Professional Documents

Culture Documents

Tax Rates 2009-10

Uploaded by

Mansoor AhmadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Rates 2009-10

Uploaded by

Mansoor AhmadCopyright:

Available Formats

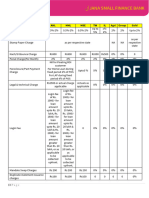

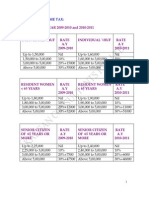

PROPOSED TAX CARD For Client and Staff Use

Tax Year 2010

TAX RATES FOR IND, OTHER TAX RATES FOR SALARID CLASS RATES FOR DEDUCTION OF TAX AT SOURCE

THAN SALARID PERSON & AOP Particulars Rate

Income group Tax Rate Income group Tax Rate - Other dividend income 10%

Up to Rs. 100,000 0% Up to Rs. 200,000 0% - Raffle lottery or crossword puzzle, Sales promotion schemes 20%

Rs. 100,001 to Rs. 110,000 0.5% Rs. 200,001 to Rs. 250,000 0.50%

Rs. 110,001 to Rs. 125,000 1.0% Rs. 250,001 to Rs. 350,000 0.75% - Yield on a National Saving Deposit Certificate, including a

Rs. 125,001 to Rs. 150,000 2.0% Rs. 350,001 to Rs. 400,000 1.50% Defence Saving Certificate, under the National Saving Scheme. 10%

Rs. 150,001 to Rs. 175,000 3.0% Rs. 400,001 to Rs. 450,000 2.50% - Interest on an account or deposits with banks / financial institutions 10%

Rs. 175,001 to Rs. 200,000 4.0% Rs. 450,001 to Rs. 550,000 3.50% - Profit on any security issued by the Federal Government, a

Rs. 200,001 to Rs. 300,000 5.0% Rs. 550,001 to Rs. 650,000 4.50% Provincial Government or a local authority to any person

other than a financial institution.

20%

Rs. 300,001 to Rs. 400,000 7.5% Rs. 650,001 to Rs. 750,000 6.00% - Profit on any bond, certificate, debenture, security or instrument

of any kind (not a loan agreement between a borrower and a

Rs. 400,001 to Rs. 500,000 10.0% Rs. 750,001 to Rs. 900,000 7.50% banking company or a development finance institution) by a

Rs. 500,001 to Rs. 600,000 12.5% Rs. 900,001 to Rs. 1,050,000 9.00% banking company, financial institution, finance society or a

company a as defind in the 2001 Ordinance, other than to a

Rs. 600,001 to Rs. 800,000 15.0% Rs. 1,050,001 to Rs. 1,200,000 10.00%

financial institution.

Rs. 800,001 to Rs. 1,000,000 17.5% Rs. 1,200,001 to Rs. 1,450,000 11.00% 10%

Rs. 1,000,001 to Rs. 1,300,000 21.0% Rs. 1,450,001 to Rs. 1,700,000 12.50% - Brokerage & Commission 10%

Rs. 1,300,001 25.0% Rs. 1,700,001 to Rs. 1,950,000 14.00% - On Export of Raw Cotton and Cotton Yarn 1.0%

Rs. 1,950,001 to Rs. 2,250,000 15.0% - Brokerage & Commission-for Travel and Insurance Agents 10%

TAX RATES FOR IND & AOP-RENTAL INCOME Rs. 2,250,001 to Rs. 2,850,000 16.0% - On Contracts of all types 6%

Up to Rs. 150,000/- NIL Rs. 2,850,001 to Rs. 3,550,000 17.5% - Telephone Bills/Prepaid payphone Cards 10%

Rs. 150,001 to Rs. 5% Rs. 3,550,001 to Rs. 4,550,000 18.5% - Cash withdrawl from Bank 0.3%

400,000/- Rs. 4,550,001 to Rs. 8,650,000 19.0% - Supply of Rice, Cotton and Cotton seed 1.5%

Rs. 400,001 to Rs. Rs. 12,500/- and 7.5% of Rs. 8,650,001 to above 20.0% - Telephone and mobile subscriber exceeding bill Rs. 1000/- 10%

1,000,000/- exceeding amount - Other supplies 3.5%

Rs. 1,000,001 and Rs. 57,500/- and 10% of New proviso has been added for the purpose of providing - Imports other than following 5%

above exceeding amount marginal reliev of different slabs of income. - DAP Phasphate 5%

- Plant and Machinery 0%

TAX RATES FOR COMPANIES-RENTAL INCOME - On gas consumption charges of CNG Stations 4%

- Services rendered:

Rs. 1 to Rs. 5% - Transport Services 2%

400,000/- - News Media Services 2%

Rs. 400,001 to Rs. Rs. 20,000/- and 7.5% of - - Other Services 6%

1,000,000/- exceeding amount Payments to non-residents for execution of:

Rs. 1,000,001 and Rs. 65,000/- and 10% of - Turnkey Contract 6%

above exceeding amount - Contract, Sub-Contract for the design, Construction or

supply of plant & equipment:

The taxable property incoem shall be taxed under the above - Under a hydel power project or a transmission line project 6%

prescribed tax rates. - Under any other power project 6%

- Any other contract: 6%

TAX RATES FOR IND & AOP UNDER SECTION 155 TAX RATES FOR COMPANIES UNDER

SECTION 155 - Advertisement by the Private TV Channels 6%

Up to Rs. 150,000/- NIL Upto - Petroleum Products 10%

Rs. 150,001 to Rs. 5% Rs. 1 to Rs. 5% - Royalties / Fee for technical services 15%

400,000/- 400,000/- - Local purchase of edible oil 4%

Rs. 400,001 to Rs. Rs. 12,500/- and 7.5% of Rs. 400,001 to Rs. Rs. 20,000/- and 10% of - On payment other than salary, dividend, supplies, services, execution

1,000,000/- exceeding amount 1,000,000/- exceeding amount of contracts, property, prize money, winning from reffles, lottery or

Rs. 1,000,001 and Rs. 57,500/- and 10% of Rs. 1,000,001 and Rs. 65,000/- and 10% of - cross word puzzles. 30%

above exceeding amount above exceeding amount Payment to non resident media 10%

Other rates

- Special tax rebate of 50% of the tax payable shall be allowed for the assessee of 60 years of age or above and earning - On Sale and purchase of shares 0.01%

income upto Rs. 750,000/- per annum. - On purchase of motor vehicle

Engine capicity Amount

- The rate of tax as prescribed by section 113A for qualifying under PTR is 0.5% of the Turnover, provided the turnover Upto Rs. 850cc Rs. 10000/-

does not exceed 5 Million. per annum. The said immunity is not for the benefit of share limited companies. 851 cc to 1000cc Rs. 14,000/-

1001 cc to 1300cc Rs. 22,500/-

1301 cc to 1600cc Rs. 22,500/-

- The rate of tax as prescribed by section 113B for qualifying under PTR are given as under: 1601 cc to 1800cc Rs. 35,000/-

1801 cc to 2000cc Rs. 30,000/-

From Rs. 1 to Rs. 5 M Rs. 25,000/- 2000 and above Rs. 50,000/-

From Rs. 5M to Rs. 10M 25000+0.5% of the turover exceeding Rs. 5M Rates for Builders and Developers

From Rs. 10 M and above Rs. 50,000/-+ 0.75% of the turover exceeding Rs. 10M In case of Building Rs. 50/- per Sq. Ft

The income of the working women other than salaraied class to the extent of Rs. 125,000/- will be exempt from tax.

- In case of Land Rs. 100/- per Sq. yard

The income of the working women in case of salaraied class to the extent of Rs. 260,000/- will be exempt from tax.

-

_ Exemption available to the research scholars and teachers is reduced to the 50% of tehir tax liability.

RATE OF TAX FOR SMALL COMPANY 20%

If turnover exceeds Rs. 250M but<Rs. 350M 25% Plus

If turnover exceeds Rs. 350M but<Rs. 500M 30% Plus

If turnover exceeds Rs. 500M 35% Plus

COMPANIES RATE OF TAX ON SHIPING OR AIR TRANSPORT

TAX YEAR

Rate of tax for all kinds of companies 2008 2009 The rate of tax imposed under section 7 shall be:

35% 35% - In the case of shipping 8% of the gross amount

received or receivable;

- In the case of air transport 3% of the gross amount

received or receivable;

RATES OF APPEAL FEE

Stage Appeal Fee

Commissioner (Appeals) /Addl. Commissioner - Rs. 1,000

Income Tax Appellate Tribunal. - Rs. 2,000/-

You might also like

- Ratio Analysis and Forecasting Quiz - CourseraDocument6 pagesRatio Analysis and Forecasting Quiz - CourseraLuisSalvador19874% (28)

- Excel-Based Model To Value Firms Experiencing Financial DistressDocument4 pagesExcel-Based Model To Value Firms Experiencing Financial DistressgenergiaNo ratings yet

- Arpia Lovely Rose Quiz Chapter 9 Income TaxesDocument8 pagesArpia Lovely Rose Quiz Chapter 9 Income TaxesLovely ArpiaNo ratings yet

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanNo ratings yet

- Tax Rates 2010Document1 pageTax Rates 2010Ch Attique WainsNo ratings yet

- Tax Card 2012Document1 pageTax Card 2012Ch Attique WainsNo ratings yet

- Budget Highlights FY 2080-81Document7 pagesBudget Highlights FY 2080-81RajibDahalNo ratings yet

- Income Tax WHT Rates Card 2016-17Document8 pagesIncome Tax WHT Rates Card 2016-17Sami SattiNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNo ratings yet

- Tax Rates 2009Document1 pageTax Rates 2009Ch Attique WainsNo ratings yet

- Commission Structure - May 2019Document16 pagesCommission Structure - May 2019Sabuj MollaNo ratings yet

- Module 1 Direct Tax DR BRR 2022 StudentsDocument9 pagesModule 1 Direct Tax DR BRR 2022 StudentsDr. Batani Raghavendra RaoNo ratings yet

- Why We Need Transparent Pricing in Microfinance: Chuck Waterfield Microfinance Transparency 11 November 2008Document63 pagesWhy We Need Transparent Pricing in Microfinance: Chuck Waterfield Microfinance Transparency 11 November 2008ziad saberiNo ratings yet

- Applicable For Pcc/Ipcc May-2010/Nov-2010Document17 pagesApplicable For Pcc/Ipcc May-2010/Nov-2010Anshul AgarwalNo ratings yet

- Projected Profit Rates December 2023Document5 pagesProjected Profit Rates December 2023khanthegreat853No ratings yet

- Deposit RatesDocument2 pagesDeposit Ratesanammansoor03No ratings yet

- Lodge No. 761, 105 Phil. 983Document19 pagesLodge No. 761, 105 Phil. 983Kim EstalNo ratings yet

- Budget, 2010 Amendment at A Glance: Compiled By: PAMS & AssociatesDocument15 pagesBudget, 2010 Amendment at A Glance: Compiled By: PAMS & Associatespawanagrawal83No ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

- Tax Rates For Tax Year 2020Document5 pagesTax Rates For Tax Year 2020Ghulam MuhiuddinNo ratings yet

- Tax Card For Tax Year 2020Document1 pageTax Card For Tax Year 2020zohaib shahNo ratings yet

- SOC AssetsDocument2 pagesSOC AssetsptsmithrafoundationNo ratings yet

- Unit 2 - Scope of Income and Residential Status, Rebate and ReliefDocument25 pagesUnit 2 - Scope of Income and Residential Status, Rebate and ReliefKhushi ThakurNo ratings yet

- WHT Tax Card - 2024Document1 pageWHT Tax Card - 2024shahid100% (1)

- Dexter Consultants: Updated Through Finance Act 2022Document1 pageDexter Consultants: Updated Through Finance Act 2022fahid aslamNo ratings yet

- Income TaxDocument5 pagesIncome TaxAshish NarulaNo ratings yet

- Donor's Tax - Bureau of Internal RevenueDocument11 pagesDonor's Tax - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- Tax Rates For Individuals: Fast Moving Consumer GoodsDocument1 pageTax Rates For Individuals: Fast Moving Consumer GoodsHakim JanNo ratings yet

- MARCH Estate and Inheritance TaxDocument6 pagesMARCH Estate and Inheritance TaxJewelyn CioconNo ratings yet

- Highlights of Budgetary Changes 2022 - TAXDocument41 pagesHighlights of Budgetary Changes 2022 - TAXRoyNo ratings yet

- Budget Analysis 2011Document30 pagesBudget Analysis 2011Vandana SharmaNo ratings yet

- SIP AmrutleelaDocument14 pagesSIP AmrutleelapremNo ratings yet

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanDocument18 pagesIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanNo ratings yet

- 2 Charts Show How Much The World Depends On Taiwan For: Revenue RecognitionDocument5 pages2 Charts Show How Much The World Depends On Taiwan For: Revenue RecognitionDuong Trinh MinhNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- AFM PPT FinalDocument45 pagesAFM PPT Final0nilNo ratings yet

- 2019 Tax Card PakistanDocument9 pages2019 Tax Card PakistanRaja Hamza rasgNo ratings yet

- Tax RatesDocument4 pagesTax RatesOnkar BandichhodeNo ratings yet

- Latepayment BFL 1222Document1 pageLatepayment BFL 1222Junaid ShaikNo ratings yet

- Fee Structure For Registration/Renewal of Shops and Establishments Act, 1966Document4 pagesFee Structure For Registration/Renewal of Shops and Establishments Act, 1966Chetan RandhawaNo ratings yet

- Passive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCDocument10 pagesPassive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCBARBEKS 202021No ratings yet

- ChecklistDocument8 pagesChecklistumeshburman7026No ratings yet

- Tax On Mutual Funds and SharesDocument6 pagesTax On Mutual Funds and SharesGiri SukumarNo ratings yet

- Investment Proof Submission Guidelines 2022-23Document17 pagesInvestment Proof Submission Guidelines 2022-23Rajshree SamantrayNo ratings yet

- TesterDocument16 pagesTesterSiddharth arunNo ratings yet

- Client: Taiwan Semiconductor Manufacturing Co., Ltd. (NYSE: TSM / TSE: 2330) Auditor: Deloitte (1) Understanding of The ClientDocument8 pagesClient: Taiwan Semiconductor Manufacturing Co., Ltd. (NYSE: TSM / TSE: 2330) Auditor: Deloitte (1) Understanding of The ClientDuong Trinh MinhNo ratings yet

- Income Tax Guidelines For Financial Year 2021-22: Key PointsDocument13 pagesIncome Tax Guidelines For Financial Year 2021-22: Key PointsBhanuSavarniNo ratings yet

- Donor'S Tax: BIR Form 1800Document4 pagesDonor'S Tax: BIR Form 1800JAYAR MENDZNo ratings yet

- 3.1 - FCFF ExcerciseDocument9 pages3.1 - FCFF ExcerciseHTNo ratings yet

- Brokerage Margin Account and Interest Rates - TD AmeritradeDocument10 pagesBrokerage Margin Account and Interest Rates - TD AmeritradeNash Paul PolzlNo ratings yet

- Tax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsDocument3 pagesTax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsThe MaximusNo ratings yet

- Investing and You: by Rajiv Satija Upmarket Financial Advisory ServicesDocument32 pagesInvesting and You: by Rajiv Satija Upmarket Financial Advisory ServicesrajivsatijaNo ratings yet

- Schedule of Charges Branchless Banking Apr To Jun 2019 EnglishDocument2 pagesSchedule of Charges Branchless Banking Apr To Jun 2019 EnglishJahangirNo ratings yet

- WHT Rate Card 2018-19Document2 pagesWHT Rate Card 2018-19taqi1122No ratings yet

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- Iiisla S.fee ScheduleDocument9 pagesIiisla S.fee ScheduleDavinder Kumar GargNo ratings yet

- Other Than Senior and Super Senior CitizenDocument6 pagesOther Than Senior and Super Senior CitizenKishan PatelNo ratings yet

- UntitledDocument5 pagesUntitledRwings JeansNo ratings yet

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- LDA CITY R FormDocument1 pageLDA CITY R FormMansoor AhmadNo ratings yet

- (1986) 53 Tax 122 (S.C.Pak) ) Sh. M. Imail & CODocument9 pages(1986) 53 Tax 122 (S.C.Pak) ) Sh. M. Imail & COMansoor AhmadNo ratings yet

- 2014 P T D 383 (Peshawar High Court) Before Yahya Afridi and Nisar Hussain Khan, JJ Collector of Customs Versus Messrs Lucky Cement LTDDocument2 pages2014 P T D 383 (Peshawar High Court) Before Yahya Afridi and Nisar Hussain Khan, JJ Collector of Customs Versus Messrs Lucky Cement LTDMansoor AhmadNo ratings yet

- 05Document29 pages05Mansoor AhmadNo ratings yet

- Contract Act, 1872Document24 pagesContract Act, 1872lakmepreyaNo ratings yet

- Fiaz CVDocument1 pageFiaz CVMansoor AhmadNo ratings yet

- Business Tax Reviewer UpdatedDocument36 pagesBusiness Tax Reviewer UpdatedCaptain ObviousNo ratings yet

- ch01 Introduction To TaxDocument27 pagesch01 Introduction To TaxShawn Lynette BrayNo ratings yet

- Intacc Chap 16 ReviewerDocument8 pagesIntacc Chap 16 ReviewerJea XeleneNo ratings yet

- Framework of Understanding Taxes in The Philippines-1Document9 pagesFramework of Understanding Taxes in The Philippines-1Mergierose DalgoNo ratings yet

- Tabc - Train - Noel N. Cobangbang, CpaDocument117 pagesTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNo ratings yet

- Tax On Idividuals: Practice ProblemsDocument17 pagesTax On Idividuals: Practice ProblemsLealyn CuestaNo ratings yet

- The Effect of Tax Administration On Revenue Generation in Enugu State-1Document115 pagesThe Effect of Tax Administration On Revenue Generation in Enugu State-1yetuns85% (13)

- Aswath Damodaran - Technology ValuationDocument115 pagesAswath Damodaran - Technology Valuationpappu.subscription100% (1)

- Debt and Taxes Merton H. Miller: Finanzas Corporativas Carlos ArangoDocument21 pagesDebt and Taxes Merton H. Miller: Finanzas Corporativas Carlos ArangoLUZ MARINANo ratings yet

- QPDsDocument4 pagesQPDsDanisa NdhlovuNo ratings yet

- Chapter 1 - Federal Income Taxation - An OverviewDocument42 pagesChapter 1 - Federal Income Taxation - An Overviewapi-279744222No ratings yet

- Individual Income TaxDocument18 pagesIndividual Income TaxMaeNeth GullanNo ratings yet

- Reuters ProVestor Plus Company ReportDocument20 pagesReuters ProVestor Plus Company ReportDunes BasherNo ratings yet

- Sec 1 Math SA1 2017 Pasir Ris PDFDocument21 pagesSec 1 Math SA1 2017 Pasir Ris PDFc.h.i.s.e.t.No ratings yet

- Tax Rebate Calculator of Salaried Class Indviduals 2013-14Document4 pagesTax Rebate Calculator of Salaried Class Indviduals 2013-14waheedNo ratings yet

- Tax MCqsDocument10 pagesTax MCqsassadrafaqNo ratings yet

- RMC No 67-2012Document5 pagesRMC No 67-2012evilminionsattackNo ratings yet

- Cash Flows and Capital Budgeting: Learning ObjectivesDocument55 pagesCash Flows and Capital Budgeting: Learning ObjectivesShoniqua JohnsonNo ratings yet

- Gender Bias in Tax Systems:: The Example of GhanaDocument22 pagesGender Bias in Tax Systems:: The Example of GhanaDangyi GodSeesNo ratings yet

- Kratzke FedIncTax Fall 2010Document51 pagesKratzke FedIncTax Fall 2010dezraty14088No ratings yet

- Business Tax Environment: by Aliza Abid BhuttaDocument15 pagesBusiness Tax Environment: by Aliza Abid BhuttaAhmed zeeshanNo ratings yet

- .Arch94-03 - Corporate Income TaxationDocument18 pages.Arch94-03 - Corporate Income TaxationShintaro KisaragiNo ratings yet

- 2013Q4 Google Earnings SlidesDocument14 pages2013Q4 Google Earnings Slides10TAMBKANo ratings yet

- Alternative Investments and EquityDocument613 pagesAlternative Investments and EquitySen RinaNo ratings yet

- Questions Chapter TwoDocument5 pagesQuestions Chapter TwoRose Sánchez0% (1)

- Finance Zutter CH 1 4 REVIEWDocument112 pagesFinance Zutter CH 1 4 REVIEWMarjorie PalmaNo ratings yet

- Engineering Economy: Chapter 7: Depreciation and Income TaxesDocument30 pagesEngineering Economy: Chapter 7: Depreciation and Income TaxesBibhu R. TuladharNo ratings yet