Professional Documents

Culture Documents

Financial and Managerial Accounting

Uploaded by

cons theOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial and Managerial Accounting

Uploaded by

cons theCopyright:

Available Formats

Chapter 1 Introduction to Accounting and Business

35

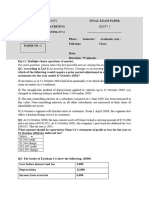

EX 1-15 Net income and stockholders’ equity for four businesses OBJ. 5

Kilo: Net income, Four different corporations, Juliet, Kilo, Lima, and Mike, show the same balance sheet data

$230,000 at the beginning and end of a year. These data, exclusive of the amount of stockholders’

equity, are summarized as follows:

Total Assets Total Liabilities

Beginning of the year $ 600,000 $150,000

End of the year 1,125,000 500,000

On the basis of the above data and the following additional information for the year,

determine the net income (or loss) of each company for the year. (Hint: First determine

the amount of increase or decrease in stockholders’ equity during the year.)

Juliet: No additional capital stock was issued, and no dividends were paid.

Kilo: No additional capital stock was issued, but dividends of $55,000 were paid.

Lima: Additional capital stock of $100,000 was issued, but no dividends were paid.

Mike: Additional capital stock of $100,000 was issued, and dividends of $55,000 were paid.

EX 1-16 Balance sheet items OBJ. 5

From the following list of selected items taken from the records of Hoosier Appliance

Service as of a specific date, identify those that would appear on the balance sheet:

1. Accounts Receivable 6. Supplies

2. Cash 7. Supplies Expense

3. Fees Earned 8. Utilities Expense

4. Land 9. Wages Expense

5. Capital Stock 10. Wages Payable

EX 1-17 Income statement items OBJ. 5

Based on the data presented in Exercise 1-16, identify those items that would appear on

the income statement.

EX 1-18 Retained earnings statement OBJ. 5

Retained earnings, Financial information related to Infra-Systems Company for the month ended November

November 30, 2014: 30, 2014, is as follows:

$635,000

Net income for November $275,000

Dividends paid during November 40,000

Retained earnings, November 1, 2014 400,000

a. Prepare a retained earnngs statement for the month ended November 30, 2014.

b. Why is the retained earnings statement prepared before the November 30, 2014, bal-

ance sheet?

EX 1-19 Income statement OBJ. 5

Net income: Exploration Services was organized on March 1, 2014. A summary of the revenue and

$284,000 expense transactions for March follows:

Fees earned $1,100,000

Wages expense 715,000

Rent expense 80,000

Supplies expense 9,000

Miscellaneous expense 12,000

Prepare an income statement for the month ended March 31.

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Chapter 2 (Exercises)Document10 pagesChapter 2 (Exercises)claudiazdeandresNo ratings yet

- Ffa Mock3 JS2020Document20 pagesFfa Mock3 JS2020alibanaylaNo ratings yet

- Exercise DayDocument30 pagesExercise DayThai Anh HoNo ratings yet

- Chapter 2 Exercises 1Document13 pagesChapter 2 Exercises 1Ana María Del CerroNo ratings yet

- 2 Libby 9e Guided Examples Chapter 9 ExercisesDocument4 pages2 Libby 9e Guided Examples Chapter 9 Exercisesthanh subNo ratings yet

- Exercise 1. Classification of Cash FlowDocument8 pagesExercise 1. Classification of Cash FlowMienh HaNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Liabilities Exercises SolutionsDocument8 pagesLiabilities Exercises Solutionsthanh subNo ratings yet

- ACC 215 Homework 1Document8 pagesACC 215 Homework 1abiroeskeNo ratings yet

- Bài tập FRA - FRCDocument12 pagesBài tập FRA - FRCThủy VũNo ratings yet

- AccountingDocument6 pagesAccountingaya walidNo ratings yet

- ch01 PDFDocument2 pagesch01 PDFDanish BaigNo ratings yet

- Tutorial 2Document21 pagesTutorial 2Krrish BosamiaNo ratings yet

- CH 1 ProblemsDocument8 pagesCH 1 Problemsbangun7770% (1)

- Chapter 3 HINM 318Document24 pagesChapter 3 HINM 318MOHAMMAD BORENENo ratings yet

- Accounting IDocument18 pagesAccounting IMohammed mostafaNo ratings yet

- Homework on Single EntryDocument2 pagesHomework on Single EntryalyssaNo ratings yet

- Worksheet 1Document4 pagesWorksheet 1mahistudyaccNo ratings yet

- CH 01 LectureDocument10 pagesCH 01 LectureIsairis R.No ratings yet

- Chapter 1 ExerciseDocument11 pagesChapter 1 ExerciseUsama MukhtarNo ratings yet

- Module 1, Chapter 1 Handout Introduction To Financial StatementsDocument5 pagesModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbNo ratings yet

- Accounting Week 1Document4 pagesAccounting Week 1Muhammad Fikri MaulanaNo ratings yet

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- Financial Reporting QuestionDocument5 pagesFinancial Reporting QuestionAVNEET SinghNo ratings yet

- Finaco1 Module 2 AssignmentDocument10 pagesFinaco1 Module 2 AssignmentbLaXe AssassinNo ratings yet

- Last Assignment (Najeeb)Document7 pagesLast Assignment (Najeeb)Najeeb KhanNo ratings yet

- 13. Single EntryDocument24 pages13. Single Entrylascona.christinerheaNo ratings yet

- Basic Accounting Lesson 7: Worksheet and Financial StatementsDocument33 pagesBasic Accounting Lesson 7: Worksheet and Financial StatementsGutierrez Ronalyn Y.No ratings yet

- Klausur WS2021-22-1Document6 pagesKlausur WS2021-22-1marynayarmak.stNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Acct ExcerciseDocument18 pagesAcct ExcerciseJerome MogaNo ratings yet

- CH 01Document2 pagesCH 01flrnciairnNo ratings yet

- Conceptual Framework - Presentation and Disclosure Concepts of Capital Presentation and DisclosureDocument3 pagesConceptual Framework - Presentation and Disclosure Concepts of Capital Presentation and DisclosureEllen MaskariñoNo ratings yet

- Ch02 - Introduction To Published Accounts - v2Document16 pagesCh02 - Introduction To Published Accounts - v2Davy KHSCNo ratings yet

- Exercises Set B 1 Exercises Set B CompressDocument7 pagesExercises Set B 1 Exercises Set B CompressHoèn Hoèn100% (1)

- Diagnostic Quiz On Accounting 2Document9 pagesDiagnostic Quiz On Accounting 2Anne Ford67% (3)

- AccountingDocument123 pagesAccountingMEROO statuesNo ratings yet

- Error Correction: Date of Loan Amount Maturity Date Term of LoanDocument4 pagesError Correction: Date of Loan Amount Maturity Date Term of LoanElaineCopino100% (1)

- ACCTG 114 Lecture (04-07-2022)Document1 pageACCTG 114 Lecture (04-07-2022)Janna Mari FriasNo ratings yet

- Exercise Sheet For Financial Accounting - Answer IMBADocument53 pagesExercise Sheet For Financial Accounting - Answer IMBAHager Salah100% (1)

- Chapter 1 Problems and Solutions EnglishDocument6 pagesChapter 1 Problems and Solutions EnglishyandaveNo ratings yet

- CH 02Document5 pagesCH 02Tien Thanh Dang0% (1)

- Exam June 2008Document9 pagesExam June 2008kalowekamoNo ratings yet

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- Chapter 1 AccountingDocument9 pagesChapter 1 Accountingmoon loverNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument8 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDrMartinSmithbxnd100% (38)

- 2024 Becker CPA Financial (FAR) Mock Exam QuestionsDocument19 pages2024 Becker CPA Financial (FAR) Mock Exam QuestionscraigsappletreeNo ratings yet

- Preweek ReviewDocument31 pagesPreweek ReviewLeah Hope CedroNo ratings yet

- Mr. Sam's new consulting company transactionsDocument7 pagesMr. Sam's new consulting company transactionsMoni TafechNo ratings yet

- Chapter 4 Acctg 1 LessonDocument14 pagesChapter 4 Acctg 1 Lessonizai vitorNo ratings yet

- Bus. Finance W3-4 - C5 (Answer)Document5 pagesBus. Finance W3-4 - C5 (Answer)Rory GdLNo ratings yet

- Advanced Accounting II AssignmentDocument3 pagesAdvanced Accounting II AssignmentMelkamu Moges100% (2)

- Class 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeDocument4 pagesClass 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeKevin ChengNo ratings yet

- Financial Statements Practice ProblemsDocument5 pagesFinancial Statements Practice ProblemsnajascjNo ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons the100% (1)

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Exhibit 1: Chapter 2 Analyzing TransactionsDocument1 pageExhibit 1: Chapter 2 Analyzing Transactionscons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Intro to accounting and PS Music caseDocument1 pageIntro to accounting and PS Music casecons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Problems Series B: InstructionsDocument1 pageProblems Series B: Instructionscons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Introduction to Accounting Chapter 1Document1 pageIntroduction to Accounting Chapter 1cons theNo ratings yet

- Wilderness Travel Service financial statementsDocument1 pageWilderness Travel Service financial statementscons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Introduction to Accounting EquationDocument1 pageIntroduction to Accounting Equationcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Horizontal and Vertical Analysis of Maruti SuzukiDocument31 pagesHorizontal and Vertical Analysis of Maruti SuzukiAnushka GuptaNo ratings yet

- Ratio Analysis (Divya Jadi Booti)Document85 pagesRatio Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Problem Solving: A: What Is The Capital Balance of Bea On December 31, 2022?Document6 pagesProblem Solving: A: What Is The Capital Balance of Bea On December 31, 2022?Actg SolmanNo ratings yet

- Fitih ProposalDocument21 pagesFitih ProposalMOTI100% (1)

- Financial Evaluation of Debenhams PLCDocument16 pagesFinancial Evaluation of Debenhams PLCMuhammad Sajid SaeedNo ratings yet

- Chapter 1 - Introduction To Financial AnalysisDocument42 pagesChapter 1 - Introduction To Financial AnalysisMinh Anh NgNo ratings yet

- Birla Institute of Technology & Science, Pilani (Rajasthan) 333031 Business Analysis and Valuation (MBA G593/ECON F355/BITS F493) Comprehensive Term Examination (1st Semester 2017 – 18Document2 pagesBirla Institute of Technology & Science, Pilani (Rajasthan) 333031 Business Analysis and Valuation (MBA G593/ECON F355/BITS F493) Comprehensive Term Examination (1st Semester 2017 – 18Shreyansh SinghviNo ratings yet

- What Is SAP CO ModuleDocument4 pagesWhat Is SAP CO ModuleLakshmana Swamy0% (2)

- Accounting For Partnership FARDocument31 pagesAccounting For Partnership FARlousevero10No ratings yet

- Steps To A Basic Company Financial AnalysisDocument21 pagesSteps To A Basic Company Financial AnalysisIvana PopovicNo ratings yet

- Sketson Skydiving Financial ReportsDocument18 pagesSketson Skydiving Financial ReportsGabriella Elizabeth Khoe MunandarNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingBernie Mojico CaronanNo ratings yet

- IFRS and GAAP Accounting - Top 10 Differences & Effects On BusinessDocument5 pagesIFRS and GAAP Accounting - Top 10 Differences & Effects On BusinessKaviraj MathNo ratings yet

- Chapter 2 HandoutDocument7 pagesChapter 2 HandoutAnonymous jm4quoNo ratings yet

- Answer Keys - CH 2Document12 pagesAnswer Keys - CH 2Ysa LimsicoNo ratings yet

- A Framework For The Classification of Accounts ManipulationsDocument94 pagesA Framework For The Classification of Accounts ManipulationsKarolNo ratings yet

- K184091145 Võ Sông Ngân Hà MIDTERM IFRSDocument19 pagesK184091145 Võ Sông Ngân Hà MIDTERM IFRSHùynh Mỹ TrangNo ratings yet

- University of Mauritius Special Retake Exams July 2019 Financial ReportingDocument9 pagesUniversity of Mauritius Special Retake Exams July 2019 Financial ReportingMîñåk ŞhïïNo ratings yet

- Financial Statement Analysis OverviewDocument27 pagesFinancial Statement Analysis OverviewViola cariniNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- ACCT 219-Cost Accounting PDFDocument167 pagesACCT 219-Cost Accounting PDFaponojecy74% (27)

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- Amaysim Australia LimitedDocument9 pagesAmaysim Australia LimitedMahnoor NooriNo ratings yet

- MBA731 Class Activity Question 2 CashflowDocument5 pagesMBA731 Class Activity Question 2 CashflowWisdom MandazaNo ratings yet

- Exercises 2Document16 pagesExercises 2Mrcool AtifNo ratings yet

- Nmims: Financial Statement AnalysisDocument296 pagesNmims: Financial Statement AnalysisBhavi GolchhaNo ratings yet

- Neraca LajurDocument2 pagesNeraca LajurBulan julpi suwelly100% (1)

- AKM 1 - CH 4Document76 pagesAKM 1 - CH 4Fauziah AbdunnafiNo ratings yet

- Chapter 11Document31 pagesChapter 11SeanNo ratings yet

- Chap 009Document57 pagesChap 009palak32100% (3)