Professional Documents

Culture Documents

STL 30.09 2010

Uploaded by

Amol Patil0 ratings0% found this document useful (0 votes)

10 views1 pageUN-AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30-09-2010 (Rs. In Lakhs) Sl. No. Particulars Income a. Net Sales / Income from Operations b. Other Operating Income c. Total Expenditure a. (Increase) / Decrease in Stock in Trade and Work in Progress b. Consumption of Raw Materials / Cost of Goods c. Employees Cost d. Dep

Original Description:

Original Title

STL-30.09-2010

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUN-AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30-09-2010 (Rs. In Lakhs) Sl. No. Particulars Income a. Net Sales / Income from Operations b. Other Operating Income c. Total Expenditure a. (Increase) / Decrease in Stock in Trade and Work in Progress b. Consumption of Raw Materials / Cost of Goods c. Employees Cost d. Dep

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageSTL 30.09 2010

Uploaded by

Amol PatilUN-AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30-09-2010 (Rs. In Lakhs) Sl. No. Particulars Income a. Net Sales / Income from Operations b. Other Operating Income c. Total Expenditure a. (Increase) / Decrease in Stock in Trade and Work in Progress b. Consumption of Raw Materials / Cost of Goods c. Employees Cost d. Dep

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

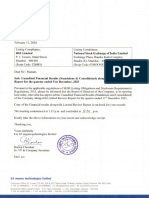

SUJANA TOWERS LIMITED

Regd. Office : Plot No.18, Nagarjuna Hills, Panjagutta, Hyderabad - 500 082.

UN-AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30-09-2010 Notes :

(Rs. in Lakhs) 1 To facilitate comparison, figures of the previous period have been re-arranged, whereever necessary.

3 months Correspon- Year to date Year to date Previous 2 As the Company’s Business Activity falls within a single primary business segment viz., “Power and Telecom Infrastructure”

ended ding figures for figures for accounting the disclosure requirement of Accounting Standard (AS) - 17 “Segment Reporting” as notified in section 211 (3C) of the

30.09.2010 3 months current previous year ended Companies Act, 1956 is not applicable to the Company.

Sl. Particulars

No. ended in the period year 30.09.2009 3 The number of investor complaints pending at the beginning of the quarter - 3, received during the quarter - 6 and disposed off

previous ended ended during the quarter - 9 and lying unresolved at the end of the quarter - Nil.

year 30.09.2010 30.09.2009 4 The above un-audited financial results were reviewed by the Audit Committee and approved by the Board of Directors at their

30.09.2009 meeting held on 11.11.2010.

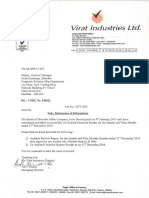

Un-audited Un-audited Un-audited Audited Audited 5 The Company has four subsidiaries viz., (1) M/s Telesuprecon Limited, Mauritius, (2) M/s Digitech Business Systems Limited,

Hong Kong (3) M/s Sujana Transmissions Limited, Hyderabad, India and (4) M/s STL Africa Limited, Mauritius, out of which

1. Income

the operations of M/s Sujana Transmissions Limited and are yet to be commenced. The following consolidated figures include

a. Net Sales/ Income from Operations 30,624.01 23,939.79 1,00,644.50 69,886.15 69,886.15 the figures of the subsidiaries, which are not reviewed by the auditors of the Company.

b. Other Operating Income 96.90 (58.11) 183.90 226.87 226.87

c. Total 30,720.92 23,881.68 100,828.40 70,113.02 70,113.02

a) Turn Over (Rs. in Lacs) 34,807.89

2. Expenditure

a. (Increase)/Decrease in Stock in Trade and (2,029.27) (101.03) (2,454.41) 2,674.57 2,674.57 b) Net Profit after Tax (Rs. in Lacs) 3,422.93

Work in Progress c) Earnings Per Share

b. Consumption of Raw Materials/Cost of Goods 24,565.43 19,534.11 82,987.09 54,762.62 54,762.62

- Basic (in Rs.) 3.79

c. Employees Cost 193.23 136.68 708.41 626.56 626.56

d. Depreciation 448.22 346.38 1,633.90 1,343.89 1,343.89 - Diluted (in Rs.) 3.30

e. Other Expenditure 1,744.78 606.95 5,181.15 2,703.96 2,703.96

f. Total 24,922.39 20,523.09 88,056.14 62,111.60 62,111.60

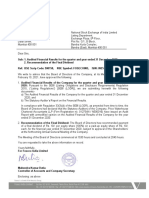

3. Profit from Operations Before Other Income, 5,798.53 3,358.59 12,772.26 8,001.42 8,001.42 STATEMENT OF ASSETS AND LIABILITIES AS AT THE END OF HALF YEAR

Interest & Exceptional Items (1-2) 30-09-2010 (STAND ALONE)

4. Other Income - - 46.21 - - (Rs. in Lakhs)

5. Profit Before Interest & Exceptional Items (3+4) 5,798.53 3,358.59 12,818.47 8,001.42 8,001.42

6. Interest 1,719.76 801.70 5,164.60 3,066.41 3,066.41 12 months ended Corresponding 12 months

Particulars 30-09-2010 ended in the previous year

7. Profit After Interest But Before Exceptional 4,078.77 2,556.89 7,653.87 4,935.01 4,935.01

30-09-2009

Items (5-6)

8. Exceptional Items - - - - - Un-audited Audited

9. Profit (+)/ Loss(-) from Ordinary Activities Before 4,078.77 2,556.89 7,653.87 4,935.01 4,935.01

Tax (7+8) Shareholder’s Funds

10. Tax Expenses 1,359.79 906.66 2,588.96 1,736.68 1,736.68

(a) Capital 4,813.29 2,368.44

11. Net Profit (+)/Loss from Ordinary Activities 2,718.98 1,650.23 5,064.91 3,198.33 3,198.33

After Tax (9-10) (b) Reserves and Surplus 62,881.50 32,183.24

12. Extraordinary Item (Net of Tax Expenses) - - - - - Loan Funds 46,398.83 27,727.84

13. Net Profit(+)/Loss(-) for the Year/Period (11-12) 2,718.98 1,650.23 5,064.91 3,198.33 3,198.33

Total 1,14,093.61 62,279.52

14. Paid-up Equity Share Capital 4,516.49 2,071.65 4,516.49 2,071.65 2,071.65

(Face Value of Rs.5/- each) FixedAssets 33,372.87 33,870.62

15. Reserves excluding Revaluation Reserves 52,512.14 27,355.35 55,512.14 27,355.35 27,355.35 Investments 7.16 7.16

as per balance sheet of previous accounting Period Current Assets, Loans andadvances

16. Earnings Per Share (EPS)

(a) Inventories 6,638.99 3,622.75

a. Basic and Diluted* EPS before Extraordinary 3.01 3.98 5.61 3.73 7.70

Items for the period, for the year to date and 2.62* 3.98* 4.88* 3.73* 7.70* (b) Sundry Debtors 55,163.53 15,862.46

for the previous year (not to be annualised) (c) Cash and Bank balances 15,346.15 1,850.22

b. Basic and Diluted* EPS after Extraordinary 3.01 3.98 5.61 3.73 7.70

(d) Other current assets 9,269.36 -

Items for the period, for the year to date and 2.62* 3.98* 4.88* 3.73* 7.70*

for the previous year (not to be annualised) (e) Loans and Advances 13,577.88 10,806.08

17. Public Shareholding Less : Current Liabilities and Provisions

- Number of Shares 5,52,89,566 2,73,91,155 5,52,89,566 2,73,91,155 2,73,91,155 (a) Liabilities 15,738.17 2,524.36

- Percentage of Share Holding 61.21 66.11 61.21 66.11 66.11

(b) Provisions 3,544.15 1,215.41

18. Promoters and Promoter Group Shareholding **

a) Pledged / Encumbered Total 1,14,093.61 62,279.52

- Number of shares 87,48,815 1,291,000 87,48,815 12,91,000 12,91,000 Miscellaneous Expenditure (Not Written Off or Adjusted) - -

- Percentage of shares (as a % of the total 24.97 9.19 24.97 9.19 9.19 Profit and Loss Account - -

shareholding of promoter and promoter group)

- Percentage of shares (as a % of the total 9.69 3.12 9.69 3.12 3.12

share capital of the Company)

b) Non - encumbered

- Number of shares 2,62,91,465 1,27,50,880 2,62,91,465 1,27,50,880 1,27,50,880 By Order of the Board

- Percentage of shares (as a % of the total 75.03 90.81 75.03 90.81 90.81 For SUJANA TOWERS LIMITED

shareholding of the Promoter and

Sd/-

Promoter group)

- Percentage of shares (as a % of the total 29.11 30.77 29.11 30.77 30.77

Place : Hyderabad Y. KAMESH

share capital of the company) Date : 11.11.2010 MANAGING DIRECTOR

You might also like

- Digitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Document5 pagesDigitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Mahesh hamneNo ratings yet

- August 11, 2023: 153/LG/SE/AUG/2023/GBSLDocument8 pagesAugust 11, 2023: 153/LG/SE/AUG/2023/GBSLmd zafarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- CLOUD 10102023160435 BMOutcomeCloudRevised-1Document7 pagesCLOUD 10102023160435 BMOutcomeCloudRevised-1pallabbasakNo ratings yet

- Published Result Q-1-10 PrintDocument1 pagePublished Result Q-1-10 Prints natarajanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 63 Moon Q3 ResultsDocument16 pages63 Moon Q3 Resultsdownloads.xaNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Latest Financials - DR Agarwals May 2022Document11 pagesLatest Financials - DR Agarwals May 2022Mr SmartNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- OutcomeofBoardMeeting 1Document14 pagesOutcomeofBoardMeeting 1abhishektheoneNo ratings yet

- 91invuf 2Document1 page91invuf 2Mahamadali DesaiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Reg30LODR QFR LRReport 31dec2020 WebsiteDocument15 pagesReg30LODR QFR LRReport 31dec2020 WebsiteAnveshNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Results Trident16446Document6 pagesResults Trident16446mohitNo ratings yet

- Scrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Document3 pagesScrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Amruta TarmaleNo ratings yet

- Rl1Chfilzri (Indlll) LTDDocument4 pagesRl1Chfilzri (Indlll) LTDJigneshNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Balaji Published Results 28-102010Document2 pagesBalaji Published Results 28-102010Saurabh YadavNo ratings yet

- Unaudited Quarterly Results Alok IndustriesDocument2 pagesUnaudited Quarterly Results Alok IndustriesAbhijeet PimpalgaonkarNo ratings yet

- Jamna Auto Industries Limited Unaudited ResultsDocument4 pagesJamna Auto Industries Limited Unaudited ResultspoloNo ratings yet

- Financial Results Latl 30062022Document8 pagesFinancial Results Latl 30062022gyani1982No ratings yet

- JBIL Reports Q3 FY23 ResultsDocument10 pagesJBIL Reports Q3 FY23 ResultsRaghav HNo ratings yet

- Mahindra & Mahindra Limited: Rs. in CroresDocument4 pagesMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuNo ratings yet

- Bannari Amman Spinning Mills LimitedDocument20 pagesBannari Amman Spinning Mills LimitedVT GNo ratings yet

- Mahindra Towers, Dr. G. M. Bhosale Marg, Worli, Mumbai 400 018 India Tel: +91 22 24901441 Fax: +91 22 24975081Document22 pagesMahindra Towers, Dr. G. M. Bhosale Marg, Worli, Mumbai 400 018 India Tel: +91 22 24901441 Fax: +91 22 24975081Mannu SinghNo ratings yet

- JM Financial: L Indi N L 1 LDocument9 pagesJM Financial: L Indi N L 1 LPiyush LuthraNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathoreNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Cost Records & Annexures Landcraft 19-20Document11 pagesCost Records & Annexures Landcraft 19-20shitanshuNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Lnril: Fort - of Held 11 ToDocument11 pagesLnril: Fort - of Held 11 Tomd zafarNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Gujarat State Petronet LTD.: (Standalone & Consolidated) Along With The Limited Review Reports Is Enclosed HerewithDocument20 pagesGujarat State Petronet LTD.: (Standalone & Consolidated) Along With The Limited Review Reports Is Enclosed HerewithGhano GhayalNo ratings yet

- Audited Financial Results For The Quarter and Year Ended 31st March, 2021Document21 pagesAudited Financial Results For The Quarter and Year Ended 31st March, 2021Vilas ShahNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results Q1 August 2018Document13 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- Half Year Financial Results 30 Sept 2022Document11 pagesHalf Year Financial Results 30 Sept 2022Ashwin staffNo ratings yet

- Revised Standalone Financial Results For December 31, 2016 (Result)Document4 pagesRevised Standalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q1FY22Document8 pagesQ1FY22Anjalidevi TNo ratings yet

- RavalgaonresultsadDocument1 pageRavalgaonresultsadvahora123No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Result Sep, 17Document4 pagesStandalone Result Sep, 17Varun SidanaNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- ParallelAccounting SAP ERPDocument48 pagesParallelAccounting SAP ERPradmilhfNo ratings yet

- Accounting Level-3/Series 2-2004 (Code 3001)Document20 pagesAccounting Level-3/Series 2-2004 (Code 3001)Hein Linn KyawNo ratings yet

- On IFRS, US GAAP and Indian GAAPDocument64 pagesOn IFRS, US GAAP and Indian GAAPrishipath100% (1)

- Example of The Statement of EquityDocument2 pagesExample of The Statement of EquityLaston MilanziNo ratings yet

- 1 Discuss Briefly About Fair Value Measurement and ImpairmentDocument13 pages1 Discuss Briefly About Fair Value Measurement and ImpairmentBosena TadegeNo ratings yet

- Comprehensive Problem - PROBLEM NO.3Document2 pagesComprehensive Problem - PROBLEM NO.3Rosalie Colarte LangbayNo ratings yet

- Lbo Case StudyDocument6 pagesLbo Case StudyRishabh MishraNo ratings yet

- IA1 Goodwill ProblemSolvingDocument3 pagesIA1 Goodwill ProblemSolvingSheila Grace BajaNo ratings yet

- Joseph L. Rice LP Announcement LetterDocument1 pageJoseph L. Rice LP Announcement LetterDealBookNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution ManualDocument9 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution Manualbeatrice100% (23)

- IFRS Framework and StandardsDocument63 pagesIFRS Framework and StandardsLoki LukeNo ratings yet

- Financial Accounting A Managerial PerspectiveDocument3 pagesFinancial Accounting A Managerial PerspectiveBir TajpuriyaNo ratings yet

- Kertas Kerja - UTSDocument10 pagesKertas Kerja - UTSAlviana RenoNo ratings yet

- VC Problem Set SolutionsDocument3 pagesVC Problem Set SolutionsJerry Chang0% (1)

- A Guide To Understanding The 10 Fundamental Accounting PrinciplesDocument6 pagesA Guide To Understanding The 10 Fundamental Accounting PrinciplesEng. NKURUNZIZA ApollinaireNo ratings yet

- WT Stock ValuationDocument9 pagesWT Stock ValuationMuhammadWaseemNo ratings yet

- Intermediate Accounting 1 NotesDocument18 pagesIntermediate Accounting 1 NotesLyka EstradaNo ratings yet

- Understanding The Balance SheetDocument38 pagesUnderstanding The Balance Sheetravisankar100% (1)

- Neith: Trial Balance at 31 March 2020 Dr. CRDocument42 pagesNeith: Trial Balance at 31 March 2020 Dr. CRabdulhadisaqib290No ratings yet

- T1-FRM-4-Ch4-Transfer-Mech-v3.1 - Study NotesDocument16 pagesT1-FRM-4-Ch4-Transfer-Mech-v3.1 - Study NotescristianoNo ratings yet

- Module 3 - Overhead Allocation and ApportionmentDocument55 pagesModule 3 - Overhead Allocation and Apportionmentkaizen4apexNo ratings yet

- Learning Journal Unit 2 BUS 4404Document2 pagesLearning Journal Unit 2 BUS 4404Martina MakotaNo ratings yet

- EY Xyz Holdings Singapore Limited 2014 PDFDocument234 pagesEY Xyz Holdings Singapore Limited 2014 PDFMildred PagsNo ratings yet

- Bsa Department: Philippine School of Business Administration-ManilaDocument8 pagesBsa Department: Philippine School of Business Administration-ManilaKendrew SujideNo ratings yet

- Бүлгийн сорил - Капиталын оновчтой бүтэц - Attempt reviewDocument14 pagesБүлгийн сорил - Капиталын оновчтой бүтэц - Attempt reviewТэгшжаргал ХалиунNo ratings yet

- Accounting for Manufacturing Concerns: Calculating CostsDocument3 pagesAccounting for Manufacturing Concerns: Calculating CostsAhsan MemonNo ratings yet

- Test Bank For Community Health Nursing A Canadian Perspective 5th Edition Lynnette Leeseberg Stamler Lynnette Leeseberg Stamler Lucia Yiu Aliyah Dosani Josephine Etowa Cheryl Van Daalen SmithDocument86 pagesTest Bank For Community Health Nursing A Canadian Perspective 5th Edition Lynnette Leeseberg Stamler Lynnette Leeseberg Stamler Lucia Yiu Aliyah Dosani Josephine Etowa Cheryl Van Daalen SmithLinda Burnham100% (31)

- Full-2023-AGM-presentation-including-voting-results 1Document53 pagesFull-2023-AGM-presentation-including-voting-results 1Nərmin ƏliyevaNo ratings yet

- 0182 00057818 03Document11 pages0182 00057818 03Junaid MirNo ratings yet

- Assignment 2 Transactions To FS AnswerDocument24 pagesAssignment 2 Transactions To FS AnswerJorniNo ratings yet