Professional Documents

Culture Documents

Form 16

Uploaded by

robin0903Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16

Uploaded by

robin0903Copyright:

Available Formats

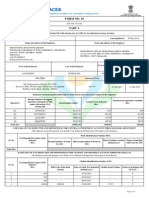

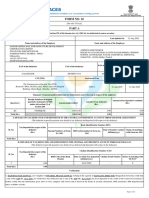

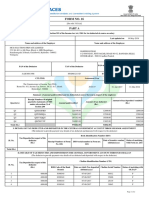

FORM NO.

16

[ See rule 31(1) (a) ] " ORIGINAL "

Certificate under section 203 of the Income-tax Act, 1961

for tax deducted at source from income chargeable under the head "Salaries"

Name and address of the employer Name and designation of the Employee

Reliance Infrastructure Limited Mr/Ms: Sh. ARVIND P RAI

Reliance Energy Centre,

Desig.: SR. EXECUTIVE

Santacruz (East),Mumbai400055

Emp #: 40012639

Maharashtra Loc : B044-NZ-BORIVALI REC STN(T)

PAN/GIR NO. of the Deductor TAN No. of the Deductor PAN/GIR No. of the Employee

AACCR7446Q MUMR16295G ADKPR9199J

Acknowledgement Nos. of all quarterly statements of TDS under

sub-section(3) of section 200 as provided by TIN facilitation Centre Period Assessment year

or NSDL web-site

Quarter Acknowledgement No. From To

1 (April-June) 060640200183581

01.04.2008 31.03.2009 2009- 2010

2 (July-September) 060640200192305

3 (October-December) 060640300114122

4 (January-March) YET TO BE FURNISHED

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

Particulars Rs. Rs. Rs.

1. Gross salary

a) Salary as per provisions contained in sec.17(1) 419471.84

b) Value of perquisites under section 17(2)

( as per Form No.12BA wherever applicable ) 0.00

c) Profits in lieu of salary under section 17(3)

( as per Form No.12BA wherever applicable ) 0.00

d) Total 419471.84

2. Less: Allowance to the extent exempt under section 10 9571.43

3. Balance(1-2) 409900.41

4. DEDUCTIONS:

(a) Entertainment allowance 0.00

(b) Tax on Employment 2500.00

5. Aggregate of 4(a) and (b) 2500.00

6. INCOME CHARGEABLE UNDER THE HEAD "SALARIES"(3-5) 407400.41

7. Add: Any other Income reported by the employee 0.00

8. GROSS TOTAL INCOME(6+7) 407400.41

9. DEDUCTIONS UNDER CHAPTER VI-A Gross Amount Deductible Amount

A) sections 80C, 80CCC and 80CCD

a) section 80C

i) Employee Provident Fund 31774.00

ii) Payment towards Life Insurance Policy 27816.00

iii) Subscription to notified mutual fund 20000.00 79590.00 79590.00

(b) section 80CCC 0.00 0.00

(c) section 80CCD 0.00 0.00

Note : 1. aggregate amount deductible under section 80C shall not exceed

one lakh rupees

2. aggregate amount deductible under the three sections i.e 80C,

80CCC and 80CCD shall not exceed one lakh rupees

B) other sections (for e.g. 80E, 80G etc.) under chapter VIA

10. Aggregate of deductible amounts under Chapter VI-A 79590.00

11. Total Income(8-10) 327810.00

12. Tax on total income 20562.00

13. Surcharge ( on tax computed at S.No. 12 ) 0.00

40012639 Sh. ARVIND P RAI

14. Education Cess ( On tax at S.No 12 and surcharge at S. No. 13) 617.00

15. Tax payable (12+13+14) 21179.00

0.00

16. Relief under sec 89(attach details)

21179.00

17. Tax Payable (15-16)

18. Less: a) Tax deducted at source u/s 192(1) 21179.00

b) Tax paid by the employer on behalf of the employee

u/s 192(1A) on perquisites u/s 17(2) 0.00

c) Tax Deducted by previous employer 0.00

(Corresponding income has been included in the gross salary)

d) Total tax deducted 21179.00

19. Tax payable/refundable(17-18) 0.00

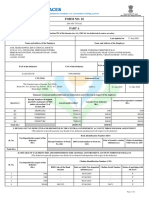

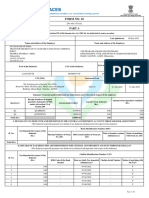

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

(The Employer is to provide transaction-wise details of tax deducted and deposited)

Education Total Tax BSR Code Date on Transfer No

TDS Surcharge Cess deposited Cheque/DD.No. if of Bank which tax voucher/challan

Sl no. Rs. Rs. Branch deposited Identification no.

Rs. Rs. any

(dd/mm/yy)

001 ¤0 ¤0 ¤0 ¤0 00000000000000 6390340 07.05.2008 01727

002 ¤0 ¤0 ¤0 ¤0 00000000000000 6390340 07.06.2008 00340

003 ¤180.59 ¤0 ¤5.41 ¤186 00000000036700 6390400 07.07.2008 00260

004 ¤180.58 ¤0 ¤5.42 ¤186 00000000000000 6390340 07.08.2008 00162

005 ¤180.59 ¤0 ¤5.41 ¤186 00000000000000 6390340 05.09.2008 00527

006 ¤229.05 ¤0 ¤6.95 ¤236 00000000000000 6390340 07.10.2008 00557

007 ¤567.06 ¤0 ¤16.94 ¤584 00000000000000 6390340 06.11.2008 00672

008 ¤567.06 ¤0 ¤16.94 ¤584 00000000000000 6390340 05.12.2008 01977

009 ¤611.51 ¤0 ¤18.49 ¤630 00000000000000 6390340 07.01.2009 00146

010 ¤5247.42 ¤0 ¤157.58 ¤5405 00000000000000 6390340 06.02.2009 05446

011 ¤6236.04 ¤0 ¤186.96 ¤6423 00000000000000 6390340 07.03.2009 02504

012 ¤6561.99 ¤0 ¤197.01 ¤6759 00000000000000 6390340 06.04.2009 07429

I MADHUKAR MOOLWANEY son/daughter of K.G.MOOLWANEY working in the capacity of SR EX VICE PRESIDENT do hereby certify that

a sum of Rs 21,179 [ Rupees TWENTY ONE THOUSAND ONE HUNDRED SEVENTY NINE Rupees ( in words ) ]

has been deducted at source and paid to the credit of the Central Government. I further certify that the information given

above is true and correct based on the book of accounts , documents and other available records.

MADHUKAR Digitally signed by MADHUKAR MOOLWANEY

DN: c=IN, o=mtnlTrustLine Enterprise Subscriber, ou=mtnlTrustLine, cn=MADHUKAR

MOOLWANEY, serialNumber=00116243, email=madhukar.moolwaney@relianceada.com

MOOLWANEY Reason: I attest to the accuracy and integrity of this document

Date: 2009.06.13 11:56:12 +05'30'

Signature of the person responsible for deduction of tax

For Reliance Infrastructure Limited

Date:30.04.2009 Full

MADHUKAR MOOLWANEY

Place:MUMBAI Name:

Designation:SR EX VICE PRESIDENT

You might also like

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Biapg2824f - Partb - 2019-20 Sameer PDFDocument3 pagesBiapg2824f - Partb - 2019-20 Sameer PDFGanesh LohakareNo ratings yet

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CANo ratings yet

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocument2 pagesEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Form 16 2020 21Document6 pagesForm 16 2020 21Manoj MahimkarNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 16 SV PDFDocument2 pagesForm 16 SV PDFPravin HireNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Salary SlipDocument1 pageSalary SlipAnkit SinghNo ratings yet

- Form PDFDocument2 pagesForm PDFSuresh DoosaNo ratings yet

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978No ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNo ratings yet

- Form 16 20-21Document2 pagesForm 16 20-21Mohammad AliNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- UnknownDocument1 pageUnknownBSNL BBOVERWIFINo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Indiabulls Securities LimitedDocument1 pageIndiabulls Securities Limitedraj200224No ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- Ahhpt7531m 2020-21 PDFDocument2 pagesAhhpt7531m 2020-21 PDFAshish BhartiNo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

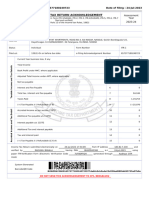

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- PYKRP16676330000010193 NewDocument2 pagesPYKRP16676330000010193 NewGagan SwainNo ratings yet

- Pay Slip BSNLDocument1 pagePay Slip BSNLJohn FernendiceNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- UnknownDocument1 pageUnknownAnji BaduguNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Arun Kumar Salary 2019-10Document1 pageArun Kumar Salary 2019-10Rizwan AhmadNo ratings yet

- Government of Telangana: PAYSLIP:-DEC-2020Document2 pagesGovernment of Telangana: PAYSLIP:-DEC-2020Raghavendra BiduruNo ratings yet

- Payslip SepDocument1 pagePayslip SepBrajesh PandeyNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Components Value Qty Digikey Part Number Description: RR12P560DCT-ND RR12P1.0KDCT-NDDocument1 pageComponents Value Qty Digikey Part Number Description: RR12P560DCT-ND RR12P1.0KDCT-NDrobin0903No ratings yet

- Specification For HV CapacitorDocument5 pagesSpecification For HV Capacitorrobin0903No ratings yet

- Transformer Oil 1Document57 pagesTransformer Oil 1robin0903No ratings yet

- DS1305 - RTCCDocument22 pagesDS1305 - RTCCAnca Daniela TeodorescuNo ratings yet

- F07 Comparison C62vsC57.93Document4 pagesF07 Comparison C62vsC57.93robin0903No ratings yet

- Specification of Timer Interval Meter: Make ModelDocument1 pageSpecification of Timer Interval Meter: Make Modelrobin0903No ratings yet

- Transformer Acceptable Test ValueDocument15 pagesTransformer Acceptable Test Valuerobin0903No ratings yet

- XQ 2Document2 pagesXQ 2robin0903No ratings yet

- FHHHHH TRRRRRRRRRRRR GFGFDocument1 pageFHHHHH TRRRRRRRRRRRR GFGFrobin0903No ratings yet

- Year Amount of Deposit Previous Balance InterestDocument3 pagesYear Amount of Deposit Previous Balance Interestrobin0903No ratings yet

- Parameter Old Secure New SecureDocument2 pagesParameter Old Secure New Securerobin0903No ratings yet

- Status IPDocument1 pageStatus IProbin0903No ratings yet

- 1065Document11 pages1065robin0903No ratings yet

- XQ 2Document2 pagesXQ 2robin0903No ratings yet

- 23Document1 page23robin0903No ratings yet

- XQ 2Document2 pagesXQ 2robin0903No ratings yet

- XQ 2Document2 pagesXQ 2robin0903No ratings yet

- XQ 1Document2 pagesXQ 1robin0903No ratings yet

- XQ 2Document2 pagesXQ 2robin0903No ratings yet

- FHHHHHDocument2 pagesFHHHHHrobin0903No ratings yet

- Xo 21Document2 pagesXo 21robin0903No ratings yet

- XQ 2Document2 pagesXQ 2robin0903No ratings yet

- FHHHHHDocument2 pagesFHHHHHrobin0903No ratings yet

- Serial NoDocument1 pageSerial Norobin0903No ratings yet

- Serial NoDocument1 pageSerial Norobin0903No ratings yet

- 1Document72 pages1robin0903No ratings yet

- Income Tax CalculatorDocument3 pagesIncome Tax Calculatorrobin0903No ratings yet

- Emi Calculator 08Document2 pagesEmi Calculator 08Zeeshan AnwarNo ratings yet

- 78Document2 pages78robin0903No ratings yet

- Table of The Student's T-DistributionDocument1 pageTable of The Student's T-Distributionrobin0903No ratings yet

- Starbucks Strategy: Strengths Weaknesses Opportunities Threats Issues and Recommendations Facing StarbucksDocument12 pagesStarbucks Strategy: Strengths Weaknesses Opportunities Threats Issues and Recommendations Facing Starbucksrahulindo50% (2)

- Determinants of Career Change of Overseas Filipino Professionals in The Middle EastDocument14 pagesDeterminants of Career Change of Overseas Filipino Professionals in The Middle EastLee Hock SengNo ratings yet

- 施工设计服务合同 Construction Design ContractDocument7 pages施工设计服务合同 Construction Design ContractRebi HamzaNo ratings yet

- A Tale of Two CulturesDocument1 pageA Tale of Two CulturesLenny Ariani Kusuma NingrumNo ratings yet

- Trends in HR Post Covid-19: Made By-Abhay Tiwari Akash Yadav Supriya Prajapati Shivam PalDocument17 pagesTrends in HR Post Covid-19: Made By-Abhay Tiwari Akash Yadav Supriya Prajapati Shivam PalAkash yadavNo ratings yet

- Subject Areas For Transactional Business Intelligence in HCMDocument396 pagesSubject Areas For Transactional Business Intelligence in HCMPankaj SharmaNo ratings yet

- Performance Based PayDocument22 pagesPerformance Based PaySonam GondlekarNo ratings yet

- Labour Dissonance at Maruti Suzuki India LimitedDocument4 pagesLabour Dissonance at Maruti Suzuki India LimitedSantoshi SravanyaNo ratings yet

- Staff Summary For CR Services (v15)Document12 pagesStaff Summary For CR Services (v15)Nate BoroyanNo ratings yet

- Jollibee Food Corporation RRLDocument10 pagesJollibee Food Corporation RRLAui Pau100% (1)

- Cambridge International As and A Level Business Studies Revision GuideDocument217 pagesCambridge International As and A Level Business Studies Revision GuideAlyan Hanif92% (12)

- Tenant Application Form - Sep 11Document2 pagesTenant Application Form - Sep 11applecoffeeNo ratings yet

- NRSP Case StudyDocument44 pagesNRSP Case StudyhumaNo ratings yet

- Airtel CocDocument20 pagesAirtel CocAsim KhanNo ratings yet

- Sustainable Development of Srilanka Through A Harbor: Sri Lanka Institute of MarketingDocument35 pagesSustainable Development of Srilanka Through A Harbor: Sri Lanka Institute of MarketingMuhammed RasidNo ratings yet

- Locsin vs. PLDTDocument22 pagesLocsin vs. PLDTKeith BalbinNo ratings yet

- Tax Deducted On Source Under Income Tax Act, 1961Document71 pagesTax Deducted On Source Under Income Tax Act, 1961Arnav100% (1)

- Case Studies Unit 1 & 2 Business StudiesDocument30 pagesCase Studies Unit 1 & 2 Business StudiesSomanya Kaur100% (5)

- Martos Et Al. vs. New San Jose Builders, Inc.Document2 pagesMartos Et Al. vs. New San Jose Builders, Inc.Joseph MacalintalNo ratings yet

- MSBP LogbookcDocument8 pagesMSBP LogbookcAnh Nguyen Le MinhNo ratings yet

- Assessment Templates BSBPMG522 Undertake Project Work: Student's DeclarationDocument14 pagesAssessment Templates BSBPMG522 Undertake Project Work: Student's DeclarationMiguel MolinaNo ratings yet

- Accident Investigation FormDocument4 pagesAccident Investigation FormRameish Rao Subarmaniyan100% (1)

- 247 Shell Oil Workers Union v. Shell Oil CompanyDocument2 pages247 Shell Oil Workers Union v. Shell Oil CompanyKelsey Olivar Mendoza100% (1)

- Swan Mundaring Reform Project Management Plan LGNSW Amalgamation ToolkitDocument140 pagesSwan Mundaring Reform Project Management Plan LGNSW Amalgamation ToolkitSyed Mujahid AliNo ratings yet

- Conceptual BlocksDocument11 pagesConceptual Blocksapi-298975236100% (3)

- Astm A 10.3Document16 pagesAstm A 10.3edu_caneteNo ratings yet

- Organizational Changes and Job Satisfaction Among Support StaffDocument38 pagesOrganizational Changes and Job Satisfaction Among Support Staffsu hnin aungNo ratings yet

- ECSR - D - Group 9Document10 pagesECSR - D - Group 9sheetal mehtaNo ratings yet

- Collaborative Problem Solving - Creativity Problem Definition Exp PieDocument24 pagesCollaborative Problem Solving - Creativity Problem Definition Exp PieEDISON ALARCONNo ratings yet

- ICLG - Cartels & Leniency 2015Document9 pagesICLG - Cartels & Leniency 2015LabodeAdegokeNo ratings yet