Professional Documents

Culture Documents

Alice 2

Uploaded by

Naailah نائلة MaudarunOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alice 2

Uploaded by

Naailah نائلة MaudarunCopyright:

Available Formats

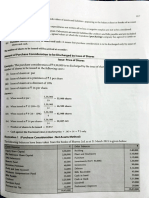

EXAMPLE 2

On 1 June HJ87 Ailce Dought a house in Derby 1m £35.000,

She occupied the house as hor PPR urtil 1 May 1989 when she leH to work in Exeter

In roited accommodation

She returned to the house in Del by on 1 November 1990 and stayed unlil 1 July 1993

whon she left to take up a post in the USA. agam living Ir rented accommodation

She returned to Derby on 1 February 1996 and stayed until 1 December 2005 WhEW

she bought 1'\house In Nottingham and made U'lis her principal private resldenc€'

On 1 February 201 () she 50;d the house in Derby lor £154.000

Compute the c:!'1argeabte gain

Solv tion

£:

Sale proceeds 154,000

less AcquISitioncost ~15aoo

Chargeable galt' (before PPH exemption) 1'9,GOO

Aicos period of ownership o! tile house In Den:.JvIii total Qf c.72 trior 'hs; car. bi'

down into the fol!owing penocJs.

II) 1 June '987 to :30 Apri! 1989 2~j n'ionths Actual reSIC3f1CO

(II) 1 May 1989 to 31 October 1990 1B months WOrKing 'I' UK

32 months Actual roslde'ice

(ili) 1 Novemi)or 1990 to :~O,June 1993

\Ivi 1 July 1993 to 31 January 1996 31 months Vvorkmg abroad

Iv) 1 Februarv 1996 to 30 November 2005 118 months Actual residence

(VI) 1 December 2005 to 31 January 2()10 50 rnonU,ci Living In new PPR

Periods (I) and (v) are exempt since J\lice was actually resident in the property during

those periods (Ii) ,s exempt since f\lice was workH1g e1seWri{)re in the UK, the !our-

Perio,i

year tlmo !lmll has not beer' exceeded and she was resident in the property both betore

and after the absence Similarly, period (jv) is exernpt The last 36 months of o'lvnership

are always exempt. which leaves the first 14 months of periOd Ivi) to conslde' Dunng

Ihese 14 months Alice W(1S claiming anotr1er property to be her PPH, so the p(JflO(1cannot

count as a period of deemed residence and the gain arising dUring these! <\ montil~, is

charSleable. The remaining 25B months bene!it fmm the PPH exemption The chargeable

gain IS therefore as fOiiow$

£.

Totalgan ias above) 119.000

2SB x.\'1 , L. '

I.ess 9 00 0 1t2,875

272

Cfiargeable gam 6125

308

re

lip In relation to the previous example in tillS chapter, assume now Ihat J\llce always lot her

g Derby house when she was not resident there Computo the d1argeable gain.

!ot

. is .J

de Solution

The only chargeabl0 period was a period of 14 months. during which a (Jain of £6 125

arOSf: and durinq WhiCh tho propony was If:!. Lettinq relief is available H~~the lowest of

(a) Hie part of the gHIf1WhiChreiates to the letting period (£6,125) ..

(b) Tho part of the gain which IS exempt because of the PPR exemptions (i:112.875!

iC) 1:40,QOO.

Therefore letting relief is £6.125 and the chargeable gain is reduced to £nil.

309

You might also like

- IBLP-990s 2002-2006Document93 pagesIBLP-990s 2002-2006oh_frabjous_joyNo ratings yet

- The Arduin Grimoire - Vol 2 - Welcome To Skull TowerDocument52 pagesThe Arduin Grimoire - Vol 2 - Welcome To Skull TowerMailACasoNo ratings yet

- Nevada Reply BriefDocument36 pagesNevada Reply BriefBasseemNo ratings yet

- Ice Plant DesignDocument10 pagesIce Plant DesignRV RecazaNo ratings yet

- EXXON MOBIL - Heat Transfer & Heat ExchangersDocument116 pagesEXXON MOBIL - Heat Transfer & Heat Exchangersfateton42100% (3)

- 12.2 Thermodynamics 02 SolutionsDocument11 pages12.2 Thermodynamics 02 Solutionsjeruel sabacanNo ratings yet

- Variant Configuration Step by Step ConfigDocument18 pagesVariant Configuration Step by Step Configraghava_83100% (1)

- 02 - AbapDocument139 pages02 - Abapdina cordovaNo ratings yet

- PSC Single SpanDocument99 pagesPSC Single SpanRaden Budi HermawanNo ratings yet

- Taxation With AnswerDocument13 pagesTaxation With AnsweraizaNo ratings yet

- Restructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)Document126 pagesRestructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)CliffhangerNo ratings yet

- Bcom Comp IV Apr2019 Income Tax Law and Practice-IDocument4 pagesBcom Comp IV Apr2019 Income Tax Law and Practice-IKunal NandaNo ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- HW1 2 ProblemsDocument9 pagesHW1 2 ProblemsBiswadeep ChakrabortyNo ratings yet

- Prescriptive Analytics Assignment - Raju Kumar - Part15Document1 pagePrescriptive Analytics Assignment - Raju Kumar - Part15Raju KumarNo ratings yet

- Sem112 06solution RevenueDocument1 pageSem112 06solution RevenueKok AlvinNo ratings yet

- Adobe ScanDocument13 pagesAdobe ScanFathimaNo ratings yet

- 2022 09 13 Naling IvyjoyDocument4 pages2022 09 13 Naling IvyjoyVjoy LimNo ratings yet

- U BTU LB V FT LB FT S U BTU LB V FT LB FT S BTU LB: Name: Course & Yr Level: Score Time: Days: DateDocument4 pagesU BTU LB V FT LB FT S U BTU LB V FT LB FT S BTU LB: Name: Course & Yr Level: Score Time: Days: Datejia generosaNo ratings yet

- Solutions For Module 3 IllustrationDocument22 pagesSolutions For Module 3 IllustrationColeen GaliciaNo ratings yet

- The Rifle Shots Manual of Target Shooting - SniderDocument128 pagesThe Rifle Shots Manual of Target Shooting - SniderHugh KnightNo ratings yet

- Cost Accounting22Document4 pagesCost Accounting22aromalsolteroNo ratings yet

- Assignment 6Document4 pagesAssignment 6Long Trần QuangNo ratings yet

- (N11) Advisory IHTDocument7 pages(N11) Advisory IHTMuguti EriazeriNo ratings yet

- Winter09 3P96 Midterm1 SolutionDocument5 pagesWinter09 3P96 Midterm1 SolutionAdnan Hassan100% (2)

- Paid UnpaidDocument5 pagesPaid UnpaidElisha Lois ManluluNo ratings yet

- Applied Thermodynamics 2011Document3 pagesApplied Thermodynamics 2011suhas_snaNo ratings yet

- Missing CourseDocument8 pagesMissing CourseRagunath RamasamyNo ratings yet

- Practice ProblemsDocument3 pagesPractice Problemschuchu tvNo ratings yet

- Midterm - Taxation2 - Module - Estate TaxDocument18 pagesMidterm - Taxation2 - Module - Estate TaxEJ HipolitoNo ratings yet

- The Given Figure Is Shown BelowDocument4 pagesThe Given Figure Is Shown BelowAnonymous ySoSbd5No ratings yet

- Calculating Philippine Estate, VAT and Income TaxesDocument17 pagesCalculating Philippine Estate, VAT and Income TaxesJohayra AbbasNo ratings yet

- Macroeconomics Answer Key Consumption and InvestmentDocument4 pagesMacroeconomics Answer Key Consumption and InvestmentAbhijit PaikarayNo ratings yet

- numericalsDocument5 pagesnumericalsSukhvir SinghNo ratings yet

- Business Tax AssignementDocument7 pagesBusiness Tax AssignementAleya MonteverdeNo ratings yet

- SA - ThermodynamicsDocument9 pagesSA - Thermodynamicsdheeraj831No ratings yet

- Problem2 5pdfDocument2 pagesProblem2 5pdfSwam PyaeNo ratings yet

- Aec10 - Business Taxation Solution Tabag CH2Document4 pagesAec10 - Business Taxation Solution Tabag CH2EdeksupligNo ratings yet

- CGT ReliefsDocument7 pagesCGT ReliefsWajih RehmanNo ratings yet

- 7 1bpostDocument1 page7 1bposteperlaNo ratings yet

- Advanced Accounting (Plant Assets)Document3 pagesAdvanced Accounting (Plant Assets)John JackNo ratings yet

- IT Module QPDocument67 pagesIT Module QPImran KhanNo ratings yet

- Topic 1.2 Corporate Liquidation Part 2Document15 pagesTopic 1.2 Corporate Liquidation Part 2Allira OrcajadaNo ratings yet

- Business and Transfer Taxes Problem HDocument1 pageBusiness and Transfer Taxes Problem HAcctg101No ratings yet

- Chapter 10 15Document89 pagesChapter 10 15Aira Mae P. VispoNo ratings yet

- FINACIAL Accounting Supplementary 2020Document3 pagesFINACIAL Accounting Supplementary 2020shakirshaduli780No ratings yet

- 04 - Task - Performance - 1 (10) BUSTAXDocument5 pages04 - Task - Performance - 1 (10) BUSTAXAries Christian S PadillaNo ratings yet

- An Introduction To Hydraulics: Draulics MDocument24 pagesAn Introduction To Hydraulics: Draulics MDaniel RojasNo ratings yet

- Final Offer DomonicDocument3 pagesFinal Offer DomonicMar VicNo ratings yet

- Fossil Fuel Burning and Generating HandbookDocument132 pagesFossil Fuel Burning and Generating HandbookepriyonoNo ratings yet

- Energy UnitsUnits Conversion 2022Document12 pagesEnergy UnitsUnits Conversion 2022Ndapiwa KengaletsweNo ratings yet

- 1st Mock ExamDocument6 pages1st Mock ExamAdzcer HadullaNo ratings yet

- CHAPTER 15 Transfer Business TaxDocument9 pagesCHAPTER 15 Transfer Business TaxJamaica DavidNo ratings yet

- TX2 101Document3 pagesTX2 101Pau SantosNo ratings yet

- Taxes: Sec 1245 and Sec 1250 Property RecaptureDocument2 pagesTaxes: Sec 1245 and Sec 1250 Property RecaptureEl Sayed AbdelgawwadNo ratings yet

- SO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioDocument231 pagesSO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioAnne EstrellaNo ratings yet

- The Otto Cycle (Internal Combustion Cycle)Document4 pagesThe Otto Cycle (Internal Combustion Cycle)Nur SyahimaNo ratings yet

- Transport and HVAC Equipment LogDocument2 pagesTransport and HVAC Equipment LogNaomi Aira Gole CruzNo ratings yet

- 3Document1 page3joshiabhinavaj247No ratings yet

- Logarithmic ScaleDocument7 pagesLogarithmic ScaleMinh Khoa PhạmNo ratings yet

- Financial Accounting 1 - Inventory Valuation and Biological assets-REAH M. HDocument11 pagesFinancial Accounting 1 - Inventory Valuation and Biological assets-REAH M. HJohn Mark FolienteNo ratings yet

- Log Problems Exponential Problems.Document4 pagesLog Problems Exponential Problems.May Flor MalagambaNo ratings yet

- Amalgamation Illustration PDFDocument25 pagesAmalgamation Illustration PDFyash nawariyaNo ratings yet

- Foundations of Finance: The Capital Asset Pricing Model (CAPMDocument19 pagesFoundations of Finance: The Capital Asset Pricing Model (CAPMNaailah نائلة MaudarunNo ratings yet

- Taking Demographic ProjectionsDocument3 pagesTaking Demographic ProjectionsNaailah نائلة MaudarunNo ratings yet

- TutorialDocument9 pagesTutorialNaailah نائلة MaudarunNo ratings yet

- 5 BMDocument20 pages5 BMNaailah نائلة MaudarunNo ratings yet

- Laplace TableDocument2 pagesLaplace Tablecabeza2750% (2)

- Chilled Beam SystemsDocument3 pagesChilled Beam SystemsIppiNo ratings yet

- PH Measurement TechniqueDocument5 pagesPH Measurement TechniquevahidNo ratings yet

- NSTP 1: Pre-AssessmentDocument3 pagesNSTP 1: Pre-AssessmentMaureen FloresNo ratings yet

- Supply AnalysisDocument5 pagesSupply AnalysisCherie DiazNo ratings yet

- Pic32mx1xx2xx283644-Pin Datasheet Ds60001168lDocument350 pagesPic32mx1xx2xx283644-Pin Datasheet Ds60001168lR khanNo ratings yet

- Day / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Document4 pagesDay / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Lhea RecenteNo ratings yet

- Family health assessment nursing problemsDocument8 pagesFamily health assessment nursing problemsMari MazNo ratings yet

- Mom Luby and The Social WorkerDocument1 pageMom Luby and The Social WorkerqtissskrazyNo ratings yet

- Thesis Submission Certificate FormatDocument6 pagesThesis Submission Certificate Formatmichellespragueplano100% (3)

- 110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive ExamsDocument42 pages110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive Examsvijay_marathe01No ratings yet

- MongoDB vs RDBMS - A ComparisonDocument20 pagesMongoDB vs RDBMS - A ComparisonShashank GuptaNo ratings yet

- Grid Xtreme VR Data Sheet enDocument3 pagesGrid Xtreme VR Data Sheet enlong bạchNo ratings yet

- Converted File d7206cc0Document15 pagesConverted File d7206cc0warzarwNo ratings yet

- SWOT Analysis of Fruit Juice BusinessDocument16 pagesSWOT Analysis of Fruit Juice BusinessMultiple UzersNo ratings yet

- Science Q4 Lesson BDA EarthquakeDocument41 pagesScience Q4 Lesson BDA EarthquakeAnaLizaD.SebastianNo ratings yet

- Danielle Smith: To Whom It May ConcernDocument2 pagesDanielle Smith: To Whom It May ConcernDanielle SmithNo ratings yet

- UE Capability Information (UL-DCCH) - Part2Document51 pagesUE Capability Information (UL-DCCH) - Part2AhmedNo ratings yet

- Identifying Community Health ProblemsDocument4 pagesIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItableNo ratings yet

- Constitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Document3 pagesConstitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Mukesh ShuklaNo ratings yet

- Brochure of H1 Series Compact InverterDocument10 pagesBrochure of H1 Series Compact InverterEnzo LizziNo ratings yet

- 38-St. Luke - S vs. SanchezDocument25 pages38-St. Luke - S vs. SanchezFatzie MendozaNo ratings yet

- Ganbare Douki Chan MALDocument5 pagesGanbare Douki Chan MALShivam AgnihotriNo ratings yet

- Csit 101 Assignment1Document3 pagesCsit 101 Assignment1api-266677293No ratings yet

- Coca Cola Concept-1Document7 pagesCoca Cola Concept-1srinivas250No ratings yet

- Private Car Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleDocument3 pagesPrivate Car Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleijustyadavNo ratings yet