Professional Documents

Culture Documents

146291372

Uploaded by

Adhita MeryantoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

146291372

Uploaded by

Adhita MeryantoCopyright:

Available Formats

USDA Foreign Agricultural Service

GAIN Report

Global Agriculture Information Network

Template Version 2.09

Required Report - public distribution

Date: 6/13/2007

GAIN Report Number: ID7019

ID7019

Indonesia

Bio-Fuels

Biofuels Annual 2007

2007

Approved by:

Elisa Wagner

U.S. Embassy, Jakarta

Prepared by:

Aji K. Bromokusumo

Report Highlights:

Biofuel production is expected to increase as new plants being built begin production.

However, domestic consumption will be limited by a decrease in the mixture of biofuel with

gasoline and diesel, increasing the amount of exports. Government efforts to foster a biofuel

industry have seen greater success with encouraging production, but feedstock availability is

not growing as quickly.

Includes PSD Changes: Yes

Includes Trade Matrix: No

Annual Report

Jakarta [ID1]

[ID]

GAIN Report - ID7019 Page 2 of 7

Table of Contents

Executive Summary ............................................................................................. 3

Production .......................................................................................................... 3

Biodiesel Production:............................................................................................ 3

Ethanol Production: ............................................................................................. 4

Planned Production: ............................................................................................. 4

Consumption....................................................................................................... 4

Trade.................................................................................................................. 5

Policy ................................................................................................................. 5

PSD Table ........................................................................................................... 7

Quantity of Feedstock........................................................................................... 7

Biofuels Production .............................................................................................. 7

UNCLASSIFIED USDA Foreign Agricultural Service

GAIN Report - ID7019 Page 3 of 7

Executive Summary

Biofuel is currently sold by Pertamina, the government-owned oil and gas company that until

recently had a monopoly on retail sales of gas and diesel for transportation use. Pertamina’s

gasoline and ethanol mix includes 5 percent ethanol, which is sold in 2 retail stations, one in

Jakarta and one in eastern Java. Pertamina’s diesel and biodiesel mix includes 5 percent

biodiesel, which is sold in over 220 stations, mostly in Jakarta. However, Pertamina

announced it will decrease the biodiesel in its diesel blend to 2.5 percent following the

decline in fossil fuel prices and the increase in crude palm oil prices, while the ethanol

concentration will be decreased to 3 percent.

There are two main issues facing the Indonesian biofuel industry, the cost of producing

biofuel versus the cost of fossil fuels and the competition for feedstock for fuel and food use.

Indonesia has the potential to become a major producer of biofuel. However, there are

challenges that the government must address before large scale production can occur.

National policy encourages biofuel processing and there have been many announced plans to

build processing plants. Preparations for increased processing without an accompanying

increase in input availability for at least the short term is creating competition between food

and fuel use for feedstock.

Indonesia produces crude palm oil and molasses, which are the primary feedstock used in

Indonesian biofuel production. Jatropha and cassava are seriously being considered by

Indonesian government officials because of the potential to offer employment in poorer areas

not easily served by electricity and because there would be no competition between biofuel

and food.

Production

In 2006, there were 2 biodiesel plants and 2 ethanol plants in production. By the end of

2007, FAS/Jakarta estimates there will be a total of 9 biodiesel plants and 4 ethanol plants in

production. As a result, biofuel production will increase to 755,000 MT. By the end of 2009,

annual biodiesel production could reach 1,000,000 MT and annual ethanol production should

reach 390,000 MT. Production capacity will be higher, but the availability of feedstock will be

a limiting factor. If available feedstock continues to be a problem or if export markets do not

grow, then some producers may choose to halt plans to build production facilities.

Biodiesel Production:

Total production of biodiesel will reach 675,000 MT in 2007, though production capacity is

higher. The raw material used most often to produce biodiesel in Indonesia is crude palm oil

(CPO) because of the well established CPO industry and potential for the increase in

production. Since Pertamina will decrease the biodiesel content by half, production will not

reach full potential and exports are expected to grow. An increase in exports can already be

seen because of more favorable prices in the international market. By law, Pertamina cannot

pay more for its biodiesel than the international market price in Singapore. Estimates are

that CPO would need to be closer to prices seen last year for a 5 percent mix to be cost

competitive with fossil fuels.

Another potential feedstock is jatropha. It is still in the very early stage of development and

currently there are concerns that it is not feasible for large-scale production. At least 2

companies are making serious preparations to use jatropha as a feedstock. Though using

jatropha would remove the conflict between food and fuel, jatropha is more labor-intensive

and produces less oil than CPO. At this time, Indonesian government efforts appear to be

focused on using jatropha in villages where electricity is not cost-effective.

UNCLASSIFIED USDA Foreign Agricultural Service

GAIN Report - ID7019 Page 4 of 7

Oil per hectare

Plants Kilogram Liter

Oil palm 5,000 5,950

Coconut 2,260 2,689

Jatropha 1,590 1,892

Rapeseed 1,000 1,190

Peanuts 890 1,059

Sunflowers 800 952

Soybean 375 446

Corn (maize) 145 172

Source: National Seminar Biofuel, Department of Energy and Mineral Resource, Republic of

Indonesia, May 05, 2006

Ethanol Production:

There are two bio-ethanol factories in Indonesia and both use molasses as raw material.

Indonesian molasses is preferred because of its high sugar content. Most sugar mills in

Indonesia are less-efficient state-owned enterprises and many still use Dutch colonial

technology. Though corn has higher yield per hectare, it is too expensive to make production

cost effective.

Ethanol producers face several challenges, one of which is disposing liquid waste. Another is

that alcohol is strictly prohibited in Indonesia for religious reasons, so sales of ethanol are

heavily regulated with high tariffs and taxes.

Indonesian government officials and industry are also looking at cassava as a feedstock for

ethanol. Since molasses is also used to produce monosodium glutamate, cassava may be an

attractive alternative. At least 2 companies are currently making plans to use cassava as a

feedstock.

Currently in Indonesia, 1 ton of molasses yields about 250 liter and 1 ton of cassava yields

about 155 liter of anhydrous ethanol.

Planned Production:

At the beginning of 2007, 67 contracts committing to biofuel development were signed by

industry and government with an estimated investment value of $12.4 billion. However,

many of these announced plans are for companies with no experience in biofuel production

or a related business. In addition the higher price of inputs, the lower price of fossil fuel, and

the lack of significant growth in domestic consumption discourage further investment. The

incentives provided by the government include favorable interest rates for buying land, which

provides some businesses an opportunity to buy land at better than market rates.

Consumption

Indonesia’s interest in biofuel also comes from concern over a depletion of oil reserves and a

recent sharp increase in retail fuel prices. Government estimates show Indonesia’s oil

reserves being depleted in less than 20 years. Also, fuel was subsidized until last year by the

government. With a worldwide increase in fuel prices and the end of the government fuel

subsidy, retail prices for fuel sharply increased.

UNCLASSIFIED USDA Foreign Agricultural Service

GAIN Report - ID7019 Page 5 of 7

Pertamina is the only seller of biofuel for transportation at the retail level, so announced

plans to decrease the amount of biodiesel and ethanol used in its blends will have a direct

impact on domestic consumption.

Pertamina sells a mixture of 5 percent biodiesel with petroleum diesel in 210 petrol stations

in Jakarta and 12 petrol stations in Surabaya. Due to the high price of the raw materials,

such as CPO and methanol, Pertamina is reducing the biodiesel mixture to 2.5 percent.

Pertamina sells a mixture of 5 percent ethanol with gasoline in 1 petrol station in Malang,

East Java and 1 petrol station in Jakarta. Pertamina is also reducing the ethanol mixture to 3

percent.

Fuel Consumption 2006 (in Kiloliter)

Transportation Industry

Gasoline 17,000,000 35,000

Diesel 11,000,000 15,000,000

Source: Ministry of Energy and Mineral Resources

According to government plans, jatropha oil will largely be used to create villages that are

energy self-sufficient. The jatropha oil will substitute for kerosene, popularly used for stoves.

Plans are to create 1,000 self-sufficient energy villages utilizing 1 million kiloliters of jatropha

oil by 2010.

Trade

Indonesia exports biodiesel in the form of FAME (Fatty Acid Methyl Esther), which is to be

blended with diesel in the destination country. Most Indonesian exports of biodiesel are to

China and other Asian markets. There are also sales to the European Union and the United

States. Biodiesel sales to the European Union are limited because of concerns over the

freezing point of biodiesel from CPO. Ethanol sales to the United States are limited because

of competition with Brazil, which has an advantage due to lower freight costs.

Initial trade reports for 2007 indicate that Indonesian exports to China of CPO derivatives are

increasing. It is expected that the trend will continue. Recent pric e increases in Indonesia for

other CPO-derived products including cooking oil, have seen sharp increases, suggesting that

CPO supplies in Indonesia are under pressure. In addition, Malaysia and Indonesia are the

major suppliers of CPO to China. However, Indonesia is the producer that has the capability

to continue supplying the Chinese market at China’s current import levels.

The main export market for Indonesian ethanol is Japan. It is expected that the trend of

Indonesian ethanol replacing Brazilian product in this market will continue.

There are no specific harmonized tariff codes for biodiesel and ethanol. Therefore,

FAS/Jakarta assumes Indonesian biodiesel exports are under 1516.20, which is the best

category for FAME and other CPO-derivatives, and ethanol is under 2207.10, which includes

ethanol with 80 percent purity and higher.

Policy

Despite government allocations of $2.8 billion towards biofuel development, the five banks

appointed for the program have only realized about $310,000 in investment, despite an

interest rate subsidy of 5 percent.

UNCLASSIFIED USDA Foreign Agricultural Service

GAIN Report - ID7019 Page 6 of 7

Indonesia established a National Team for Biofuel Development, which has the goals of

alleviating poverty, create jobs, and encourage economic development. The national team is

an independent team that coordinates with government ministries, the private sector, and

non-governmental organizations to foster the development of biodiesel from CPO and

jatropha and ethanol from molasses and cassava.

The National Team of Biofuel Development 2010 targets are:

1. Create 3.5 millions jobs for the unemployed.

2. Increase income for on-farm and off-farm workers in biofuel sectors up to Regional

Minimum Wages levels.

3. Develop biofuel plantations on 5.25 million hectares land.

4. Create 1,000 self-sufficient energy villages and 12 special biofuel zones.

5. Reduce fossil fuels by at least 10 percent.

6. Save $10 billion in foreign exchange reserves.

7. Improve biofuel local demand and exports.

The Team is to develop 12 special biofuel zones in order to simplify the bureaucratic

requirements for biofuel investment:

1. Pacitan – Wonogiri – Wonosari (Central and East Java): cassava

2. Garut – Cianjur – South Sukabumi (West Java): cassava

3. Lebak – Pandeglang (West Java): jatropha

4. Lampung – South Sumatera – Jambi (southern part of Sumatera): cassava,

sugarcane, jatropha, oil palm

5. Riau (southern part of Sumatera): oil palm

6. Aceh (northern part of Sumatera): cassava, sugarcane, jatropha

7. East Kalimantan: jatropha, oil palm

8. Sulawesi: cassava, sugarcane, jatropha, oil palm

9. Nusa Tenggara: cassava, Jatropha curcas

10. North and West Papua: oil palm

11. Merauke – Mappi – Boven Digul – Tanah Merah (Papua island): cassava, sugarcane,

jatropha, oil palm

Local governments are also to develop feedstock potential appropriate to their area.

Note:

US$ 1 = Rp. 8,800 as of May 30, 2007.

Density biodiesel: 0.88 gr/c m3; bioethanol: 0.79 gr

/c m 3

1 MT of biodiesel = 1.136 Kiloliter

1 MT of ethanol = 1.267 Kiloliter

UNCLASSIFIED USDA Foreign Agricultural Service

GAIN Report - ID7019 Page 7 of 7

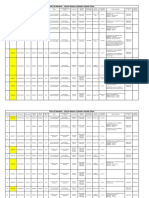

PSD Table

Quantity of Feedstock

Quantity of Feedstock Use In Biofuel Production

2003 2004 2005 2006 2007

Biodiesel (in MT)

Vegetable Oil

Soybean Oil 0 0 0 0 0

Rapeseed Oil 0 0 0 0 0

Palm Oil 11,500 14,000 15,400 15,900 17,100

Coconut Oil 0 0 0 0 0

Animal Fats 0 0 0 0 0

Recycled vegetable oil 0 0 0 0 0

Other 0 0 0 0 0

Ethanol

Corn 0 0 0 0 0

Wheat 0 0 0 0 0

Sugarcane 0 0 0 0 0

Sugar beet 0 0 0 0 0

Rye 0 0 0 0 0

Molasses 0 0 0 27,000 23,436

Wood 0 0 0 0 0

Cassava/tubers 0 0 0 0 0

Biofuels Production

Biofuel Production/Consumption/Trade (000 MT)

2003 2004 2005 2006 2007

Biodiesel

Beginning stocks 0 0 0 0 0

Production 0 0 8 70 675

Imports 0 0 0 0 0

Total supply 0 0 8 70 675

Exports 0 0 6 46 573

Consumption 0 0 2 24 102

Ending stocks 0 0 0 0 0

Ethanol

Beginning stocks 0 0 0 0 0

Production 0 0 0 36 100

Imports 0 0 0 0 0

Total supply 0 0 0 36 100

Exports 0 0 0 30 90

Consumption 0 0 0 6 10

Ending stocks 0 0 0 0 0

F:\Shared\Biofuels\Biofuels Annual 2007.doc

UNCLASSIFIED USDA Foreign Agricultural Service

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Japanese VocabDocument66 pagesJapanese Vocabapi-380898390% (10)

- Tae Kim - Japanese Grammar GuideDocument354 pagesTae Kim - Japanese Grammar GuideAcebo Clau100% (4)

- Top Malls in Chennai CityDocument8 pagesTop Malls in Chennai CityNavin ChandarNo ratings yet

- Quantification of Dell S Competitive AdvantageDocument3 pagesQuantification of Dell S Competitive AdvantageSandeep Yadav50% (2)

- Hexanitrostilbene: Hexanitrostilbene (HNS), Also Called JD-X, Is An Organic Compound With TheDocument7 pagesHexanitrostilbene: Hexanitrostilbene (HNS), Also Called JD-X, Is An Organic Compound With TheAdhita MeryantoNo ratings yet

- HMX - Powerful Nitroamine ExplosiveDocument21 pagesHMX - Powerful Nitroamine ExplosiveAdhita MeryantoNo ratings yet

- Percakapan Bhs Inggris 7 HRDocument18 pagesPercakapan Bhs Inggris 7 HRraden hilmi100% (1)

- PL2303 Windows Driver User Manual v1.9.0Document20 pagesPL2303 Windows Driver User Manual v1.9.0larry_macias_alvarezNo ratings yet

- Selection Method of Surfactants For Chemical Enhanced Oil RecoveryDocument8 pagesSelection Method of Surfactants For Chemical Enhanced Oil RecoveryAdhita MeryantoNo ratings yet

- PL2303 DriverInstallerv1.8.19 ReleaseNoteDocument4 pagesPL2303 DriverInstallerv1.8.19 ReleaseNoteOun GinsengNo ratings yet

- A Unified Formula For Determination of Wellhead Pressure and Bottom-Hole PressureDocument8 pagesA Unified Formula For Determination of Wellhead Pressure and Bottom-Hole PressureZarda Akramul ArbyNo ratings yet

- HMX - Powerful Nitroamine ExplosiveDocument21 pagesHMX - Powerful Nitroamine ExplosiveAdhita MeryantoNo ratings yet

- HMX - Powerful Nitroamine ExplosiveDocument21 pagesHMX - Powerful Nitroamine ExplosiveAdhita MeryantoNo ratings yet

- A Unified Formula For Determination of Wellhead Pressure and Bottom-Hole PressureDocument8 pagesA Unified Formula For Determination of Wellhead Pressure and Bottom-Hole PressureZarda Akramul ArbyNo ratings yet

- READMEDocument1 pageREADMEAdhita MeryantoNo ratings yet

- DeletedDocument1 pageDeletedFelipe LanaNo ratings yet

- Draft PDFDocument401 pagesDraft PDFeas4787skumarNo ratings yet

- PL2303CheckChipVersion ReadMeDocument1 pagePL2303CheckChipVersion ReadMeShafeek MakNo ratings yet

- ReadDocument1 pageReadBeta WattimenaNo ratings yet

- LogoVerificationReport PDFDocument1 pageLogoVerificationReport PDFAdhita MeryantoNo ratings yet

- Let's Learn Japanese Basic 1 Volume 1 Learner's TextbookDocument104 pagesLet's Learn Japanese Basic 1 Volume 1 Learner's Textbookdenix100% (2)

- l3070 e 0 0 PDFDocument128 pagesl3070 e 0 0 PDFAdhita MeryantoNo ratings yet

- Sinker Bar Weight vs Static Pressure for WirelinesDocument3 pagesSinker Bar Weight vs Static Pressure for WirelinesAdhita Meryanto100% (1)

- TU4118Document8 pagesTU4118Adhita MeryantoNo ratings yet

- QA-RD7AE-V8 English API Formula SheetDocument4 pagesQA-RD7AE-V8 English API Formula SheetYogesh GavaliNo ratings yet

- Man Rec STC R06Document12 pagesMan Rec STC R06Adhita MeryantoNo ratings yet

- 6.03.1 Z-Chart - Open HoleDocument2 pages6.03.1 Z-Chart - Open HoleAdhita MeryantoNo ratings yet

- Bukti TransaksiDocument1 pageBukti TransaksiAdhita MeryantoNo ratings yet

- L1329 BDocument4 pagesL1329 BAdhita MeryantoNo ratings yet

- WP54 UNGEGN WG Country Names Document 2011Document129 pagesWP54 UNGEGN WG Country Names Document 2011Adhita MeryantoNo ratings yet

- Fundamentals Formation Testing OverviewDocument25 pagesFundamentals Formation Testing Overviewshahbrotherz4287No ratings yet

- FR Jobs Lesson PlanDocument5 pagesFR Jobs Lesson PlanAdhita MeryantoNo ratings yet

- PRODUCTDocument82 pagesPRODUCTSrishti AggarwalNo ratings yet

- Marine Engineering 1921Document908 pagesMarine Engineering 1921Samuel Sneddon-Nelmes0% (1)

- DNA Gel Electrophoresis Lab Solves MysteryDocument8 pagesDNA Gel Electrophoresis Lab Solves MysteryAmit KumarNo ratings yet

- (23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion SpringsDocument6 pages(23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion Springsstefan.vince536No ratings yet

- Oracle Learning ManagementDocument168 pagesOracle Learning ManagementAbhishek Singh TomarNo ratings yet

- Iso 9001 CRMDocument6 pagesIso 9001 CRMleovenceNo ratings yet

- TWP10Document100 pagesTWP10ed9481No ratings yet

- Agricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsDocument84 pagesAgricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsRachel vNo ratings yet

- Petty Cash Vouchers:: Accountability Accounted ForDocument3 pagesPetty Cash Vouchers:: Accountability Accounted ForCrizhae OconNo ratings yet

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samNo ratings yet

- MBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorDocument20 pagesMBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorPooja GodiyalNo ratings yet

- Reflection Homophone 2Document3 pagesReflection Homophone 2api-356065858No ratings yet

- Modified Syllabus of Control SystemDocument2 pagesModified Syllabus of Control SystemDigambar PatilNo ratings yet

- 17BCE0552 Java DA1 PDFDocument10 pages17BCE0552 Java DA1 PDFABHIMAYU JENANo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- April 26, 2019 Strathmore TimesDocument16 pagesApril 26, 2019 Strathmore TimesStrathmore Times100% (1)

- RACI Matrix: Phase 1 - Initiaton/Set UpDocument3 pagesRACI Matrix: Phase 1 - Initiaton/Set UpHarshpreet BhatiaNo ratings yet

- Prenatal and Post Natal Growth of MandibleDocument5 pagesPrenatal and Post Natal Growth of MandiblehabeebNo ratings yet

- Movement and Position: Question Paper 4Document14 pagesMovement and Position: Question Paper 4SlaheddineNo ratings yet

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaNo ratings yet

- SQL Guide AdvancedDocument26 pagesSQL Guide AdvancedRustik2020No ratings yet

- Ensayo Bim - Jaime Alejandro Martinez Uribe PDFDocument3 pagesEnsayo Bim - Jaime Alejandro Martinez Uribe PDFAlejandro MartinezNo ratings yet

- Us Virgin Island WWWWDocument166 pagesUs Virgin Island WWWWErickvannNo ratings yet

- Thin Film Deposition TechniquesDocument20 pagesThin Film Deposition TechniquesShayan Ahmad Khattak, BS Physics Student, UoPNo ratings yet

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDocument6 pagesLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0No ratings yet

- Progressive Myoclonic Epilepsies - Practical Neurology 2015. MalekDocument8 pagesProgressive Myoclonic Epilepsies - Practical Neurology 2015. MalekchintanNo ratings yet

- ServiceDocument47 pagesServiceMarko KoširNo ratings yet

- Water Jet CuttingDocument15 pagesWater Jet CuttingDevendar YadavNo ratings yet