Professional Documents

Culture Documents

xaxbshZBLb1lnizdKQJiTw PDF

Uploaded by

shreveporttimesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

xaxbshZBLb1lnizdKQJiTw PDF

Uploaded by

shreveporttimesCopyright:

Available Formats

Office hours are 8:00 a.m. to 4:30 p.m.

Monday through

Post Office Box 4969 Thursday and Friday 9:00 a.m. to 4:30 p.m.

Baton Rouge, LA 70821-4969 For assistance, you may call (855) 307-3893 or email us at:

Business.Inquiries@LA.Gov.

Visit our website at www.revenue.louisiana.gov

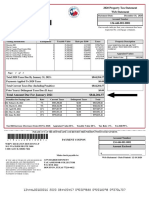

NOTICE OF TAX DUE

CITY OF SHREVEPORT

DEPT OF FINANCE

Date of Notice: December 03, 2018

505 TRAVIS ST STE 600

SHREVEPORT LA 71101-3028 Letter ID: L1428948832

Account ID:

Tax Type: Withholding

PLEASE DO NOT IGNORE THIS NOTICE

Filing Period: 09/30/2018 Calculated Through: December 21, 2018

1. Tax due: $941,266.00

2. Interest: $0.00

3. Penalties $47,063.30

A. Late Payment $0.00

B. Delinquent Filing $47,063.30

C. Under Estimated $0.00

D. NSF Fee(s) $0.00

E. Other Penalties $0.00

4. Other charges: $0.00

5. Balance Due: $988,329.30

6. Less credits from other periods: $0.00

7. Less payments and credits: ($941,266.00)

8. Total amount due and payable: $47,063.30

TOTAL PERIOD BALANCE: $47,063.30

According to our records, you owe tax, interest, and penalty as indicated. If you agree, please remit the amount due. If

you disagree, please contact us immediately. Louisiana law (R.S. 47:1568) provides that you have 30 days from the date

of this notice for your response or payment to reach our office. If we do not receive a response or payment within 30

days, Louisiana law (R.S. 47:1568) requires us to begin collection proceedings. Please give this matter your prompt

attention.

Post Office Box 4969

Baton Rouge, LA 70821-4969

www.revenue.louisiana.gov

00697466883340101853

Important

R.S. 47:1502 R.S. 47:1604.1(C) - Understatement of tax negligence

The collector shall collect and enforce the collection of all taxes, penalty for taxes other than individual income tax

penalties, interest, and other charges that may be due under the This statute provides that if a taxpayer understated the tax

provisions of Sub-title II of this Title and administer the legislative liability by 25 percent or more and with no intent to defraud, a

mandate therein contained. To that end, the collector is vested with all negligence penalty may be imposed. The penalty is calculated

the power and authority conferred by this Title, except such as is at 15 percent of the tax or deficiency found to be due. This

specifically conferred upon other officials. penalty can be assessed in addition to the 10 percent

negligence penalty.

For more information on LOUISIANA REVISED STATUTES see the

Legislative website at www.legis.state.la.us. This statute also provides that if the taxpayer understated the

tax liability by 25 percent or more, and the circumstances

R.S. 47:1568(B) - Assessment of tax indicate intent to defraud, the penalty is calculated at 20

Please give this matter your prompt attention. It is very important that percent of the tax or deficiency found to be due. This penalty

your response or payment be received in this office within 30 days from can be assessed in addition to the 10 percent negligence

the date of this notice. If not, under provisions of Louisiana Revised penalty.

Statutes, Title 47, Section 1568, a Warrant For Distraint must be issued

which renders your property, both real and personal, subject to seizure This statute also provides that if a taxpayer understated their

in satisfaction of the outstanding liability and will subject you to an tax table income by 25 percent or more of their Adjusted

additional penalty of $10 under R.S. 47:1606. Remittance should be in Gross Income, and the circumstances indicate intent to

the form of a personal check, cashier’s check, money order, or certified defraud, the penalty is calculated at 20 percent of the tax or

check. deficiency found to be due. This penalty can be assessed in

addition to the 10 percent negligence penalty.

R.S. 47:1601 - Interest

This statute provides that when a taxpayer fails to pay any tax before R.S. 47:1604.2 - Returned check penalty (NSF Fee)

the statutory due date, interest will be added to the amount of tax due This statute provides that a returned payment penalty must be

and shall be computed from the due date until the tax is paid. The imposed if a check or electronic debit used to make payment

annual interest rate is variable and is posted on LDR’s website on Form of a tax, penalty, interest, or fee is returned unpaid by the

R-1111, Interest Rate Schedule Collected on Unpaid Taxes. Also, LDR bank on which it is drawn. The penalty is 1 percent of the

announces the current year’s interest rate in a Revenue Information amount of the check or electronic debt, or $20, whichever is

Bulletin that also includes the rate for prior years. greater. In addition, a returned payment will be considered a

failure to pay the tax and will give rise to interest and the late

Computation of interest on notices of tax due shall be fifteen (15) days payment penalty.

after the issue date of the notice. If payment is received on or before the

fifteenth day after the issue date of the notice, no refund of interest shall If your check was returned unpaid, send your payment in the

be made. If payment is received after the fifteenth day but on or before form of a cashier’s check, money order, or certified check.

the thirtieth day, no additional interest will be assessed.

R.S. 47:1605 - Examination and hearing costs

This statute provides that if a taxpayer fails to file a required

R.S. 47:1602(A)(1) - Delinquent filing penalty

return, or files a grossly incorrect, false or fraudulent return,

This statute imposes a delinquent filing penalty when a taxpayer fails to

and the Department of Revenue audits the taxpayer, a specific

file a return on time. The delinquent filing penalty is 5 percent of the tax

penalty may be added to the amount of tax found to be due, in

due if the delinquency is for 30 days or less. An additional 5 percent

addition to any other penalty provided.

must be imposed for each additional 30 days or fraction thereof during

which the delinquency continues, not to exceed 25 percent of the

original tax due. R.S. 47:642 - Failure to file reports

If any person, whether the person be a severer or purchaser,

R.S. 47:1602(A)(2) - Late payment penalty for taxes other than fails to make a report of the gross production and value of its

individual income tax natural products upon which the severance tax is herein levied

This statute imposes a late payment penalty when a taxpayer files a within the time and in the manner prescribed, there shall be

return but fails to pay the tax due on the return by the statutory due imposed upon that person a specific penalty of two hundred

date, determined without regard to any extension of time for filing the fifty dollars for each reporting period, in addition to any other

return. The penalty is 5 percent of the unremitted tax if the failure to penalties provided.

remit is for 30 days or less and an additional 5 percent for each

additional 30 days or fraction thereof that the unremitted tax is not The specific penalties described above are by law an

paid.This penalty will not be imposed for any 30-day period for which a obligation that must be collected and accounted for in the

delinquent filing penalty is due and cannot be imposed for more than same manner as if they were part of the tax due, and can be

five 30-day periods in total for each return required to be filed. enforced either in a separate action or in the same action for

the collection of the tax.

R.S. 47:1604.1(A) - Negligence penalty

This statute provides that if a taxpayer fails to file a required tax return

or files an incorrect return, and the circumstances indicate negligence or

disregard of rules and regulations but no intent to defraud, a negligence

penalty may be imposed. The penalty is calculated at 10 percent of the

tax or deficiency found to be due.

You might also like

- Chase Sep V 2.9Document11 pagesChase Sep V 2.9faxev83733100% (1)

- Bank Statement SummaryDocument11 pagesBank Statement Summaryfaxev8373350% (2)

- 01-24-2019 PDFDocument8 pages01-24-2019 PDFAnonymous xS9JZWO9gfNo ratings yet

- August 05Document4 pagesAugust 05Matthew LundstromNo ratings yet

- Business checking statement summaryDocument2 pagesBusiness checking statement summaryKelleyNo ratings yet

- April 2020 2 PDFDocument4 pagesApril 2020 2 PDFSueyloo250% (2)

- 2022 Property Tax Statement for 405 Flintrock WayDocument1 page2022 Property Tax Statement for 405 Flintrock WayLOUNGE HOMENo ratings yet

- Best Buy Citibank StatementDocument8 pagesBest Buy Citibank Statementadrian mayoNo ratings yet

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochNo ratings yet

- Your Adv Plus Banking: Account SummaryDocument6 pagesYour Adv Plus Banking: Account SummaryЮлия ПNo ratings yet

- March 2020 PDFDocument6 pagesMarch 2020 PDFJonathan Seagull LivingstonNo ratings yet

- 09-28-2018 PDFDocument12 pages09-28-2018 PDFAnonymous haqBJBY100% (2)

- Your Adv Plus Banking: Account SummaryDocument6 pagesYour Adv Plus Banking: Account Summaryhanh nguyen hoang ngoc100% (1)

- Time Series Forecasting - Project ReportDocument68 pagesTime Series Forecasting - Project ReportKhursheedKhan50% (2)

- June 14 PDFDocument4 pagesJune 14 PDFSusan Romdenne100% (1)

- Document SOS1Document5 pagesDocument SOS1Mickie FieldsNo ratings yet

- California Delinquency NoticeDocument2 pagesCalifornia Delinquency NoticeCami Mondeaux100% (1)

- Dcoument7 AMEXStatement Mar 2015Document11 pagesDcoument7 AMEXStatement Mar 2015Daniel TaylorNo ratings yet

- Camille DavidsonDocument2 pagesCamille DavidsonMark WilliamsNo ratings yet

- Bank of America Bank StatementDocument4 pagesBank of America Bank Statementiimoadi333No ratings yet

- Estmt - 2019 07 25Document8 pagesEstmt - 2019 07 25Sandra RíosNo ratings yet

- Your Business Advantage Fundamentals™ Banking: Account SummaryDocument6 pagesYour Business Advantage Fundamentals™ Banking: Account SummaryH.I.M Dr. Lawiy ZodokNo ratings yet

- Travis Card StatementDocument4 pagesTravis Card StatementPapa BoolioNo ratings yet

- March 2022Document5 pagesMarch 2022Сергей РатиновNo ratings yet

- New Balance $6,751.10 Payment Due Date 10/05/19: American Express Classic Gold CardDocument8 pagesNew Balance $6,751.10 Payment Due Date 10/05/19: American Express Classic Gold CardIrshad aliNo ratings yet

- Noa 2023-Han DongDocument2 pagesNoa 2023-Han Dongh865cqy6c9No ratings yet

- BankOfAmerica StatementDocument4 pagesBankOfAmerica StatementAmanda ALEXNo ratings yet

- January 09, 2018Document6 pagesJanuary 09, 2018Monina JonesNo ratings yet

- 01-14-2016Document6 pages01-14-2016SusanaNo ratings yet

- 03-23-2017 PDFDocument6 pages03-23-2017 PDFal pomerantzNo ratings yet

- March 06 2017Document10 pagesMarch 06 2017Anonymous u7HLgyXDTNo ratings yet

- Natalee Lang - Tax Notice of Assessment For 20202021Document2 pagesNatalee Lang - Tax Notice of Assessment For 20202021MWA Films100% (1)

- IRS Demand Letter - 14 July 2022Document2 pagesIRS Demand Letter - 14 July 2022KPLC 7 NewsNo ratings yet

- Costco Anywhere Visa Card by CitiDocument4 pagesCostco Anywhere Visa Card by CitiOsvaldo CalderonUACJNo ratings yet

- TDJULYDocument4 pagesTDJULYВлад АнгелNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Asterisk-Free Checking Account Account: - 7392: Brad Sergi 3819 Plane Tree DR W COLUMBUS OH 43228-3560Document2 pagesAsterisk-Free Checking Account Account: - 7392: Brad Sergi 3819 Plane Tree DR W COLUMBUS OH 43228-3560Glenda0% (1)

- March Statement Minimum Payment Due: $25.00 New Balance As of 03/11/21: $94.56 Payment Due Date: 04/09/21Document3 pagesMarch Statement Minimum Payment Due: $25.00 New Balance As of 03/11/21: $94.56 Payment Due Date: 04/09/21RajaNo ratings yet

- Tally QuestionsDocument73 pagesTally QuestionsVishal Shah100% (1)

- Dep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDocument69 pagesDep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDAYONo ratings yet

- Statement ImageDocument3 pagesStatement ImageClayton StreeterNo ratings yet

- New Balance $4,053.61 Payment Due Date 09/05/19: American Express Classic Gold CardDocument7 pagesNew Balance $4,053.61 Payment Due Date 09/05/19: American Express Classic Gold CardIrshad aliNo ratings yet

- Document5 AMEX Dec 2013Document14 pagesDocument5 AMEX Dec 2013Daniel TaylorNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: Miss Hina Khan Unit 24 29 Nicholls Tce Woodville West Sa 5011Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Hina Khan Unit 24 29 Nicholls Tce Woodville West Sa 5011hina khanNo ratings yet

- Laude vs. Ginez-Jabalde (MCLE)Document29 pagesLaude vs. Ginez-Jabalde (MCLE)Justin CebrianNo ratings yet

- Lecture Notes in Airport Engineering PDFDocument91 pagesLecture Notes in Airport Engineering PDFMaya RajNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochNo ratings yet

- Utility-Bill AlfredoDocument1 pageUtility-Bill AlfredophiliplampleyNo ratings yet

- Production of Activated CarbonDocument11 pagesProduction of Activated CarbonShii Bautista100% (1)

- Oracle Weblogic Server 12c Administration II - Activity Guide PDFDocument188 pagesOracle Weblogic Server 12c Administration II - Activity Guide PDFNestor Torres Pacheco100% (1)

- Your overpayment balance is paid in fullDocument2 pagesYour overpayment balance is paid in fullNikole MontezNo ratings yet

- Your Payment Information - This Is A BillDocument2 pagesYour Payment Information - This Is A BillesenombreunicoNo ratings yet

- Your Payment Information - This Is A BillDocument2 pagesYour Payment Information - This Is A BillesenombreunicoNo ratings yet

- Breaking Code Silence DelinquentDocument2 pagesBreaking Code Silence DelinquentbcswhistleblowerNo ratings yet

- Document8 AMEXStatement Jul 2015Document11 pagesDocument8 AMEXStatement Jul 2015Daniel TaylorNo ratings yet

- Camille Davidson StatementDocument2 pagesCamille Davidson StatementPeter MariluchNo ratings yet

- 2015 Noa Elena - 1Document1 page2015 Noa Elena - 1Ded MarozNo ratings yet

- 2020 Property Tax Statement for Houston High-RiseDocument1 page2020 Property Tax Statement for Houston High-RiseAisar UddinNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977No ratings yet

- Brown POQDocument4 pagesBrown POQJonas GonzalesNo ratings yet

- Converge SOA detailsDocument1 pageConverge SOA detailsHershee SantosNo ratings yet

- Paystub-0202 DANEA MCLAURINDocument1 pagePaystub-0202 DANEA MCLAURINmarkchristory07No ratings yet

- Maintenance Bill: Uptown Condominium Owners Welfare AssociationDocument1 pageMaintenance Bill: Uptown Condominium Owners Welfare AssociationkiranNo ratings yet

- eStatement1481IN - 2024 02 23Document3 pageseStatement1481IN - 2024 02 23sanjitsha2708No ratings yet

- January 2016 Credit Card Statement - Mountain SageDocument5 pagesJanuary 2016 Credit Card Statement - Mountain Sagechluk1968No ratings yet

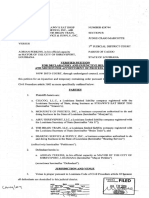

- Woerner PetitionDocument16 pagesWoerner PetitionshreveporttimesNo ratings yet

- Delegation Letter To Ochsner LSU Health Page 1Document1 pageDelegation Letter To Ochsner LSU Health Page 1shreveporttimesNo ratings yet

- Ochsner LSU Health ResponseDocument3 pagesOchsner LSU Health ResponseshreveporttimesNo ratings yet

- SPD Academy Evaluation Final VersionDocument3 pagesSPD Academy Evaluation Final VersionshreveporttimesNo ratings yet

- ADEM Response Pilgrims SIDDocument1 pageADEM Response Pilgrims SIDshreveporttimesNo ratings yet

- Delegation Letter To Ochsner LSU Health Shreveport Page 2Document1 pageDelegation Letter To Ochsner LSU Health Shreveport Page 2shreveporttimesNo ratings yet

- Shreveport Letter - NRADocument2 pagesShreveport Letter - NRAshreveporttimesNo ratings yet

- NTSB Accident Report On Civilian Plane CrashDocument3 pagesNTSB Accident Report On Civilian Plane CrashshreveporttimesNo ratings yet

- Louisiana ALICE Report Embargoed Until August 6, 2020 DigitalDocument183 pagesLouisiana ALICE Report Embargoed Until August 6, 2020 DigitalshreveporttimesNo ratings yet

- Breakdown of Admissions From Elementary Schools To Caddo Middle MagnetDocument5 pagesBreakdown of Admissions From Elementary Schools To Caddo Middle MagnetshreveporttimesNo ratings yet

- Commission Report To Council Final VersionDocument8 pagesCommission Report To Council Final VersionshreveporttimesNo ratings yet

- Police Pay1Document1 pagePolice Pay1shreveporttimesNo ratings yet

- Police Pay2Document2 pagesPolice Pay2shreveporttimesNo ratings yet

- Gov. Greg Abbott Letter To Secretary PompeoDocument2 pagesGov. Greg Abbott Letter To Secretary PompeoshreveporttimesNo ratings yet

- Police Pay3Document1 pagePolice Pay3shreveporttimesNo ratings yet

- Beginning of Season Memo Email 2020Document5 pagesBeginning of Season Memo Email 2020shreveporttimesNo ratings yet

- Police Pay2Document2 pagesPolice Pay2shreveporttimesNo ratings yet

- Bossier City Property Tax Renewal Proposition Fact SheetDocument1 pageBossier City Property Tax Renewal Proposition Fact SheetshreveporttimesNo ratings yet

- Postal Carrier Attacked - Offense ReportDocument1 pagePostal Carrier Attacked - Offense ReportshreveporttimesNo ratings yet

- Shreveport Economic Recovery Task Force PlanDocument33 pagesShreveport Economic Recovery Task Force PlanshreveporttimesNo ratings yet

- Football Dates 2020Document2 pagesFootball Dates 2020shreveporttimesNo ratings yet

- 89 Jbe 2020Document4 pages89 Jbe 2020shreveporttimesNo ratings yet

- Levette Fuller DWI Conviction Set AsideDocument1 pageLevette Fuller DWI Conviction Set AsideshreveporttimesNo ratings yet

- Football Dates 2020Document2 pagesFootball Dates 2020shreveporttimesNo ratings yet

- Shreveport Mask Mandate Lawsuit JudgmentDocument5 pagesShreveport Mask Mandate Lawsuit JudgmentshreveporttimesNo ratings yet

- Paul Doe Vs Diocese of Shreveport 624777Document19 pagesPaul Doe Vs Diocese of Shreveport 624777shreveporttimesNo ratings yet

- Shreveport City Council Emergency Mask OrderDocument6 pagesShreveport City Council Emergency Mask OrdershreveporttimesNo ratings yet

- Petition by Shreveport BusinessesDocument26 pagesPetition by Shreveport BusinessesshreveporttimesNo ratings yet

- Order Prelim Approving Partial Settlement Notice Plan - SIGNEDDocument8 pagesOrder Prelim Approving Partial Settlement Notice Plan - SIGNEDshreveporttimesNo ratings yet

- Marshall Street Incident ReportDocument1 pageMarshall Street Incident ReportshreveporttimesNo ratings yet

- OTA710C User ManualDocument32 pagesOTA710C User ManualEver Daniel Barreto Rojas100% (2)

- Ap22 FRQ World History ModernDocument13 pagesAp22 FRQ World History ModernDylan DanovNo ratings yet

- SOLUTIONS : Midterm Exam For Simulation (CAP 4800)Document14 pagesSOLUTIONS : Midterm Exam For Simulation (CAP 4800)Amit DostNo ratings yet

- Kitchen in The Food Service IndustryDocument37 pagesKitchen in The Food Service IndustryTresha Mae Dimdam ValenzuelaNo ratings yet

- Newspaper CritiqueDocument4 pagesNewspaper CritiquebojoiNo ratings yet

- Chapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaDocument63 pagesChapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaMelgrey InocenoNo ratings yet

- Lesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019Document2 pagesLesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019mNo ratings yet

- Group 2 - Assignment 2 - A Case Study of Telecom SectorDocument13 pagesGroup 2 - Assignment 2 - A Case Study of Telecom Sectorfajarina ambarasariNo ratings yet

- Oteco 3Document12 pagesOteco 3VRV.RELATORIO.AVARIA RELATORIO.AVARIANo ratings yet

- University of The West of England (Uwe) : Bristol Business School MSC Management (International Human Resource Management)Document5 pagesUniversity of The West of England (Uwe) : Bristol Business School MSC Management (International Human Resource Management)Olusegun_Spend_3039No ratings yet

- How To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )Document11 pagesHow To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )oscar_198810No ratings yet

- Siemens ProjectDocument17 pagesSiemens ProjectMayisha Alamgir100% (1)

- Plastic Waste Powerpoint TemplateDocument39 pagesPlastic Waste Powerpoint TemplateVinh Lê KhảiNo ratings yet

- Project Report "A Study of Value Added Tax" "Kirloskar Oil Engines Limited" (Kirloskar Valve Plant)Document4 pagesProject Report "A Study of Value Added Tax" "Kirloskar Oil Engines Limited" (Kirloskar Valve Plant)Sohel BangiNo ratings yet

- Seaflo Outdoor - New Pedal Kayak Recommendation July 2022Document8 pagesSeaflo Outdoor - New Pedal Kayak Recommendation July 2022wgcvNo ratings yet

- Less Than a Decade to Avoid Catastrophic Climate ChangeDocument1 pageLess Than a Decade to Avoid Catastrophic Climate ChangeXie YuJiaNo ratings yet

- In Gov cbse-SSCER-191298202020 PDFDocument1 pageIn Gov cbse-SSCER-191298202020 PDFrishichauhan25No ratings yet

- Chapter 4-Ohm's LawDocument12 pagesChapter 4-Ohm's LawErin LoveNo ratings yet

- Graphics Coursework GcseDocument7 pagesGraphics Coursework Gcseafiwhlkrm100% (2)

- Quiz UtpDocument7 pagesQuiz UtplesterNo ratings yet

- Project Proposal: Retail Environment Design To Create Brand ExperienceDocument3 pagesProject Proposal: Retail Environment Design To Create Brand ExperienceMithin R KumarNo ratings yet

- Url Profile Results 200128191050Document25 pagesUrl Profile Results 200128191050Wafiboi O. EtanoNo ratings yet