Professional Documents

Culture Documents

MFS Content

Uploaded by

taqleef0 ratings0% found this document useful (0 votes)

20 views8 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views8 pagesMFS Content

Uploaded by

taqleefCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

CONTENTS

Module 1: Introduction to Indian Financial System

1.1. Introduction To Indian Financial System 3

1.1.1. Meaning & Definition of Financial System 3

1.1.2. Features of Financial System 3

1.1.3. Evolution of Indian Financial System 4

1.1.3.1. Phase I: Pre-1951 Organization 4

1.1.3.2. Phase II: 1951 to Mid-Eighties 5

1.1.3.3. Phase III: Post-Nineties (Development Since 1991) 8

1.1.4. Structure/Constituents of Indian Financial System 10

1.1.5. Functions of Financial System 12

1.1.6. Role of Financial System 13

1.1.7. Weakness of Financial System 14

1.2. Financial Institutions/ Intermediaries 15

1.2.1. Introduction 15

1.2.2. Role/Functions of Financial Institutions/ Intermediaries 16

1.2.3. Cost Involved in Intermediation 17

1.2.4. Financial Intermediation Process 17

1.2.5. Advantages of Financial Intermediaries 18

1.2.6. Disadvantages of Financial Intermediaries 19

1.2.7. Various Financial Intermediaries 20

1.3. Banking Institutions 20

1.3.1. Meaning & Definition of Bank 20

1.3.2. Functions of Banking Institutions 21

1.4. Structure Of Banking System 22

1.4.1. Scheduled Banks 23

1.4.1.1. Co-operative Banks 23

1.4.1.2. Commercial Banks 24

1.4.1.2.1. Public Sector Banks 24

1.4.1.2.2. Private Sector Banks 26

1.4.2. Non-Scheduled Banks 28

1.4.3. Defects of Indian Banking System 29

1.4.4. Advantages of Banking Institutions 30

1.4.5. Disadvantages of Banking Institutions 31

1.5. Non Banking Financial Companies/ Institutions (NBFC) 32

1.5.1. Meaning and Definition of NBFCs 32

1.5.2. Evolution of Non-Banking Financial Companies/ Institutions 33

1.5.3. Structure of Non-Banking Financial Companies 34

1.5.4. Functions of NBFCs 35

1.5.5. Types of Services Provided by NBFCs 36

1.5.6. Legal Requirements of NBFCs 36

1.5.7. Working of NBFCs 38

1.5.7.1. Procedure for Obtaining Registration 38

1.5.8. Importance of NBFCs 40

1.5.9. Control of NBFCs by RBI 41

1.5.9.1. Regulations of NBFCs 41

1.5.9.2. Guidelines on Fair Practices Code for NBFCs 41

1.5.9.3. RBI’s Prudential Norms for NBFCs 47

1.5.10. Difference between Banks and NBFCs 49

1.6. Reserve Bank Of India (RBI) 50

1.6.1. Introduction 50

1.6.2. Features of RBI 51

1.6.3. Organizational Structure of RBI 51

1.6.4. Internal Organization and Management 52

1.6.5. Departments of RBI 52

1.6.6. Functions of Reserve Banks of India 53

1.6.6.1. Central Banking Functions 54

1.6.6.2. Supervisory Functions 55

1.6.6.3. Promotional Functions 57

1.6.7. Role of Reserve Bank of India 58

1.6.8. Achievements of Reserve Bank of India 61

1.7. Introduction To Different Markets/Financial Market 62

1.7.1. Introduction 62

1.7.2. Characteristics of Financial Markets 63

1.7.3. Functions of Financial Markets 64

1.7.4. Types of Financial Markets 64

1.8. Money Market 64

1.8.1. Meaning and Definition of Money Market 64

1.8.2. Nature/Characteristics of Money Market 65

1.8.3. Participants of Money Market 66

1.8.4. Money Market Instruments 67

1.8.5. Advantages/Importance of Money Market 67

1.8.6. Disadvantages of Money Market 68

1.9. Capital Market 68

1.9.1. Meaning and Definition of Capital Market 68

1.9.2. Nature of Capital Market 69

1.9.3. Features of Capital Market 69

1.9.4. Functions of Capital Market 70

1.9.5. Importance of Capital Market 70

1.9.6. Difference between Capital Market and Money Market 71

1.9.7. Constituents of Capital Market 72

1.10. Primary Market/New Issue Market 72

1.10.1. Meaning of Primary Market 72

1.10.2. Features of Primary Market 72

1.10.3. Functions of Primary Market 73

1.10.4. Operations in Primary Market 74

1.10.5. Instruments in Primary Market 78

1.10.6. Intermediaries in Primary Market 78

1.10.7. Limitations of Primary Market 79

1.10.8. SEBI Regulation or Guidelines for Primary Market 79

1.11. Secondary Market/ Stock Exchange 81

1.11.1. Meaning & Definition of Secondary Market 81

1.11.2. Features of Secondary Market 82

1.11.3. Functions of Secondary Market 82

1.11.4. Procedure for Dealing at Secondary Market 83

1.11.5. Reasons for Transactions in Secondary Market 84

1.11.6. Weaknesses of Secondary Market 84

1.11.7. SEBI Regulation or Guidelines for Secondary Market 85

1.11.8. Relationship between Primary and Secondary Market 87

1.11.9. Difference between Primary and Secondary Market 87

1.12. Commodity Market 88

1.12.1. Meaning & Definition of Commodity Market 88

1.12.1.1. Classification of commodity Market 89

1.12.1.2. Services of Commodity Market 89

1.12.1.3. Types of Transactions in Commodity Markets 90

1.12.1.4. Commodity Exchanges 92

1.13. Derivative Market 94

1.13.1. Meaning of Derivative Market 94

1.13.2. Functions of Derivative Markets 94

1.13.3. Types of Derivatives 95

1.13.4. Traders in Derivative Markets 96

1.13.5. Advantages of Derivatives 97

1.13.6. Misuses/Disadvantages of Derivatives 98

1.14. Foreign Exchange Market 99

1.14.1. Meaning and Definition of Foreign Exchange Market 99

1.14.2. Characteristics of Foreign Exchange Market 100

1.14.3. Functions of Foreign Exchange Market 101

1.14.4. Advantages of Foreign Exchange Market 101

1.14.5. Disadvantages of Foreign Exchange Market 102

Module 2: Asset/Fund based Financial Services-I

2.1. Asset/Fund Based Financial Services 104

2.1.1. Introduction 104

2.1.2. Need of Asset-Based Financial Services 104

2.1.3. Features of Asset-Based Financial Services 105

2.1.4. Factors Affecting Asset-Based Financial Services 105

2.1.5. Advantages of Asset-Based Financial Services 106

2.1.6. Disadvantage of Asset-Based Financial Services 106

2.1.7. Role of Asset-Based Financial Services 106

2.1.8. Types of Asset-Based Financial Services 107

2.2. Theoretical Framework Of Leasing 108

2.2.1. Meaning and Definition of Leasing 108

2.2.2. Essential Elements of Lease Financing 109

2.2.3. Parties Involved in Leasing 109

2.2.4. Pricing of Leasing 112

2.2.5. Leasing Process 113

2.2.6. Classification of Leasing 113

2.2.7. Factors that Contributed to the Growth of Leasing 117

2.2.8. Importance/Advantages of Leasing 118

2.2.9. Limitations/Disadvantages of Leasing 120

2.2.10. Financial Evaluation of Leasing 121

2.2.10.1. Lessee’s Point of View 121

2.2.10.2. Lessor's Point of View 124

2.2.11. Accounting Aspect of Leasing 128

2.2.11.1. Accounting for Leases by a Lessee 129

2.2.11.2. Accounting for Leases by Lessors 129

2.2.12. Tax Aspects of Leasing 130

2.2.12.1. Income Tax Considerations 130

2.2.12.2. Sales Tax Aspects 132

2.2.13. Regulatory Framework of Leasing 133

2.2.13.1. Contract Act 133

2.2.13.1.1. General Provisions of Contract Act 133

2.2.13.1.2. Remedies for Breach of Contract 135

2.2.13.1.3. Special Provisions 136

2.2.13.2. Other Acts/Laws 138

2.2.13.3. Lease Documentation and Agreement 138

2.3. Hire Purchase Finance 140

2.3.1. Introduction 140

2.3.2. Meaning of Hire Purchase 140

2.3.3. Definition of Hire Purchase Agreement 140

2.3.4. Features of Hire Purchase Agreement 141

2.3.5. Clauses of Hire Purchase Agreement 142

2.3.6. Parties in Hire Purchase 142

2.3.7. Classification/Types of Hire Purchase 142

2.3.8. Importance/Advantages of Hire Purchase 143

2.3.9. Limitations/Disadvantages of Hire Purchase 143

2.3.10. Financial Evaluation of Hire Purchase Deals/Transaction 144

2.3.10.1. From the Viewpoint of the Hirer (Hire-Purchaser) 144

2.3.10.1.1. Decision-Criterion 144

2.3.10.2. From the Viewpoint of Finance Company (Hire-Vendor) 145

2.3.11. Accounting Aspect of Hire Purchase in India 145

2.3.11.1. Methods of Interest Calculation 146

2.3.11.2. Methods of Reporting 146

2.3.12. Tax Aspects of Hire Purchase 147

2.3.12.1. Income Tax Aspect 147

2.3.12.2. Sales Tax Aspects 148

2.3.12.3. Interest Tax Aspects 149

2.3.13. Differences between Leasing & Hire Purchase 149

2.3.14. Regulatory Framework of Hire Purchase 150

2.3.14.1. Sales of Goods Act 150

2.3.14.2. Goods 151

2.3.14.3. Price 152

2.3.14.4. Earnest Money or Security Deposit 152

2.3.14.5. Doctrine of Caveat Emptor (Let the Buyer Beware) 152

2.3.14.6. Transfer of Property in Goods 153

2.3.14.7. Performance of a Sale Contract 153

2.3.14.8. Delivery of Goods 153

2.3.14.9. Acceptance of Delivery by Buyer 153

Module 3: Asset/Fund based Financial Services-II

3.1. Consumer Credit 156

3.1.1. Introduction 156

3.1.2. Meaning & Definition of Consumer Credit 156

3.1.3. Features of Consumer Credit 156

3.1.4. Types of Consumer Credit 157

3.1.5. Sources of Consumer Credit 158

3.1.6. Terms & Conditions of Consumer Credit 159

3.1.7. Consumer Credit Scoring 160

3.1.8. Uses/Benefits of Consumer Credit 161

3.1.9. Limitations of Consumer Credit 162

3.2. Factoring 162

3.2.1. Meaning and Definition of Factoring 162

3.2.2. Features of Factoring 163

3.2.3. Functions of a Factor 164

3.2.4. Types of Factoring 165

3.2.5. Factoring Charges 167

3.2.6. Working/Mechanism of Factoring 167

3.2.7. Advantages/Uses/Benefits of Factoring 168

3.2.8. Limitations of Factoring 169

3.2.9. Financial Aspects of Factoring/Cost-Benefit Analysis of Factoring 169

3.2.10. Legal Aspect of Factoring 169

3.3. Forfeiting 171

3.3.1. Meaning of Forfeiting 171

3.3.2. Need for Forfeiting 171

3.3.3. Characteristics of Forfeiting 171

3.3.4. Working/Mechanism of Forfeiting 172

3.3.5. Pricing of Forfaiting Transaction 173

3.3.6. Advantages/Uses/Benefits of Forfeiting 173

3.3.7. Limitations of Forfeiting 174

3.3.8. Difference between Forfeiting & Factoring 174

3.4. Bills Discounting 175

3.4.1. Meaning & Definition of Bill Discounting 175

3.4.2. Parties to a Bill of Exchange 175

3.4.3. Types of Bills 176

3.4.4. Steps Involved in Bills Discounting 177

3.4.5. Precautions in Bill Discounting 178

3.4.6. Bills Systems 179

3.4.7. Uses/Benefits of Bills Discounting 180

3.4.8. Difference between Bill Discounting & Factoring 181

3.5. Housing Finance 182

3.5.1. Introduction 182

3.5.2. Need for Housing Finance 182

3.5.3. Models of Housing Projects 183

3.5.4. Housing Finance Institutions in India 185

3.5.4.1. National Housing Bank (NHB) 185

3.5.4.1.1. Objectives of NHB 185

3.5.4.1.2. Role and Rationale of NHB 185

3.5.4.2. Housing Development Finance Corporation Limited (HDFC) 186

3.5.4.2.1. Objectives of HDFC 186

3.5.4.2.2. Type of Loans Offered by HDFC 187

3.5.4.3. Housing and Urban Development Corporation of India (HUDCO) 187

3.5.4.3.1. Objectives of HUDCO 187

3.5.5. Problems/Major Issues in Housing Finance 188

3.6. Insurance Services 190

3.6.1. Meaning and Definition of Insurance Services 190

3.6.2. Need of Insurance Services 190

3.6.3. Characteristics of Insurance Services 191

3.6.4. Functions of Insurance Services 193

3.6.5. Legal Principles of Insurance 194

3.6.6. Types/Categories of Insurance Services 195

3.6.7. Costs of Insurance Services to the Society 196

3.6.8. Benefits of Insurance Services to the Society 197

3.6.9. Regulation of Insurance - Insurance Regulatory & Development 198

Authority (IRDA)

3.7. Venture Capital Financing 198

3.7.1. Meaning & Definition of Venture Capital 198

3.7.2. Characteristics of Venture Capital 199

3.7.3. Objectives of Venture Capital 200

3.7.4. Dimensions of Venture Capital Financing 200

3.7.5. Stages of Venture Capital Financing 200

3.7.6. Methods of Evaluation of Venture Capital 201

3.7.7. Advantages of Venture Capital Financing 203

3.7.8. Disadvantages of Venture Capital Financing 203

3.7.9. Venture Capital Industry in India 203

3.7.10. Government/SEBI Guidelines for the Venture Capital Companies 206

3.8. Mutual Funds Services 207

3.8.1. Meaning and Definition of Mutual Funds 207

3.8.2. Characteristics of Mutual Funds 208

3.8.3. Mutual Funds Superiority Over Other Investment Options 208

3.8.4. Structure of Mutual Fund 209

3.8.5. Types/Classification of Mutual Fund 211

3.8.5.1. General Classification 211

3.8.5.2. Broad Classification 213

3.8.6. Risks Associated with Mutual Funds 219

3.8.7. Selection of Mutual Fund 220

3.8.8. Advantages of Mutual Funds 221

3.8.9. Shortcomings in Operation of Mutual Funds 223

3.8.10. SEBI Guidelines for Mutual Funds 226

Module 4: Merchant Banking Services and Issue Management

4.1. Merchant Banking Services 229

4.1.1. Meaning and Definition of Merchant Banking 229

4.1.2. Characteristics of Merchant Banks 229

4.1.3. Objectives of Merchant Banking 230

4.1.4. Advantages of Merchant Banking /Banker 230

4.1.5. Disadvantages of Merchant Banking 231

4.1.6. Regulation Of Merchant Banking/Bankers 231

4.1.7. Services of Merchant Bankers 234

4.2. Merchant Banking Services Related To Issue Management 237

4.2.1. Introduction 237

4.2.2. Underwriter 237

4.2.2.1. Role and Responsibilities of Underwriter 237

4.2.2.2. Code of Conduct for Underwriters 239

4.2.3. Banker to an Issue 240

4.2.3.1. Role and Responsibilities of Banker 240

4.2.3.2. RBI’s Role 241

4.2.3.3. Code of Conduct for Bankers 241

4.2.4. Brokers to the Issue 242

4.2.5. Registrar to an Issue & Share Transfer Agents 243

4.2.5.1. Code of Conduct 243

4.2.6. Debenture Trustees 244

4.2.6.1. Role and Responsibilities of Debenture Trustees 244

4.2.6.2. SEBI’s Role 245

4.2.6.3. Code of Conduct for Debenture Trustees 246

4.2.7. Portfolio Managers 247

4.2.7.1. Principal Officer of a Portfolio Manager 248

4.2.7.2. Procedure for Registration 248

4.2.7.3. Obligations and Responsibilities of Portfolio Manager 248

4.2.7.4. Inspection and Disciplinary Proceedings 251

4.2.7.5. Action in Case of Default 251

4.3. Issue Management Activities And Procedure 252

4.3.1. Introduction 252

4.3.2. Eligibility Norms 252

4.3.3. Issue Advertisement 254

4.3.4. Issue of Debt Instruments 256

4.3.5. Pricing of Issues 256

4.3.6. Promoters’ Contribution & Lock-In Requirements 260

4.3.7. Contents of Offer Document 264

4.3.8. Book- Building 265

4.3.9. Issue of Indian Depository Receipts (IDRs) 271

4.4. Pre Issue & Post Issue Obligations & Other Requirements 273

4.4.1. Pre-Issue Obligations 273

4.4.2. Post-Issue Obligations 280

4.4.2.1. Post-Issue Monitoring Reports 280

4.4.2.2. Redressal of Investor Grievances 281

4.4.2.3. Coordination with Intermediaries 281

4.4.2.4. Post-Issue Advertisements 281

4.4.2.5. Basis of Allotment 281

4.4.2.6. Proportionate Allotment Procedure 282

4.4.2.7. Reservation for Small Individual Applicants 283

4.4.2.8. Other Responsibilities 283

4.4.3. Other Issue Requirements 284

Module 5: Fee Based Financial Services

5.1. Fee Based/ Advisory Financial Services 294

5.2. Credit Rating 294

5.2.1. Meaning and Definition of Credit Rating 294

5.2.2. Features of Credit Rating 295

5.2.3. Objectives of Credit Rating 296

5.2.4. Types of Credit Rating 296

5.2.5. Credit Rating Process 297

5.2.6. Major Factors in Credit Rating 299

5.2.7. Credit Rating Agencies in India 301

5.2.8. Utility/Benefits of Credit Rating 303

5.2.9. Limitations of Credit Rating 305

5.3. Stock Broking 306

5.3.1. Introduction 306

5.3.2. Stock Brokers 306

5.3.3. Sub Brokers 307

5.3.4. Foreign Brokers 308

5.3.5. Types of Stock Broking Services 309

5.3.6. Brokerage Terms 309

5.4. Custodial Services 312

5.4.1. Meaning and Definition of Custodial Services 312

5.4.2. Types of Custodial Services 313

5.4.3. SEBI Regulation of Custodial Service 318

5.5. Depository System 323

5.5.1. Meaning of Depository System 323

5.5.2. Need for Setting up a Depository System in India 323

5.5.3. Features of Depository System 324

5.5.4. Methods in the Depository System 325

5.5.5. Functioning of Depository System 325

5.5.6. Benefits of Depository System 326

5.5.7. Limitations of the Depository System 328

5.5.8. Constituents of the Depository System 328

5.5.9. Depository 328

5.5.10. Depository Participant 332

5.5.11. Company/Registrars and Share Transfer Agents 334

5.5.12. Investor 335

5.5.13. Stock Exchanges and Stockbrokers 335

5.5.14. Clearing Corporation/Clearing House and Clearing Members 336

5.5.15. SEBI Regulation 337

5.6. Short Selling 348

5.6.1. Meaning of Short Selling 348

5.6.2. Short Selling Terms 349

5.6.3. Mechanism of Short Selling Stock 349

5.6.4. Rules Governing Short Sales 350

5.7. Securities Lending And Borrowing 350

5.7.1. Introduction 350

5.7.2. Features of Security Lending and Borrowing (SLB) Scheme 351

5.7.3. Eligibility Criteria for Approved Intermediary 353

5.7.4. Obligations and Responsibilities of Approved Intermediary 353

5.7.5. Automated Lending and Borrowing Mechanism (ALBM) 354

5.7.5.1. ALBM Terminology 355

5.7.5.2. Procedure of ALBM 355

5.7.6. Advantages of Securities Lending and Borrowing (SLB) Scheme 356

5.8. Securities Buying And Selling/Securities Trading 356

5.8.1. Introduction 356

5.8.2. Types of Orders 356

5.8.3. Nature of Transaction in Security Trading 357

5.8.4. Types of Transaction 358

5.8.5. Transaction Costs 358

5.8.6. Types of Security Trading 360

5.8.7. Methods of Security Trading 361

5.8.8. Procedure of Securities Buying and Selling 362

5.8.9. Key Considerations of Security Trading 363

5.9. Credit Cards 364

5.9.1. Introduction 364

5.9.2. Features of Credit Cards 365

5.9.3. Types of Credit Card 366

5.9.4. Credit Card Terms 367

5.9.5. Factor Considering for Choice of Credit Cards 368

5.9.6. Working Of Credit Cards/How Credit Cards Work 369

5.9.7. Advantages of Credit Cards 370

5.9.8. Disadvantages of Credit Cards 371

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- ADocument6 pagesAJuan Gabriel Garcia LunaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

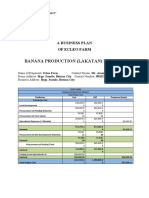

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- This Study Resource Was Shared Via: TopicsDocument4 pagesThis Study Resource Was Shared Via: TopicsNana GandaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- US Double Taxation TreatiesDocument1 pageUS Double Taxation TreatiesOnline Trading PlatformsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hablon Production Center Statement of Financial Performance For The Years Ended December 31Document41 pagesHablon Production Center Statement of Financial Performance For The Years Ended December 31angelica valenzuelaNo ratings yet

- Fourosix-Reality Branding 1M SaniDocument1 pageFourosix-Reality Branding 1M SaniMahi AkhtarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Asia Pacific MarketView Q1 2018 FINALDocument18 pagesAsia Pacific MarketView Q1 2018 FINALPrima Advisory SolutionsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Exam 3 Practice Exam, Econ 204, Fall 2019Document10 pagesExam 3 Practice Exam, Econ 204, Fall 2019abdulelahaljaafariNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Residual Income Model PowerpointDocument29 pagesResidual Income Model Powerpointqwertman3000No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Sriphala Carbons FinancialsDocument16 pagesSriphala Carbons Financials8442No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- F2 Exam Kit BPP PDFDocument192 pagesF2 Exam Kit BPP PDFHasan50% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Pledge From Atty BontosDocument7 pagesPledge From Atty BontosarielramadaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Banks Vietnam Risks From Real 16jan2023 PBC - 1349912Document9 pagesBanks Vietnam Risks From Real 16jan2023 PBC - 1349912Kim Yen NguyenNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Maintenance and replacement of internal fixtures at residential areaDocument40 pagesMaintenance and replacement of internal fixtures at residential areamvs srikarNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Final Accounts Problems and Solutions - Final Accounts QuestionsDocument20 pagesFinal Accounts Problems and Solutions - Final Accounts QuestionshafizarameenfatimahNo ratings yet

- BAM 026 Group 1Document8 pagesBAM 026 Group 1Maureen SanchezNo ratings yet

- Investment Unit: Key Terms and ConceptsDocument3 pagesInvestment Unit: Key Terms and ConceptsnhNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Chapter-7 Investment ManagementDocument7 pagesChapter-7 Investment Managementhasan alNo ratings yet

- This Study Resource Was: Case: San Miguel in The New MillenniumDocument2 pagesThis Study Resource Was: Case: San Miguel in The New MillenniumBaby BabeNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GST invoice summary reportDocument28 pagesGST invoice summary reportHarinath HnNo ratings yet

- Invoice DocumentDocument1 pageInvoice DocumentAman SharmaNo ratings yet

- OECD Economic Outlook - June 2023Document253 pagesOECD Economic Outlook - June 2023Sanjaya AriyawansaNo ratings yet

- Reconstitution: Russell 3000 Index - AdditionsDocument10 pagesReconstitution: Russell 3000 Index - AdditionsepbeaverNo ratings yet

- Level of Financial Literacy (HUMSS 4, Macrohon Group)Document37 pagesLevel of Financial Literacy (HUMSS 4, Macrohon Group)Charyl MorenoNo ratings yet

- Definition of A ChequeDocument2 pagesDefinition of A Chequeashutoshkumar31311No ratings yet

- A Closed-Form GARCH Option Pricing ModelDocument34 pagesA Closed-Form GARCH Option Pricing ModelBhuwanNo ratings yet

- Saka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFDocument18 pagesSaka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFAnurag RayNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Special Intake For 2022 Elite Lite Activity Bonus W.E.F. 1 Oct 2022Document5 pagesSpecial Intake For 2022 Elite Lite Activity Bonus W.E.F. 1 Oct 2022Kanaka DhasheneNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)