Professional Documents

Culture Documents

Carollo, Joe - Form 1 Statement of Financial Interests 2018

Uploaded by

al_crespoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carollo, Joe - Form 1 Statement of Financial Interests 2018

Uploaded by

al_crespoCopyright:

Available Formats

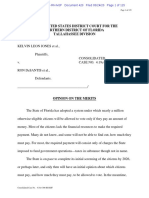

EXHIBIT B

FORM 1 STATEMENT OF 2018

Please

address,

print or

agency

type

name,

your

and

name, mailing

position below:

FINANCIAL INTERESTS FOR OFFICE USE ONLY:

eLASJ NAME-- FIRST NAME-- MIDD NAME

re- 49e- Z-- , e

MAILINIG ADDRES

3 so 0 / -, efiJ7e/ u fz/ v-

e_

CITY: • ZIP: COUNTY

T/ f-/j " 33/ 33 /if/ 7/ e/- I

a

NAME OF AGENCY

1/ 41•

NME OF OFFICE OR POS

M/ 404d141/...

ION HELD OR SOU

54/e-ve....-

HT:

m

Lf

You are not limited to the space on the lines on this form. Attach additional sheets, if necessary.

At m

CHECK ONLY IF LI CANDIDATE OR Li NEW EMPLOYEE OR APPOINTEE r-

BOTH PARTS OF THIS SECTION MUST BE COMPLETED * ":* a,.

DISCLOSURE PERIOD:

THIS STATEMENT REFLECTS YOUR FINANCIAL INTERESTS FOR THE PRECEDING TAX YEAR, WHETHER BASED ON A CALENDAR

YEAR OR ON A FISCAL YEAR. PLEASE STATE BELOW WHETHER THIS STATEMENT IS FOR THE PRECEDING TAX YEAR ENDING

EITHER( must check one):

DECEMBER 31, 2018 OR J SPECIFY TAX YEAR IF OTHER THAN THE CALENDAR YEAR:

MANNER OF CALCULATING REPORTABLE INTERESTS:

FILERS HAVE THE OPTION OF USING REPORTING THRESHOLDS THAT ARE ABSOLUTE DOLLAR VALUES, WHICH REQUIRES FEWER

CALCULATIONS. OR USING COMPARATIVE THRESHOLDS. WHICH ARE USUALLY BASED ON PERCENTAGE VALUES ( see instructions

for further details). CHECK THE ONE YOU ARE USING( must check one):

J COMPARATIVE ( PERCENTAGE) THRESHOLDS OR DOLLAR VALUE THRESHOLDS

PART A-- PRIMARY SOURCES OF INCOME [ Major sources of income to the reporting person- See instructions]

If you have nothing to report, write" none" or" n/ a")

NAME OF SOURCE SOURCE' S DESCRIPTION OF THE SOURCE' S

OF INCOME ADDRESS PRINCIPAL BUSINESS ACTIVITY

C-l y f'//.

9,' a / w

f VI /14/-6 . v_

A7/;•41/ 17/ 3 3/ 3y

y

1 /

sr/ • - Gs •; C . / 44,- d# 4 s t/

G • 1// i>/ i•33/ "

PART 2d1,/ B- SECONDARY SOURCES OF INCOME

Major customers, clients. and other sources of income to businesses owned by the reporting person- See instructions]

If you have nothing to report. write" none" or" n/ a")

NAME OF NAME OF MAJOR SOURCES ADDRESS PRINCIPAL BUSINESS

BUSINESS ENTITY OF BUSINESS' INCOME OF SOURCE ACTIVITY OF SOURCE

SV /` 1 .t/ vir! viSv l

A. • _

des'- 2

Sdei e c' G fi - o/ (

dz•

Ld4/ .. r/ e_.- tl ,724 D

PART C--

AL PROPERTY [ Land, buildings owned by the reporting person- See instructions]

If you have nothing to report, write" none" or" n/ a")

FILING INSTRUCTIONS for when

and where to file this form are

located at the bottom of page 2.

33 0 /1 114-11-/

114-

114-

1/

/ 1/ t"

11-/ S./S. e-i 333

INSTRUCTIONS on who must file

this form and how to fill it out

begin on page 3.

CE FORM 1- E fectve January 1 2019 Continued on reverse side) GE

Incorporated 1) 0

by reference in Rule 34- 8. 202( FA.

PART D— INTANGIBLE PERSONAL PROPERTY[ Stocks, bonds, certificates of deposit, etc.- See instructions]

If you have nothing to report, write" none" or" n/ a")

TYPE OF INTANGIBLE USINESS ENTITY TO WHICH THE PROPERTY RELATES

AeCie,/;%// 90,

' 44 ge, d

lcc

l. ; A» , f sd /,sgssie. . ,S Lv T.er

PART E— LIABILITIES ( Major debts- See instructions] V

If you have nothing to report, write" none" or" n/ a")

NAME OF CREDITOR ADDRESS OF CREDITOR

721- 4 Z---

ri%-- o'• .6e90/- 21, E/ ev:// 4e 7•

3779V

PART F— INTERESTS IN SPECIFIED BUSINESSES [ Ownership or positions in certain types of businesses- See instructions]

If you have nothing to report, write" none" or" n/ a")

ES NTITY# 1 BUSINESS; EN1i '# 2

NAME OF BUSINESS ENTITY V/

C

I•

ADDRESS OF BUSINESS ENTITY 1---

i!.:::.

r"" rnn

PRINCIPAL BUSINESS ACTIVITY I (-%

G-

t„ —

Ill

POSITION HELD WITH ENTITYmac-

I OWN MORE THAN A 5% INTEREST IN THE BUSINESS TIi

J

NATURE OF MY OWNERSHIP INTEREST r- "

fil

i

PART G— TRAINING

For elected municipal officers required to complete annual ethics training pursuant to section 112. 3142, F. S.

I CERTIFY THAT I HAVE COMPLETED THE REQUIRED TRAINING.

IF ANY OF PARTS A THROUGH G ARE CONTINUED ON A SEPARATE SHEET, PLEASE CHECK HERE

SIGNATURE OF FILER: CPA or ATTORNEY SIGNATURE ONLY

If a certified public accountant licensed under Chapter 473, or attorney

Signature: in good standing with the Florida Bar prepared this form for you, he or

she must complete the following statement:

I, prepared the CE

Form 1 in accordance with Section 112. 3145. Florida Statutes, and the

instructions to the form. Upon my reasonable knowledge and belief, the

disclosure herein is true and correct.

Date Signe .

i

CPA/ Attorney Signature:

7/ / v d/

Date Signed:

FILING INSTRUCTIONS:

If you were mailed the form by the Commission on Ethics or a County Candidates file this form together with their filing papers.

Supervisor of Elections for your annual disclosure filing, return the MULTIPLE FILING UNNECESSARY: A candidate who files a Form

form to that location.

under, see 3 To determine what category your position falls 1 with a qualifying officer is not required to file with the Commission

instructions.

page of

or Supervisor of Elections.

Local officers/ employees file with the Supervisor of Elections WHEN TO FILE: Initially, each local officer/employee, state officer,

of the county in which they permanently reside. ( If you do not and specified state employee must file within 30 days of the

permanently reside in Florida, file with the Supervisor of the county date of his or her appointment or of the beginning of employment.

where your agency has its headquarters.) Form 1 filers who file with Appointees who must be confirmed by the Senate must file prior to

the Supervisor of Elections may file by mail or email. Contact your confirmation, even if that is less than 30 days from the date of their

Supervisor of Elections for the mailing address or email address to appointment.

use. Do not email your form to the Commission on Ethics. it will be pp

returned. Candidates must file at the same time they file their qualifying

State officers or specified state employees who file with the papers.

Commission on Ethics may file by mail or email. To file by mail, Thereafter, file by July 1 following each calendar year in which they

send the completed form to P. O. Drawer 15709, Tallahassee, FL hold their positions.

32317-5709: physical address: 325 John Knox Rd, Bldg E, Ste 200, Finally, file a final disclosure form ( Form 1F) within 60 days of

Tallahassee, FL 32303. To file with the Commission by email, scan leaving office or employment. Filing a CE Form 1F( Final Statement

your completed form and any attachments as a pdf( do not use any of Financial Interests) does no relieve the filer of filing a CE Form 1

other format) and send it to CEForm1@leg. state. fl. us. Do not file by if the filer was in his or her position on December 31, 2018.

both mail and email. Choose only one filing method. Form 6s will not

be accepted via email.

CE FORM 1- Effective' January 1, 2019. PAGE 2

Incorporated by reference in Rule 34- 8. 202( 1). F. A. C.

Commissioner Joe Carollo

Statement of Financial Interests FORM 1 ( cont' d)

Additional boards to be included with my 2018Statement of Financial Interests FORM 1:

Name of Office or Position held or sought: CONT.

Southeast Overtown/ Park West Community Redevelopment Agency

Omni Community Redevelopment Agency

Midtown Community Redevelopment Agency

Bayfront Park Management Trust

r Q

C.)'1; 1 C i.3

r— Fri

ta.

1

o='

i

Fri

You might also like

- Miami Shores Village PD Comprehensive Report of Racism, Malfeasance and Criminal ViolationsDocument54 pagesMiami Shores Village PD Comprehensive Report of Racism, Malfeasance and Criminal Violationsal_crespo100% (1)

- Suarez, Francis X. - Public Disclosure of Financial InterestsDocument2 pagesSuarez, Francis X. - Public Disclosure of Financial Interestsal_crespoNo ratings yet

- Captain Ortiz ReprimandDocument5 pagesCaptain Ortiz Reprimandal_crespo100% (1)

- County Silver Bluff AppealDocument37 pagesCounty Silver Bluff Appealal_crespoNo ratings yet

- Petition To Stop Park in The RoadsDocument13 pagesPetition To Stop Park in The Roadsal_crespoNo ratings yet

- Don't Like The ChiefDocument3 pagesDon't Like The Chiefal_crespoNo ratings yet

- Suarez, Francis X. - Form 1Document3 pagesSuarez, Francis X. - Form 1al_crespoNo ratings yet

- Code Compliance Officers Sues Miami Commissioner Alex Diaz de La PortillaDocument8 pagesCode Compliance Officers Sues Miami Commissioner Alex Diaz de La PortillaPolitical CortaditoNo ratings yet

- Portilla Compliant PDFDocument30 pagesPortilla Compliant PDFal_crespoNo ratings yet

- Grant Stern LawsuitDocument19 pagesGrant Stern Lawsuital_crespoNo ratings yet

- Outside Employment FormsDocument3 pagesOutside Employment Formsal_crespoNo ratings yet

- Letter On Miami 21 Task Force Violating Florida Code of EthicsDocument18 pagesLetter On Miami 21 Task Force Violating Florida Code of Ethicsal_crespoNo ratings yet

- DLP Statement of OrganizationDocument3 pagesDLP Statement of Organizational_crespoNo ratings yet

- Advantage ContractDocument12 pagesAdvantage Contractal_crespoNo ratings yet

- R-20-0203 - Zero Tolerance For Vandalism or Destruction of City or Private PropertyDocument2 pagesR-20-0203 - Zero Tolerance For Vandalism or Destruction of City or Private Propertyal_crespoNo ratings yet

- Mayor Pocket - CIPDocument2 pagesMayor Pocket - CIPal_crespoNo ratings yet

- MD CRA Grand Jury ReportDocument44 pagesMD CRA Grand Jury Reportal_crespoNo ratings yet

- Carollo Motion To StayDocument7 pagesCarollo Motion To Stayal_crespoNo ratings yet

- City of Miami: Inter-Office MemorandumDocument17 pagesCity of Miami: Inter-Office Memorandumal_crespoNo ratings yet

- Alex LetterDocument3 pagesAlex Letteral_crespoNo ratings yet

- Winker Motion On CarolloDocument3 pagesWinker Motion On Carolloal_crespoNo ratings yet

- 3rd DCA OpinionDocument5 pages3rd DCA Opinional_crespoNo ratings yet

- 2020-06-11 City Commission - Public Agenda-2350Document73 pages2020-06-11 City Commission - Public Agenda-2350al_crespoNo ratings yet

- Memo Projections - June Meeting - Based On May Data With ReportsDocument16 pagesMemo Projections - June Meeting - Based On May Data With Reportsal_crespoNo ratings yet

- Pension OrdinanceDocument4 pagesPension Ordinanceal_crespoNo ratings yet

- Grace Sdolares ArgumentDocument6 pagesGrace Sdolares Argumental_crespoNo ratings yet

- 2017-10-12 City Commission - Full Minutes-1620Document91 pages2017-10-12 City Commission - Full Minutes-1620al_crespoNo ratings yet

- West Grove - Motion To InterveneDocument12 pagesWest Grove - Motion To Interveneal_crespoNo ratings yet

- Amendment No. 1 To Order No. 20-11 Local Emergency Measures Implemented by The City ManagerDocument4 pagesAmendment No. 1 To Order No. 20-11 Local Emergency Measures Implemented by The City Manageral_crespoNo ratings yet

- If They Can't Pay, Judge Says Florida Felons Can Still VoteDocument125 pagesIf They Can't Pay, Judge Says Florida Felons Can Still Vote10News WTSPNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Heller, Jack, CPCUMARPDocument4 pagesHeller, Jack, CPCUMARPTexas WatchdogNo ratings yet

- I FHMHFMDocument1 pageI FHMHFMRaghuraman NarasimmaluNo ratings yet

- 9 Ef 603 A 76 Fed 1167 F 9 AbDocument2 pages9 Ef 603 A 76 Fed 1167 F 9 Abapi-423734234No ratings yet

- 02 Entrepreneurship Skills Complete NotesDocument17 pages02 Entrepreneurship Skills Complete Notesopolla nianorNo ratings yet

- Tata Docomo bill details for account 910080161Document5 pagesTata Docomo bill details for account 910080161Vatsal PurohitNo ratings yet

- Problem Set Mod 1Document4 pagesProblem Set Mod 1Lindsay MadeloNo ratings yet

- Ratio Analysis & Financial Benchmarking for NonprofitsDocument38 pagesRatio Analysis & Financial Benchmarking for NonprofitsRehan NasirNo ratings yet

- Keynesian is-LM ModelDocument45 pagesKeynesian is-LM ModelNorsurianaNo ratings yet

- HCI 2007 Prelim H2 P2 QN PaperDocument2 pagesHCI 2007 Prelim H2 P2 QN PaperFang Wen LimNo ratings yet

- Management Accounting Overhead VariancesDocument12 pagesManagement Accounting Overhead VariancesNors PataytayNo ratings yet

- Power Exchange OperationDocument114 pagesPower Exchange OperationNRLDCNo ratings yet

- HEIRS OF DR. INTAC vs. CADocument3 pagesHEIRS OF DR. INTAC vs. CAmiles1280100% (3)

- Basic Tax OutlineDocument108 pagesBasic Tax OutlinestaceyNo ratings yet

- A Study On Customer Satisfaction of Reliance Life InsuranceDocument57 pagesA Study On Customer Satisfaction of Reliance Life InsuranceRishabh PandeNo ratings yet

- Insurance Law Key ConceptsDocument5 pagesInsurance Law Key ConceptsMarc GelacioNo ratings yet

- IASB Conceptual Framework OverviewDocument28 pagesIASB Conceptual Framework OverviewTinoManhangaNo ratings yet

- Week 15 - Revision 2Document113 pagesWeek 15 - Revision 2Trung Nguyễn QuangNo ratings yet

- Draft Constitution of Made Men WorldwideDocument11 pagesDraft Constitution of Made Men WorldwidebrightNo ratings yet

- Report On Salem Telephone CompanyDocument11 pagesReport On Salem Telephone Companyasheesh100% (1)

- Important InfoDocument6 pagesImportant InfoPraveen BabuNo ratings yet

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- JnvuDocument14 pagesJnvuSourav SenNo ratings yet

- Theory Base of Accounting, As and IFRSDocument39 pagesTheory Base of Accounting, As and IFRSYash Goyal0% (1)

- V LO Wroclaw Sprawdzian Kompetencji Jezykowych 2020 PDocument11 pagesV LO Wroclaw Sprawdzian Kompetencji Jezykowych 2020 PARKINo ratings yet

- Maintain Data Origin TypeDocument6 pagesMaintain Data Origin Typeshiva_1912-1No ratings yet

- 5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A PlanDocument6 pages5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A Planapi-245262597100% (1)

- Oriental Petroleum & Minerals Corporation: Coral Reef Growth Beneath Nido-AP PlatformDocument28 pagesOriental Petroleum & Minerals Corporation: Coral Reef Growth Beneath Nido-AP PlatformTABAH RIZKINo ratings yet

- Help Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFDocument194 pagesHelp Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFarpannathNo ratings yet

- Amended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDocument11 pagesAmended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramVaishaNo ratings yet

- Business Environment-Monetary & Fiscal PolicyDocument10 pagesBusiness Environment-Monetary & Fiscal Policymanavazhagan0% (1)