Professional Documents

Culture Documents

Capital Budgeting 1

Uploaded by

Swapna SagarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting 1

Uploaded by

Swapna SagarCopyright:

Available Formats

CAPITAL BUDGETING DECISION

NATURE AND SIGNIFICANCE

TECHNIQUES OF CAPITAL BUDGETING

I NON-DISCOUNTED CASH FLOW TECHNIQUES

i) Pay Back Period

ii) Accounting Rate of Return (ARR)

II DISCOUNTED CASH FLOW TECHNIQUES

i) Net Present Value (NPV)

ii) Internal Rate of Return (IRR)

iii) Profitability Index (PI)

DISCOUNTED CASH FLOW TECHNIQUES

1. Payback Period: The number of years required to recover the original cash outlay

invested in a project.

Payack period (PBP) =Cash outlay (investment)

Annual Cash Inflow

Acceptance Rule : Accept - Reject / Ranking of projects

Evaluation:

Advantages:

1. Simple to understand and easy to calculate

2. Less Expensive

Disadvantages:

1. It ignores cash flows beyond the PBP

2. It is a measure of project’s capital recovery, not its profitability.

3. It fails to consider the magnitude and timing of cash flows.

4. Notational basis for setting maximum PBP.

5. Not consistent with the objective of maximising the market value of the firm’s

shares.

2. Accounting Rate of Return:

Average income (after taxes)

ARR = ________________________

Average investment

Average investment = (Original investment + Salvage value)

Or

Total of book values after / Life of the project

After Depreciation

Acceptance Rule =

Evaluation:

Advantages:

1. Simple to calculate

2. It is based on accounting information which is readily available with

businessmen.

3. It considers benefits over the entire life of the project.

Disadvantages:

1. It is based on accounting profit, not cash flow.

2. It does not take into account the time value of money

3. It does not consider the length of project lines.

DISCOUNTED CASH FLOW TECHNIQUES

i) Net Present Value:

NPV = PV of Cash inflows – PV of Cash outlay

= [ A1 + A2 + A3 + …… + Aη ]-C

(1+K) (1+K)2 (1+K)3 (1+K) n

= n At - C

∑ (1+K)ι

ι =1

Where A1, A2 …………. Represent cash inflows

K is the firm’s cost of capital

C is the Investment outlay (cost of the investment proposal)

η is the expected life of the project.

Acceptance Rule:

Advantages:

1. It recognises the time value of money

2. It considers all cash hours over the entire life of the project

3. It is consistent with the objective of maximisation of wealth

Disadvantages:

1. Assumption that discount rate is known.

2. It may not give satisfactory answer where the projects being compared involve

different amounts of investment.

3. It may mislead when dealing with alternative projects or limited funds under

the condition of unequal lives.

ii) Internal Rate of Return

A Rate which equates the present value of cash inflows with the present value of cash

outflows of an investment.

η Αι -C

o= ∑ (1+r)t

t= 1

Acceptance Rule:

If IRR is higher than or equal to the minimum required rate of return (cost of

capital or hurdle rate) then accept the project. Otherwise, reject.

EVALUATION:

Advantages:

1. Considers the time value of money.

2. It considers the cash flow stream in its entirety.

3. It is more acceptable to businessmen who want to think in terms of rate of

return.

4. Unlike the NPV method, the calculation of cost of capital is not a pre-

condition for this method.

5. It is compatible with the objective of wealth maximisation.

Disadvantages:

1. Difficult to use in practice due to complicated computations.

2. It may yield results inconsistent with the NPV method if the projects differ in their

(a) expected liver, or (b) cash outlays, or (c) timing of cash flows.

3. It implies that intermediate cash flows generated by the project are reinvested at

the internal rate of the project, whereas NPV method implies reinvestment at cost

of capital. The later assumption seems to be more appropriate.

iii) PROFITABILITY INDEX OR BENEFIT-COST RATIO

It is the ratio of the present value of future cash benefits, at the required rate of

return to the initial cash outflow of the investment.

i.e., PI = PV of Cash Inflows

or Initial Cash outlay

η

= ∑ Aι

ι =1 ( 1+) τ

C

EVALUATION

Advantages:

1. Considers time value of money

2. Under unconstrained conditons, pi criteria will accept and reject the same

project as the net present value criterion.

3. When the capital budget is limited in the current period, the pi criteria may

rank use of capital.

DISADVANTAGES:

1. Its use is not recommended beause it propvides no means for aggregating several smaller

projects into a packagethat can be compared with a large project.

2. when cash outflows occur beyondthe current period, the pi criterion is unsuitable as a selection

criterion.

CHOICE OF METHOD:

NPV VS. PI

NPV Vs. IRR

You might also like

- Advertising Campaign: by Swapna MarkaDocument8 pagesAdvertising Campaign: by Swapna MarkaSwapna SagarNo ratings yet

- Idea CellularDocument24 pagesIdea Cellularprerna karwa100% (1)

- IntroductionDocument19 pagesIntroductionSwapna SagarNo ratings yet

- The 1980s Latin American Debt Crisis: Origins, Responses and LessonsDocument19 pagesThe 1980s Latin American Debt Crisis: Origins, Responses and LessonsSwapna SagarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sale Agreement SampleDocument4 pagesSale Agreement SampleAbdul Malik67% (3)

- (Section-A / Aip) : Delhi Public School GandhinagarDocument2 pages(Section-A / Aip) : Delhi Public School GandhinagarVvs SadanNo ratings yet

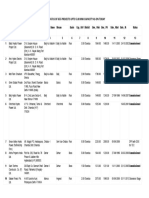

- Exp Mun Feb-15 (Excel)Document7,510 pagesExp Mun Feb-15 (Excel)Vivek DomadiaNo ratings yet

- Investigation of Cyber CrimesDocument9 pagesInvestigation of Cyber CrimesHitesh BansalNo ratings yet

- Corporate Office Design GuideDocument23 pagesCorporate Office Design GuideAshfaque SalzNo ratings yet

- AmulDocument4 pagesAmulR BNo ratings yet

- Strategic Planning and Program Budgeting in Romania RecentDocument6 pagesStrategic Planning and Program Budgeting in Romania RecentCarmina Ioana TomariuNo ratings yet

- Is The Question Too Broad or Too Narrow?Document3 pagesIs The Question Too Broad or Too Narrow?teo100% (1)

- CVA: Health Education PlanDocument4 pagesCVA: Health Education Plandanluki100% (3)

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDocument45 pagesList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21No ratings yet

- Research Course Outline For Resarch Methodology Fall 2011 (MBA)Document3 pagesResearch Course Outline For Resarch Methodology Fall 2011 (MBA)mudassarramzanNo ratings yet

- Business Beyond Profit Motivation Role of Employees As Decision-Makers in The Business EnterpriseDocument6 pagesBusiness Beyond Profit Motivation Role of Employees As Decision-Makers in The Business EnterpriseCaladhiel100% (1)

- Special Blood CollectionDocument99 pagesSpecial Blood CollectionVenomNo ratings yet

- 2020052336Document4 pages2020052336Kapil GurunathNo ratings yet

- Unit 6 Lesson 3 Congruent Vs SimilarDocument7 pagesUnit 6 Lesson 3 Congruent Vs Similar012 Ni Putu Devi AgustinaNo ratings yet

- Curriculum Vitae (October 31, 2011)Document5 pagesCurriculum Vitae (October 31, 2011)Alvin Ringgo C. Reyes100% (1)

- Diaz, Rony V. - at War's End An ElegyDocument6 pagesDiaz, Rony V. - at War's End An ElegyIan Rosales CasocotNo ratings yet

- Archives of Gerontology and Geriatrics: Naile Bilgili, Fatma ArpacıDocument7 pagesArchives of Gerontology and Geriatrics: Naile Bilgili, Fatma ArpacıIsyfaun NisaNo ratings yet

- Temperature Rise HV MotorDocument11 pagesTemperature Rise HV Motorashwani2101No ratings yet

- Philippine Association of Service Exporters vs Drilon Guidelines on Deployment BanDocument1 pagePhilippine Association of Service Exporters vs Drilon Guidelines on Deployment BanRhev Xandra AcuñaNo ratings yet

- Comment On Motion To Release Vehicle BeridoDocument3 pagesComment On Motion To Release Vehicle BeridoRaffy PangilinanNo ratings yet

- Activity Codes - Jun 2011 - v4Document2 pagesActivity Codes - Jun 2011 - v4Venugopal HariharanNo ratings yet

- Identification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceanDocument80 pagesIdentification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceancavrisNo ratings yet

- Adjusted School Reading Program of Buneg EsDocument7 pagesAdjusted School Reading Program of Buneg EsGener Taña AntonioNo ratings yet

- Coasts Case Studies PDFDocument13 pagesCoasts Case Studies PDFMelanie HarveyNo ratings yet

- Amazfit Bip 5 Manual enDocument30 pagesAmazfit Bip 5 Manual enJohn WalesNo ratings yet

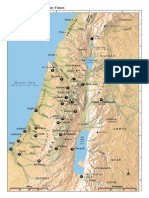

- Israel Bible MapDocument1 pageIsrael Bible MapMoses_JakkalaNo ratings yet

- Sale of GoodsDocument41 pagesSale of GoodsKellyNo ratings yet

- Data Processing & Hosting Services in The US Industry Report PDFDocument34 pagesData Processing & Hosting Services in The US Industry Report PDFimobiwan4711No ratings yet

- MEAB Enewsletter 14 IssueDocument5 pagesMEAB Enewsletter 14 Issuekristine8018No ratings yet