Professional Documents

Culture Documents

Form6 PDF

Uploaded by

al_crespo0 ratings0% found this document useful (0 votes)

25 views2 pagesOriginal Title

241635-Form6.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views2 pagesForm6 PDF

Uploaded by

al_crespoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

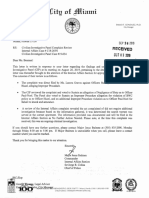

FORM 6 FULL AND PUBLIC DISCLOSURE 2018

OF FINANCIAL INTERESTS FOR OFFICE uae Da

COMMISSION ON ETH!

sromaxen aane 329 18 pas 669 dL JUN 24 12019

Eee Roy rao

Sern ote “S54 rocoae MINIMA

145 SE 25th Ra 0

Miami, FL 33129-2500 ID No. 241635

eat A Cont. Code

‘Suarez, Xavier Louis

CHECK IF THIS ISAFILING BYACANDIOATE

PART A — NET WORTH.

Please enter the value of your net worth as of December 31, 2018 or a more current date. [Note: Net worth is not cal-

culated by subtracting your reported liabilities from your reported assets, so please see the instructions on page 3.)

My net worth as of Sune 1 2019 wass/IIRX O00 £57

PART B~ ASSETS

HOUSEHOLD GOODS AND PERSONAL EFFECTS:

Household goods and personal effects may be reported in a lump sum if their aggregate value exceeds $1,000. This catagory includes any ofthe

following, snot held for investment purposes: jewelry; colectons of stamps, guns, and numismatic items; at objects, household equipment and

furishings: clothing; other household items; and vehicles for personal use, whether owned or laased.

“The aggregate value of my household goods and personal effects (described above) is $_ JC) OOO

[ASSETS INDIVIDUALLY VALUED AT OVER $1,000:

DESCRIPTION OF ASSET (specific description Is required - ee instructions p.4) VALUE OF ASSET

Se LE LAM NIL Pre PL Jadowx Es

pi Gerde, 2625 Collin Pe AIT? Mian Guede fyisece E57

3))Geode_ 2555 Galins Pre +i e02 Minne Corer Ee AS7S cw = Sr

Caste PENBIGH FQN, aa. Ear

Dee ee A _G ES yes ha i

PART C LIABILITIES

LIABILITIES IN EXCESS OF $1,000 (See instructions on page 4:

NAME AND ADDRESS OF CREDITOR [AMOUNT OF LIABILITY

\[Cece LetnSevngs Wut Palm Quin 2 5 GMA $POLCee

Wk of Poagen Charlitie NC us Gxtats Oar Sabie De [MPS

3) PAH uartgge Servis Pa Sux Lyyse! Pephune 02 15250 | 2a5 osu

Amzx Pevaluing < re toe Fox

JOINT AND SEVERAL LIABILITIES NOT REPORTED ABOVE

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

MEF =

fom tame ay ry PRET

Frente oy masrence n Re 34.0029), FAC,

PART D -- INCOME

Idontty each separate source and amount of income wich exceeded $1,000 during the year, including secondary sources of income. Or attach a complete

‘copy af your 2018 federal income tax rtum, including all W2s, schedules, and atachments, Please redact any socal sect of account numbers before

attaching your relumns, a8 the aw requires these cocuments be posted to the Commissions website

a

1c to flea copy of my 2018 federal income tax return and all W2s, schedules, and attachments.

[Wyou check tis box and attach a copy of your 2018 tax return, you need not complete the remainder of Part

PRIMARY SOURCES OF INCOME (See instructions on page 5):

NAME OF SOURCE OF INCOME pXCEEDING $1,000 ADDRESS OF SOURCE OF INCOME aMounr

Lew 0eRor 0” Yavin Sua ASC ZR Mane PC fio,ow =

fant Wide Ca yrs Hise SUSE tan A Y 36, Clo, A

‘SECONDARY SOURCES OF INCOME (Naor customers. cents ec, of businesses owned by poring peron-see nstudions on pape 5

ade OF NAME OF MAJOR SOURCES ApoRESS PRINCIPAL BUSINESS

BUSINESS ENTITY, OF BUSINESS INCOME __| OF SOURCE, ACTIVITY OF SOURCE,

Bue Ae Sew 2% i) a) ecadity BL | Pe Sow

“oly, TR

PART E ~ INTERESTS IN SPECIFIED BUSINESSES [Instructions on page 6]

BUSINESS ENTITY #1 BUSINESS ENTITY 42 BUSINESS ENTITY #3

TAME OF,

BUSINESS ENTITY

‘ADDRESS OF

BUSINESS ENTITY

PRINCIPAL BUSINESS

ACTIVITY 4

POSITION HELD

WITH ENTITY.

TOWN MORE THANA SY

INTEREST IN THE BUSINESS

NATURE OF MY

OWNERSHIP INTEREST

e4

PART F- TRAINING

For officers required to complete annual ethics training pursuant to section 112.3142, FS.

()_I CERTIFY THAT | HAVE COMPLETED THE REQUIRED TRAINING.

STATE OF FONDA

OATH Seu or ns fay ade.

the prion whose name poet ae Seco ttt eis LO yt

beninrng of tis fom, do dopose on oath oration qV 20% vy _

‘and say thatthe information disclosed on this form

‘and any attachments hereto is true, accurate,

and complete

- (Pint, Typo, aF Stamp Commissioned Name of NA

Sy =

yn SL. Perna Keown OF Pron Kneton

‘Type of Identicaion Produced

‘SIGNATURE OF REPORTING OFFICIAL OR CANDIDATE

Wa certified public accountant licensed under Chapter 473, or attorney in good standing with the Florida Bar prepared this form for you, he or

‘she must complete the following statement

\ prepared the CE Form 6 in accordance with At. Il, See. 8, Florida Constitution,

Section 172 3144, Floida Stalules, and the listuctons tothe form. Upon my reasonable knowledge and belie, the disclosure herein is rue

‘and correct

Signature Date

Preparation of this form by a CPA or attorney does not relieve the filer of the responsibility to sign the

INTINUED ON A SEPARAT T, PLEASE CHECK HERE)

TEFORNG Choc Janay 107 PAGED

ed ay eterno en 3.8.02, FAG

form under oath.

You might also like

- Miami Shores Village PD Comprehensive Report of Racism, Malfeasance and Criminal ViolationsDocument54 pagesMiami Shores Village PD Comprehensive Report of Racism, Malfeasance and Criminal Violationsal_crespo100% (1)

- Captain Ortiz ReprimandDocument5 pagesCaptain Ortiz Reprimandal_crespo100% (1)

- Outside Employment FormsDocument3 pagesOutside Employment Formsal_crespoNo ratings yet

- Lystad ContractDocument4 pagesLystad Contractal_crespoNo ratings yet

- Suarez, Francis X. - Form 1Document3 pagesSuarez, Francis X. - Form 1al_crespoNo ratings yet

- DLP Statement of OrganizationDocument3 pagesDLP Statement of Organizational_crespoNo ratings yet

- Petition To Stop Park in The RoadsDocument13 pagesPetition To Stop Park in The Roadsal_crespoNo ratings yet

- Don't Like The ChiefDocument3 pagesDon't Like The Chiefal_crespoNo ratings yet

- Suarez, Francis X. - Public Disclosure of Financial InterestsDocument2 pagesSuarez, Francis X. - Public Disclosure of Financial Interestsal_crespoNo ratings yet

- County Silver Bluff AppealDocument37 pagesCounty Silver Bluff Appealal_crespoNo ratings yet

- Advantage ContractDocument12 pagesAdvantage Contractal_crespoNo ratings yet

- Code Compliance Officers Sues Miami Commissioner Alex Diaz de La PortillaDocument8 pagesCode Compliance Officers Sues Miami Commissioner Alex Diaz de La PortillaPolitical CortaditoNo ratings yet

- R-20-0203 - Zero Tolerance For Vandalism or Destruction of City or Private PropertyDocument2 pagesR-20-0203 - Zero Tolerance For Vandalism or Destruction of City or Private Propertyal_crespoNo ratings yet

- Grant Stern LawsuitDocument19 pagesGrant Stern Lawsuital_crespoNo ratings yet

- Portilla Compliant PDFDocument30 pagesPortilla Compliant PDFal_crespoNo ratings yet

- Letter On Miami 21 Task Force Violating Florida Code of EthicsDocument18 pagesLetter On Miami 21 Task Force Violating Florida Code of Ethicsal_crespoNo ratings yet

- Carollo Motion To StayDocument7 pagesCarollo Motion To Stayal_crespoNo ratings yet

- MD CRA Grand Jury ReportDocument44 pagesMD CRA Grand Jury Reportal_crespoNo ratings yet

- Alex LetterDocument3 pagesAlex Letteral_crespoNo ratings yet

- Reiner LetterDocument2 pagesReiner Letteral_crespoNo ratings yet

- Mayor Pocket - CIPDocument2 pagesMayor Pocket - CIPal_crespoNo ratings yet

- CampaignDocument 2 PDFDocument2 pagesCampaignDocument 2 PDFal_crespoNo ratings yet

- 2020-06-11 City Commission - Public Agenda-2350Document73 pages2020-06-11 City Commission - Public Agenda-2350al_crespoNo ratings yet

- Winker Motion On CarolloDocument3 pagesWinker Motion On Carolloal_crespoNo ratings yet

- Pension OrdinanceDocument4 pagesPension Ordinanceal_crespoNo ratings yet

- 2017-10-12 City Commission - Full Minutes-1620Document91 pages2017-10-12 City Commission - Full Minutes-1620al_crespoNo ratings yet

- Memo Projections - June Meeting - Based On May Data With ReportsDocument16 pagesMemo Projections - June Meeting - Based On May Data With Reportsal_crespoNo ratings yet

- Grace Sdolares ArgumentDocument6 pagesGrace Sdolares Argumental_crespoNo ratings yet

- 09-10-2019: Damaso Letter To ColinaDocument3 pages09-10-2019: Damaso Letter To Colinaal_crespoNo ratings yet

- CIO: 09-03-2019 Response 09-26-2019Document4 pagesCIO: 09-03-2019 Response 09-26-2019al_crespoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)