Professional Documents

Culture Documents

Tax Savings Declaration Form 2010-11

Uploaded by

Priyanka KhemkaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Savings Declaration Form 2010-11

Uploaded by

Priyanka KhemkaCopyright:

Available Formats

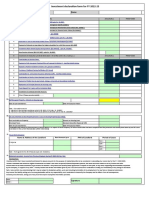

TAX SAVINGS DECLARATION FORM FOR FINANCIAL YEAR 2010-2011 (Assessment Year 2011-2012)

NAME: Priyanka Khemka SEX: Female

EMP.CODE: PAN NO: BFHPK9939K

ADDRESS: S-141, Greater Kailash, Part 2, New Delhi (Ground Floor)

I hereby confirm that I will be investing/ contributing the following amounts for the purpose of rebate/deduction to be considered

in calculating my income tax for the financial year 2010-2011. I further undertake that wherever eligible investments are made in

the name of spouse/children/dependent parents, the same have been/will be made out of my current years income and claim

thereof has/shall not be made by anybody else. I further undertake to submit all the Investment Proofs and Rent Receipts (if any)

on or before 5th March 2011 failing which the tax may be deducted accordingly from my salary.

I A Deduction to be claimed U/S 80 Amount (Rs.)

1 Mediclaim Policy Premium [u/s 80D]-upto Rs.15,000/-

2 Medical treatment of handicapped dependent [u/s80DB]-upto Rs.50,000/-

3 Medical treatment of specified diseases for self/dependent [u/s80DDB]-upto Rs.40,000/-

4 Deduction in case of self being totally blind or physically handicapped [u/s80 U]- upto Rs 50,000/-

5 INTEREST paid on loan taken for higher education [U/s 80 E]-upto Rs 40,000/-

Total Amount

B Interest on Housing Loan [u/s 24(2)] -- Maximum up to Rs.1,50,000

WILL BE APPLYING FOR A LON OF 15 LACS FOR 20 YEARS

C Rebate U/S 80C

1 Payment of Life Insurance Premium

2 Deposit in Public Provident Fund

3 Purchase of National Saving Certificates (NSC)

4 Payment of ULIP / Equity linked Mutual Fund 52000

5 Payment of tuition fees for any of two children

6 Repayment of Housing Loan (only Principal Amount)

(Incl. Registration fees for the first year of housing loan)

7 Interest on N.S.C. Purchased in The Previous 5 years

year of Purchase 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010

Amount Invested

(Rs.)

8 Pension Scheme

9 Other (Please provide details)

10 Infrastructure Bonds

Total Amount from 1 to 9 (Restricted to Rs. 1,00,000/-) & 10 (Restricted to Rs. 20,000/-)

II House Rent Allowance (H.R.A.)

Name & Add of Rent Amount (Per

Address of accommodation Rent Amount (Per Annum)

1 the Landlord Month)

2 The house is located in a Metro / Non Metro ( Please tick)

III Previous Employment Salary (Salary earned from 01-04-2010 till date of joining)

1 If Yes, Form 16 from previous employer or Form 12 B attached

2 If no form 16 or 12B attached, confirm whether the standard deduction and Working

3 Woman Rebate considered by the previous employer or not

I further undertake to submit all the Investment Proofs and Rent Receipts (if any) on or before 5th March, 2011.

I further undertake that wherever eligible investments are made in the name of spouse/children/dependent parents,

the same have been made out of my current years income and claim thereof has/shall not be made by anybody else.

I hereby declare that all the information given by me is true and correct and that I have not used this declaration to

get Income Tax rebate benefit anywhere else.

Place :

Date: Signature

You might also like

- INVESTMENT DECLARATIONDocument1 pageINVESTMENT DECLARATIONShishir RoyNo ratings yet

- Investment Declaration Form - F.Y. 2021-2022: A. Deduction U/S 80CDocument1 pageInvestment Declaration Form - F.Y. 2021-2022: A. Deduction U/S 80CPrithwish MukherjeeNo ratings yet

- 02 Future Proof Declaration FormatDocument3 pages02 Future Proof Declaration FormatLucy SapamNo ratings yet

- For Shalini Investment Declaration-2012-13Document1 pageFor Shalini Investment Declaration-2012-13Poorni GanesanNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Tax Calcuations 1Document2 pagesTax Calcuations 1G Uday KiranNo ratings yet

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Covering Sheet For Investment Proof 2011-12Document1 pageCovering Sheet For Investment Proof 2011-12sanyu1208No ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- IT Declaration Format-05-12-2023Document6 pagesIT Declaration Format-05-12-2023somaNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Income Tax Declaration Form 2012-13Document2 pagesIncome Tax Declaration Form 2012-13asfsadfSNo ratings yet

- Smartivity Labs Employee Tax Form GuideDocument2 pagesSmartivity Labs Employee Tax Form GuideSanjeev Kumar50% (2)

- Forms Required For Tax Proofs 1011Document5 pagesForms Required For Tax Proofs 1011Neeraj JosephNo ratings yet

- TFW Application Forms NEW - 20210809102815Document5 pagesTFW Application Forms NEW - 20210809102815doney PhilipNo ratings yet

- IT Declaration 2011-12Document2 pagesIT Declaration 2011-12Vijaya Saradhi PeddiNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- Income tax filing deadline reminderDocument2 pagesIncome tax filing deadline remindermakamkkumarNo ratings yet

- Circular Ay 2010 11Document4 pagesCircular Ay 2010 11shaitankhopriNo ratings yet

- IT Declaration Form 2012-13Document1 pageIT Declaration Form 2012-13Suresh SharmaNo ratings yet

- Zuari Indian Oiltanking Ltd Investment Declaration 2010-11Document2 pagesZuari Indian Oiltanking Ltd Investment Declaration 2010-11shivshenoyNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Investment Declaration FY 2024-25Document6 pagesInvestment Declaration FY 2024-25Kumar BhaskarNo ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- ANNUAL INCOME TAX STATEMENTDocument4 pagesANNUAL INCOME TAX STATEMENTManoj SankaranarayanaNo ratings yet

- Epsf FormDocument1 pageEpsf Formpawanrai5982No ratings yet

- Employee Declaration Form 11-12Document3 pagesEmployee Declaration Form 11-12Amit KhotNo ratings yet

- It Declaration Year 2011 12Document1 pageIt Declaration Year 2011 12Vijay BokadeNo ratings yet

- 36 It Declaration Fy1011Document1 page36 It Declaration Fy1011nad1002No ratings yet

- MOE FAS Application FormDocument7 pagesMOE FAS Application FormRoyNo ratings yet

- Income-Tax Declaration FormDocument5 pagesIncome-Tax Declaration FormGanesh MaddipotiNo ratings yet

- Epsf Form & Guideliness - 2016-17Document8 pagesEpsf Form & Guideliness - 2016-17SumanNo ratings yet

- Income Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreeDocument6 pagesIncome Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreevickycdNo ratings yet

- BUFIN ITDeclarationFormDocument2 pagesBUFIN ITDeclarationFormdpfsopfopsfhopNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- Investment Declaration Form F.Y 2023-24Document4 pagesInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Fin - e - 321 - 2019 - Pensiom GODocument32 pagesFin - e - 321 - 2019 - Pensiom GORytham Puni100% (2)

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Appendix B MOE FAS Application Form 2023Document7 pagesAppendix B MOE FAS Application Form 2023yvonneisteachingNo ratings yet

- Mirae Aseet Application FormDocument5 pagesMirae Aseet Application Formanandmoon273No ratings yet

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNo ratings yet

- 1 MPB-501 - Application For Pension 2 MPC - 60Document10 pages1 MPB-501 - Application For Pension 2 MPC - 60Anitha Mary DambaleNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Income Tax Declaration Form FY 22023 24 AY2024 25Document1 pageIncome Tax Declaration Form FY 22023 24 AY2024 25mrleftyftwNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- HRA, 80C, 80D, 80CCD Investment Declaration GuideDocument10 pagesHRA, 80C, 80D, 80CCD Investment Declaration GuidecutieedivyaNo ratings yet

- Application Form Allotment of Accommodation Departmental PoolDocument5 pagesApplication Form Allotment of Accommodation Departmental Poolvishu kumarNo ratings yet

- Dependency Form PDFDocument5 pagesDependency Form PDFVivek VenugopalNo ratings yet

- Yuken India Savings Declaration FY 2010-11Document3 pagesYuken India Savings Declaration FY 2010-11maiudayNo ratings yet

- Investment Declaration Form For The Financial Year 2014 - 15Document7 pagesInvestment Declaration Form For The Financial Year 2014 - 15devanyaNo ratings yet

- Guide to Income Tax Proofs for Investments and DeductionsDocument2 pagesGuide to Income Tax Proofs for Investments and Deductionssamuraioo7No ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SNo ratings yet

- Tax Investments Format 2010-11Document2 pagesTax Investments Format 2010-11mcnavineNo ratings yet

- Investment and tax saving proofs for 2017-18Document5 pagesInvestment and tax saving proofs for 2017-18vishalkavi18No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Querry Report FormatDocument5 pagesQuerry Report FormatPriyanka KhemkaNo ratings yet

- Dental Practice UFC Queries for October 2009Document1 pageDental Practice UFC Queries for October 2009Priyanka KhemkaNo ratings yet

- Querry Report FormatDocument5 pagesQuerry Report FormatPriyanka KhemkaNo ratings yet

- Dental Practice UFC Queries for October 2009Document1 pageDental Practice UFC Queries for October 2009Priyanka KhemkaNo ratings yet

- ACCTG311 Partnership Formation and AccountingDocument2 pagesACCTG311 Partnership Formation and AccountingJirah BernalNo ratings yet

- TRAIN Tax Law: Primer, Guide & BIR Sample ComputationsDocument4 pagesTRAIN Tax Law: Primer, Guide & BIR Sample ComputationsSymuelly Oliva PoyosNo ratings yet

- Z Im Wum MEMLHx BAGNDocument15 pagesZ Im Wum MEMLHx BAGNIssac EbbuNo ratings yet

- Salary Tax - Sonali SecuritiesDocument19 pagesSalary Tax - Sonali Securitieslimon islamNo ratings yet

- Rapid Delivery Excel Worksheet Exhibits Fall 2015 DoneDocument41 pagesRapid Delivery Excel Worksheet Exhibits Fall 2015 Doneapi-377798915No ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- Law On Income TaxDocument10 pagesLaw On Income TaxJuliever EncarnacionNo ratings yet

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- 172 Fernandez Hermanos, Inc. v. CIR (Uy)Document4 pages172 Fernandez Hermanos, Inc. v. CIR (Uy)Avie UyNo ratings yet

- TaxPrime Provides Premium PPSWP ServicesDocument6 pagesTaxPrime Provides Premium PPSWP ServicesFirmanto MadjiedNo ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- DD / MC Dilna Form: Bank SealDocument1 pageDD / MC Dilna Form: Bank Sealwolf tanvirNo ratings yet

- 060 Air Canada V CIR PDFDocument3 pages060 Air Canada V CIR PDFBeata CarolinoNo ratings yet

- China Bank Vs CIR Passive Investment IncomeDocument7 pagesChina Bank Vs CIR Passive Investment IncomeThremzone17No ratings yet

- SQA Accounting Assignment 1 02000759Document4 pagesSQA Accounting Assignment 1 02000759SENITH J100% (1)

- PEDRO RELATIVO, ET AL., Defendants-AppellantsDocument3 pagesPEDRO RELATIVO, ET AL., Defendants-AppellantsErwin L BernardinoNo ratings yet

- Media and Entertainment Sector Impact of Goods and Services Tax (GST)Document33 pagesMedia and Entertainment Sector Impact of Goods and Services Tax (GST)Ishwar Meena100% (1)

- SBSA Statement 2023-03-10Document42 pagesSBSA Statement 2023-03-10Maestro ProsperNo ratings yet

- Apauline IciciDocument41 pagesApauline Icicihalotog831No ratings yet

- Lembar Siklus BerkahDocument34 pagesLembar Siklus BerkahSri Muji RahayuNo ratings yet

- The Illinois QTIP Election To The RescueDocument5 pagesThe Illinois QTIP Election To The RescuerobertkolasaNo ratings yet

- Obligations: 1. RegistrationDocument5 pagesObligations: 1. RegistrationPhilip AlamboNo ratings yet

- Child Care Subsidy (0028112904)Document9 pagesChild Care Subsidy (0028112904)ammar naeemNo ratings yet

- Annual Income Tax ReturnDocument2 pagesAnnual Income Tax ReturnRAS ConsultancyNo ratings yet

- IMAT Booking Locations 2023Document3 pagesIMAT Booking Locations 2023Paulo Otávio Diniz RodriguesNo ratings yet

- Payment ReceiptDocument4 pagesPayment ReceiptJane BiebsNo ratings yet

- Snow Solutions (Final Exam)Document11 pagesSnow Solutions (Final Exam)pavneetsinghrainaNo ratings yet

- Babcock University Acct 434 Lecture 4 Double Taxation ReliefDocument24 pagesBabcock University Acct 434 Lecture 4 Double Taxation ReliefdemolaojaomoNo ratings yet

- Statement EUDocument41 pagesStatement EUuyên đỗNo ratings yet

- View paystub details like earnings, taxes, deductionsDocument1 pageView paystub details like earnings, taxes, deductionsjohnathan greyNo ratings yet