument5 pagesAccounting Standards SummaryVinesh MoilyNo ratings yet

- Chapter - 2 Review of LiteratureDocument29 pagesChapter - 2 Review of LiteratureNiraj tiwariNo ratings yet

- 12006.departmental AccountsDocument10 pages12006.departmental Accountsyuvraj216No ratings yet

- Non-Banking Financial CompaniesDocument59 pagesNon-Banking Financial CompaniesFarhan JagirdarNo ratings yet

- Research Organization Patterns for Effective PresentationsDocument6 pagesResearch Organization Patterns for Effective PresentationsMutinta MubitaNo ratings yet

- Accounting For ManagersDocument4 pagesAccounting For ManagersGopalakrishnan KuppuswamyNo ratings yet

- MBA QuestionsDocument15 pagesMBA QuestionsKhanal NilambarNo ratings yet

- Accounting Interview Questions: What Is Minority Interest?Document16 pagesAccounting Interview Questions: What Is Minority Interest?vemula_ramakoti94840% (1)

- Money and Banking: Chapter - 8Document36 pagesMoney and Banking: Chapter - 8Nihar NanyamNo ratings yet

- Security Analysis and Portfolio ManagementDocument21 pagesSecurity Analysis and Portfolio ManagementShiva ShankarNo ratings yet

- Introduction To Accounting TheoryDocument172 pagesIntroduction To Accounting TheoryPrakash100% (4)

- Business Organisation and Office ManagementDocument9 pagesBusiness Organisation and Office ManagementLohith DhakshaNo ratings yet

- Foreign Exchange Risk and ExposureDocument77 pagesForeign Exchange Risk and ExposureRammohanreddy RajidiNo ratings yet

- Capital Budgeting Sums-Doc For PDF (Encrypted)Document7 pagesCapital Budgeting Sums-Doc For PDF (Encrypted)Prasad GharatNo ratings yet

- Advance Financial ManagementDocument6 pagesAdvance Financial Management03217925346No ratings yet

- The History of Origin and Growth of Merchant Banking Throughout The WorldDocument18 pagesThe History of Origin and Growth of Merchant Banking Throughout The WorldJeegar Shah0% (1)

- Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest VersioDocument51 pagesSolution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Versiomarcuskenyatta275No ratings yet

- Chapter 3 - IND AS 2 InventoriesDocument18 pagesChapter 3 - IND AS 2 InventoriesAmbati Madhava ReddyNo ratings yet

- Financial Feasibility Study ChaptersDocument52 pagesFinancial Feasibility Study ChaptersDing RarugalNo ratings yet

- Accounting For Customer LoyaltyDocument22 pagesAccounting For Customer LoyaltyHumayun Khalid0% (1)

- Auditing Liabilities AssertionsDocument7 pagesAuditing Liabilities AssertionsSanjeevParajuliNo ratings yet

- Liyan A Rach Chi 2009Document20 pagesLiyan A Rach Chi 2009Nurul khomariyahNo ratings yet

- Module 1 PDFDocument13 pagesModule 1 PDFWaridi GroupNo ratings yet

- Sri Lanka Accounting StandardDocument6 pagesSri Lanka Accounting StandardYoosuf Mohamed IrsathNo ratings yet

- GST Procedural UpdatesDocument15 pagesGST Procedural UpdatesSP CONTRACTORNo ratings yet

- BBA - III RD F. M. (Question Paper)Document4 pagesBBA - III RD F. M. (Question Paper)DrRashmiranjan PanigrahiNo ratings yet

- Accounting For Decision Making Notes Lecture Notes Lectures 1 13Document11 pagesAccounting For Decision Making Notes Lecture Notes Lectures 1 13HiếuNo ratings yet

- Sea Audit IFRS 16 GuideDocument118 pagesSea Audit IFRS 16 GuideG.A.A.P PRO ACCTNo ratings yet

- A Look at Current Financial Reporting Issues For PNG: in DepthDocument29 pagesA Look at Current Financial Reporting Issues For PNG: in DepthMahediNo ratings yet

- IFRS 16 Leases at A Glance PDFDocument3 pagesIFRS 16 Leases at A Glance PDFEMDLNo ratings yet

- Chapter 16 - LeasingDocument20 pagesChapter 16 - LeasingADNAN FAROOQNo ratings yet

- EY Real-Estate-Leases 2016Document18 pagesEY Real-Estate-Leases 2016Marta NojeNo ratings yet

- IFRS 16 Effects AnalysisDocument104 pagesIFRS 16 Effects AnalysisKhaled SherifNo ratings yet

- Understanding IFRS 16Document4 pagesUnderstanding IFRS 16ryansingh2344No ratings yet

- KPMG Pfrs 16 OverviewDocument93 pagesKPMG Pfrs 16 OverviewFelicity AnneNo ratings yet

- Successful Migration from Legacy Systems to SAP S/4HANA Cloud with CognitusDocument1 pageSuccessful Migration from Legacy Systems to SAP S/4HANA Cloud with CognitusAni Nalitayui LifityaNo ratings yet

- Controlling Configuration Guide COPA (Profitability Analysis) SocarDocument105 pagesControlling Configuration Guide COPA (Profitability Analysis) SocarAni Nalitayui LifityaNo ratings yet

- Flow CO SAPDocument5 pagesFlow CO SAPAni Nalitayui LifityaNo ratings yet

- MindMajix SAP FICA Interview QuestionsDocument6 pagesMindMajix SAP FICA Interview QuestionsAni Nalitayui LifityaNo ratings yet

- PWC PSAK 73 IFRS 16Document1 pagePWC PSAK 73 IFRS 16Ani Nalitayui LifityaNo ratings yet

- Simple Startup Budgeting TemplateDocument21 pagesSimple Startup Budgeting TemplateAni Nalitayui LifityaNo ratings yet

- 370 Umoja Assets Under Construction UserGuide v2.1Document104 pages370 Umoja Assets Under Construction UserGuide v2.1krism25No ratings yet

- SAP FICO Interview QuestionsDocument5 pagesSAP FICO Interview QuestionsAni Nalitayui LifityaNo ratings yet

- SAP CO-Template Upload CC Planning-JalinDocument1 pageSAP CO-Template Upload CC Planning-JalinAni Nalitayui LifityaNo ratings yet

- SAP FICO Interview QuestionsDocument5 pagesSAP FICO Interview QuestionsAni Nalitayui LifityaNo ratings yet

- List of Schedules For AuditDocument19 pagesList of Schedules For AuditHimanshu GaurNo ratings yet

- MindMajix SAP FICA Interview QuestionsDocument6 pagesMindMajix SAP FICA Interview QuestionsAni Nalitayui LifityaNo ratings yet

- Catatan TTTDocument1 pageCatatan TTTAni Nalitayui LifityaNo ratings yet

- Inventory ConfigurationDocument80 pagesInventory ConfigurationMahad Ahmed100% (1)

- Ac020 en 46c FV PDFDocument270 pagesAc020 en 46c FV PDFSamuel MonteNo ratings yet

- Duplicate Cleaner LogDocument1 pageDuplicate Cleaner LogAni Nalitayui LifityaNo ratings yet

- SAP Production Order Variance 1Document2 pagesSAP Production Order Variance 1Ani Nalitayui LifityaNo ratings yet

- Statistical Key Figures SKF Posting KB31N SAP CODocument5 pagesStatistical Key Figures SKF Posting KB31N SAP COAni Nalitayui LifityaNo ratings yet

- Workflow Approval of Payment Proposals in SAPDocument2 pagesWorkflow Approval of Payment Proposals in SAPAni Nalitayui LifityaNo ratings yet

- Automatic Clearing Open Item F.13 SAPF124-SAPF124E FI SAPDocument3 pagesAutomatic Clearing Open Item F.13 SAPF124-SAPF124E FI SAPAni Nalitayui LifityaNo ratings yet

- Settlement Cost Element SAPDocument3 pagesSettlement Cost Element SAPAni Nalitayui LifityaNo ratings yet

- Standard Cost Estimate CO SAPDocument4 pagesStandard Cost Estimate CO SAPAni Nalitayui LifityaNo ratings yet

- How To VSM PDFDocument17 pagesHow To VSM PDFAni Nalitayui LifityaNo ratings yet

- (Material Ledger) Activation With CKMSTART For Previous Period - SAP CODocument9 pages(Material Ledger) Activation With CKMSTART For Previous Period - SAP COAni Nalitayui LifityaNo ratings yet

- Expense Analysis Splitting Manufacture Cost Center SAP CODocument2 pagesExpense Analysis Splitting Manufacture Cost Center SAP COAni Nalitayui LifityaNo ratings yet

- ABC Costing in SAP - Determine Overhead CostsDocument2 pagesABC Costing in SAP - Determine Overhead CostsAni Nalitayui LifityaNo ratings yet

- Product Costing - Cost Estimation in SAPDocument12 pagesProduct Costing - Cost Estimation in SAPlakhbir60% (5)

- Costing View in SAP Product Costing - MindMajixDocument12 pagesCosting View in SAP Product Costing - MindMajixAni Nalitayui LifityaNo ratings yet

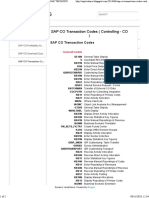

- SAP CO Transaction CodesDocument2 pagesSAP CO Transaction CodesAni Nalitayui LifityaNo ratings yet

- Trading Options: The Ultimate Guide ToDocument25 pagesTrading Options: The Ultimate Guide ToHikmah Republika100% (1)

- Chapter 14 Financial StatementsDocument82 pagesChapter 14 Financial StatementsKate CuencaNo ratings yet

- ScrisoriDocument2 pagesScrisoriSimona GheorgheNo ratings yet

- Fundamentals of Investment Management 10th Edition Hirt Solutions ManualDocument35 pagesFundamentals of Investment Management 10th Edition Hirt Solutions Manualaffluencevillanzn0qkr100% (28)

- 17 ErsandiDocument70 pages17 Ersandimeds 2ndNo ratings yet

- Equity Investment BrochureDocument3 pagesEquity Investment BrochureCHANDRAKANT RANANo ratings yet

- Pangea Mortgage Capital Closes $8.5 Million LoanDocument3 pagesPangea Mortgage Capital Closes $8.5 Million LoanPR.comNo ratings yet

- Attitudes Toward The Government Shutdown and The Debt Ceiling, October 2013Document34 pagesAttitudes Toward The Government Shutdown and The Debt Ceiling, October 2013American Enterprise InstituteNo ratings yet

- Caso 2 Royal MailDocument12 pagesCaso 2 Royal Mailjuanito perezNo ratings yet

- 2 Financial Reporting Theory UpdatedDocument52 pages2 Financial Reporting Theory UpdatedSiham OsmanNo ratings yet

- Ily Abella Surveyors Income StatementDocument6 pagesIly Abella Surveyors Income StatementJoy Santos33% (3)

- Assessment of Local Fiscal Performance DevelopmentsDocument2 pagesAssessment of Local Fiscal Performance DevelopmentsKei SenpaiNo ratings yet

- PMGT WhitepaperDocument56 pagesPMGT WhitepapermbidNo ratings yet

- C VDocument8 pagesC VAnonymous K8uhur100% (1)

- Richard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCDocument4 pagesRichard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCNick HuronNo ratings yet

- Mr. Radhakrishnan's business transactionsDocument11 pagesMr. Radhakrishnan's business transactionsPriyasNo ratings yet

- Negotiable Instruments Chavez - 027 050Document24 pagesNegotiable Instruments Chavez - 027 050JM LinaugoNo ratings yet

- FADocument46 pagesFANishant JainNo ratings yet

- Marketing of Financial ServicesDocument10 pagesMarketing of Financial ServicesRohit SoniNo ratings yet

- C 1044Document28 pagesC 1044Maya Julieta Catacutan-EstabilloNo ratings yet

- Effect of Capital Structure on ProfitabilityDocument8 pagesEffect of Capital Structure on Profitabilitysuela100% (1)

- Case 15-5 Xerox Corporation RecommendationsDocument2 pagesCase 15-5 Xerox Corporation RecommendationsgabrielyangNo ratings yet

- GPNR 2019-20 Notice and Directors ReportDocument9 pagesGPNR 2019-20 Notice and Directors ReportChethanNo ratings yet

- Idt For May and Nov 13Document149 pagesIdt For May and Nov 13Rakesh SinghNo ratings yet

- TallyDocument109 pagesTallyRamya RamamurthyNo ratings yet

- Debt Vs EquityDocument10 pagesDebt Vs EquityKedar ParabNo ratings yet

- RBS Shareholder Fraud AllegationsDocument326 pagesRBS Shareholder Fraud AllegationsFailure of Royal Bank of Scotland (RBS) Risk ManagementNo ratings yet

- Easypaisa-All Pricing and CommissioningDocument17 pagesEasypaisa-All Pricing and Commissioningqaisar_murtaza50% (4)

- Final Thesis MA Tigist TesfayeDocument51 pagesFinal Thesis MA Tigist Tesfayekiya felelkeNo ratings yet

- History of Cooperation in IndonesiaDocument8 pagesHistory of Cooperation in IndonesiakudaNo ratings yet