Professional Documents

Culture Documents

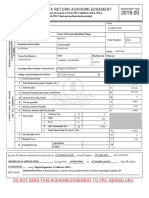

Income Tax Return of Sunil Dave

Uploaded by

JIGNA NAKAROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Return of Sunil Dave

Uploaded by

JIGNA NAKARCopyright:

Available Formats

Code :- SDD

Name : SUNIL DHIRAJLAL DAVE

Father's Name : DHIRAJLAL DAVE

Address(O) : 01, JAM KHAMBHALIYA, JAMKHAMBHALIA, GUJARAT-361008

Address(R) : ., PROP. GYANDEEP CLASSES, LUHAR SHALA, JAMKHAMBHALIA, GUJARAT-361305

Permanent Account No : ABOPD4303L Date of Birth : 30/03/1965

Sex : Male

Status : Individual Resident Status Resident

Previous year : 2018-2019 Assessment Year : 2019-2020

Ward/Circle : Return : ORIGINAL

Nature of Business or OTHER SERVICES N.E.C. - 21008

Profession

Computation of Total Income

Income Heads Income Income After

Before Set off Set off

Income from Salary 17600 17600

Income from House Property 0 0

Income From Business or Profession 146366 146366

Income from Capital Gains 0 0

Income from Other Sources 128895 128895

Gross Total Income 292861

Less : Deduction under Chapter VIA 4753

Total Income 288108

Rounding off u/s 288A 288110

Income Taxable at Normal Rate 288110

Income Taxable at Special Rate 0

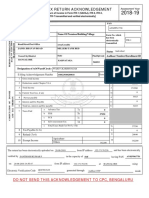

TAX CALCULATION

Basic Exemption Limit Rs. 250000

Tax at Normal Rates 1906

Total Tax 1906

Less : Tax Rebate u/s 87A 1906

Tax Payable 0

Less : TDS/TCS 1552

Assessed Tax -1552

Amount Refundable 1550

Amount Refundable Rounded Off u/s 288 B 1550

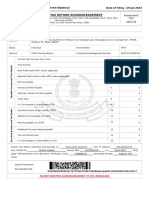

COMPREHENSIVE DETAIL

Income from salary 17600

Name of employer : PRIVATE

Period : From 01/04/2018 To 31/03/2019

Particular Total Exempted Taxable

Amount Amount Amount

Gross Salary 57600 0 57600

Allowance :

Total 57600 0 57600

Standard Deduction 40000

Total Taxable Salary 17600

Income from Business & Profession Details

146366

GNANDEEP CLASES

Net Profit As Per P&L A/c 332861

Add:Items Inadmissible/for Separate 0

Consideration

Depreciation Separately Considered 0

Less:Items Admissible/for Separate 186495

Consideration

Income taxable under other heads of income 186495

Description Amount

Income chargeble under the head Salary 57600

Income chargeble under the head Other 128895

Sources

Depreciation Allowed as Per IT Act 0

Income From GNANDEEP CLASES 146366

Total of Business & Profession 146366

Income From Other Sources 128895

Interest on Bank Savings 4753

SB SBI 748

SB CBI 4005

Interest on Bank FDR 124142

1. SBI FDR 15502

2. POST OFFICE DEPOSITS 108640

Total Income 128895

Total of Other Sources 128895

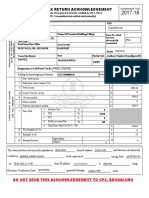

Deductions Under Chapter VIA 4753

Description Gross Deductable

Amount Amount

u/s 80TTA (Interest on deposit in saving 4753 4753

account)

Tax Deducted/Collected at Source Details

Deductor/Employer's Name TAN Section Amount Paid TDS Amount Allow. Amt.

STATE BANK OF INDIA MUMS86157B 194A 15283 1552 1552

Total 15283 1552 1552

Return Filing Due Date : 31/07/2019 Return Filing Section : 139(1)

Interest Calculated Upto : 02/07/2019

Details of Bank Accounts :

No of Bank Account :- 1

Sr.No. IFS Code Name & Branch Account No. Type

1 CBIN0280582 CENTRAL BANK OF INDIA-KHAMBHALIA 1425006140 Saving

Verified By : SUNIL DHIRAJLAL DAVE

You might also like

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- ITR-3 Form PDFDocument28 pagesITR-3 Form PDFPankaj Kumar KesarwaniNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKrishna KumarNo ratings yet

- ITR-4 Acknowledgement for AY 2021-22Document1 pageITR-4 Acknowledgement for AY 2021-22Aditya Adi SinghNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- ITR-1 Form PDFDocument3 pagesITR-1 Form PDFAravind S NarayanNo ratings yet

- Salaryslip YM2023013686 December 2023Document1 pageSalaryslip YM2023013686 December 2023jessypriyadharshini9No ratings yet

- 3.kingsun Financial Statement FinalDocument22 pages3.kingsun Financial Statement FinalDharamrajNo ratings yet

- Presentation Made To Analysts / Investors (Company Update)Document20 pagesPresentation Made To Analysts / Investors (Company Update)Shyam SunderNo ratings yet

- Payslip 11 2022Document1 pagePayslip 11 2022Md SharidNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageVarun KandoiNo ratings yet

- Indusind BankDocument65 pagesIndusind BankNadeem KhanNo ratings yet

- Payslip 636885798246330527Document1 pagePayslip 636885798246330527chaitanya kulkarniNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- Worldwide SolutionsDocument1 pageWorldwide SolutionsKamlesh NandanwarNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Pay Slip - Jan 2017Document1 pagePay Slip - Jan 2017Nagarjuna MuthineniNo ratings yet

- Offer Letter GBDocument1 pageOffer Letter GBHarshitBhargavaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 392007Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 392007vipin agarwal0% (1)

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementNANDAN SALESNo ratings yet

- Payslip Prakhar PRA745634 1635359400000Document1 pagePayslip Prakhar PRA745634 163535940000024hours service centerNo ratings yet

- Acknowledgement AY 22-23Document1 pageAcknowledgement AY 22-23Nirav RavalNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargNo ratings yet

- Salary Slip Report SpecimenDocument1 pageSalary Slip Report SpecimenMuhammad Zeeshan HaiderNo ratings yet

- India Payslip January 2022Document1 pageIndia Payslip January 2022Mir KazimNo ratings yet

- 1485929534574Document15 pages1485929534574Anonymous 0Vc8t87vANo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryPradeep NegiNo ratings yet

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- PDF 438429930210822Document1 pagePDF 438429930210822peetamber agarwalNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Pay Slip 10949 February, 2021Document1 pagePay Slip 10949 February, 2021Abebe SharewNo ratings yet

- Transaction and holding statement for Mani ArunkumarDocument2 pagesTransaction and holding statement for Mani ArunkumarArun KumarNo ratings yet

- 914010004015551 (5)Document3 pages914010004015551 (5)Eureka KashyapNo ratings yet

- Earnings Deductions: Empl ID Month SEP YearDocument1 pageEarnings Deductions: Empl ID Month SEP Yearharshwardhan prajapatiNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Salary Slip JunevijayDocument5 pagesSalary Slip JunevijayKaruna DubeyNo ratings yet

- ICICI Lombard Payslip APR 2014Document1 pageICICI Lombard Payslip APR 2014abhijitj0555100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- PaySlip July 2022Document1 pagePaySlip July 2022Kaushal YadavNo ratings yet

- Mahindra World City April 2022 payslipDocument1 pageMahindra World City April 2022 payslipSidvik InfotechNo ratings yet

- SasssDocument1 pageSasssAdil SyedNo ratings yet

- Acctstmt FDocument3 pagesAcctstmt FAbhay SinghNo ratings yet

- Offer Letter: D-278, Near Hanuman MandirDocument3 pagesOffer Letter: D-278, Near Hanuman MandirGhanshyam SinghNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearpawan kumar raiNo ratings yet

- March Pay in SlipDocument1 pageMarch Pay in SlipMahenderNo ratings yet

- Rahbar Infotech Solutions PVT - LTD.: Salary Slip For The Month ofDocument1 pageRahbar Infotech Solutions PVT - LTD.: Salary Slip For The Month ofSalman KhanNo ratings yet

- Rochak Agrawal-Offer PDFDocument4 pagesRochak Agrawal-Offer PDFrochak agrawalNo ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusunilchampNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSagar Kumar GuptaNo ratings yet

- Aman Sharma ITR AY2021Document3 pagesAman Sharma ITR AY2021Abhishek SaxenaNo ratings yet

- Income Tax Return for FY 2016-17Document2 pagesIncome Tax Return for FY 2016-17Suman jhaNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- 19-20 ComputationDocument3 pages19-20 ComputationTanvi DhingraNo ratings yet

- Management Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Document4 pagesManagement Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)No ratings yet

- COPQ: Cost of Poor QualityDocument24 pagesCOPQ: Cost of Poor Qualityrrvalero0% (1)

- Problems of IBMDocument5 pagesProblems of IBMMurugesh SanjeeviNo ratings yet

- Embassy DRHP 2010Document714 pagesEmbassy DRHP 2010Sanjana GuptaNo ratings yet

- DPR Krishi KendraDocument18 pagesDPR Krishi KendraShivaditya S AwasthiNo ratings yet

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- Тasks for individual workDocument7 pagesТasks for individual workДарина БережнаяNo ratings yet

- Explain The Major Indicators of DevelopmentDocument2 pagesExplain The Major Indicators of DevelopmentTrust ChiradzaNo ratings yet

- PayslipSalary Slips - 9-2020 PDFDocument1 pagePayslipSalary Slips - 9-2020 PDFSukant ChampatiNo ratings yet

- Nidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)Document2 pagesNidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)jdchandrapal4980No ratings yet

- ACT112.QS2 With AnswersDocument6 pagesACT112.QS2 With AnswersGinie Lyn Rosal88% (8)

- Rajat Ghosh's electric mobility futureDocument21 pagesRajat Ghosh's electric mobility futuremeghana chavanNo ratings yet

- DipIFR D24-J25 Syllabus and Study Guide - FinalDocument15 pagesDipIFR D24-J25 Syllabus and Study Guide - FinalFrans R. Calderon MendozaNo ratings yet

- Taxation UPDocument28 pagesTaxation UPmarkbagzNo ratings yet

- CHAPTER 08-Investment ProductsDocument21 pagesCHAPTER 08-Investment Productspawan verma vermaNo ratings yet

- RCA Solutions Mod5Document5 pagesRCA Solutions Mod5Danica Austria DimalibotNo ratings yet

- Kumari BankDocument6 pagesKumari BankYogesh KatwalNo ratings yet

- CF Micro8 Tif02Document61 pagesCF Micro8 Tif02هناءالحلوNo ratings yet

- By Gaurav Goyal Assistant Professor, Lmtsom, TuDocument28 pagesBy Gaurav Goyal Assistant Professor, Lmtsom, TuSachin MalhotraNo ratings yet

- Group 2 employee detailsDocument20 pagesGroup 2 employee detailsReeja Mariam MathewNo ratings yet

- Consulting Case Solutions:: Assignment OnDocument11 pagesConsulting Case Solutions:: Assignment OnAkash KhatriNo ratings yet

- Financial Ratios of VinamilkDocument6 pagesFinancial Ratios of VinamilkDương DươngNo ratings yet

- SWOT AnalysisDocument2 pagesSWOT Analysisapi-3710417100% (1)

- Accounting Balance Sheet ExercisesDocument2 pagesAccounting Balance Sheet ExercisesJoanna SzczęsnaNo ratings yet

- (SM) Financial Analysis Malaysia Airline CompanyDocument10 pages(SM) Financial Analysis Malaysia Airline Companymad2kNo ratings yet

- Tax RemediesDocument51 pagesTax RemediesBevz23100% (6)

- Consol WorksheetDocument104 pagesConsol WorksheetOppa JihuNo ratings yet

- Battle of The Exes: Understanding The Effect of The Ex Ante and Ex Post Approaches On Damage CalculationsDocument3 pagesBattle of The Exes: Understanding The Effect of The Ex Ante and Ex Post Approaches On Damage CalculationsVeris Consulting, Inc.No ratings yet

- Manual Auto Fibo PhenomenonDocument17 pagesManual Auto Fibo PhenomenonRodrigo Oliveira100% (1)

- FM Case Study 4Document7 pagesFM Case Study 4Arush BahglaNo ratings yet