Professional Documents

Culture Documents

Auditing Theory: Quiz 2

Uploaded by

KIM RAGAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing Theory: Quiz 2

Uploaded by

KIM RAGACopyright:

Available Formats

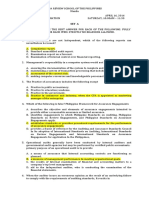

Name:_____________________ Schedule:__________________

Score:______________

AUDITING THEORY

QUIZ 2:

1. _______ is a systematic process of objectively obtaining and evaluating

evidence regarding assertions about economic events to ascertain the degree

of correspondence between these assertions and criteria and communicating

the results to interested parties.

a. Accounting c. Auditing

b. Attestation d. Management Accounting

2. The purpose of an audit of financial statements is to:

a. Enhance the understanding of the stakeholders of the company

b. Provide government agencies, such as BIR with basis for assessments

c. Enhance the degree of confidence of intended users of the financial

statements.

d. Enhance the knowledge and skills of external auditors.

3. This is the term used to refer to the person or persons conducting the

audit, usually the engagement partner or other members of the engagement

team, or, as applicable, to the firm.

a. Intended Users c. Management

b. Auditor d. Practitioner

4. Representations by management, explicit or otherwise, that are embodied in

the financial statements, as used by the auditor to consider the different

types of potential misstatements that may occur.

a. Financial statement assertions

b. Disclosure requirements

c. Notes to Financial statements

d. Audit Evidence

5. Financial statements need to be prepared in accordance with one, or a

combination of:

a. Philippine Financial Reporting Standards (PFRS)

b. Identified Financial Reporting Framework

c. Other authoritative Basis

d. All of the answers

6. The auditor communicates the results of his or her work through the medium

of the:

a. Audit Engagement Letter

b. Audit Report

c. Management Letter

d. Notes to Financial Statements

7. ________ refers to the gathering of evidence on the assertions embodied in

the financial statements of an entity and using the evidence to determine

Page 1 of 4

whether the assertions adhere to the generally accepted accounting

principles (GAAP) or another comprehensive and authoritative financial

reporting framework and this type of audit requires a CPA.

a. Financial Statements Audit c. Compliance audit

b. Operational Audits d. Government Audits

8. ________ involves “a systematic review of an organization’s activities in

relation to specified objectives for the purposes of assessing the

efficiency and effectiveness of operations, identifying opportunities for

improvement, and developing recommendations for improvement or further

action.

a. Financial Statements Audit c. Compliance audit

b. Operational Audits d. Government Audits

9. ________ is a type of audit used to determine whether a person or entity

ad adhered to laws and regulations.

a. Financial Statements Audit c. Compliance audit

b. Operational Audits d. Government Audits

10. ________ involves the determination of whether government funds are being

handle properly and in compliance with existing laws and whether the

government programs of a particular agency are being conducted efficiently

and economically.

a. Financial Statements Audit c. Compliance audit

b. Operational Audits d. Government Audits

11. ________ is recognized as the Supreme Audit Institution in the Republic

of the Philippines.

a. Commission on Audit c. Court of Tax Appeals

b. Commission on Elections d. BIR

12. In government auditing, the three elements of expanded scope auditing

are:

a. Goal analysis, audit of operations, audit of systems

b. Financial and compliance, economy and efficiency, program results

c. Pre-audit, post audit, internal audit

d. National government audit, local government audit, corporation audit

13. An audit designed to determine the extent to which the desired results

of an activity established by the legislative or other body are being

achieved.

a. Economy Audit c. Program results audit

b. Efficiency Audit d. Financial – related audit

14. The objective of an audit of financial statements is:

a. The expression of an opinion on the fairness of such financial

statements

b. To detect management fraud

c. To issue several legal requirements

d. To issue an opinion about the operating effectiveness of management

operations.

Page 2 of 4

15. The risk that information is misstated or misleading is known as:

a. Audit risk c. Operation risk

b. Business risk d. Information risk

16. Several factors contribute to the existence of information risk includes

the following:

I. Remoteness of information users from information provider.

II. Potential bias and motives of information provider.

III. Voluminous Data

IV. Complex exchange transactions

a. I, II and III only c. I, II and IV only

b. II, III and IV only d. I, II, III and IV

17. Statement I: An audit is not a guarantee of the exactness of accuracy of

assertions in the financial statements.

Statement II: An audit is not intended to, and cannot, provide a guarantee

or absolute assurance that the financial statements are free from

material misstatement due to fraud and error.

a. Only statement I is true c. Both statements are true

b. Only Statement II is true d. Both statements are false

18. Inherent limitations of an audit arise from the following:

I. Nature of financial reporting

II. Nature of audit procedures

III. Need for the audit to be conducted within a reasonable period of

time and at a reasonable cost

a. I only c. I and II only

b. I, II, and III d. II and III only

19. The auditor does not express an opinion on such matters as:

I. Future viability of the entity

II. Efficiency or effectiveness of internal control

III. Extent of compliance with laws and regulations that may be

applicable to the entity.

a. I only c. I and II only

b. I, II, and III d. II and III only

20. The primary responsibility for the prevention and detection of fraud and

error rests with:

a. The external auditor, the company’s management, and those charged

with governance

b. The company’s management

c. Those charged with governance

d. The company’s management and those charged with governance

21. A financial statement audit aids in the communication of economic data

because of the audit

Page 3 of 4

a. Assures the reader of financial statements that any fraudulent

activity has been corrected.

b. Guarantees that financial data are fairly presented.

c. Lends credibility to the financial statements.

d. Confirms the accuracy of management’s financial representations.

22. Which of the following elements does not relate to audit quality?

a. Audit Competence

b. Audit Fees

c. Independence

d. Due Diligence

23. The following statements relate to internal auditing? Which is incorrect?

a. Internal auditing is carried out within an entity by employees of the

entity or by personnel contracted for the purpose.

b. Internal auditing has become a function that evaluates and improves

an organization’s risk management, control and governance processes

to add value to the organization.

c. The internal auditor’s judgments are subordinated to those of

management.

d. Internal auditing has evolved into a highly professional activity that

extends beyond the appraisal of the efficiency and effectiveness of

an entity’s operations.

24. Internal auditors review the adequacy of the company’s internal control

system primarily to

a. Help determine the nature, timing, and extent of tests necessary to

achieve audit objectives.

b. Determine whether the internal control system provides reasonable

assurance that the company’s objectives and goals are met efficiently

and economically.

c. Ensure that material weaknesses in the system of internal control are

corrected.

d. Determine whether the internal control system ensures that financial

statements are fairly presented.

25. The internal auditing department’s responsibility for determining fraud

is to

a. Establish an effective internal control system.

b. Maintain internal control.

c. Examine and evaluate the system of internal control.

d. Exercise operating authority over fraud prevention activities.

Page 4 of 4

You might also like

- Civil Service Examination - Math (Repaired)Document81 pagesCivil Service Examination - Math (Repaired)KIM RAGANo ratings yet

- Semi FinalsDocument7 pagesSemi FinalsKIM RAGANo ratings yet

- Investment in Equity Securities - SeatworkDocument2 pagesInvestment in Equity Securities - SeatworkLester ColladosNo ratings yet

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- Handbook - Business Continuity Manual PDFDocument78 pagesHandbook - Business Continuity Manual PDFFawaaz KhurwolahNo ratings yet

- Long Quiz 2Document8 pagesLong Quiz 2KathleenNo ratings yet

- MCQs PrelimsDocument37 pagesMCQs PrelimsElaine ALdovinoNo ratings yet

- Lesson 05B. Inter-Company Transactions - A.TDocument8 pagesLesson 05B. Inter-Company Transactions - A.THayes HareNo ratings yet

- At - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Document85 pagesAt - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Waleed MustafaNo ratings yet

- Bouncing LawDocument3 pagesBouncing LawALYSSA MAE ABAAGNo ratings yet

- Part 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Document66 pagesPart 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Alyssa PilapilNo ratings yet

- TTTDocument6 pagesTTTAngelika BalmeoNo ratings yet

- p2 Regulatory Framework and Legal Issues in Business Part 1 Domingo 2021Document140 pagesp2 Regulatory Framework and Legal Issues in Business Part 1 Domingo 2021Mae Marie De DiosNo ratings yet

- Cost Behavior Analysis Boris A. Sevilla: Egg Company Manufactures and Sells A Single Product. A PartiallyDocument5 pagesCost Behavior Analysis Boris A. Sevilla: Egg Company Manufactures and Sells A Single Product. A PartiallyCher NaNo ratings yet

- Logos Are Special. They Are Not Just A Combination of Shapes, Text, and Graphics. They Tell Stories.Document3 pagesLogos Are Special. They Are Not Just A Combination of Shapes, Text, and Graphics. They Tell Stories.Donnalyn TablacNo ratings yet

- f06 136A1 FinalrevisedDocument16 pagesf06 136A1 FinalrevisedMitz ArzadonNo ratings yet

- Ch04-Audit Evidence and Audit ProgramsDocument24 pagesCh04-Audit Evidence and Audit ProgramsJames PeraterNo ratings yet

- Taxation On Corporations (CREATE Law)Document1 pageTaxation On Corporations (CREATE Law)leejongsukNo ratings yet

- RFBT Law On Private CorporationsDocument39 pagesRFBT Law On Private CorporationsEunice Lyafe PanilagNo ratings yet

- Quiz - Understanding The Entity and Its EnvironmentDocument4 pagesQuiz - Understanding The Entity and Its EnvironmentKathleenNo ratings yet

- Fischer - Fundamentals of Advanced Accounting 1eDocument27 pagesFischer - Fundamentals of Advanced Accounting 1eyechueNo ratings yet

- Reo Cpa Review Management Services Pre-Week - May 2023 BatchDocument23 pagesReo Cpa Review Management Services Pre-Week - May 2023 BatchAliah Punguinagina MagintaoNo ratings yet

- MCQ (New Topics-Special Laws) - PartDocument1 pageMCQ (New Topics-Special Laws) - PartJEP WalwalNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Chapter 19Document9 pagesChapter 19Marc Siblag IIINo ratings yet

- Chap 004 BDocument72 pagesChap 004 BJessica ColaNo ratings yet

- ConsignmentDocument9 pagesConsignmentVishal GattaniNo ratings yet

- Theories PDFDocument47 pagesTheories PDFIsabella GimaoNo ratings yet

- Reviewer IN Management Advisory Services: Teacher S ProfileDocument6 pagesReviewer IN Management Advisory Services: Teacher S ProfileAnna AldaveNo ratings yet

- Income Taxation-FinalsDocument14 pagesIncome Taxation-FinalsTheaNo ratings yet

- Past CPA Board On MASDocument7 pagesPast CPA Board On MASCarl Vincent AquinoNo ratings yet

- 02 Audit of Mining Entities PDFDocument12 pages02 Audit of Mining Entities PDFelaine piliNo ratings yet

- Accounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsDocument13 pagesAccounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsAndrew wigginNo ratings yet

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- Ust Jpia Inventories Reviewer Ca51010 PDFDocument10 pagesUst Jpia Inventories Reviewer Ca51010 PDFLlyana paula SuyuNo ratings yet

- FM112 Students Chapter IIDocument12 pagesFM112 Students Chapter IIThricia Mae IgnacioNo ratings yet

- RemovalDocument6 pagesRemovalJessa Mae BanseNo ratings yet

- Batas Pambansa BLG 22Document19 pagesBatas Pambansa BLG 22Samn Pistola CadleyNo ratings yet

- At Preweek (Part 2) FinalDocument17 pagesAt Preweek (Part 2) FinalJane Michelle EmanNo ratings yet

- Reviewer Pfrs 15 Revenue From Contracts With CustomersDocument4 pagesReviewer Pfrs 15 Revenue From Contracts With CustomersMaria TheresaNo ratings yet

- ACCTG 2A and B Accounting For PartnershiDocument16 pagesACCTG 2A and B Accounting For PartnershiMarvin RabinoNo ratings yet

- Chapter 6Document8 pagesChapter 6Christine Joy OriginalNo ratings yet

- RFBT 05 17 Special Corporate LawsDocument65 pagesRFBT 05 17 Special Corporate LawsHarold Dan AcebedoNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementDaniel HunksNo ratings yet

- AFAR 2303 Cost Accounting-1Document30 pagesAFAR 2303 Cost Accounting-1Dzulija TalipanNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- SC Chapter 08 Absorption Variable Costing Invty MGMNTDocument21 pagesSC Chapter 08 Absorption Variable Costing Invty MGMNTDaniel John Cañares Legaspi50% (2)

- InventoriesDocument6 pagesInventoriesheythereitsclaireNo ratings yet

- MCQ (New Topics-Special Laws) - PartDocument2 pagesMCQ (New Topics-Special Laws) - PartJEP WalwalNo ratings yet

- MODULE 3-Short Problems (2.0)Document4 pagesMODULE 3-Short Problems (2.0)asdasdaNo ratings yet

- Ia 2 Finals AnswersDocument1 pageIa 2 Finals AnswersErica VillaruelNo ratings yet

- Toaz - Info Afar Backflush Costing With Answers 1 PRDocument5 pagesToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonNo ratings yet

- At PreboardDocument12 pagesAt PreboardKevin Ryan EscobarNo ratings yet

- Standard Costing Multiple ChoiceDocument11 pagesStandard Costing Multiple ChoiceRuiz, CherryjaneNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Business and Transfer Taxation Quiz Assignment #2 AY 2021-2022Document4 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Business and Transfer Taxation Quiz Assignment #2 AY 2021-2022Ervin Jay ManuelNo ratings yet

- LECTURE 9 - Chapter 14 Audit Prepaid Expense PPEDocument33 pagesLECTURE 9 - Chapter 14 Audit Prepaid Expense PPEPhuc Hong PhamNo ratings yet

- tAX FINALSDocument8 pagestAX FINALSAmie Jane MirandaNo ratings yet

- AT Quiz 1 - Audit Services and CPA ProfessionDocument6 pagesAT Quiz 1 - Audit Services and CPA ProfessionDe Chavez May Ann M.No ratings yet

- Audit Assessment True or False and MCQ - CompressDocument8 pagesAudit Assessment True or False and MCQ - CompressHazel BawasantaNo ratings yet

- Aud Module 1-5Document23 pagesAud Module 1-5yaanvinaNo ratings yet

- Audit Mcqs - CparDocument31 pagesAudit Mcqs - Cparjpbluejn50% (2)

- At 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerDocument6 pagesAt 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerRei-Anne Rea100% (1)

- Mod 1 Auditing ConceptsDocument17 pagesMod 1 Auditing ConceptsDavid DavidNo ratings yet

- Individual Taxpayers Tax Filing ExercisesDocument3 pagesIndividual Taxpayers Tax Filing ExercisesKIM RAGANo ratings yet

- Process CostingDocument4 pagesProcess CostingKIM RAGA100% (4)

- Quiz Joint CostDocument4 pagesQuiz Joint CostKIM RAGA100% (1)

- Absorption and Variable CostingDocument5 pagesAbsorption and Variable CostingKIM RAGANo ratings yet

- MS Review 1Document5 pagesMS Review 1KIM RAGANo ratings yet

- Aud Theo Quizzer 1Document16 pagesAud Theo Quizzer 1KIM RAGANo ratings yet

- FAR First Pre BoardDocument18 pagesFAR First Pre BoardKIM RAGANo ratings yet

- MidtermsDocument10 pagesMidtermsKIM RAGA0% (1)

- Audit SamplingDocument7 pagesAudit SamplingKIM RAGANo ratings yet

- Ms 3Document6 pagesMs 3KIM RAGANo ratings yet

- A SemiDocument2 pagesA SemiKIM RAGANo ratings yet

- Cost Terms, Concepts and Clasifications: Objectives Such As Acquiring Goods and ServicesDocument9 pagesCost Terms, Concepts and Clasifications: Objectives Such As Acquiring Goods and ServicesKIM RAGANo ratings yet

- Managerial Accounting Is Concerned With Providing Information To ManagersDocument5 pagesManagerial Accounting Is Concerned With Providing Information To ManagersKIM RAGANo ratings yet

- Auditing Theory: C. Both I and IIDocument8 pagesAuditing Theory: C. Both I and IIKIM RAGANo ratings yet

- Semi FinalsDocument9 pagesSemi FinalsKIM RAGANo ratings yet

- Auditing Theory: Quizzer 4Document7 pagesAuditing Theory: Quizzer 4KIM RAGANo ratings yet

- Auditing Theory: All of TheseDocument7 pagesAuditing Theory: All of TheseKIM RAGANo ratings yet

- DocxDocument86 pagesDocxMubarrach MatabalaoNo ratings yet

- DocxDocument6 pagesDocxMika MolinaNo ratings yet

- Adp Project ReportDocument14 pagesAdp Project ReportHamza SandhuNo ratings yet

- Unof Cis Chapter1 Test PrelimDocument6 pagesUnof Cis Chapter1 Test PrelimRoisu De KuriNo ratings yet

- Module 6 - Risk AssuranceDocument8 pagesModule 6 - Risk AssuranceMarjon DimafilisNo ratings yet

- Transaction-Related Audit Objective Possible Internal Controls Common Tests of ControlsDocument3 pagesTransaction-Related Audit Objective Possible Internal Controls Common Tests of ControlsJustin DavenportNo ratings yet

- CFAP SyllabusDocument16 pagesCFAP SyllabusTuseef Ahmad QadriNo ratings yet

- External Auditor Assessment Tool Us 2019-04Document32 pagesExternal Auditor Assessment Tool Us 2019-04HBL AFGHANISTANNo ratings yet

- Independent Auditor'S Report: Key Audit MattersDocument47 pagesIndependent Auditor'S Report: Key Audit MattersGrid DyNo ratings yet

- SOX Audit For Beginners: March 30Document17 pagesSOX Audit For Beginners: March 30Jemimah Burgas100% (1)

- At 04 Audit Evidence and Audit Documentation PDFDocument6 pagesAt 04 Audit Evidence and Audit Documentation PDFMadelyn Jane IgnacioNo ratings yet

- Independent University, Bangladesh: MGT-201 Principles of ManagementDocument25 pagesIndependent University, Bangladesh: MGT-201 Principles of ManagementSaajed Morshed JaigirdarNo ratings yet

- Managing and Auditing IT VulnerabilitiesDocument21 pagesManaging and Auditing IT VulnerabilitiesMishaal Akram ShafiNo ratings yet

- The Operational Aspects (Production Technology, Processes and Systems)Document2 pagesThe Operational Aspects (Production Technology, Processes and Systems)JoanneNo ratings yet

- Auditing: Types of AuditDocument43 pagesAuditing: Types of Auditjohn paolo josonNo ratings yet

- Pyq Aud339 Sem 5 Pyq Jan 2018Document35 pagesPyq Aud339 Sem 5 Pyq Jan 2018Nurul AdrianaNo ratings yet

- (Formerly Pancake House, INC.) : SEC Form 17-C Manual On Corporate GovernanceDocument30 pages(Formerly Pancake House, INC.) : SEC Form 17-C Manual On Corporate GovernanceJohn GuevarraNo ratings yet

- Ca Final IscaDocument130 pagesCa Final IscaKumar SwamyNo ratings yet

- Set A Instructions: Choose The Best Answer For Each of The Following. FullyDocument16 pagesSet A Instructions: Choose The Best Answer For Each of The Following. Fullynicole bancoroNo ratings yet

- Audit of InventoryDocument47 pagesAudit of InventoryChrisia PaggaoNo ratings yet

- Practice Examination in Auditing TheoryDocument28 pagesPractice Examination in Auditing TheoryGabriel PonceNo ratings yet

- Implementation Guide 2130: Standard 2130 - ControlDocument5 pagesImplementation Guide 2130: Standard 2130 - ControlAnia MacmodNo ratings yet

- Newsline Issue 3 2016Document84 pagesNewsline Issue 3 2016Easye TroublejNo ratings yet

- 2016 Audit Management Letter Final PDFDocument21 pages2016 Audit Management Letter Final PDFMeriah NainggolanNo ratings yet

- Cis Audit Test BankDocument3 pagesCis Audit Test BankPachiNo ratings yet

- Carol Kamau Final ReportDocument72 pagesCarol Kamau Final ReportAbdikarimNo ratings yet

- Wk01 - Understanding COSO - COBIT - SOXDocument16 pagesWk01 - Understanding COSO - COBIT - SOXHuongTranNo ratings yet

- Tomas Del Rosario College: City of BalangaDocument2 pagesTomas Del Rosario College: City of BalangavaneknekNo ratings yet

- Chapter 6 Audit in An Automated EnvironmentDocument28 pagesChapter 6 Audit in An Automated EnvironmentRajeswarirameshkumarVenkataramanNo ratings yet