Professional Documents

Culture Documents

Maple Fund Manager Report - October 2010: ST TH

Uploaded by

sajidali_sa0 ratings0% found this document useful (0 votes)

15 views1 pageState Bank of Pakistan increased the policy interest rate by 50 basis points from 13% to 13.5%, because of the fears of higher government borrowing, inflation, lower economic growth and revenue during the current fiscal year. Wholesale prices rose 21.50% from a year ago, and 2.09% from August. The reserve money is 1,679,286m and growing at a rate of 9% which was previously 1,507,581m at growth rate of 5.52% in 2009.

Original Description:

Original Title

Maple

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentState Bank of Pakistan increased the policy interest rate by 50 basis points from 13% to 13.5%, because of the fears of higher government borrowing, inflation, lower economic growth and revenue during the current fiscal year. Wholesale prices rose 21.50% from a year ago, and 2.09% from August. The reserve money is 1,679,286m and growing at a rate of 9% which was previously 1,507,581m at growth rate of 5.52% in 2009.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageMaple Fund Manager Report - October 2010: ST TH

Uploaded by

sajidali_saState Bank of Pakistan increased the policy interest rate by 50 basis points from 13% to 13.5%, because of the fears of higher government borrowing, inflation, lower economic growth and revenue during the current fiscal year. Wholesale prices rose 21.50% from a year ago, and 2.09% from August. The reserve money is 1,679,286m and growing at a rate of 9% which was previously 1,507,581m at growth rate of 5.52% in 2009.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

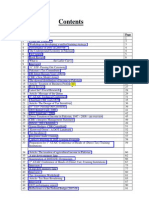

Maple Fund Manager Report - October 2010

Investment Objective profile is from moderate to high.

Maple fund is an equity fund and its objective is to maximize return for The fund investment comprises of

shareholders. Longterm growth is achieved by diversified portfolio and companies that shown prospects of

outperforming the market. The

investments into high yielding equity securities.

fund would continue to capitalize

on lucrative opportunities in the

Economic Review market by keeping a close eye on

The State Bank increased the policy interest rate by 50 basis points from 13% the changes in macroeconomic

to 13.5%, because of the fears of higher government borrowing, inflation, front. The portfolio return is higher

lower economic growth and revenue during the current fiscal year. The reason than the market return assuming a

behind this downturn is the catastrophic floods that left serious implications for bit little higher level of risk.

macroeconomic stability and growth prospects. The current inflation rate in

country reported by SBP is 11.7% but other sources indicate it between 14% to Fund Mangers

20%. Inflation is likely to stay on the higher side because of increasing food Sana Zahid

prices, rising international oil prices and elimination of electricity subsidies. Sehrish Nazir

State Bank of Pakistan is likely to continue to pursue a tight monetary policy. Sanjay Kumar

Wholesale prices rose 21.50% from a year ago, and 2.09% from August. Kainaat Rizvi

Remittances continued to show a rising trend as $2,646.30m was received in

the first quarter of fiscal year 2010‐11, showing an increase of $314.8m or

13.50%. The reserve money is 1,679,286m and growing at a rate of 9% which

was previously 1,507,581m at growth rate of 5.52% in 2009. FDI is 2150.8m

USD compared with 3719.9USD last year. Foreign debt is $53.01bn previously General Information

$51.05bn. Per capita income is 1046 and GDP growth rate is 4.1%. Trade Launch Date: Oct 1,2010

balance in August 2010 is -$1.24bn compared with last year -$1044m. Fund Size:

10m

Money Market Review Type: Equity

State bank of Pakistan sold Rs.17bn ($197.2m) of t-bills on Friday Oct 1 2010 Risk Profile: Moderate-

in its second repo of the day, under a six day repo contract at 11.69% to mom- High

up liquidity. Federal government has planned to raise Rs. 80bn in the second Portfolio β: 1.13

quarter of current 2010-2011 fiscal year. In this regard, State Bank has issued

details of the new Government of Pakistan Ijara Sukuk issuance program Maple KSE 100

including details of the underlying asset and the related documentation. Б: 0.0089 0.0056

National saving scheme (NSS) is also planning to launch short term Sharp Ratio: 6.27 6.69

investment certificate later this month. In the money market, overnight Returns : 6.71% 4.48%

rates rose to top levels of 13.40%, compared with Wednesday's (Oct 27, 2010)

close of between 12.50% and 13%, despite scheduled inflows of Rs.3bn ($34.9

million), due to tight liquidity in the interbank market. SBP collected Rs.124bn Performance Comparison

against the target of Rs.8 bn by executing Open Market Operation. Oct 1 Nov 1 % change

Benchmark 10042 10056

Stock Market Review 4.49%

In KSE, index performance was bearish and closed in negative note after four Maple 10m 10.68m 6.84%

consecutive positive weeks. The KSE 100-share index closed at 10,598.40

points by losing 54.08 points or 0.5 percent. The index started rising up from

1st October and it kept fluctuating. As on 25th October the index reach highest

point since last 2 years It closes the October month with increase in the index

point of 555.96 or 5.536%. Oct: 27 - Highest index points in October:

10,704.16. Increase in foreign investment boosted up the confidence of local

investors. Foreign interest in oil & gas, chemical & banking sector scrip

expectations of good earnings announcements this quarter kept investor

sentiment positive throughout the trading session. Raises in local cement

prices and demand for reconstruction & rehabilitation of flood affected regions

invited investor interest in cement sector.EU tax-free access for textile

products improved sentiments in the textile sector. Oct: 5 2O1O-Lowest index

points in October: 10,024.86 Oil & Gas sector have outperformed the market,

whereas banks, chemicals and auto sectors underperformed the market. NML,

PSO, POL, ENGRO and MCB were the top -5 scrip constituting 54 per cent of Asset Allocation%

market.

Fund Review

Maple fund investment is inclined towards banking, oil & gas, and

pharmaceuticals. The share price of pharmaceutical companies has shown an

upward trend because of Pakistan worst flood calamity which resulted an

increase in demand of medicine. The fund beta is 1.13 which shows fund risk

You might also like

- Fund Managers Report: July 2011Document13 pagesFund Managers Report: July 2011Huzaifa MarviNo ratings yet

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDocument61 pagesC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNo ratings yet

- Cumulative Performance (%) : NAVPU Graph Investment ObjectiveDocument1 pageCumulative Performance (%) : NAVPU Graph Investment ObjectivescionchoNo ratings yet

- FM Report July 2010Document11 pagesFM Report July 2010smashinguzairNo ratings yet

- Askari Investment Management: Fund Manager ReportDocument4 pagesAskari Investment Management: Fund Manager ReportSeth ValdezNo ratings yet

- Balanced Aug2011Document1 pageBalanced Aug2011Charlene TrillesNo ratings yet

- Chinese Inv MGMTDocument12 pagesChinese Inv MGMTAngela PetrelliNo ratings yet

- Dividend Payout of Meezan Sovereign Fund and Meezan Cash FundDocument11 pagesDividend Payout of Meezan Sovereign Fund and Meezan Cash FundVALUEWALK LLCNo ratings yet

- Ing Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)Document1 pageIng Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)sunjun79No ratings yet

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- Securities Market 20110413 EDocument8 pagesSecurities Market 20110413 EDavid JensenNo ratings yet

- Prospects 2010Document5 pagesProspects 2010IPS Sri LankaNo ratings yet

- FMR - December 2015Document17 pagesFMR - December 2015Salman ArshadNo ratings yet

- FMR Feb2011Document10 pagesFMR Feb2011faisaladeemNo ratings yet

- SPOT OPPORTUNITIES IN FMCG SECTORDocument55 pagesSPOT OPPORTUNITIES IN FMCG SECTORakcool91No ratings yet

- SIMS Monthly Economic Report - October 2011Document10 pagesSIMS Monthly Economic Report - October 2011George PantherNo ratings yet

- Eco Letter - July 29, 2011Document2 pagesEco Letter - July 29, 2011Altaf CharaniyaNo ratings yet

- % of Par Value of Rs. 50/-Funds Dividend (RS.)Document10 pages% of Par Value of Rs. 50/-Funds Dividend (RS.)Salman ArshadNo ratings yet

- Economic Policy: Monetary Policy and Outlook: Created On 11 Nov 2011 Page 13 of 27Document3 pagesEconomic Policy: Monetary Policy and Outlook: Created On 11 Nov 2011 Page 13 of 27Satyam Chowdary KondaveetiNo ratings yet

- Colombo Stock Market: ASI Daily ClosingDocument24 pagesColombo Stock Market: ASI Daily ClosingRandora LkNo ratings yet

- Banking Industry OverviewDocument14 pagesBanking Industry OverviewyatikkNo ratings yet

- Fund Period Dividend (RS.) Per Unit % of Par Value of Rs. 50/-FYTD Return Meezan Cash Fund (MCF)Document12 pagesFund Period Dividend (RS.) Per Unit % of Par Value of Rs. 50/-FYTD Return Meezan Cash Fund (MCF)faisaladeemNo ratings yet

- Vol. No. 7 Issue No. 9: March 2010Document32 pagesVol. No. 7 Issue No. 9: March 2010Dr. Sanjeev KumarNo ratings yet

- Monetary Policy of PakistanDocument8 pagesMonetary Policy of PakistanWajeeha HasnainNo ratings yet

- Peso Balanced Fund: Investment ObjectiveDocument10 pagesPeso Balanced Fund: Investment ObjectiveErwin Dela CruzNo ratings yet

- Value Seeker 30 August 10Document1 pageValue Seeker 30 August 10Fahad AslamNo ratings yet

- TAKAFULINK EKUITI FUNDDocument2 pagesTAKAFULINK EKUITI FUNDNazmi IshakNo ratings yet

- Market Insight Q3FY12 RBI Policy Review Jan12Document3 pagesMarket Insight Q3FY12 RBI Policy Review Jan12poojarajeswariNo ratings yet

- Funds Dividend Rs. Per Unit Total Dividend For FY11 (RS.) Total Dividend As A % of Opening NAV Total Return % For FY11Document9 pagesFunds Dividend Rs. Per Unit Total Dividend For FY11 (RS.) Total Dividend As A % of Opening NAV Total Return % For FY11cbmerbilalNo ratings yet

- MPD 24 May English)Document3 pagesMPD 24 May English)Aazar Aziz KaziNo ratings yet

- Chap 4Document9 pagesChap 4Mostofa Mahbub UllahNo ratings yet

- Vietnam's Key Economic Indicators and Stabilization MeasuresDocument4 pagesVietnam's Key Economic Indicators and Stabilization MeasuresMc ElNo ratings yet

- Fixed Income Securities MarketDocument20 pagesFixed Income Securities MarketSarah AbrarNo ratings yet

- Fund Fact Sheets April2011 EquityDocument1 pageFund Fact Sheets April2011 EquityFrancis ValenciaNo ratings yet

- Integration of Indian Financial Market With Global MarketDocument20 pagesIntegration of Indian Financial Market With Global Marketab29cd83% (6)

- FMR Apr2011Document10 pagesFMR Apr2011Salman ArshadNo ratings yet

- Case StudyDocument28 pagesCase StudyNCP Shem ManaoisNo ratings yet

- Alternative Investments An Introduction To Funds of Hedge Funds 04 Jul 2011 (Credit Suisse)Document18 pagesAlternative Investments An Introduction To Funds of Hedge Funds 04 Jul 2011 (Credit Suisse)QuantDev-MNo ratings yet

- Industry Insights-Issue 03Document12 pagesIndustry Insights-Issue 03nmijindadiNo ratings yet

- Chart BookDocument74 pagesChart BookMuthirevula SiddarthaNo ratings yet

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigDocument9 pagesMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadNo ratings yet

- Fund Managers' Report July 2016Document16 pagesFund Managers' Report July 2016mahboobulhaqNo ratings yet

- SWOT Analysis of Bank Alfalah: StrengthsDocument14 pagesSWOT Analysis of Bank Alfalah: Strengthsusman_3No ratings yet

- SWOT Analysis of Bank AlfalahDocument14 pagesSWOT Analysis of Bank Alfalahamina8720% (1)

- Biznews Aug 11 To Aug 18Document7 pagesBiznews Aug 11 To Aug 18api-3727613No ratings yet

- Turkey 2011 OutlookDocument5 pagesTurkey 2011 OutlookenergytrNo ratings yet

- Fund Dividend (RS.) Per Unit % of Par Value of Rs. 50-/ Bonus Units Issued For Each 100 Units To Growth Unit HoldersDocument10 pagesFund Dividend (RS.) Per Unit % of Par Value of Rs. 50-/ Bonus Units Issued For Each 100 Units To Growth Unit HoldersSalman ArshadNo ratings yet

- Pak and ImfimfDocument7 pagesPak and ImfimfinayyatNo ratings yet

- Imf A Blessing or Curse For Pakistan S e 2 PDFDocument7 pagesImf A Blessing or Curse For Pakistan S e 2 PDFinayyatNo ratings yet

- Recent Economic Developments: Republic of IndonesiaDocument25 pagesRecent Economic Developments: Republic of IndonesiaDanang WidodoNo ratings yet

- Shariah Growth Fund: Fund Fact Sheet October 2011Document1 pageShariah Growth Fund: Fund Fact Sheet October 2011Wan Mohd FadhlanNo ratings yet

- Lbs August 213Document123 pagesLbs August 213adoekitiNo ratings yet

- Meezan Cash Fund pays second interim dividendDocument8 pagesMeezan Cash Fund pays second interim dividendSalman ArshadNo ratings yet

- Crisil Sme Connect Jul10Document44 pagesCrisil Sme Connect Jul10atia2kNo ratings yet

- Economic LetterDocument2 pagesEconomic LetterAmanullah Bashir GilalNo ratings yet

- Pakistan Terminal Operators Invoice DetailsDocument1 pagePakistan Terminal Operators Invoice Detailssajidali_saNo ratings yet

- Accounts AssistantDocument9 pagesAccounts AssistantSyed عامر ShahNo ratings yet

- Accounts AssistantDocument9 pagesAccounts AssistantSyed عامر ShahNo ratings yet

- Processed Foods & BeveragesDocument33 pagesProcessed Foods & Beveragessajidali_saNo ratings yet

- Nuclear PowerDocument2 pagesNuclear Powersajidali_saNo ratings yet

- Consumer Behavior ReportDocument4 pagesConsumer Behavior Reportsajidali_saNo ratings yet

- SCB ReportDocument29 pagesSCB Reportsajidali_saNo ratings yet

- Analysis On Sugar Industry of Pakistan: Prepared byDocument9 pagesAnalysis On Sugar Industry of Pakistan: Prepared bysajidali_saNo ratings yet

- Leather Industry ReportDocument18 pagesLeather Industry Reportsajidali_saNo ratings yet

- Dua and PrayersDocument4 pagesDua and Prayerssajidali_saNo ratings yet

- Allama Iqbal - Selective Verses: Contributed by Aminur Rashid Sunday, 26 April 2009 Last Updated Sunday, 26 April 2009Document21 pagesAllama Iqbal - Selective Verses: Contributed by Aminur Rashid Sunday, 26 April 2009 Last Updated Sunday, 26 April 2009sajidali_saNo ratings yet

- Project Management TechniquesDocument21 pagesProject Management Techniquessajidali_saNo ratings yet

- Global Professional Accountant ACCA BrochureDocument12 pagesGlobal Professional Accountant ACCA BrochureRishikaNo ratings yet

- DOTgazette - Aug06 - July08.Document196 pagesDOTgazette - Aug06 - July08.M Munir Qureishi100% (1)

- Cost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCDocument5 pagesCost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCshikha_asr2273No ratings yet

- Basu (2005) Reinventing Public Enterprises and Its Management As The Engine of Development and Growth PDFDocument15 pagesBasu (2005) Reinventing Public Enterprises and Its Management As The Engine of Development and Growth PDFlittleconspiratorNo ratings yet

- Fast Path NavigationsDocument8 pagesFast Path Navigationsakshay sasidhar100% (1)

- MFL Annual Report 2021Document176 pagesMFL Annual Report 2021Ovee Maidul IslamNo ratings yet

- Presentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitDocument14 pagesPresentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitPreetaman SinghNo ratings yet

- Finance of International Trade and Related Treasury OperationsDocument2 pagesFinance of International Trade and Related Treasury OperationsmuhammadNo ratings yet

- MCQ SCM FinalsDocument17 pagesMCQ SCM Finalsbaltazarjosh806No ratings yet

- CfQuiz1aSpr15 PDFDocument4 pagesCfQuiz1aSpr15 PDFPavneet Kaur BhatiaNo ratings yet

- Resume 3Document2 pagesResume 3api-459046445No ratings yet

- Life Cycle Cost Analysis of Asphalt and Concrete PavementsDocument94 pagesLife Cycle Cost Analysis of Asphalt and Concrete PavementsPeteris SkelsNo ratings yet

- Protect Against Rising Rates With CapsDocument13 pagesProtect Against Rising Rates With Capsz_k_j_vNo ratings yet

- Personal FinanceDocument259 pagesPersonal Financeapi-3805479100% (4)

- Bwa M 033116Document10 pagesBwa M 033116Chungsrobot Manufacturingcompany100% (1)

- Bankers Trust and Birth of Modern Risk ManagementDocument49 pagesBankers Trust and Birth of Modern Risk ManagementIgnat FrangyanNo ratings yet

- Income TaxDocument7 pagesIncome Tax20BCC64 Aruni JoneNo ratings yet

- Payroll Schemas and Personnel Calculation Rules (PCR'S) : Saltar Al Final de Los Metadatos Ir Al Inicio de Los MetadatosDocument22 pagesPayroll Schemas and Personnel Calculation Rules (PCR'S) : Saltar Al Final de Los Metadatos Ir Al Inicio de Los MetadatosGregorioNo ratings yet

- Gruber4e ch18Document46 pagesGruber4e ch18Amber Pierce100% (2)

- Hoboken-United Water Agreement (1994)Document69 pagesHoboken-United Water Agreement (1994)GrafixAvengerNo ratings yet

- Total Item Description Unit PriceDocument3 pagesTotal Item Description Unit PriceMartin Kyuks100% (2)

- Audit of Cash and Bank BalancesDocument14 pagesAudit of Cash and Bank BalancessninaricaNo ratings yet

- Strategic MGT Fill in The BlanksDocument0 pagesStrategic MGT Fill in The BlanksSardar AftabNo ratings yet

- The Quiet Panic - Kyle Bass On Hong Kong's Looming Financial & Political Crisis - Zero HedgeDocument11 pagesThe Quiet Panic - Kyle Bass On Hong Kong's Looming Financial & Political Crisis - Zero HedgeLuizNo ratings yet

- Answer Formula Edited XDocument176 pagesAnswer Formula Edited Xmostafa motailqNo ratings yet

- A Stduy of Working Capital Management of Everest Bank Limited LaxmiDocument7 pagesA Stduy of Working Capital Management of Everest Bank Limited LaxmiMukesh CnghNo ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Property Investment Tips Ebook - RWinvest PDFDocument40 pagesProperty Investment Tips Ebook - RWinvest PDFddr95827No ratings yet

- The Dynamics of International Business NegotiationsDocument6 pagesThe Dynamics of International Business NegotiationsRavi GaubaNo ratings yet

- Excess and Surplus Lines Laws in The United States - 2018 PDFDocument154 pagesExcess and Surplus Lines Laws in The United States - 2018 PDFJosué Chávez CastellanosNo ratings yet