Professional Documents

Culture Documents

Beta Coefficient of ACI

Uploaded by

debasisdattaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beta Coefficient of ACI

Uploaded by

debasisdattaCopyright:

Available Formats

AN ASSIGNMENT

ON

FINANCIAL MANAGEMENT

C-620

Calculating Beta and Standard Deviation for a DSE Listed Company

A Case Study on Advance Chemical Industries (ACI) Limited

SUBMITTED TO

Mr. Md. Shariful Islam

Fellow (Assistant Professor)

Institute of Business Administration

University of Rajshahi

SUBMITTED BY

Debasis Dutta

Roll no. B-030003

Batch-03; Semester-1st

Institute of Business Administration

University of Rajshahi

Date of Submission: 07 December, 2010

Investment Analysis into Advanced Chemical Industries (ACI) Limited Page 1

A CASE STUDY ON ACI LTD.

Advanced Chemical Industries (ACI) Limited

Address: ACI Centre, 245 Tejgaon I/A Dhaka 1208

Industry: Consumer Products / FMCG

Company Profile1

Advanced Chemical Industries (ACI) Limited is one of the leading conglomerates in

Bangladesh, with a multinational heritage. ACI was established as the subsidiary of Imperial

Chemical Industries (ICI) in the then East Pakistan in 1968. After independence the company has

been incorporated in Bangladesh on the 24th of January 1973 as ICI Bangladesh Manufacturers

Limited and also as Public Limited Company. This Company also obtained listing with Dhaka

Stock Exchange on 28 December, 1976 and its first trading of shares took place on 9 March,

1994. Later on 5 May, 1992, ICI plc divested 70% of its shareholding to local management.

Subsequently the company was registered in the name of Advanced Chemical Industries

Limited. Listing with Chittagong Stock Exchange was made on 22 October 1995.

Basic Information:2

Advanced Chemical Industries (ACI) has an authorized capital of BDT 500.0 mn and the paid up

capital is BDT 194.0 mn. The face value of the company’s stock is BDT 10.0. The lot market lot

is consisting of 50 units. ACI is a Pharmaceuticals & Chemicals concerned business. The

company is publicly owned where Sponsor/Director occupies 36.77, Govt. possesses 0,

Institute holds 30.54 and Public have 32.69 of Share Percentage. The company has issued right at

1997 only and it was 1 right per share.

Market information2

The last trade was at BDT 376.00 on Dec 6, 2010. The market condition of ACI was at boom at

January and February of this year now a day it is going more or less stable. The trade range for

December 06, 2010 was BDT 372.0 - 380.0. The following figure could reveal the trend of

market price of ACI from February.

3

1

www.aci-bd.com

2

www.dsebd.org

3

www.stockbangladesh.com

Investment Analysis into Advanced Chemical Industries (ACI) Limited Page 2

In response to a DSE query, the Company has informed that there is no undisclosed price

sensitive information of the Company for such unusual price hike at February.

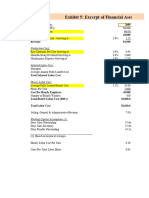

Interim Financial Performance: 20104

Unaudited / Audited

Particulars Q1 Q2 Q3 Q4

(3 months) (6 Months) (9 Months) (12 Months)

Turn Over in BDT* (mn) 3886.1 7030.84 10300.47 n/a

Net Profit After Tax in BDT *(mn)

76.43 45.35 114.16 n/a

(Continuing Operations)

Basic EPS in BDT*

3.42 2.34 5.88 n/a

(Based on continuing operations)

Net Asset Value(NAV) per share in BDT 0.00 113.07 116.62 n/a

The current Price Earning Ratio (P/E) Based on continuing operation of ACI is 48.1. But the

Price Earning Ratio (P/E) Based on Last audited financial is 12.31.

Yearly Financial Performance

Year Basic EPS Net Asset Value Per Share Net Profit After Tax (mn)

2008 57.69 154.85 932.91

2009 30.64 151.62 594.48

All figures in BDT (Bangladeshi Taka)

Price sensitive information:

The Board of Directors has recommended cash dividend @ 105% (i.e. Tk. 10.50 per share of Tk.

10.00 each) for the year 2009 on June 16, 2010. The company has also reported consolidated net

profit of Tk. 594.00 mn. with consolidated EPS of Tk. 30.64 for the year on 31.12.09 as against

Tk. 918.00 mn. and Tk. 47.30 respectively as on 31.12.08. The Company has also reported net

profit of Tk. 987.00 mn. EPS of Tk. 50. 85, and Net Asset Value per share of Tk. 156.16.

As per un-audited quarterly accounts for the 3rd quarter ended on 30th September 2010 (July'10

to Sep'10), the company has reported consolidated profit after tax and minority interest of Tk.

68.81 million with consolidated EPS of Tk. 3.55 as against Tk. 14.30 million (with capital gain

on sale of shares of Tk. 63.51 million) and Tk. 0.74 respectively for the same period of the

previous year. Whereas consolidated profit after tax and minority interest was Tk. 114.16 million

with consolidated EPS of Tk. 5.88 for the period of 9 months (Jan'10 to Sep'10) ended on

30.09.10 as against Tk. 437.40 million (with capital gain on sale of shares of Tk. 437.40 million)

and Tk. 22.54 respectively for the same period of the previous year. Again, as per un-audited

quarterly accounts for the 3rd quarter ended on 30th September 2010 (July'10 to Sep'10), the

company has also reported profit after tax of Tk. 151.32 million with EPS of Tk. 7.80 as against

Tk. 142.60 million (with capital gain on sale of shares of Tk. 74.69 million) and Tk. 7.35

respectively for the same period of the previous year. Whereas profit after tax of the company

4

www.dsebd.org

Investment Analysis into Advanced Chemical Industries (ACI) Limited Page 3

was Tk. 435.74 million with EPS of Tk. 22.46 for the period of 9 months (Jan' 10 to Sep' 10)

ended on 30.09.10 as against Tk. 655.18 million (with capital gain on sale of shares of Tk.

512.80 million) and Tk. 33.77 respectively for the same period of the previous year.

The company had informed on November 02, 2010 that the Board of Directors of the company

has approved the formation of a new subsidiary in the name of 'ACI Edible Oils' Limited. The

new subsidiary company will be involved in processing, marketing and selling of quality edible

oils already being marketed by ACI in the brand name 'Pure'.

The Board of Directors in its Meeting on 20 April 2010 approved the proposal to set-up second

plant of ACI Salt at an approximate cost of Taka 500 million. The plant will provide additional

15 MT finished salt per hour.

Calculation of Beta coefficient and Standard deviation of ACI5

Market Index Stock Price 2

XY X² (Y - Y)

X Y

8,771.41 377.10 3,307,698.71 76,937,633.39 253.45

8,838.10 382.20 3,377,921.82 78,112,011.61 117.07

8,721.09 392.50 3,423,027.83 76,057,410.79 0.27

8,443.35 381.60 3,221,982.36 71,290,159.22 130.42

8,187.33 378.50 3,098,904.41 67,032,372.53 210.83

7,986.92 383.70 3,064,581.20 63,790,891.09 86.86

7,937.05 402.20 3,192,281.51 62,996,762.70 84.27

7,615.37 382.50 2,912,879.03 57,993,860.24 110.67

7,492.83 386.70 2,897,477.36 56,142,501.41 39.94

7,480.34 393.40 2,942,765.76 55,955,486.52 0.14

7,097.38 392.20 2,783,592.44 50,372,802.86 0.67

6,904.08 396.30 2,736,086.90 47,666,320.65 10.76

6,797.47 395.30 2,687,039.89 46,205,598.40 5.20

6,807.24 394.10 2,682,733.28 46,338,516.42 1.17

6,774.87 397.90 2,695,720.77 45,898,863.52 23.81

6,653.29 399.60 2,658,654.68 44,266,267.82 43.30

6,743.21 400.00 2,697,284.00 45,470,881.10 48.72

6,672.97 404.70 2,700,550.96 44,528,528.62 136.42

6,575.59 405.80 2,668,374.42 43,238,383.85 163.33

6,342.76 414.00 2,625,902.64 40,230,604.42 440.16

58,375,459.9 1,120,525,857.1

Total 148,842.65 7,860.30 1,907.47

7 5

N ∑XY - (∑X)( ∑Y) 20 × 58,375,459 .97 - 148,842.65 × 7,860.3

β= β= = (0.0095)

N ∑X − (∑X )

2 2

20 ×1,120,525, 857.15 - (148,842.6 5) 2

∑(Y - Y)

2

σY = 19074 .47

N -1

σY = =10 .02

19

5

www.stockbangladesh.com

Investment Analysis into Advanced Chemical Industries (ACI) Limited Page 4

Beta Coefficient of ACI is (0.0095) and Standard Deviation is 10.02%

Comment: The Beta and Standard Deviation calculated in case of ACI is very much congruent

to each other. The standard deviation of ACI is showing that the firm is less risky and only a

level of 10.02%, whether the firms systematic risk which is measured by ß is also showing a

negative correlation with market but at a substantially low rate. This is indicating that the firm is

behaving negatively with the market movement.

As a risk averse investor one should invest in this firm, and if so the investment decision is

highly motivated through low risk level of the firm.

As a speculator one will not invest in these sorts of stock as the market of ACI is more or less

stable and somewhere it is going down. In the earlier stages we have mentioned a lot of

information which help guide ones investing decisions. There are some sorts of price sensitive

decisions, which could turn the market of ACI again at a hike as January 2010. As the firm is a

‘A’ category firm and declaring regular dividend and arranging regular AGM the firm is

undoubtedly doing well. But having the trend of downward EPS one may become confused, but

if we look at the interim financial report we could see an upward trending of turnover. The

unaudited P/E of this period of ACI is beyond the limit of SEC and it is around to 48, which is

seems to be a difficulty to borrow, but it is based on only quarterly data. As a long term investor

one can invest into it. As the firm has declared the dividend this year so there is no way to be

influenced by dividend declaration. But as the price of ACI is much lower someone can invest

into it.

Investment Analysis into Advanced Chemical Industries (ACI) Limited Page 5

Normal P-P Plot of Regression Standardized Residual

Dependent Variable: VAR00001

1.00

.75

Expected Cum Prob

.50

.25

0.00

0.00 .25 .50 .75 1.00

Observed Cum Prob

Investment Analysis into Advanced Chemical Industries (ACI) Limited Page 6

You might also like

- Submission v2Document32 pagesSubmission v2MUKESH KUMARNo ratings yet

- Premier CementDocument13 pagesPremier CementWasif KhanNo ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- We Are Not Above Nature, We Are A Part of NatureDocument216 pagesWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVNo ratings yet

- in Rs. Cr.Document20 pagesin Rs. Cr.tanuj_mohantyNo ratings yet

- E. Sensitivities and ScenariosDocument3 pagesE. Sensitivities and ScenariosDadangNo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- Cia DAMDocument24 pagesCia DAMvishalNo ratings yet

- Kode Nama Emiten Income Tax Expense FY2016 (Reported) Income Tax Expense FY2017 (Reported)Document16 pagesKode Nama Emiten Income Tax Expense FY2016 (Reported) Income Tax Expense FY2017 (Reported)Haikal RafifNo ratings yet

- Fa - Assignment LaxmiDocument36 pagesFa - Assignment Laxmilaxmi joshiNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- SOAL UTS MK 2020-2021 HarmonoDocument5 pagesSOAL UTS MK 2020-2021 HarmonoAulia Khoirun NisaNo ratings yet

- I Aktiva Lancar: NO Rekening 2015 2016Document12 pagesI Aktiva Lancar: NO Rekening 2015 2016dimasNo ratings yet

- I Aktiva Lancar: NO Rekening 2015 2016Document12 pagesI Aktiva Lancar: NO Rekening 2015 2016dimasNo ratings yet

- Pembahasan Kuis ALK 3 Kasus 2020Document11 pagesPembahasan Kuis ALK 3 Kasus 2020ihza srNo ratings yet

- 3.8L Agarbatti MakingDocument9 pages3.8L Agarbatti MakingVedant AssociatesNo ratings yet

- GL BS - 2C2PDocument1 pageGL BS - 2C2PKyaw Htin WinNo ratings yet

- Tata Steel: PrintDocument1 pageTata Steel: PrintSEHWAG MATHAVANNo ratings yet

- Shell Financial Data BloombergDocument48 pagesShell Financial Data BloombergShardul MudeNo ratings yet

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDocument4 pages58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- Receipts Estimates and Spending CeilingDocument3 pagesReceipts Estimates and Spending CeilingrejieobsiomaNo ratings yet

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- 2021 Financial PerformanceDocument14 pages2021 Financial PerformanceVicxie Fae CupatanNo ratings yet

- India Cements FADocument154 pagesIndia Cements FARohit KumarNo ratings yet

- ExecutivesummaryDocument4 pagesExecutivesummaryMayurNo ratings yet

- IT Department Time Series Data FY 2000 01 To 2018 19Document11 pagesIT Department Time Series Data FY 2000 01 To 2018 19Ajay RakdeNo ratings yet

- Punjab National Bank: Assets Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesPunjab National Bank: Assets Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. MillionSaurabGhimireNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- ABB Power Systems & Automation CompanyDocument13 pagesABB Power Systems & Automation CompanyMohamed SamehNo ratings yet

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Profit and LossDocument2 pagesProfit and LossSourav RajeevNo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- Unaudited Financial Results Q2 FY2022 23 Bandhan BankDocument6 pagesUnaudited Financial Results Q2 FY2022 23 Bandhan BankPradyut RoyNo ratings yet

- Asset Liability Management at HDFC BankDocument31 pagesAsset Liability Management at HDFC BankwebstdsnrNo ratings yet

- Top Companies in Oil and Natural Gas SectorDocument24 pagesTop Companies in Oil and Natural Gas SectorSravanKumar IyerNo ratings yet

- Assignment OF Sapm Submitted To, Submitted by Mr. Lovey Sir Name-Saurabh Arora Faculty of LIM Regd No - 10905517 Roll No - RT1903B40Document10 pagesAssignment OF Sapm Submitted To, Submitted by Mr. Lovey Sir Name-Saurabh Arora Faculty of LIM Regd No - 10905517 Roll No - RT1903B40Nipun BhardwajNo ratings yet

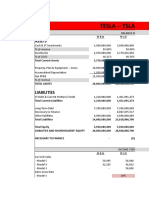

- Tesla ForecastDocument6 pagesTesla ForecastDanikaLiNo ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- TotalEnergies Financial Data BloombergDocument48 pagesTotalEnergies Financial Data BloombergShardul MudeNo ratings yet

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDocument3 pagesPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitNo ratings yet

- Sweet Beginnings Co.Document11 pagesSweet Beginnings Co.Andrew Farol67% (3)

- Sweet Beginnings CoDocument11 pagesSweet Beginnings CoJonalyn LodorNo ratings yet

- Sweet Beginnings Co PDFDocument11 pagesSweet Beginnings Co PDFannica castroNo ratings yet

- Premium Chart New India Mediclaim 22092020Document1 pagePremium Chart New India Mediclaim 22092020भृगुवंशी आयुष त्रिवेदीNo ratings yet

- Company Info - Print Financials - P&LDocument1 pageCompany Info - Print Financials - P&LUtkarshNo ratings yet

- Sweet Beginnings Co - XLSX CASE STUDY ANSWERDocument11 pagesSweet Beginnings Co - XLSX CASE STUDY ANSWERYna AlfonsoNo ratings yet

- Consolidated Balance Sheet (Rs. in MN)Document24 pagesConsolidated Balance Sheet (Rs. in MN)prernagadiaNo ratings yet

- Balance Sheet of State Bank of IndiaDocument5 pagesBalance Sheet of State Bank of Indiakanishtha1No ratings yet

- Arfin India LimitedDocument4 pagesArfin India Limitedkumar52No ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountAnonymous HAkNRaNo ratings yet

- Chapter Three: Staring From 2007 To 2010Document1 pageChapter Three: Staring From 2007 To 2010Abera ZerihunNo ratings yet

- Revenue:: AssumptionsDocument38 pagesRevenue:: AssumptionsusmanthesaviorNo ratings yet

- DCF ValuationV!Document80 pagesDCF ValuationV!Sohini DeyNo ratings yet

- Time Series Data 2021 22 PDFDocument8 pagesTime Series Data 2021 22 PDFPrashant BorseNo ratings yet

- Valuation For Nestlé Lanka PLCDocument20 pagesValuation For Nestlé Lanka PLCErandika Lakmali GamageNo ratings yet

- Bluestar PNLDocument6 pagesBluestar PNLg23033No ratings yet

- PT Sam Putra Inti: Balance SheetDocument21 pagesPT Sam Putra Inti: Balance SheetIkhsan Al IzyraNo ratings yet

- The Data Science Workshop: A New, Interactive Approach to Learning Data ScienceFrom EverandThe Data Science Workshop: A New, Interactive Approach to Learning Data ScienceNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Strength and Microscale Properties of Bamboo FiberDocument14 pagesStrength and Microscale Properties of Bamboo FiberDm EerzaNo ratings yet

- 14 CE Chapter 14 - Developing Pricing StrategiesDocument34 pages14 CE Chapter 14 - Developing Pricing StrategiesAsha JaylalNo ratings yet

- Immovable Sale-Purchase (Land) ContractDocument6 pagesImmovable Sale-Purchase (Land) ContractMeta GoNo ratings yet

- Tax Accounting Jones CH 4 HW SolutionsDocument7 pagesTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraNo ratings yet

- Apst GraduatestageDocument1 pageApst Graduatestageapi-253013067No ratings yet

- Perhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020Document6 pagesPerhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020andreas evanNo ratings yet

- Pie in The Sky 3Document5 pagesPie in The Sky 3arsi_yaarNo ratings yet

- Teralight ProfileDocument12 pagesTeralight ProfileMohammed TariqNo ratings yet

- Fire and Life Safety Assessment ReportDocument5 pagesFire and Life Safety Assessment ReportJune CostalesNo ratings yet

- R 18 Model B Installation of TC Auxiliary Lights and WingletsDocument29 pagesR 18 Model B Installation of TC Auxiliary Lights and WingletsAlejandro RodríguezNo ratings yet

- QP 4Document4 pagesQP 4Yusra RaoufNo ratings yet

- DTMF Controlled Robot Without Microcontroller (Aranju Peter)Document10 pagesDTMF Controlled Robot Without Microcontroller (Aranju Peter)adebayo gabrielNo ratings yet

- ILRF Soccer Ball ReportDocument40 pagesILRF Soccer Ball ReportgabalauiNo ratings yet

- Salva v. MakalintalDocument2 pagesSalva v. MakalintalGain DeeNo ratings yet

- ESK-Balcony Air-ADocument2 pagesESK-Balcony Air-AJUANKI PNo ratings yet

- EP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4Document5 pagesEP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4doyaNo ratings yet

- Giuliani Letter To Sen. GrahamDocument4 pagesGiuliani Letter To Sen. GrahamFox News83% (12)

- Study of Means End Value Chain ModelDocument19 pagesStudy of Means End Value Chain ModelPiyush Padgil100% (1)

- Atom Medical Usa Model 103 Infa Warmer I - 2 PDFDocument7 pagesAtom Medical Usa Model 103 Infa Warmer I - 2 PDFLuqman BhanuNo ratings yet

- 0901b8038042b661 PDFDocument8 pages0901b8038042b661 PDFWaqasAhmedNo ratings yet

- Chapter03 - How To Retrieve Data From A Single TableDocument35 pagesChapter03 - How To Retrieve Data From A Single TableGML KillNo ratings yet

- Catalogue of The Herbert Allen Collection of English PorcelainDocument298 pagesCatalogue of The Herbert Allen Collection of English PorcelainPuiu Vasile ChiojdoiuNo ratings yet

- LISTA Nascar 2014Document42 pagesLISTA Nascar 2014osmarxsNo ratings yet

- Consultancy Services For The Feasibility Study of A Second Runway at SSR International AirportDocument6 pagesConsultancy Services For The Feasibility Study of A Second Runway at SSR International AirportNitish RamdaworNo ratings yet

- RWJ Corp Ch19 Dividends and Other PayoutsDocument28 pagesRWJ Corp Ch19 Dividends and Other Payoutsmuhibbuddin noorNo ratings yet

- Mcqs in Wills and SuccessionDocument14 pagesMcqs in Wills and Successionjudy andrade100% (1)

- CENT - Company Presentation Q1 2020 PDFDocument22 pagesCENT - Company Presentation Q1 2020 PDFsabrina rahmawatiNo ratings yet

- Midterm Exam StatconDocument4 pagesMidterm Exam Statconlhemnaval100% (4)

- How To Attain Success Through The Strength of The Vibration of NumbersDocument95 pagesHow To Attain Success Through The Strength of The Vibration of NumberszahkulNo ratings yet

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDocument9 pagesUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiNo ratings yet