Professional Documents

Culture Documents

Asian insurers brace for more IPOs on regulatory changes, growth

Uploaded by

Tarun TandonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asian insurers brace for more IPOs on regulatory changes, growth

Uploaded by

Tarun TandonCopyright:

Available Formats

By Denny Thomas

HONG KONG | Tue Sep 14, 2010 2:20pm IST

(Reuters) - Asian bourses are bracing for more insurance IPOs over

the next year, after AIA Group Ltd's expected record offer next month,

with regulatory changes and higher capital requirements forcing

companies to tap stock markets.

Asia will account for up to 40 percent of the global life insurance market's growth over the next five

years, according to a McKinsey study last year. China and India will represent about 70 percent of

that growth, the study says.

Even for mature markets such as Singapore, analysts expect an 11 percent annual growth rate in life

insurance premiums, while bigger markets such as India and China are likely to grow at about 15

percent annum.

"This is going to be the age of IPOs. There is more to come in Korea, China and India as well," one

banker said.

Korea's Kyobo Life Insurance Co and Mirae Asset Life, India's ICICI-Prudential and Reliance

Capital's (RLCP.BO) insurance unit as well as Dutch bancassurer ING's (ING.AS) Asian life

insurance business are among the sector IPOs waiting in the wings, bankers say.

That apart, China's Taikang Life and China Reinsurance Group plan to list on the Shanghai stock

exchange, which bankers say have an estimated value of about $7 billion.

"People are keen to invest in the life insurance sector as they get comfort from the fact that this is a

regulated sector. Fundamentally, it's play on the growth of middle class and spending power," said

another banker.

The sources declined to be identified as they were not authorised to speak to the media.

IPOs in India, the world's 10th biggest insurance market, will be sparked by the proposed increase in

foreign investment limits to 49 percent from 26 percent.

Asian insurance IPOs have already raised about $16 billion this year and AIA Group's $15 billion

float is set to make 2010 a record year for insurance IPOs in Asia.

AIA -- the Asian life insurance arm of American International Group Inc (AIG.N) -- is expected to list

in October, in what is likely to be Hong Kong's stock exchange's biggest-ever IPO.

M&A BUBBLING TOO

Apart from IPOs, dealmakers are also betting on a busy period for M&A in the Asian insurance

industry, which accounts for about 30 percent of global life insurance premiums.

Total insurance premiums in Asia rose by about 17 percent to $696 billion in 2008 from a year ago,

according to research firm Celent.

Apply for United Bank of India IPO: Swastika

Investmart

Published on Wed, Feb 24, 2010 at 12:40 | Updated at Wed, Feb 24, 2010 at 13:18 | Source : Moneycontrol.com

Swastika Investmart has come out with a research report on United Bank of India initial public offering

(IPO). The research firm has recommend applying for the issue with medium term investment perspective

and potential target of Rs 75-80 in next 6-10 months. However, considering the side-ways movement

seen in stock markets currently, stock may not witness good listing gains.

The 5 crore equity shares initial public offering (IPO) of United Bank of India has opened for subscription

on February 23, 2010. The price will be determined through a 100% book building process. The price

band is at Rs 60-66 per share and the issue is available at a 5% discount to retail investors. The IPO will

close on February 25, 2010.

It comprises a net issue of 4.75 crore equity shares to the public and a reservation of 25 lakh equity

shares for subscription by eligible employees. The issue shall constitute 15.80% of the post issue paid-up

capital and the net issue shall constitute 15.01% of the post-issue capital of the bank.

This issue has been graded by CARE as CARE IPO grade 4 indicating above average fundamentals and

by ICRA as ICRA IPO grade 3 indicating average fundamentals.

UBI will be able to raise Rs 300 crore to Rs 330 crore at the lower and upper price band, respectively.

The bank aims to utilise the funds to augment the capital base to meet Basel - II standards and to fund its

advances' growth.

Initial Public Offering (IPO) Free Essay,

Term Paper and Book Report

Initial Public Offering Paper Learning Team C Chris Smith, Kimberly Grimsley, LaShawn Williams, Tim Magin FIN325

Financial Analysis for Managers II David Harding September 17, 2007 Initial Public Offering Introduction A highlight for any

company is the issuance of publicly traded stock. While the reasons for an initial public offering (IPO) are straightforward,

the device for doing so is complex. An IPO is offering stock to the public on an open market for the first time. Consequently,

the alternate term for this process is "going public." The first recorded IPO was in July 1791 when equity in the Bank of the

United States was first offered for sale. In this paper Learning Team C will summarize the process companies go through in

order to go to market in an initial public offering. This will include the registration process, cost of issuance, the impact of

ownership control, and the source and application of funds. Registration, Disclosure and Compliance Issues The Securities

Act of 1933 mandates that a company provide a registration.

You might also like

- Financial ServicesDocument2 pagesFinancial Serviceskiranks_121No ratings yet

- India's Financial Sector - Rapid Growth and OpportunitiesDocument4 pagesIndia's Financial Sector - Rapid Growth and OpportunitiesPuneet GeraNo ratings yet

- DissertationDocument75 pagesDissertationRajesh TyagiNo ratings yet

- "Financial Advisory Services" Subject: Entreprenuership ManagementDocument17 pages"Financial Advisory Services" Subject: Entreprenuership ManagementParas GharatNo ratings yet

- Research Paper On Equity MarketDocument7 pagesResearch Paper On Equity Marketkkxtkqund100% (1)

- SBI Life Launches Ulip Plan Smart Horizon: (Sangeethamathivanan M)Document7 pagesSBI Life Launches Ulip Plan Smart Horizon: (Sangeethamathivanan M)sangitlishaNo ratings yet

- FS IndustryDocument6 pagesFS IndustryShams SNo ratings yet

- Equity Research Paper SampleDocument5 pagesEquity Research Paper Samplegz8y6jhk100% (1)

- International Environment of Management: G.H.Patel Post Graduation Institute of Business Management 2020-21Document15 pagesInternational Environment of Management: G.H.Patel Post Graduation Institute of Business Management 2020-21Ajay BorichaNo ratings yet

- India's Financial Services IndustryDocument6 pagesIndia's Financial Services IndustryRavi KumarNo ratings yet

- Asia Credit Trading: Cacib Asia Ig Rap Monday, 26 September 2016 +852 5544 7491Document4 pagesAsia Credit Trading: Cacib Asia Ig Rap Monday, 26 September 2016 +852 5544 7491kn0qNo ratings yet

- Financial Services in IndiaDocument5 pagesFinancial Services in IndiavmktptNo ratings yet

- ICICI Life Insurance Recruitment ProcessDocument44 pagesICICI Life Insurance Recruitment ProcessSmruti Ranjan ChhualsinghNo ratings yet

- Recruitment and Selection ProcessDocument33 pagesRecruitment and Selection Processurmi_patel22No ratings yet

- Recruitment and Selection Process: ICICI Life Insurance Company LTDDocument45 pagesRecruitment and Selection Process: ICICI Life Insurance Company LTDMuthu PriyaNo ratings yet

- India Insurance Report Q2 2009Document4 pagesIndia Insurance Report Q2 2009DivaxNo ratings yet

- Scope of Banking, Insurance Sectors in IndiaDocument9 pagesScope of Banking, Insurance Sectors in IndiaMilind ZalaNo ratings yet

- Analyzing Performance of IPOs in India and Factors Affecting Investor DecisionsDocument15 pagesAnalyzing Performance of IPOs in India and Factors Affecting Investor DecisionsSingh GurpreetNo ratings yet

- Northern Arc Capital raises $25M debt from FMO for lending to women, MSMEsDocument7 pagesNorthern Arc Capital raises $25M debt from FMO for lending to women, MSMEsBSA3Tagum MariletNo ratings yet

- Literature Review: Page - 8Document10 pagesLiterature Review: Page - 8MstechNo ratings yet

- Life insurance industry growth and regulations in 2020Document15 pagesLife insurance industry growth and regulations in 2020Ajay BorichaNo ratings yet

- IDBI ProjectDocument81 pagesIDBI ProjectVasanthi SahithyaNo ratings yet

- 'Interest Rates Are Now Less Meaningful To Equities': Bullish On FMCG On A Restructuring ModeDocument4 pages'Interest Rates Are Now Less Meaningful To Equities': Bullish On FMCG On A Restructuring ModeSmita ShahNo ratings yet

- Wise M Ney: Run For India'S Win!Document20 pagesWise M Ney: Run For India'S Win!Deepak ChachraNo ratings yet

- Icici Bba ProjectDocument51 pagesIcici Bba ProjectHarsha GuptaNo ratings yet

- Chapter 1 Page NoDocument70 pagesChapter 1 Page NoKaran PandeyNo ratings yet

- Northern Arc Capital Raises $25 Million Debt From FMODocument10 pagesNorthern Arc Capital Raises $25 Million Debt From FMOBSA3Tagum MariletNo ratings yet

- Northern Arc Capital Raises $25 Million Debt From FMODocument10 pagesNorthern Arc Capital Raises $25 Million Debt From FMOBSA3Tagum MariletNo ratings yet

- Factors Influencing Customer Buying Behaviour Towards InsuranceDocument52 pagesFactors Influencing Customer Buying Behaviour Towards InsurancePriyatharshiniNo ratings yet

- Customer Satisfaction of Life Insurance CompaniesDocument7 pagesCustomer Satisfaction of Life Insurance CompaniesGudiyaNo ratings yet

- Personal Finance News of 2010 from TheWealthWisherDocument2 pagesPersonal Finance News of 2010 from TheWealthWisherRashid NoorNo ratings yet

- Financial Services in India - A Brief OverviewDocument3 pagesFinancial Services in India - A Brief OverviewAdri MitraNo ratings yet

- The Derrick 20theditionDocument21 pagesThe Derrick 20theditionGagandeep SinghNo ratings yet

- Consumer Buying Behavior Towards ICICI Prudential Life Insurance ProductsDocument5 pagesConsumer Buying Behavior Towards ICICI Prudential Life Insurance ProductsVijay100% (1)

- Etm 2011 8 22 33Document1 pageEtm 2011 8 22 33Saurabh DardaNo ratings yet

- Project Report ON "Investment Banking On HSBC"Document54 pagesProject Report ON "Investment Banking On HSBC"Ajit JainNo ratings yet

- Sun Life Financial and Indian Economic Surge: Case Analysis - International BusinessDocument9 pagesSun Life Financial and Indian Economic Surge: Case Analysis - International Businessgurubhai24No ratings yet

- IPO (Penna Cements) : By, Vishnu Murali FM-1708 MBA 16-ADocument8 pagesIPO (Penna Cements) : By, Vishnu Murali FM-1708 MBA 16-AVishnu MuraliNo ratings yet

- An Empirical Study On Perception of Consumer in Insurance SectorDocument14 pagesAn Empirical Study On Perception of Consumer in Insurance SectorVenkateshwar DayalNo ratings yet

- Summer Training ReportDocument68 pagesSummer Training ReportpriyaNo ratings yet

- A Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project FinanceDocument88 pagesA Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project Financesatish pawarNo ratings yet

- 1 - 1st September 2007 (010907)Document4 pages1 - 1st September 2007 (010907)Chaanakya_cuimNo ratings yet

- Financial and Insurance Sector in IndiaDocument5 pagesFinancial and Insurance Sector in Indiaameetsingh1984No ratings yet

- Datta Sai AssisgnDocument11 pagesDatta Sai Assisgnm_dattaiasNo ratings yet

- Executive Summary: Industry SnapshotDocument105 pagesExecutive Summary: Industry SnapshotRajveer SinghNo ratings yet

- 12 - 16th September 2008 (160908)Document7 pages12 - 16th September 2008 (160908)Chaanakya_cuimNo ratings yet

- Coal India LTDDocument5 pagesCoal India LTDipslogNo ratings yet

- Comparative Analysis of ICICI and SBI Mutual FundDocument21 pagesComparative Analysis of ICICI and SBI Mutual FundNitish KharatNo ratings yet

- Research Paper On Life Insurance Corporation of IndiaDocument5 pagesResearch Paper On Life Insurance Corporation of Indiaafnhcikzzncojo100% (1)

- Recruitement and SelectionDocument49 pagesRecruitement and Selectionsaikripa121No ratings yet

- Draft - For HelpDocument42 pagesDraft - For HelpdeepakrajgNo ratings yet

- Recruitment and Selection Process of Insurance CompaniesDocument85 pagesRecruitment and Selection Process of Insurance CompaniesAkhtar NawazNo ratings yet

- 8 - 16th July 2008 (160708)Document7 pages8 - 16th July 2008 (160708)Chaanakya_cuimNo ratings yet

- HDFC Project MbaDocument9 pagesHDFC Project MbaNetra NairNo ratings yet

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- HR Project On Recruitment & Selection Procedure of Pru. ICICI..........Document43 pagesHR Project On Recruitment & Selection Procedure of Pru. ICICI..........Hanif KadekarNo ratings yet

- FINALDocument31 pagesFINALkavi2288No ratings yet

- The Alchemy of Investment: Winning Strategies of Professional InvestmentFrom EverandThe Alchemy of Investment: Winning Strategies of Professional InvestmentNo ratings yet

- Indian Stock Market and Investors StrategyFrom EverandIndian Stock Market and Investors StrategyRating: 3.5 out of 5 stars3.5/5 (3)

- The Case Is To Understand The Rural Communication Environment and VillagerDocument4 pagesThe Case Is To Understand The Rural Communication Environment and VillagerTarun TandonNo ratings yet

- UTI MUTUAL FUND REGISTRATION AND REGULATIONDocument22 pagesUTI MUTUAL FUND REGISTRATION AND REGULATIONVanasti SinghalNo ratings yet

- Sales and Promotion AssignmentDocument1 pageSales and Promotion AssignmentashishsumanNo ratings yet

- IntroductionDocument5 pagesIntroductionTarun TandonNo ratings yet

- Pledging of ReceivablesDocument2 pagesPledging of ReceivablesPrince Alexis GarciaNo ratings yet

- Pre-Advice Swift Mt-799 Sblc/B.G. VerbiageDocument2 pagesPre-Advice Swift Mt-799 Sblc/B.G. Verbiagenavid kamravaNo ratings yet

- ERRORLESS DT Concept Book May 21 & June 21 Used in Full Course VideoDocument313 pagesERRORLESS DT Concept Book May 21 & June 21 Used in Full Course VideoDilip KumarNo ratings yet

- What Increases Demand For A Currency by BookMyForex MediumDocument2 pagesWhat Increases Demand For A Currency by BookMyForex MediumJoneskim KimoNo ratings yet

- Option Chain Manual FullDocument29 pagesOption Chain Manual FullProduction 18-22No ratings yet

- Junst2106036-Statement Huc0102 ContruccionDocument8 pagesJunst2106036-Statement Huc0102 Contruccioncarmen canturin cabreraNo ratings yet

- 3rd Cases-Labor-Ft PDFDocument42 pages3rd Cases-Labor-Ft PDF001nooneNo ratings yet

- How To Calculate NPV (With Downloadable Calculator)Document7 pagesHow To Calculate NPV (With Downloadable Calculator)Richard Obeng KorantengNo ratings yet

- Commercial Paper: (Industrial Paper, Finance Paper, Corporate Paper)Document27 pagesCommercial Paper: (Industrial Paper, Finance Paper, Corporate Paper)shivakumar N100% (1)

- Successful Forex Trading Secrets RevealedDocument37 pagesSuccessful Forex Trading Secrets RevealedAndrei Rotaru83% (6)

- Downturn Upturn Expectations Consumption: Vocabulary 1: THE BUSINESS CYCLEDocument9 pagesDownturn Upturn Expectations Consumption: Vocabulary 1: THE BUSINESS CYCLEANH LƯƠNG NGUYỄN VÂNNo ratings yet

- Functions and Effects of Money in an EconomyDocument71 pagesFunctions and Effects of Money in an Economysweet haniaNo ratings yet

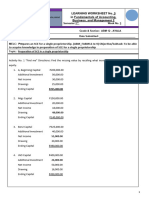

- FAB2 W3 No Answer KeyDocument3 pagesFAB2 W3 No Answer KeyClintwest Caliste Autida BartinaNo ratings yet

- FA 3 Sem 5Document13 pagesFA 3 Sem 5Vasant SriudomNo ratings yet

- International Business Chapter 9Document20 pagesInternational Business Chapter 9Rabiatul AndawiyahNo ratings yet

- Financial Ratios OsborneDocument27 pagesFinancial Ratios Osbornemitsonu100% (1)

- Booking 1059985616Document2 pagesBooking 1059985616Deni SetiawanNo ratings yet

- The Evolution of Credit and Money SystemsDocument4 pagesThe Evolution of Credit and Money SystemsChantelle IshiNo ratings yet

- Supreme Court rules on salary payment dispute for US engineer in PhilippinesDocument10 pagesSupreme Court rules on salary payment dispute for US engineer in PhilippinesKarl Rigo AndrinoNo ratings yet

- Pakistan Stock Exchange Limited: Internet Trading Subscribers ListDocument3 pagesPakistan Stock Exchange Limited: Internet Trading Subscribers ListMuhammad AhmedNo ratings yet

- EXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsDocument37 pagesEXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsAnonymous Lih1laaxNo ratings yet

- Background of The StudyDocument2 pagesBackground of The StudyAdonis GaoiranNo ratings yet

- Chapter 3 ReceivablesDocument22 pagesChapter 3 ReceivablesCale Robert RascoNo ratings yet

- Retio Analysis Profitability Ratios: Gross MarginDocument7 pagesRetio Analysis Profitability Ratios: Gross MarginAmjath JamalNo ratings yet

- CBDTDocument11 pagesCBDTNidhi GowdaNo ratings yet

- Annexure-I: DOB............... Age... ... Date of Retirement...........................Document8 pagesAnnexure-I: DOB............... Age... ... Date of Retirement...........................Inked IntutionsNo ratings yet

- Del Monte Pacific LimitedDocument7 pagesDel Monte Pacific LimitedPrincess Diane VicenteNo ratings yet

- The Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedDocument3 pagesThe Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedMohd AqdasNo ratings yet

- Profitable and easy saving for your futureDocument4 pagesProfitable and easy saving for your futureKate ShtankoNo ratings yet

- TT06 - QuesDocument3 pagesTT06 - QuesLe Tuong MinhNo ratings yet